Organize - Odaily

Author - Qin Xiaofeng

1. Overall overview

Grayscale Investments filed on Tuesday with the U.S. Securities and Exchange Commission (SEC) for a new futures Ethereum ETF, which would be filed under the Securities Act of 1933, the same Securities Act that regulates the filing of commodity and spot Bitcoin ETFs. Grayscale also previously filed for a separate Ethereum futures ETF under the Investment Company Act of 1940, under which most security-based ETFs are registered.

In addition, the U.S. SEC is reviewing spot Ethereum ETF applications submitted by two asset management companies, ARK Invest and VanEck, and the SEC has solicited public comments on the potential benefits and risks of approving these ETFs. The SEC opened a 45-day public comment period on both documents and said:"The Commission is issuing this notice to solicit comments from interested persons on the proposed rule changes."

Christine Kim, vice president of research at Galaxy, published an article summarizing the 118th Ethereum Core Developer Consensus Conference (ACDC). This meeting mainly discussed Devnet-9 preparations and changes to the Ethereum Consensus Layer (CL). Ethereum core developer Tim Beiko raised questions about the Dencun test schedule. He said that if developers are not sure to release Dencun on the public test network before Devconnect, the Ethereum Developer Conference in November 2023, then Dencun’s mainnet activation is likely It wont happen this year.

In the secondary market, the current ETH price may continue to consolidate in the short term, with support at $1,550 and resistance at $1,600.

2. Secondary market

1. Spot market

OKX QuotesData shows that ETH once rose to 1,670 USDT last week and closed at 1,590 USDT during the week, a month-on-month decrease of 2.4%.

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,600. The lower support is $1,550. If it falls below, it may fall further to $1,500; the upper resistance is $1,600.

2. Network operation status

EtherscanData shows that the number of blocks produced by the Ethereum network in the past week was 49,948, a month-on-month increase of 0.4%; the number of weekly active addresses was 2,723,878, a month-on-month decrease of 23.3%; the block reward income was 2,814 ETH, a month-on-month decrease of 12.1%; the weekly ETH The number of items destroyed reached 9,314, a decrease of 20.2% from the previous month.

On-chain data shows that on September 21, the gas fee of Ethereum soared to 300 gwei in a short period of time. The sudden increase in gas fee may be caused by Binance’s wallet consolidation. In response to this, Binance officially responded that the platform is only doing aggregation processing when gas fees are low.

3. Large amount changes

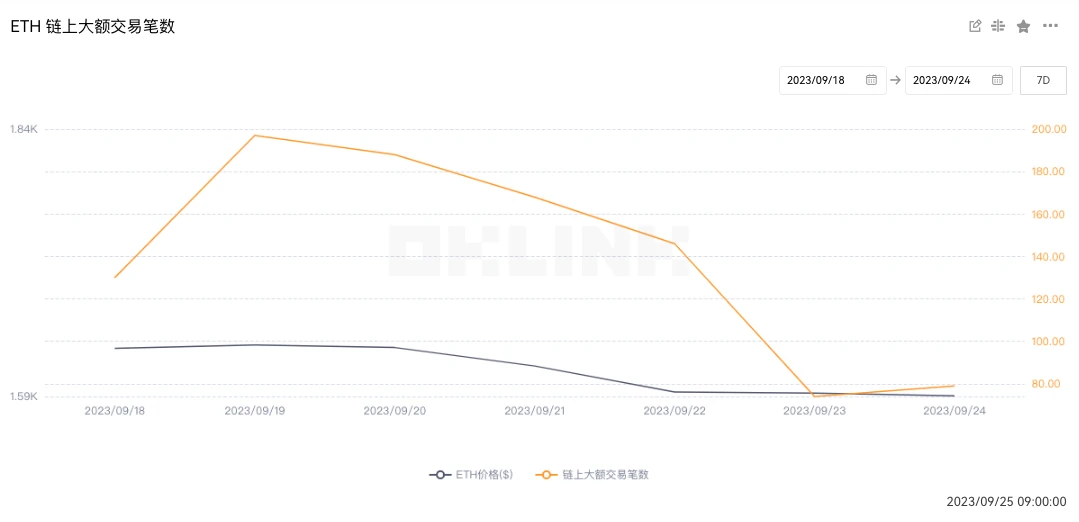

OKlink dataIt shows that the number of large-value transactions on the chain reached 982 last week, a decrease of 56.2% compared with the previous week (2244). The trading enthusiasm of giant whales has dropped significantly.

