introduction

With the development of low-cost L2 and even proprietary chains, the trend from CEX to on-chain derivatives has become unstoppable. Although a series of on-chain derivatives have achieved remarkable results, their market share is still small compared to CEX. Tracing back to its root cause, there is a gap in funds and models between chains and derivatives, which in turn leads to insufficient user usage and conversion rates. The derivatives track urgently needs a force for change.

In response to this, a series of ecosystems and leading projects have launched the derivatives infrastructure organization SOFA.org , whose members include investment management company Galaxy Asia Trading Ltd., Layer 2 Arbitrum, Linea, infrastructure Chainlink, OKX Wallet, SignalPlus, VC OKX Ventures, HashKey Capital, etc. Organization members will contribute to the co-creation and construction of SOFA.org from multiple dimensions , bringing new forces to the derivatives track.

SOFA.org aims to establish a complete clearing and settlement ecosystem to solve the old problems of derivatives. Products within the ecosystem will follow a unified framework to achieve the operation mode of the underlying architecture, middle-level protocols, and the connection between top-level users and funds. In addition, SOFA.org will launch the token RCH to promote the operation of the entire ecosystem through its innovative token economics.

How SOFA reshapes the future of on-chain derivatives

Whether it is the collapse of FTX and 3AC in recent years, or the bankruptcy of traditional finance such as Lehman Brothers, which is further away from us, the opacity risks, leverage risks and counterparty default risks brought by centralized institutions all demonstrate the importance of decentralization.

In the field of Crypto, the trend of migrating derivatives trading from CEX to the chain is also intensifying. Multiple chains have already produced their own leading derivatives protocols, such as GMX, AEVO, etc. Each protocol has its own characteristics and outstanding advantages. However, there are still several problems. First of all, at the capital level, positions are limited to opening and closing positions within the account, which limits the use of funds and is not conducive to the design and use of further combination products. On the other hand, since derivatives involve a large amount of funds, the impact of security risks is far-reaching, so it is difficult for users to fully trust the security of new chains and new protocols, resulting in limited development.

SOFA.org was born to transform the competitive landscape and model of on-chain derivatives. First of all, SOFA.org will use the immutability of smart contracts and the on-chain asset settlement capabilities to ensure that all parties to the transaction do not need to rely on intermediaries. The counterparty transactions between users and market makers will be automatically settled by standardized vaults, realizing the core values of trustlessness and decentralization.

SOFA.org innovatively tokenizes the risks of financial instruments, including not only the nominal amount, but also records other key parameters of the transaction, and converts them into position tokens on the chain. Position tokens represent ownership of assets on the chain and can be freely transferred and used in combination like regular ERC-20 tokens. They can be used as collateral for other protocols, thereby greatly enhancing capital liquidity and utilization efficiency.

In addition to the above features, SOFA.org will cooperate with various ecosystems and market makers to launch a rich variety of on-chain derivatives protocols to meet users security needs, leverage needs, and liquidity needs, and ultimately transform the derivatives system and development path.

Detailed explanation of products and ecological tokens

Ecological Growth Flywheel - Incentive Token RCH

Looking at the entire chain, the number of derivatives agreements has reached a certain scale. How to attract user participation among the numerous competing products?

The fundamental element is to provide good products and services. Through the content described in the previous section, SOFA.org provides users with innovative and practical derivative services, which has become the basis for its market success and prosperity. Another key point that can be fully utilized is the token economic stimulus. Protocols such as dYdX have demonstrated that an effectively designed incentive policy can bring excellent products to a new level.

In response to this, SOFA.org has designed a stable, large-capacity, and fair-distribution token system, which aims to effectively incentivize the use and development of ecological products through the incentive token RCH. The token details are as follows:

Fair distribution: The total amount of RCH is fixed at 37 million, and will be launched on June 7th, without any form of investor and pre-sale allocation . When it goes online, there will be 25 million RCH (about 2/3 of the total) and more than 700 ETH as the initial LP, and the LP will be destroyed when it goes online.

