Market Overview

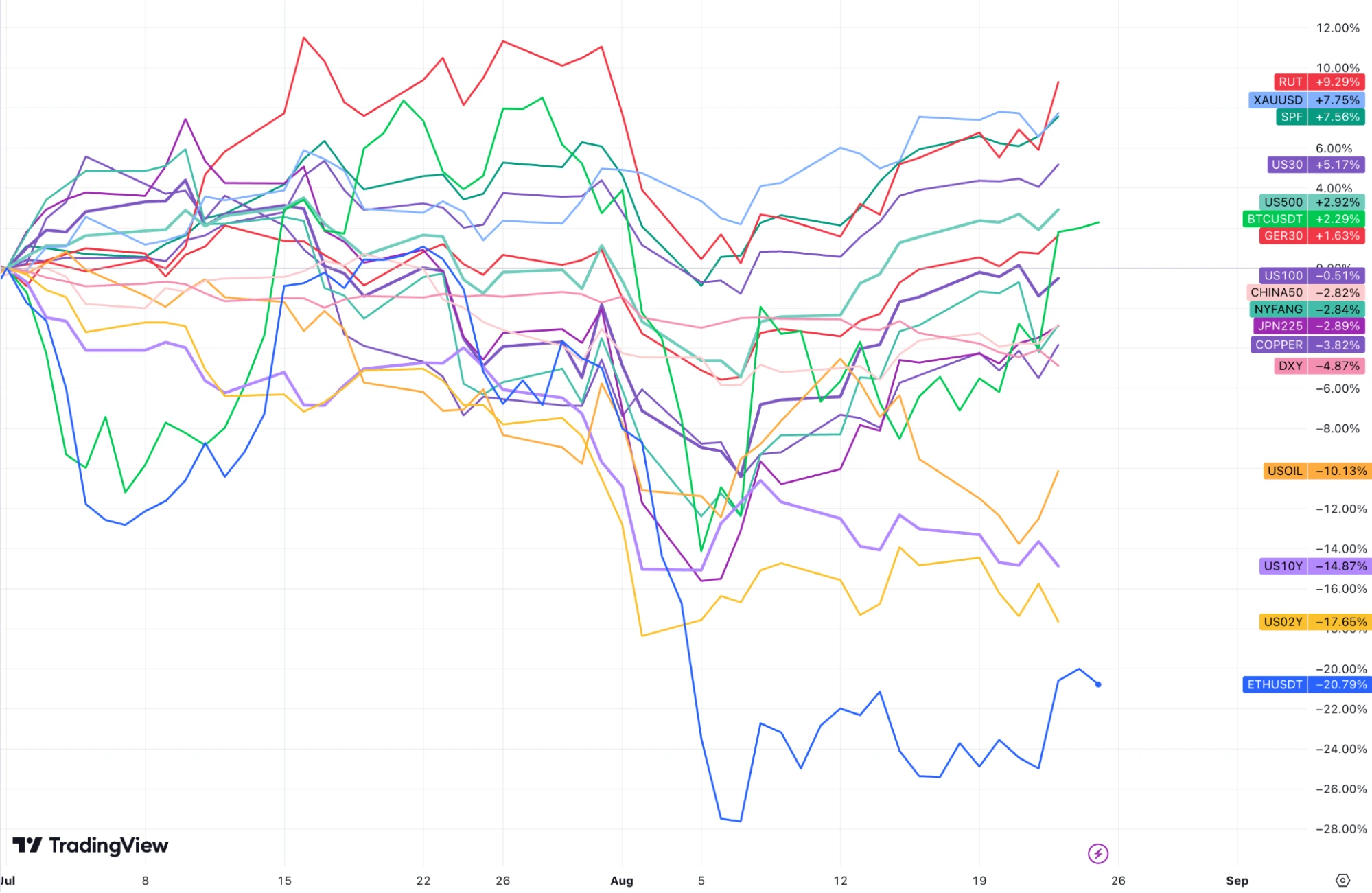

Since the third quarter, the assets that performed better: RUT (Russell 2000 Index) and XAUUSD (gold price) and SPF (financial stocks) and US bonds, the assets that performed worse: Ethereum, crude oil, and the US dollar. The almost flat pie, Nasdaq 100.

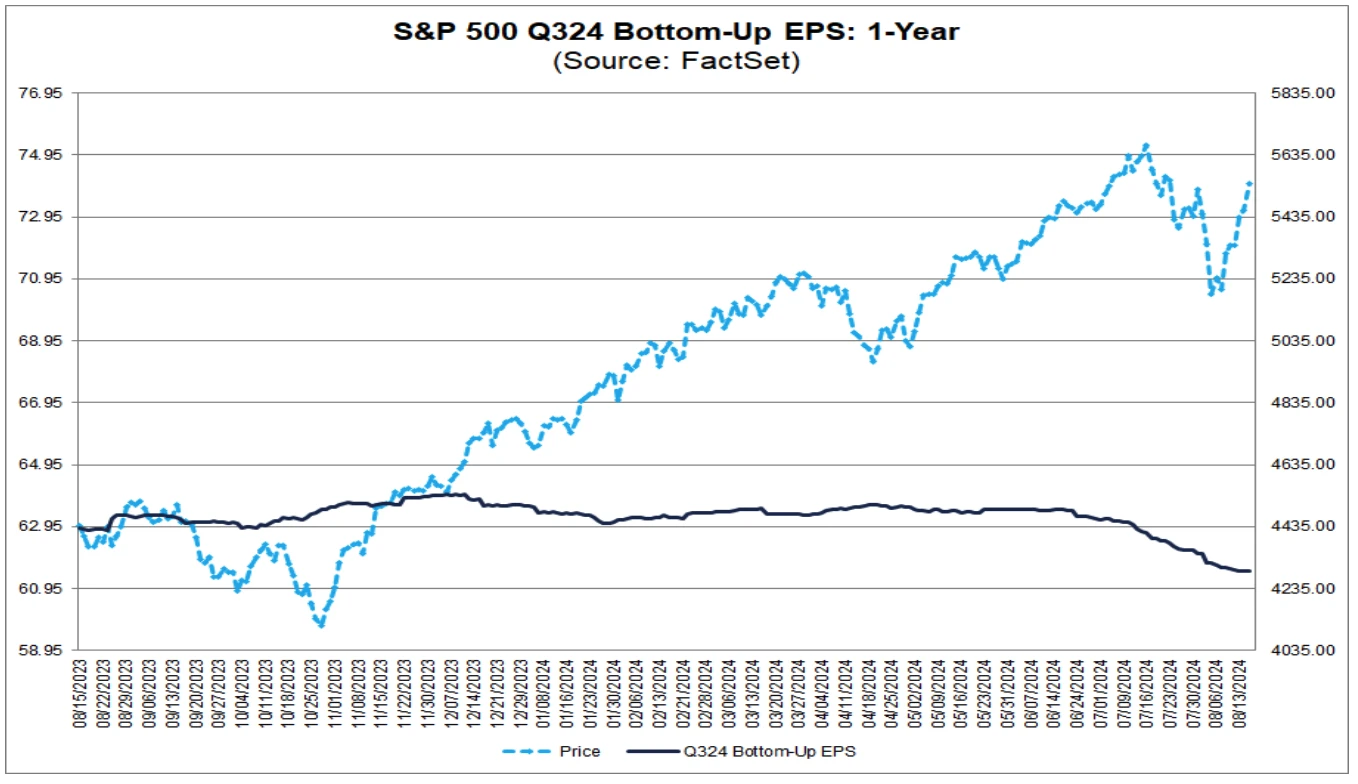

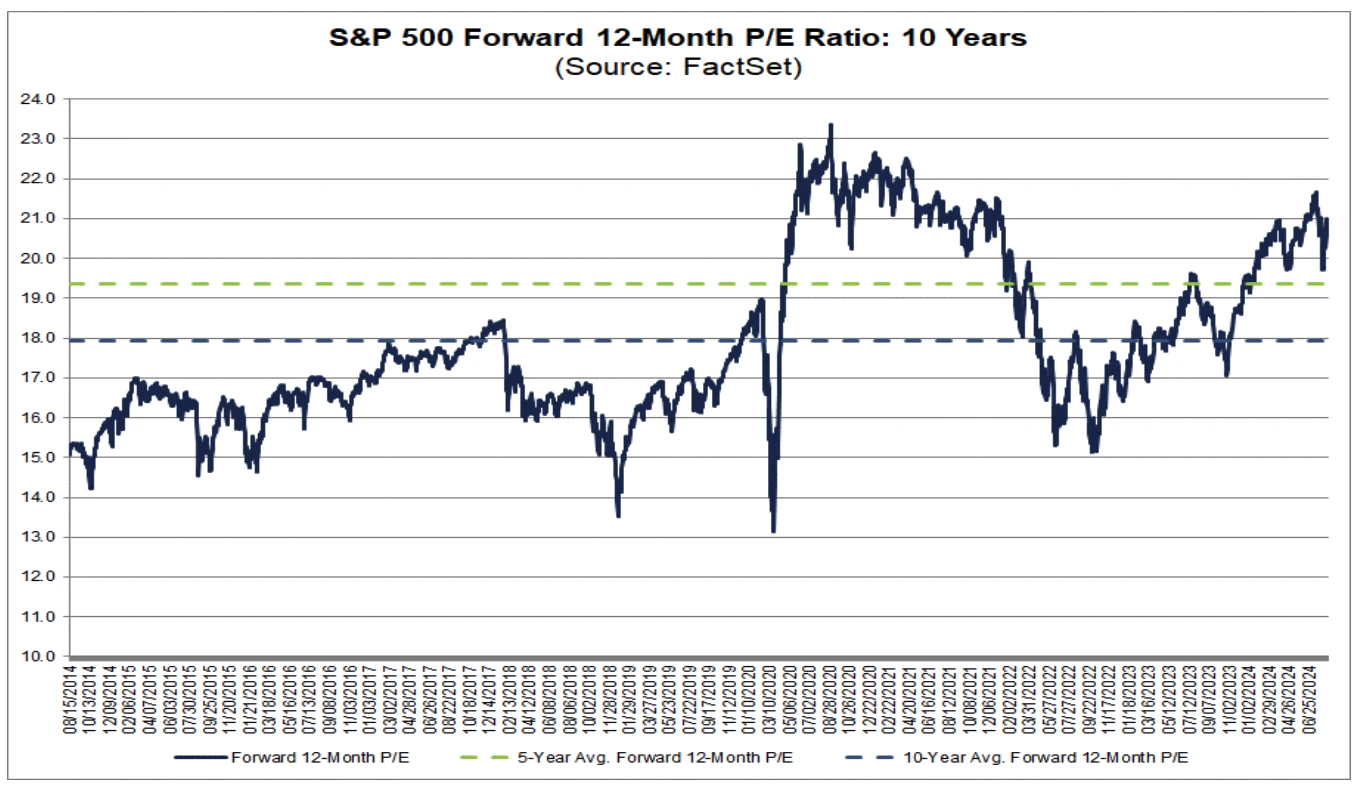

For US stocks, the current market is still in a bull market, and the main trend is still upward. However, the trading environment will lack performance themes in the last few months of the year, and the upside and downside of the market will be limited. The market continues to revise down Q3 earnings expectations:

The valuation has recently adjusted back, but it rebounded quickly, and the PE of 21 times is still much higher than the 5-year average:

