Key Takeaways:

The total market value of global cryptocurrencies is $3.63 trillion, up 6.8% from $3.4 trillion last week.

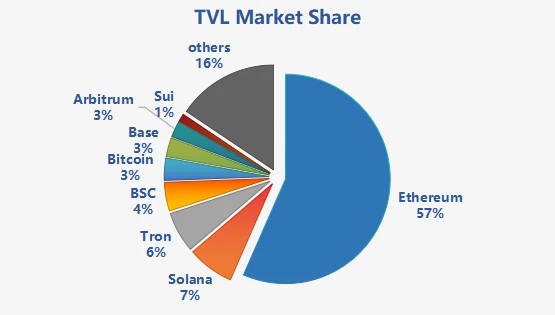

This week, the total TVL of DeFi is 126.2 billion US dollars, an increase of 1.39% from last week. According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 57%, Solana chain accounting for 7%, and Tron chain accounting for 6%.

The total market value of stablecoins is now $193.1 billion, a record high, with an increase of 1.2% in the past week. Among them, the market value of USDT is $128.8 billion, accounting for 69.7% of the total market value of stablecoins; followed by USDC with a market value of $39.9 billion, accounting for 20.7% of the total market value of stablecoins.

From the on-chain data, SOL is still in the leading position in daily trading volume, but compared with $4.497 billion last week, the overall daily trading volume of SOL this week has fallen by 37%. From the perspective of daily active addresses, the active addresses on the SOL/BNB/SUI chains this week are all on a downward trend compared with last week. Among them, the downward trend on the SUI chain is the most obvious, with an overall decline of nearly 70%. From the perspective of total locked volume (TVL) and circulating market value, ETH is still the absolute leader in the DeFi field, with its DeFi TVL reaching $72.1 billion and circulating market value reaching $447 billion, far exceeding other public chains.

Innovative projects to watch: Agentstarter : Virtuals Protocol AI Agent Launchpad; Polytrader : AI-driven Polymarket companion, built on Base chain and SOL chain. With AI, social media analysis, database analysis, Polymarket prediction and search engine models can be realized; AgentLayer : Decentralized AI Agent public chain, supporting Agent economy and AI asset trading on L2 blockchain. AgentLayer is about to launch a new market prediction product Orbs, which will be open for interaction in the form of Telegram bot, and users can directly participate in predictions on Telegram.

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

The total market value of global cryptocurrencies is $3.63 trillion, up 6.8% from $3.4 trillion last week.

