Yesterday, there were no significant macroeconomic news releases to be concerned about in the United States. However, China's data once again disappoints, with CPI falling into deflation territory for the first time since 2021. CPI YoY -0.3% (MoM +0.2%), food prices dropped significantly, and weak consumer confidence offers little help for inflation prospects.

In an era where central banks in most developed markets are attempting to ease domestic price pressures, the decline in China's CPI stands out, even in historically criticized Japan, which has seen healthy and sustained growth in its CPI during the recovery period after the pandemic.

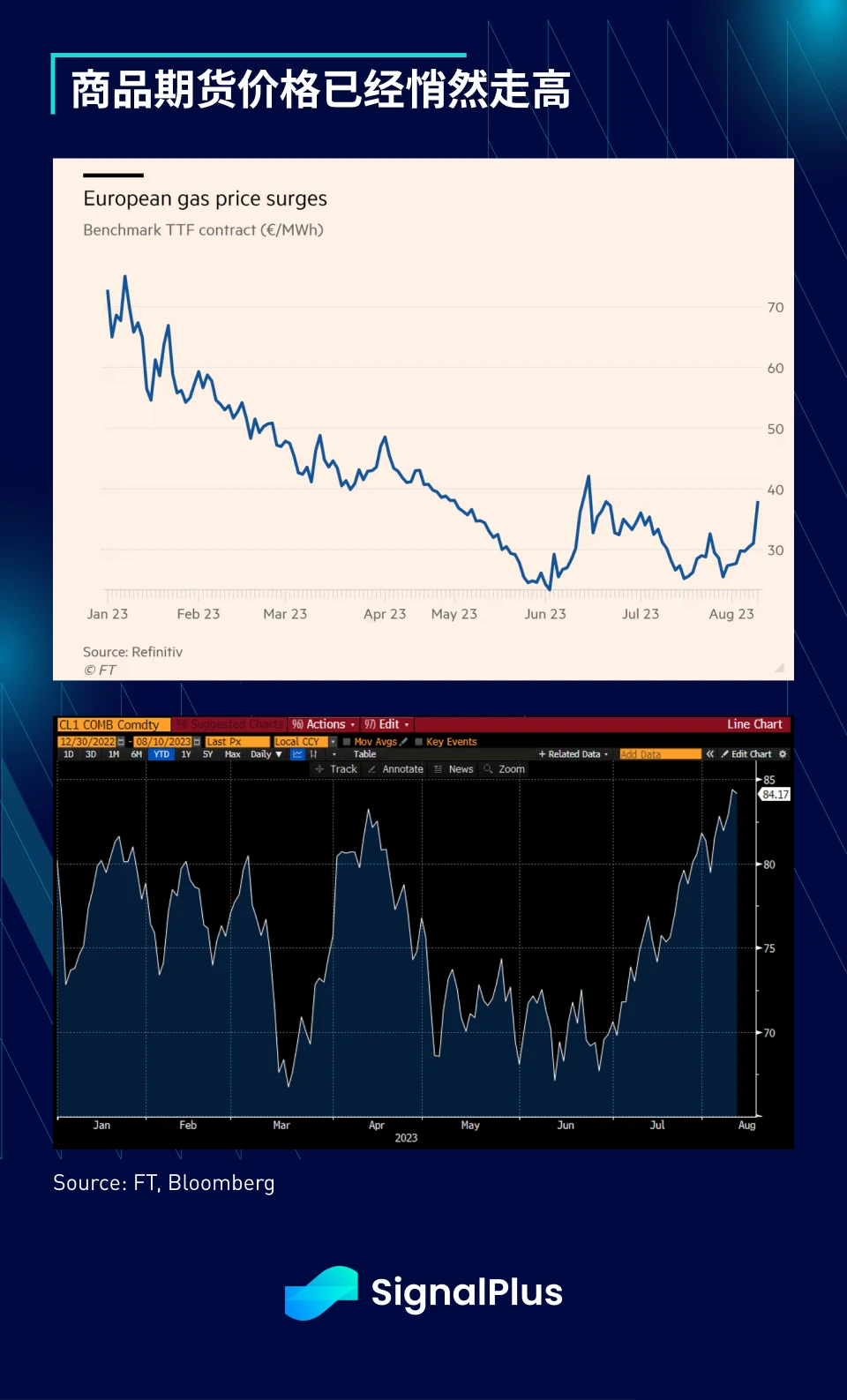

While we await the CPI data, crude oil, natural gas, and some other commodities prices have surged in the past month, with European natural gas prices rising over 30% (EU natural gas +28%, US natural gas +7%); however, despite volatile stock market movements, trading volumes in the fixed-income market remain only around 65% of normal levels. On the other hand, despite an increase in issuance by $2 billion, the performance of the 10-year US Treasury bond auction remains quite strong.

