Original author: Nancy, PANews

Messis popularity and commercial effect are undoubtedly world-class. When the two top football tournaments in Europe and the United States collided, he still led the Americas Cup to steal the show from the European Cup. This top player with his own king effect also recently appeared on the world-renowned mens fashion magazine GQ, and the cryptocurrency trading platform Bitget also appeared on the magazine.

As Messis crypto partner, Bitget signed a cooperation agreement with Messi many years ago under the leadership of new CEO Gracy Chen. Courage to face difficulties and indomitable spirit is considered to be the common point of growth for both parties. Contract holdings are ranked second in the industry, monthly visits are among the top five, and net capital inflows are third... Multiple sets of data show that in the ever-changing crypto world, Bitget, a rising star, is leveraging the CEX market structure with a radical expansion attitude.

Stick to product innovation internally and understand user needs externally may be the culture that has been written into Bitgets genes over the past six years.

27%: From breakthrough to flagship product, the market share of contract products has risen to nearly 27%

Today, the competition among enterprises is not a competition of products, but a competition of business models. Peter F. Drucker, the father of modern management, truly reflects the trendiness of business models during the Internet boom. In the earlier stage of the Internet, successful business models were more accidental. Enterprises often did not need specific strategies or even user bases, but only relied on promised profit targets. Michael Lewis, author of The Big Short, once described that business models are often used to beautify various immature plans.

This is quite similar to the history of crypto trading. However, after the early stage of development, building a good business model is becoming a consensus and a problem for new and old exchanges. After all, the crypto trading platform is a track with great value. The increasingly rich trading varieties and functions can bring about the continuous development of monetization channels. Such a good business will naturally not be missed.

Various cases in the past have also confirmed that the reshuffle between crypto trading platforms is indeed extremely fierce. As a latecomer, Bitget chose to enter the derivatives track, laying a solid foundation for the internal battle of crypto trading.

In 2018, Bitget encountered obstacles at the beginning, when the crypto trading world was in the bear market. However, after in-depth research on market demand, Bitget quickly made strategic adjustments and chose to cut off the spot business the following year and switch to the contract track where user demand was stronger. You know, compared with the spot market, the contract market is a cruel money-eating beast, but the magnified yield still attracts investors to flock in.

The launch of the USDT forward contract marked the beginning of Bitgets comeback. The trading volume of the worlds first platform with both forward and reverse contracts quickly exceeded the 100 million US dollar mark. Subsequently, Bitget took advantage of the victory and launched a one-stop service of one-click copy trading, allowing users with zero experience or novice contracts to use this product to follow excellent traders to automatically execute orders. Users do not need to watch the market or operate manually, and all transactions are transparent and open.

In recent years, Bitget has been focusing on the copy trading function and continuously increasing its innovation efforts in this core competitiveness, including the use of contract quantitative robots to provide investors with high-quality investment portfolios and investment decisions using AI technology and algorithms, the diversified exploration copy trading that allows investors to use a sum of money to copy the strategies of multiple elite traders at the same time, the intelligent proportion copy trading mode that allows users to automatically calculate the copy trading cost according to the proportion of funds used by trading experts, and the independent contract copy trading account that can isolate risks. The continuous iteration and update of these functions also reflects Bitgets business philosophy centered on user experience. The official website shows that as of July 23, Bitget has obtained the participation of 165,000 trading experts, more than 800,000 copy trading users, and the total copy trading income exceeds US$530 million.

In addition, Bitget has also launched a variety of products such as one-click reversal, stop profit and stop loss, and lightning closing in contract products to provide a more efficient trading experience.

