I. Introduction

When exploring Bitcoin’s ecosystem, we can divide its projects into three broad categories: mainnet scaling protocols, second-layer solutions, and Turing-complete solutions.The mainnet extension protocol is implemented directly on Bitcoin’s main chain, extending its functionality. Second-layer solutions are built on top of the Bitcoin main chain, providing additional features and improvements, such as increasing transaction speeds and reducing transaction costs. Finally, the Turing-completeness solution introduces smart contract functionality to Bitcoin, allowing it to support more complex applications and open up new areas of Bitcoin use cases. Together, these three categories form a diverse and growing Bitcoin ecosystem. This article will provide a comprehensive analysis around these three categories.

2. Bitcoin main chain extension protocol

(1)Ordinals

(1 Introduction

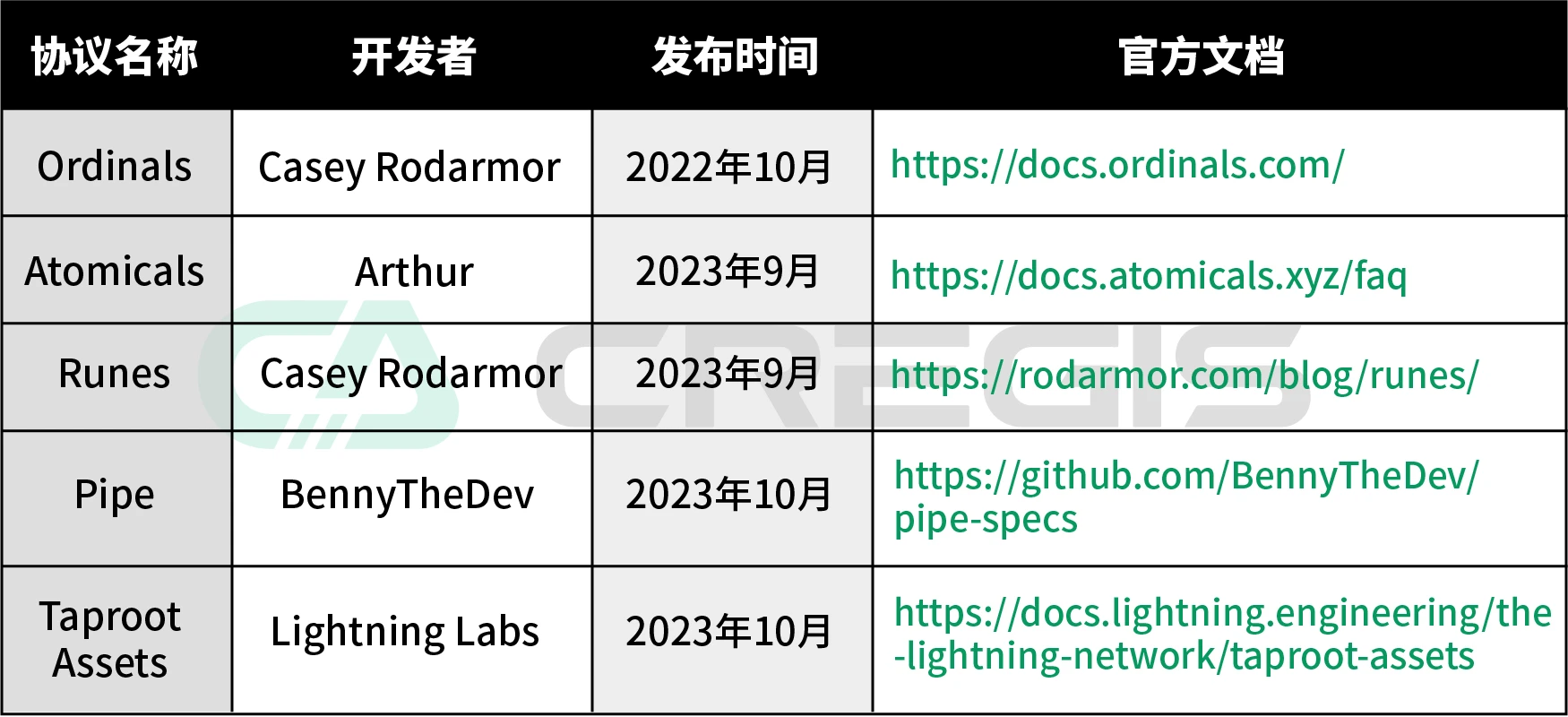

The Ordinals protocol was released by developer Casey Rodarmor in June 2022 on his Github. The ordinals protocol leverages the properties of the Bitcoin blockchain to allow each Satoshi (the smallest unit of Bitcoin) to be uniquely tagged and tracked. The core idea of Ordinals is to provide"inscription"The process of attaching metadata such as text, images, and videos to a single Satoshi to create a unique digital asset. Users can use the open source project ord (https://github.com/ordinals/ord) to achieve on-chain data storage.

(2) Development history

January 2020:Bitcoin core developer Pieter Wuille released BIP 341 and BIP 342 Bitcoin improvement proposals that bring possibilities to todays Bitcoin ecosystem.

June 2022:Casey Rodarmor made technical extensions and expansions to Tapscript in BIP 342, and proposed the technical concepts of Bitcoins Ordinals and inscription to implement the implementation of assigning a unique number to each satoshi and adding comments. Extended functionality.

March 2023:Domodata conducts BRC-20 experiments, and uses the Ordinals protocol and inscriptions function to store json data on the Bitcoin chain to prove the off-chain token balance status, thus realizing the function of issuing tokens to the Bitcoin ecosystem in disguise.

December 9, 2023:The National Vulnerability Database officially codes the Ordinals inscription feature as CVE-2023-50428

(3) Core technology

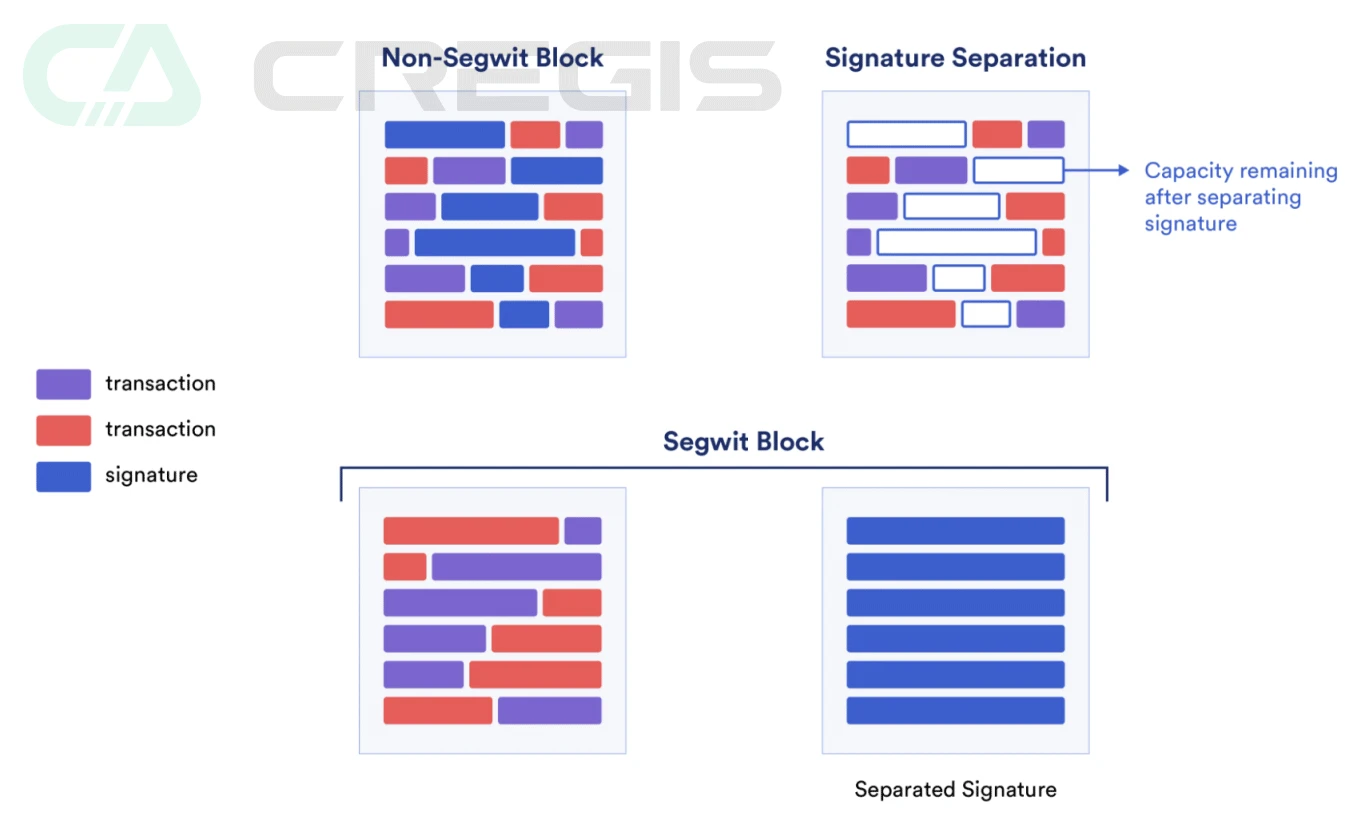

The Ordinals protocol is essentially based on Bitcoins Taproot upgrade and Segregated Witness (SegWit) technology. It stores any data in Segregated Witness through opcodes, thus realizing the on-chain storage function. Currently, the National Vulnerability Database officially lists the “inscriptions” function of Ordinals asCVE-2023-50428 。

The main purpose of the Taproot upgrade is to improve Bitcoin’s privacy and scalability, not to write data to the blockchain. After Taproot is upgraded, when creating a witness script, you can use OP_FALSE, OP_IF and other opcodes to embed arbitrary data in the script as signature data. When a transaction is made, the signature data will be separated from the transaction subject, and any data brought in through the operation code will be stored in the witness data (Witness data).

