Original author: Lisa, LD Capital

I. General Election Overview

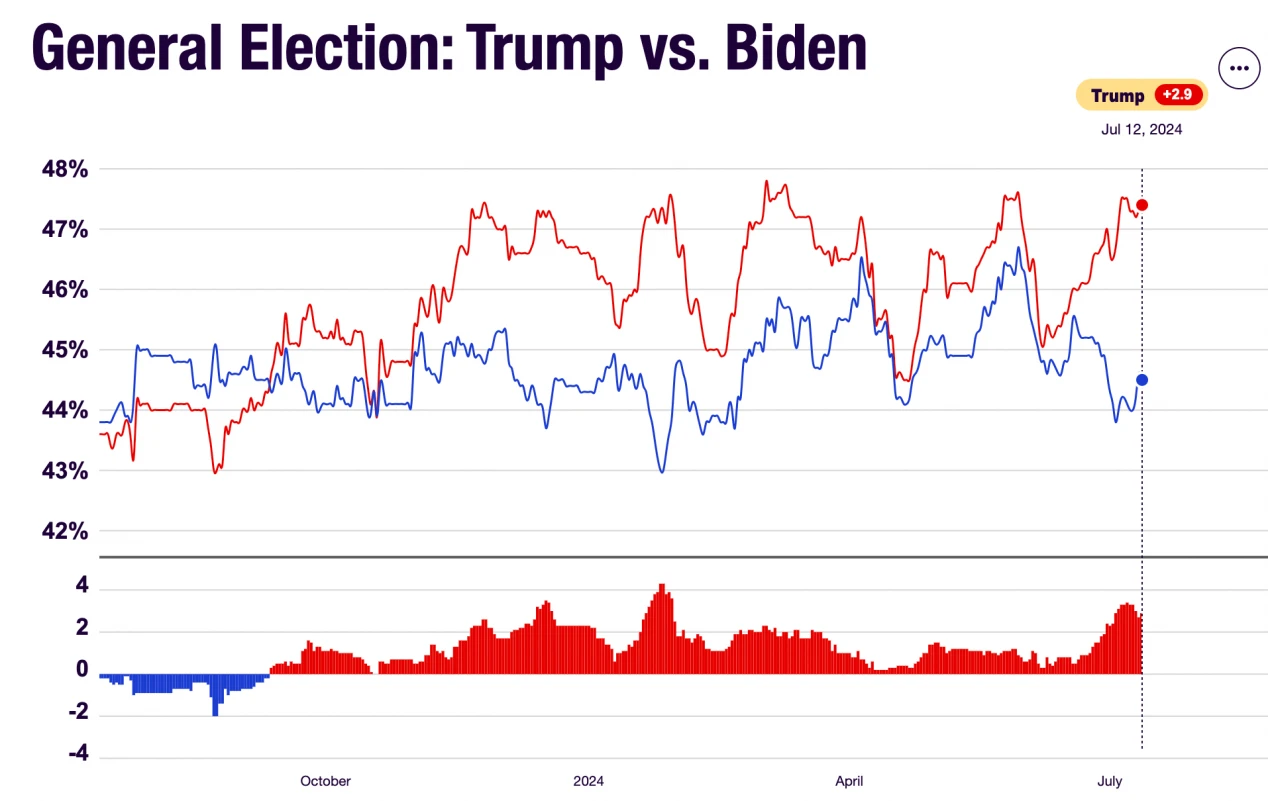

On June 28, Beijing time, Biden and Trump had their first debate of the 2024 election. Trump performed significantly better, while Biden performed poorly, which caused widespread concern among the public about whether his mental state at an advanced age could be competent. After the debate, Trumps approval rating rose sharply. At the same time, Trump also has an overwhelming advantage in swing states, leading in the seven major swing states (North Carolina, Arizona, Georgia, Nevada, Wisconsin, Michigan and Pennsylvania).

Source: https://www.realclearpolling.com/polls/president/general/2024/trump-vs-biden

There are three key moments in the future election:

1) National Conventions: The Republican National Convention on July 15-18, 2024, and the Democratic National Convention on August 19-22, 2024 will elect the party’s presidential and vice presidential candidates, respectively.

2) Second round of candidate debate: September 10, 2024.

3) Presidential Election Day: November 5, 2024.

II. Major Policy Differences

Trump and Biden have relatively consistent views on infrastructure, trade, diplomacy, expanding investment spending and encouraging the return of manufacturing. However, they have major policy differences on finance, taxation, immigration and new energy industries.

1) Finance and taxation

Trump advocates to continue to reduce corporate income tax from 21% to 15%, and does not advocate directly increasing fiscal spending; while Bidens Balancing Act advocates raising tax rates on companies and the wealthy, raising the corporate tax rate to 28%, while continuing to reduce student loans. In the last cycle of administration, Trumps tax cuts boosted US stock earnings and promoted the return of overseas funds. The tax cuts proposed in this round of elections are weaker than those of the year (the last round of tax reform adjusted the tax rate from 35% to 21%), and the boosting effect is also relatively weaker than that of the year. CICC estimates that the net profit growth rate of the SP 500 index in 2025 can be increased by 3.4 ppt from the market consensus expectation of 13.7% to 17%.

2) Immigration

The number of illegal immigrants in the United States has increased significantly since Biden was sworn in in 2021. Compared with Bidens moderate immigration policy, Trump advocates continuing to tighten immigration policies, but relatively relaxing the requirements for high-level talents. The tightening of immigration policies may weaken the momentum of US economic growth and promote the re-acceleration of wage growth.

