The process of tokenization is to issue a blockchain token for a certain underlying asset to create a corresponding digital asset.

As banks, asset managers and financial market infrastructure continue to use blockchain and distributed ledger technology to expand their underlying financial infrastructure, tokenization technology is bringing about a huge transformation to the global market. Tokenization covers almost all assets and is one of the most promising blockchain use cases.

According to a survey by Bank of New York Mellon and Celent, 97% of institutional investors agree that tokenization will disrupt the asset management industry. In addition, tokenization can also create new financial markets and financial instruments for the capital market. Assets that were previously scattered across various systems and could not be connected can now coexist on the blockchains universal settlement layer.

This article will explore what tokenization is, how it works, and how the Chainlink platform can bring greater functionality and liquidity to the tokenized asset economy.

How tokenization works

The process of tokenization is to issue blockchain tokens for underlying assets such as cash, commodities, debt, financial instruments, and real estate to create corresponding digital assets. In this way, token assets can have more powerful functions and participate in the global financial service ecosystem on public and private chains.

It is worth mentioning that tokenization is not only beneficial to the financial industry, but industries such as international trade , insurance , art and entertainment are also actively adopting tokenization technology.

If you want to learn more about the tokenization process, please read the blog post How to Tokenize Assets

Advantages of Tokenization

Real-time settlement

Smart contracts can ensure instant and automatic settlement of transactions, reduce counterparty risks and enable round-the-clock trading.

In traditional systems, settlement takes several days (e.g., T+ 2), while blockchain can execute transactions instantly (T+ 0). This not only improves market efficiency and accessibility, but also significantly reduces costs and improves performance by leveraging decentralized financial market infrastructure (dFMI) such as blockchain and oracles.

fluidity

Tokenization uses blockchain technology to establish universal standards for the execution and calculation of transactions, thereby greatly improving liquidity and capital efficiency, accelerating capital flows, and unlocking global liquidity pools. Tokenization injects liquidity into illiquid asset classes such as private equity, allowing such assets to participate in a broader on-chain market. In addition, these assets can be seamlessly integrated into the systems of traditional financial institutions.

cut costs

Tokenization simplifies processes and eliminates reliance on middlemen, thus significantly reducing the operating costs of financial markets. During the tokenization process, smart contracts are deployed on the chain, so transactions can be automatically executed and compliance matters can be handled, reducing the management burden and related costs of financial institutions.

Automation can also help reduce costs in transaction processing and asset management. Blockchain is inherently transparent, so it can improve the efficiency of audits and financial reporting.

Expanding asset classes

Tokenization can enrich asset classes for investors, allowing them to invest in asset classes that were previously unavailable or difficult to access. Tokenization lowers the entry barrier for market participants, which not only improves the efficiency of the financial system, but also allows more people to participate.

In addition, tokenization can also divide the ownership of high-value items. For example, in the traditional market, it is difficult to divide the ownership of assets such as real estate into small pieces, but tokenization can easily do this and minimize the holding and transaction costs of each piece of ownership, thus greatly broadening the range of potential investors.

Improve transparency

Tokenization can improve the transparency of all financial ecosystems. Every transaction is recorded in a decentralized ledger and is open to all market participants, so ownership and transaction records can always remain transparent and can be easily verified.

Such high transparency will help reduce market risks, and all stakeholders can view every change in asset ownership or status. Since blockchain is tamper-proof, once data is added to the chain, it cannot be modified, so the transfer and ownership change information of assets will be clearly recorded on the chain.

Tokenization Case

Stablecoins

Stablecoins are stable digital currencies that are anchored to assets with low volatility, such as fiat currencies or gold. These tokens are anchored to underlying assets to maintain a stable value, so they can be used in daily transactions. Stablecoins leverage the transparency and security of blockchain to provide an efficient and scalable solution for faster and cheaper transfers, and can participate in global markets without the need for intermediaries.

Credit

Tokenizing debt means transforming traditional debt instruments into tradable on-chain tokens, which can simplify processes such as insurance, settlement, and trading. This will help improve liquidity and make it easier for investors to buy and sell debt securities. Tokenizing debt can also divide the ownership of debt instruments and allow more qualified investors to participate in these markets.

real estate

Tokenizing real estate means using digital tokens to represent a portion of real estate ownership. Doing so can divide high-value real estate ownership into small portions, which can not only lower the entry threshold to the real estate market, but also improve liquidity, allowing more qualified investors to enter and exit the market, and eliminating traditional market barriers and time limits for real estate transactions.

