A. Market Viewpoints

I. Macroeconomic Liquidity

Tightening monetary liquidity. The minutes of the June meeting of the Federal Reserve showed that almost all officials believe that there will be multiple rate hikes this year, but at a slower pace. They emphasized that high inflation is one of the key considerations for monetary policy outlook, maintaining the expectation of a mild economic recession in 2023 but with increased confidence in a soft landing of the economy. U.S. stocks remain strong, with the Nasdaq index delivering its best performance in 20 years. The cryptocurrency market continues to fluctuate sideways, with a decreasing correlation to U.S. stocks.

II. Overall Market Trends

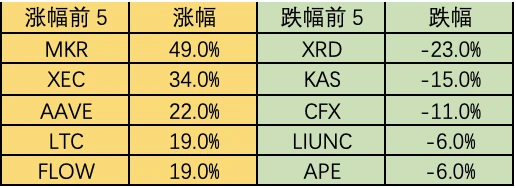

Top 100 market cap gainers:

This week, the market experienced a narrow range of volatility, with active performance in altcoins. BlackRock, Fidelity, and other funds have resubmitted applications for a BTC spot ETF, greatly increasing the probability of approval this time. The main theme in the market is opportunities under U.S. SEC regulations, specifically RWA and POW.

MKR: The proportion of MKR's RWA revenue from on-chain real assets is 50%, and the RWA business scale of 1.2 billion US dollars has a first-mover advantage. If RWA is regulated, MKR will limit the risk exposure to 25%. At the same time, MKR is linked to protocol income surplus, and when the surplus exceeds 250 million US dollars, MKR will be repurchased and destroyed, entering a deflationary mode. Conversely, if the protocol generates bad debt, MKR will be increased to compensate for the debt.

XVG: XVG, a privacy payment coin, was originally delisted by Binance Exchange due to European regulatory requirements. However, on June 26th, the delisting decision was revoked and new contracts were launched.

LBR: LBR, in the liquidity collateral track, has a higher mining income. In August, it will launch version 2, which is similar to RDNT's 5% LP lock-up mode.

III. BTC Market

1) On-chain Data

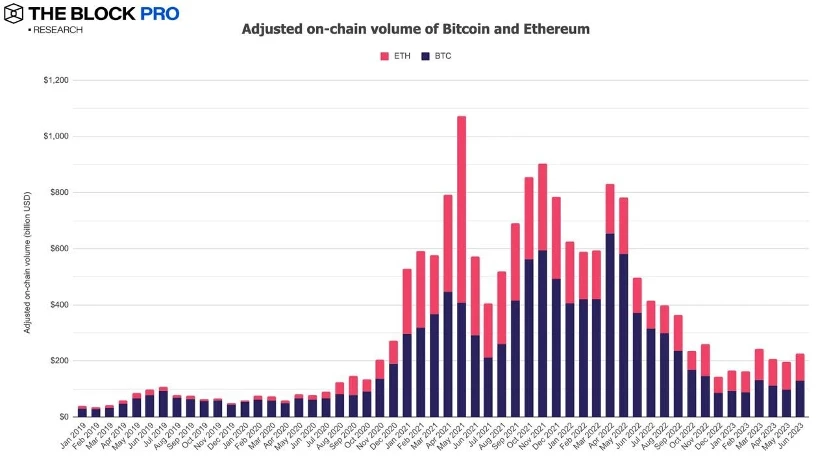

BTC has seen some degree of recovery. In June, BTC's on-chain transaction volume increased by 33% compared to the previous month, while ETH's on-chain transaction volume decreased by 2%. After the spot trading volume on centralized exchanges hit its lowest level since November 2020, it finally saw a rise of 6% in June.

Funds continue to flow out of the market, and the risk-free interest rate of US Treasuries at 5% is more tempting. In June, the on-chain trading volume of stablecoins increased by 20%, but the supply of stablecoins continued to shrink by 3%. Among them, the market share of the US dollar stablecoin USDT continues to rise to 70%.

Long-term trend indicator MVRV-ZScore is based on the market's overall cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is in the top range; when the indicator is less than 2, it is in the bottom range. When MVRV falls below the key level of 1, holders are generally in a loss state. The current indicator is 0.76, entering the recovery phase.