Stable output for incentives: After the token is issued, 12,500 RCH will be airdropped to users trading within the ecosystem every day, and the airdrop amount will be reduced by 20% every 180 days until all RCH airdrops are completed.

Deflation design: In addition, all the fees obtained by the protocols in the SOFA.org ecosystem will be used to purchase RCH on Uniswap and destroy it to achieve total deflation. In addition, all derivative projects that join the SOFA.org Association must add a fee repurchase and destruction mechanism to the protocol, and the deflationary force will continue to increase with the development of the ecosystem.

Based on the above design, RCH has established a stable price floor and will not face selling pressure from VC or other pre-sellers, providing investors with a fair opportunity to participate . The destruction mechanism based on handling fees provides medium- and long-term value for tokens. The long-term operation of the ecosystem will bring long-term upward development power to tokens without fear of short-term fluctuations.

For users, the RCH model will bring them continuous transaction subsidies, and they can obtain additional income while using excellent derivatives protocols. In addition, RCH has long-term storage value. With the development of the ecosystem, the increase in the number of users and transaction volume will further increase the price of RCH, which will then be fed back to the users trading enthusiasm, thus forming a complete growth flywheel for the SOFA.org ecosystem .

Running the basic process

SOFA.org will initially focus on the settlement system and tokenization of crypto structured products, launching Ethereum and Arbitrum, and will subsequently support more EVM-compatible chains such as Linea and X Layer. As mentioned above, a major feature of SOFA.org is that the transaction process is carried out on the chain, eliminating the centralization risk and counterparty default risk. Its basic process can be simplified into the following steps:

Institutional market makers continuously provide real-time prices of structured products to the protocol;

The user chooses to purchase a product based on the displayed price, and the funds are then sent and locked in the product’s DeFi vault (Valut);

The market makers maximum exposure funds will also be sent and locked in the vault. If either party fails to submit the required funds at this time, the transaction will not be executed;

Users and market makers will receive corresponding position tokens, which can be freely transferred and used in combination.

After achieving the basic requirement of decentralization through full on-chain execution, how will SOFA.org build and develop an on-chain derivatives system?

On-chain derivatives protocols

SOFA.orgs answer is architecture standardization and product matrix enrichment . All derivatives protocols that join the SOFA.org Association need to meet two requirements. The first is to write the protocol fee into the RCH repurchase and destruction mechanism, and the other is to meet the design specifications of SOFA.org, so that SOFA.orgs basic clearing facilities can be interoperable on these protocols, and position tokens can also be nested in various protocols within the ecosystem. The standardization of the architecture eliminates some security issues on the one hand, and lays the foundation for the formation of ecological network effects on the other.

Users’ risk preferences vary, and the corresponding derivatives are also complex, so a comprehensive and matching system is needed to link the two. The interoperable architecture provides users with a rich means to build an investment portfolio that meets their risk preferences. For the ecosystem and the protocol, TVL and traffic sharing mean the establishment of bilateral network effects. In addition, the RCH airdrop distribution mechanism helps the protocol achieve a fast cold start and promotes its improvement of product experience and services.

