Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

It’s the beginning of a new day, and a new round of plunge.

OKX market data shows that BTC once fell below 77,000 USDT (the lowest fell to 76,600 USDT), getting closer and closer to the 70,000 point that BitMEX co-founder Arthur Hayes has been calling for a long time. As of around 9:15 (the same below), it was temporarily reported at 77,451 USDT, a 24-hour drop of 4.46%.

As for altcoins, the words disastrous and rivers of blood that have been used too much in the past few days are no longer enough to describe the tragic situation. As an old investor who has experienced the last round of bull-bear transitions, I personally feel that the overall sentiment of altcoins is worse than when ETH bottomed out at $881 in 2022.

ETH fell to as low as 1752 USDT today and is currently trading at 1809 USDT, a 24-hour drop of 10.87%;

SOL once fell to 112 USDT, and is currently trading at 115.85 USDT, a 24-hour drop of 8.49%;

There is no need to mention other altcoins and on-chain memes. Most popular altcoins have hit historical lows.

Alternative data shows that todays Fear and Greed Index is temporarily reported at 24, and the level is still in an extreme panic state.

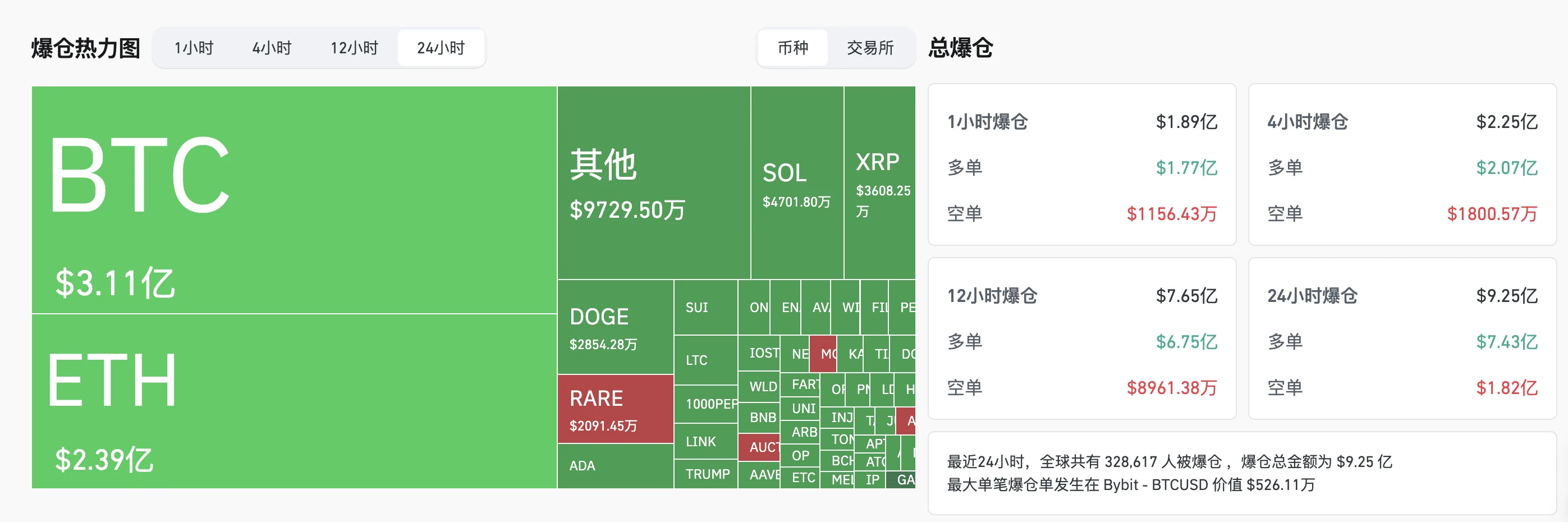

In terms of derivatives data, Coinglass data shows that in the past 24 hours, the entire network has had a liquidation of $925 million, of which the vast majority are long orders, amounting to $743 million. In terms of currencies, BTC had a liquidation of $311 million and ETH had a liquidation of $239 million.