2) Futures market

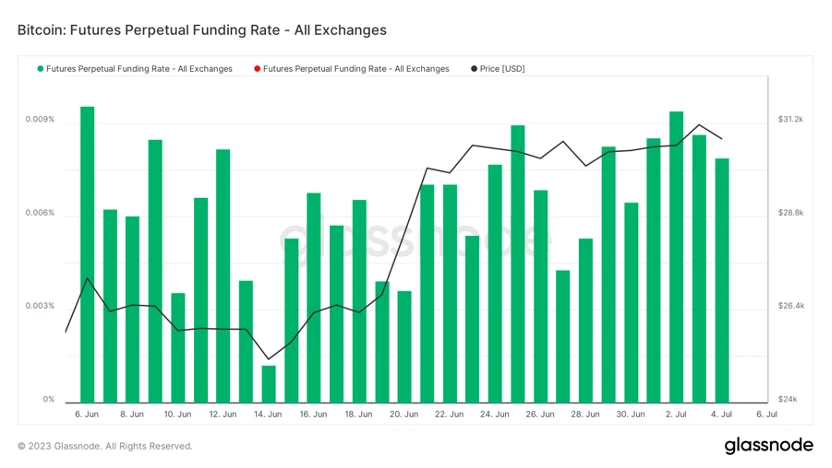

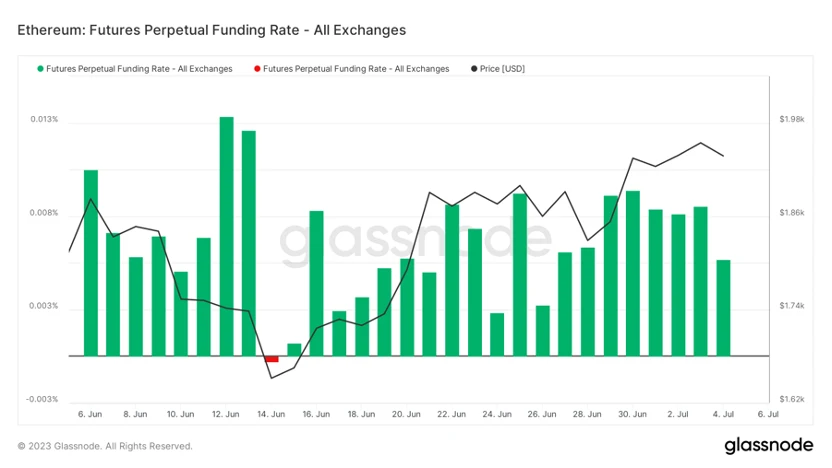

Future funding rate: Neutral this week. Rates range from 0.05% to 0.1%, with more long leverage, indicating a short-term top in the market; rates range from -0.1% to 0%, with more short leverage, indicating a short-term bottom in the market.