Ordinals bypasses the data carrier size limit through the above method and stores data with an upper limit of 4 MB in the witness data (Witness data) part of any bit block, realizing the function of casting NFT in disguise.

(4) Application cases

In March 2023, Domodata developed the BRC-20 inscription standard based on the ordinals protocol, using Satoshis (Satoshis) to store and manage various information of tokens, such as token names, symbols, total amounts, etc., and convert this information in JSON format After encoding, it is written into Satoshis (Satoshi) to form inscriptions one by one. Finally, by summarizing the transaction activities of all inscriptions, the balance status of BRC-20 digital assets can be found, thus realizing the deployment, casting and transfer functions of digital assets.

Among the digital assets minted based on the Ordinals protocol and the brc 20 standard, the top three in market value are SATS, ORDI and MUBI. Their market performance is as follows:

(5) Advantages and Disadvantages

The Ordinals protocol has brought both positive impacts and concerns to the Bitcoin ecosystem. The positive impact is mainly reflected in market popularity and miner income.

advantage

Attract users:The combination of the Ordinals protocol and the BRC-20 standard allows users to mint digital assets in the Bitcoin network. For example, the price of ordi has skyrocketed, attracting a large number of users and developers to participate in the Bitcoin ecosystem. At the same time, the number of transactions on the Bitcoin chain increased by 62% month-on-month (MoM) in November 2023, mainly due to Ordinals and BRC-20.

Miner income:The income of Bitcoin miners comes from block rewards and transaction fees. Due to the market popularity of Ordinals and BRC-20, the average transaction fee of each Bitcoin transaction has increased significantly since the beginning of May this year. In March, the pink transaction fee was only 0.19 BTC, 5 It reached 4.85 BTC in the month.

shortcoming

Data on the chain:The data stored via the Ordinals protocol is additional non-financial data that will be included in the blockchain forever. Those wishing to run a full node will need to spend more hard drive space. Over time, the requirements to run a Bitcoin full node will continue to increase, leading to a greater concentration of full nodes on the verification chain.

transaction fee:The emergence of Ordinals will increase the cost for node operators to run full nodes, increase transaction fees, increase the burden on the chain, and may have a negative impact on users who want to conduct on-chain transactions.

(2) Atomics

(1 Introduction

The Atomics protocol was developed by Arthur and released in September 2023. Atomics’ mission is to “permanently return control of personal digital sovereignty and solidify Bitcoin’s status as a proof-of-work beacon.”

The Atomics protocol is based on BTC UTXO for minting and dissemination, 1 token = 1 sat. The Atomics protocol integrates the ARC-20 minting standard and can be used through its open source tool atomicals-js (https://github.com/atomicals/atomicals-js) to realize the minting function without resorting to third-party tools and minting standards (such as the BRC-20 standard) to implement the asset minting function.

At the same time, Atomics is an asset casting protocol based on proof of work, which requires computer CPU mining to obtain digital assets. Compared with Ordinals+BRC-20, the asset minting method using gas has a higher technical threshold and will not bring additional burden to the Bitcoin network.

(2) Development history

June 2022-March 2023:The Ordinals protocol + BRC-20 standard brings new vitality to the Bitcoin ecosystem.

September 2023:Arthur once developed domain name DID-related projects on Ordinals, discovered the limitations of Ordinals, and then systematically redeveloped the Atomics protocol.

September 21, 2023:The first token “ATOM” based on the Atomics protocol was released and was mined within 5 hours.

December 13, 2024:Arthur, the author of the Atomics protocol, was interviewed to share the recent developments of the Atomics protocol. Called “Atomics Protocol, it was originallyRealm system(for correlating network address and resource information), the project aims to revolutionize the problem of online identity and naming.

December 14, 2024: The mainstream ARC-20 token in the Atomics protocol ecosystem experienced a general rise. The price of ATOM once exceeded $13, setting a record high.

(3) Core technology

The Atomics protocol is upgraded based on Taproot and enables the casting of digital assets by engraving json data in UTXO. In each UTXO of Bitcoin, information representing a specific asset can be embedded, such as the number, type, etc. of the token.

1 Satoshi = 1 Token

The Atomics protocol is different from Ordinals, which was originally designed for NFTs. It rethinks how to mint digital assets on Bitcoin from the ground up. It uses Satoshi, the smallest unit of Bitcoin, as the basic atom. The UTXO of each Satoshi represents the Token itself, forming a binding relationship of 1 Satoshi = 1 Token, which means that the value of each token will never be less than one. The value of Satoshi.

Transaction verification

In Atomics, transaction verification only requires querying the UTXO corresponding to Satoshi on the BTC chain. In addition, ARC 20 Token maintains the same atomicity as BTC itself, and its transfer calculation completely relies on BTCs basic network processing, thereby reducing dependence on third-party sequencers and enhancing the decentralized nature of the system.

Exchange of BTC and ARC 20

ARC-20 uses Satoshi units in the Bitcoin network to represent each token, which can be split and combined just like regular Bitcoin. ARC-20 tokens can be minted by anyone and transferred to any Bitcoin address type, and work with UTXO-enabled wallets. Since BTC is essentially composed of UTXO, the exchange of BTC and ARC-20 only requires the exchange of the input and output of UTXO.

proof of work

Bitwork mining is a concept in the Atomics protocol, which essentially introduces a proof-of-work mechanism that mines tokens through CPU/GPU mining.

(4) Application cases

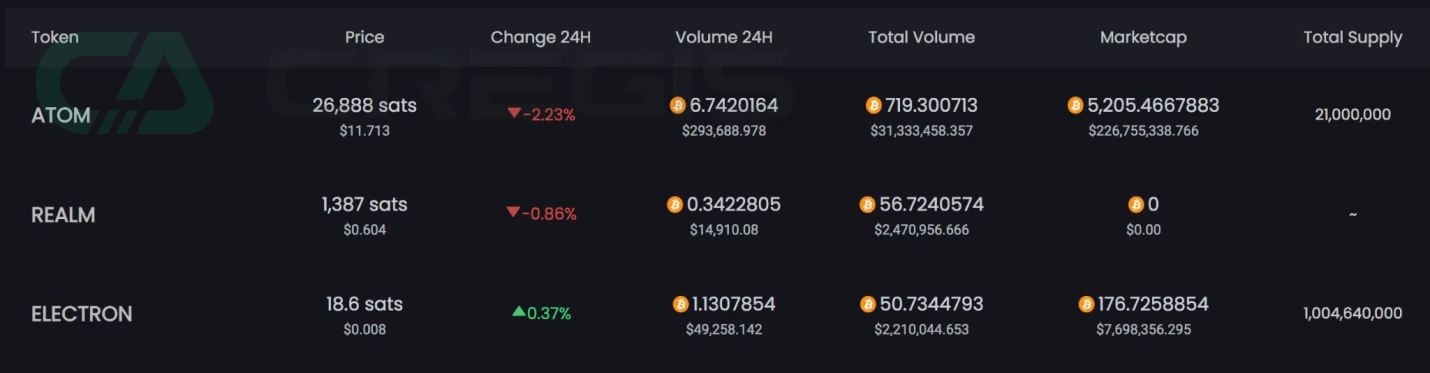

The Atomics protocol will be launched in September 2023. ARC-20 and REALM are still in the early stages of development and need to wait for improvement from the community and developers. The top three digital assets based on the Atomics protocol are ATOM, REALM and ELECTON by market value. Their market performance is as follows:

(5) The difference between Atomocals and ordinals

(3) Runes and Pipes

(1 Introduction

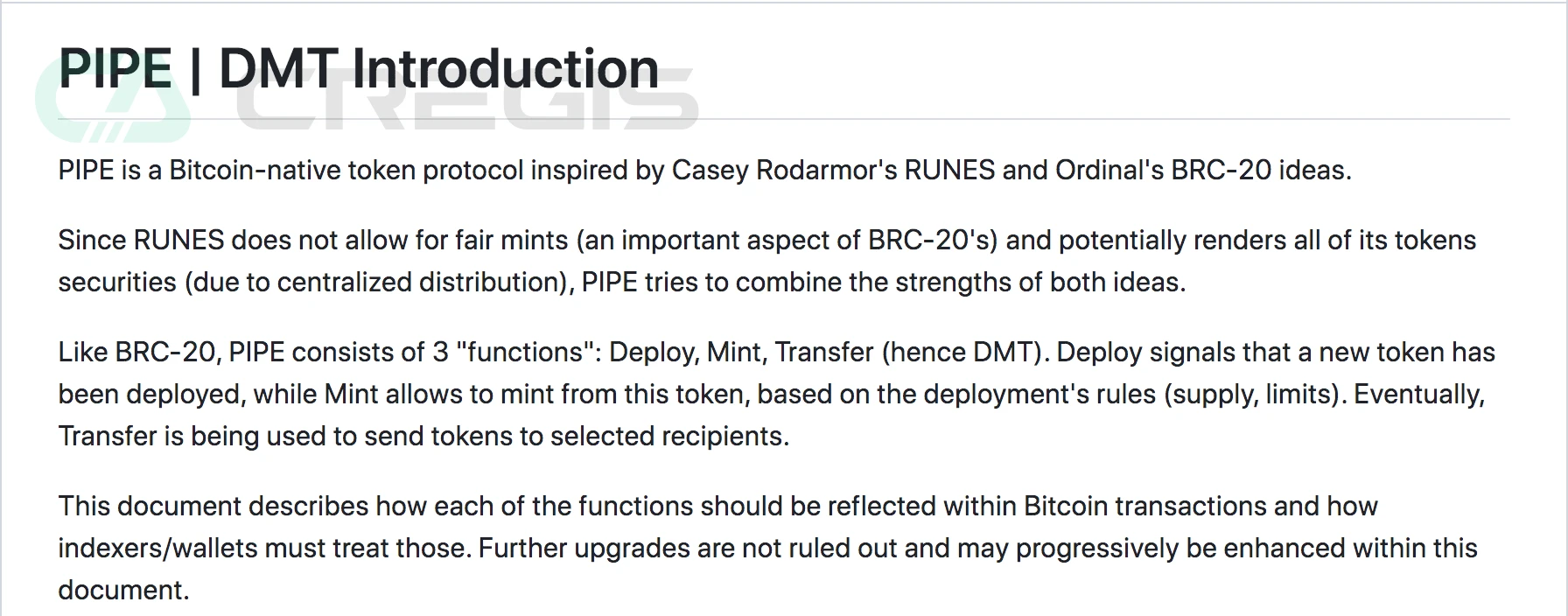

The Runes protocol and the Pipe protocol are both minting protocols of the Bitcoin network, but the former is a technical idea, while the latter is the technical implementation of the former. The Runes protocol was a technical idea proposed by Ordinals developer Casey Rodarmor and published on his personal blog. The Pipe protocol is a usable protocol written by BennyTheDev based on the technical ideas of Casey Rodarmor.

Pipes protocol design is very similar to ARC 20. It also writes minting data (deployment, minting, transfer) directly to UTXO, and then transfers the transfer directly to the Bitcoin mainnet for processing.

(2) Development history

September 26, 2023:Ordinals developer Casey Rodarmor announced on xRunes protocolblog post.

September 27, 2023:BennyTheDev is based on Casey Rodarmors Runes and Ordinals and the BRC-20Pipe protocol

November 2, 2023:Casey Rodarmor said in a space that development of the Runes protocol will be suspended and he will continue to focus on optimizing the Ordinals protocol.

(3) Application cases

BennyTheDev, the author of the Pipe protocol, is alsoTrac Systemthe founder of. Trac Systems lists the Pipe protocol as an important part of its ecosystem.

(4) Taproot Assets

(1 Introduction

The Taproot Assets protocol (formerly taro) was released by Lightning Labs in October this year. The Taproot Assets protocol supports the issuance of stablecoins and other assets on Bitcoin and the Lightning Network.

The Taproot Assets protocol treats the Bitcoin mainnet as a Token registry, only writes token information in the UTXO of the Bitcoin mainnet, and does not store token transfer, minting and other functions. Information about all assets issued by the Taproot Assets protocol is kept by the Taproot Assets universe, which keeps information about issued assets, quantities and rules, and keeps evidence about recent transfers.

(2) Development history

In October 2023, Bitcoin second-layer infrastructure developer Lightning Labs released the Taproot Assets protocol on the main network, supporting the issuance of stablecoins and other assets on Bitcoin and the Lightning Network.

November 15, 2022: Lightning Labs releases taro v 0.1.0

May 16, 2023: Lightning Labs releases Taproot Assets v 0.2.0

October 18, 2023: Lightning Labs announced on the official x that Taproot Assets v 0.3.0 version is the first mainnet version, through which digital assets can be issued on the chain in an expanded manner.

(3) Core technology

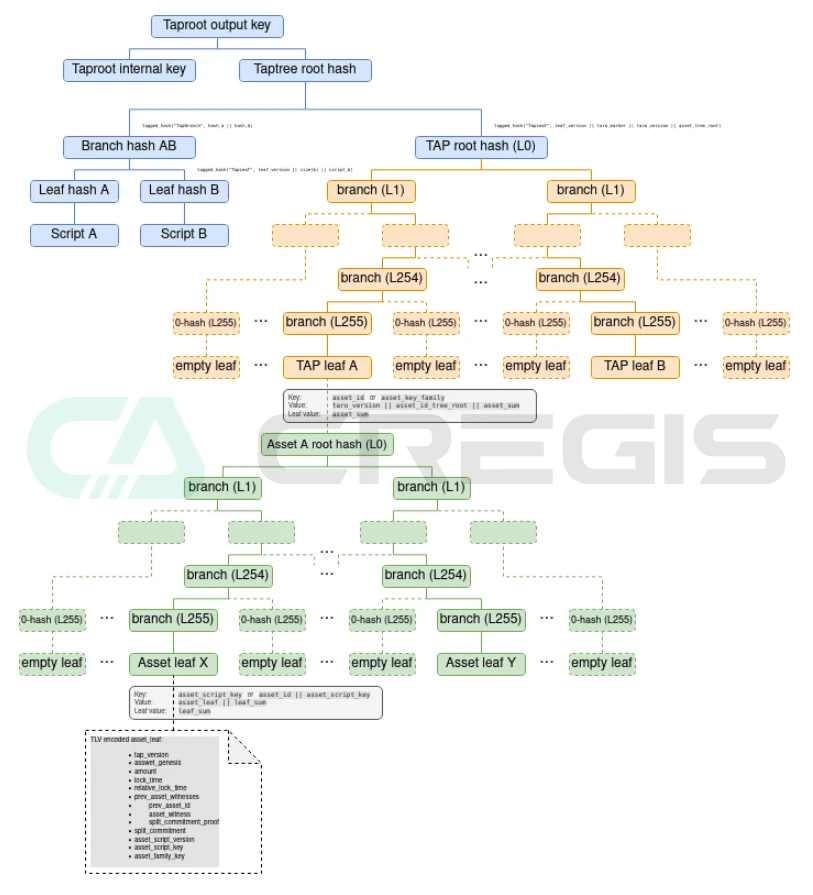

Taproot Assets is a Bitcoin on-chain protocol designed based on Taproot upgrade. Taproot Assets uses Merkle Sum, Sparse Merkle Tree (MS-SMT) and Taptweak to commit information that defines the creation and ownership of assets. Taproot Assets relies on Taproot to implement a new tree structure that allows developers to embed arbitrary asset metadata in existing outputs.

Creating assets under the Taproot Assets framework requires executing a single on-chain root transaction (Taproot transaction), in which there is no limit on the number of assets that can be minted and the number of accounts that can hold them. To achieve asset transfer, you need to reorganize the Merkle tree and publish a new on-chain transaction. This single on-chain transaction can reflect an unlimited number of internal Taproot Assets transactions.

With this approach, funds are allocated to account holders, and when trading Taproot Assets, all movement and allocation of funds are recorded in this single on-chain transaction. In this way, Taproot Assets allows complex asset management and transactions on the Bitcoin network and Lightning Network.