4. Rich list address

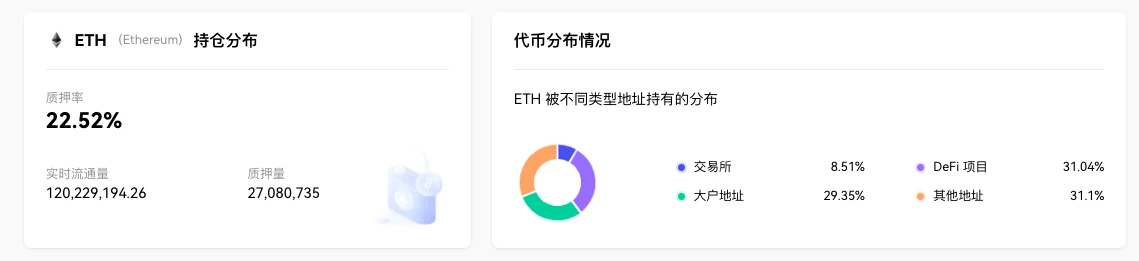

OKLinkdataIt shows that the current total deposits of ETH 2.0 have reached 27.08 million ETH, and the pledge rate is 22.52%; from the perspective of ETH holding address distribution, exchanges accounted for 8.51%, a month-on-month decrease of 0.07%; DeFi projects accounted for 31.04%, a month-on-month increase of 0.26% ; Large addresses (top 1,000 addresses excluding exchanges and DeFi projects) accounted for 29.35%, a month-on-month decrease of 0.03%; other addresses accounted for 31.1%, a month-on-month decrease of 0.16%.

In terms of whale actions, a whale address deposited 6,000 ETH (worth approximately US$9.96 million) into Kraken on September 19. This address had participated in the Ethereum ICO and received 254,908 ETH (currently worth 422.6 million US dollars). USD), the ETH ICO price is approximately USD 0.31.

5. Lockup data

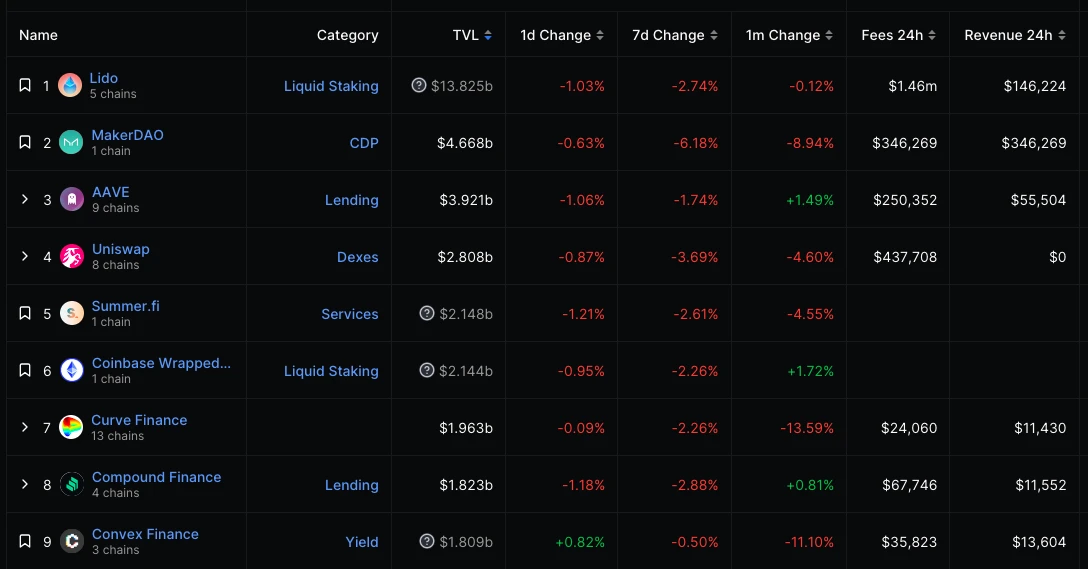

DeFiLlamaData shows that the value of locked-up collateral on the chain dropped from US$21.33 billion to US$20.63 billion last week, a month-on-month decrease of 3.2%; from a single project perspective, the top three lock-up values are: Lido US$13.82 billion; MakerDAO 4.66 billion USD;Aave USD 3.92 billion;

3. Ecology and Technology

1.Technological progress

Christine Kim, vice president of research at Galaxy, published an article summarizing the 118th Ethereum Core Developer Consensus Conference (ACDC). This meeting mainly discussed Devnet-9 preparations and changes to the Ethereum Consensus Layer (CL). Devnet-9 is the second testnet and includes the full set of code changes in the Dencun upgrade. Devnet-9 will be the first testnet to activate EIP-7514 and EIP-7516, two new EIPs that were added to the Dencun upgrade at last week’s executive layer meeting.

Parithosh Jayanthi, DevOps engineer at the Ethereum Foundation, said that his team will launch Devnet-9 on September 27; EL and CL client teams such as Lodestar, EthereumJS, Lighthouse, and Geth have confirmed their readiness for this testnet release.