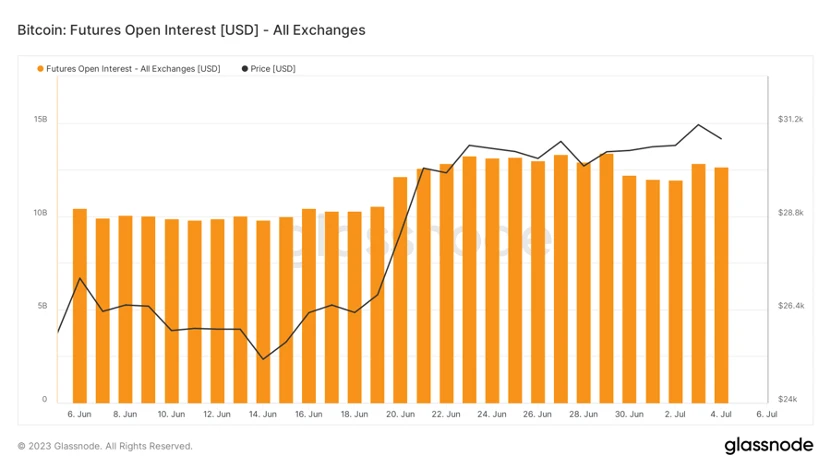

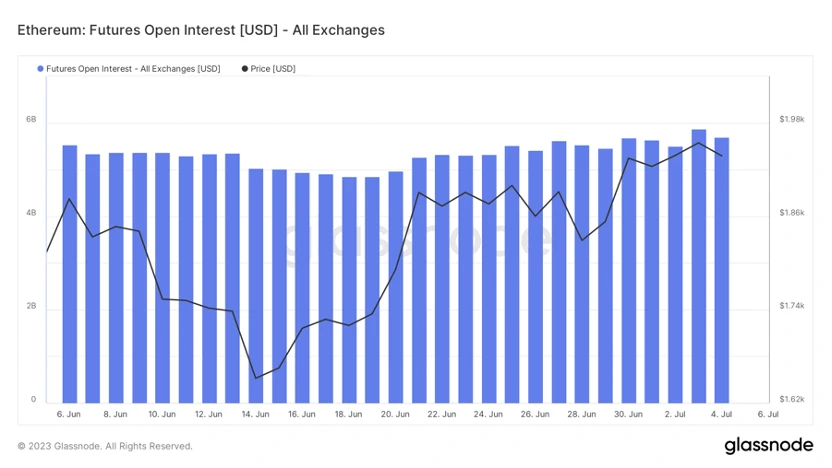

Future open interest: The total open interest remains high this week, indicating that the main funds have not left the market. Overall, the open interest of BTC futures in June has increased by 21%, but the open interest of ETH futures has decreased by 5%, and the market focus is mainly on BTC.

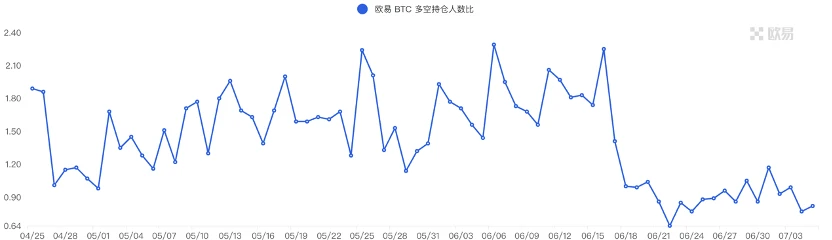

Futures long/short ratio: 1.2. The market sentiment is not obvious. The sentiment of retail investors is mostly a contrarian indicator, with panic below 0.7 and greed above 2.0. The fluctuation of the long/short ratio data weakens its reference significance.

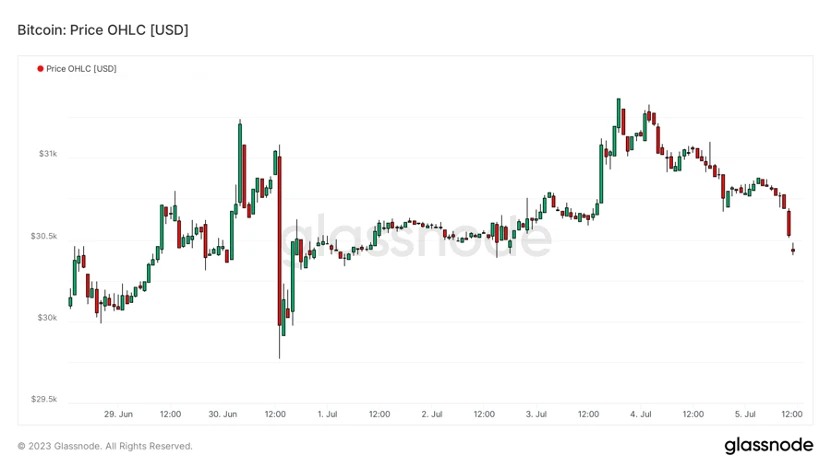

3) Current market situation

This week, BTC is oscillating at a high level. Miners have sold 54,000 BTC to Binance Exchange in the past three weeks, putting pressure on the upside. Stablecoins continue to flow out, and the market lacks incremental funds for a rally. The positive impact of the spot ETF will still take time to materialize, and the short-term market will follow the fluctuations of the U.S. stock market.

B. Market Data:

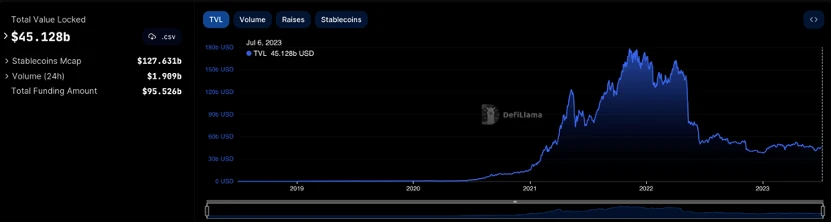

1. Total Lock-up Volume of Public Chains

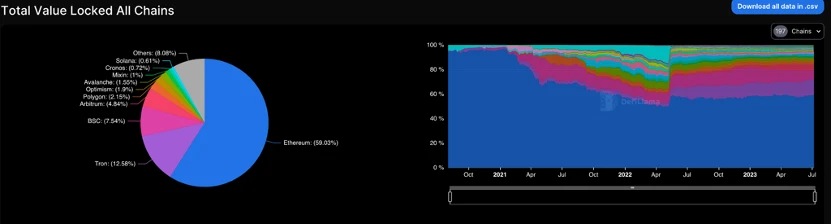

2. Proportions of TVL for Each Public Chain

This week, the mainstream coins market continued to recover, with TVL increasing by 0.9 billion and ETH chain TVL proportion also rebounding compared to the previous two weeks, remaining around 59%.