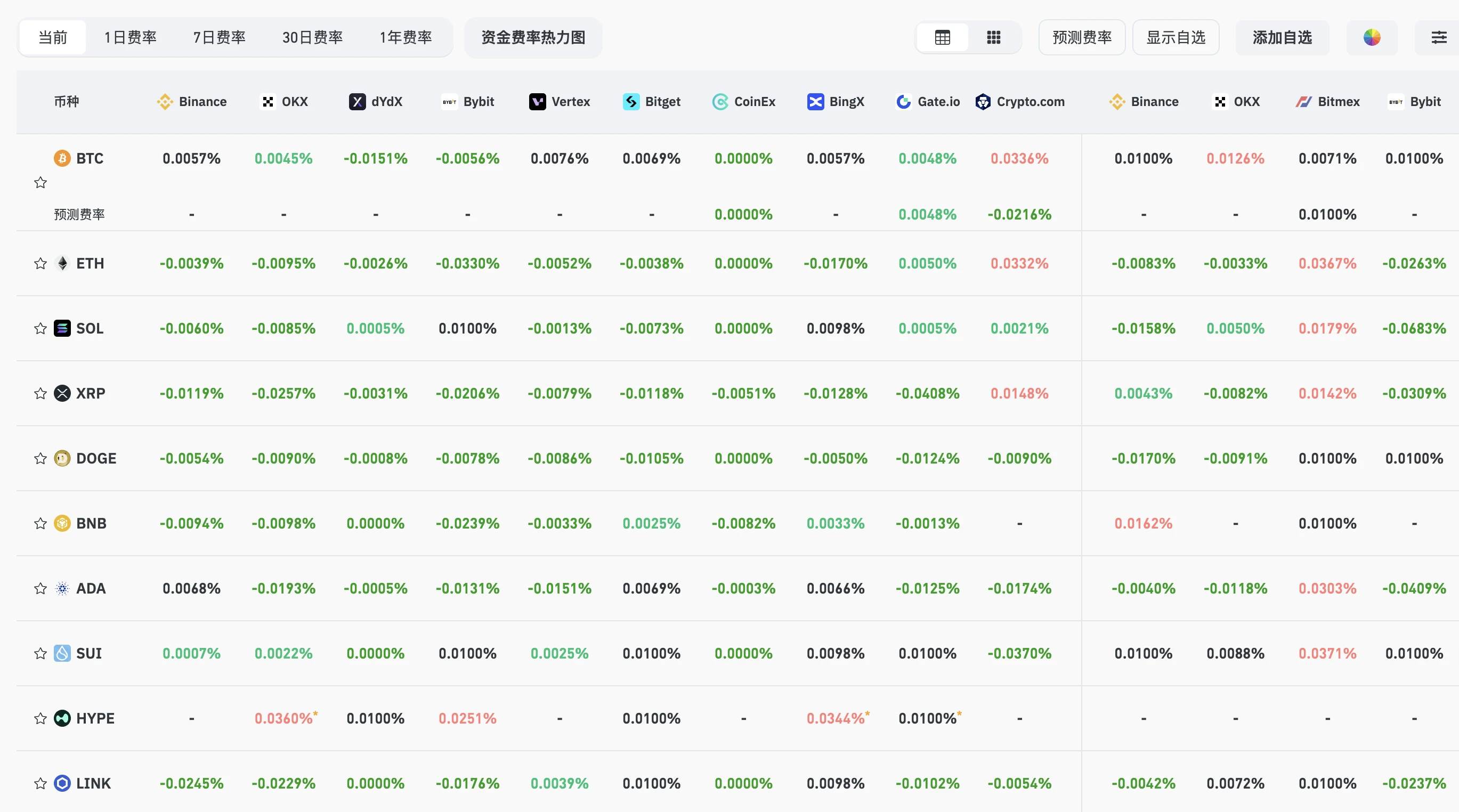

In addition, the funding rates on major platforms have generally turned negative, which means that the overall market has now turned bearish.

Reasons for the crash: Recession ➡️ US stocks ➡️ Cryptocurrency market

As the process of cryptocurrency mainstreaming progresses, the linkage between the market and the U.S. stock market becomes stronger and stronger. Looking back at the market trends from last night to this morning, the cryptocurrency market began to fall almost at the same frequency as the U.S. stock market.

U.S. stock quotes showed that the Nasdaq index closed down 4%, the SP 500 index closed down 2.7%, and the Dow Jones index closed down 2.08%; in terms of individual stocks, large technology stocks suffered heavy losses, with Tesla falling more than 15%, Nvidia falling more than 5%, Coinbase falling more than 17.58%, and Strategy closing down 16.68%.

Looking around the market for analysis, mainstream institutions seem to generally attribute the current plunge in U.S. stocks to expectations of an economic recession. As panic intensifies, the entire market seems to be shifting from risky assets to safe assets.

Kobeissi Letter also mentioned in its analysis report this morning: The trade war is just an excuse. The real reason for the markets decline is the sudden shift in risk appetite. In just a few days, we went from extreme greed to extreme fear. The positioning was so polarized that the market turned in the exact opposite direction.

This shift in trend is also reflected within the cryptocurrency market.