Data source: Cryptorank

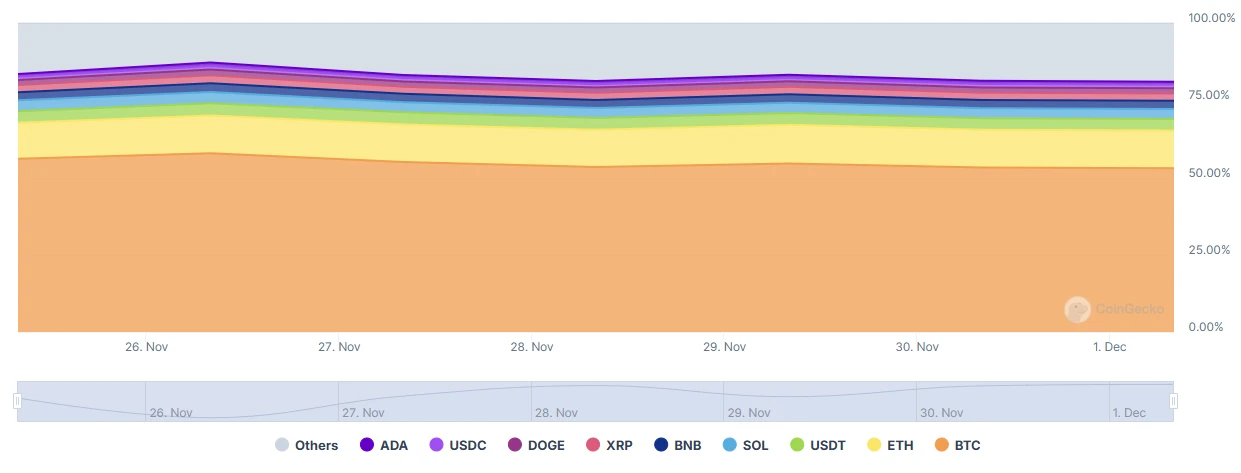

As of today, Bitcoin (BTC) has a market cap of $1.92 trillion, accounting for 53.03%. Meanwhile, stablecoins have a market cap of $193.1 billion, accounting for 5.44% of the total cryptocurrency market cap.

Data source: coingeck

2. Fear Index and ETF Inflow and Outflow Data

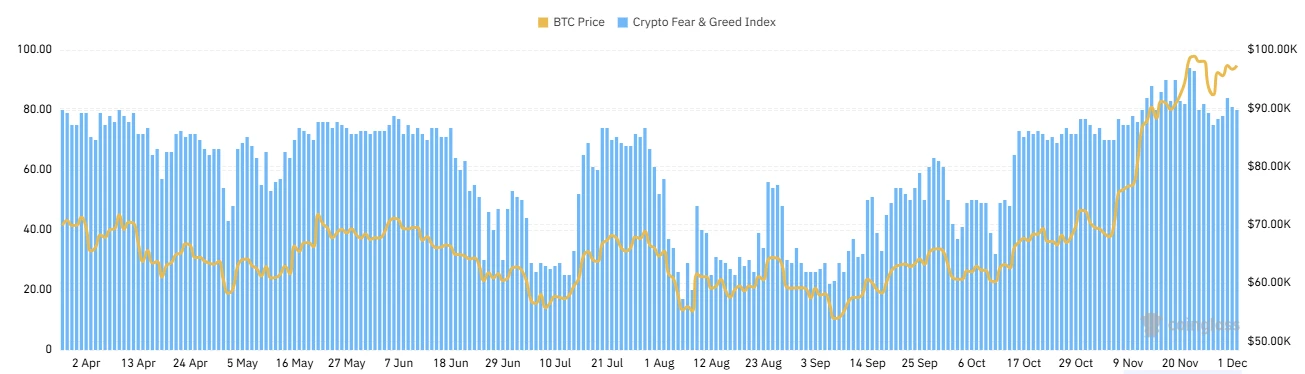

The cryptocurrency fear index is at 80, indicating greed.

Data source: coinglass

3. ETF inflow and outflow data

As of December 2, 2024, the total net inflow of US Bitcoin spot ETFs was approximately US$30.7 billion, and the net inflow of US Ethereum spot ETFs was approximately US$573 million. On November 30, according to Farside Investors data, the US Ethereum spot ETF had a net inflow of US$332 million, which was the first time in history that it exceeded the Bitcoin spot ETF.

Data source: CoinW Research Institute, sosovalue

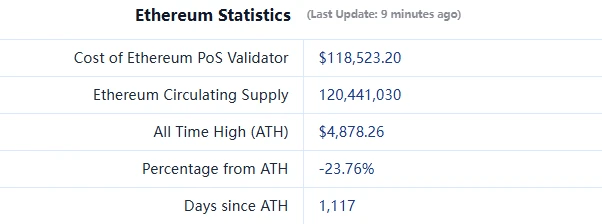

4. ETH/BTC and ETH/USD exchange ratio

ETHUSD: Currently $3,703, historical high $4,878

ETHBTC: Currently 0.037965, the highest in history is 0.1238, a drop of about 69.3%

