Key Takeaways

– Bitcoin’s market cycle reflects a growth trend: Despite market volatility, Bitcoin’s price movements are primarily influenced by institutional capital inflows, macroeconomic factors, and regulatory policies, such as the market surge on December 4, 2024, which highlights Bitcoin’s market resilience.

– Spot Bitcoin ETF drives institutional adoption: The approval of a spot Bitcoin ETF releases a large amount of new capital, which not only reshapes market liquidity and price trends, but also further enhances the legitimacy of Bitcoin in the eyes of traditional investors.

– Market liquidity and trading dynamics rely on stablecoins and exchange fund flows: USDT plays a key role in the Bitcoin trading ecosystem, and fund flows between exchanges reflect real-time trader sentiment and market layout.

– On-chain data and macro factors affecting the future of Bitcoin: Bitcoin Network Activity Index (BNI), scaling solutions, regulatory policies and the global economic environment will continue to influence the long-term adoption and price trends of Bitcoin.

Over the past decade, Bitcoin has grown from a niche digital experiment to a mainstream financial asset. This rise is driven by surging investor demand, rapid technological development, and the need for an alternative to the traditional monetary system. However, Bitcoins growth has been accompanied by dramatic price increases and deep pullbacks, including market shocks in early 2025. To understand these fluctuations, it is necessary to analyze several key factors in depth, such as:

– Unprecedented surge in demand (e.g. the market explosion on December 4, 2024)

– How Spot Bitcoin ETFs Change the Institutional Investment Landscape

– Fund flow patterns between exchanges, providing insights into trader behavior

– Stablecoins (especially Tether’s USDT) as a pillar of market liquidity

– On-chain metrics such as the Bitcoin Network Activity Index (BNI)

This article links these factors together to present a complete perspective, analyzing why Bitcoins price trends, liquidity changes, and market adoption rates fluctuate so dramatically.

Table of contents

Bitcoin Market Volatility in 2025: Correction After a Strong Start

December 4, 2024: Historic surge in demand

– Unprecedented trading volumes

– Key drivers of the surge in demand

– The impact of this incident on Bitcoin liquidity and market maturity

Spot Bitcoin ETF: Unleashing a flood of institutional capital

– The difference between spot ETF and futures ETF

– Institutional capital inflows and market impact

– Psychological and structural changes in Bitcoin adoption

Inter-Exchange Fund Flows: Decoding Trader Movements

– How traders transfer Bitcoin between platforms

– Fund flows on spot exchanges vs. derivatives exchanges

– Case Study: Market Reaction to ETF Approval

Stablecoins as Market Pillars: The Rise of USDT

– The role of USDT in liquidity and trading

– Market impact and growing adoption

– Disputes and regulatory review

Bitcoin Network Activity Index (BNI): A look at the health of the chain

– Key indicators: number of active addresses, number of transactions and handling fees

– How BNI reflects market sentiment

– Limitations of BNI and auxiliary data indicators

How internal and external factors affect the development of Bitcoin

– Protocol upgrade and expansion solutions

– Miner behavior and its impact on the market

– Macro trends: monetary policy, regulation and global stability

Outlook and potential catalysts

Bitcoin Market Volatility in 2025: Correction After a Strong Start

In early 2025, Bitcoin price movements reflected the impact of institutional capital flows, macroeconomic trends and regulatory policies, reaching a new high before experiencing a sharp correction.

Bitcoin price trend (January to March 2025)

– January 2025: Opened at $93,576, reached an all-time high of $109,500 on January 20, and finally closed at $102,260 (+9.3%).

– February 2025: Prices plunged 17.6%, the biggest monthly drop since June 2022, closing at $78,310, largely due to a slowdown in institutional inflows.

– March 2025 (as of March 6): Rebound to $94,000, driven by market optimism about regulatory policy.

Spot Bitcoin: BTC/USDT Spot

The main drivers of Bitcoin price movement in early 2025

Institutional profit taking and ETF impact

– January’s gains were primarily driven by inflows into spot Bitcoin ETFs.

– The decline in February reflected institutional profit-taking, which led to a pullback in Bitcoin prices.

Macroeconomic and regulatory uncertainty

– Speculation surrounding U.S. monetary policy and crypto regulation has made market sentiment cautious.

– Inflation concerns have dampened the performance of risk assets, including Bitcoin .

Retail Market Reaction and Recovery

– After the February price drop, retail investors re-entered the market, driving the March rebound.

– The recovery trend shows that the market remains confident in the long-term potential of Bitcoin.