Additionally, the developers discussed deployment strategies for EIP-4788, deploying trusted settings for EIP 4844 on Devnet-9, and more.

Ethereum core developer Tim Beiko raised questions about the Dencun test schedule. He said that if developers are not sure to release Dencun on the public test network before Devconnect, the Ethereum Developer Conference in November 2023, then Dencun’s mainnet activation is likely It wont happen this year. Previously, Tim Beiko suggested launching Dencun on these testnets in the order of Holesky, Goerli, and Sepolia. However, since Holesky failed to launch on September 15 and will be relaunched on September 28, Jayanthi proposed to launch Dencun on Goerli first, and then Launched again on Holesky. Because Goerli is a soon-to-be-deprecated testnet, this means developers are free to experiment with modifications to the Dencun specification.

Tim Beiko and Del Fante agreed to test Dencun on Goerli before Holesky, and many developers also agreed to release Dencun on the public testnet before Devconnect.

According to previous news on September 17, blockchain tools and infrastructure developer Nethermind said that developers will re-launch Holesky within a week, with the planned time being September 22, Ethereum developer Michael Sproul revealed in a GitHub pull request The re-launch time is expected to be September 28th.

2. Voice of the Community

Former Ethereum consultant Steven Nerayoff has once again refuted fraud accusations made against him by Vitalik Buterin. This comes after attorney John Deaton revealed that he had seen some receipts in Nerayoff’s possession showing irregularities in the 2014 Ethereum ICO.

In the video, Nerayoff elaborated on the fraud claims made by Vitalik, claiming that Vitalik and his father, Dmitry Buterin, staged an orchestrated character attack to make him a scapegoat. In the video, Vitalik can be heard accusing Nerayoff of committing a huge fraud by extorting money over a companys ICO.

Nerayoff also claimed that Virgil Griffith, a senior researcher and developer at the Ethereum Foundation, had been dumped by Vitalik after he was convicted of helping North Korea evade sanctions. (CoinGape)

In 2019, the FBI arrested Steven Nerayoff and Alchemist partner Michael Hlady and filed racketeering charges; in 2021, Michael Hlady pleaded guilty to conspiring to extort millions of dollars in Ethereum from a startup, and thus faced up to 20 years in prison and a fine. Hlady and his co-conspirator, Steven Nerayoff, allegedly threatened to destroy a startup executive if they did not agree to demands for additional funds and tokens.

JPMorgan Chase pointed out in a research report on Thursday that the Ethereum Shanghai upgrade implemented in April did not promote network activity as much as expected. The report pointed out that since the Shanghai upgrade, the number of daily transactions on Ethereum has dropped by 12%, the number of daily active addresses has dropped by nearly 20%, and the DeFi protocol TVL has dropped by nearly 8%.

Additionally, the drop in network activity suggests that the “bearish forces” of the past year, including the collapse of Terra and FTX, a crackdown by U.S. regulators, and the shrinking stablecoin market, may be outweighing the positive impact of the Shanghai upgrade.

The report also adds that while staking has grown by 50% since the Shanghai upgrade, which has helped improve network security, “the share of liquidity staking protocols such as Lido remains disturbingly high, raising questions about centralization . (CoinDesk)

3.Project trends

(1) The Lido community has voted to adopt the proposal of “adding 7 Ethereum operators”

The Snapshot page shows that the Lido community has voted to pass the Add 7 Ethereum Operators proposal, with a final support rate of 99.99%. It is reported that the proposal aims to enhance decentralization features and resiliency, and introduce new organizations with strong skills and in line with Lido’s values. Next, the Lido community will conduct an on-chain Aragon vote on October 3, 2023 to add 7 node operators to the Curated Operator Set.

Aaves proposal to deploy Freeze Stewards to multiple chains has been approved. Freeze Stewards allows administrators to freeze assets and has been previously deployed on the Aave V3 Ethereum pool. The proposal aims to deploy this feature to multiple chains, including Optimism, Arbitrum, Polygon, Metis, Base.

(3) Scroll mainnet may be launched within a few weeks

Scroll co-founder Ye Zhang said that Scroll will be launched after some final testing, and major projects such as Uniswap and Aave are ready to deploy on Scroll at launch. Zhang said that some other systems such as Linea have unproven parts of the circuit, while he believes that Scroll provides complete proof of all Ethereum opcodes and transaction components. (Cointelegraph)

(4) Taiko launches Alpha-5 test network Jólnir, introducing new proposals and proof mechanisms

Taiko, the second-layer Ethereum network based on zkRollup, announced the launch of the Alpha-5 test network Jólnir, adding a proposal and proof implementation mechanism inspired by Proposer-Builder Separation (PBS).

