Key Summary

– Cryptocurrency Strategic Reserves (CSRs) could change the landscape of trade wars: Governments may stockpile digital assets such as Bitcoin and stablecoins to fight inflation, circumvent sanctions, and reduce reliance on traditional fiat currency reserves.

– Opportunities and risks coexist: CSR may enhance financial resilience and promote financial innovation, but at the same time, it also brings about drastic market volatility, regulatory uncertainty, and may even threaten the stability of the country’s monetary system.

– The escalation of the trade war may accelerate the adoption of cryptocurrencies: the global financial system may be split, forming different “digital currency camps” and intensifying the competition between cryptocurrencies and traditional fiat currencies.

– How can the government find a balance between innovation and stability? : By gradually regulating stablecoins, exploring some applications of cryptocurrencies, and promoting the research and development of blockchain technology, it may be possible to seize the opportunities of emerging financial technologies while reducing economic shocks.

In recent years, the concept of Crypto Strategic Reserve (CSR) has gradually attracted attention among economists and geopolitical experts. In the past, the core means of trade wars usually revolved around tariffs, supply chain adjustments and currency manipulation, but if countries begin to include cryptocurrencies in their national reserves, it may completely change the way financial power operates and even reshape the global economic landscape.

This article will delve into this emerging trend, analyzing how governments are combining protectionist trade measures with strategic cryptocurrency reserves, and detailing the strategy, potential advantages, risks, and possible impacts of this model on the global financial system.

Table of contents

The Rise of Crypto Strategic Reserves (CSRs)

– Redefining national reserves: from gold to Bitcoin

– CSR goals: fighting inflation, avoiding sanctions and enhancing financial autonomy

Key Cryptocurrencies Explained

– Bitcoin (BTC): Digital Gold or High-Risk Asset?

– Stablecoins: Stability vs. Centralization Risk

– Ethereum (ETH), Ripple (XRP), Solana (SOL) and Cardano (ADA): How to Play a Role in Trading Strategy?

Motivations for Cryptocurrency Trading Strategies

– Hedge against currency fluctuations and exchange rate risks

– Financial leverage to combat sanctions and trade barriers

– Digital trends and the future layout of the national economy

Potential Advantages of Cryptocurrency Strategic Reserves

– Improve economic resilience and avoid the risk of fiat currency instability

– Avoid financial blockades and sanctions

– Stimulate domestic blockchain innovation and financial technology development

– Enhance the country’s competitiveness in the global digital financial system

– Market volatility and economic instability

– Weakening the influence of sovereign currencies and central bank policies

– Regulatory uncertainty and political risk

– Security, hosting challenges and environmental costs

The trade war escalates and the battle for strategic cryptocurrency reserves

– Competing digital camps: Bitcoin reserves vs. digital currencies (CBDC)

– Best- and worst-case scenarios for global finance

The Federal Reserve and the Digital Dollar Ban

– Potential conflict between the Fed and US cryptocurrency strategy

– Possible impact on monetary policy and financial markets

Investment strategies and key recommendations

Origins of the trade war

Trade wars usually occur when countries impose tariffs or other trade barriers on imported goods in order to protect their own industries and reduce their dependence on foreign countries. The America First policy promoted by US President Donald Trump is a typical example. He has imposed tariffs on China, Canada, Mexico and other countries.

Tariff policy is like a double-edged sword - on the one hand, it can promote the development of domestic manufacturing, such as steel, automobiles and other industries; but on the other hand, it tends to push up commodity prices, increase inflationary pressure, and exacerbate international tensions.

Such protectionist policies have far-reaching impacts on national economies. When inflation rises, central banks may respond by raising interest rates, which in turn affects business operations and consumer spending. Supporters believe that tariffs can promote the recovery of some industries, but opponents believe that it will increase consumer costs and increase instability in the global market. In any case, tariffs and trade barriers remain important bargaining chips for governments in economic and geopolitical games.

Image Credit: Supply Chain Beyond

The Rise of Crypto Strategic Reserves (CSRs)

For a long time, national reserves of various countries mainly consisted of foreign exchange, gold and government bonds. However, in recent years, some policymakers and economists have begun to think: If cryptocurrencies, especially Bitcoin or stablecoins, are included in national reserves, will financial resilience be enhanced? This idea gave rise to the concept of Crypto Strategic Reserve (CSR).