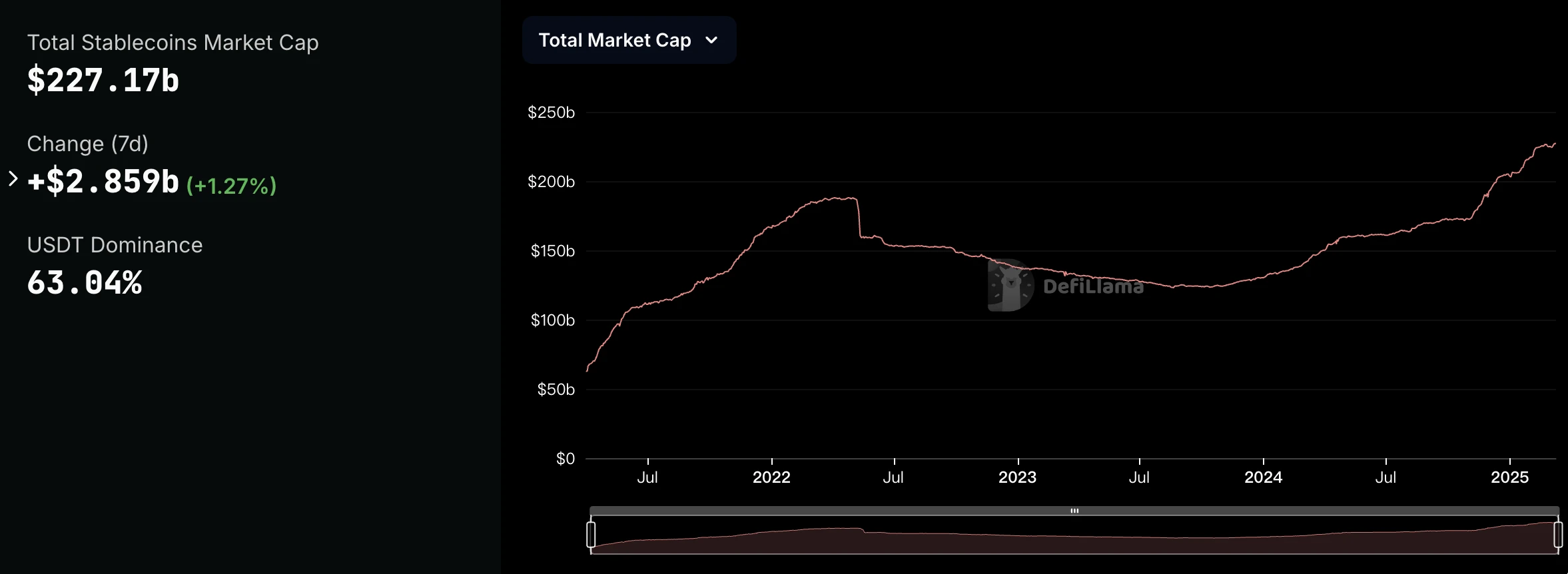

Defillama data shows that the total stablecoin supply of the entire network has reached 227.11 billion, a record high. At the same time, the scale of stablecoin deposits in the Aave lending market is also at a historical high . Interpreted in a positive direction, this means that the funds in the market are still abundant; but interpreted in the opposite direction, the trading desire of funds seems to be extremely low, and large investors seem to prefer to lie in DeFi and collect rent and wait and see.

How do institutions/bigwigs predict the future market?

Is the correction over? What will happen in the future? Although the current market is full of uncertainties, combined with the predictions of the leading institutions/bigwigs about the future market, it seems that we can more or less capture some operating trends.

Arthur Hayes, co-founder of BitMEX, who has been bearish for a long time, posted again this morning, reiterating his prediction that BTC will bottom out at 70,000, and suggested that retail investors buy the dip after major central banks turn to loose policies.

Be damn patient! BTC will most likely bottom out around $70,000. A 36% drop from the all-time high of $110,000 is pretty normal in a bull market. Then we need to see the stock market ($SPX and $NDX) go into free fall. Then the traditional financial market puppets (TradFi muppet) have to break. Then we see the Federal Reserve (Fed), the People’s Bank of China (PBOC), the European Central Bank (ECB), and the Bank of Japan (BOJ) all start easing policy to revive their respective countries.

Finally, you can enter the market with a full position. Traders may try to buy the bottom, and if you are risk-averse, you can wait until the central bank starts to ease before investing more money. You may not buy the bottom, but you will not suffer mentally from long periods of sideways trading and potential unrealized losses.

Raoul Pal, founder and CEO of RealVision, predicted on X that given that M2 is returning to a high level, this round of correction may be nearing its end.

These pains shall pass... In Q4 2024, cryptocurrencies were impacted by a liquidity crunch due to a stronger dollar and rising interest rates. This trend is almost over, financial conditions are easing rapidly, and M2 is returning to new highs. This is just a routine adjustment...

In summary, combined with the predictions of many top bosses, this round of correction seems to have entered the second half, and there may not be much room for downward movement... However, in a market with such a fragile structure and extremely large volatility, please operate with caution, keep your bullets, and restrain your leverage. After all, only by staying on the table will you have a chance to have the last laugh.