(4) Application cases

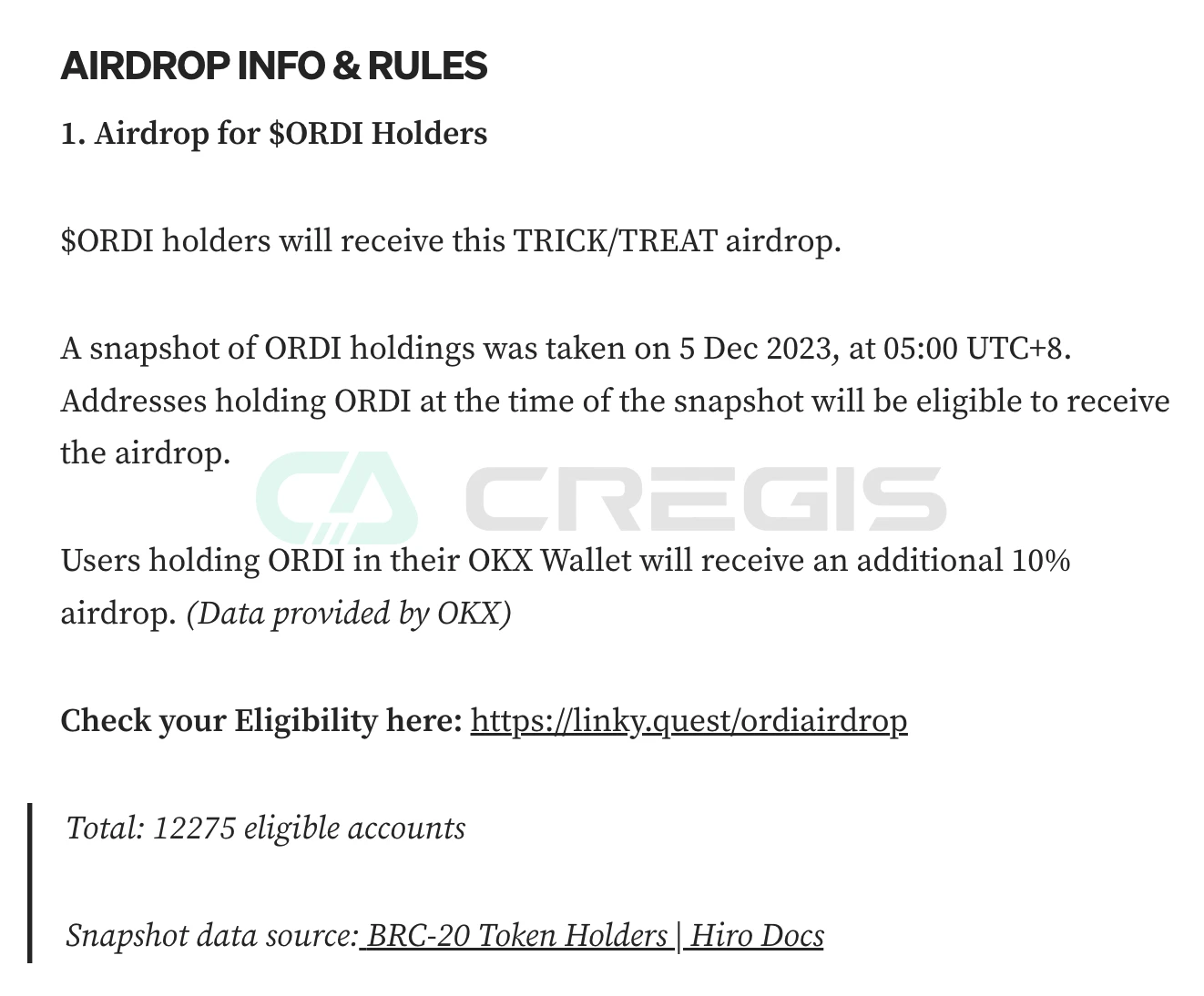

At present, the Taproot Assets ecosystem is still in the early stages of development, and there are few mature projects. One of the most famous projects is Nostr Assets. Nostr Assets has now created a total of two tokens, Trick and Treat, and issued airdrops to ordi holders.

(5) Advantages and Disadvantages

advantage

Low transaction costs:Taproot Assets is integrated with the Lightning Network and does not completely rely on the Bitcoin main network to operate. Therefore, these assets must be deposited into the Lightning Network before they can be traded, so transaction costs are lower than on the main network.

The main network resources occupy less resources:Taproot Assets only stores token information in UTXO on the Bitcoin main network, and does not store functional information such as token transfers.

shortcoming

Centralization:The tokens of Taproot Assets rely on a third-party storage indexer. Without the storage indexer, these tokens will be lost forever. Therefore, users need to run the Bitcoin full node and Taproot Assets client independently, otherwise they will completely rely on the centralized server to trade Taproot Assets tokens.

Distribution method:Users cannot directly mint tokens on the Bitcoin main network on their own, but require the project party (one address) to mint all tokens at once, and then transfer the project partys address to the Lightning Network for distribution. The project party itself can also reserve tokens.

3. Bitcoin second-layer solution

(1) Lightning Network

(1 Introduction

Lightning Network is a second-layer network solution for Bitcoin based on off-chain state channels. It is designed to solve the scalability issues of the Bitcoin network, allowing for faster, more efficient and cheaper transactions.

(2) History

February 2015:Joseph Poon and Thaddeus Dryja released a draft of the Lightning Network white paper.

May 2017:Blockstream’s Christian Decker makes the first complete, secure Lightning payment on a non-test network, and the first Lightning payment on Litecoin, sending a micropayment that is typically impossible or economical on the blockchain, fully settled In a fraction of a second.

January 2019:Twitter user hodlonaut tested the Lightning Network in a game-like promotion, sending 100,000 satoshis (0.001 Bitcoin) to trusted recipients, with each recipient adding 10,000 satoshis ($0.34 at the time) to the next. A trusted recipient. “Lightning Torch” payments have benefited high-profile individuals, including Twitter CEO Jack Dorsey, Litecoin creator Charlie Lee, Lightning Labs CEO Elizabeth Stark, and Binance CEO Changpeng “CZ” Zhao, among others. The Lightning Torch was passed 292 times before reaching the previously hardcoded limit of 4,390,000 satoshis. The final payment from the Lightning Torch was made on April 13, 2019 as a donation of 4,290,000 satoshis ($217.78 at the time) to Bitcoin in Venezuela, a non-profit organization that promotes Bitcoin in Venezuela.

June 2021:The Legislative Assembly of El Salvador voted to pass legislation making Bitcoin legal tender in El Salvador. The decision is based on the success of El Zonte’s Bitcoin Beach ecosystem, which uses Lightning Network-based wallets. The government launched a wallet using the Lightning Network protocol while giving citizens the freedom to use other Bitcoin Lightning wallets.

(3) Core technology

Andreas Antonopoulos calls the Lightning Network a second-layer routing network. Payment channels allow participants to transfer funds to each other without exposing all their transactions on the blockchain. This is done by punishing uncooperative participants. When opening a channel, participants must submit an amount (in a funds transaction on the blockchain).

If we assume that there is a vast network of channels on the Bitcoin blockchain, and that all Bitcoin users participate in this graph by opening at least one channel on the Bitcoin blockchain, then it is possible to create a near infinite number of channels within this network Quantity transactions.

(4) Application cases

Cryptocurrency exchanges such as Bitfinex and Kraken use it to enable deposits and withdrawals. Laszlo Hanyecz, who became famous in the cryptocurrency community for paying 10,000 Bitcoin for two pizzas in 2010, purchased two more pizzas using the Lightning Network in 2018 and paid 0.00649 Bitcoin.

(5) Advantages and Disadvantages

advantage

Atomic Swap:Atomic swaps were first introduced by Tier Nolan in 2013 on the BitcoinTalk forum. Nolan outlined the basic principles of cross-chain cryptocurrency exchange using simple cryptocurrency transactions across different types of blockchains.

Granularity:Some implementations of the Lightning Network allow payments smaller than a satoshi, the smallest unit on the Bitcoin base layer. Routing fees paid to Lightning Network intermediate nodes are typically priced in milliseconds or msat.

Privacy:The details of individual Lightning Network payments are not publicly recorded on the blockchain. Lightning Network payments can be routed through many consecutive channels, and each node operator can see the payment through their channel, but if they are not adjacent, they will not be able to see the source or destination of those funds.

Speed:The settlement time for Lightning Network transactions is less than a minute and can be measured in milliseconds. In comparison, the Bitcoin blockchain’s confirmation time occurs on average every ten minutes.

Transaction throughput:There is no fundamental limit to the amount of payments that can occur per second under the protocol. Transaction volume is limited only by the capacity and speed of each node.

shortcoming

Channel closed:The Lightning Network consists of two-way payment channels between two nodes, which are combined to create smart contracts. If either party abandons the channel, the channel will be closed and settled on the blockchain.