Why is this important?

Bitcoins market volatility in early 2025 continued the trend at the end of 2024, especially the surge in demand on December 4, 2024. Institutional investment, macroeconomic pressure and regulatory policy uncertainty remain the core factors affecting the market.

December 4, 2024: Historic surge in demand

In Bitcoin’s recent history, December 4, 2024 marked an unprecedented surge in transaction demand. On that day, Bitcoin’s daily trading volume reached 279,000 BTC, far exceeding the peak trading volume during previous bull markets. This event highlighted Bitcoin’s appeal to retail and institutional investors, while demonstrating its market influence that can attract global attention.

Image Credit: CryptoQuant

Key drivers of the surge in demand

Optimistic expectations for regulatory policies

The results of the US presidential election indicate that the new government may be more friendly to cryptocurrencies. The market generally expects that the new government will promote more relaxed crypto policies, and this optimism has attracted hedge funds and small and medium-sized investors to enter the market quickly.

Macroeconomic pressures

Ongoing inflation concerns and economic uncertainty have prompted many investors to view Bitcoin as a safe-haven asset, further fueling its digital gold narrative. This has led to a flow of funds from traditional safe-haven assets to Bitcoin, exacerbating the inflow of funds into the market.

Retail investors’ FOMO (Fear of Missing Out)

As the price of Bitcoin soared, a large amount of retail funds poured in to avoid missing the opportunity. The promotion of social media and crypto KOLs further amplified the market enthusiasm, ultimately leading to a nearly vertical rise in prices and trading volumes.

Why is this important?

The peak demand on this day is an important stress test for Bitcoin liquidity. Exchanges need to cope with record trading volumes, and the market maturity has been significantly improved compared to the past bull market.

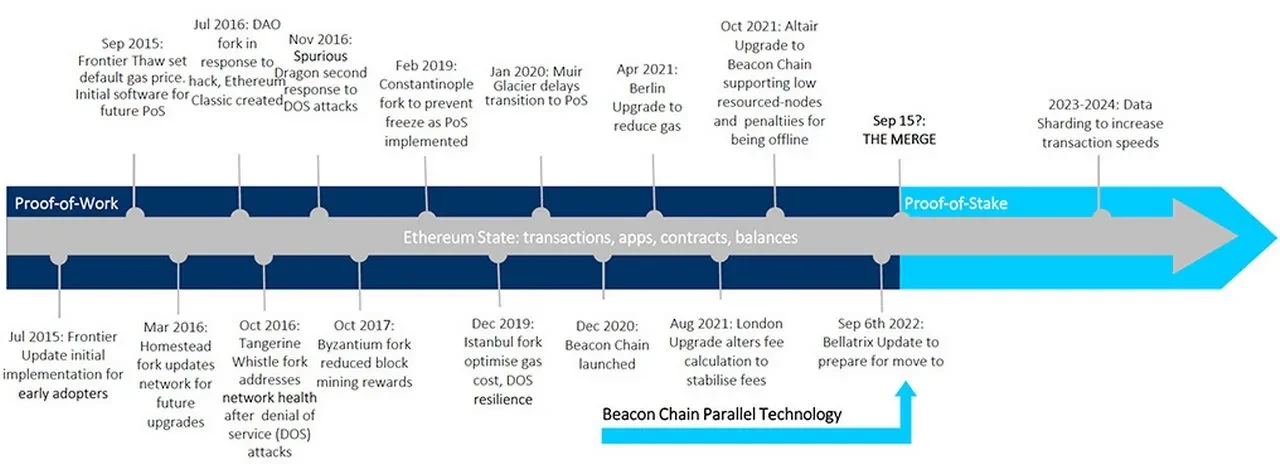

Technological upgrades, such as capacity expansion solutions, have played a key role in helping the network cope with high transaction volume demands.

The combination of institutional and retail enthusiasm makes December 4, 2024 a critical moment for understanding Bitcoin’s potential and volatility.

Spot Bitcoin ETF: Unleashing a flood of institutional capital

Institutional interest in Bitcoin has continued to grow over the years, but the United States approval of a spot Bitcoin ETF in January 2024 officially ushered in a new era of massive inflows of institutional capital.