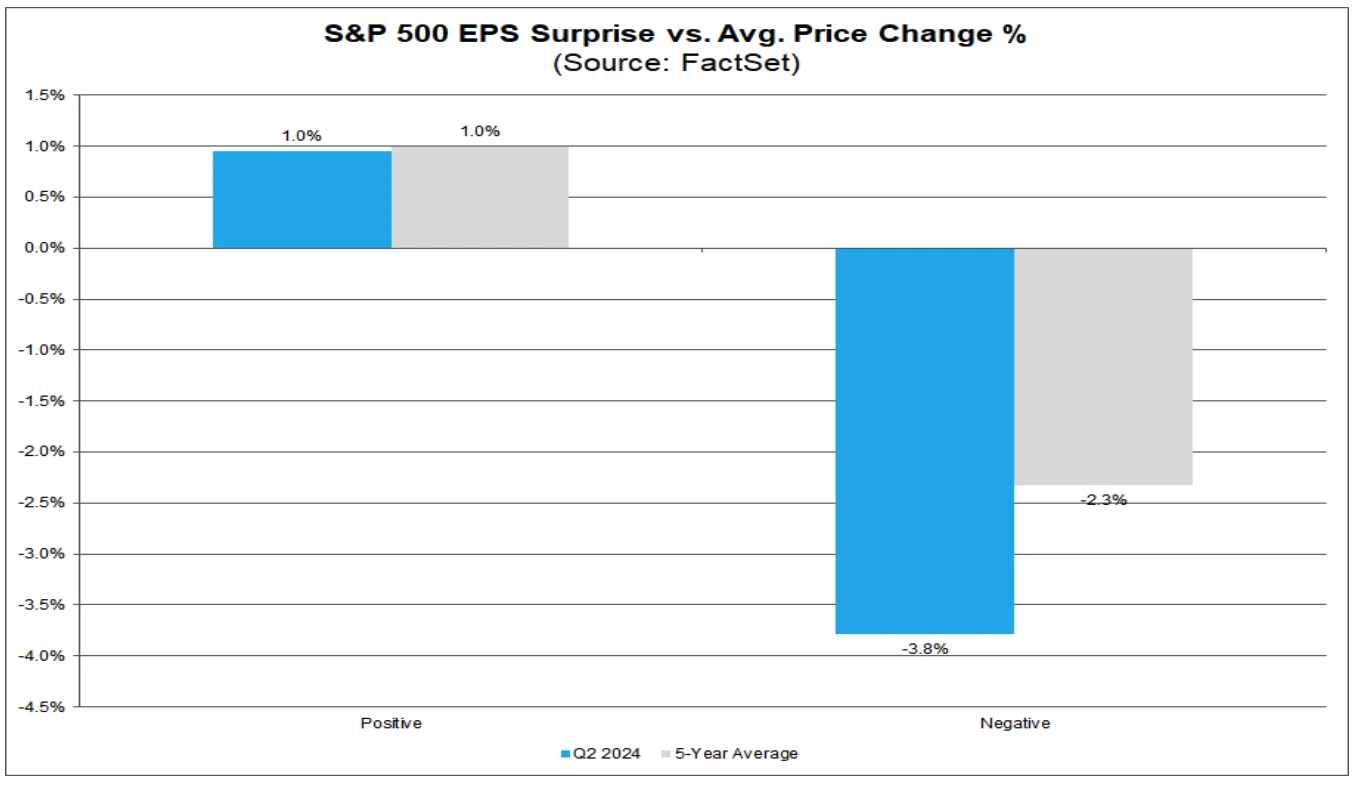

93% of the companies in the SP 500 have announced actual results, of which 79% have exceeded EPS expectations and 60% have exceeded revenue expectations. The stock price performance of companies that exceeded expectations is roughly in line with the historical average, but the stock price performance of companies that missed expectations is worse than the historical average:

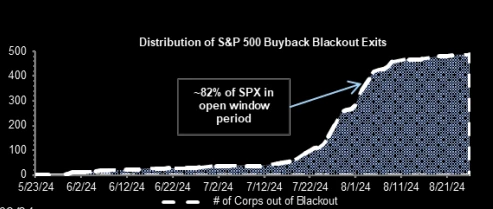

Buybacks are currently the strongest technical support for the U.S. stock market. Corporate buyback activity has reached twice the normal level in the past few weeks, about $5 billion a day (about $1 trillion a year). This buying force may continue until mid-September and then gradually fade.

Large technology stocks have weakened in mid-summer, mainly due to lower earnings expectations and waning enthusiasm for AI themes. However, the long-term growth potential of these stocks remains, and prices are unlikely to fall.

There was a time when the market was really bullish, for example, the period from October last year to June this year experienced some of the best risk-adjusted returns in a generation (NDX sharpe ration reached 4). Today, the stock market has higher PE multiples, economic and financial growth is slower, and the markets expectations of the Fed are higher, so it is relatively difficult to expect the stock market to perform as well as the previous 3 quarters in the future. And we have seen signs that large funds are gradually switching to defensive themes (for example, both subjective and passive strategy funds have increased their holdings in the healthcare sector, which provides defensiveness and growth unrelated to AI). We do not expect this trend to reverse soon, so it is safer to take a neutral attitude towards the stock market in the next few months.

At the Jackson Hole meeting on Friday, Fed Chairman Powell made the clearest statement on rate cuts so far. The September rate cut is a foregone conclusion. He also said that he does not want to further cool the labor market and that he is more confident that inflation will return to the 2% path. But he still insisted that the speed of policy easing will depend on future data performance.

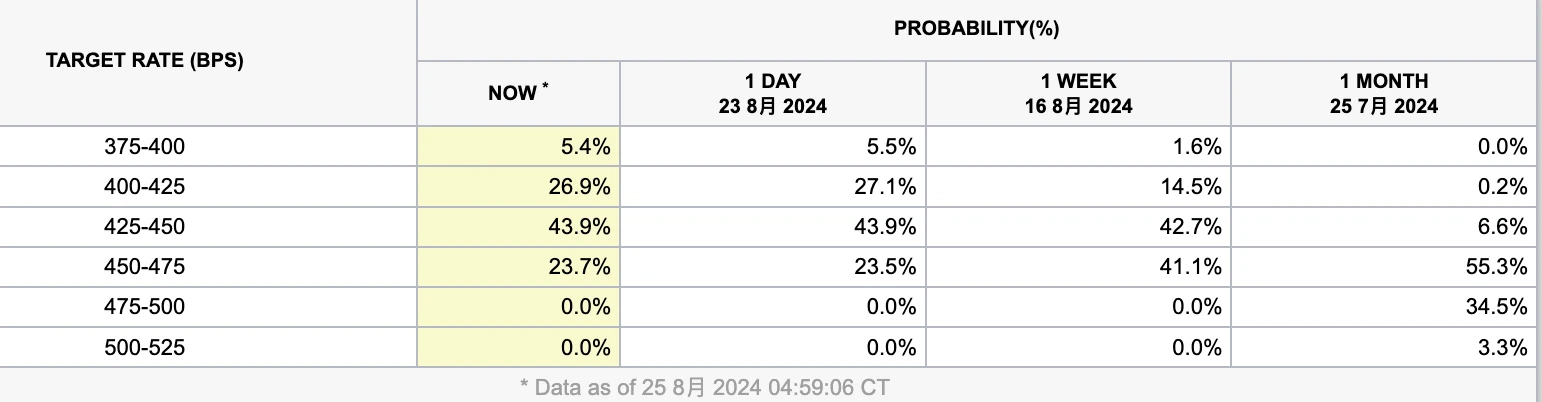

Therefore, I personally think that Powell’s statement this time was not more dovish than expected, so it did not cause much splash in the traditional financial market. What everyone is most concerned about is whether there will be a single 50 bp interest rate cut this year, and Powell did not hint at all. Therefore, the expectations for interest rate cuts this year have hardly changed from before:

Therefore, if future economic data improves, the currently priced-in 100 bp rate cut expectation may even be adjusted downward.

