As Bitcoin broke through its previous high and once topped $70,000, the bull market seemed to have officially returned.

Spurred by the significant wealth effect, external funds have begun to flow into the cryptocurrency world at an accelerated pace. DefiLlama data shows that as of March 20, the total market value of stablecoins has reached 147.52 billion U.S. dollars, with a weekly increase of 1.05%. Among them, the total market value of USDT has exceeded the 100 billion U.S. dollar mark, and it continues to sit firmly in the competition with a market share of over 70%. Taoist name.

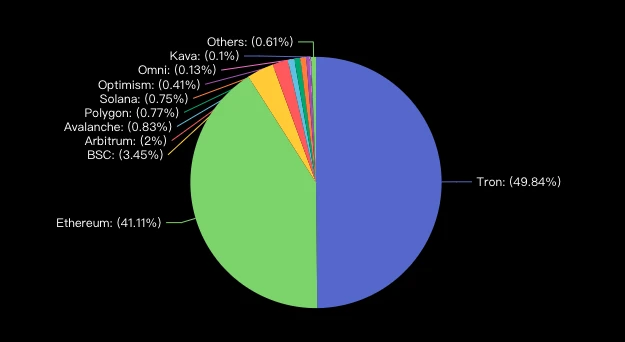

Take a closer look at the issuance status of USDT,The TRC-20 version of USDT issued based on TRON has occupied nearly half (49.84%) of the market share, which is almost equal to the sum of the shares of other chains.

Compared with networks such as Ethereum, TRON has shown obvious advantages in transaction costs, becoming the only blockchain network that achieves excellent both volume and efficiency and is regarded as the preferred solution for the cryptocurrency settlement layer. With the comfortable services provided by TRON, users are less motivated to change their existing usage habits, further consolidating TRON’s dominant position in the settlement layer.

In late February this year, Justin Sun published an article on

now,As the largest issuance base of USDT, TRON has initially formed the prototype of a value settlement layer in the decentralized world.Its high-performance, low-cost blockchain platform provides a stable and efficient settlement system for cryptocurrency transactions, greatly promoting the circulation and trading activities of cryptocurrency. As more and more users choose to trade on TRON, TRONs value in the encryption industry will continue to be highlighted and will surely provide strong support for the development of the entire cryptocurrency industry.

The answer under the numbers: What is the advantage of TRON in the settlement layer?

As Layer 1/Layer 2s own development and inter-chain composability become more mature, their respective basic capabilities as underlying networks to carry the application layer have become relatively homogeneous. However, due to the differences in performance, layout time, and direction, Due to different influencing factors such as emphasis, there are obvious differences in the ecological performance of the major Layer 1/Layer 2.

Taking asset settlement as an example, as one of the main strategic directions of TRON, with its extremely fast confirmation speed and extremely low transaction costs, TRON is not only the largest issuance network of USDT, but also the largest USDT user base at present. The underlying network where value flows most frequently.

The figure below shows a detailed data comparison between TRON and Layer 1 such as Ethereum and Solana, as well as Layer 2 such as Arbitrum and Optimism, taking the supply and circulation related parameters of USDT as an example. The data is taken from mainstream chains such as Tronscan and Etherscan. Browsers and data aggregation platforms such as Dune and GasFeesNow.

Combining the above chart, it can be seen that in terms of magnitude, only Ethereum can currently compete with TRON in terms of supply of USDT. However, there is a certain gap between the number of currency holding addresses and the number of related transactions representing transaction activity and TRON. , there are obvious disadvantages in terms of transaction costs; from a cost perspective, although Solana and Layer 2 such as Arbitrum and Optimism can provide fees equivalent to or even lower than TRON, they have significant disadvantages in terms of supply, number of currency holding addresses, and transactions. However, there is a huge gap of more than one magnitude in terms of the number of pens.

Taken together, TRON is currently the only blockchain network that has achieved “both volume and efficiency”, which also means that TRON can basically be regarded as the only alternative for the current cryptocurrency settlement layer.As mentioned above, due to the current trend of homogeneity in the basic capabilities of Layer 1/Layer 2, with TRON’s existing first-mover advantage and performance, it will be difficult for other ecosystems to catch up - because in TRON Under the comfortable service provided by TRON, users are less motivated to change their usage inertia, which will further consolidate or even amplify TRONs position advantage in the settlement layer.

Of course, as a representative of the settlement layer in the industry, TRON will not just limit its sights to the relatively small circle of cryptocurrency, but will try to shoulder the responsibility of using technological innovation to solve existing pain points in the financial industry. .

Currently, the traditional banking industry still relies on SWIFT, which was founded in 1973, to handle international banking settlements. For many years, SWIFT has been criticized for its processing efficiency of 3-5 working days and its extremely expensive commission charging mechanism.

