Original article by Taiki Maeda

Original translation: TechFlow

In my MKR/SKY report a few months ago , I suggested that the resumption of buybacks would allow it to outperform most crypto assets on a risk-adjusted basis. Since the buyback was announced on February 20:

MKR is up 46% compared to BTC.

MKR rose 70% compared to ETH.

MKR is one of the few cryptocurrencies to see a year-to-date (YTD) price increase: +24%.

In this update, I will discuss three reasons why I think this trend will continue:

Launch of SKY staking mechanism

Forced SKY token migration (>10% of supply will be destroyed)

SPK Token Mining Plan

Introducing SKY staking mechanism

Currently, MKR/SKY is a token that uses all protocol revenue to buy back tokens. At the current buyback rate, the protocol buys back about $15 million per month ($500,000 per day), which is equivalent to buying back about 1% of the circulating supply per month (the highest proportion among all crypto projects).

On April 30, Rune published a proposal on the forum to launch the SKY staking mechanism. According to the proposal, 50% of the protocol revenue will be distributed to SKY stakers, paid in USDS. In other words, about $250,000 will be used for repurchase every day, and $250,000 will be distributed to stakers.

Assuming 33% of the SKY supply is staked, stakers can expect to earn a staking yield of 7-8%.

Forced SKY Token Migration

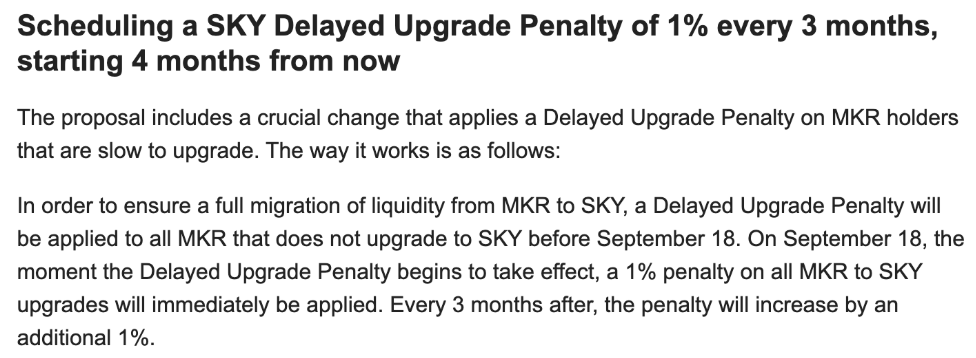

In the same update, it was also mentioned that a mandatory migration from MKR to SKY would take place:

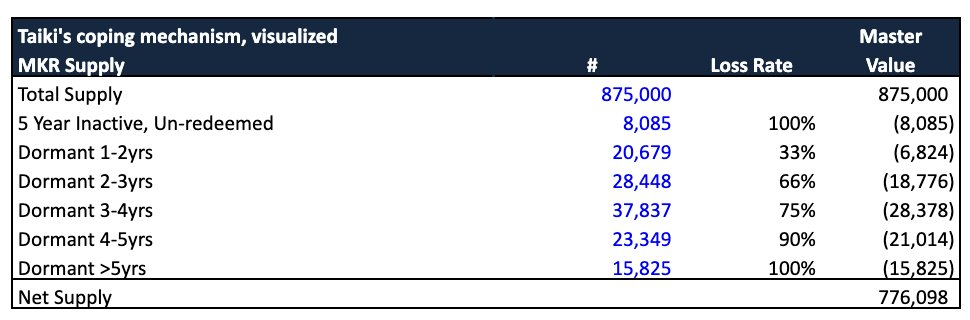

Since MKR is one of the oldest ERC 20 tokens (launched in 2017), there are bound to be some tokens that are permanently lost. This could be due to lost private keys, lost wallets, or death of the holder. By analyzing on-chain data , I discovered some sleeping MKR tokens that will inevitably be destroyed from the supply.