Data source: ratiogang

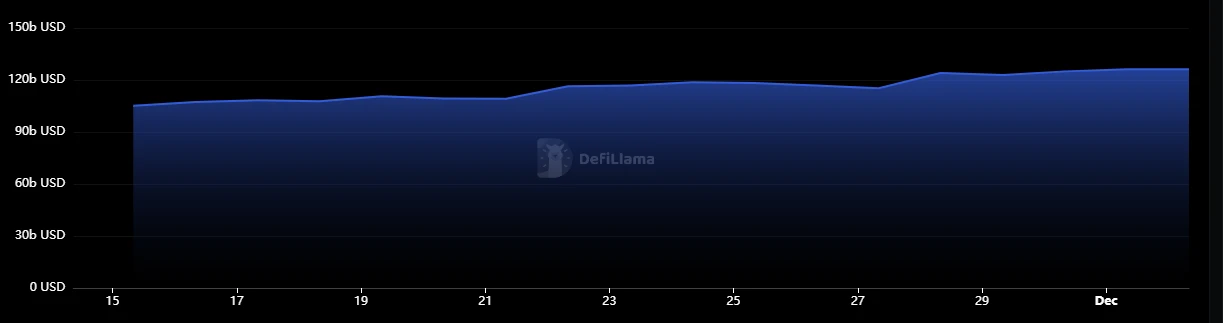

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $126.2 billion, up 1.39% from last week.

Data source: defillama

By public chain, the three public chains with the highest TVL are Ethereum chain accounting for 57%; Solana chain accounting for 7%; and Tron chain accounting for 6%.

Data source: CoinW Research Institute, defillama

Data as of December 2, 2024

6. On-chain data

Mainly analyzing the relevant data of the current major public chains ETH, SOL, BNB, TON, SUI and APT from the perspective of daily transaction volume, daily active addresses, transaction fees and total locked value (TVL).

Data source: CoinW Research Institute, defillama, Nansen

Data as of December 2, 2024

Daily trading volume and transaction fees: Daily trading volume and transaction fees are the core indicators for measuring the activity of public chains and user experience. In terms of daily trading volume, SOL is still in the leading position, but compared with the trading volume of 4.497 billion US dollars last week, the overall daily trading volume of SOL this week has dropped by 37%. This also reflects that the popularity of Meme coins has shown a downward trend compared to the peak PVP period. In terms of transaction fees, SOL has a clear advantage over ETH chain and GAS.

Daily active addresses: Daily active addresses reflect the ecological participation and user stickiness of the public chain. From the perspective of daily active addresses, the active addresses on the SOL/BNB/SUI chains this week are all on a downward trend compared to last week. Among them, the downward trend of the SUI chain is the most obvious, with an overall decrease of nearly 70% compared to 1,579,833 last week. This also reflects that the Meme players of the SUI chain are gradually withdrawing, and SUI needs a new narrative to further drive it.

Total locked value (TVL) and circulating market value: reflects the maturity of DeFi and the degree of trust users have in the platform. From the perspective of TVL, ETH is still the absolute leader in the DeFi field, with its DeFi TVL reaching $72.1 billion and circulating market value reaching $447 billion, far exceeding other public chains.

