Organize - Odaily

Author - Qin Xiaofeng

1. Overall overview

The ETH/BTC exchange rate fell to 0.05663, reaching its lowest level since July 2022, according to TradingView data. This ratio has dropped by nearly 30% since Ethereum implemented Merge in mid-September last year.

Bloomberg ETF analyst James Seyffart posted on the The fund does not directly short ETH and aims to profit from falling prices in the asset. Analysts say the SEC expedited approval of all long/legacy Ethereum futures ETFs but set this one up for a normal/anticipated date, with its filing filed alongside other ETFs in August.

In the secondary market, the current ETH price may continue to consolidate in the short term, with support at $1,550 and resistance at $1,600.

2. Secondary market

1. Spot market

OKX QuotesData shows that ETH fell to 1,520 USDT last week and closed at 1,555 USDT during the week, a month-on-month decrease of 3.7%.

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,550. The lower support is $1,550. If it falls below, it may fall further to $1,500; the upper resistance is $1,600.

2. Network operation status

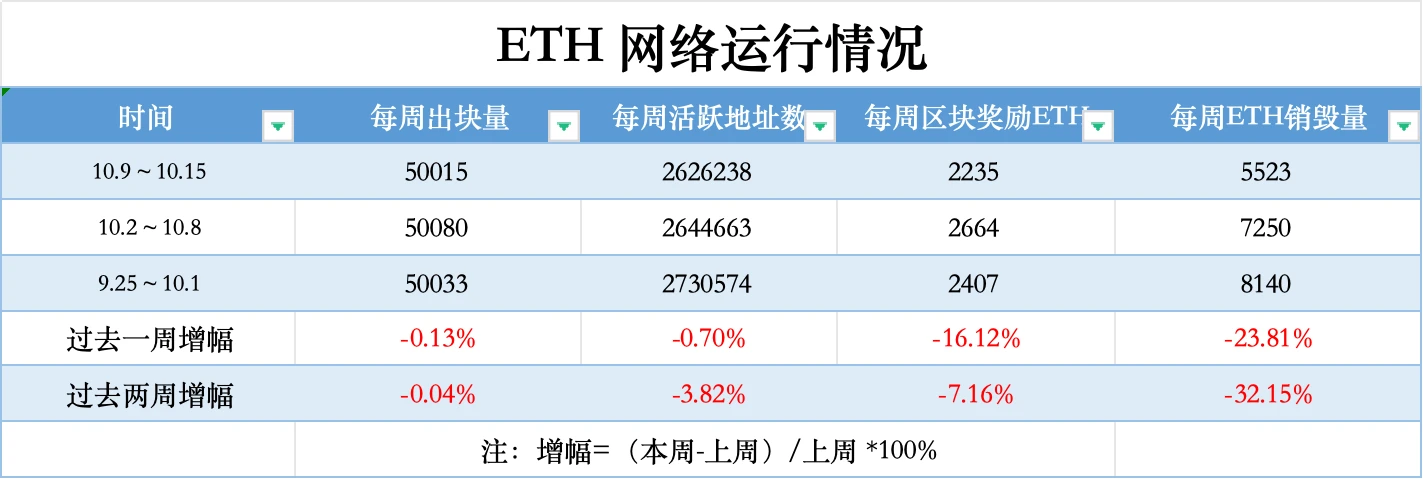

Etherscan Data shows that the number of blocks produced by the Ethereum network in the past week was 50,015, a month-on-month decrease of 0.13%; the number of weekly active addresses was 2,626,238, a month-on-month decrease of 0.7%; the block reward income was 2,235 ETH, a month-on-month decrease of 16.1%; the weekly ETH The number of items destroyed reached 5,523, a decrease of 23.8% from the previous month.