Fraud monitoring:Due to the nature of the dispute mechanism of the Lightning Network, all users are required to constantly observe whether there is fraud in the block chain. Therefore, the concept of Watchtower was developed, and trust needs to be outsourced to watchtower nodes to monitor fraud.

(2) stacks

(1 Introduction

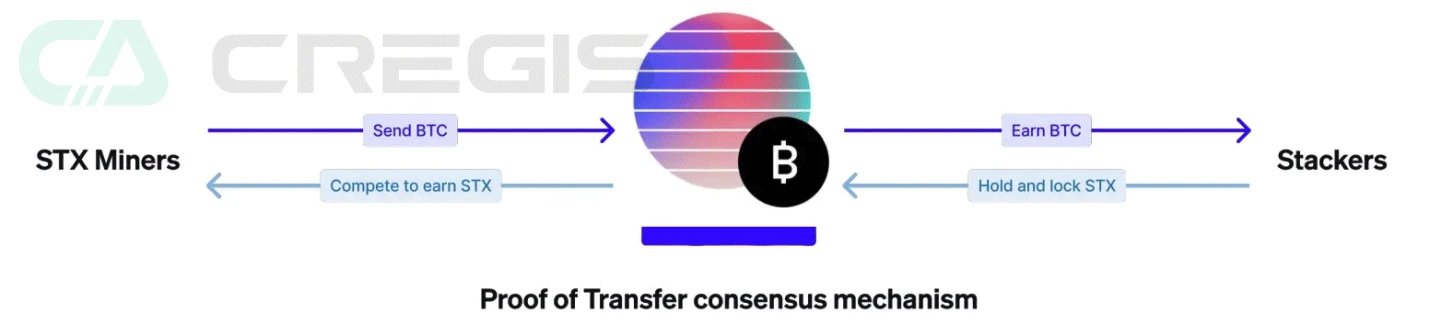

Stacks is a second-layer network solution for Bitcoin based on sidechains. The initial version was released in early 2021. The goal is to expand the functionality of Bitcoin while maintaining its core features such as decentralization and security. Stacks essentially builds a new chain outside of the Bitcoin chain, with an independent governance structure and transaction model. Compared with Ethereums second-layer solution Rollup, Stacks uses the PoX (Proof of Transfer) consensus algorithm, and transaction verifiers need to pledge STX tokens (mining BTC), while miners need to pledge BTC (mining STX) on the Bitcoin main chain. .

(2) History

year 2013:Muneeb Ali and Ryan Shea founded Stacks while studying computer science at Princeton University.

2017:Stacks released a public alpha version of the Blockstack browser, which has garnered significant public and investor support and launched a $47.4 million token offering at the end of the year.

2018:More than 360 applications are developed using Stacks. Riding on market popularity, Stacks’ token offering raised $23 million. In addition to the huge amount of money, this is also the first SEC-certified token issuance in U.S. history.

2019:Stacks 2.0 is all in beta development.

January 2020:The release of Stacks 2.0 marks a new turning point for Stacks, which introduces smart contracts, POX (Proof of Transfer), and Stacking.

Launching in early 2021:The mainnet of Stacks 2.0 is online.

2022:Stacks continues to focus on improving development, growing the community, and introducing new ways to interact with the Bitcoin network

Q4 2023-Q1 2024:roll outNakamoto upgrade

(3) Core technology

The technical architecture of Stacks includes a core layer and a subnet. Its core layer interacts with the Bitcoin layer based on the PoX (proof of transfer) mechanism. PoX is a stake pledge similar to PoS. The interaction process between the two is as follows:

STX miner:In the Stacks network, STX miners participate in leader elections by sending transactions on the Bitcoin blockchain. This process involves a verifiable random function (VRF) that randomly selects the leader for each round. In this process, miners increase their chances of becoming the next block leader by offering higher Bitcoin bids. Once elected as leader, miners will create and record new blocks on the Stacks blockchain.

Stacking for STX holders:STX holders can participate in consensus and earn Bitcoin rewards by participating in a process called “Stacking.” In this process, users lock their STX tokens for a period (approximately two weeks) while running or supporting a full node and sending useful information on the network via STX transactions. STX holders who actively participate in Stacking will receive Bitcoin rewards in the corresponding period based on their contribution to the network.

(3)Rootstock

(1 Introduction

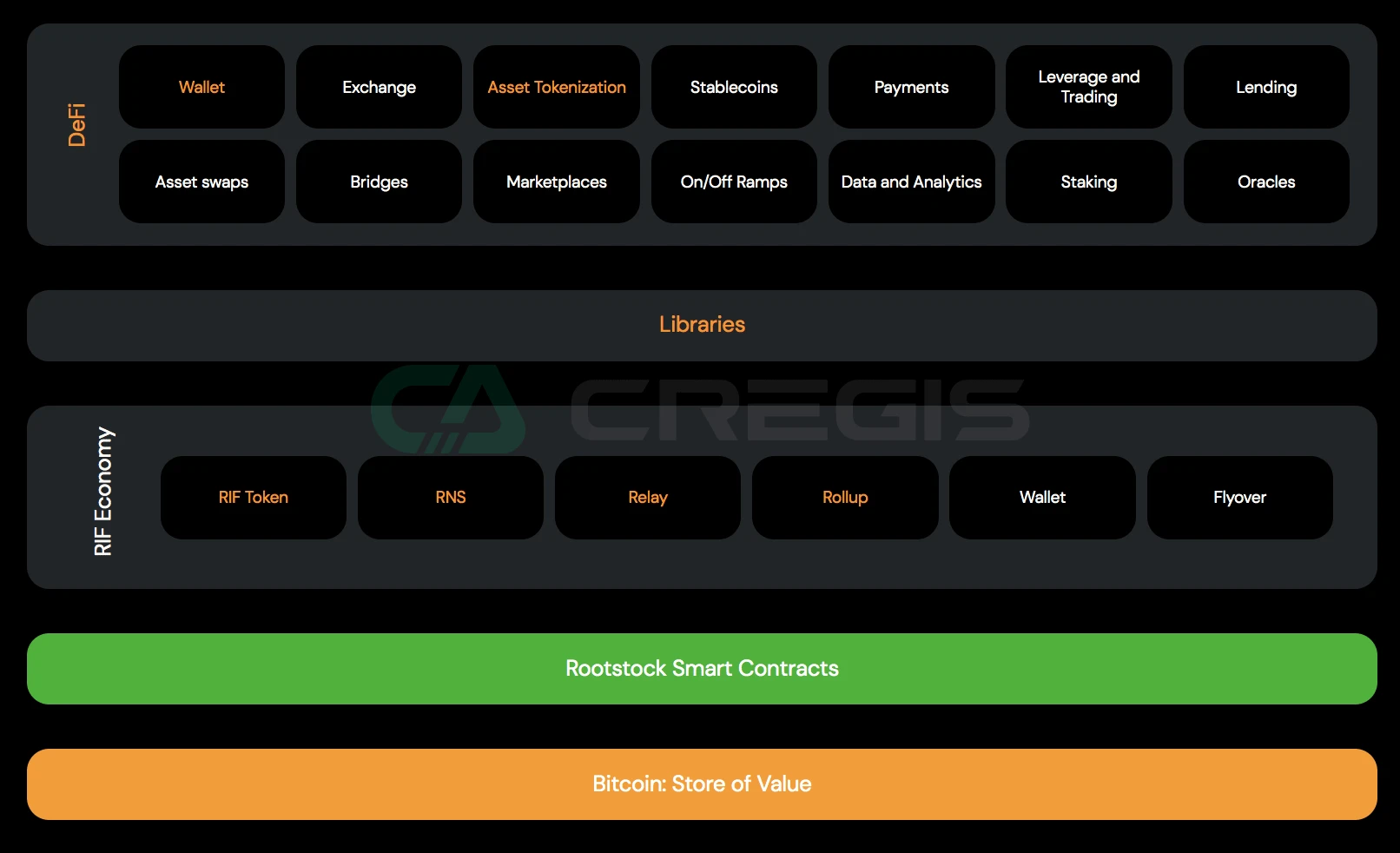

Rootstock (RSK) is a Bitcoin second-layer network solution based on sidechains developed by RSK Labs. It was launched on the Bitcoin mainnet in 2018 and introduced smart contract functionality. As an EVM-compatible sidechain on the Bitcoin network, RSK allows developers to build dApps and smart contracts using the language of Ethereum and integrate into the Bitcoin ecosystem.

(2) History

2015:RSK technical white paper released.

2016:RSK Labs (later renamed IOV Labs) was established.

January 2018:The RSK mainnet is online, realizing functions such as two-way anchoring of Bitcoin, joint mining, transaction transfer, and smart contract deployment.

November 2018:RIF Labs issues RIF OS through the RSK smart contract platform and merges with RSK at the same time. This project extends the RSK protocol and adds various P2P functions.

