Original | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

Early this morning, according to OKX market data , the BTC price once broke through 110,000 US dollars, and the 24- hour increase was close to 3%. This also means that Bitcoin lived up to expectations and the BTC price hit a record high after a lapse of 4 months.

At the same time, Ethereum once broke through US$2,600 and is currently trading at US$2,580, with a 24- hour increase of 5.04%; SOL broke through US$175 and is currently trading at US$174.8, with a 24 -hour increase of 3.60%.

8 The latest data from MarketCap shows that the market value of Bitcoin has returned to above 2.1 trillion US dollars, currently reaching 2.166 trillion US dollars, surpassing e-commerce giant Amazon and rising to fifth place in the global asset market value ranking.

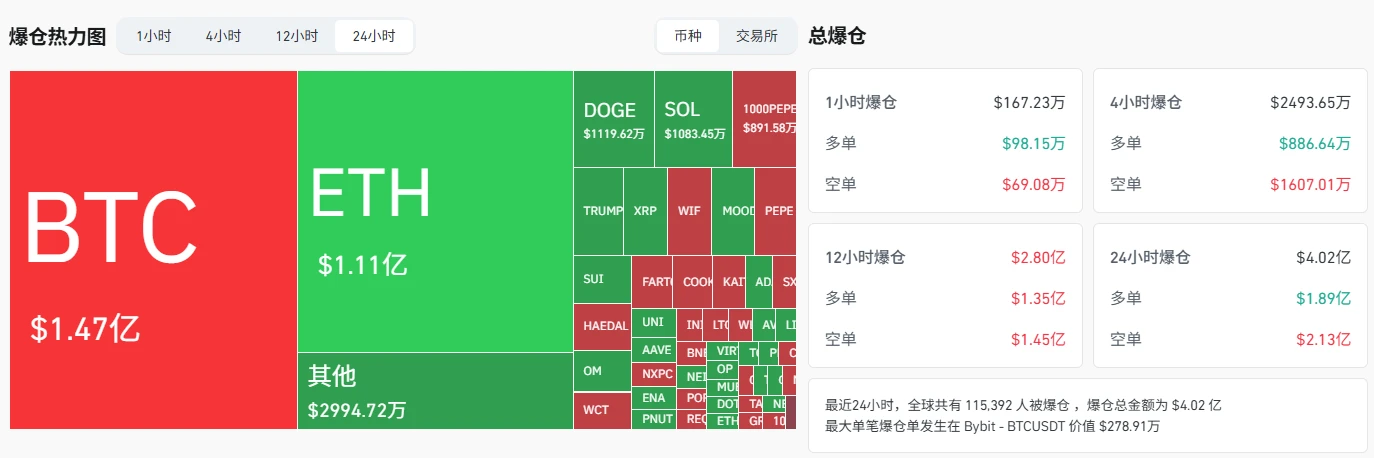

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has a liquidation of $402 million, of which long orders have a liquidation of $189 million and short orders have a liquidation of $213 million. In terms of currencies, BTC has a liquidation of $147 million and ETH has a liquidation of $111 million.

In the process of Bitcoin setting a new record high, the most eye-catching thing is that two whale traders with a very high winning rate in Bitcoin trading, James Wynn and the 50x Insider Whale, opened opposing orders on Hyperliquid. Now Odaily Planet Daily will take you to review the high-energy operations of these two whales.

James Wynn and the 50x Insider Whale exciting long-short game

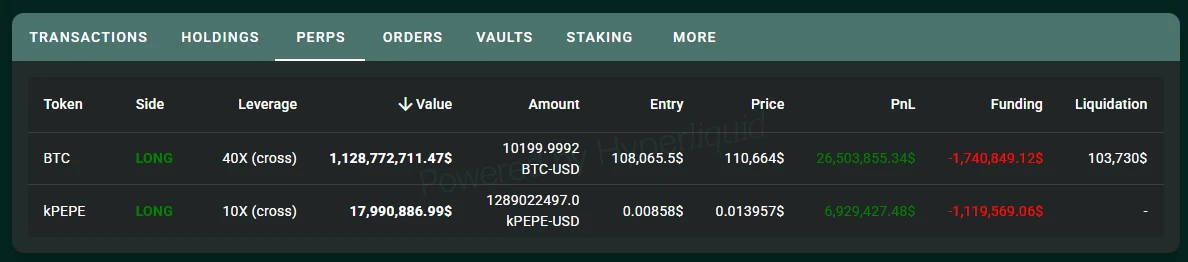

James Wynn: Long BTC, long positions once exceeded $1.1 billion

In the past two days, as the price of BTC has risen, James Wynn has continued to increase his 40x leveraged BTC long positions to 10,199 BTC. The current position is worth as much as US$1.11 billion, which may have refreshed the record for the maximum value of a single position on Hyperliquid.