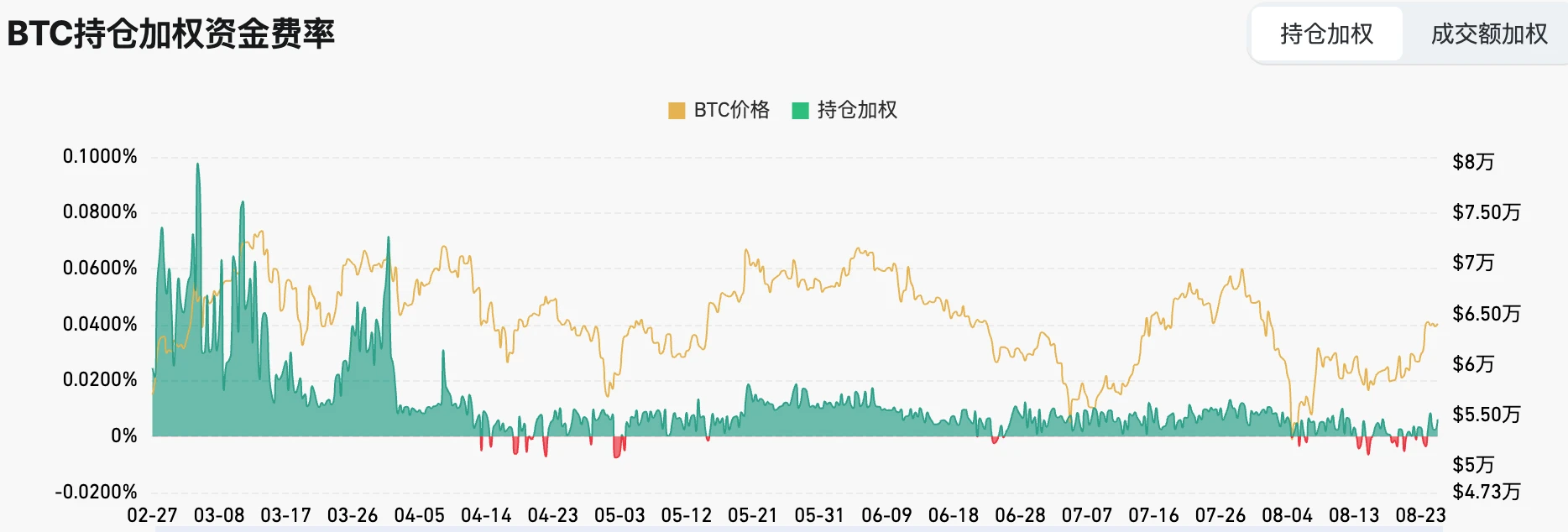

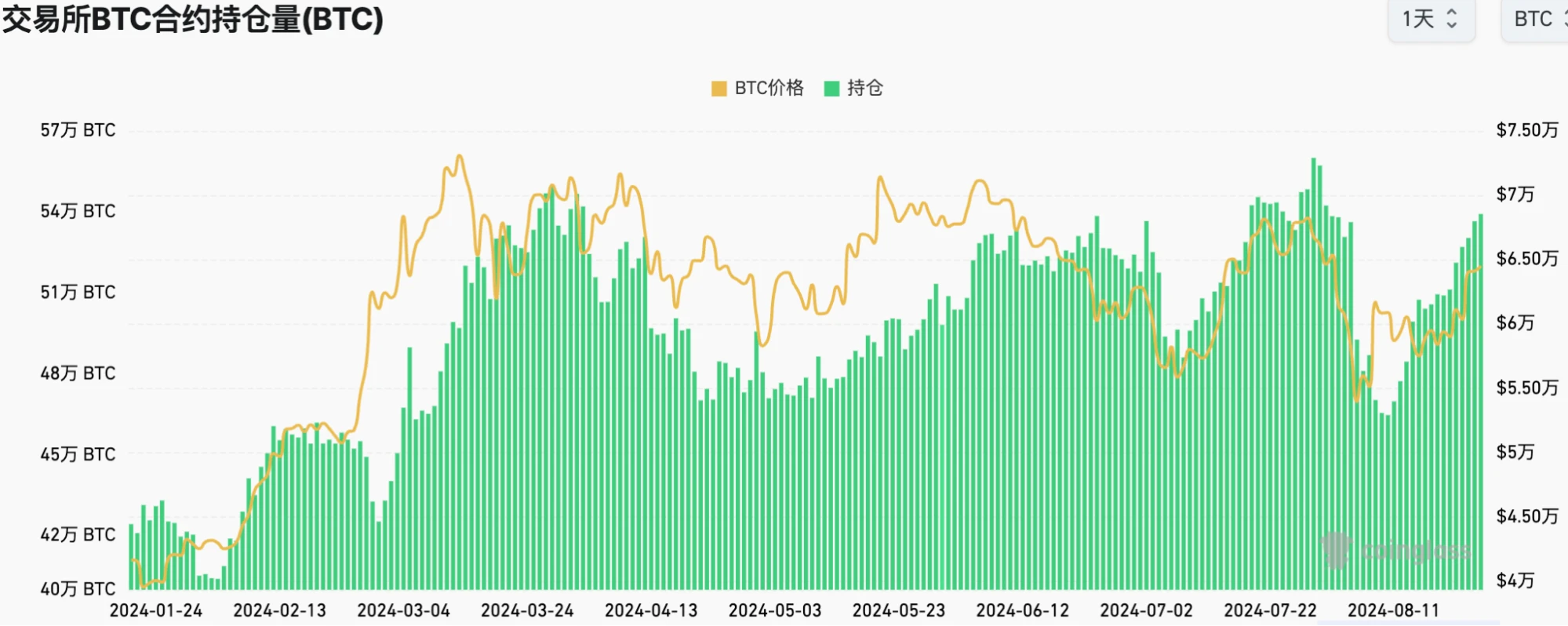

However, the crypto market reacted strongly. This may be due to the squeeze caused by too much accumulation of short positions (for example, the recent increase in open interest has been very fast, but contracts often have negative rates), and the fact that the pace of understanding of macro news by currency players is not as unified as that of traditional markets, that is, the damping of message transmission is relatively large. Many people may not know that Powell will speak at the JH conference this week. However, whether the current market environment supports the crypto market to hit new highs may be a question mark. Generally speaking, in order to hit new highs, the macro environment must be relaxed and risk-averse. Crypto-native themes are also indispensable, including NFT, defi, spot ETF release, and meme craze. At present, the only theme with strong momentum is Tele ecosystem growth. Whether it has the potential to become the next theme depends on the performance of the latest token-issuing projects. What is the quality of the incremental users brought?

At the same time, the jump in the crypto market is also related to the sharp downward revision of last years non-farm payrolls in the United States this week. However, as we have analyzed in depth in previous videos, this downward revision is excessive, ignoring the contribution of illegal immigrants to employment, and these people were included in the original employment statistics, so this revision is of little significance. As a result, the traditional market reacted lukewarmly, while the crypto market saw this as a sign of a sharp interest rate cut.

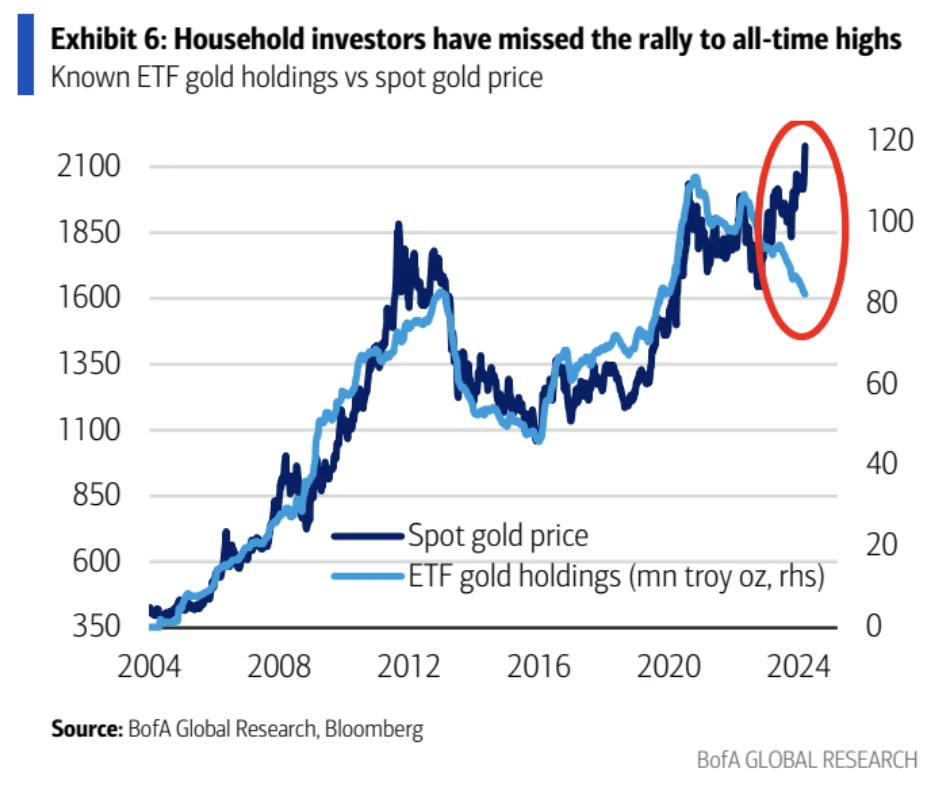

From the experience of the gold market, most of the time the price is positively correlated with the holdings of ETFs, but the market structure has changed in the past two years, and most retail investors and even institutional investors have missed the rise in gold, and the main purchasing power has become the central bank:

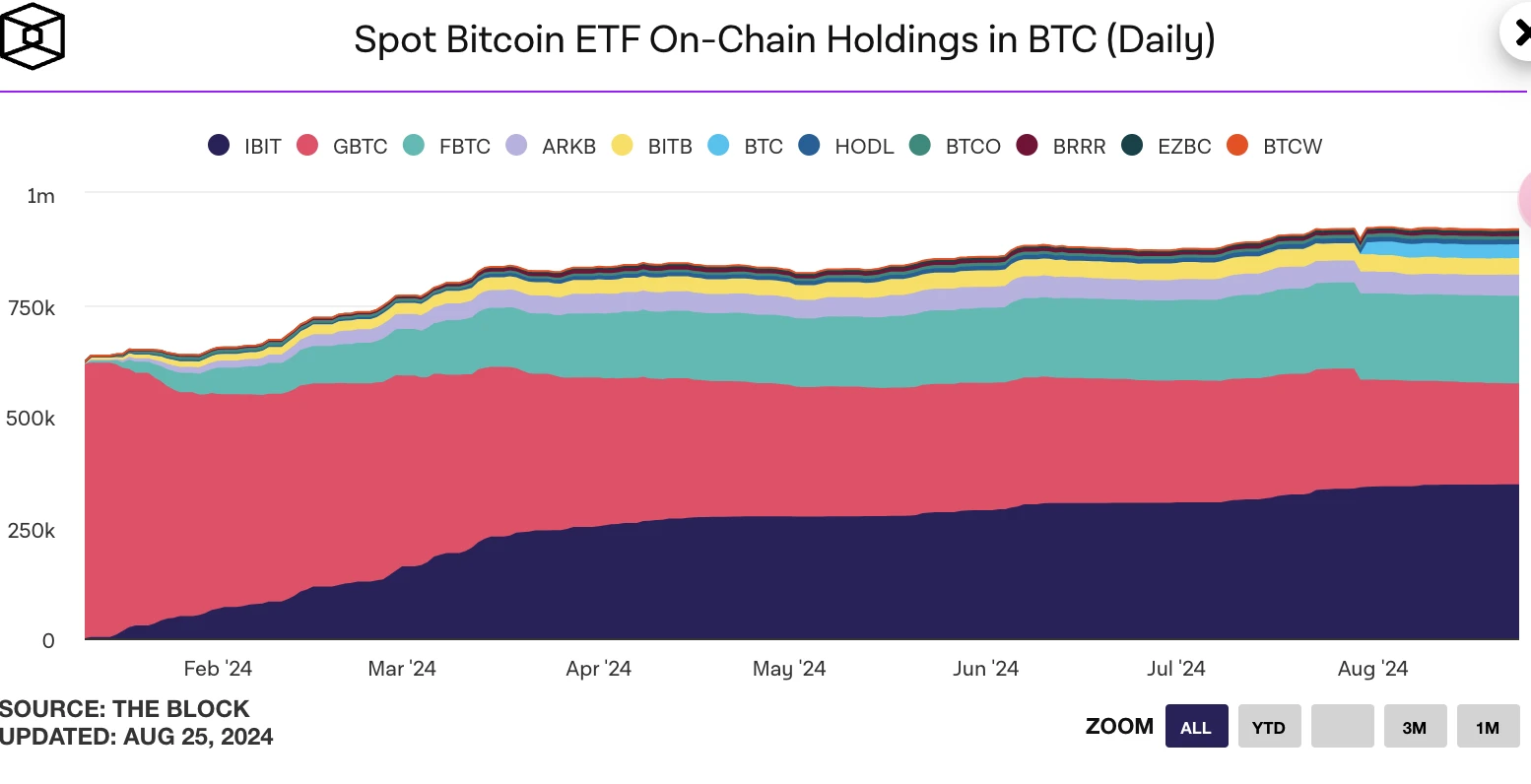

From the figure below, we can see that the inflow rate of Bitcoin ETF has slowed down significantly since April. In terms of Bitcoin, it has only increased by 10% in the past five months, which is consistent with its price peaking in March. If the risk-free rate declines, it may attract more investors to enter the gold and Bitcoin markets, which is very likely.

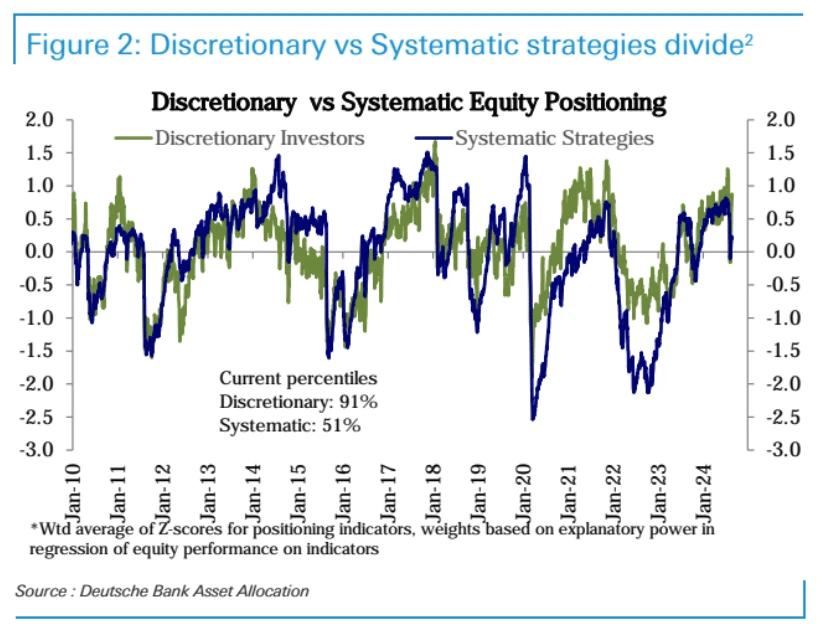

In terms of stock positions, subjective strategy funds did quite well in the early summer, reducing their positions in time and having an opportunity to attack in August. The following figure shows that the green line subjective strategy funds have recently replenished their positions very quickly, and their positions have returned to the historical 91st percentile, but the systematic strategy funds have reacted a little slower and are currently only at the 51st percentile:

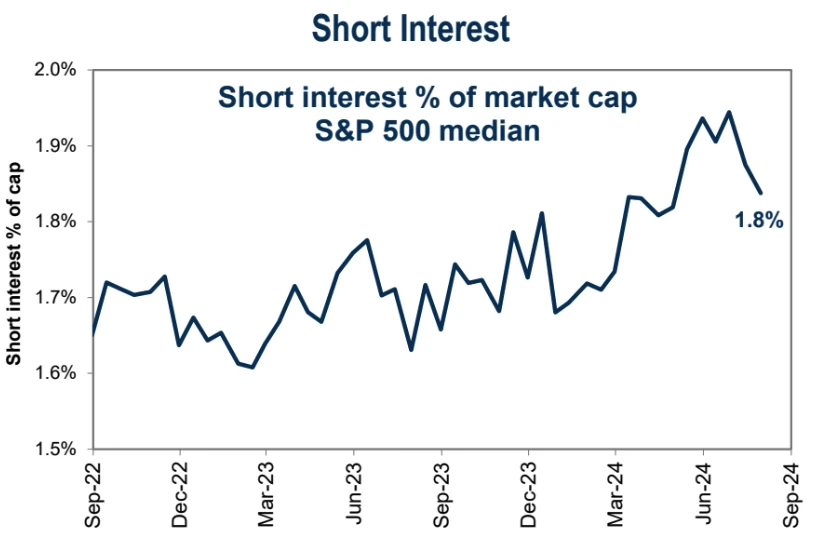

Stock market shorts closed their positions during the decline:

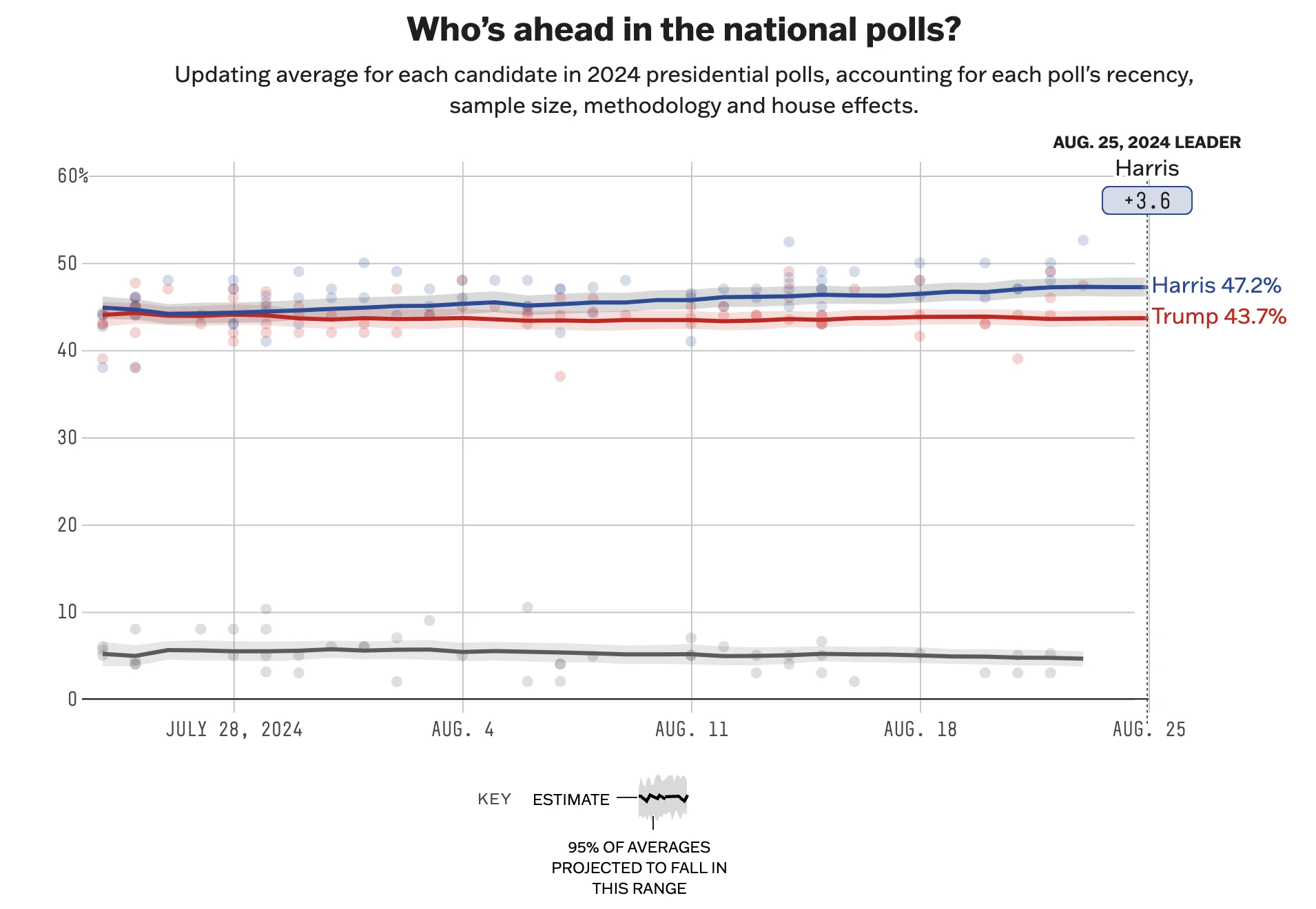

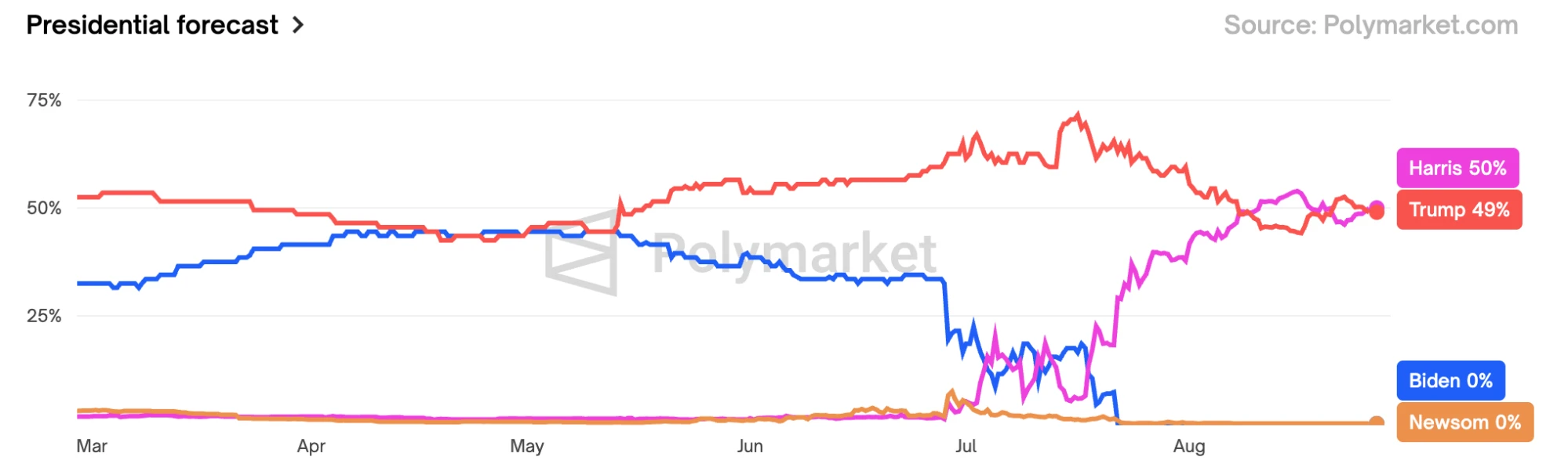

In politics, Trumps approval rating has stopped falling, and his betting approval rating has risen. Trump also received the support of Kennedy Jr. over the weekend. Trump trading may heat up again, which is generally a good thing for the stock market or the crypto market.

Fund Flow

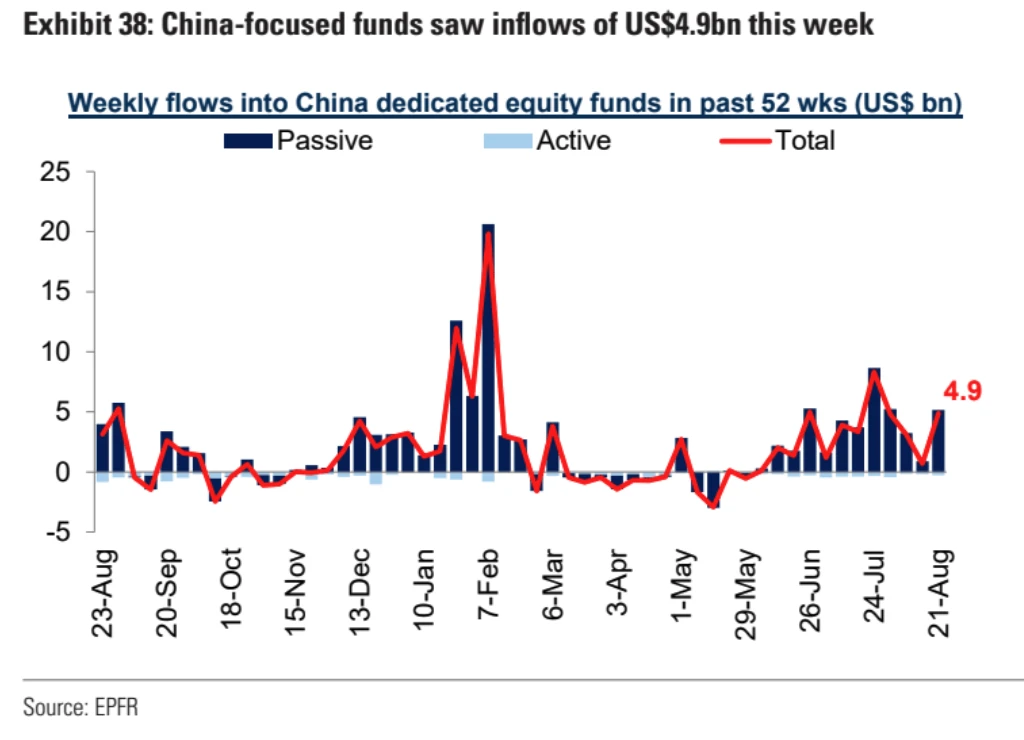

The Chinese stock market has been falling, but funds with Chinese concepts have been receiving net inflows. This weeks net inflow of $4.9 billion hit a five-week high and marked the 12th consecutive week of net inflows. Compared with other emerging market countries, China also has the largest inflows. Those who dare to choose to increase their positions against the trend in the current market downturn are either national teams or long-term funds, betting that as long as the stock market is not shut down, it will eventually rise again.