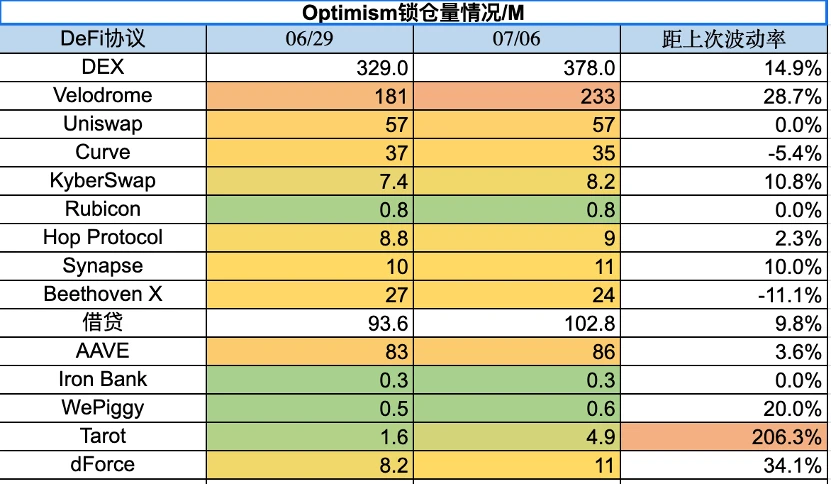

From the TVL data of the past seven days, the market is in a high-level oscillation state, with TVL of popular public chains generally rising to varying degrees. BSC chain's TVL increased by 2.09%, Solana increased by 11.31%. And the core public chains of all Ethereum Layer 2 networks have seen an increase in TVL, Arbitrum increased by 0.69%, Optimism increased by 10.13% this week, Polygon increased by 4.43%, Avalanche increased by 2.55%.

