Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

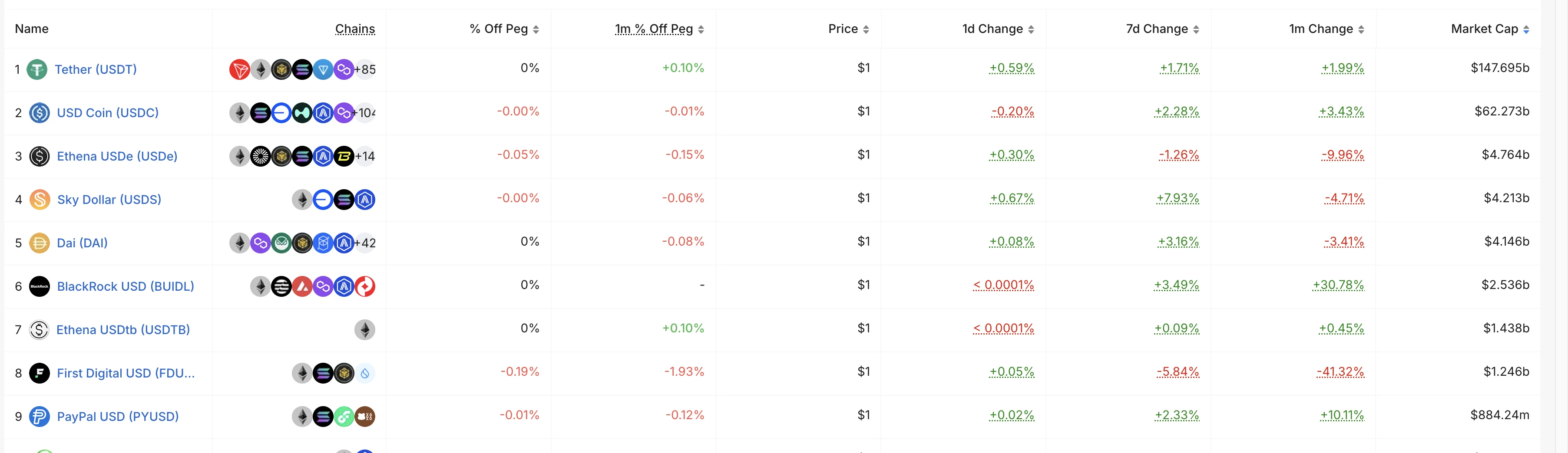

As the mainstay of the cryptocurrency market, stablecoins not only serve as a medium of exchange with stable value, but also play a key role in DeFi, cross-border payments, asset management and other fields. Between 2024 and 2025, the cryptocurrency market welcomed a number of emerging stablecoin projects, which quickly became the focus of the market with their differentiated technical architecture and precise business positioning.

As the mainstay of the cryptocurrency market, stablecoins not only serve as a medium of exchange with stable value, but also play a key role in DeFi, cross-border payments, asset management and other fields. Between 2024 and 2025, the cryptocurrency market welcomed a number of emerging stablecoin projects, which quickly became the focus of the market with their differentiated technical architecture and precise business positioning.

In this article, Odaily Planet Daily focuses on six highly anticipated new stablecoin projects, including Ripples RLUSD, WLFIs USD 1, Usuals USD 0, Ethenas USDe, SKYs USDS and PayPals PYUSD. It conducts in-depth analysis from the dimensions of launch background, core technology, market performance, revenue model, user participation opportunities, etc., comprehensively analyzes their market positioning and development potential, and provides readers with a clear guide to observe industry changes.

1. Ripple RLUSD

In April 2024, Ripple officially announced the launch of RLUSD, a stablecoin pegged 1:1 to the US dollar, taking a key step in the stablecoin track. Its reserve assets consist of US dollar deposits, US short-term Treasury bonds and cash equivalents, providing a solid guarantee for the stability of the currency price. In August of the same year, RLUSD took the lead in launching testing on the XRP Ledger and Ethereum mainnets, and then expanded its support scope to Chainlinks The Root Network, building a three-chain parallel pattern, supporting cross-chain and bridging operations, and greatly enhancing the flexibility of asset circulation.