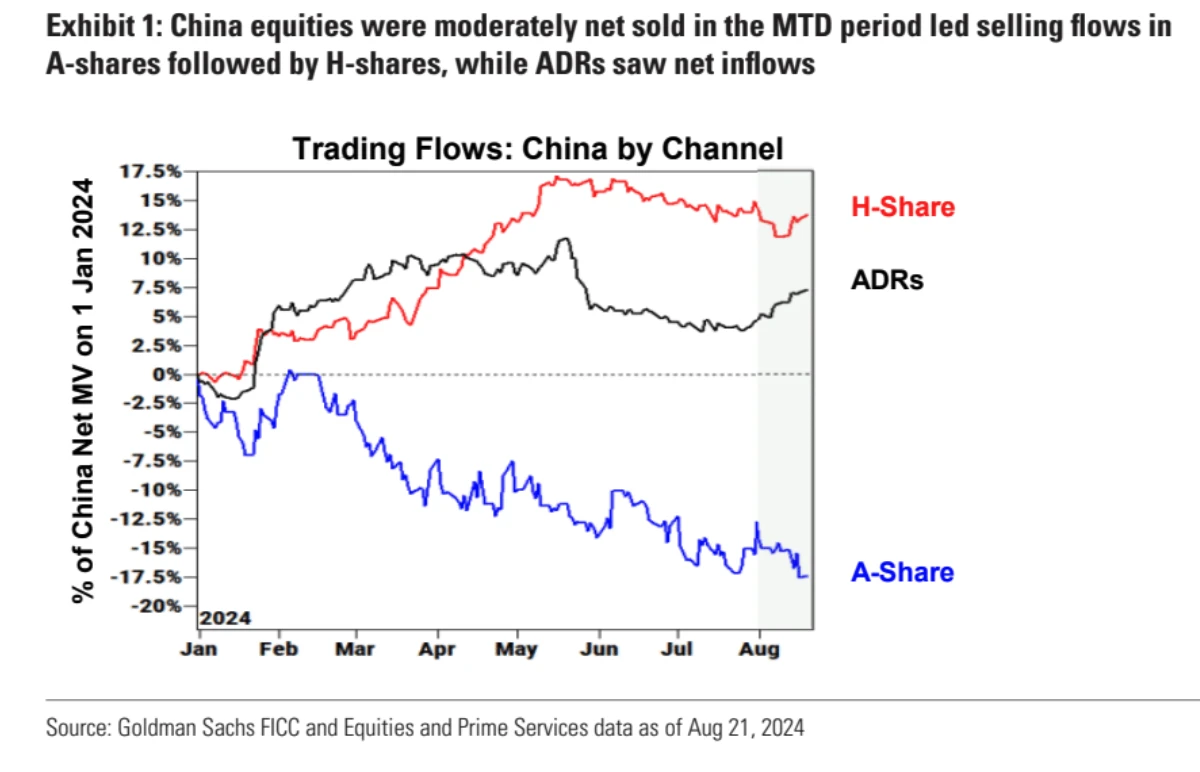

However, from the perspective of Goldman Sachs clients, they have been reducing their holdings of A shares since February, and the most recent increases are mainly in H shares and Chinese concept stocks:

Despite the global stock market recovery and capital inflows, the low-risk money market has also seen inflows for four consecutive weeks, with the total size rising to $6.24 trillion, a new record high. This shows that market liquidity is still very abundant:

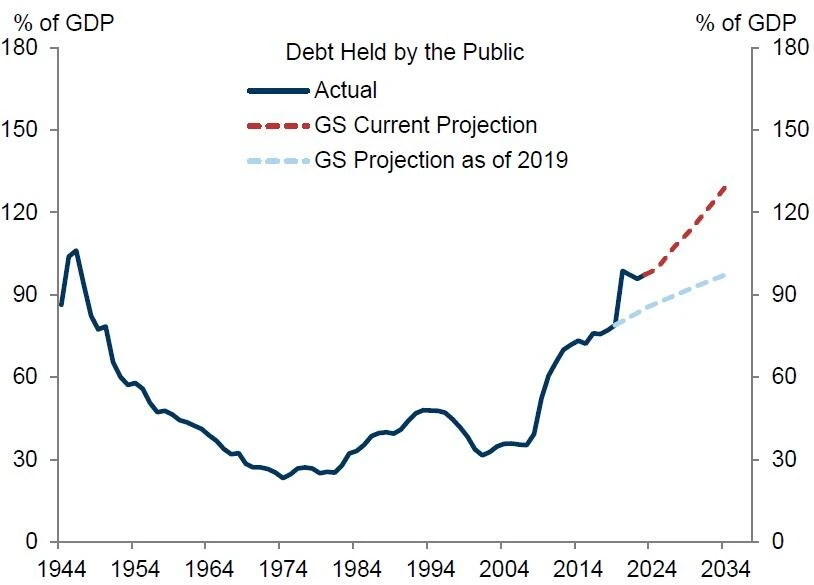

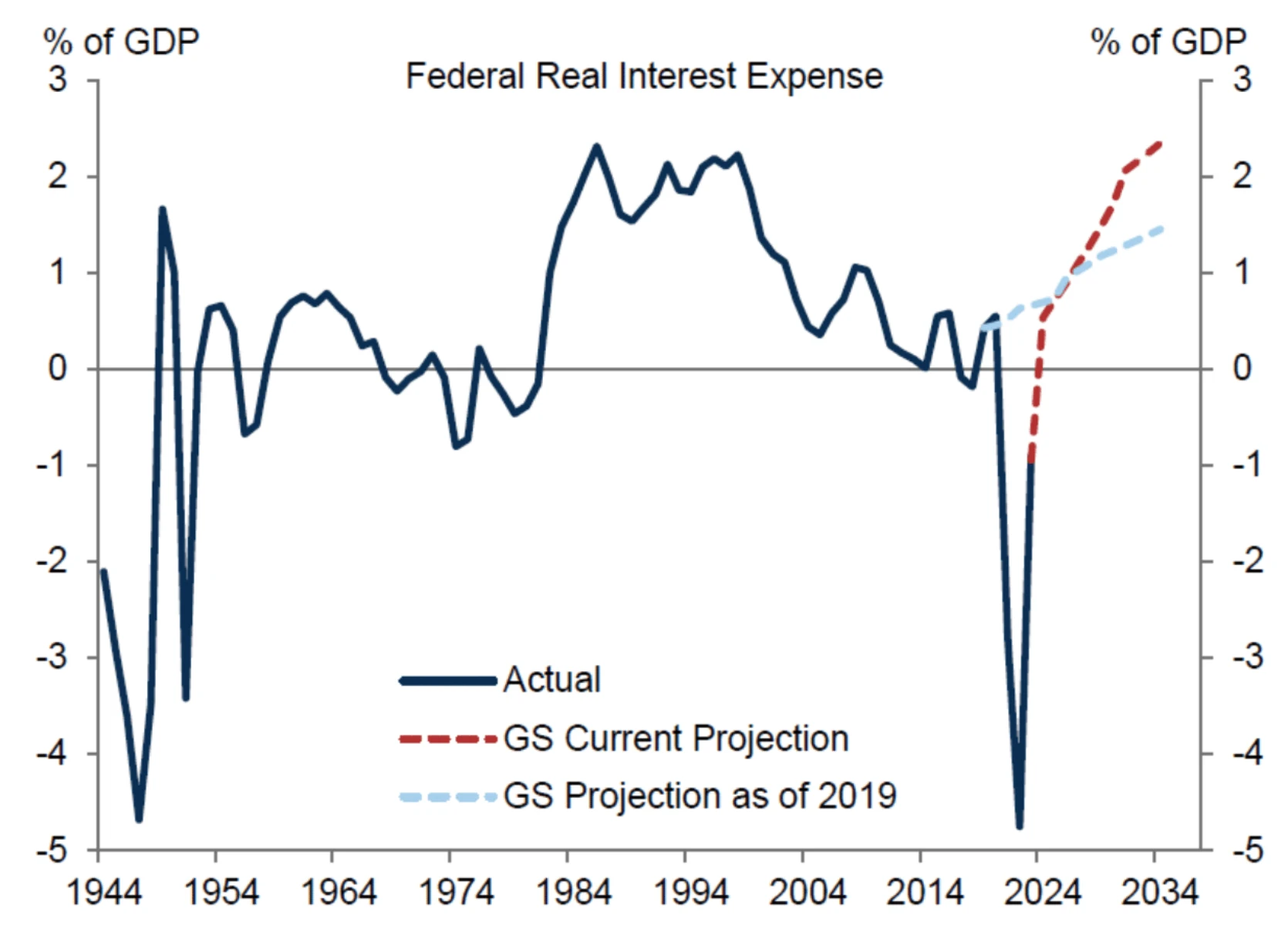

Keep paying attention to the fiscal situation of the United States, which is basically hyped up as a topic every year. As shown in the figure below, the US government debt may reach 130% of GDP within ten years, and the interest expenditure alone will reach 2.4% of GDP. The military expenditure to maintain the US global hegemony is only 3.5%, which is obviously unsustainable.

Weaker dollar

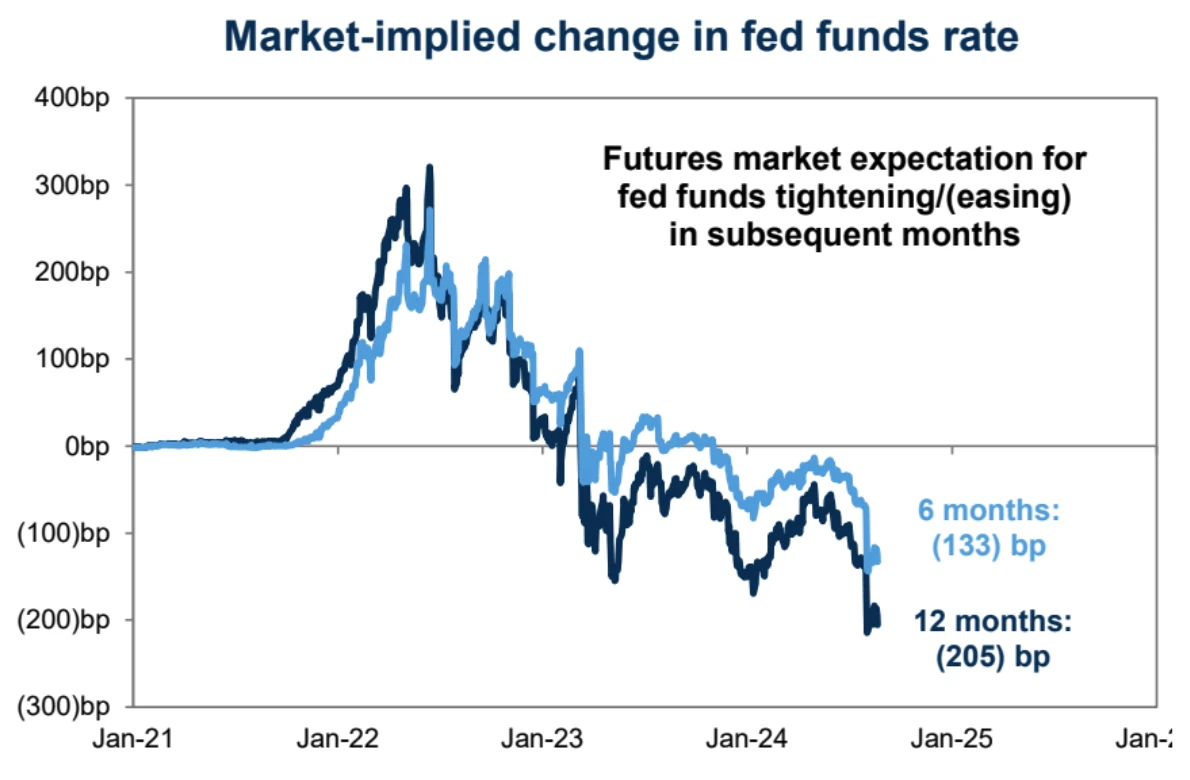

Over the past month, the U.S. Dollar Index (DXY) has fallen 3.5%, the fastest rate of decline since the end of 2022, which is related to the markets increased expectations for the Federal Reserve to cut interest rates.

Looking back at the beginning of 2022, the Federal Reserve adopted an aggressive interest rate hike policy to combat inflation, which drove the dollar to strengthen. However, by October 2022, the market began to expect that the Feds interest rate hike cycle was coming to an end and might even begin to consider cutting interest rates. This expectation led to a decline in market demand for the dollar, pushing the dollar to weaken.