I based this on reasonable assumptions, such as: If there are 23,349 MKR tokens that have not been moved in the past 4-5 years, I can assume that about 90% of them are permanently lost, i.e. destroyed. Based on these assumptions, I expect that about 100,000 MKR will be destroyed due to migration (about 11.4% of the circulating supply). Based on other examples of lost tokens (such as Aragon DAO), I think this is a conservative estimate.

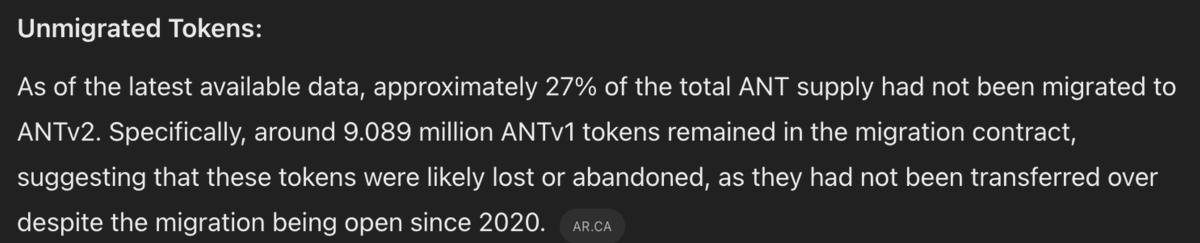

Take the Aragon DAO token ($ANT) in 2023, which was trading below the treasury value. “Treasury raiders” or RFVooors purchased tokens at a discount to the net asset value (NAV) and demanded that the treasury be redeemed for a profit. This operation was successful, and a migration process of ANT tokens to new tokens was initiated to redeem the treasury value. During this process, approximately 27% of the tokens were not migrated, and it can be inferred that these tokens were permanently lost.

Therefore, I expect that 10-20% of MKR will be destroyed in the next few months or years, which will support the token price. In addition, this forced migration may prompt more centralized exchanges (CEX) to list SKY, which will bring additional benefits.

SPK Token Launch

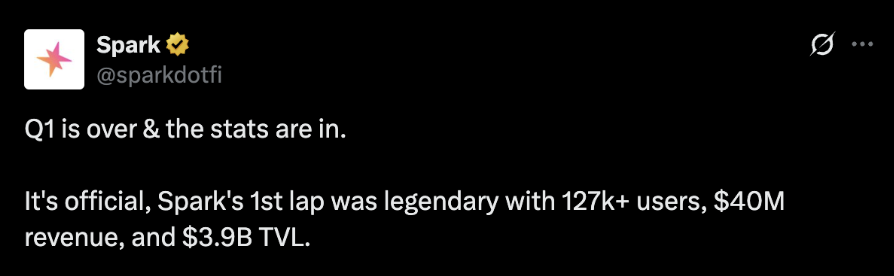

Spark is a project that combines a lending market with on-chain asset management, and with almost no incentives, achieved $40 million in revenue in Q1 2023. They are able to borrow stablecoins for SKY at subsidized rates, allocating capital on-chain.

SPK will be a fair launch/mining token that users can only mine by staking USDS or SKY (the specific economic model can be found in the relevant documents ). In the first two years of token issuance, 50% of $SPK incentives will be allocated. If the fully diluted valuation (FDV) is assumed to be $500 million, $250 million of the value will be allocated to SKY/USDS stakers. This not only provides staking income for the native token, but also promotes the growth of USDS, which will further drive more buybacks in the future.

In addition, there are other subDAOs or star projects coming online soon (such as Solana Star, RWA Star, etc.), and the launch of these new projects will further support the repurchase plan.

Stablecoin Bill

The GENIUS ACT is expected to be signed by Trump in July or August. Although the bill is primarily targeted at centralized stablecoin issuers (and therefore has little impact on decentralized issuers), this policy narrative could provide a positive market impetus for MKR/SKY. Industry experts predict that the bill is expected to be passed in July or August.

Summarize

Stablecoins are the future and are one of the most profitable projects in the crypto space.