Relatively speaking,On-chain settlement services represented by TRON have demonstrated many advantages such as being permissionless, open and transparent, low-cost and efficient., however, as the traditional financial world’s acceptance of blockchain technology is still limited, on-chain settlement services have not yet become popular in the traditional financial field in the short term. However, as the public’s awareness of blockchain and cryptocurrency continues to increase, these advantages It will continue to amplify and emerge, so we are still optimistic about the long-term development trend of on-chain settlement services in the financial industry.

Ecological status quo: TVL continues to rise, and protocol revenue reaches a new high

When the market value of public chains exploded in early 2021, we wrote an article on the ecological development of TRON.Observation articles, in that article, we came to the conclusion that since the outbreak of DeFi, the external public chain that has experienced the largest value overflow from the Ethereum network is TRON.

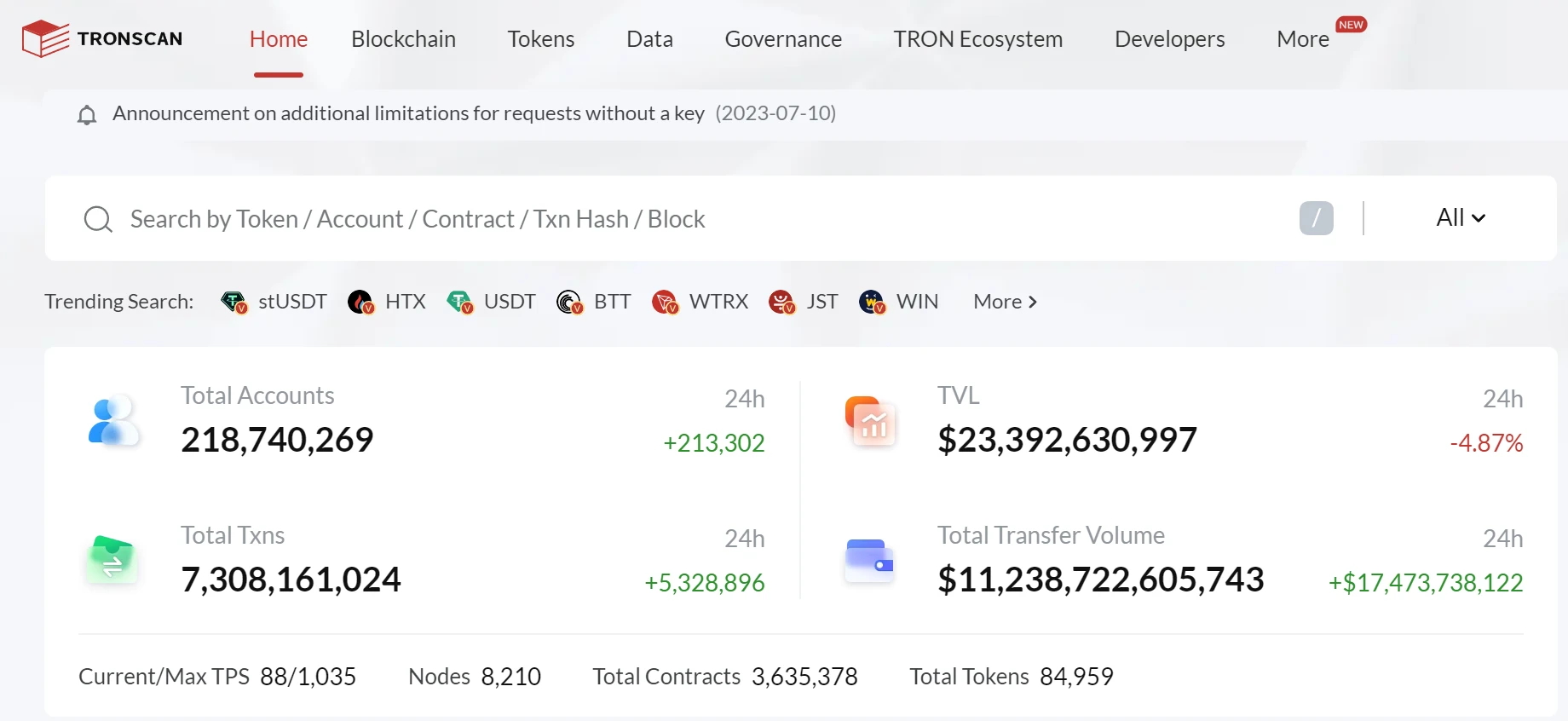

Three years later, we seem to be able to use factual performance to prove the above conclusion.Tronscan data shows that as of the time of publication, the total value (TVL) locked in the major DeFi protocols in the TRON ecosystem has reached 23.3 billion US dollars, ranking second among all Layer 1 and Layer 2, second only to Ethereum.. From a trend perspective, the TVL of the TRON ecosystem has also maintained a relatively steady growth trend.

