Summary of key points

● Markets continued to fall, including U.S. stocks, mainly due to concerns about Trumps tariff policy and worsening economic conditions as shown by the latest unemployment data. Bitcoin ETFs experienced their largest outflows so far on Tuesday.

● The best performing tokens were KAITO, VINE, and CHILLGUY, with increases of 45.7%, 30.1%, and 17.9%, respectively; while the worst performing tokens were RAY, BROCCOLLI, and SOL, with decreases ranging from 26.2% to 53.5%.

● In the trading strategy section, we will analyze the macroeconomic situation and try to answer: What is the market bottom signal? How to seize the opportunity to buy $BTC pullback?

Data Overview

Top Performing Tokens

● $KAITO (+ 45.7%): As a newly listed token, KAITO has strong team support and is currently the most outstanding

● $VINE (+16.28%): Vine was a social experiment memecoin started by its actual founders with the goal of getting Elon Musk’s endorsement. As we all know, this goal has not been achieved yet - we think this is more like a near-death rally phenomenon

● $CHILLGUY (+17.9%): Chillguy is still the third best performing token on BitMEX despite being in the red

Underperforming Tokens

● $RAY (-10.6%): Raydium fell more than 50% as its largest partner pump.fun announced that it would build its own decentralized exchange

● $BROCCOLLO (-47.0%): Even CZ’s dogs can’t handle this market crash

● $SOL (-26.2%): With a large-scale unlocking in March, SOL continues to fall, becoming the worst performing token among the major layer 1 public chains.

Market News

Macroeconomics

● ETH ETF weekly outflow: -$242 million ( source )

● BTC ETF weekly outflow: -$2.45 billion ( source )

● Unemployment claims rise to 242,000, a three-month high ( source )

● Trump threatens to double tariffs on China and says punitive tariffs on Mexico and Canada will take effect on March 4 ( Source )

● SEC releases stance on memecoins, echoing Hester Peirce’s comments ( source )

● Pakistan to set up committee to oversee cryptocurrency policy: report ( source )

● Hackers stole $1.5 billion from Bybit exchange, making it the largest cryptocurrency theft in history ( source )

● Infini suffered a $50 million attack (source )

● Metaplanet seeks to raise over $13 million in bond sales to buy more Bitcoin ( source )

● SEC terminates investigation into Gemini, Cameron Winklevoss demands compensation ( source )

Project News

● Ethereum Foundation’s Aya Miyaguchi leaves executive director position to become president ( source )

● SEC drops lawsuit against MetaMask developer Consensys ( source )

● MetaMask will allow users to hold Bitcoin and Solana in wallet innovation ( source )

● Blockchain restaurant loyalty app Blackbird goes live with Flynet mainnet ( source )

● PayPal-backed Raise receives $63 million in funding to expand blockchain-based gift card system ( source )

● Crypto asset manager Bitwise strengthens balance sheet with $70 million in equity financing ( source )

Trading strategies

NOTE: The following does not constitute financial advice. This is merely a compilation of market news and we encourage you to do your own research before executing any trades. The following does not represent any guaranteed returns and BitMEX cannot be held responsible if your trades do not execute as expected.

Macroeconomic factors and bottoming signals behind the Bitcoin plunge

Bitcoins recent sharp drop from a high of nearly $110,000 in mid-January to below $80,000 has caused many traders and retail investors to panic. Many are worried that the bull run is over, while others are looking for signs that the market is about to bottom. This article will explore the macroeconomic factors that have driven Bitcoins recent plunge and analyze the signs that may indicate that the market is about to bottom.

Macro factors

Trump’s policy uncertainty and trade war risks

● After Trump’s victory in the 2025 US election, the market initially had high expectations for his crypto-friendly policies, which led to a short-lived rise in risk assets including Bitcoin.

● However, Trump’s trade policies, especially high tariffs and protectionist measures, quickly changed market sentiment. Investors began to worry that a new round of trade war could have a negative impact on global economic growth and push up inflation.

● The result has been a massive outflow of funds from riskier assets like Bitcoin, with the Bitcoin ETF seeing its largest net outflow in history this week.

The Fed’s hawkish monetary policy

● Despite early market expectations for a rate cut, the Federal Reserve remained hawkish in the face of persistent inflation and strong employment data.

● The high interest rate environment increases the opportunity cost of holding non-yielding assets such as Bitcoin, causing investors to shift funds to more stable assets that can generate interest income.