On December 17, 2024, RLUSD obtained the authoritative approval of the New York Department of Financial Services (NYDFS) and officially landed on global trading platforms such as Uphold, Bitso, and MoonPay, marking a major breakthrough in its compliance process. In 2025, RLUSDs application scenarios continued to expand: In January, it was integrated into Ripple Payments to enable real-time cross-border payment services; In April , Aave V3 Ethereum market provided support for it, successfully opening the door to the DeFi field and further expanding its user base and market influence.

Standard Chartered Bank predicts that the stablecoin market will reach $2 trillion by 2028. The launch of RLUSD is Ripples strategic layout in this blue ocean market. On the one hand, RLUSD helps Ripple consolidate its competitiveness in the global cross-border payment market and meet the liquidity needs of the XRP ecosystem; on the other hand, RLUSD is highly consistent with Ripples core business, and by providing instant settlement services and reducing foreign exchange fluctuation risks, it has become an ideal tool for cross-border payments for corporate customers.

Ripple has significant advantages in promoting RLUSD. Its global payment network covers more than 90 markets and handles more than 90% of foreign exchange transactions every day. Its compliance qualifications such as NYDFS license and its cooperation experience with global exchanges such as Bitstamp and Kraken have built a high market entry barrier. In terms of market positioning, RLUSD focuses on B2B payment scenarios, serving financial institutions and corporate customers. At the same time, with the help of DeFi platforms such as Aave, it extends its reach to retail investors and the DeFi market, striving to seize more market share in the rapidly growing stablecoin market.

Classification

Mechanism: Non-algorithmic, relying on traditional financial asset reserves, emphasizing compliance and transparency, and monthly reserve reports issued by third-party auditing agencies (such as BPM).

Profitability: RLUSD itself does not provide direct returns, but it can obtain returns through DeFi protocols (such as Aave) by participating in lending.