Currently, TRON has built a complete ecosystem around stablecoins, lending, DEX, LSD, games and many other application directions, and is attracting a large number of active users with its rich application types.

As of March 20, some data provided by Tronscan can intuitively show the current ecological activity status of the TRON network:

The total number of accounts on the TRON network has exceeded 218 million, and the number of active addresses in the past day has exceeded 2.34 million;

The cumulative transaction records of the TRON network have exceeded 7.3 billion, and the number of new transactions in the past day has exceeded 4.76 million;

The number of daily contract calls on the TRON network exceeds 2.3 million times...

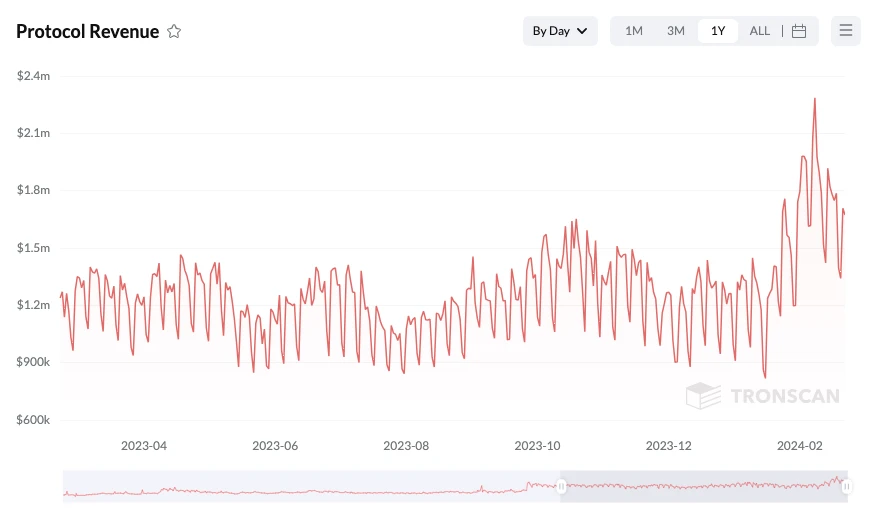

The active ecological situation is bringing huge benefits to TRX stakers.Earlier this month, TRONs single-day protocol revenue reached a record high of 16,800,159 TRX, worth approximately $2,286,203.In addition, according to Tronscan data, TRON’s total protocol revenue in the past year has reached US$458 million.

Stimulated by generous profits, the pledge rate of the TRON network is also constantly increasing, and as more and more users choose to pledge their TRX, the TRON ecosystem is also expected to usher in a positive value cycle :The pledge rate increases and the amount of TRX in circulation decreases - Network security and decentralization improve, and market selling pressure decreases - The ecology becomes more stable, and the potential for currency price increases increases - User activity increases, and the rate of return is expected to continue to increase - The pledge rate continues to increase...

Of course, this will not necessarily be a permanent cycle, but it may allow TRX’s pledge rate and price performance to find a balance at a higher level. In this process, various parties in the TRON ecosystem will All characters will benefit.

In the second half of public chain competition, TRON is already half a step ahead

In the past few years, the on-chain ecosystem has ushered in an explosion of application layers. Represented by application directions such as DeFi, NFT, and GameFi, a large number of public chains such as Ethereum, BNB Chain, Solana, and Avalanche have launched fierce competition, and TRON TRON has participated in this competition from beginning to end and has always maintained its position in the first echelon. Justin Sun has also frequently participated in TRON and multiple DeFi projects in the external ecosystem, directly supporting the development of many early projects with actions.

In October last year, when talking about the future of public chain development, Justin Sun mentioned that the biggest advantage of blockchain is its ability to provide global services. The purpose of TRON development is also to provide services to everyone around the world.

In our opinion, the competition among public chains has just passed the first half. With the approval of ETFs, cryptocurrencies have begun to break out of their own small circles, gradually approaching the traditional world, and then linking to everyone around the world.

Looking to the future, the true integration of cryptocurrency into the traditional world should not just be included as an asset in the investment portfolio of institutions, but should also use its iterative technological advantages to solve some of the inherent problems faced by traditional finance. This will inevitably lead to our The issue of settlement efficiency was mentioned earlier, and in this aspect, TRON has shown sufficient advantages compared to similar competitors.

In the future, TRON may cooperate with international banks to establish a cross-border payment gateway, using TRC-20 USDT as a settlement tool to achieve fast and low-cost cross-border payment services, similar to the cross-border payment solutions that Ripple cooperates with some banks. plan. At the same time, TRON may also cooperate with financial institutions to issue digital bonds based on the TRON network, using smart contracts to realize automated interest payments and bond transaction settlement. Or similar to Alipays smart contract payment solution, TRON cooperates with payment service providers to use smart contract technology to achieve automated settlement and payment services.

In the second half of the competition, TRON is already half a step ahead.