● This tightening of monetary policy reduced market liquidity and caused Bitcoin prices to fall as institutional investors and large funds reassessed their risk exposure.

Economic slowdown and stagnation concerns

● Economic indicators pointed to slowing growth, raising concerns about potential stagflation (economic stagnation accompanied by high inflation).

● As these concerns spread, investors turned to safer assets and away from high-risk investments like Bitcoin.

● Persistent inflation concerns and economic stagnation continue to weigh on market sentiment, making investors reluctant to re-enter the Bitcoin market until macroeconomic conditions improve.

Stock Market Bubble and Spillover Effect

● The recent decline in the stock market, especially in the technology sector, has had a knock-on effect on Bitcoin.

● Bitcoin prices tend to correlate with the broader stock market when risk appetite is low. Bitcoin has seen a similar pullback as stocks sold off amid concerns about overvaluation.

● Bitcoin is affected by broader market sentiment as investors move away from risky assets, despite being a unique asset class.

Summary: Trumps trade policies, the Federal Reserves hawkish stance, concerns about an economic slowdown, and stock market instability have combined to create a macroeconomic environment that has exerted significant downward pressure on Bitcoin prices.

Bottom signal

While Bitcoin’s current decline can be attributed to these macroeconomic factors, there are several potential bottoming signals that investors can watch out for. Understanding these signals can help retail traders time their entry as the market approaches a bottom.

Extreme panic levels in market sentiment

● The Fear Greed Index is a powerful tool for measuring sentiment in the cryptocurrency market. When the index enters the Extreme Fear zone, it generally indicates that the market may be oversold and a reversal may be imminent.

● Currently, the index is in extreme fear territory, indicating excessive investor pessimism. Historically, when sentiment reaches this level, it often marks the moment when the price of Bitcoin begins to stabilize and move upward again.

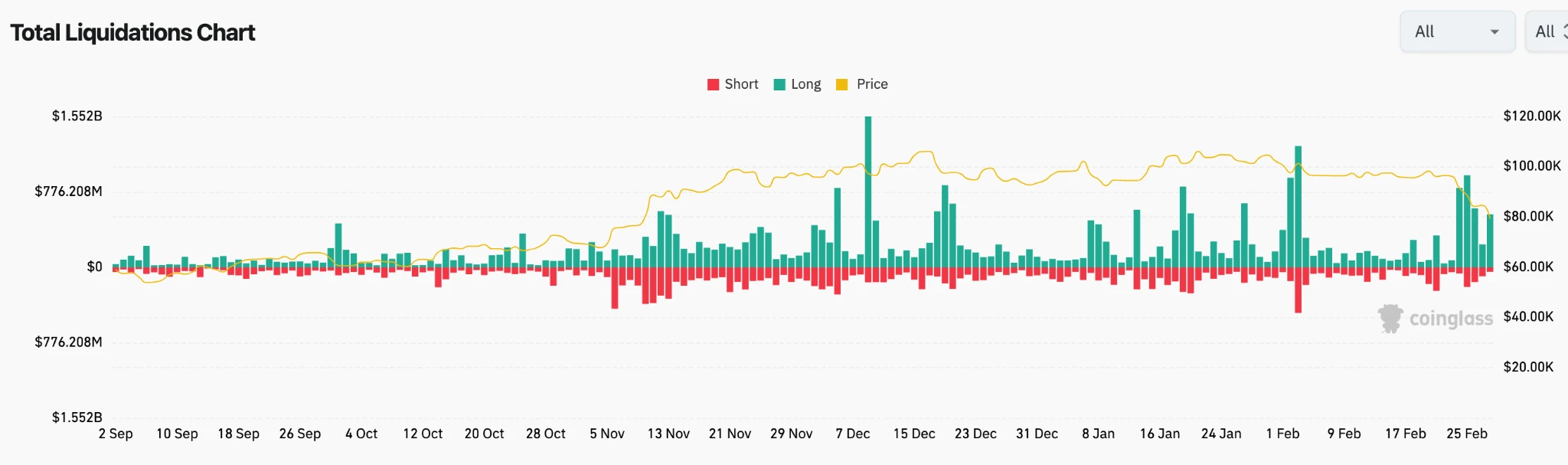

Mass liquidation and deleveraging

● The crypto derivatives market has seen a large number of leveraged position liquidations as the price of Bitcoin has fallen. When a large number of leveraged positions are liquidated, it creates additional downward pressure, but it may also indicate that the market is close to a capitulation point.