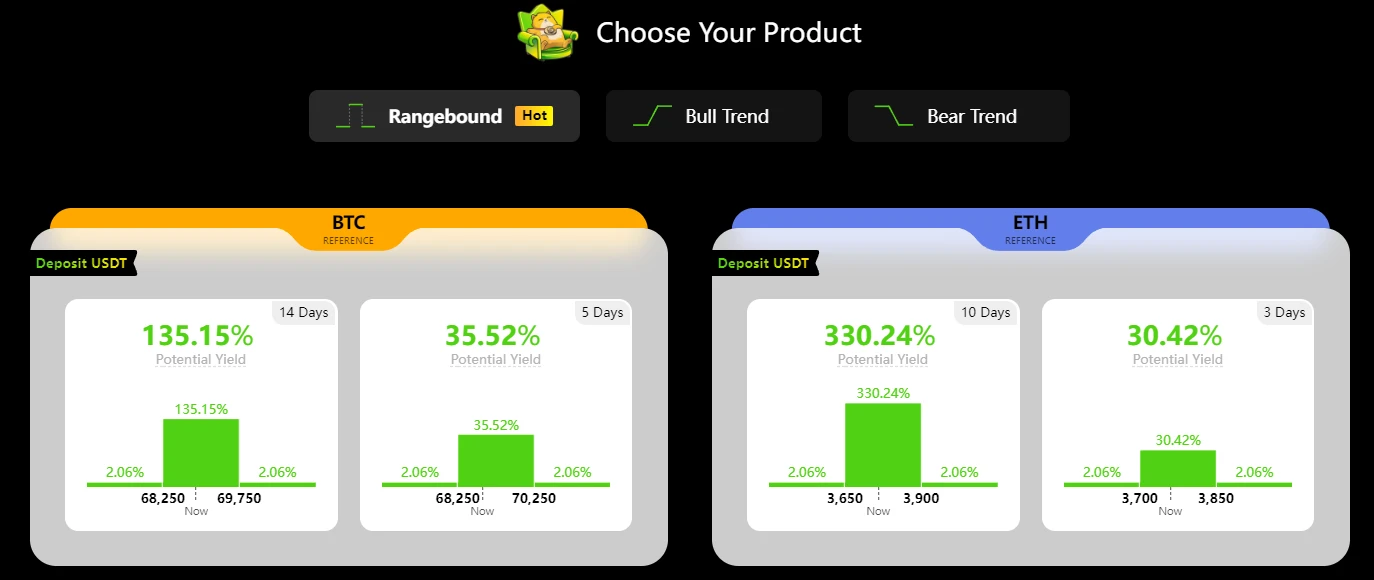

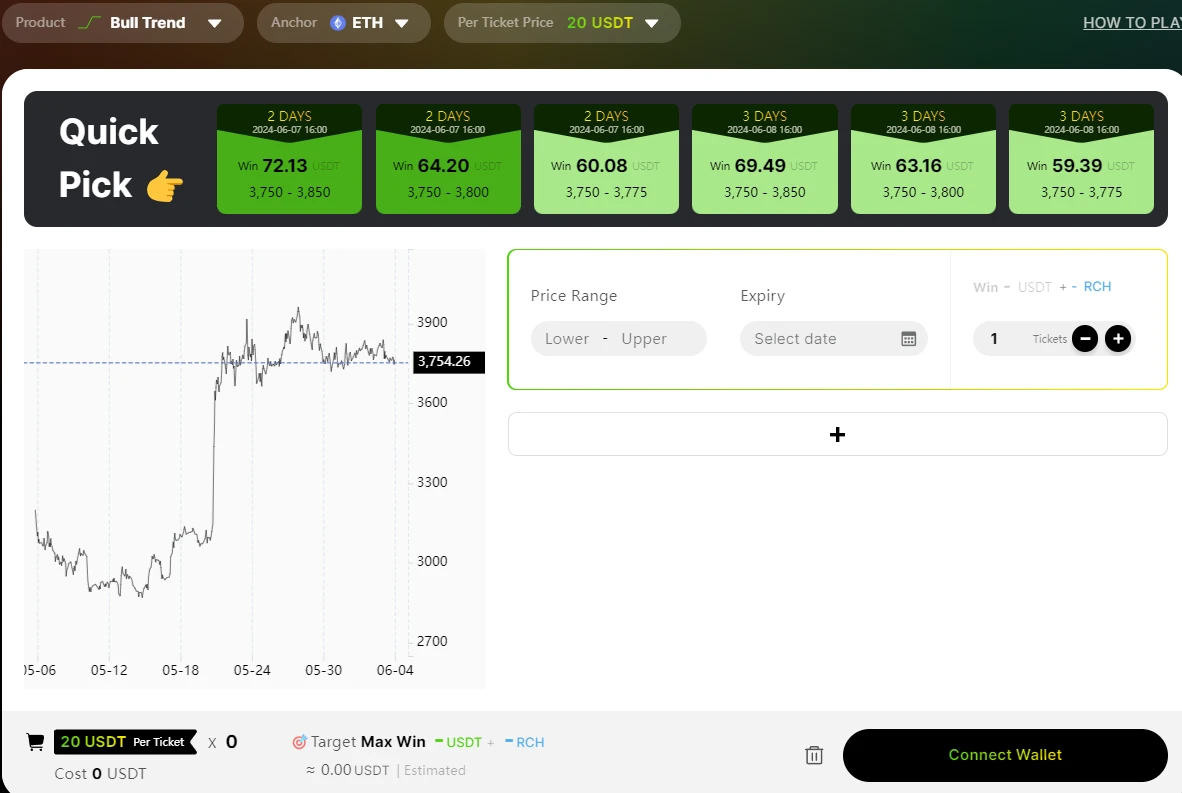

On June 7, the day when the token goes online, SOFA.org will launch two protocols, Earn and Surge. These two protocols are aimed at on-chain structured financial products. Earn is a fixed income + type, and Surge is a high-income structured product.

In the Earn protocol, users can choose between three directions: Rangebound, Bull Trend, and Bear Treand. When the price trend is consistent with the users predicted direction, the user will receive excess returns. Even if it exceeds the range, there will be a guaranteed minimum yield.

Surge also provides interval selection, but there is no guaranteed return. Instead, users who make correct predictions are given high rewards. The risk level is completely different from Earn, but the risk can be controlled by adjusting the prediction interval. Both meet the basic needs of users for different risk levels.

As mentioned above, users’ positions in the above two products will be tokenized, and SOFA.org will use the ERC-1155 standard to implement it. In addition to the standard functions of ERC-20, it also allows the splitting and merging of assets, and can store key information such as position validity period and price, thereby allowing the combination of position tokens in other protocols.

For example, users can use position tokens as collateral to borrow more funds for operations, thereby improving capital utilization efficiency and gaining more market participation opportunities while maintaining the original product returns.

Similarly, users can also use the combined protocol to reduce leverage and introduce high-risk position tokens into low-risk protocols to hedge risks.

In addition, the ultimate owner of the token will obtain the expiration rights of the derivatives, which means flexibility in the time dimension . Users can lock in profits in advance through nested use, and can also combine high-risk and high-return products similar to end-of-day options. It is reported that this year SOFA.org will also launch basic products such as the dual-currency financial management protocol of the on-chain quantitative grid and the lending protocol that provides revolving loan leverage for other protocols.