3) Industrial policy

The two have major differences in areas such as energy. Trump advocates returning to traditional energy, speeding up the issuance of oil and gas exploration licenses, increasing the development of traditional fossil energy, etc. to ensure the United States cost leadership in energy and electricity, and may cancel green subsidies for new energy vehicles and batteries; Biden advocates continuing to promote the development of clean energy.

4) Trade policy

Both Biden and Trump are implementing high tariff policies, which may push up the cost of imported raw materials and commodity prices in the United States, thereby creating resistance to the downward trend of CPI. Compared with Trumps policy, the two are more radical. Biden announced in May that he would increase tariffs on Chinese imports. Bidens increase only covers $18 billion of goods and some of the increase will not be implemented until 2026. Trump said that he would impose a 10% base tariff on goods entering the United States, and impose additional tariffs of 60% or higher on China, and specific taxes on certain regions or industries.

It can be seen that there are obviously more green arrows for Trump in the above picture. His tariff policy, domestic tax cuts and immigration policy are not conducive to the decline in inflation.

III. General Characteristics of Asset Prices in Election Years

First, from the perspective of the whole year, there is no significant difference between the overall market performance and the changes in the federal funds rate during the election year and other years.

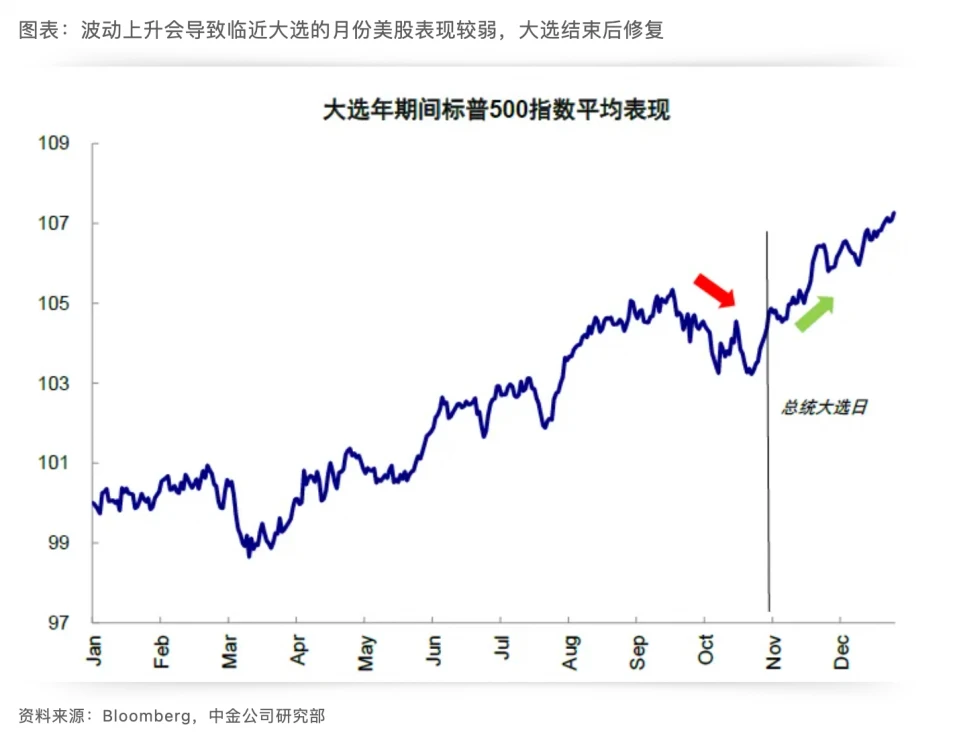

In terms of quarters and months, the change in the federal funds rate in the pre-election period (mainly the third quarter of the election year) is significantly smaller than in other quarters, while asset prices show higher volatility during this period. The reason behind this may be that monetary policy tends to remain on hold in order to avoid suspicion when the election is approaching, while asset prices fluctuate due to the uncertainty of the election results. Contrary to the strong seasonality in October to December in non-election years, stock prices in October before the election are significantly weaker than in non-election years.

IV. Review of the market situation after Trump’s last election

On November 9, 2016, the preliminary results of the US presidential election were announced, and Republican presidential candidate Donald Trump won the presidential election and became the 45th president of the United States. At that time, Trumps victory exceeded market expectations and triggered asset price fluctuations. The market bet on Trump Trade, which showed high US bond interest rates, a strong dollar and strong US stocks in November and December 2016. After the expected digestion, the transaction declined. The following are the price changes of various assets at that time (all weekly charts).

U.S. Treasury yields fall after rising

Corresponding to the fluctuation of US Treasury yields, gold fell first and then rose

SP rises

Nasdaq rises

BTC rises

This round of Trump Trade started much earlier. After the first candidate debate, the markets expectations for Trumps victory increased significantly, and the market began to lay out Trump Trade in advance. The 10-year US Treasury yield rose to around 4.5% on the second day of the debate.

Combined with the extra votes that Trumps shooting on July 14 may bring him, the most likely outcome is that Trump is elected president and the Republicans control both the House and Senate. It can be predicted that the shooting of Trump over the weekend will bring about a rise in U.S. stocks on the coming Monday.

V. Conclusion

The impact of the US election on the market:

1) The election itself cannot be used as a reason for bullish trading. The simple logic that the Democratic Party needs the US stock market to continue to rise in order to win the election does not hold true;

2) In regular election years, there is downside risk in the market due to increased volatility around October;

3) The main directions of trading the election results (Trump Trade) are long CPI, long US bond interest rates (long here is relative to the markets downward expectations, and its meaning is to create resistance to the downward trend of CPI and US bond interest rates rather than an absolute increase), short gold, long US stocks but the strength is not as great as the last time Trump was elected; long BTC (it is believed that BTC follows the US stock market more, and the divergence from the US stock market is not sustainable in the long run Trump is crypto-friendly).