At the end of January, the IV volatility of BTC options was very high, and everyone’s expectations for volatility in January were very high; if you still want to buy options, it is recommended that you also consider buying February options.

Current mood:

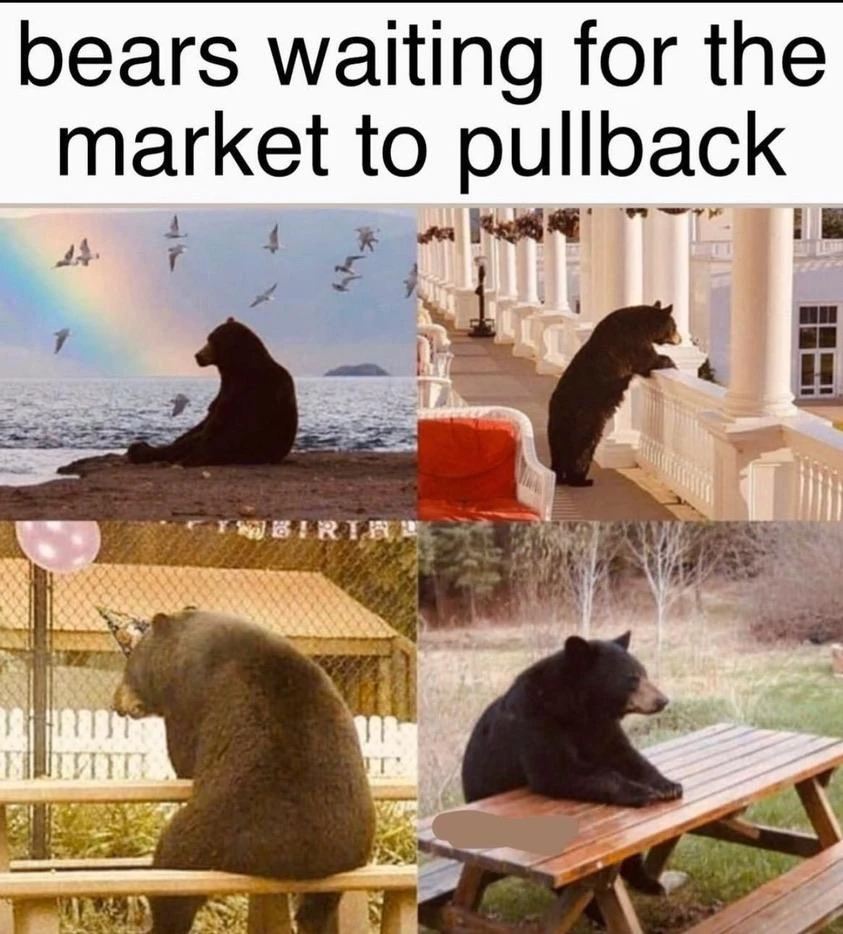

As November comes to an end and the year-end holidays are approaching, risk appetite still firmly controls price trends, and the market continues to rise slowly but continuously; lets take a quick look at the performance of each asset class over the past month:

Against this backdrop of rapid easing of asset performance and financial conditions, some might think that market participants should be in a celebratory mood and feel optimistic about the outlook, but conversely, many market observers and commentators appear to remain pessimistic, Many still predict that a recession is coming, and as the slowdown deepens, central banks will be forced to adopt aggressive easing policies. Whatever the reason, there is always reason for macro to complain.

There were no macro events that caused market ripples yesterday. Following Waller’s unexpected dovish remarks on Tuesday, the Fed’s Bostic, Mester and Barkin’s comments were more balanced. The main conclusion the market drew from Waller was that “as inflation slows, the Fed will Cut interest rates, prompting another strong rebound in fixed income in early trading.

With the market pricing in a full rate cut by May next year and the 2-year Treasury yield falling another 9 basis points, Powell will participate in a fireside chat at Spelman College at 11 a.m. New York time on Friday. In the pre-prepared question and answer session, will Powell try to refute market expectations for loose policy? Or will he give a gentle nod to market pricing by reiterating his stance of neutrality? This is the sixth time this cycle that the bond market has tried to go against the Fed. What do we call crazy? Doing the same thing over and over again and expecting different results. Fortunately, the markets memory is very short.