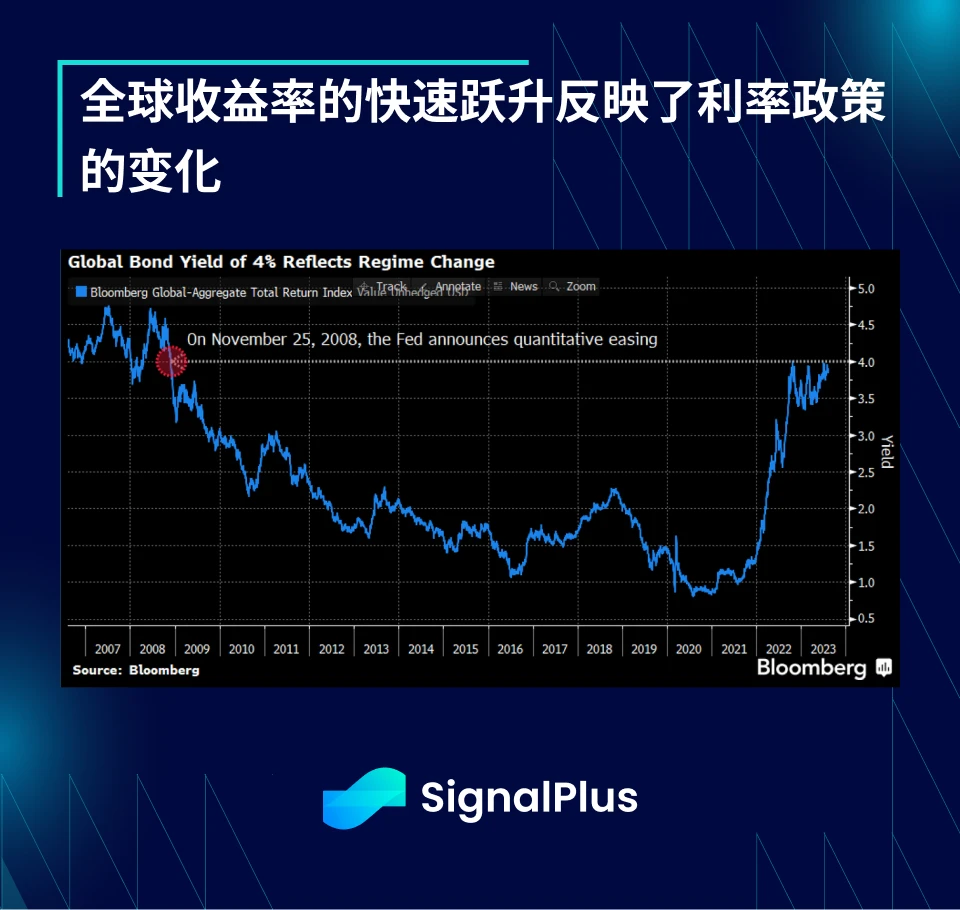

A fascinating chart from Bloomberg shows that the rapid rise in global bond yields has almost completely reversed the effects of the past 15 years' QE/ZIRP policies within 24 months. Perhaps this truly signifies the end of the low-interest-rate era, and the new generation of investors will have different expectations for returns.