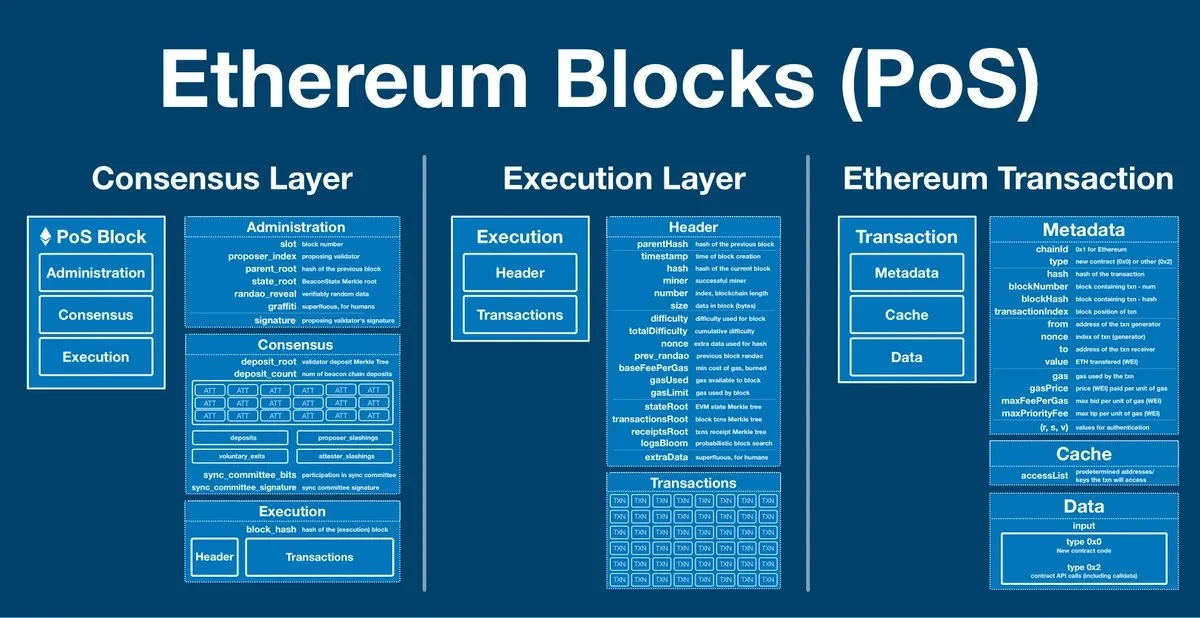

The difference between spot ETF and futures ETF

– Spot ETFs directly hold real Bitcoin and reflect real-time market prices. In contrast, futures ETFs track Bitcoin contract prices, which may lead to “rollover costs” and price deviations.

– Spot ETFs lower the investment threshold, allowing large funds, pension plans, and even ordinary investors to participate without having to manage private keys or directly use cryptocurrency exchanges.

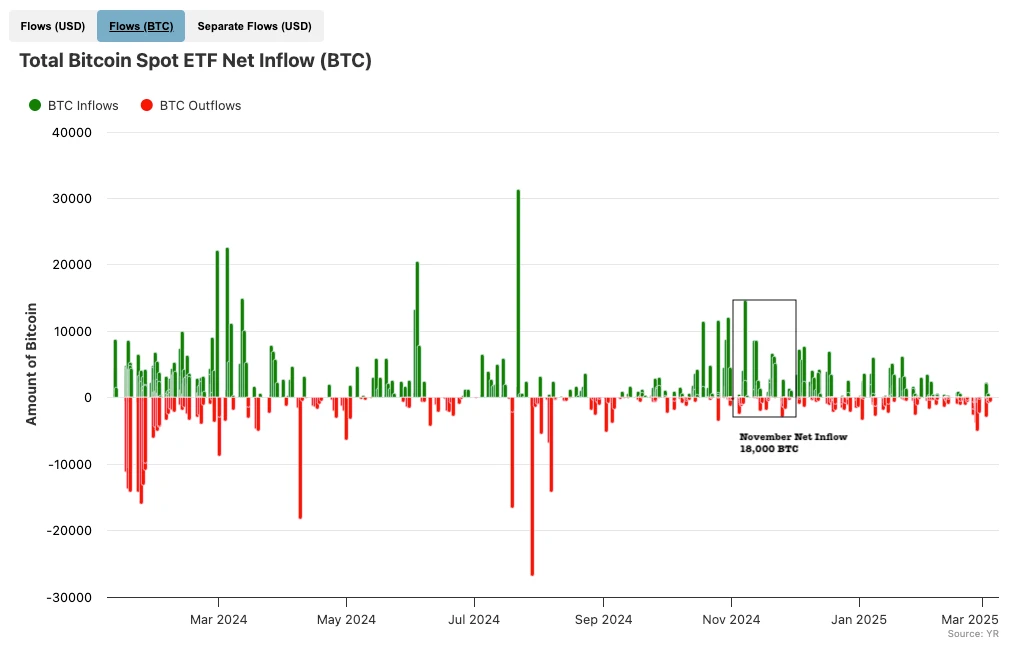

Record daily purchases

– In November 2024, spot ETFs purchased a total of 18,000 BTC in a single day, a milestone that indicates a large amount of new capital is pouring into the market.