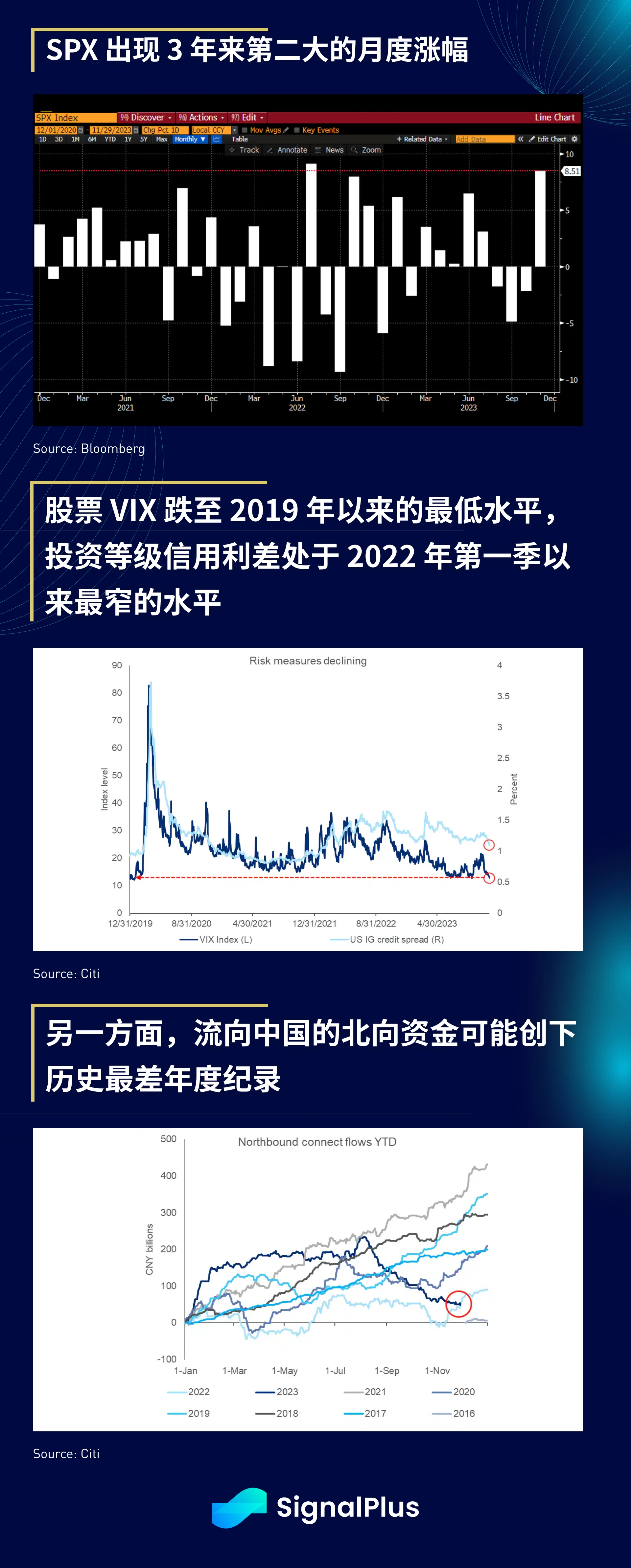

Cryptocurrency price trends are similar, with prices remaining at recent levels and difficult to break through recent highs; Directional Easy accounts still continue to see strong buying orders for BTC spot exposure, and BTC spot prices try to challenge 38k, but volatility fails to rise accordingly.