Todays market seems to be a repeat of that year, except that the hype at that time was too advanced, and today the interest rate cut is about to land. If the US dollar falls too much, the unwinding of long-term carry trades may emerge again, and then become a force to suppress the stock market:

Two major themes next week: inflation and Nvidia

Key price data include the PCE (personal consumption expenditures) inflation rate in the United States, Europes preliminary CPI (consumer price index) for August, and Tokyos CPI. Major economies will also release consumer confidence indexes and economic activity indicators. In terms of corporate earnings, the focus will be on Nvidias earnings report after the U.S. stock market closes on Wednesday.

The PCE released on Friday is the last PCE price data before the next Fed meeting on September 18. Economists expect core PCE inflation to remain at +0.2% month-on-month, with personal income and consumption increasing by +0.2% and +0.3% respectively, the same as in June, which means that the market expects inflation to maintain a moderate growth momentum and will not decline further, leaving room for possible downward surprises.

Nvidia earnings preview: The dark clouds are dispersing, which is expected to inject a shot of adrenaline into the market

Nvidias performance is not only a barometer of AI and technology stocks, but also a barometer of the entire financial market sentiment. NVs demand is not a problem for the time being, and the most critical topic is the impact of the postponement of the Blackwell architecture. After reading several institutional analysis reports, I found that the mainstream view on Wall Street is that this impact is not significant. Analysts generally maintain optimistic expectations for this financial report, and in the past four quarters, NVDAs actual announced results have exceeded market expectations.

The most core indicators of market expectations are:

Revenue of $28.6 billion, up 110% year-on-year and 10% quarter-on-quarter

EPS: USD 0.63, +133.3% YoY, +5% QoQ

Data center revenue was $24.5 billion, up 137% year-on-year and 8% quarter-on-quarter

Profit margin: 75.5%, same as Q1

The most concerning issues are:

1. Has the Blackwell architecture been delayed?

UBS analysts believe that Nvidias first batch of Blackwell chips will be delayed by 4-6 weeks at most, and is expected to be delayed until the end of January 2025. Many customers have switched to purchasing H200, which has a very short delivery time. TSMC has begun production of Blackwell chips, but the initial production is lower than the original plan because the CoWoS-L packaging technology used by B100 and B200 is more complex and has yield challenges. H100 and H200 use CoWoS-S technology.

However, this new product was not included in the recent performance forecast:

Since Blackwell will not enter sales expectations until Q4 2024 (Q1 2025) at the earliest, and NVIDIA only provides single-quarter performance guidance, the delay will have little impact on the performance of Q2 and Q3 2024. At the recent SIG GRAPH conference, NVIDIA did not mention the impact of the Blackwell GPU delay, indicating that the impact of the delay may not be significant.

2. Has demand for existing products increased?

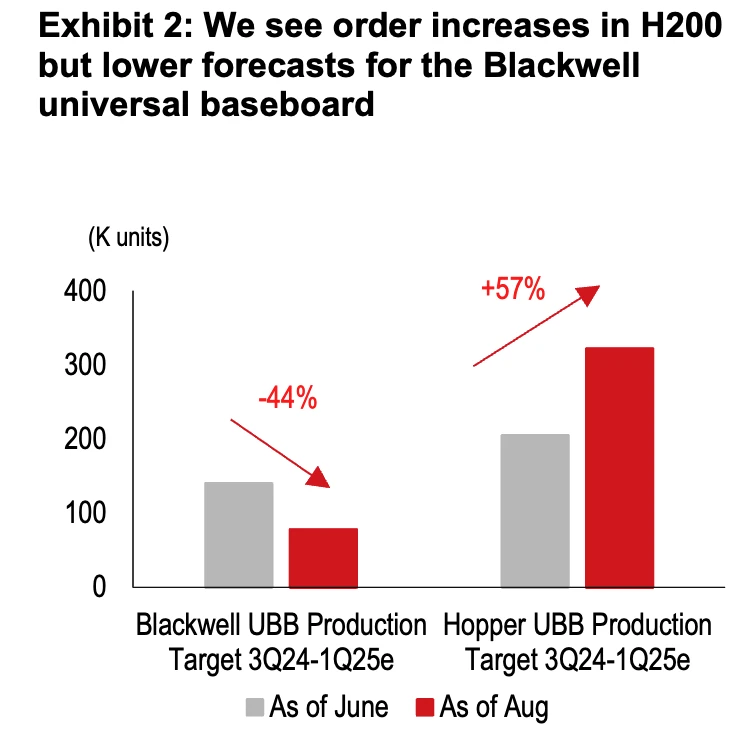

Secondly, the decline in B100/B200 can be compensated by increasing the growth of H200/H20 in the second half of 2024.

According to HSBCs forecast, production of B100/B200 substrates (UBB) has been revised by 44%, although deliveries may be partially postponed to the first half of 2025, resulting in reduced shipments in the second half of 2024. However, orders for H200 UBB have increased significantly, with an estimated increase of 57% between the third quarter of 2024 and the first quarter of 2025.

Based on this projection, H200 revenues of $23.5 billion in H2 2024 should more than offset the potential $19.5 billion loss in B100 and GB200 related revenues - equivalent to 500,000 B100 GPUs or $15 billion in implied revenue loss, and an additional $4.5 billion in ancillary facility (NVL 36) revenue loss. We also see potential upside from strong H20 GPU momentum, primarily for the Chinese market, with potential shipments of 700,000 units or $6.3 billion in implied revenues in H2 2024.

In addition, TSMCs step-by-step increase in CoWoS production capacity may also support revenue growth from the supply side.

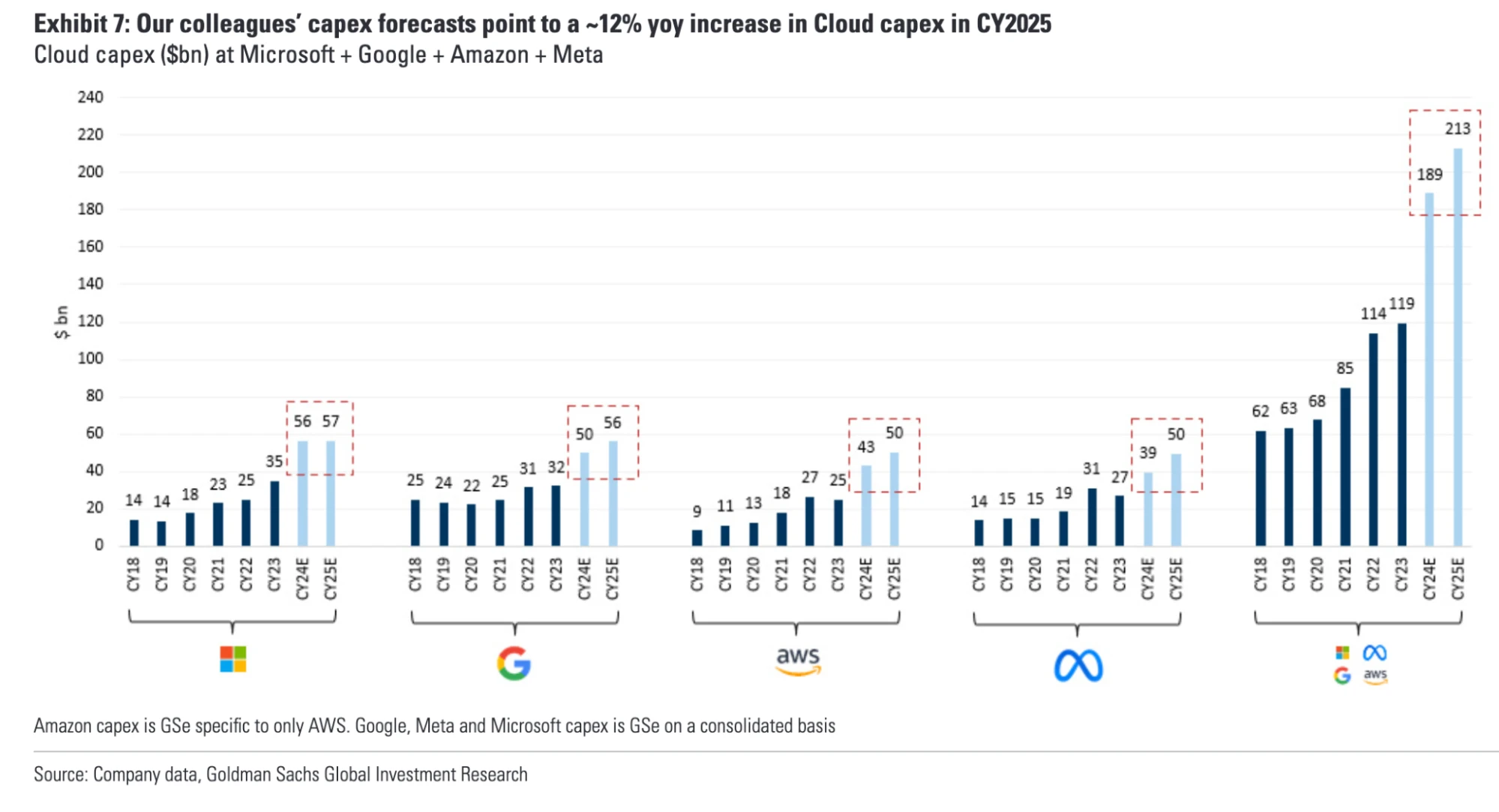

On the customer side, U.S. hyperscale technology companies account for more than 50% of NVIDIAs data center revenue, and their recent comments indicate that NVIDIAs demand outlook will continue to increase. Goldman Sachs forecast model shows that year-on-year growth in global cloud computing capital expenditures will reach 60% and 12% in 2024 and 2025, respectively, higher than previous forecasts (48% and 9%, respectively). But it can also be seen that this year is a big year for growth, and it is impossible to maintain the same level of growth next year:

Below is a summary of recent comments from the largest technology companies regarding AI capital spending, showing their expectations for capital spending growth in 2024 and 2025:

Alphabet: Expects to spend $12 billion or more in capital expenditures per quarter through the remainder of 2024, for total spending that could reach $12 billion to $13.5 billion.

Microsoft: Capital spending is expected to be higher in 2025 than in 2024 to meet growth demand for its AI and cloud products.

Capital expenditures are expected to increase quarterly to meet cloud computing and AI demands that currently exceed Microsofts capacity.

In particular, capacity constraints on AI in Azure cloud services are expected to continue through the first half of fiscal 2025.

Meta: Raised its 2024 capital spending outlook to between $37 billion and $40 billion from $35 billion to $40 billion previously.

Significant capital expenditure increases are expected in 2025 as companies plan investments to support their AI research and product development efforts.

Amazon: Capital expenditures are expected to be higher in the second half of 2025.

The major portion of capital expenditures will be used to support the growing demand for the companys generative AI and non-generative AI workloads.