In Jólnir, the Proposer needs to obtain a bond from the Prover to propose a block. Prover needs to deposit some TTKOj tokens to obtain the bond. If a Prover proves their assigned block within the specified attestation time target, they will reclaim the bond and keep the upfront fees they received from the off-chain Proposer.

TTKOj has been distributed to A 1 and A 2 testnet Proposers and Prover (2.5 TTKOj per address). A 3 and A 4 testnet Proposers and Prover will also receive TTKOj soon. Additionally, Taiko will no longer support Eldfell L3. Grímsvötn L2 will continue to operate until October 31st to support project migration.

Optimism has announced its third round of RetroPGF (Retrospective Public Goods Funding). Applications are now open for RetroPGF’s third round, which runs through October 23, and will allocate 30 million OPs to builders, artists, creators, and educators who demonstrate impact in building the Optimism Collective. Every type of contributor to the Optimism ecosystem is eligible to receive RetroPGF. Whether you are a developer implementing an Ethereum client or an educator creating Optimism video content, everyone is eligible.

(6) Wormhole launches a new proposal seeking to allocate 2.5 million ARB to import 100 million USDC into Arbitrum

The Wormhole Foundation has launched a draft proposal seeking to allocate 2.5 million ARB to import 100 million USDC into Arbitrum, providing 8% to users who mint native USDC on Arbitrum through Wormhole and its partner Circles Cross-Chain Transfer Protocol (CCTP) The annualized rate of return is valid for up to 3 months and is accumulated weekly. This means users can earn up to 2% of their total earnings over a 3-month period.

According to previous news, Wormhole Connect has integrated the Circle cross-chain transfer protocol CCTP, and users can transfer native USDC between Ethereum, Avalanche, Arbitrum and Optimism networks through the cross-chain bridge based on Wormhole.

(7) Grayscale announced that it would give up its rights related to PoW Ethereum tokens

Grayscale has announced that it will relinquish all rights related to the PoW Ethereum (ETHPoW) token after the Ethereum Merge. After a thorough review, Grayscale determined that the ETHPoW token lacked liquidity and that the product custodian did not support such tokens.

The Ethereum Merge event completed on September 15, 2022, forking the Ethereum blockchain into the primary PoS of ETH and the secondary PoW of the EthereumPoW (ETHW) token. Grayscale considered whether to acquire EthereumPoW and sell ETHW on behalf of shareholders, but ultimately gave up due to uncertainty about support for the ETHW token from digital asset custodians and exchanges. (Cointelegraph)

(8) Grayscale applies for a new futures Ethereum ETF

Grayscale Investments filed on Tuesday with the U.S. Securities and Exchange Commission (SEC) for a new futures Ethereum ETF, which would be filed under the Securities Act of 1933, the same Securities Act that regulates the filing of commodity and spot Bitcoin ETFs. Grayscale also previously filed for a separate Ethereum futures ETF under the Investment Company Act of 1940, under which most security-based ETFs are registered. (WSJ)

(9) SEC seeks public comments on approving spot Ethereum ETFs reported by ARK Invest and VanEck

The U.S. SEC is reviewing applications for spot Ethereum ETFs from two asset management companies, ARK Invest and VanEck, and has solicited public comments on the potential benefits and risks of approving these ETFs. The SEC opened a 45-day public comment period on both documents and said:"The Commission is issuing this notice to solicit comments from interested persons on the proposed rule changes."(cryptonews)

NYDIG issued a document stating that the U.S. SEC must respond to Nasdaq’s request to list the iShares Bitcoin Trust ETF before October 17 (which may be approval, rejection, or delay). The SEC also has until October 16 to respond to the Bitwise Bitcoin ETP Trust. Additionally, October 13 is the final date to appeal the SEC’s decision in the Grayscale case, which may provide clues as to how the agency is considering its position on spot ETFs.

(10) Ethereum Gas median hit a new low since November 22

Dune statistics show that the median gas of Ethereum hit a new low since November 22, falling to 9.7 gwei on September 17. The previous low was 8.8 gwei on October 30, 2022.

(11) ETH/BTC ratio falls to 14-month low

According to TradingView data, the ETH/BTC ratio fell to around 0.0602, its lowest since July last year and a 14-month low. Marcus Thielen, head of strategy and research at Matrixport, said Ethereum’s protocol revenue has been declining over the past three months and expects BTC to continue to outperform the broader crypto market, including ETH. Crypto analyst Benjamin Cowen said ETH’s valuation relative to BTC could collapse. (CoinDesk)

Arbitrum airdrop claims have ended at Ethereum network block height 18208000, and the unclaimed 69, 448, 385 ARB (approximately $56.54 million) have been transferred from the airdrop contract to the DAO treasury.