Commodity

Tokenizing commodities such as oil, gold , or agricultural products means turning the ownership of these commodities into on-chain tokens. Doing so can bring more liquidity and a wider market to these assets, improve the convenience and transparency of transactions, achieve real-time pricing, and reduce the costs associated with storage and transportation.

Qualified investors can directly purchase part ownership of physical commodities without being responsible for storing physical assets, while sellers can open up global markets more efficiently.

Art and Collectibles

Tokenizing artworks and collectibles can create a digital record of ownership for physical goods, ensure the authenticity and traceability of these goods, and sell them to the global market at the same time. Art tokens can help artists and collectors participate in a larger market and divide the ownership of high-value items, lowering the entry barrier for new market entrants. In addition, we can track the ownership history more securely and transparently, combat counterfeiting, simplify the ownership transfer process, and still ensure the security of physical assets throughout the process.

music

Tokenization in the music industry refers to the use of digital tokens to represent music copyrights and royalties. This will transform the way artists and copyright owners manage and monetize their works. After songs, albums or royalties are turned into tokens, artists can retain greater control over their creations and directly earn revenue from sales, licensing, and even secondary market transactions, completely eliminating their dependence on platforms in the traditional music industry.

This will increase the transparency of royalty distribution and ensure that artists and contributors can share royalties more fairly and accurately. In addition, this will unlock a new fan economy model. Fans can purchase tokens linked to music works or future earnings to support their favorite artists.

game

Tokenizing game assets , including turning digital assets in GameFi or the metaverse into tokens, such as game skins, weapons, or game currencies. Doing so will give gamers greater control over their game assets, create a more open game market, coordinate the interests of different participants, and achieve cross-platform compatibility between various game ecosystems.

Related Solutions

Issuing tokens is just the first step. Once token assets are issued on the chain, a series of supporting services are needed to achieve higher levels of programmability and create a robust secondary market. Let’s talk about how the key infrastructure of the Chainlink platform will enhance the on-chain economy.