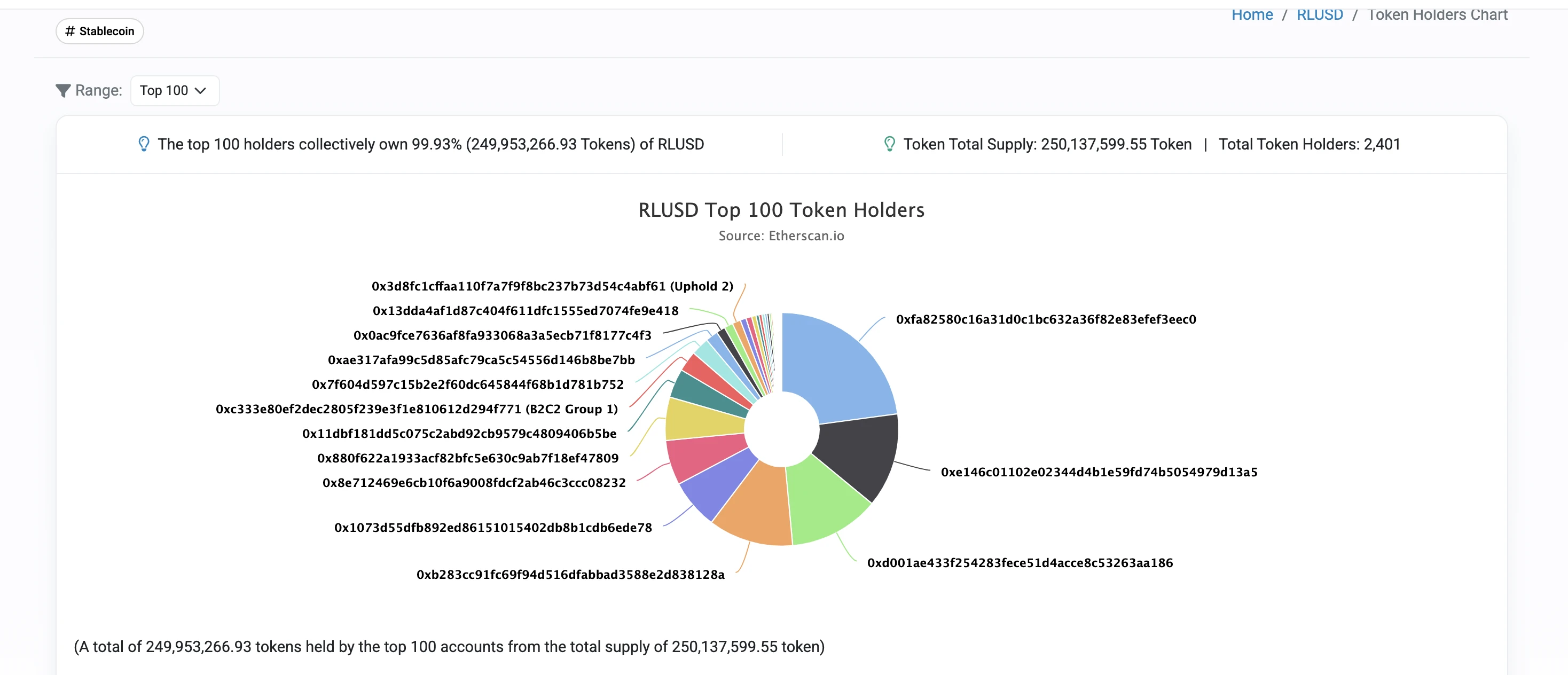

Market Data and Performance

As of now, the total market value and circulating supply of RLUSD are both around 317 million (due to slight deviations in the data of each platform), and the 24-hour trading volume is about 23 million US dollars, showing active market liquidity. From the on-chain data, RLUSD is most concentrated on the Ethereum chain, with a holding of about 250 million, held by 2,401 addresses, and the 100 largest wallets control 99.93% of the supply, showing a highly concentrated distribution feature.

After RLUSD was launched on the Aave V3 market of the Ethereum mainnet, it supports the lending function and sets a supply limit of 50 million and a lending limit of 5 million. In the early days of its launch, the market responded enthusiastically, and the deposit volume exceeded 76 million US dollars in just 4 days. Although affected by market fluctuations, the current deposit volume has fallen back to 67.13 million US dollars, it still maintains a high level and continues to provide stable liquidity support to the market.

User Engagement Opportunities

Currently, RLUSD has not launched direct liquidity mining or staking reward mechanisms. If users want to earn income, they can deposit RLUSD into the Aave V3 market on the Ethereum mainnet and participate in lending business. Its annualized rate of return will be dynamically adjusted according to the actual market situation. In addition, users can also participate in market transactions to obtain potential income by buying and selling RLUSD and other stablecoins (such as RLUSD/USDC) on supported trading platforms such as Curve and Kraken.

2. WLFI USD1

On March 25, 2025, World Liberty Financial (WLFI) officially launched the stablecoin USD 1. The stablecoin claims to have the support of Trump, adopts a 1:1 anchoring mechanism to the US dollar, and is 100% backed by US short-term Treasury bonds, US dollar deposits and other cash equivalents. USD 1 initially chose to be issued on Ethereum and Binance Smart Chain (BSC), and plans to expand to more blockchain networks in the future. In terms of asset security and transparency, its reserves are institutionally managed by BitGo, regularly audited by third-party accounting firms, and Chainlinks Proof of Reserve (PoR) mechanism is introduced to ensure that the status of assets is publicly traceable.

WLFIs core business focuses on digital asset financial services, and is committed to building a bridge for users to seamlessly cross-border transactions and participate in DeFi. The launch of USD 1 aims to break the barriers between TradFi and DeFi. On the one hand, it uses Trumps influence to attract investors who are interested in related projects, and on the other hand, it enhances its political and commercial influence in the crypto market, trying to gain a foothold in the fiercely competitive stablecoin market with its brand advantages and compliant operations.

The issuance of USD 1 and its association with the Trump family have created a unique brand effect, which has brought it extremely high market attention. This advantage has not only attracted a large number of retail investors, but also aroused attention among institutional client groups, becoming an important driving force for its market expansion.

Classification

Type: Fiat currency anchored.

Mechanism: Non-algorithmic, relying on traditional financial assets, emphasizing institutional-grade custody (such as BitGo).

Market Data and Performance

On April 12, 2025, WLFI announced a USD 1 airdrop proposal for early supporters, which triggered a strong market response. Although USD 1 has not yet been officially listed, its 24-hour trading volume on Binance Smart Chain (BSC) and Ethereum has rapidly climbed to nearly US$44 million . On April 16, DWF Labs, a leading market maker in the crypto market, announced a $25 million investment in WLFI and promised to provide liquidity support for USD 1. This investment has significantly enhanced the market credibility of USD 1, especially on DEX PancakeSwap (BSC), where the activity of USD 1 and BSC-USD trading pairs has been significantly enhanced.