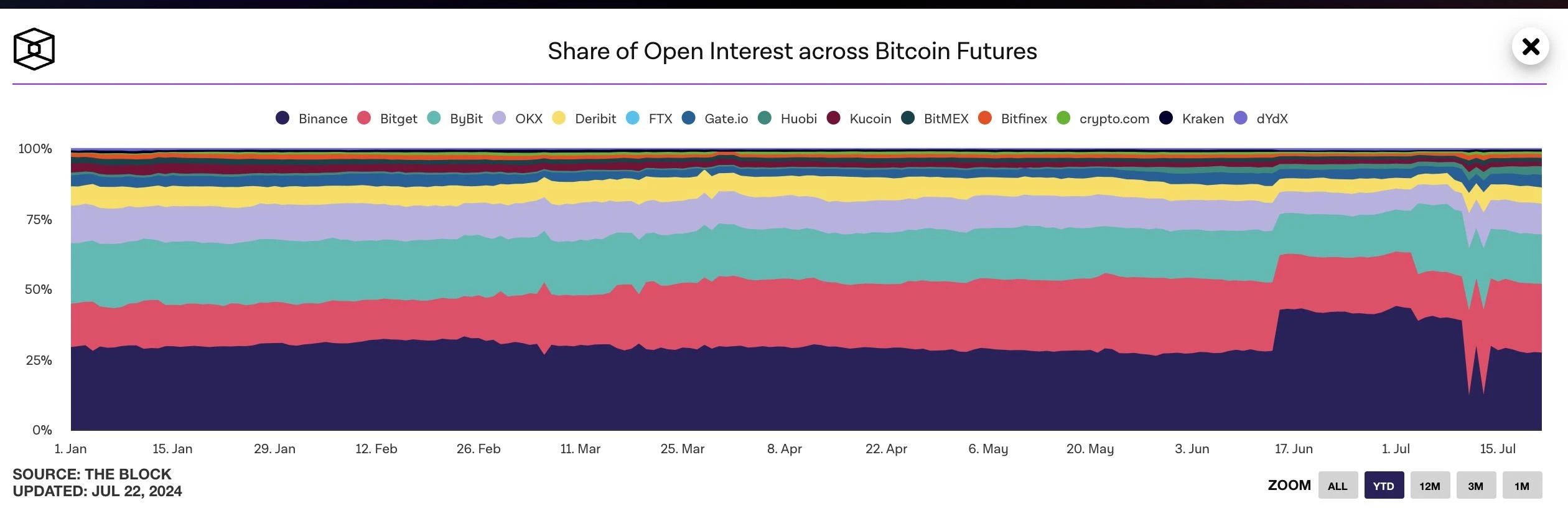

Today, derivatives have become Bitgets golden signboard and its unique value memory point. The Block data shows that as of July 21, the open interest of Bitcoin on derivatives exchanges across the network reached 29.37 billion US dollars, of which Bitget ranked second among mainstream exchanges with a position of over 7.18 billion US dollars, second only to Binance. And from the perspective of market growth rate, Bitgets market share has risen by more than 149.3% from one year ago to nearly 27.4%.

Data source for the proportion of open Bitcoin contracts of various companies: The Block

30 million: Multiple measures have been taken to consolidate the brand value and reputation, with monthly visits exceeding 30 million times

On the road to becoming a leader, Bitget has gained recognition from more and more users.