May 2019:A core component of RIF, the Lumino network, was released and RIF Labs subsequently changed its name to IOV Labs.

February 2023:IOVLabs launches RIF Flyover protocol to facilitate BTC transfers between the Bitcoin mainnet and RSK sidechain.

May 2023:IOVLabs launches $2.5 million grant program to support Rootstock adoption.

(3) Core technology

The project architecture of Rootstock (RSK) can be briefly summarized into the following three core components:

Merged mining:RSK allows Bitcoin miners to mine Bitcoin and RSK blocks simultaneously, increasing the earning potential for developers. Since RSK and Bitcoin use the same proof-of-work (PoW) consensus mechanism, miners are able to mine both blockchains simultaneously. This method of merged mining not only improves miners’ profitability but also maintains the security of the Bitcoin blockchain.

Powpeg:This is a two-way bridge for transferring Bitcoin between Bitcoin and the RSK blockchain. Implemented through RSK’s asset smartBTC (RBTC), the bridge allows users to seamlessly transfer funds between the two blockchains at no additional cost.

RSK Virtual Machine (RVM):RVM is based on the Ethereum Virtual Machine and allows the execution of Ethereum smart contracts on RSK. This provides developers with a platform coding in Solidity to build Ethereum-compatible applications on RSK.

RIF OS (Root Infrastructure Framework Open Standard) is built on Rootstock and provides developers with a series of infrastructure and services, supporting DeFi, storage, domain name services and payment solutions. RIF OS aims to lower the threshold for developers to adopt blockchain technology and promote the development of a fair market for decentralized infrastructure services by providing open and decentralized tools.

(4) Liquid

(1 Introduction

Launched by Blockstream in 2018, Liquid is a second-layer network solution for Bitcoin based on sidechains. An important component of Liquid is its solution for Bitcoin DeFI, which allows users to use decentralized financial services powered by the Bitcoin blockchain by sending Bitcoin to Liquid.

Liquid pegs itself to Bitcoin via a peg system that operates independently of the Bitcoin network. Liquid has the L-BTC or Liquid Bitcoin native token, which is created by locking Bitcoin into multi-signature wallets managed by a consortium of different members. Assets on a sidechain are pegged at a 1:1 ratio to the value of the native asset they represent, allowing anyone to use their tokens and coins on another blockchain.

(2) History

October 2018:The Liquid Network is launched by Blockstream and the world’s largest cryptocurrency exchange and trading desk (Liquid was only around this time)

July 2019:Lightning Network supports Liquid Network

January 2020:Liquid network supports BTCPay Server

July 2020:Liquid Alliance reaches 53 members

August 2021:Received US$210 million in Series B financing, with valuation reaching $3.2B

January 2022:Liquid Federation membership increases to 63

October 2023:Blockstream launches Greenlight for scalable, unmanaged Lightning integration

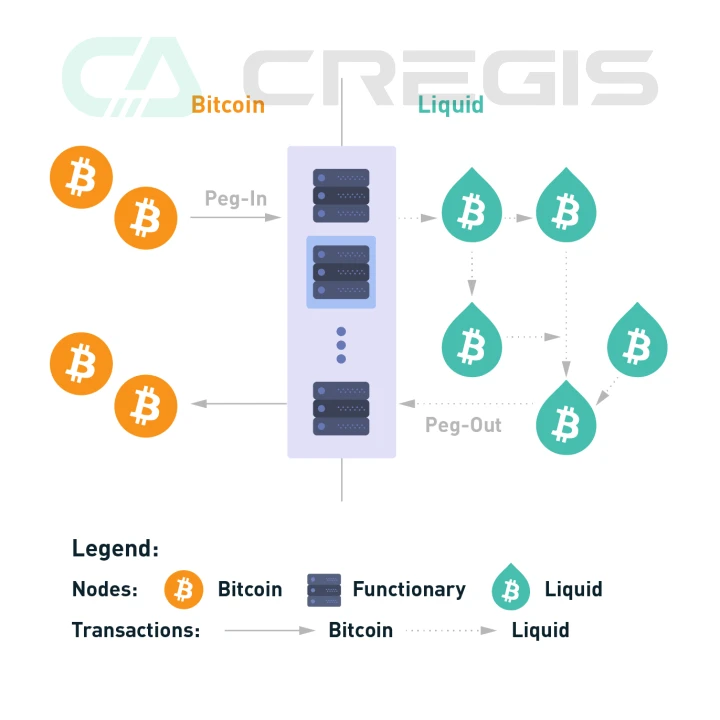

(3) Core technology

Liquid is essentially a side chain of Bitcoin. It transfers Bitcoin from the main chain to the side chain at a ratio of 1:1. It can also transfer tokens on the side chain back to the main chain at a ratio of 1:1. Through side chains, we can achieve functions that cannot be achieved by the main chain without changing the original blockchain. Such as fast transfers, private transfers, and smart contracts.

The Liquid Network operates via 2-way peg (two-way peg) technology, allowing BTC on the main chain to generate an equal amount of L-BTC on the side chain. Transfers on the Liquid network are made via L-BTC, a digital currency pegged to BTC at a 1:1 ratio. Users obtain L-BTC by locking Bitcoin (peg-in), and after completing 102 Bitcoin block confirmations, an equal amount of L-BTC is generated on the Liquid network. With L-BTC, users can enjoy the Liquid network’s fast transfers. Transferring L-BTC back to BTC (peg-out) only requires two Liquid Network block confirmations, but must be done through a Liquid Network member institution. Liquid network members are responsible for generating blocks, similar to miners in the Bitcoin network. They generate one block every minute, with fast transfer speed and reliable time. Members of Liquid Network include Bitfinex, OKCoin, Huobi, etc. The full membership list can be viewed on Liquid.net.

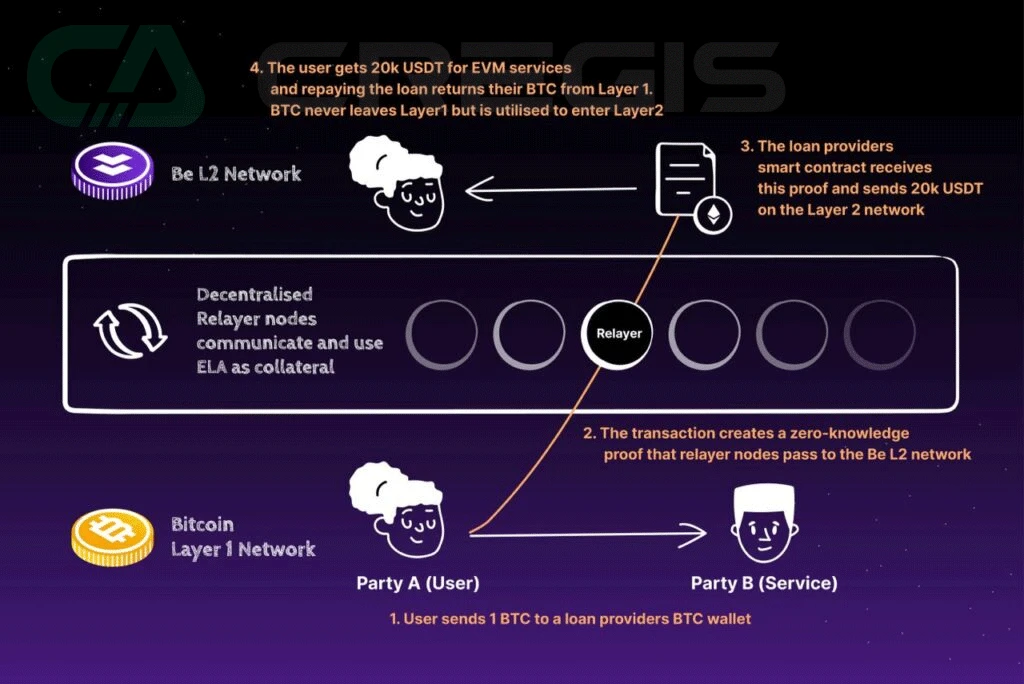

(5) Be L2

(1 Introduction

Elastos announced on November 25 that it plans to launch the Bitcoin second-layer network Be L2. The announcement stated that Be L2 will enhance Bitcoin’s functions without changing the core principles of Bitcoin, such as transaction speed, Smart contracts and privacy protection.

(2) Development planning

Elastos’ Be L2 will release a white paper this December. The Be L2 white paper will detail the operating mechanism and one-year product planning. The proof of concept technology will be completed in the first 3 months, followed by the decentralization of the repeater in the next 3 months, and then integrated into Hero products.

(3) Architecture

Zero knowledge proof:In the Be L2 network, zero-knowledge proof technology will be used. When a Bitcoin user conducts a transaction, the system will generate a special certificate to prove to the Be L2 second-layer network that the transaction did occur without disclosing the specific content of the transaction, such as the identities of the parties to the transaction, the amount of the transaction, and other information. In this way, the verifiability of transactions and user privacy are guaranteed.