As of now, the total market value of USD 1 tokens has reached 127 million US dollars, and the circulating supply is the same as the market value, which is also 127 million. On-chain data shows that on the BSC chain , the total supply of USD 1 is 113,479,585, and the number of holders is 1,812. The token market value on this chain accounts for as high as 88.97%; while the total supply of USD 1 on the Ethereum chain is only 14,491,580, and the number of holders is only 322. In comparison, the circulation scale and user participation on the Ethereum chain are significantly lower.

User Engagement Opportunities

Users can trade through DEX (such as PancakeSwap) or wait for more DeFi protocol integrations to be launched. In addition, users are advised to follow the WLFI official X account ( @worldlibertyfi ) to obtain the latest updates, airdrop plans, launch arrangements and other important announcements of USD 1 in a timely manner, and to grasp the project progress at the first time.

3. Usual USD0

USD0 launched by Usual Labs is positioned as a yield-based stablecoin , and its value is pegged to the US dollar at a 1:1 ratio. The core feature of the project is the use of RWA for collateralization, especially short-term US Treasury bonds or other low-risk assets, to ensure the stability of USD0 . In this way, USD 0 can circulate in the DeFi ecosystem while providing users with a low-risk, predictable stablecoin option.

Currently, USD 0 is mainly issued and circulated on multiple blockchain platforms such as Ethereum, BNB Chain, and Base. The project provides a simple collateral mechanism, where users can mint USD 0 by mortgaging USDC or other stable assets, thereby providing liquidity for the DeFi market. In addition, Usual has also launched USD 0++, a special bond-type stablecoin (based on USD 0s LST, similar to Lidos stETH). USD 0++ provides an annualized return of approximately 4% by locking up 4-year treasury assets, while supporting liquidity mining and lending on DEXs such as Uniswap V3 and Curve Finance.

Usual Labs launched USD0 to fill the markets demand gap for high-quality and diversified stablecoins, especially in the DeFi field. Through the deep integration of RWA and DeFi protocols, USD0 is committed to increasing the scale of total value locked (TVL) and enhancing user participation. In the DeFi ecosystem, high liquidity and price stability of stablecoins are crucial, but traditional fiat-pegged stablecoins such as USDT and USDC are mostly managed by centralized institutions and face regulatory uncertainty and trust risks. USD0 , with its decentralized nature, provides DeFi users with a more attractive option.

In December 2024, Usual Labs reached a cooperation with Ethana and announced that USDtb and sUSDe would be included in the core of future business strategy. Both parties plan to accept USDtb as collateral and gradually migrate some of the supporting assets of USD 0 to USDtb. Usual Labs also plans to become one of the major holders of USDtb.

Classification

Type: RWA anchored, reserves include short-term treasury bonds and part of Ethenas USDtb.

Mechanism: Non-algorithmic, relies on RWA and USDtb assets.

Market Data and Performance

On January 9, 2025, Usual Labs suddenly announced a major adjustment to the redemption mechanism of USD0++ , significantly reducing the original 1:1 fixed exchange rate to as low as 0.87 USD 0. This move quickly caused a shock in the market, and the market price of USD0++ plummeted to 0.89 USD in an instant, which was significantly different from the parity of the US dollar. Since many DeFi protocols previously regarded USD0 and USD0++ as equivalent assets, this adjustment directly caused widespread confusion in the market, and user dissatisfaction continued to rise.

Back in early 2025, the market value of USD0 had soared to a historical peak of about $1.9 billion. However, in just two months after the redemption mechanism was adjusted, its market value evaporated by about $1.2 billion, falling sharply to around $662 million, and the markets confidence in the protocol suffered a severe blow.

In response to the doubts, Usual Labs said that this adjustment is part of the established strategy, which aims to reposition USD0++ as a zero-interest bond product, different from traditional stablecoins. However, due to the lack of advance notice and fully transparent communication, a large number of users failed to prepare in advance, which triggered a crisis of trust and caused a significant decline in the liquidity of the USD0 ecosystem.