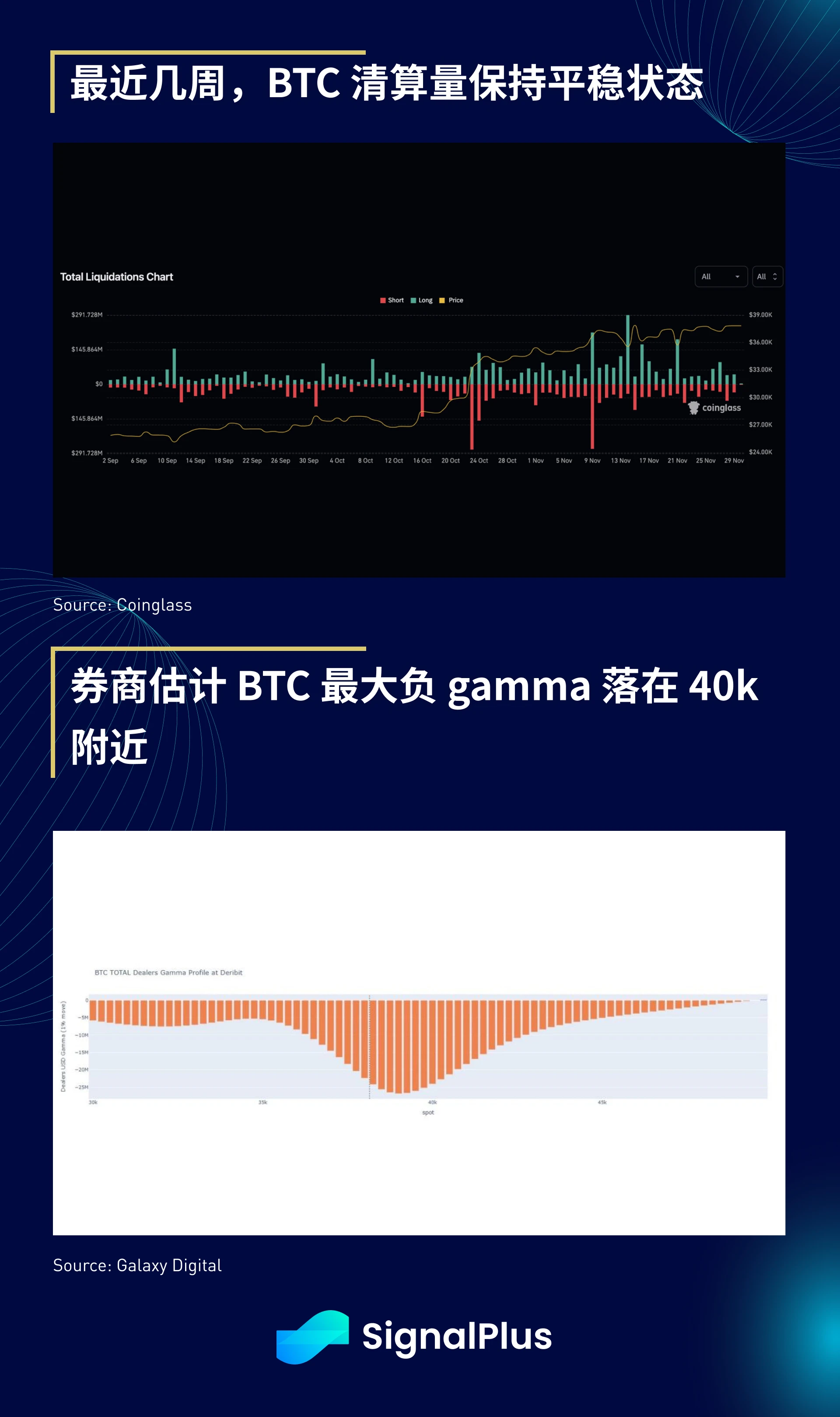

Futures liquidation volume has been roughly stable at recent levels. Since brokers estimate that the maximum negative gamma is at 40k, the next more painful level of BTC may fall in the 38.5k-39k range; market risk sentiment remains optimistic, and in the ETF theme Under the fermentation, trading is still biased upward, and interest in institutional participation continues to flow in through CME and Coinbase. The possibility of price increases before the end of the year is still high.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com