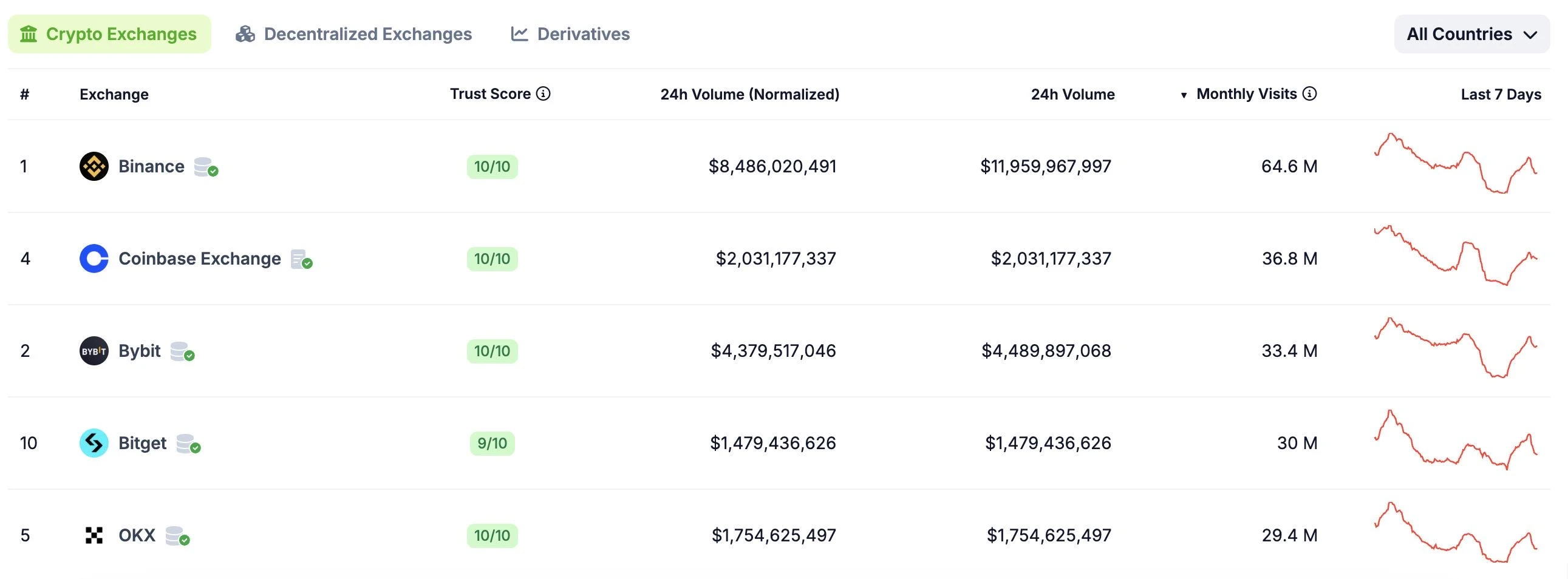

Website traffic is a direct reflection of popularity. According to CoinGecko data, Bitget ranks fourth in the industry with over 30 million visits in monthly visit volume. According to data tracked by Similarweb up to May this year , over 76.7% of the visits came from direct traffic, which means that these visitors directly entered the URL or visited the website from their favorites, which also shows that Bitget has established a high enough brand loyalty and recognition.

Top 5 CEXs by Monthly Visits Source: CoinGecko

In fact, the establishment of Bitgets brand value is inseparable from its multi-dimensional brand building, which is also a powerful business card for market competitiveness. As early as October 2022, Bitget signed a contract with Messi for more than 100 million yuan, and this year Bitget also launched a new brand promotional video with Messi after renewing the contract again, using the celebrity effect to expand its brand influence and market value.

While expanding its popularity, Bitget is also continuing to invest in brand reputation and loyalty. Charity activities are one of the important ways for current crypto companies to establish social influence. Since May 2023, Bitget has launched the charity education program Blockchain 4 Youth, and plans to invest $10 million in the next five years to encourage the younger generation to embrace Web3 and blockchain technology and cultivate their interest in crypto assets. The official website shows that Blockchain 4 Youth has more than 6,000 participants, more than 50 partner universities, more than 50 campus lectures, and more than 2,000 certificates issued.

At the same time, just like in the traditional financial world, stock prices can not only directly reflect the value and growth potential of a company in complex market conditions, but also bring a strong eye-catching effect. The same is true for the platform coins of crypto exchanges. For crypto investors, the value of platform coins is supported by real profit creation, value capture capabilities and growth potential. Especially in this round of no takeover bull market, platform coins supported by real value are more likely to gain investors favor and even loyalty.

According to CoinGecko data, as of July 23, BGBs market value has exceeded 1.64 billion US dollars, making it the fifth largest platform currency in CEX (centralized exchange). Since the beginning of this year, BGB has increased by about 102.1%, exceeding a number of mainstream assets such as Bitcoin and Ethereum. Of course, the rise of BGB is inseparable from Bitgets continuous empowerment, including Launchpad new issuance, Launchpool new coin mining, VIP experience, handling fee discounts, preferential subscription of mainstream coins, additional income from financial management, and free withdrawals.

BGB price performance in the past year Source: Coingecko

Bitget is still continuing to empower BGB. According to Gracy Chens recent AMA in the community, Bitget will also consider the BGB repurchase and destruction plan in the future. BGBs golden shovel attributes, such as LaunchPad will strictly screen and only provide high-quality assets, and LaunchPool will focus on launching more projects this year, so that BGB pledge users can make money easily through these products. At the same time, Bitget recently announced the upgrade of BGBs smart contract address, which will further enrich the rights and interests of BGB holders, expand its use scenarios in decentralized applications such as DeFi, DEX, GameFi, and provide more value and opportunities for BGB holders.