– Asset management giants such as BlackRock and Fidelity are actively competing for market share and continue to purchase Bitcoin through ETFs. This further reduces the circulating supply on exchanges and pushes up Bitcoin price momentum.

Image Credit: BitBo

Psychological and market influences

– Well-known financial institutions holding real Bitcoins give BTC more legitimacy in the eyes of skeptics.

– ETF inflows are often accompanied by a reduction in the supply of Bitcoin on exchanges, which can further push up prices when demand rises.

Today, spot ETFs have become an important tool for the mainstreaming of Bitcoin, successfully connecting Wall Street capital with the cryptocurrency ecosystem.

Trader Movement Analysis: Fund Flows Between Exchanges

While inflows into spot Bitcoin ETFs can reflect long-term institutional investment interest, Inter-exchange Flow Pulse (IFP) provides insights into immediate market sentiment, revealing how retail and institutional investors transfer Bitcoin between different platforms.

How IFP works

– Spot exchanges (Coinbase, Kraken): provide services for buying and selling Bitcoin directly using fiat currency or stablecoins.

– Derivatives exchanges (Binance Futures, Bybit, XT.COM): provide leveraged trading such as futures, swaps, and options.

When Bitcoin flows from the spot market to the derivatives market (such as BTC/USDT contracts) in large quantities, it usually means that traders are seeking leveraged gains or hedging against market volatility. Conversely, when funds flow back from the derivatives market to the spot exchange, it usually represents profit taking or exiting high-risk positions.

Case Study: January 2024

– After the first spot Bitcoin ETF was approved, the price of Bitcoin surged. Many traders feared a “sell-the-news” market and therefore moved funds from the derivatives market back to the spot market or stablecoins.

– Over-the-counter (OTC) institutions also reported an increase in large-scale BTC buying and selling activities, reflecting that some institutional investors prefer to trade through the OTC market to reduce market impact and protect transaction privacy.

Image Credit: CryptoQuan

How IFP helps market interpretation

Inter-exchange fund flows can serve as a key indicator of short-term market sentiment, while ETF fund inflows mainly reflect the long-term investment trend of Bitcoin.

Stablecoins as Market Pillars: The Rise of USDT

As Bitcoin trading volume surges, stablecoins have become the main trading medium and liquidity management tool in the market. Among them, Tether (USDT) is the most influential stablecoin, with its supply exceeding 110 billion in early 2025, consolidating its market dominance.

Image Credit: TradingView

Why is USDT so dominant?

Hedge against market volatility

When market prices fluctuate violently, traders can quickly convert BTC (or other cryptocurrencies) into USDT without returning to the traditional banking system, thereby reducing trading risks.

Wide range of trading pairs supported

On most centralized exchanges (CEX), USDT supports almost all cryptocurrency trading pairs, providing low spreads and high liquidity to improve trading efficiency.

Global accessibility

In markets with unstable currencies or strict capital controls, USDT serves as a borderless store of value and is even used as a convenient cross-border payment method.

Controversy and resilience

– Tether has long been under regulatory scrutiny for its reserve transparency issues and was even fined for falsely claiming 1:1 asset backing.

– However, USDT’s expanding network effect, coupled with deep integration with exchanges, means its market adoption continues to grow.

How do stablecoins support the crypto market?

Stablecoins represented by Tether effectively connect traditional finance and the cryptocurrency market, provide rapid capital flows, and further strengthen Bitcoins trading ecosystem.

Bitcoin Network Activity Index (BNI): A look at the health of the chain

In addition to market capital flows and liquidity, on-chain data can reveal the actual usage of the Bitcoin network. The Bitcoin Network Activity Index (BNI) combines a variety of key data indicators, including:

– Active Addresses: The number of unique addresses that send or receive BTC.

– Transaction Counts: Higher transaction volumes usually indicate increased market speculation or user interest.

– Block Size Mempool: A larger mempool indicates transaction backlogs and network congestion; block size measures the network’s processing efficiency during peak transaction periods.