III. Lockup Amount of Each Chain Protocol

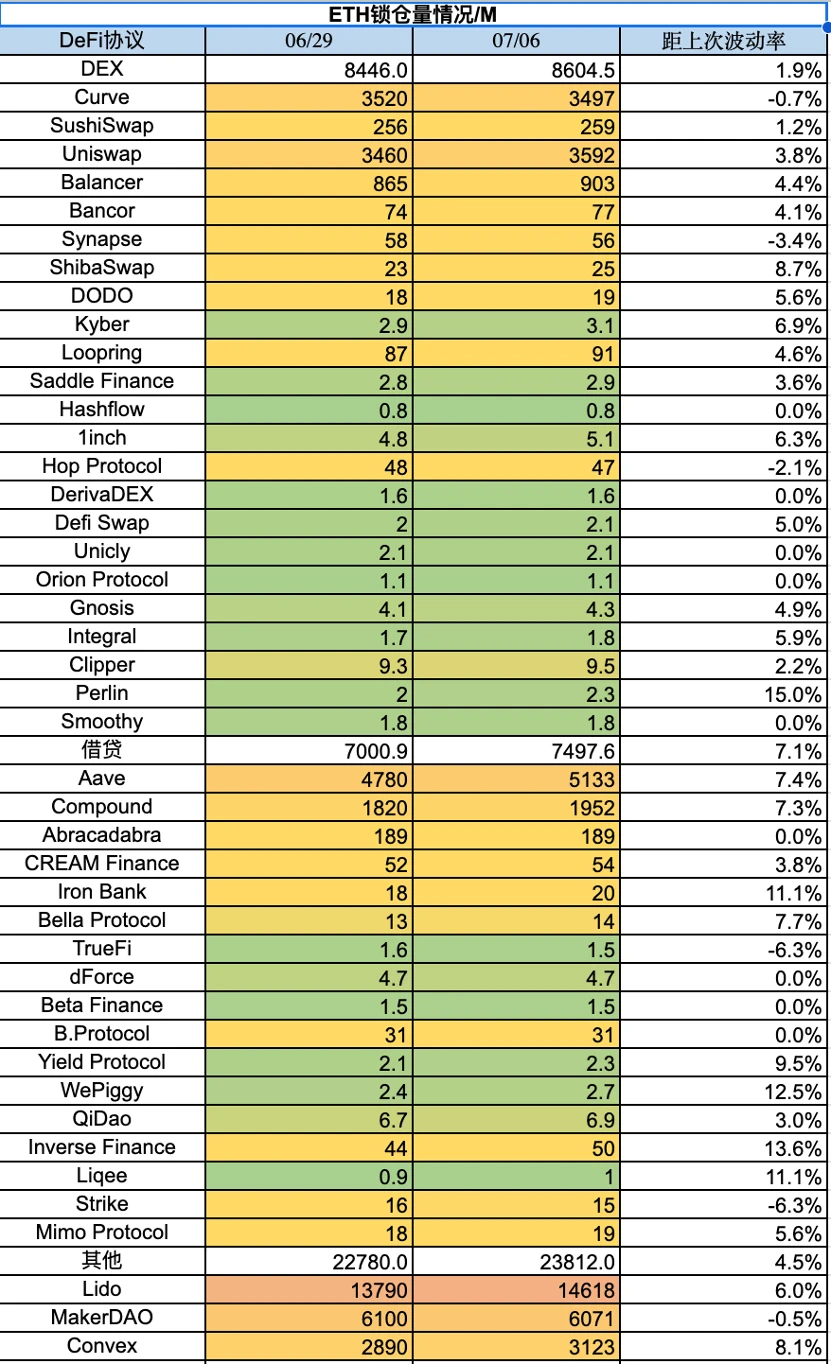

1) ETH Lockup Amount

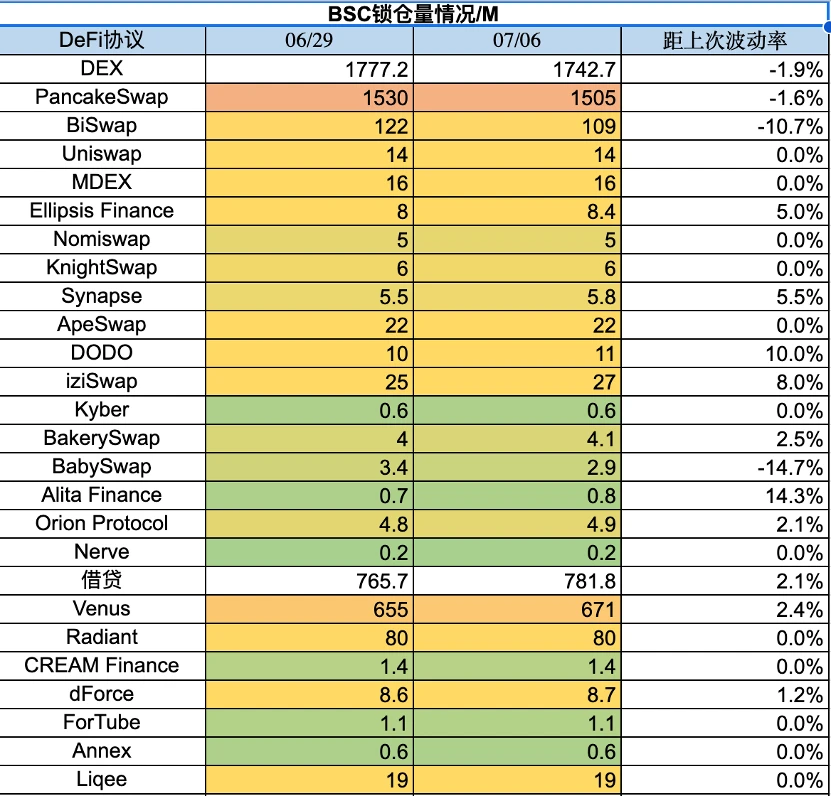

2) BSC Lockup Amount

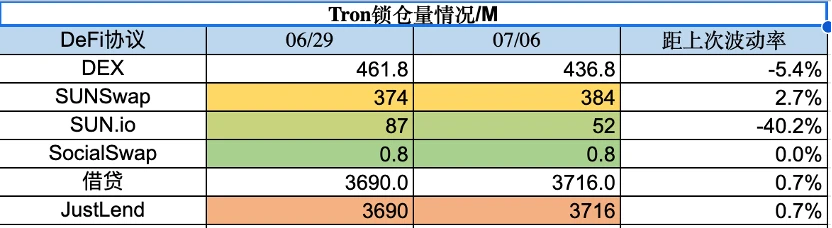

3) Tron Lockup Amount

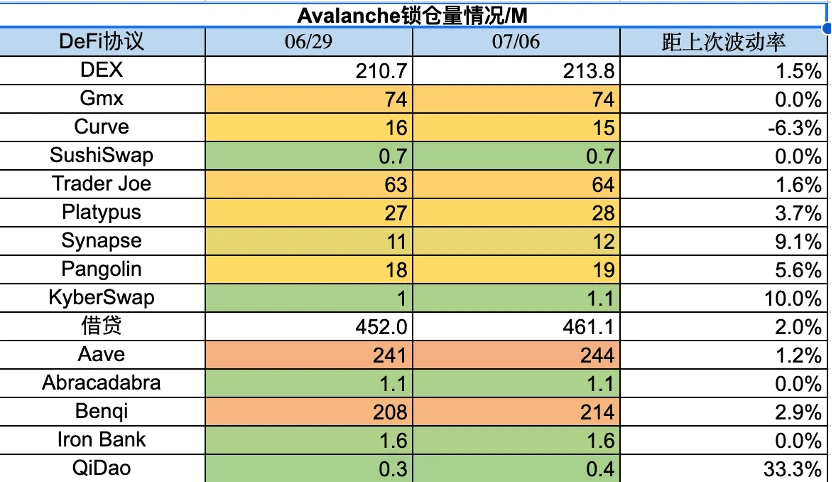

4) Avalanche Lockup Amount

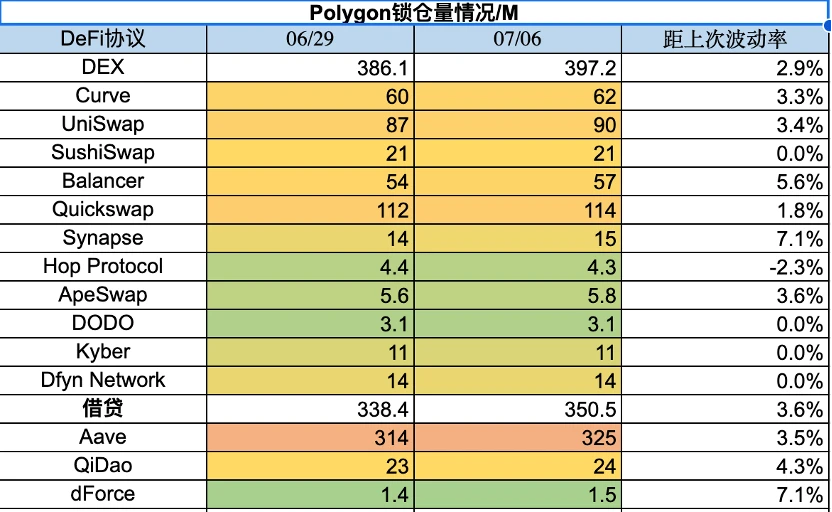

5) Polygon Lockup Amount

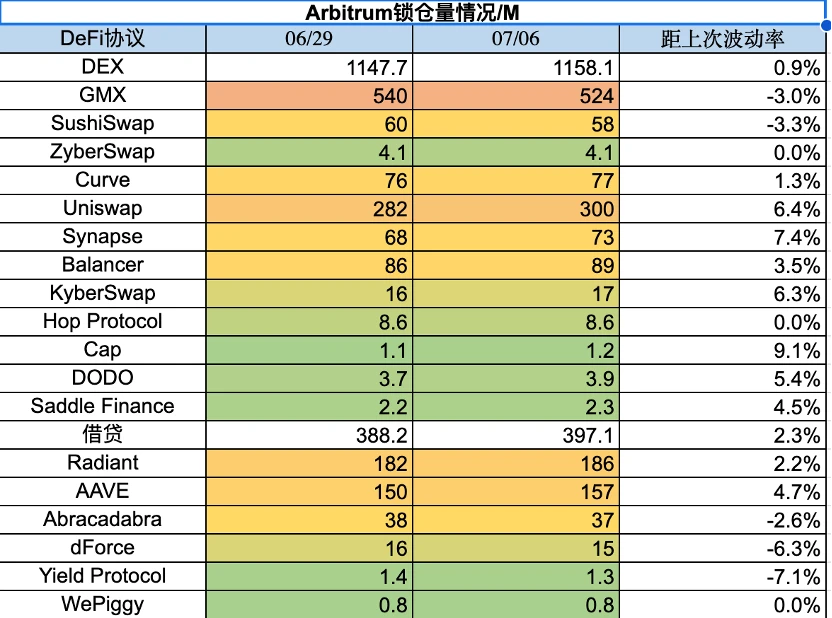