Related articles:

《USD 0++ continues to “break away from the anchor”, should we hold or run now? 》

I also recommend a memoir about the depegging of the stablecoin sUSD : Synthetix has taken another repair measure, can sUSD return to its peg?

User Engagement Opportunities

You can pledge USD0 on the Usual platform to obtain USD0++ and get an annualized rate of return of 50% ( risk warning: USUAL token rewards are linked to TVL ). Or you can provide liquidity on protocols such as Uniswap to earn income.

4. Ethena USDe

USDe, launched by Ethena, is a highly innovative stablecoin. Its collateral assets include not only crypto assets such as ETH and BTC, but also RWAs such as BUIDL, and maintain currency stability through a diversified asset portfolio. Unlike traditional fiat-anchored stablecoins, USDe uses crypto assets as its collateral foundation. With the help of smart contracts and algorithmic mechanisms, it can automatically and dynamically adjust the collateral ratio according to market fluctuations to ensure price stability. This unique design gives it greater flexibility and transparency in the DeFi ecosystem. USDe is issued and managed by Ethena Labs, which has rich experience in the blockchain and DeFi fields. It is mainly circulated on mainstream blockchain platforms such as Ethereum. Users can mint USDe by mortgaging ETH, BTC, USDC and other assets.

Ethena launched USDe with the intention of creating native trading and lending solutions for the DeFi field, building a high-yield, decentralized stablecoin ecosystem, and breaking the dependence of traditional stablecoins on the banking system. In this process, Ethena introduced RWA support through cooperation with financial giant BlackRock to provide solid institutional-grade asset endorsement for USDe. At the same time, USDe is deeply integrated with well-known DeFi protocols such as Aave and Morpho to effectively improve its liquidity; with the help of LayerZeros cross-chain strategy, the ecological coverage is further expanded. USDes target customer group focuses on DeFi native users and institutional investors, focusing on serving core scenarios such as lending, trading and income generation.

Classification

Type: Synthetic USD stablecoin, anchored by a combination of crypto assets (such as ETH) and RWA (such as BUIDL).

Mechanism: Combination of algorithms and yield models, generating income through futures arbitrage and staking, and maintaining the US dollar peg.

Market Data and Performance

USDe uses a delta-neutral strategy to maintain price stability. Specifically, the strategy uses ETH as collateral and opens an equivalent short perpetual futures contract on a derivatives exchange. With this strategy, USDe is able to provide users with an annualized rate of return (APY) of more than 25%. Such a generous return has attracted the attention and participation of a large number of DeFi users. This also makes USDe the fastest growing asset on Aave, with its lending and staking demand far exceeding traditional stablecoins USDT and USDC. In addition, in the ecosystem of the Ethena protocol, fees of up to US$200 million were generated in 2024, part of which was distributed to ENA token holders. This move not only enhanced user stickiness to the protocol, but also promoted the explosive growth of ENA token prices.

The market situation is changing rapidly, and the total market value of USDe has also been affected to a certain extent, and has declined compared to the peak of US$5.9 billion in March this year. However, even so, the current total market value of USDe is still US$4.7 billion. With its high-yield characteristics and the endorsement of financial giant BlackRock, USDe has successfully attracted widespread attention from the market, surpassing USDS launched by SKY in the stablecoin market and ranking third in the stablecoin market.

User Engagement Opportunities

Users can pledge USDe through the Ethena platform to obtain sUSDe with an annualized yield (APY) of about 27% to realize asset appreciation; they can also choose to use the lending rate difference in DeFi protocols such as Aave and Morpho to conduct arbitrage operations to obtain returns. It is recommended to pay close attention to market trends and carefully assess risks before making operations.

5. SKY USDS (upgraded version of Maker DAI)

USDS launched by Sky is derived from the original MakerDAO protocol, and also adopts a 1:1 USD anchoring mechanism, with crypto assets such as ETH as the main collateral, and is positioned as a decentralized stablecoin soft-anchored to the US dollar. As the successor of MakerDAO, Sky has completely reconstructed and upgraded the original system, and on this basis launched two native tokens, USDS and SKY, which respectively assume the functions of stable currency and ecological governance.