– Transaction Fees: Rising fees may reflect strong market demand, but may also impose a burden on users who rely on low-cost transactions.

Image Credit: CryptoQuant

Why is BNI important?

– Bullish indicators: Historical data shows that when the number of active addresses and daily transaction volume surge, it is usually accompanied by a bullish phase in the market, indicating the entry of new funds and new users.

– Limitations: BNI cannot fully predict price trends. External events such as regulatory crackdowns and institutional announcements may change market trends and exceed the influence of on-chain indicators.

How does BNI help market analysis?

BNI can provide specific data on the daily usage of the network. If combined with exchange capital inflows, stablecoin issuance and macroeconomic data, a more complete market analysis perspective can be constructed.

Internal and external factors: Shaping Bitcoin’s trajectory

To fully understand Bitcoin’s market performance, we need to pay attention not only to internal technological developments, but also to consider external macroeconomic and regulatory factors.

Internal development factors

Protocol Upgrades

Bitcoin continues to evolve, and protocol upgrades such as Taproot and Schnorr signatures have improved privacy, scalability, and smart contract capabilities. In addition, Layer-2 solutions (such as the Lightning Network) increase transaction throughput and may unlock more real-world application scenarios.

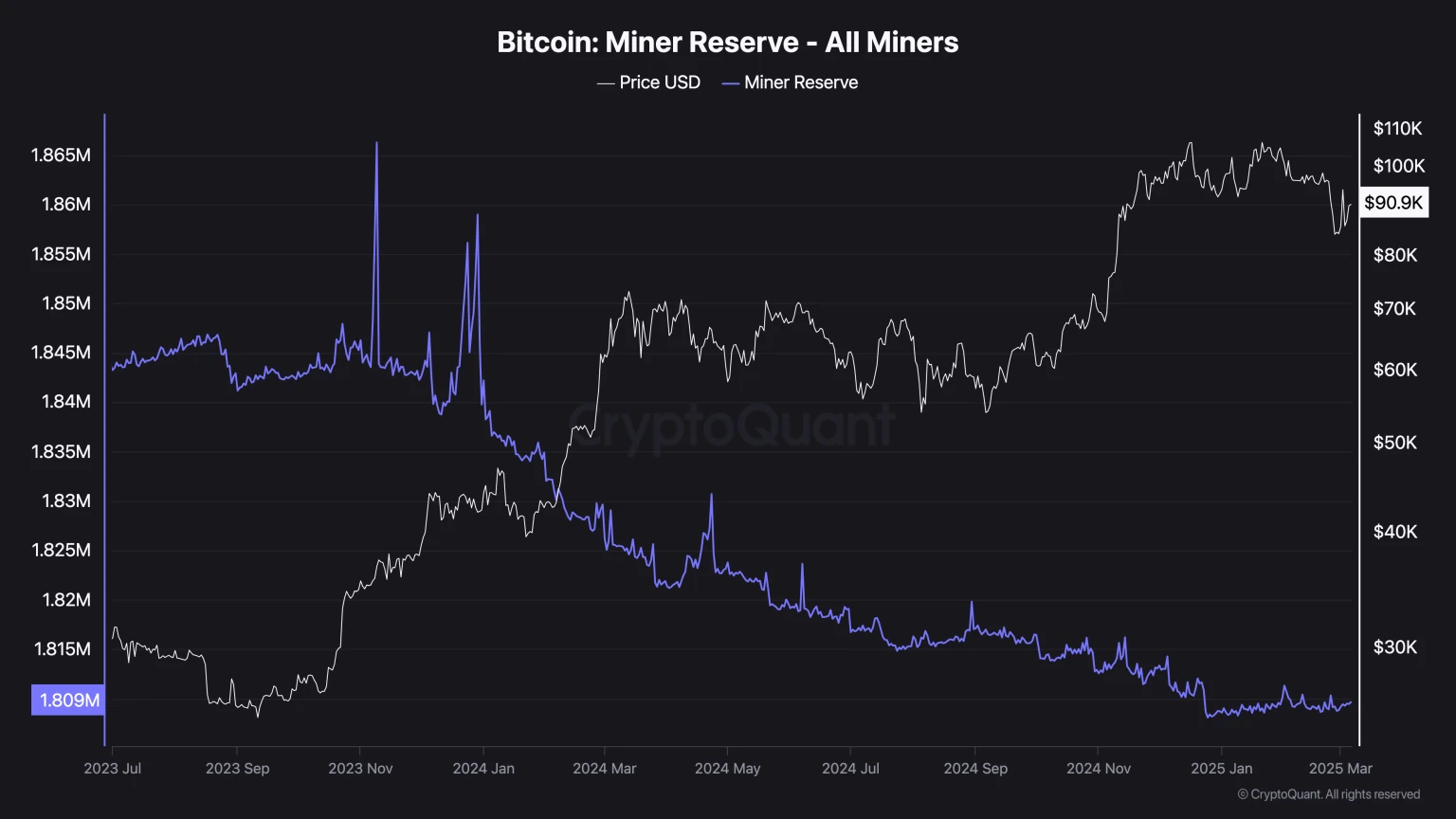

Miner Behavior

Miners directly affect block generation time, transaction fees, and overall network security. When miners migrate due to changes in electricity prices or regulations, the distribution of computing power may be affected, thereby changing the speed of transaction confirmation.

Image Credit: CryptoQuant

External factors

Monetary Policy

– Loose monetary conditions (such as low interest rates or quantitative easing) often encourage speculative flows into Bitcoin.

– Tightening policies (such as raising interest rates or shrinking the balance sheet) may lead to capital outflow from high-risk assets, including Bitcoin.

Regulatory Climate

– Countries that support cryptocurrencies (such as the U.S. approving a spot Bitcoin ETF) often promote growth in institutional investment.

– Conversely, regulatory crackdowns or unclear regulations could lead to a drop in local market demand or even force miners or exchanges to relocate.

Global Economic Stability

– Economic recession, geopolitical conflict or currency devaluation tend to reinforce Bitcoin’s narrative as a “borderless store of value asset” and attract capital into the Bitcoin market.

Outlook and potential catalysts

Looking ahead, the Bitcoin market faces multiple development paths, which will be shaped by both technological innovation and market risks:

Wider ETF expansion