3. Large amount changes

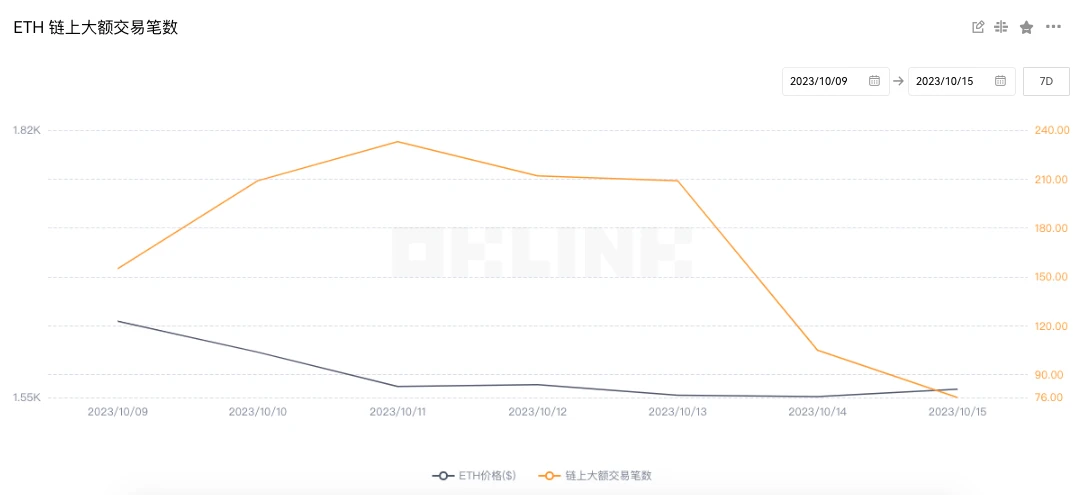

OKlink dataIt shows that the number of large-value transactions on the chain reached 1,199 last week, a decrease of 31.5% compared with the previous week (1,751). The trading enthusiasm of giant whales has dropped significantly.

4. Rich list address

OKLinkdataIt shows that the current total deposits of ETH 2.0 have reached 27.75 million ETH, and the pledge rate is 23.08%; from the distribution of ETH holding addresses, exchanges accounted for 8.59%, an increase of 0.13% month-on-month; DeFi projects accounted for 31.72%, an increase of 0.33% month-on-month. ; Large addresses (top 1,000 addresses excluding exchanges and DeFi projects) accounted for 29.02%, a month-on-month decrease of 0.26%; other addresses accounted for 30.67%, a month-on-month decrease of 0.2%.

5. Lockup data

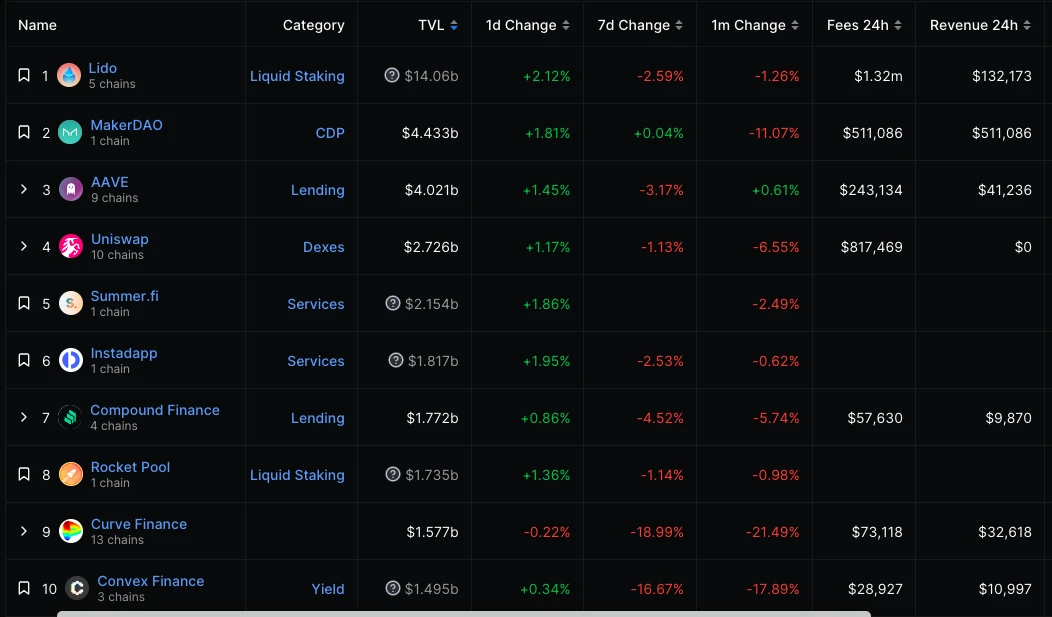

DeFiLlamaData shows that the value of locked-up collateral on the chain dropped from US$20.91 billion to US$20.11 billion last week, a month-on-month decrease of 3.8%; from a single project perspective, the top three lock-up values are: Lido US$14.06 billion; MakerDAO 4.43 billion USD; Aave USD 4.02 billion;