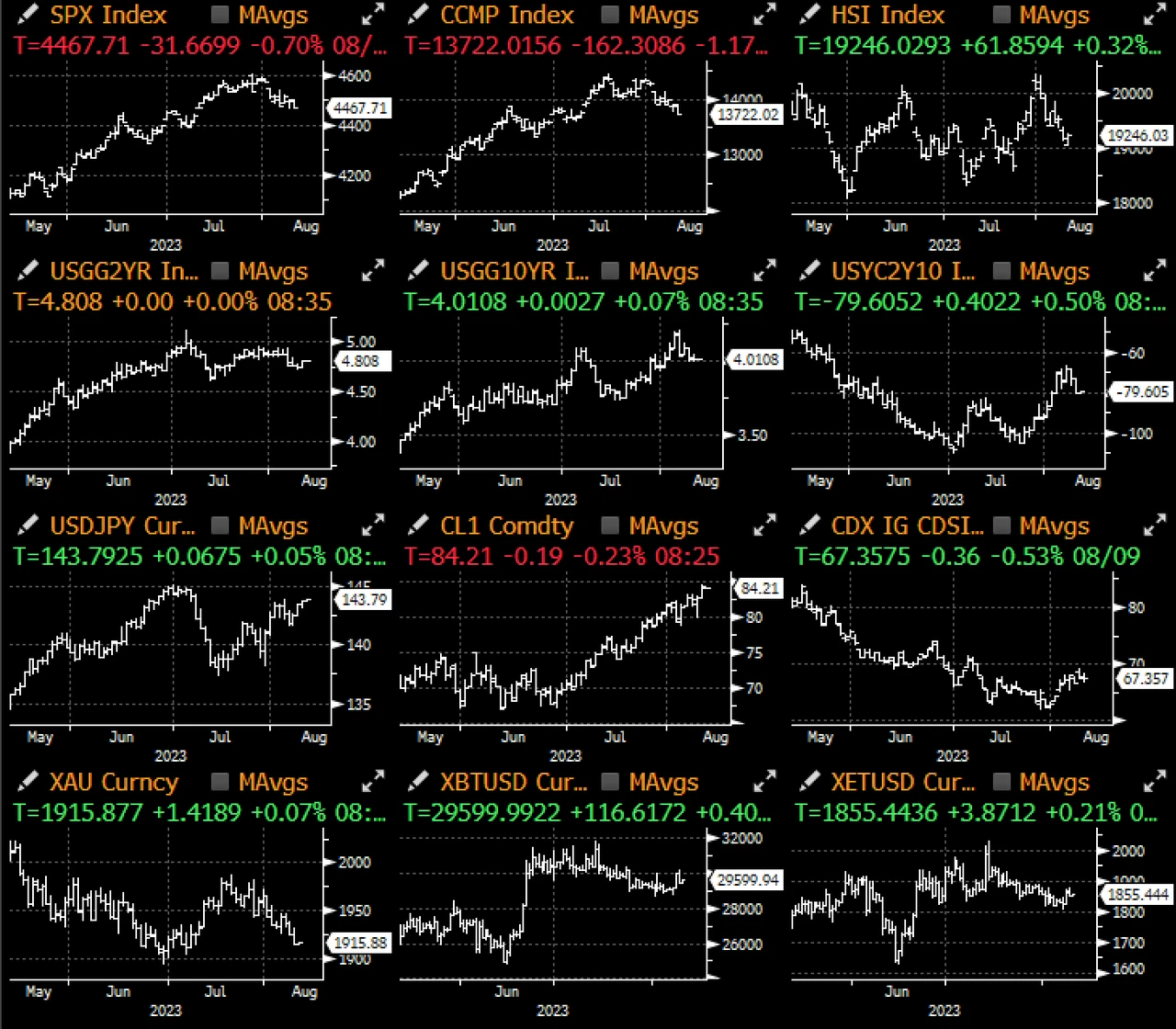

SPX fell 0.7% at closing yesterday, with the Nasdaq index, dominated by technology stocks, trading more actively. Both Nvidia and Tesla saw a daily decline of 3-5% due to position adjustments. Although the change in closing price does not seem significant, the intra-day volatility of SPX has already exceeded the level of the past 2 months. We also continue to observe some preliminary signs that the stock market may be forming a top. Stocks favored by retail investors have performed relatively poorly, and other momentum indicators such as RSI and oscillators are starting to show potential warning signals.

In the cryptocurrency sector, there are reports that the SEC intends to appeal the ruling in the Ripple case. In response to this news, Coinbase's stock price fell about 5% yesterday. Although this action is not surprising, it will still prolong the ongoing legal proceedings for several months, and any additional rulings in this case will have far-reaching implications for other cryptocurrency-related lawsuits, such as those pending against Coinbase and Binance.

Meanwhile, while spot prices remain stable, many popular Bitcoin-related ETFs have rapidly declined by 20-30% from their July highs (after the BTC ETF filing and XRP ruling), which aligns with the decrease in spot trading volume and weakened speculative interest in cryptocurrencies.

On the positive news front, Coinbase has officially launched their first L2 blockchain network, Base (EVM compatible, Optimism roll-up), hoping to attract more developers and application developers, thereby driving growth in new users. Some optimistic market participants hope that this could become a new gateway for ordinary users to use DeFi services and drive the construction of "Superchain" on the OP Stack/Optimism mainnet.

SignalPlus sponsorship, the "Advanced Options Trading Course" taught by Teacher Xian Ni Ma is now open for enrollment. Please scan the QR code on the poster to contact customer service and join.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web 3, or join our WeChat group (add assistant WeChat: chillywzq), Telegram group, and Discord community to interact with more friends.

SignalPlus Official Website: https://www.signalplus.com