Relayers and staking mechanisms:The Be L2 network will use relays to transmit and verify transactions on the Bitcoin network. The staking mechanism is used to incentivize and supervise relay operators to ensure network security.

Smart contract functions:Be L2 will introduce smart contract functions and expand the application examples of Bitcoin. Be L2 is secured by Elastos SmartWeb’s DAO Council member Cyber Republic and is voted on annually by its global community using ELA, its mined reserve currency merged with Bitcoin.

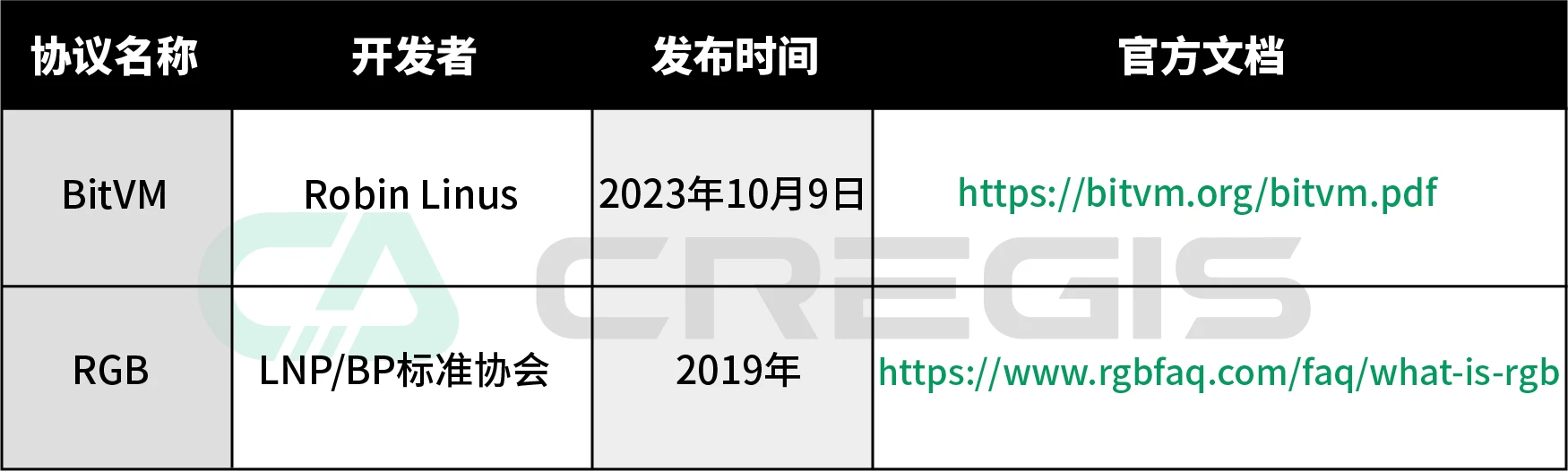

4. Bitcoin Turing Completeness Solution

(1) BitVM

(1 Introduction

Robin Linus, the leader of the ZeroSync project, published a paper on BitVM on October 9 (BitVM: Compute Anything on Bitcoin). Simply put, BitVM is the virtual machine of the Bitcoin network. Through off-chain execution and on-chain verification, it achieves Turing completeness without changing the consensus rules of the Bitcoin network.

(2) The difference between BitVM and EVM

There are still big differences between BitVM and Ethereum smart contracts. Ethereum smart contracts can support multi-party transactions, but BitVM is designed to only support two-party transaction exchanges. Most of BitVMs transaction processing is performed off-chain, minimizing the impact on the underlying Bitcoin blockchain; unlike BitVM, EVM is an on-chain engine and all operations are performed in the native environment of Ethereum in progress; BitVM is an optional add-on engine for the Bitcoin blockchain and does not require BitVM for its own operation. In contrast, the EVM is an integral part of the Ethereum blockchain; without the EVM, there would be no Ethereum.

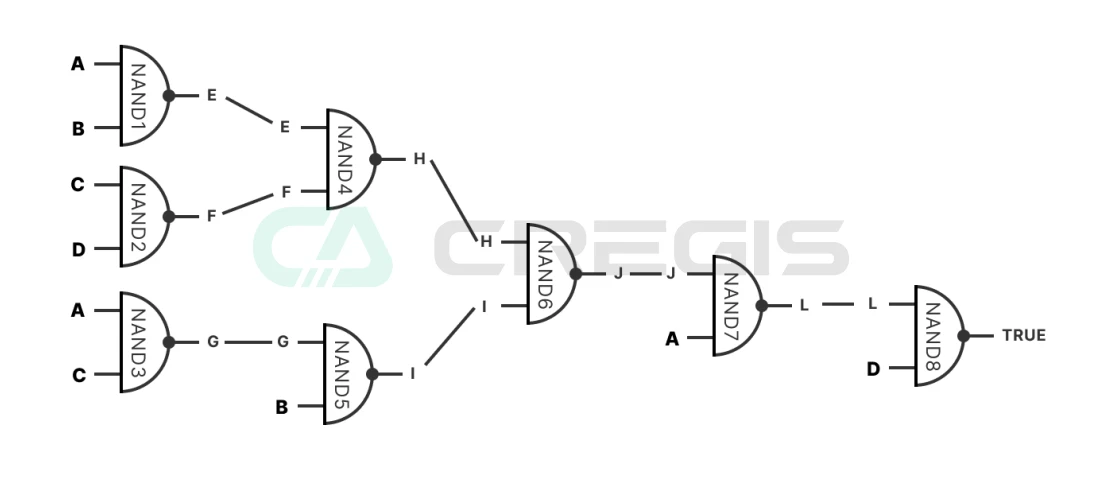

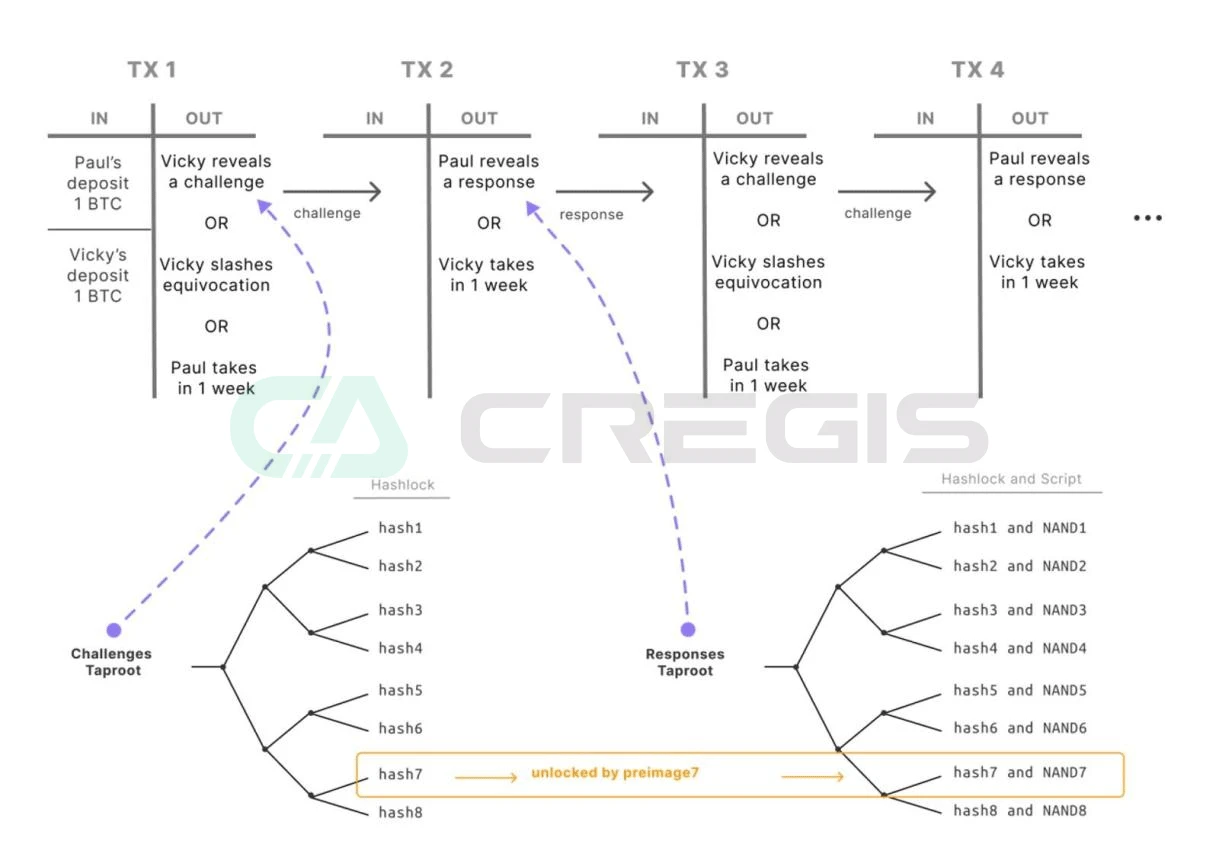

(3) Core technology

BitVM functionality is enabled through the Bitcoin Taproot upgrade. BitVM mainly relies on the taproot address matrix (taptree), which is similar to the program instructions of a binary circuit. Under this framework, the UTXO spending conditional instructions in each Script script are regarded as the smallest unit of the program, generating 0 or 1 through specific code in the taproot address, forming a taptree. The execution result of the entire taptree is a binary circuit text effect, which is equivalent to an executable binary program. The complexity of the program depends on the number of combined taproot addresses. The more addresses there are, the richer the preset instructions of the Script, and the more complex the program that taptree can execute.