6) Arbitrum Lock-up Volume

7) Optimism Lock-up Volume

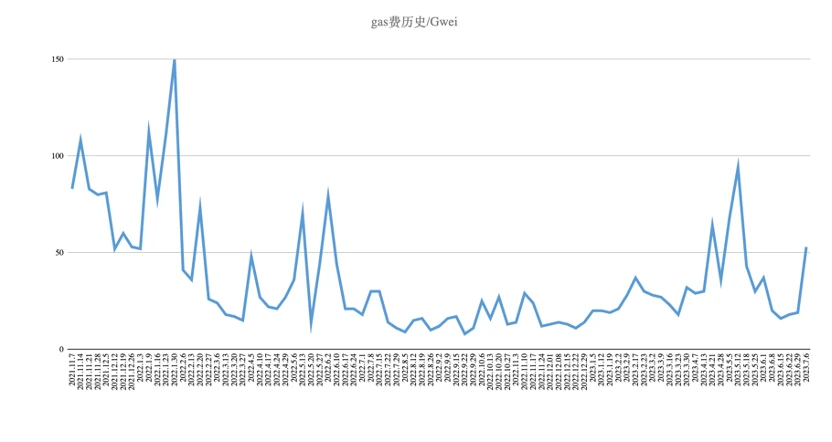

Four, ETH Gas Fee History

The current on-chain transfer fee is about $1.02, the Uniswap transaction fee is about $9.32, and the Opensea transaction fee is about $3.62. Compared to last week, gas fees have significantly increased. Recently, the market has rebounded and is in a high-range oscillation, with gas prices reaching their highest point in nearly two months.