CSR Goals

Fighting inflation

– During trade wars, tariffs tend to push up the cost of goods, fueling inflationary pressures. If a portion of national reserves is allocated to assets with limited supply, such as Bitcoin, it could help hedge against the risk of a decline in the purchasing power of fiat currencies.

Circumventing sanctions and economic blockades

– In geopolitical conflicts, hostile countries may freeze assets or restrict banking transactions. Cryptocurrencies are not controlled by a single country or institution, which can theoretically help governments maintain liquidity and financial autonomy, ensuring the flow of funds even if traditional financial channels are blocked.

Reduced reliance on competitor currencies

– If a trade war involves major economies such as China or the Eurozone, some countries may want to reduce their reliance on the RMB or the Euro, and cryptocurrencies could be an alternative option.

Promoting the development of digital economy

– Developing CSR can attract domestic blockchain and financial technology (FinTech) investment, promote the country to become a global leader in FinTech, and lay the foundation for the development of the future digital economy.

Although CSR is still in the conceptual stage, it is gradually becoming the focus of global attention as countries actively seek alternatives to de-dollarization and strive to adapt to changes in the global monetary system.

Image Credit: Coinlive

Key Cryptocurrencies Explained

Because Bitcoin has a fixed supply and the longest history, it is called digital gold.

– Advantages: High global recognition and relatively high degree of decentralization.

– Disadvantages: The price fluctuates wildly, which may lead to economic instability if used on a large scale.

Stablecoins (e.g. USDC , USDT )

Stablecoins are typically pegged to fiat currencies or commodities such as gold with the goal of reducing price volatility.

– Advantages: Stable price, suitable for cross-border transactions and daily payments.

– Disadvantages: Depends on the issuer’s reserve management and regulatory system, which poses a trust risk.

It has smart contract functions and has established a mature decentralized application (dApps) ecosystem.

– Advantages: Widely used in supply chain tracking, identity authentication and other fields.

– Disadvantages: high transaction fees, and network congestion may affect the user experience.

Focus on fast, low-cost cross-border payments and money transfers.

– Advantages: Potential to be adopted by official payment systems, which can reduce remittance costs and increase transaction speed.

– Disadvantages: Low level of decentralization and faces regulatory disputes in some countries.

Its main advantages are high transaction throughput and low transaction costs.

– Advantages: Suitable for large-scale government applications, such as digital identity authentication, public services, etc.

– Disadvantages: It is relatively new compared to other cryptocurrencies and has experienced network stability issues many times.

Adopt an academic research-driven development model and focus on sustainable development.

– Advantages: rigorous technical route, focus on environmental protection and long-term stability.

– Disadvantages: The ecosystem is developing slowly and adoption is not as fast as competitors.

If the government plans to choose cryptocurrencies as strategic reserves, it must make decisions based on specific needs, such as liquidity requirements, cross-border transaction capabilities, or potential for technological innovation.

Image Credit: MSN

Motivations for Cryptocurrency Trading Strategies

Currency Hedging

– Trade wars often lead to large fluctuations in exchange rates, reduce investor confidence, and may trigger capital outflows. Cryptocurrency Strategic Reserves (CSRs), as assets outside the traditional banking system, can be used as a hedging tool to help protect part of a country’s wealth from the depreciation of its fiat currency.

Financial leverage

– If international payment systems such as SWIFT are restricted, governments can maintain the flow of funds through cryptocurrency channels. There is already a precedent for this, and some sanctioned countries have reportedly circumvented the blockade of the global banking system through cryptocurrency.

Digitalization Trends

– With the development of central bank digital currencies (CBDCs) and decentralized finance (DeFi), adopting CSR may help make monetary policy more forward-looking while promoting innovation in the local digital financial industry.

Historical comparison

– In the past, the gold standard helped countries to resist external economic shocks. Today, cryptocurrencies may play a similar role as a safe haven for national wealth. However, compared with the stability of gold, the sharp fluctuations in cryptocurrency prices may bring greater uncertainty.