– Following the approval of the spot Bitcoin ETF in the United States, Europe, Asia, and Latin America may follow suit, further unleashing institutional capital and driving global market development.

Stablecoin Market Competition

– Other stablecoins (such as USDC ) or decentralized stablecoins (such as DAI ) may challenge Tether’s (USDT) market dominance through stricter auditing and regulatory compliance.

Capacity Expansion Solutions

– Wider adoption of Layer-2 networks and emerging sidechain technologies could make Bitcoin transactions faster and cheaper, and even make Bitcoin a more practical payment tool.

Regulatory uncertainty

– Increasing regulatory scrutiny on mining carbon footprint, stablecoin reserves and crypto exchange operations could spark market uncertainty.

– Black swan events or macroeconomic shocks (such as global recession, geopolitical risks) may still have an unexpected impact on the market.

Despite these uncertainties, Bitcoin’s decentralized protocol and growing global user base continue to attract capital and talent, ensuring it remains a market focus for years to come.

Summary and Future Outlook

The complexity of the Bitcoin market becomes clearer after analyzing from multiple angles:

– The transaction surge on December 4, 2024, demonstrated the Bitcoin network’s ability to absorb huge demand. This fluctuation came from the combined effect of institutional capital layout, retail FOMO sentiment, and macroeconomic drivers.

– Spot Bitcoin ETFs open up new channels for capital inflows, making it easier for everyone from pension funds to ordinary traders to invest in Bitcoin.

– Inter-Exchange Flow provides real-time market sentiment analysis, helping to identify when traders switch between leveraged speculation and safe positions.

– Stablecoins (especially USDT ) serve as the liquidity pillar of the market, effectively connecting on-chain and off-chain capital flows.

– BNI (Bitcoin Network Activity Index) and other on-chain metrics can measure the actual usage of the network and complement the analysis of macroeconomic data and exchange fund flows.

The development of Bitcoin is still evolving, from technical upgrades at the protocol level to changes in global monetary policy, every innovation or adjustment may affect the market landscape. However, the core value of Bitcoin lies in adaptability, technological innovation, institutional adoption, and grassroots community promotion.

Whether Bitcoin reaches new highs or experiences a market correction, these market dynamics ensure that it will remain a core focus of the evolution of digital assets.

Quick Links

– Global economic dynamics in March: a must-read for cryptocurrency investors

– When Crypto Meets Music: XT.COM x Rolling Stone China VIP Night at Consensus Hong Kong 2025

– Monad vs. Ethereum: Can this emerging L1 disrupt the market?

– Nine Cryptocurrency Trends in 2025: AI, DeFi, Tokenization, and More Innovations

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , and contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.