Chainlink CCIP

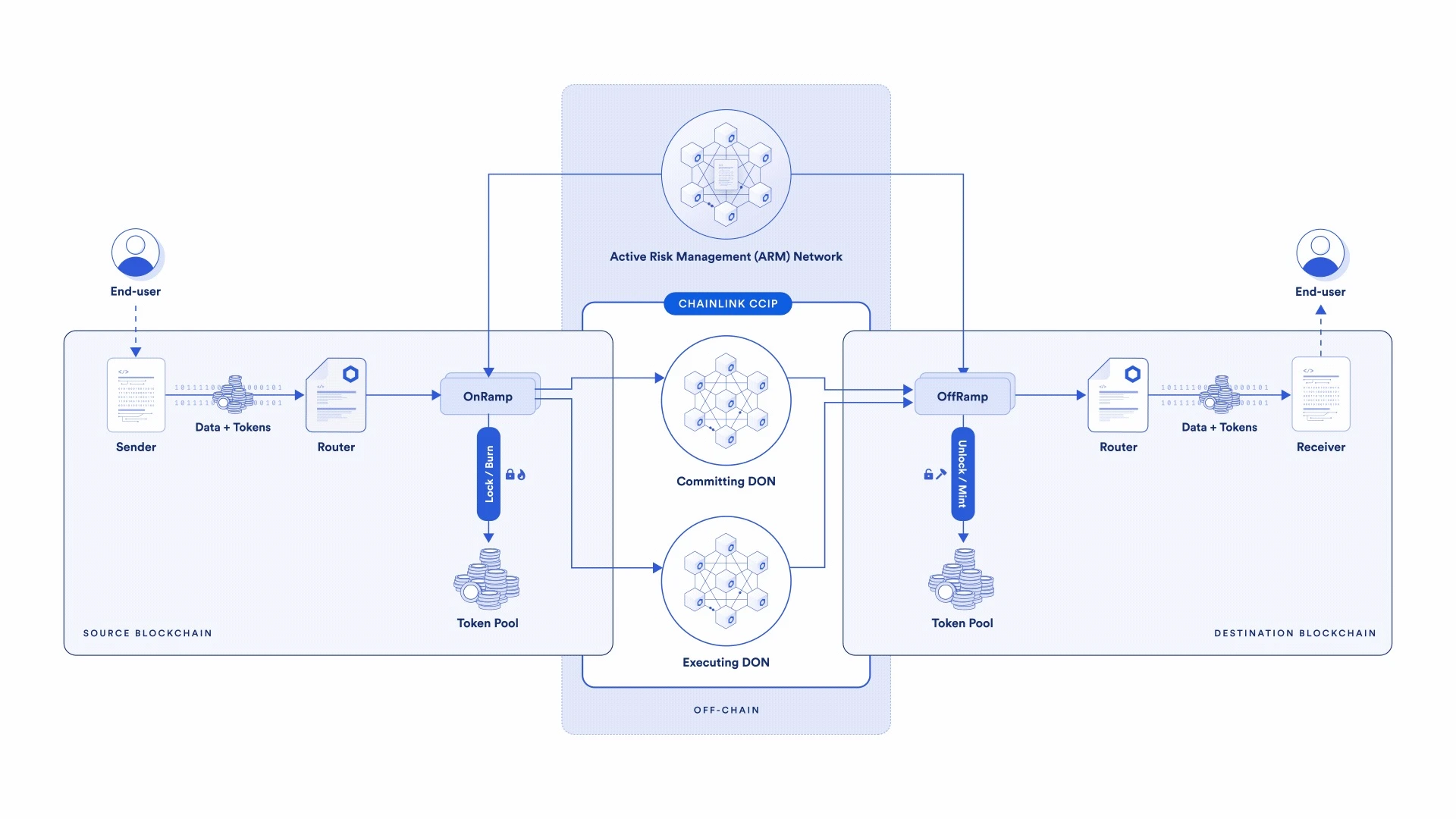

Token assets need to achieve secure cross-chain interoperability to cover users and liquidity on public and private chains. Chainlinks Cross-Chain Interoperability Protocol (CCIP) is the most secure and reliable blockchain interoperability protocol in the industry. CCIP is an abstraction layer for blockchains. Users only need to integrate a unified middleware to directly connect their existing backend systems to various blockchains and interact with token assets on the chain. At the same time, CCIP is also a cross-chain message transmission protocol. Users can transfer data and tokens across various public and private chains.

Overview of CCIP Technical Architecture

Mainstream financial institutions and financial infrastructure providers have begun working with Chainlink to explore blockchain technology and tokenized assets using CCIP, including Swift , the Depository Trust Company (DTCC) , and ANZ .

Chainlink Proof of Reserves

Token assets represent an off-chain asset or asset portfolio on the chain, so they need to transmit off-chain or cross-chain reserve data to fully play their role. Therefore, to improve the security and transparency of token assets, it is necessary to be able to directly verify certain information of the on-chain reserve.

Chainlink Proof of Reserves (PoR) can automatically, reliably, and timely verify the off-chain or cross-chain reserves of token assets. PoR uses a network of oracles to verify cross-chain or off-chain reserves of token assets, enabling transparent on-chain audits for consumers, asset issuers, and other smart contract applications. Chainlink PoR can obtain on-chain data, custodian API interfaces, or third-party off-chain proofs.

Chainlink Data Services

Token assets need to be connected to a range of real-world data sets. Without external data, token assets are useless except for representing corresponding off-chain assets on the chain. Not only does off-chain data need to be transmitted to the chain, but on-chain data also needs to be transmitted to the off-chain to keep the off-chain system synchronized with the blockchain network.

Chainlink provides industry-standard market data for DeFi and has enabled over $10 trillion in transactions for on-chain applications while ensuring security and reliability. Chainlink Data Feeds is based on a decentralized oracle network with well-reputed nodes that aggregate data from high-quality data sources and transmit it to the chain without any single point of failure risk. Chainlink Data Streams is a low-latency oracle solution that provides a transparent and decentralized infrastructure to create a high-throughput DeFi market.

Tokenized Resources

Tokenization is the latest major transformation of financial infrastructure following the financial digitalization revolution in the second half of the 20th century. Financial institutions should prepare for the coming transformation and seize this huge market opportunity.

Want to learn more about tokenized opportunities? Read the Tokenization Industry Report for a comprehensive understanding of the booming tokenization market. This report was co-authored by BCG, 21 Shares, Paxos, Backed, and Chainlink.