Image Credit: UPI

Potential Advantages of Cryptocurrency Strategic Reserves

Enhanced fiat currency stability

– When a country is in the middle of a long-term trade war, investors tend to sell the country’s currency, leading to capital outflows and currency depreciation. If a country diversifies its reserve assets to include cryptocurrencies, it may help reduce the impact of capital flight on the economy.

Circumventing financial blockades

– If a country is subject to economic sanctions or a financial blockade, cryptocurrency trading can serve as a contingency plan to ensure that the flow of funds is not completely cut off and help the government maintain the ability to purchase critical goods.

Promoting local industry development

– Government support for cryptocurrencies could attract investment in the mining industry while boosting blockchain RD and financial technology (FinTech) entrepreneurship, creating jobs and boosting overall economic growth.

Establishing a leading position in global financial technology

– Countries that take the lead in adopting strategic cryptocurrency reserves have the opportunity to become the center of the global crypto industry, attracting businesses and capital, and further establishing long-term influence and competitiveness in the international fintech field.

Image Credit: Vecteezy

Major risks and flaws of cryptocurrency strategic reserves

Market volatility and economic instability

– Cryptocurrency prices fluctuate drastically and may rise or fall sharply in a short period of time. If a country relies too much on cryptocurrencies as reserve assets, it may affect the overall economic stability when the market fluctuates violently, especially in the event of an economic recession or a surge in risk aversion in the global market.

Weakening the credit and monetary sovereignty of legal tender

– If governments adopt cryptocurrencies as reserves on a large scale, they may inadvertently undermine public trust in their own fiat currencies. For example, if a reserve currency issuer like the United States decides to hold Bitcoin on a large scale, it may accelerate the “de-dollarization” and prompt competitors to develop their own digital currencies to weaken the global influence of the US dollar.

Regulatory uncertainty

– Governments around the world have different attitudes towards cryptocurrencies. New governments may overturn their predecessors’ pro-crypto policies, leading to market instability and even capital outflows, affecting financial security.

Security and hosting issues

– National cryptocurrency reserves require highly secure storage solutions, such as multi-signature vaults or hardware security modules (HSM). If a hacker attack or security breach occurs, it may result in huge asset losses and affect public trust.

Energy consumption and environmental impact

– Bitcoin mining consumes a lot of energy. If the country invests in large-scale mining, it may increase the pressure on the power grid, cause environmental controversy, and even lead to policy opposition.

