Original source: Matt Hougan

Compiled by: Odaily Planet Daily ( @OdailyChina )

Translator: Wenser ( @wenser 2010 )

Editors note: As time enters 2025, with the emergence of US President Trumps genuine meme coin TRUMP and the short-term volatility of the market, the crypto market has once again ushered in a turning point: on the one hand, the mainstreaming process of crypto is accelerating; on the other hand, the alternating appearance of industry hotspots has caused the markets attention to decline rapidly. Many people believe that the recent market performance means that the bull market of this cycle has entered its final stage, but some people hold the opposite view, believing that the crypto ATH is still on the way and the market is still expected to double in 2025. In view of this, Odaily Planet Daily will compile and organize the recent views of Matt Hougan, chief investment officer of the well-known asset management giant Bitwise, in this article for readers reference.

Different cycles have their own catalysts, and deleveraging is inevitable

The traditional four-year cycle has come to an end in the cryptocurrency market.

Here’s a tweet about how the market has changed.

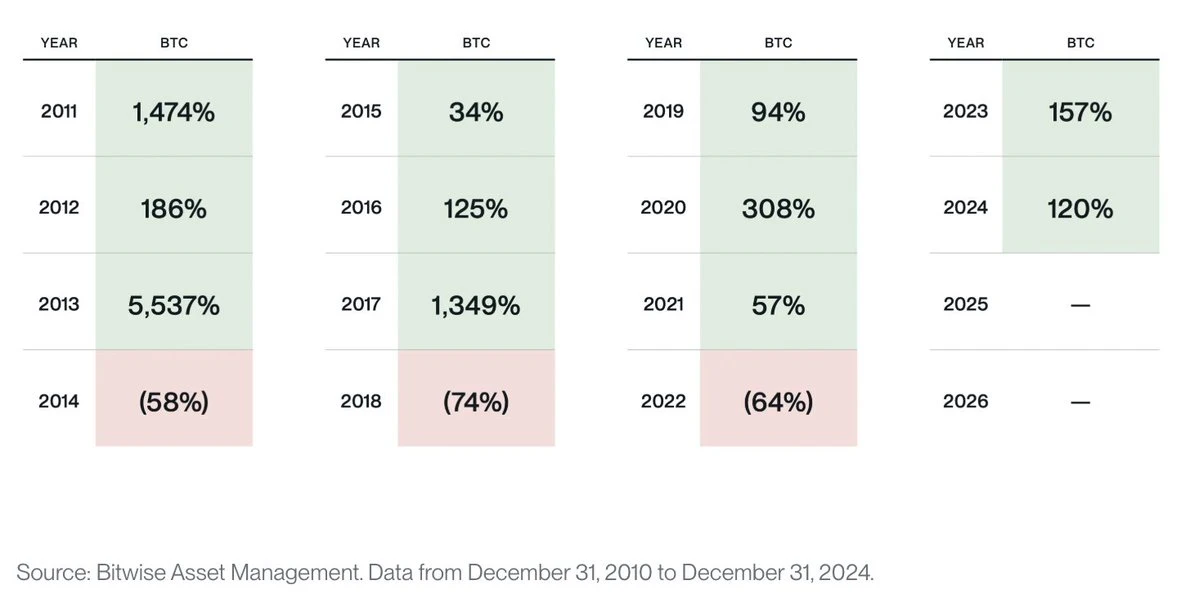

Bitcoin has historically followed the rule of a “four-year cycle” – three years of growth and one year of correction (Note from Odaily Planet Daily: this can be understood in layman’s terms as three advances and one retreat).

Bitwise sorts out BTC annual growth data

Broadly speaking, each up and down cycle is driven by the same forces that together drive broader cycles of growth and recession in the general economic system.

Typically, a market cycle begins with a catalyst that brings new investors and new capital into the market.

For example, in 2011, the first crypto companies and platforms were created to provide support for individuals to purchase Bitcoin (such as Coinbase, Mt. Gox, etc.).

Once the bull run begins, the crypto market will gain its own growth momentum:

Rising prices attract widespread attention, which in turn attracts more money. Eventually, investors become extremely greedy and increase leverage. Bubbles and frauds ensue. Sometimes, legacy infrastructure collapses under the pressure.

What happens at the end of different crypto cycles?

In 2014, Mt. Gox collapsed;

In 2018, the US SEC launched a strong crackdown on ICO.

Whatever the reason, the pullback is painful, with rapid deleveraging and desperation setting in. But eventually, the crypto market breaks out to start a new cycle.

The current cycle stems from the massive deleveraging that occurred in 2022 following many industry scandals: FTX’s collapse, Three Arrows Capital’s fall, Genesis’ bankruptcy, Blockfi’s collapse, Celsius’s collapse, etc.

The catalyst event for this up cycle occurred on March 10, 2023, when Grayscale convincingly won the opening arguments for the SEC’s bill to approve a Bitcoin ETF. Although the final ruling was not finalized until several months later, from that moment on, the imminent arrival of a Bitcoin ETF was inevitable. This also means that cryptocurrencies have officially entered the mainstream.

Sure enough, the Bitcoin spot ETF was officially launched in January 2024 and set a record for subsequent price trends—market prices rose as expected.

2026 may be the callback node, industry leverage is beginning to emerge, and Washington has become the encryption center leading the development of the industry

In the classic four-year cycle pattern, we will be preparing for a pullback in 2026.

Frankly, I do see early signs of leverage building within the crypto industry as some companies issue debt to buy Bitcoin and the growth rate of “Bitcoin mortgage loans” is rising rapidly.

However, in this cycle, the crypto industry has ushered in some new changes: Washington (referring to the U.S. government) has changed its attitude towards cryptocurrencies.

The crypto executive order has become one of the factors that must be considered: Previously, Washington has called cryptocurrencies a national priority, a statement that has laid the foundation for a regulatory framework to a certain extent. In addition, the US government may plan to establish a national-level crypto reserve.

The change in Washingtons attitude has paved the way for mainstream institutions to enter the cryptocurrency market in a big way.

But the reality is: mainstream investment institutions will not take corresponding actions in accordance with the expectations of the crypto-native group.

The change in Washingtons attitude is the result of multi-faceted efforts over many years, rather than a shift in just a few months.

Even with the best of expectations, it will take about a year for the cryptocurrency industry to align with the new crypto regulatory framework, and for many large companies and institutions to prepare from planning to action. Wall Street and mainstream investment institutions are more like giant oil tankers that are difficult to change direction in the short term, rather than speedboats that can quickly turn around. If such institutions only start to really turn to crypto next year, will the new crypto winter in 2026 arrive as we expected?

To be honest, Im not sure. After all, the scale of funds of traditional financial institutions is too large. Bitcoin spot ETFs have brought hundreds of billions of dollars and new investors capital into the cryptocurrency market; in contrast, the changes that Washington can lead will bring trillions of dollars of liquidity.

Crypto markets have followed a four-year cycle since the early days, but changes in Washington will usher in a new wave that will continue to play out over the next decade.

My personal guess is that this emerging, larger trend will hopefully overwhelm the classic “deleveraging drive” when it kicks off next year.

what does that mean?

This does not mean that the traditional four-year cycle law has completely disappeared. There is no doubt that leverage will still be generated; excess debt and liquidity will still appear; and there will still be toxic players, scammers and other poor actors in the market.

At some point, these things and these people may be eliminated, while introducing more liquidity into the market.

Furthermore, I personally expect any pullback to be shorter and shallower than in previous years.

There is no doubt that we are in a new mainstream era for cryptocurrency, and it is both exciting and intriguing.