Most of BitVMs processing is performed off-chain, and transactions processed off-chain are bundled into batches and published to the underlying Bitcoin blockchain, utilizing a validity confirmation model similar to that used in Optimistic-rollups. Meanwhile, BitVM uses a model that combines fraud proofs with a challenge-response protocol to process and verify transactions between two parties (certifiers and verifiers). The prover initiates a calculation task and sends the task through the channel established between itself and the verifier, and then the verifier confirms the validity of the calculation. Once verified, the transaction is added to the overall batch collated for publication to the underlying Bitcoin blockchain.

(2) RGB

(1 Introduction

RGB is maintained and updated by the LNP/BP Association and is a smart contract system that supports the Bitcoin network and Lightning Network. The RGB protocol proposes a more scalable, private, and future-proof solution, the cornerstone of which was proposed by Peter Todd in 2017Client-side validation and single-use-sealsthe concept of.

(2) History

2016: Giacomo Zucco first proposed the RGB concept based on Peter Todd’s ideas

2017: Original version released by BHB Network, with support from Poseidon Group

2019: Maxim Orlovsky and Giacomo Zucco established the LNP/BP Standards Association to promote the development of the RGB protocol into practical applications, with Dr. Maxim Orlovsky redesigning the protocol.

2021: The LNP/BP Standards Association demonstrates the Turing-complete virtual machine (AluVM) for the RGB protocol and starts running on the Lightning Network.

2022: New smart contract language Contractum launched

2023: Release of RGB v 0.10

(3) Core technology

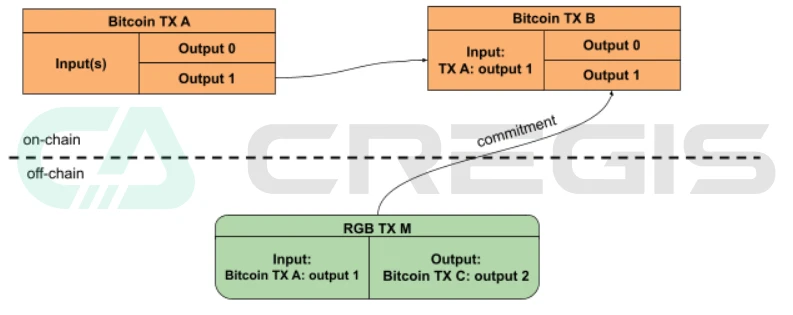

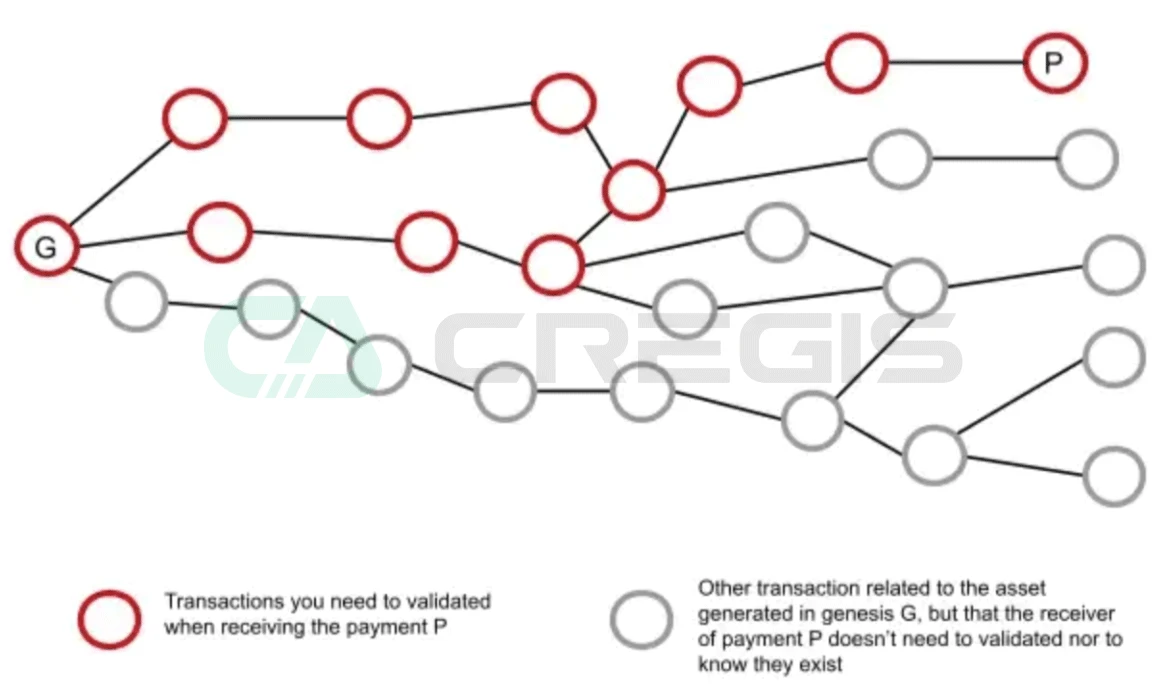

RGBs core philosophy is to use the Bitcoin blockchain only when necessary, leveraging proof-of-work and the decentralization of the network to achieve double-spend protection and censorship resistance. All verification of token transfers is removed from the global consensus layer, placed off-chain, and verified only by the client of the party receiving the payment.

So how exactly does it work? In RGB, basically tokens belong to a Bitcoin UTXO (whether it is an existing UTXO or a temporarily created one), and in order to transfer tokens, you need to spend this UTXO. When spending this UTXO, the Bitcoin transaction must contain a commitment to a message. The content of this message is RGBs payment information, which defines the input, which UTXO these tokens will be sent to, the id of the asset, the amount, Transactions spent and other data that needs to be appended.

(Image source: https://medium.com/@FedericoTenga/understanding-rgb-protocol-7dc7819d305)

The specific payment information of RGB tokens is transmitted off-chain through a dedicated communication channel, from the payer to the recipients client, and the latter verifies that it does not violate the rules of the RGB protocol. As a result, blockchain observers will not be able to obtain any information about RGB user activity.

However, verifying the payment information being sent is not enough to ensure that the sender actually owns the assets being sent to you, so in order to ensure that the sent transaction is final, you must also receive all of the tokens from the payer. The history of a transaction, from the current one all the way back to its original issuance. By verifying all transaction history, you can ensure that the assets have not been inflated and that all spending conditions attached to the assets have been met.

5. Conclusion

2023 is a landmark year for Bitcoin. Compared to first-layer blockchains that focus on smart contracts, such as Ethereum, Bitcoin suffers from certain technical limitations in terms of functionality and application use cases. However, this year, the Bitcoin ecosystem has gained new direction and vitality due to technological innovations, which have brought more application scenarios and possibilities to Bitcoin.

References

https://docs.atomicals.xyz/faq

https://rodarmor.com/blog/runes/

https://github.com/BennyTheDev/pipe-specs

https://docs.lightning.engineering/the-lightning-network/taproot-assets

https://lightning.network/how-it-works/

https://docs.stacks.co/docs/intro

https://dev.rootstock.io/kb/faqs/

https://docs.liquid.net/docs/technical-overview

https://elastos.info/blog/elastos-bel2-bitcoin-layer-2-solution/

https://www.theblock.co/post/255683/bitvm-bitcoin-smart-contracts

https://www.rgbfaq.com/faq/what-is-rgb

https://medium.com/@FedericoTenga/understanding-rgb-protocol-7dc7819d3059

https://www.btcstudy.org/2022/04/24/understanding-rgb-protocol/

https://petertodd.org/2017/scalable-single-use-seal-asset-transfer

https://github.com/bitcoin/bips/blob/master/bip-0341.mediawiki

https://github.com/bitcoin/bips/blob/master/bip-0342.mediawiki

https://github.com/bitcoin/bips/blob/master/bip-0141.mediawiki

contact us

Official website

Discord