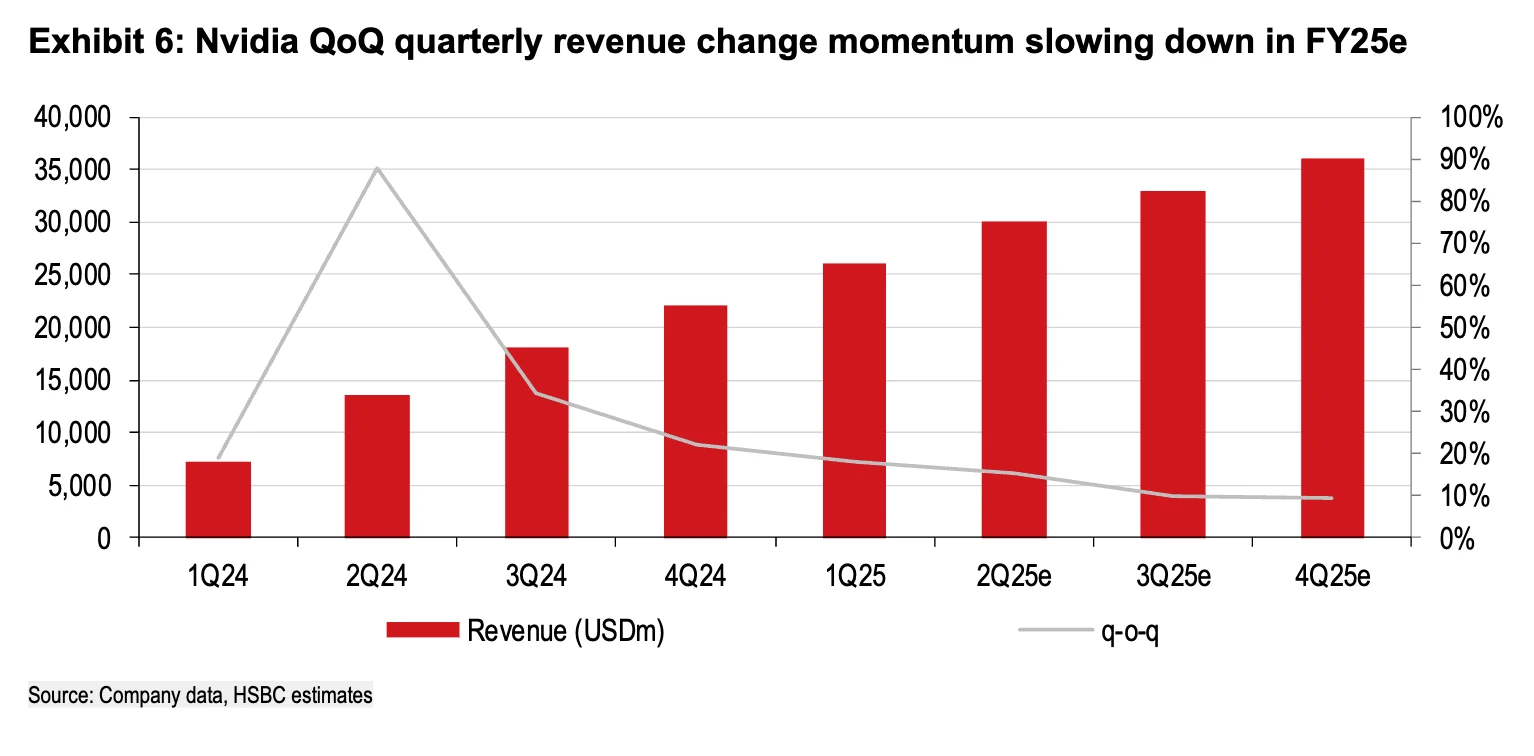

3. The extent of the slowdown in momentum

In addition to the slowdown in spending growth among large companies next year, NVs performance growth will also slow further.

The market consensus expects revenue in fiscal year 2025 to be $105.6 billion, compared to $60.9 billion last year, and the growth rate has slowed from 126% last year to 73%. The official guidance Q2 revenue is $28 billion, and the market expects it to be more optimistic, but the growth rate of performance this quarter will further slow from the 2x% growth range to the 1x% growth range:

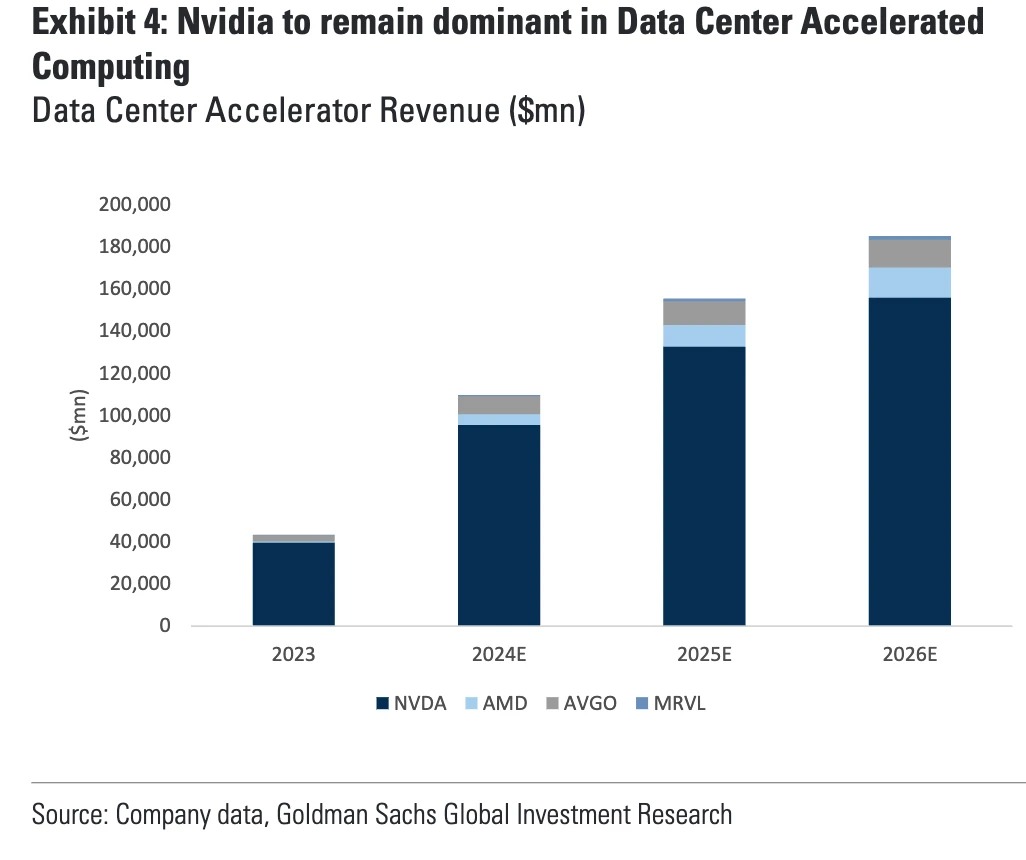

It is important to note that there are more and more players in the AI market: AMDs MI 300X chip is said to be superior to Nvidia in some aspects. Cerebras has launched chips with whole-wafer architecture, which significantly reduces interconnection and network costs and power consumption. In addition, major technology companies including Google, Amazon and Microsoft are developing their own AI chips. All of these may reduce dependence on Nvidia products in the future.

However, there are not enough cases to support this concern, and Wall Street still expects Nvidia to maintain its dominance in data center chips:

4. Focus on China

NVIDIAs demand trends in China will also be a focus in the upcoming earnings outlook, especially as the market expects increased demand in H20 . Pay attention to the following information in the earnings conference call:

How customer interest has changed since the launch of H20 .

The companys competitiveness when facing domestic competitors (mainly Huawei).

The B20 (a watered-down version of Blackwell) is scheduled for launch in 2025.

5. Changes in product lines

Due to the unprecedented production complexity faced by TSMC chip packaging (CoWoS-L vs. traditional CoWoS-S) and ARM-based Grace CPUs (compared to traditional x86 CPUs), it is possible to reduce the number of high-bandwidth memory stacks to reduce packaging complexity (allowing the use of traditional CoWoS-S instead of CoWoS-L). For example, the new NVIDIA products B 200 A and GB 200 A Ultra may use the old CoWoS-S packaging. The changes in technical specifications and cooling methods of the new products make it difficult for NVDA to maintain its previous high pricing power in the market:

Technical Specifications: The new A-series GPUs feature reduced performance compared to the standard B100 and B200 GPUs. Lower performance means lower pricing expectations for these new products. As a result, the average selling price (ASP) for the B200 A is expected to be between $25,000 and $30,000, compared to the $35,000 to $40,000 ASP for the previous B100 and B200 GPUs. This reduction in specifications and performance translates directly into reduced pricing power.

Cooling method: The upcoming GB 200 A Ultra NV L3 6 rack solution is expected to be air cooled instead of a complex liquid cooling system. This change may result in lower overall revenue compared to the previous GB 200 NV L3 6 and NVL 72 racks.

This could have an uncertain impact on performance. On the one hand, it could be good for revenue, but on the other hand, it could reduce NVDAs pricing power because its product lines would be competing with each other.

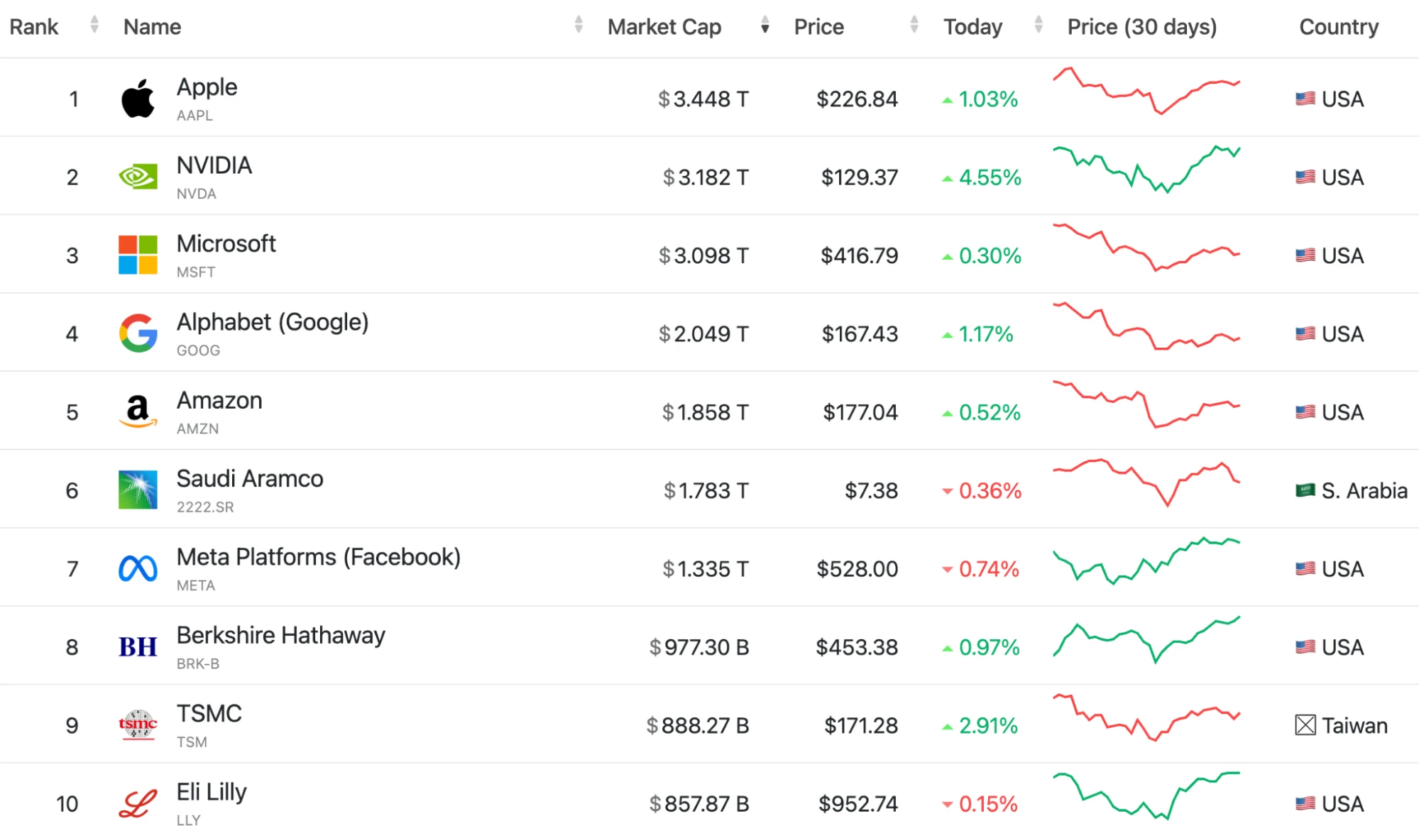

6. Stock price fluctuations

Due to the Blackwell delay, the AI narrative being slightly challenged, and the overall market correction, Nvidia once fell 30% from its peak, but investors bought on dips, causing the stock price to rebound by another 30%. The current market value of Nvidia is 3.18 trillion US dollars, ranking second in the world, only 7% away from its historical high.