SOFA.orgs move opens up unlimited possibilities for investment portfolios for users , providing ordinary users with sufficient basic products through a comprehensive derivatives network. At the same time, professional players can make full use of this combinatorial nature to create investment portfolios that meet professional needs.

Governance Token SOFA Interpretation

In addition to the ecological token RCH, SOFA.org will also launch the protocol governance token SOFA this year, aiming to promote community participation and self-innovation of the protocol through this token, and further promote ecological development.

As a decentralized, non-profit, open source technology organization, the number of protocols within the SOFA.org ecosystem will continue to increase, but how to introduce high-quality new protocols, promote the innovation of existing protocols within the ecosystem, and maintain the smooth operation of the RCH economic system are all key issues in the development of the ecosystem.

Therefore, SOFA token holders will serve as community representatives to vote on a series of key issues such as collateral categories, entry of new ecosystem partners, and daily RCH airdrop quotas. Through this mechanism, excellent new protocols will be integrated into the ecosystem through RCH airdrop quotas and achieve rapid startup. In order to maintain their competitive position, existing protocols need to continue to improve product experience and services, ensure airdrop quotas, and thus achieve healthy competition and development of protocols within the ecosystem.

According to official documents, SOFA tokens are expected to be airdropped within 6 months. In addition to early association members and consultants, early ecosystem participants and AMM liquidity providers will have the opportunity to receive token airdrops.

in conclusion

Through the design of a decentralized and interconnected ecological paradigm, coupled with an innovative and fair token incentive mechanism, SOFA.org is reshaping the development path of on-chain derivatives. It is expected to build an ecological growth flywheel through its excellent products and sustainable token incentives, bringing transformative power to the derivatives track.