● Once these liquidations subside and positions are cleaned out, it usually marks the end of panic selling and the market environment will be more conducive for prices to recover.

Technical Support Levels and Price Action

● Historically, Bitcoin has tended to form solid support at psychologically significant price levels, such as $80, 000 or $70, 000.

● If the Bitcoin price approaches these levels and shows signs of consolidation or reversal, this could indicate that the market is finding a bottom. Investors should watch for candlestick patterns such as a bullish engulfing pattern or a candle with a long lower shadow, which could indicate that buyers are gradually entering the market.

Macroeconomic indicators: Fed policy shift or easing signal

● A key signal of a market bottom is a shift in Fed policy. If the Fed hints at a pause in rate hikes or even a rate cut, this could drive funds back into risky assets such as Bitcoin.

● Signs of slowing inflation or growth in key economic sectors could also reverse market sentiment and trigger a Bitcoin rally.

● The market will reflect future policy changes in advance, so even slight changes in the Fed’s stance may lead to significant fluctuations in Bitcoin prices.

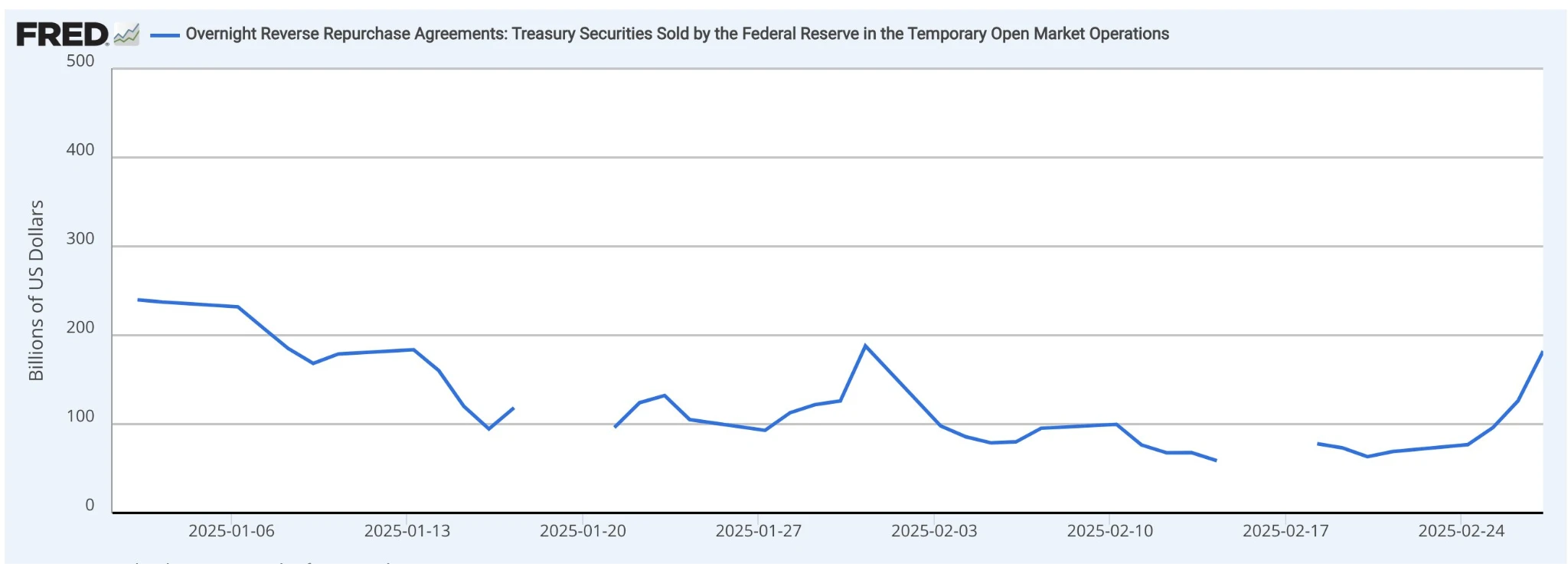

Arthur Hayes Liquidity Indicator: Reverse Repurchase Operations (RRP)

● Arthur Hayes highlighted “Reverse Repurchase Operations (RRP)” as a key liquidity indicator. High RRP balances mean that banks are holding cash rather than investing, and usually occur during periods of monetary policy tightening.