Image Credit: Freepik

The trade war escalates and the Crypto Strategic Reserve (CSR) battle

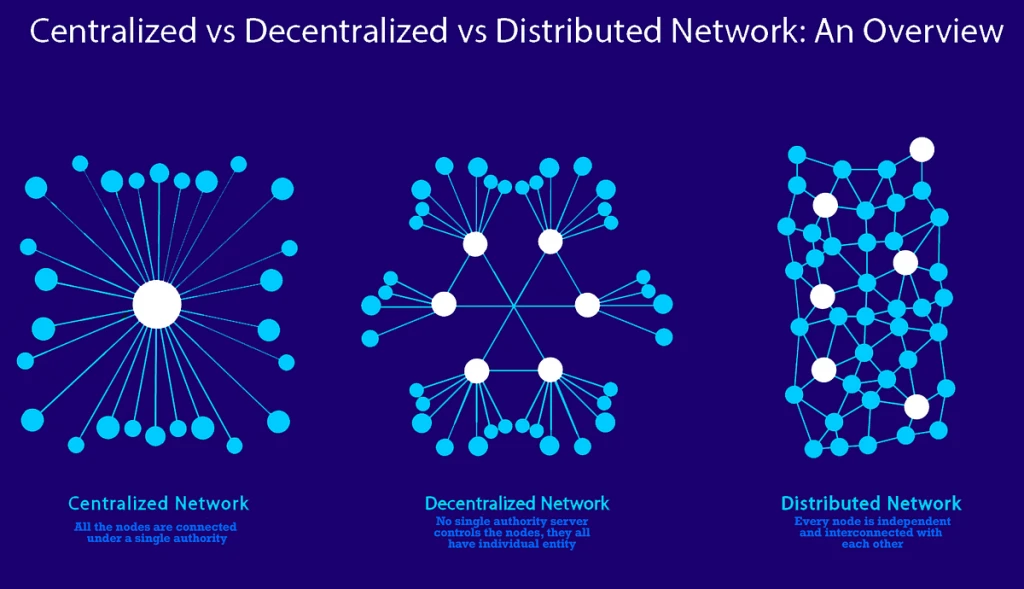

When tensions between major global economies escalate, leading to tariff increases, export restrictions, and even currency flow obstructions, the Cryptocurrency Strategic Reserve (CSR) could become a parallel financial network to help governments continue to maintain trade. If both sides adopt different digital currency systems (e.g., digital RMB vs. Bitcoin-based CSR), the global financial system could further fragment, forming a digital currency camp.

Best possible scenario

– Trade remains unimpeded: Countries with CSR can bypass the blockade of the traditional banking system and rely on cryptocurrencies to maintain international trade without being stalled by sanctions or currency restrictions.

– Financial innovation explosion: Competition among digital currency camps may prompt the rapid development of technologies such as blockchain, stablecoins, and asset tokenization (such as energy, commodities, and real estate), bringing about a new round of financial technology innovation.

Possible worst case scenario

– Severe market volatility: Geopolitical news may trigger investor panic, leading to significant fluctuations in the cryptocurrency market and affecting the traditional financial system.

- “Mining arms race”: Governments may compete to accumulate cryptocurrencies or expand the scale of mining farms , pushing up market prices and intensifying competition between countries, but the lack of unified regulation may lead to greater financial uncertainty.

Image Credit: The Wall Street Journal

The Federal Reserve and the Digital Dollar Ban

In January 2025, US President Donald Trump signed Executive Order No. 14178, officially banning the issuance of digital dollars. The order stipulates that the Federal Reserve and any federal agency may not develop or issue central bank digital currencies (CBDCs). At the same time, the US government decided to adopt a cryptocurrency strategic reserve (CSR) and include crypto assets such as Bitcoin (BTC) , Ethereum (ETH) , Ripple (XRP) , Solana (SOL) and Cardano (ADA) .

The United States’ refusal to launch a digital dollar may have the following key impacts:

Weakening the Fed’s influence

– With the ban on CBDC, the Federal Reserve loses the ability to directly regulate money supply through digital currencies, making U.S. monetary policy more difficult to operate in a cryptocurrency-driven financial environment.

Increased market volatility

– The federal government supports CSR, while the Federal Reserve maintains the traditional fiat currency system. This policy divergence may increase the volatility of the cryptocurrency market and the traditional financial market.

The Split in US Financial Strategy

– The Federal Reserve continues to implement traditional policies based on fiat currency, while the federal government chooses cryptocurrencies as reserves. This dual-track financial system may lead to regulatory confusion and increase market uncertainty.

Accelerating global de-dollarization

– Without a digital dollar as a competitor, other countries may be more inclined to adopt China’s digital yuan (e-CNY) or other state-led digital currencies, which could further erode the dollar’s dominance in the global economy.

Image Credit: CryptoSlate

Investment strategies and key recommendations

Diversify your investments to reduce risk

– Don’t put all your money on a single cryptocurrency or stablecoin. You should allocate it reasonably to reduce the impact of market fluctuations.

– It is recommended to pay attention to both large crypto assets ( BTC/USDT , ETH/USDT ) and potential projects ( ADA/USDT , SOL/USDT ), but avoid over-concentration on a certain category of assets.

Pay attention to market trends

– Pay attention to geopolitical news and central bank announcements in a timely manner, as policy adjustments may have a drastic impact on the crypto market.

– Tracking real-world adoption of cryptocurrencies (e.g., El Salvador’s Bitcoin initiative), these trends could be important indicators of future markets.

Adopt a defensive strategy

– In times of trade war or international tensions, it is recommended to allocate part of the funds to stablecoins (USDT, USDC) or fiat currency so that there is money to buy at the bottom when the market is at a low point.