SKY launched USDS to consolidate its leading position in the DeFi field, create a fully decentralized stablecoin solution, and continue the successful genes of MakerDAO. USDS is deeply integrated into SKYs core business, providing support for decentralized lending and payment scenarios, and as an important part of the governance system, it has become a trusted value storage and transaction medium for DeFi users. SKY has significant resource advantages: on the one hand, it inherits MakerDAOs long-term accumulated decentralized governance experience, and on the other hand, it is widely integrated with mainstream DeFi protocols such as Aave and Compound. In addition, through the governance token SKY, SKY has built a community-driven model to encourage users to actively participate in ecological construction.

In terms of the profit mechanism, USDS provides users with an annualized yield of 6.25% through Sky Protocol. Although this yield is lower than that of USDe, it continues to attract users who pursue stable returns with its more stable performance.

Classification

Type: Crypto asset anchored, reserves include Ethereum, USDC and other assets.

Mechanism: Algorithmic and collateralized, maintaining the peg through overcollateralization and dynamic stability fees.

Market Data and Performance

Total market capitalization: According to Defillama, the current total market capitalization of the token is approximately US$4.22 billion.

Supported blockchains: Ethereum, Base, Solana and Arbitrum.

Circulation situation: USDS circulation is low, with a 24-hour trading volume of US$2.78 million, which is in sharp contrast to the total market value.

User Engagement Opportunities

Users can deposit USDS into Sky Protocol and earn additional SKY token rewards while obtaining an annualized rate of return (APY) of approximately 6.25%. They can also choose to participate in lending operations in DeFi protocols such as Aave to make profits. It is worth noting that since USDS is mainly collateralized by crypto assets, market fluctuations may cause changes in the value of collateral assets, thereby affecting the stability of returns. It is also recommended that users fully assess the risks before operating.

6. PayPal PYUSD

PayPal USD (PYUSD) is a US dollar stablecoin launched by PayPal in August 2023. Its value is strictly pegged to the US dollar at a 1:1 ratio and is fully supported by US dollar deposits, short-term US Treasury bonds and cash equivalents. The stablecoin is issued by Paxos Trust Company and is issued on the Ethereum and Solana blockchains. Users can easily complete the purchase, sale, holding and transfer of PYUSD through the PayPal application, and the usage scenarios cover multiple fields such as peer-to-peer payment, online shopping settlement, and cryptocurrency exchange.

In April 2025, PayPal launched the PYUSD deposit plan for US users, providing users with an annualized rate of return of 3.7%. Users only need to deposit PYUSD into PayPal or Venmo wallets to obtain income rewards in the form of PYUSD, which can be flexibly used for daily payments, exchange for legal currencies or other cryptocurrencies. This move further promotes the popularity of PYUSD in the payment ecosystem.

PayPal launched PYUSD, aiming to expand its global payment ecosystem to the cryptocurrency field, and optimize the users payment and transfer experience in digital asset scenarios through the characteristics of stablecoins. As an extension of PayPals core business of online payment and cross-border transfers, PYUSD is committed to deeply integrating cryptocurrencies with existing payment networks to increase user activity and platform transaction volume. With a global user base of over 400 million, mature payment infrastructure, and close cooperation with Paxos, PayPal has laid a solid foundation for the development of PYUSD while ensuring compliance operations and asset security. Its target market focuses on retail payment users and Web2 companies, attracting users in the traditional financial field with low-risk returns, while gradually penetrating into the DeFi field to reach crypto-native user groups.

Classification

Type: Fiat currency anchored, 1:1 anchored to the US dollar, reserves are short-term government bonds and US dollar deposits.

Mechanism: Non-algorithmic, relying on Paxos’ custody and supervision.

Market Data and Performance

With the strong brand influence of PayPal, PYUSD has successfully attracted many traditional financial users to join. However, compared with the average rate of return in the DeFi market, the rate of return of PYUSD is significantly lower, which makes its competitiveness in the DeFi field relatively weak. Looking back at its market value performance, PYUSD reached a historical peak of about US$1 billion in August 2024. Later, affected by the volatility of the crypto market, its market value gradually fell back and is currently about US$880 million, ranking ninth in the overall stablecoin market.