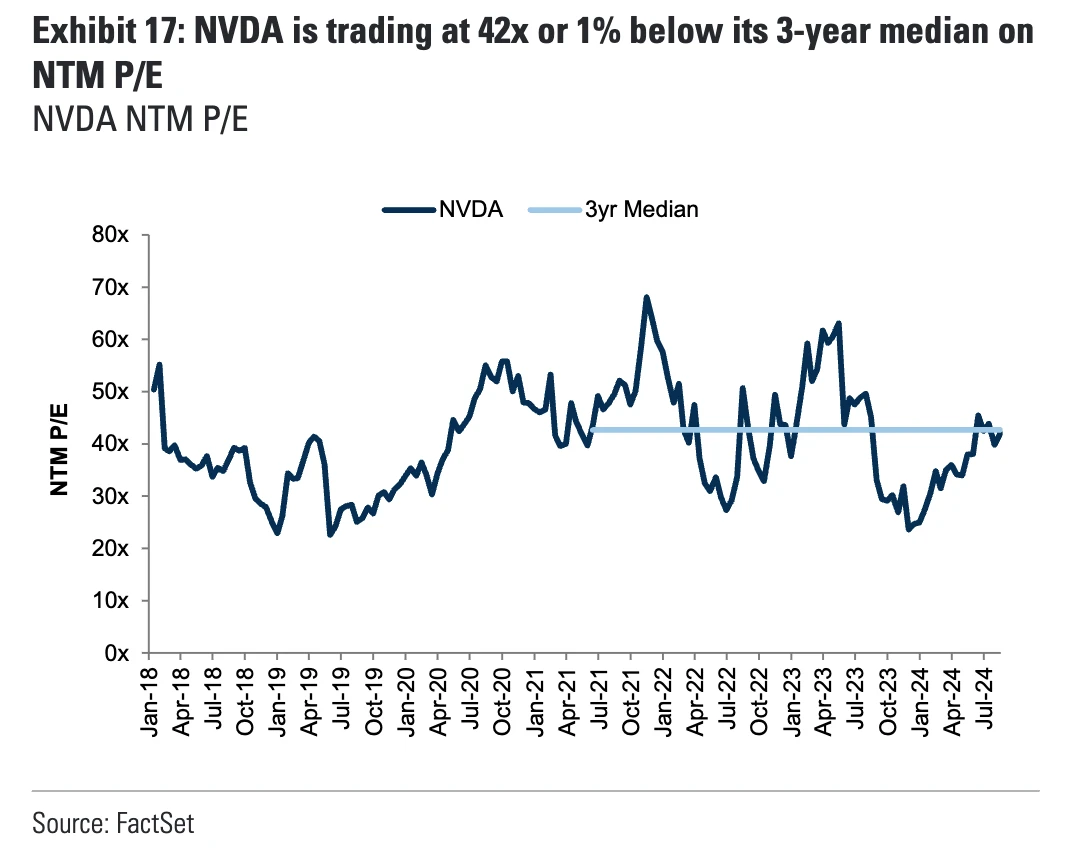

NVDAs current valuation level is basically at the median level of the past three years, neither high nor low.

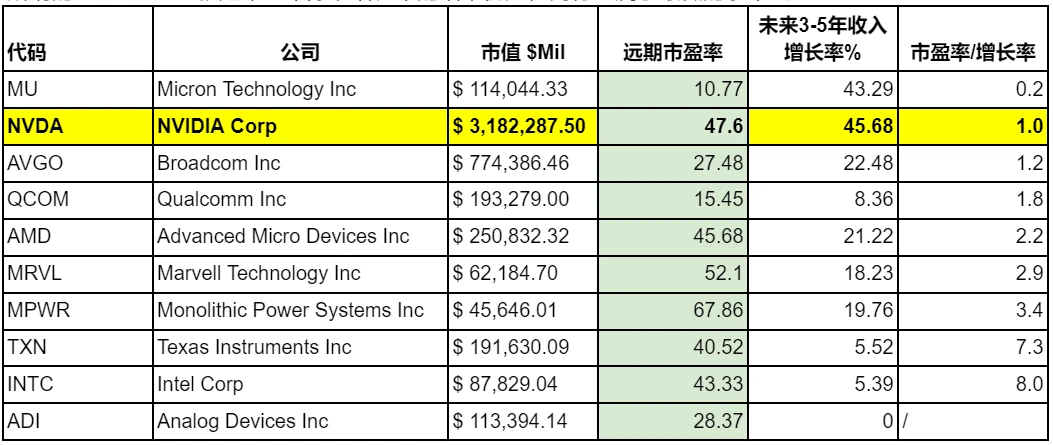

Compared with its competitors, NVDAs P/E ratio is definitely not low, reaching 47.6 times. However, since it still maintains a high growth expectation, the so-called PEG ratio, which is the result of dividing the P/E ratio by the growth rate, is still one of the lowest levels among its peers:

7. Bull-Bear Hypothesis

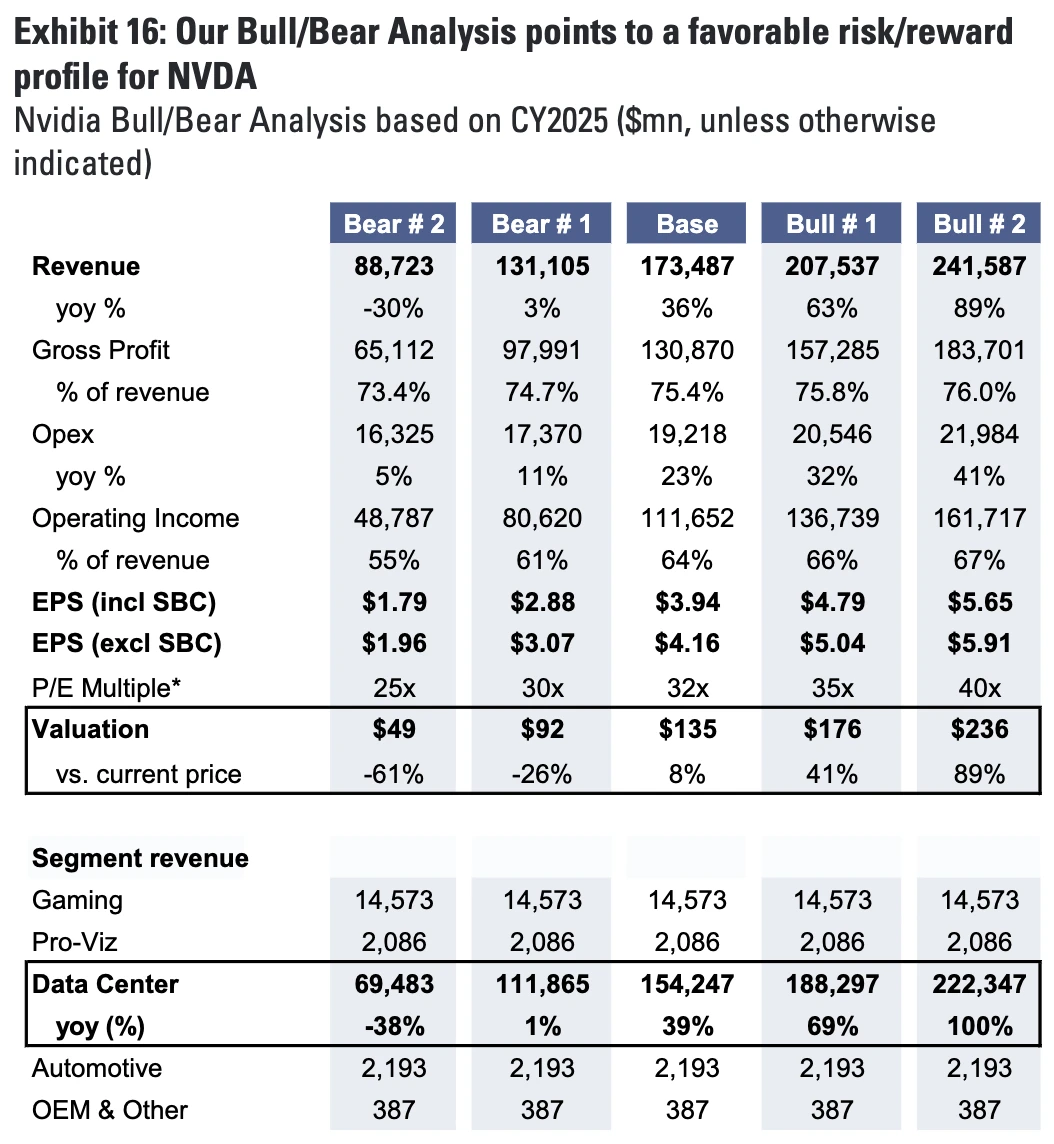

The AI narrative encountered some challenges in the first two months, mainly from the perspective of a likely low contribution to corporate revenue. Based on this pessimistic assumption, that the AI investment boom is a one-off, NVIDIAs data center business could quickly return to its pre-2023 trend level.

That is, the assumption is that data center revenue will decline to $69 billion in 2025, 38% lower than the current level and 55% lower than the baseline expectation, as the assumption of the most pessimistic scenario. Then the most optimistic assumption is that data center revenue will grow by 100% in 2025.

Goldman Sachs stock price change forecast under this bull-bear scenario is:

Based on the current share price of $124.58 and the baseline expected share price of $135, Bull #1 and Bull #2 will rise by 41% and 89% respectively, and Bear #1 and Bear #2 will fall by 61% and 26% respectively. That is, at the current price level, NVDAs potential return is still less than the risk.

8. Summary: Trends slow down, but remain optimistic

NVDA’s valuation is currently in a neutral range, and its performance remains satisfactory, but the market’s most FOMO period has passed, and its performance growth rate has entered a downward channel. It is obviously difficult for NVDA’s price to replicate the 10-100 increase of that year.

The biggest risk is that the AI narrative is falsified, but as long as this matter does not continue to ferment, the negative impact on NVDAs performance is more of a mood swing. Other negatives come more from macro interest rates and geopolitical uncertainties. For example, the U.S. Department of Commerce will conduct an annual review of semiconductor export restrictions in October, which may prohibit the export of the special version H20 chip with weakened performance, and even affect the difficulty of obtaining the castrated version B20.

Uncertainties in the market may bring some stock price fluctuations, and valuation multiples may also shrink, but we can still remain optimistic at this stage because the problems are mainly concentrated in the supply chain rather than demand. These supply chain problems can be solved and will not fundamentally undermine NVIDIAs long-term growth momentum. The company will remain attractive in the next few years. For example, there has been a 30% rebound in just a few days recently, which shows the markets enthusiasm for bargain hunting.

In particular, the outlook for AI demand may still be early, with Meta estimating that the computational load for its next-generation Llama 4 large language model will be 10 times higher than Llama 3.1, suggesting that the outlook for long-term AI computing chip demand may exceed our expectations.