560 million: Innovative products create a flywheel for business growth, with over 560 million US dollars of capital inflow in a single quarter

Historically, the start, expansion, and transformation of brands are like wars. Bitget was not considered the fast fish in the early days of cryptocurrencies where the fast fish ate the slow fish. But since its founding, Bitget has gained more than 25 million registered users in more than 100 countries and regions around the world. And from the perspective of capital flows, DeFiLlama data shows that since the beginning of 2024, Bitgets monthly capital inflows have mostly shown positive growth, with a net inflow of $779 million in assets in the first half of the year. Among them, CryptoRank.io data shows that in the second quarter alone, Bitget ranked third in CEX with a capital inflow of $561 million.

Source: CryptoRank.io

In fact, compared to making assembly line products to expand the competitive advantage in the internal battle of cryptocurrency exchanges, Bitget is making good use of the fish of cryptocurrency trading through the underlying product logic of understanding user emotions and exploring user needs and the business model of deep dredging and low dam building.

The rate of return is what investors care about most, and it is also an important driving force for retaining platform users and attracting more funds. After the start of contract trading, focusing on user interests is the key for Bitget to continue to expand into new markets.

Among them, Bitget launched the new asset mining Launchpool in 2022, allowing users to stake mainstream assets such as BTC, ETH and BGB to participate in new project airdrops and earn staking income. According to Bitgets official website, Launchpool has launched 67 projects and has received more than US$1.8 billion in funding;

Launchpad is a low-risk new platform launched by Bitget in 2023. This popular gameplay tests the ability of various trading platforms to screen high-quality projects, so the yields of each platform are different. According to PANews statistics, Bitget launched a total of 7 Launchpads in 2023, with an average maximum yield of 68.7 times, and the maximum yield of a Launchpad project temporarily launched in 2024 reached 566%. Judging from the past income data, Bitget has created a very high wealth effect for users, and will also feed back its own platform traffic. In order to reach more users, Bitget has also introduced new gameplay such as group buying and inviting friends to cash back on Launchpad.

This year, Bitget launched PoolX, a year-round version of Launchpool, which allows users to earn popular token rewards by staking designated assets without sacrificing liquidity. It has now launched 65 projects, with more than 350,000 users participating in staking, with an average annualized return of 12.77% and a total staking amount equivalent to approximately US$1 billion.

Of course, Bitget continues to innovate products to thicken the user interface. For example, Bitget recently launched pre-market trading on the over-the-counter trading platform, which can solve the over-the-counter trust problem, thereby ensuring credible transactions between buyers and sellers. Now 20 projects have been launched, with a total of 35,000 transactions and a total transaction amount of 13.6 million US dollars; the Telegram trading signal tool is an advanced interactive tool specially developed for trading signal providers in Telegram groups. It can not only automatically publish trading signals in the group, but also capture and analyze group operation data in real time; the Genesis Plan allows users to participate in simulated trading competitions without investing assets, and have the opportunity to obtain 10,000 USDT and double benefits. In addition, Bitget also has insight into user needs to capture hot narratives and hot high-quality assets in a timely manner, including the launch of a $20 million TON ecosystem fund, the first 10,000 users who recharge LayerZero (ZRO) tokens will receive donation fee refunds, and 34 tokens were launched in June alone, which also reflects Bitgets keenness in capturing market traffic.

According to Gracy Chen, Bitgets spot reform is its work focus, which will strengthen the advantages of listing coins, improve the depth and liquidity of transactions, introduce and strengthen cooperation with leading market makers, and continue to maintain the wealth effect of spot.