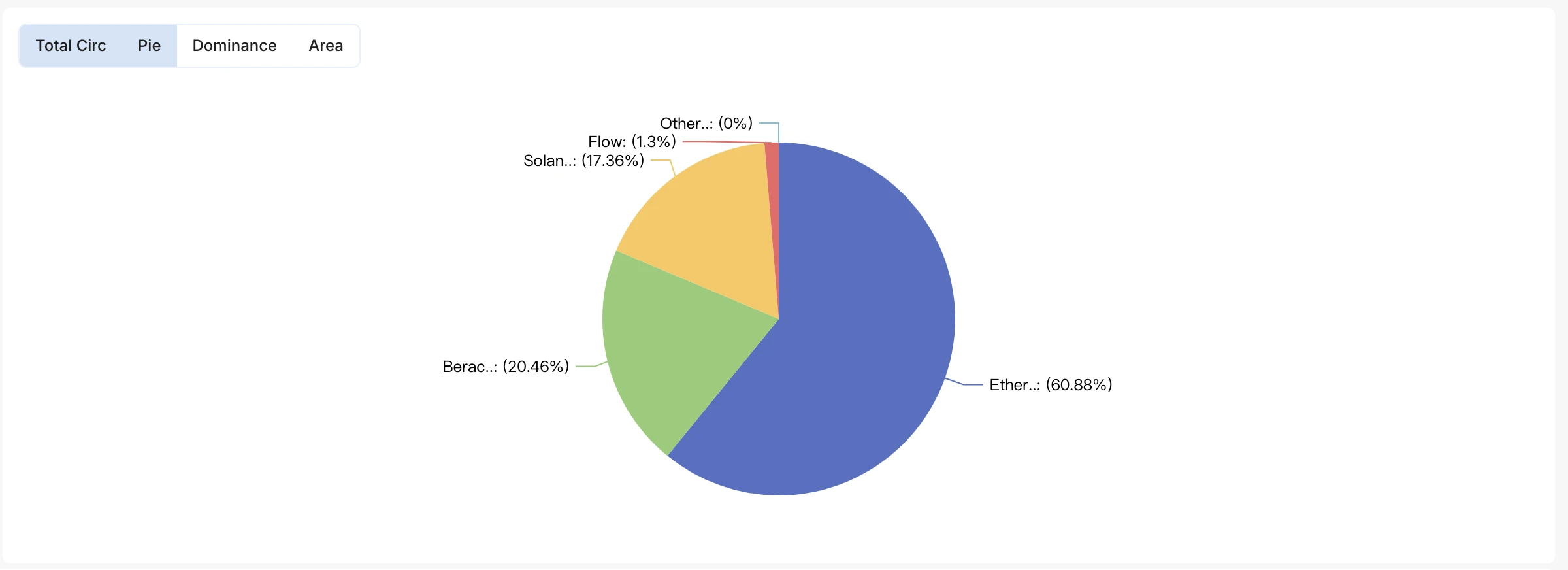

From the perspective of technical architecture, PYUSD is mainly deployed on Ethereum and Berachain blockchains, followed by Solana, supporting cross-chain payment functions and enhancing the convenience of asset circulation. However, according to coinmarketcap data, its 24-hour trading volume is only 13.93 million US dollars, and the ratio of trading volume to total market value is 1.66%, reflecting that the current market circulation activity of PYUSD is still at a low level.

User Engagement Opportunities

There are two profit paths for users: on the one hand, they can participate in the deposit plan launched by the PayPal platform and deposit PYUSD to enjoy an annualized rate of return (APY) of about 3.7%. This profit model is very friendly to traditional financial users; on the other hand, they can also trade PYUSD in the DeFi protocol of the Solana ecosystem (such as Saber) and capture market opportunities through buying, selling, and exchanging operations.

Conclusion

In general, these six stablecoins differ in terms of target market, revenue model, collateral assets and market performance. In the volatile cryptocurrency world of stablecoins , some rely on traditional brand advantages, while others rely on innovative collateral models or revenue strategies. However, the market is ever-changing, and no stablecoin can rest easy. In the future, those stablecoins that can balance returns and risks, continuously optimize product mechanisms, enhance user experience and strengthen market expansion are more likely to stand out in this competition and lead the development trend of the stablecoin market.