– If you have more advanced investment experience, you can use derivatives (options, futures) to hedge your risks and ensure that your profits are protected during large market fluctuations.

Adapting to regulatory changes

– Regulatory changes may bring new opportunities. For example, clearer tax rules may attract institutional investors, and even though KYC/AML requirements may increase compliance costs in the short term, they may still promote market growth in the long run.

– Actively adapt to regulation and ensure transaction compliance. In the future, when the market matures, compliant investors will often be in a more advantageous position.

Evaluating Mining and Staking Opportunities

– If governments support the staking of Proof-of-Stake (PoS) assets , then staking rewards may become a mainstream investment method.

– In regions with low energy costs and supportive policies, cryptocurrency mining may still be a profitable investment strategy, especially mining models based on green energy.

Image Credit: Biyond

Future Outlook

The interweaving of trade protectionism and the popularity of cryptocurrencies has brought unprecedented opportunities as well as significant risks. As the global financial landscape evolves rapidly, governments need more flexible and forward-looking strategies to respond to challenges.

Cryptocurrency strategic reserves (CSRs) may help fight inflation and circumvent sanctions, but they also bring market volatility and may even undermine the dominance of existing fiat currencies. Countries must carefully weigh the following key factors when formulating policies:

Sovereignty vs. Decentralization

– The adoption of cryptocurrencies may help the country reduce its reliance on foreign banking systems and increase its financial autonomy, but at the same time, it may also weaken the government’s control over the domestic money supply.

Volatility vs. Innovation

– The wild volatility of cryptocurrencies does pose risks, but at the same time, it could also help the country take the lead in the financial technology (FinTech) sector and boost economic growth.

Short-term instability vs. long-term strategy

– A well-executed CSR may play a key role in future economic crises, but if policies are not carefully formulated, it may also seriously affect the country’s financial stability.

The combination of cryptocurrency and trade wars is reshaping the global financial landscape. How countries find a balance between risks and opportunities will directly affect future economic competitiveness.

Image Credit: Medium

Conclusion

Trade Wars and the Rise of Cryptocurrency Strategic Reserves explores a future where geopolitical tensions and digital financial change are intertwined. Cryptocurrency strategic reserves (CSRs) may become an important tool for countries to fight inflation, circumvent sanctions, reduce currency risks, and provide financial buffers in trade conflicts. However, extreme price fluctuations, regulatory uncertainty, and potential impacts on sovereign fiat currency systems make this path challenging.

Rather than total acceptance or total rejection, decision makers are more likely to adopt a gradual strategy:

– Strengthen stablecoin supervision to ensure that the financial system will not be destabilized by market out-of-control.

– Explore some cryptocurrency applications and conduct pilot operations in areas such as trade settlement and government payments.

– Encourage private sector innovation and promote the development of cryptocurrency and blockchain technology within a regulatory framework.

For most countries, the best solution to the trade war may not be to rely solely on digital currency, but to reduce risks through diplomatic means and diversified economic policies. However, with the trend of de-dollarization and the evolution of the global digital currency system, countries that actively explore CSR may occupy a more advantageous position in the future international currency competition.

Ultimately, the fate of the strategic reserve of cryptocurrencies depends on how the government strikes a balance between innovation and stability and finds a strategy that suits itself between monetary sovereignty and global cooperation. History has proven that technological breakthroughs are often the key to a countrys competitive advantage. As to whether CSR can bring economic resilience or trigger a new financial crisis, it will depend on the forward-looking nature of the policy, the maturity of the market, and how countries plan their layout on the international financial stage.

Disclaimer: The views expressed in this article represent only the author’s personal views and do not represent the official opinions of any institution or organization.

Quick Links

– Global economic dynamics in March: a must-read for cryptocurrency investors

– Hong Kong Web3 Revolution: Key Trends and Regulatory Policies Released by Consensus 2025

– When Crypto Meets Music: XT.COM x Rolling Stone China VIP Night at Consensus Hong Kong 2025

– Monad vs. Ethereum: Can this emerging L1 disrupt the market?

– Nine Cryptocurrency Trends in 2025: AI, DeFi, Tokenization, and More Innovations

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , and contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.