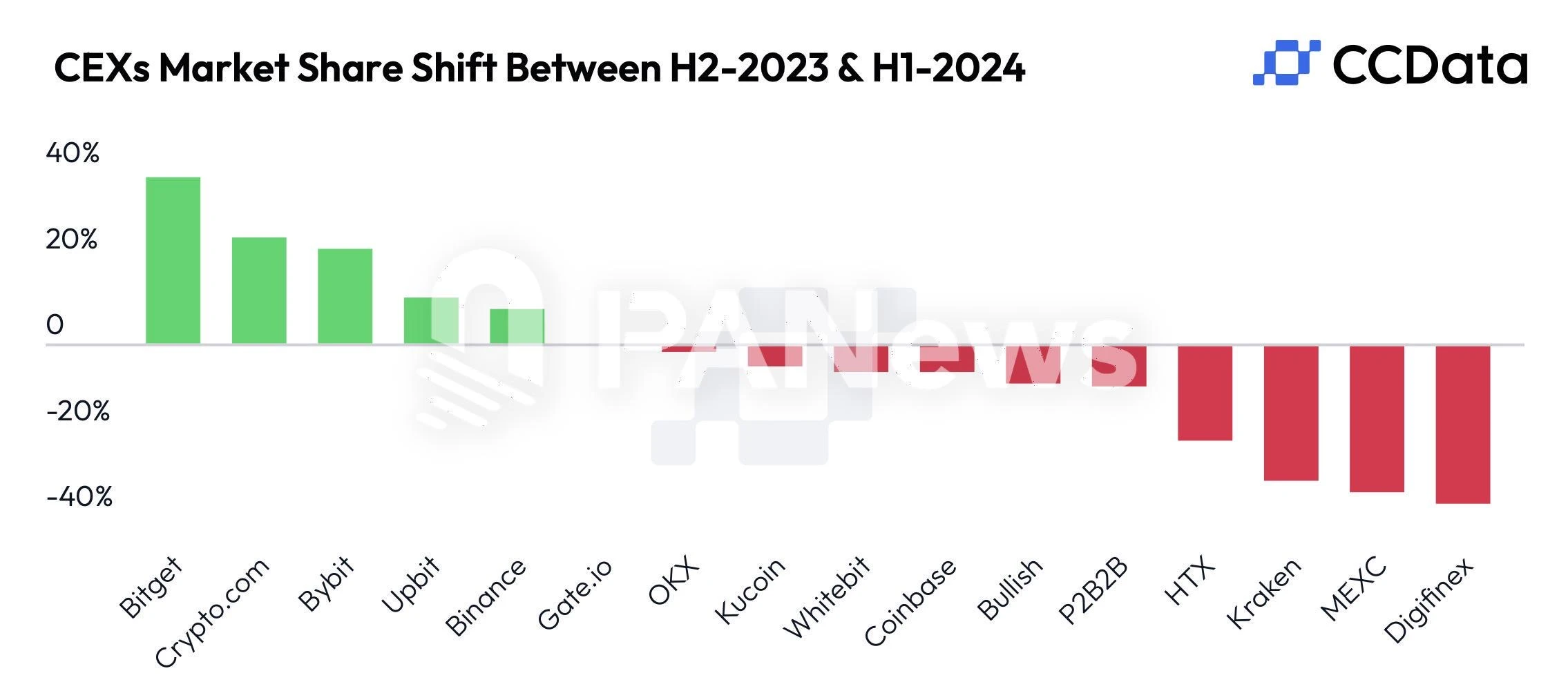

CEX market share growth in the first half of 2024 Data source: CCData

In addition, the security of the platform is also a concern for users. In response, Bitget not only improves transparency by publishing proof of reserves every month, but also sets up a $300 million protection fund to protect user assets (the June report shows that the funds average monthly valuation is $429 million), which is also the first such fund in the industry.

It is worth mentioning that in order to meet the diversified needs of users such as on-chain transactions and asset security storage, major exchanges have begun to lay out the wallet track. This field is also considered to open up traffic growth, and Bitget is no exception. Bitget wallet is a multi-functional non-custodial Web3 wallet that supports more than 100 blockchains and more than 250,000 cryptocurrencies, providing competitive exchange rates and seamless DApp integration.

Whether it is the early days of seizing opportunities for rapid expansion like Mikania, to the current growth logic of deep dredging and low dam building, Bitget has undergone continuous transformation in the past six years of encryption process, but the only unchanged thing is the user-centric concept.