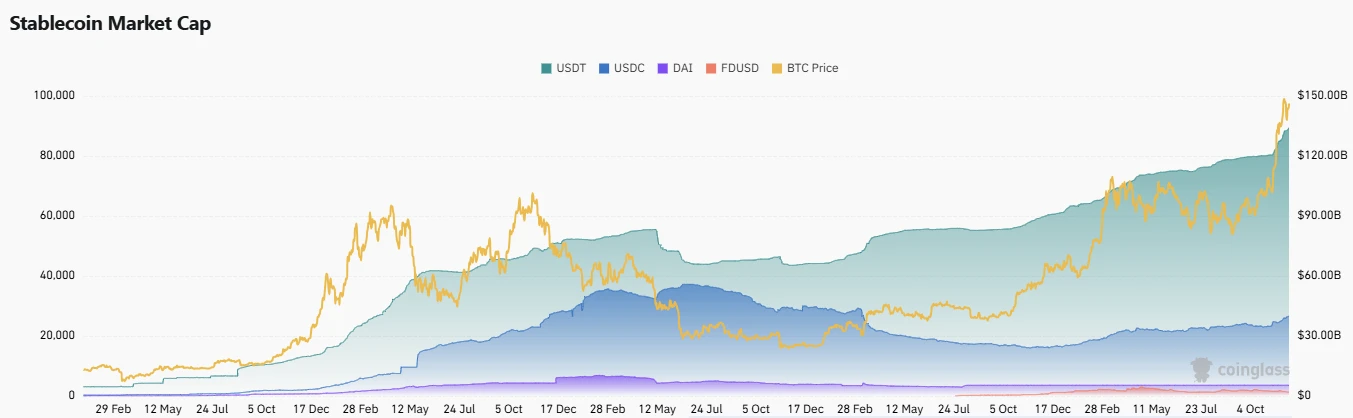

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is now $193.1 billion, a record high, with an increase of 1.2% in the past week. Among them, the market value of USDT is $128.8 billion, accounting for 69.7% of the total market value of stablecoins; followed by USDC with a market value of $39.9 billion, accounting for 20.7% of the total market value of stablecoins; and DAI with a market value of $5.36 billion, accounting for 2.8% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of December 2, 2024

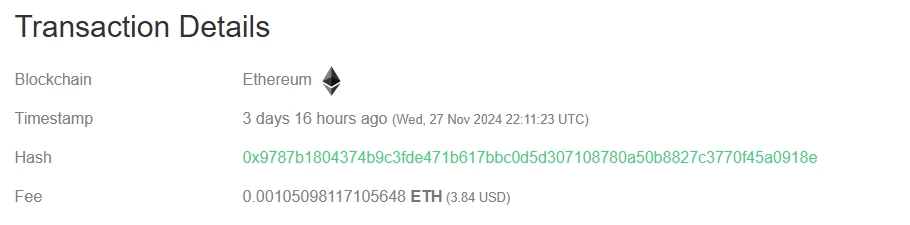

According to Whale Alert monitoring this week, USDC Treasury issued a total of more than 290 million USDC on Ethereum on November 28.

Data source: Whale Alert

2. Hot money trends this week

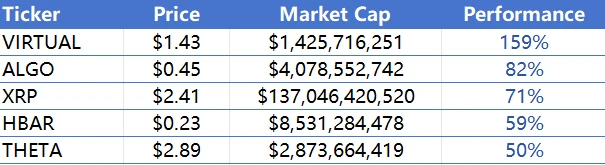

1. The top five VC coins and meme coins with the highest growth this week

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, Coingeck

Data as of December 2, 2024

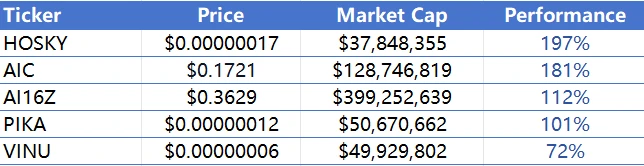

Top 5 Meme Coins That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of December 2, 2024

2. New Project Insights

Agentstarter : Virtuals Protocol AI Agent Launchpad.

Polytrader : An AI-driven companion to Polymarket, built on the Base chain and SOL chain. With AI, social media analysis, database analysis, Polymarket forecasting, and search engine models can be realized.

AgentLayer : A decentralized AI Agent public chain that supports Agent economy and AI asset trading on L2 blockchain. AgentLayer is about to launch a new market prediction product Orbs. Orbs will be open for interaction in the form of Telegram bot. Users can participate in predictions directly on Telegram. The product revenue will be used to repurchase the project token $AGENT.

3. New Industry Trends

1. Major industry events this week

Integrated public chain Supra launched the mainnet and launched TGE: The integrated public chain Supra announced the launch of the mainnet, and the SUPRA token of TGE was launched on November 27, 2024. Supra is a vertically integrated L1 public chain that provides MultiVM support, native oracles, on-chain random numbers, cross-chain communication and automation functions. Supra has completed a total of US$38 million in financing, and investment institutions include Coinbase and Animoca. Since its launch in August 2024, Supras testnet has processed more than 9 million transactions.