The deposit fees on Layer 2 networks are as follows: Arbitrum $4.06, Optimism $7.61, Polygon $7.53, ZkSync $7.24.

Five, NFT Market Data Changes

1) NFT-500 Index:

2) NFT Market Overview:

3) NFT Trading Market Share:

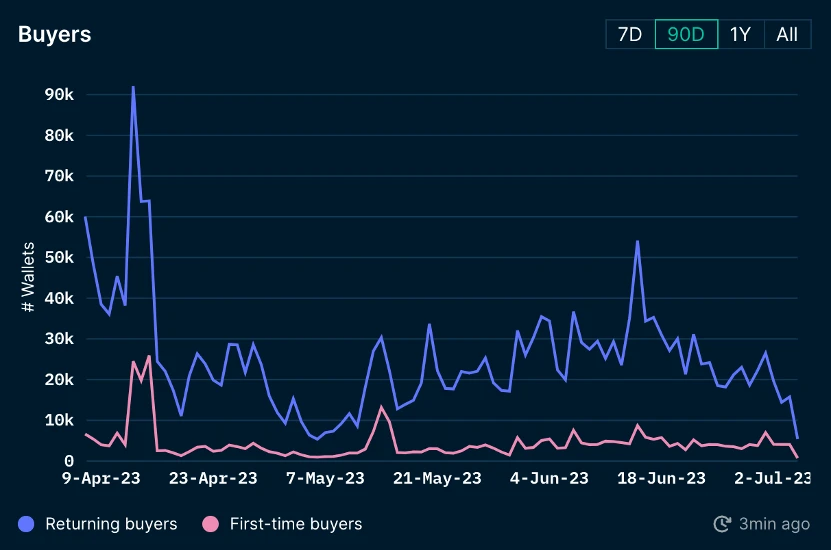

4) NFT Buyer Analysis:

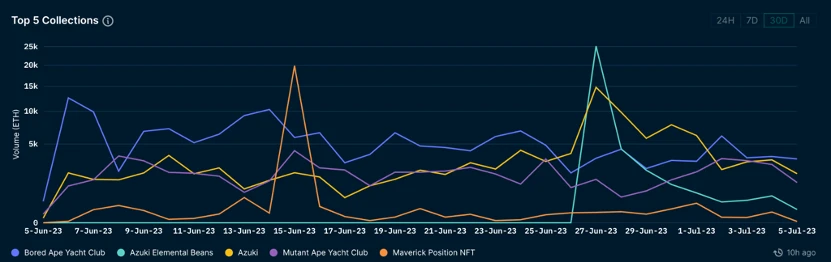

5) Top 5 Collections Volume:

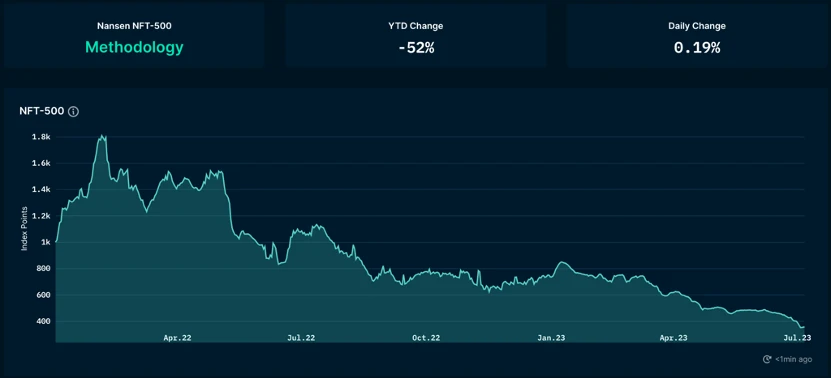

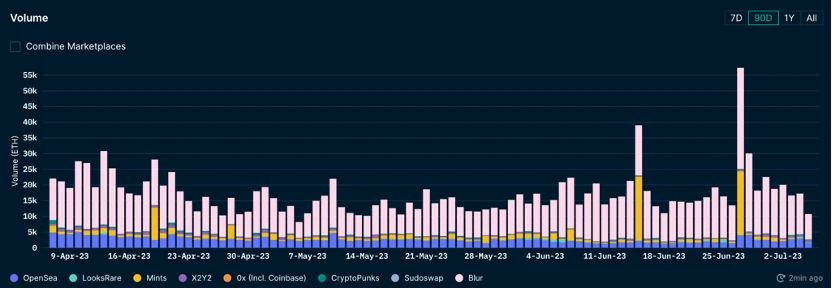

From the perspective of trading volume and market volume, the NFT market is at an all-time low. The recent significant decrease in volume of the top 5 collections indicates a generally weak overall trading volume and market size, including blue-chip NFT projects. Azuki has dropped more than 24% in a single week, and the overall market value of NFTs is still declining.

Blur still maintains an absolute leading position in trading volume. Both new and existing NFT users experienced a steep decline this week, and the number of new NFT users entering the market continues to decrease. There is no upward trend in recent months.

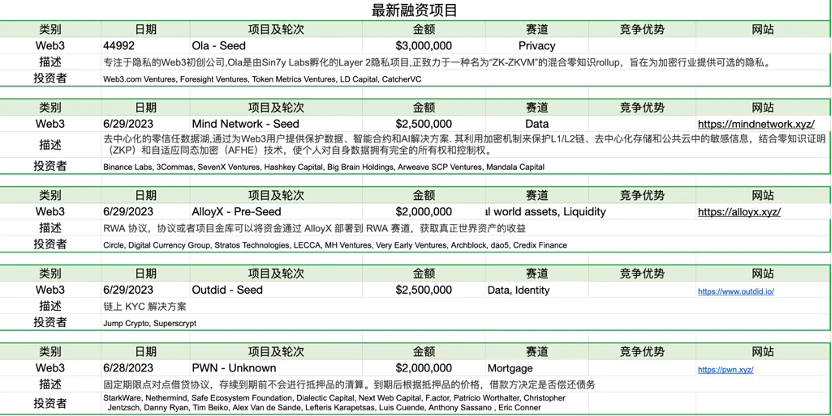

VI. Latest Financing Updates of the Project

About Foresight Ventures

Foresight Ventures bets on the innovative journey of cryptocurrencies in the next few decades. It manages several funds, including VC Fund, Secondary Active Management Fund, Multi-Strategy FOF, and Special Purpose S Fund "Foresight Secondary Fund I", with total assets under management exceeding $400 million. Foresight Ventures adheres to the principles of "Unique, Independent, Aggressive, Long-term" and provides extensive support to projects through its strong ecosystem. Its team consists of experienced professionals from top financial and technology companies, including Sequoia China, CICC, Google, and Bitmain.