3. Ecology and Technology

1.Technological progress

Christine Kim, vice president of research at Galaxy, posted a summary of the 172nd Ethereum Core Developer Execution (ACDE) conference call, which covered Cancun/Deneb (Dencun) testing and EVM Object Format (EOF) development.

Barnabas Busa, DevOps Engineer at the Ethereum Foundation, shared some updates about Devnet #9, which the developers launched on September 29:

- Devnet #9 currently has a participation rate of 93%;

- 7% of validators not running are mainly Geth (EL)/Teku (CL) validator nodes;

- There are also issues with the Erigon (EL)/Prysm (CL) client combination and the EthereumJS (EL) client;

- The Flashbots team is testing the MEV-Boost relay and builder on Devnet #9. Busa encourages other relay and builder operators to contact him so that more MEV infrastructure can be tested on Devnet #9.

- Blob transactions have not been tested with the MEV-Boost builder. The blob is being discarded by the builder, and the developer is unsure whether this is because the blob is actually invalid, does not meet the minimum base charge requirement, or is being discarded for some other reason.

Busa and the Ethereum Foundation’s Parithosh Jayanthi also shared the latest news about the upcoming Devnet #10:

- Devnet #10 wont be ready this week, but is expected to be available next week;

- For Devnet #10, developers wish to test trusted settings files from the EIP-4844 KZG ritual.

- Devnet #10 will offer a large validator set with 330,000 active validators. There will be a large number of validator deposits and exits at the genesis of Devnet #10, changing the flow limit of validator inputs from 5 to 4 within a day or two of network launch.

Busa emphasized that developers are still working to resolve big issues in Dencuns testing process. Until these questions are answered, the developers will not proceed with the launch of Devnet #10, which will likely be Dencun’s last Devnet before activating the upgrade on public Ethereum testnets such as Goerli.

Core developer Tim Beiko asked developers if they would be willing to upgrade the Goerli testnet after the release of Devnet #10. Busa recommends waiting for the results of Devnet #10 before deciding on next steps for testing the upgrade.

Additionally, Danno Ferrin, one of the advocates of EOF, stressed that he hopes EOF will be a major code change included in the post-Cancun/Deneb upgrade (Prague/Electra). The main purpose of EOF is to create a new container format for EVM code. He also said that as more and more smart contract developers adopt EOF, the current EVM may slowly be deprecated.

Regarding the testing progress of EOF, Ferrin explained that the specification of EOF has not yet been finalized, which is why no clients have implemented the upgrade yet. However, he expects testing of EOF to be very stand-alone and relatively simple, as the scope of EOF only changes the execution of the EVM.

2. Voice of the Community

According to data from Glassnode, the number of Ethereum whales holding at least 1,000 ETH (worth approximately $1.5 million) has been on a sharp downward trend since 2020, with 20 million ETH being sold.

Bitcoin whales, on the other hand, have been quietly accumulating. The number of addresses holding at least 1,000 BTC (approximately $26.9 million) has remained largely unchanged over the same period (although there have been a few sharp drops, possibly due to profit-taking following the FTX crash or the 2021 bull run).

It’s worth noting that Glassnode’s data, and the conclusions it draws, appear to be incomplete. Kunal Goel, senior research analyst at Messari, believes that the above data does not take ETH staking into account, explaining: “Transfers to the staking contract may look like an on-chain sale, but it is not.”

André Dragosch, head of research at crypto asset manager Deutsche Digital Assets (DDA), echoed Goel’s sentiments. He noted that the percentage of ETH supply in smart contracts has been increasing “in tandem”.