Bitcoin financial public chain SideProtocol opens airdrop registration on November 26: Bitcoin financial public chain Side Protocol opens airdrop, airdrop registration opens on November 26, and a total of 100 million SIDE tokens will be issued. The token $SIDE will first be issued in the SPL standard on Solana, and the mainnet is expected to be launched in January 2025, when it can be converted into mainnet tokens and participate in staking and governance.

A core member of daos.fun said that the daos.fun x pump.fun index will be released soon: baoskee, a core member of DAO startup platform daos.fun, tweeted that the daos.fun x pump.fun index will be released soon.

MetaMask supports US users to buy cryptocurrencies with Venmo: Crypto wallet MetaMask tweeted that its US users (except Texas and New York) can use Venmo to buy cryptocurrencies, and it is supported by MoonPay. Users can launch Venmo through the MetaMask extension and mobile devices.

Base founder declares no plans to issue tokens: Base founder Jesse Pollak published an article emphasizing that the Base network has no plans to launch tokens, and the focus is on building global products that people love and can solve practical problems. At the same time, he mentioned the example of Hyperliquid to illustrate that it is beneficial not to add price complexity before the product is launched.

2. Big events coming up next week

Anzen Finance, the issuer of the RWA stablecoin USDz, will conduct a public sale of ANZ on Fjord Foundry and Starship on December 2, and Anzen’s first season community airdrop will also follow.

The Taipei Blockchain Week 2024 (TBW 2024) hackathon supported by the Solana Foundation kicked off online on November 11 and will last until December 4.

Web3 game distribution infrastructure MATR1X will release important news on December 5th, which is related to veMax and may imply the opening of the MAX staking function.

Ethereum L2 Taiko Season 2 will last from September 17 to December 16, 2024, and will provide 6 million TAIKO token rewards, of which 5 million are for participants and 1 million are for DApps.

The Chicago Board Options Exchange (Cboe) will launch the first cash-settled index options tied to spot Bitcoin on December 2, based on the new Cboe Bitcoin US ETF Index. These options will be regulated by the SEC, and in addition to cash settlement, these index options will also offer European-style exercise.

3. Important investment and financing last week

Schuman Financial, seed round, financing amount of US$7.36 million, investors include RockawayX, Faction, Bankless Ventures, Kraken Ventures, Gnosis VC, Daedalus, Nexo Ventures, Delta Blockchain Fund, Archblock, etc. Schuman Financial is a stablecoin issuer that has launched EURØP, a euro-backed stablecoin designed to simplify global digital payments, on-chain foreign exchange transactions, and tokenized real-world assets. Schuman Financial has obtained a stablecoin issuer license in France and is building an ecosystem around EURØP, including SEPA integration, banking channels, and custody partnerships with Tier 1 global banks such as Societe Generale. (November 26)

Balance, with a financing amount of $10 million, has investors including Animoca Brands, Amber Group, Mask Network, GSR, MARBLEX, Web3Port, Nonagon Capital, MetaBlast Group, etc. Balance is a Web3 experience infrastructure built by the Epal team for large-scale user adoption. Through the combination of AI and blockchain technology, it is committed to providing Web2 users with a smooth Web3 transition experience. (November 26)

Partior, B1 round, raised $20 million, with investors including Deutsche Bank, Temasek, JP Morgan Chase, Jump Trading, etc. Partior is a payment clearing and settlement blockchain platform developed through the collaboration of the Ubin project, created by JP Morgan, DBS and Temasek with the support of MAS to achieve end-to-end atomic settlement of multiple currencies and replace sequential payment settlement. (November 27)

U 2 U Network, with a financing amount of US$13.8 million, and investors include Kucoin Ventures, Cointelegraph, Chain Capital, IDG Blockchain, Maxx Capital, V3 V Ventures, JDI Global, IBG, etc. U 2 U Network is a DAG-based and EVM-compatible blockchain that focuses on providing unlimited scalability and on-demand decentralization. (November 28)

usdx.money raised $45 million from investors including NGC, BAI Capital, Generative Ventures, and UOB Venture Management. The first stablecoin product of usdx.money is USDX, and the new funds will be used to promote the application of stablecoins USDX and sUSDX in multiple fields. (November 29)