● Declining RRP balances suggest that liquidity is returning to the market as banks begin to deploy reserves into risky assets such as Bitcoin.

● A decrease in RRP balance could signal a market bottom, which is a good opportunity to enter Bitcoin before a rebound begins.

History Lessons: When Did Bitcoin Bottom Out?

Studying historical patterns can provide valuable insights into when Bitcoin may have bottomed.

The 2018 bear market: trade wars and interest rate hike cycles

● In 2018, the dual pressures of the US-China trade war and the Federal Reserve’s aggressive interest rate hikes caused Bitcoin to fall from US$20,000 to around US$3,000, a drop of more than 80%.

● The market did not find a bottom until early 2019 when the Fed paused its rate hikes and economic conditions improved.

● This suggests that Bitcoin can recover quickly when macroeconomic conditions improve, such as lower interest rates and improving trade relations.

Bear Market 2022: Soaring Inflation and Aggressive Fed Rate Hikes

● In 2022, rising inflation and aggressive monetary tightening by the Federal Reserve caused Bitcoin to fall from a high of $69,000 to around $20,000 by the end of the year.

● The market found a bottom when the Fed slowed the pace of rate hikes and inflation showed signs of peaking. Bitcoin rebounded from $16,000 and hit new highs in 2023.

● This highlights that Bitcoin tends to bottom out when inflationary pressures ease and monetary conditions are loose.

Lesson learned: When Bitcoin faces significant downward pressure from macroeconomic factors such as interest rate hikes and trade tensions, the market typically experiences a sharp correction. However, once these factors improve, Bitcoin tends to reverse quickly, marking the beginning of a new bull market.

Future Outlook: When Will Bitcoin Bottom?

While Bitcoin prices are currently under pressure, there are several signs that the market may be approaching a bottom.

Short-term risk of further decline

● Bitcoin may still have room to fall in the near term. The key price levels to watch are around $80,000 and $70,000, which have been clear supports.

● If Bitcoin falls below these levels and fails to recover, the next major support could be at $60, 000. However, even if Bitcoin falls further, it may still be an excellent buying opportunity for long-term investors.

Signs of recovery: Changes in macro conditions

● A shift in the macro environment, especially changes in Fed policy, is likely to be a catalyst for Bitcoin’s recovery. If the Fed hints at a pause or slowdown in rate hikes, Bitcoin is expected to find strong support and begin to rebound.

● Likewise, positive improvements in trade relations or easing of geopolitical tensions could help restore market confidence.

Long-term outlook: Bullish fundamentals

● Despite the current downturn, Bitcoins long-term fundamentals remain strong. As Bitcoins scarcity, institutional adoption, and strategic Bitcoin reserves by governments around the world continue to develop, Bitcoin remains a strong candidate for long-term growth.

A retail investors guide to identifying bottoms and managing risk

Buy in batches: avoid buying all at once

● It is difficult to pinpoint the market bottom, so consider buying in batches.

● Diversify your investments and buy at different prices as Bitcoin continues to fall. This will average out your entry prices and reduce the risk of missing the market bottom.

Monitor key indicators and look for confirmation signals

● Pay attention to the Fear and Greed Index. When it reaches the Extreme Fear area, it may indicate a potential buying opportunity.

● Keep a close eye on macro indicators, such as the Fed’s stance and inflation data, to gauge when the market might turn bullish again.

Risk management: position control and stop loss strategy

● Only invest money you can afford to lose. If trading short term, use stop-loss orders to protect yourself from larger losses.

● Avoid using leverage in uncertain markets and ensure that the portfolio is adequately diversified.

Stay rational and patient

● Dont let fear drive your decisions. Historically, when markets reach panic bottoms, they usually recover quickly.

● Believe in the long-term fundamentals of Bitcoin and hold on to your positions amid volatility.

in conclusion

This Bitcoin crash was driven primarily by macroeconomic factors, such as Trumps trade policies, the Feds hawkish stance, and concerns about an economic slowdown. However, historical patterns suggest that once these factors improve, Bitcoin may find a bottom and begin to recover. For retail investors, it is critical to identify bottom signals, such as extreme fear, the end of the liquidation wave, and key technical levels. By being patient and managing risk, investors can prepare for a significant rise in Bitcoin after the rebound.