Dragosch emphasized that Glassnode does not include ETH tied in smart contracts into the whale supply metric mentioned earlier; in fact, the percentage of ETH supply held by the top 1% of addresses has not declined at all. (Decrypt)

3.Project trends

Arkham posted that even after Tornado Cash was sanctioned by the U.S. Treasury Department in August 2022, it remained the largest cryptocurrency mixer on Ethereum. In the past 30 days, $77.35 million in assets was transferred on the Ethereum mainnet via Tornado Cash. Tornado Cash runs on 7 different blockchains and can mix 10 cryptocurrencies, with the most mixed coins being native ETH on the Ethereum mainnet. At its peak in July 2021, the Tornado Cash mixing pool contract held over $700 million in ETH. After being sanctioned by the U.S. Treasury Department, assets in Tornado Cash fell by more than 60% and transfer volume also dropped significantly. Tornados TVL currently stands at approximately $187.9 million.

(2) Circle launches native USDC on Polygon PoS

According to official news, Circle has launched native USDC on the Polygon PoS mainnet, accessible to developers and users (no bridging required). Circle Mint and Circle API currently fully support Polygon PoS USDC. According to previous news, Circle stated that it will stop supporting deposits and withdrawals bridging USDC through Circle accounts and its APIs on November 10. Circle accounts and their APIs will only support native USDC at that time.

Pending the launch of native USDC, the Ethereum bridge form of USDC on block explorers such as PolygonScan will be renamed USDC.e. Ecosystem DApps will also be contacted to make corresponding modifications to their application UI and documentation. Circle reminds that after November 10th, users should no longer send bridged USDC.e to their Circle accounts, as it may be unrecoverable and result in the loss of funds.

(3) Decentralized stablecoin protocol Reserve launched on Base

Decentralized stablecoin protocol Reserve has been launched on Base, marking its first deployment outside of the Ethereum mainnet. The protocol has a TVL of $24 million on Ethereum. The move enables users to create their own “RToken”, a decentralized stablecoin, flatcoin (pegged to the cost of living) or a tokenized index using Reserve’s Asset Backed Currency Factory on lower-cost Base. These assets are backed by a basket of over-collateralized ERC-20 tokens.

Reserves collateral options on Ethereum and Base include major stablecoins, Ethereum and wrapped Bitcoin, which can be used individually or from Compound, MakerDAO, Aave, Convex, Curve, Morpho and Flux Finance, the project said Earn profits from the agreement. (The Block)

(4) Ethereum validators wait for the queue to be cleared

Beaconcha.in data shows that the current queue of active validators on Ethereum has been completely cleared. In early June, the queue of Ethereum validators once exceeded 96,000 people, with a waiting time of 45 days.

(5) The Ethereum Foundation sells 1,700 ETH

On October 9, on-chain data showed that the Ethereum Foundation sold 1,700 ETH in exchange for approximately 2.76 million USDC. This was also its largest single transaction in 2023. The foundation still holds approximately 316,000 ETH. and 215,000 WETH.

According to a report by IntoTheBlock, the Ethereum blockchain’s network fee revenue fell to its lowest level since April 2020, down 90% from its high in May this year. The report states that Layer 2 was developed to help Ethereum scale, which will also help reduce fees. While this development is positive for Ethereum users as they can execute transactions more cheaply than before, it affects the supply of Ethereum by keeping inflation in check by burning fewer tokens than are newly issued. Data shows that over the past 30 days, ETH supply has increased by 33,500 coins, worth approximately $52 million, due to low blockchain activity. (CoinDesk)

(7) The ETH/BTC exchange rate continues to fall, hitting a 15-month low again

The ETH/BTC exchange rate fell to 0.05663, reaching its lowest level since July 2022, according to TradingView data. This ratio has dropped by nearly 30% since Ethereum implemented Merge in mid-September last year.

(8) ProShares will launch short Ethereum futures ETF

Bloomberg ETF analyst James Seyffart posted on the The fund does not directly short ETH and aims to profit from falling prices in the asset. Analysts say the SEC expedited approval of all long/legacy Ethereum futures ETFs but set this one up for a normal/anticipated date, with its filing filed alongside other ETFs in August.