In the early morning, when BTC fell back from its high point to $106,000, its position once suffered a floating loss of more than $10 million. At present, the opening cost price of the long order is $108,065.5, the liquidation price is $103,780, and the floating profit is as high as $26 million.

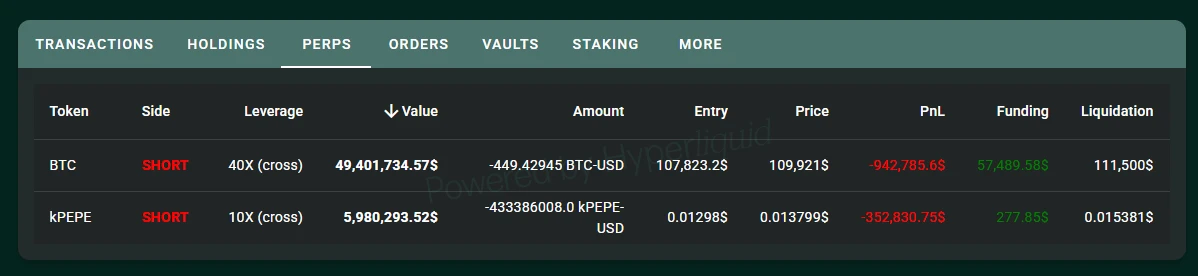

“50x Insider Whale”: Shorting BTC, reducing positions in the early morning to increase the liquidation price

The “50x Insider Whale” transferred 2.3 million USDC to Hyperliquid as margin at 4 a.m. yesterday, and opened a short position of 826 BTC with 40x leverage. As the price of BTC continued to rise, the whale’s position was reduced by half due to liquidation due to the rise in BTC prices, but he did not stop shorting. Instead, he continued to increase his USDC by 5 million as margin and increased his short position to 1,097 BTC.

After BTC broke through $110,000, its position was reduced to 449 again. The current average opening price of the short order is $107,823.2, and the liquidation price is raised to $111,500. The current floating loss is close to $1 million.

“50x Insider Whale” Holdings Information

Although BTC experienced a pullback this morning, the two whales did not close their positions, but continued to increase their positions in the direction they are optimistic about. Currently, James Wynn has a floating profit of 26 million US dollars, and the 50x insider whale has a floating loss of nearly 1 million US dollars.

As the GENIUS Stablecoin Act enters the final voting stage in the Senate, a new channel that may lead hundreds of billions of dollars of capital into the crypto market is about to open. At the same time, the US SEC has also launched a new round of crypto regulations, sending an unprecedented policy signal. Against the backdrop of the continuous release of favorable policies, market confidence has rapidly increased, further boosting the strong breakthrough of Bitcoin prices.

The market outlook is bullish, and $110,000 may just be a new starting point

In the early hours of this morning, US President Trump posted on the Truth Social platform: BITCOIN ALL TIME HIGHS, ENJOY!!, celebrating the record high price of Bitcoin. In addition, many celebrities are full of confidence in its future development prospects.

Michael Saylor: If you don’t buy Bitcoin at its historical high, you’re missing out

In the early morning, as BTC broke through its all-time high, Strategy Executive Chairman Michael Saylor posted on the X platform, If you dont buy Bitcoin at its all-time high, youre missing out.

Arthur Hayes: Bitcoin may rise to $200,000, and US Treasury policy is the key driving force

Arthur Hayes said in a recent interview that Bitcoin could rise to $200,000, and stressed that the main driving force of the current bull market may be the U.S. Treasurys policy, not the Federal Reserve. Arthur Hayes analyzed that when the Federal Reserve reduces its purchase of U.S. Treasury bonds, although rising yields lead to tighter market liquidity, the Treasurys debt management and issuance plans may create new market momentum.

Standard Chartered: US SEC data supports Bitcoin reaching $500,000 in 2028

Geoff Kendrick of Standard Chartered Bank said that the recent 13F filings with the U.S. Securities and Exchange Commission (SEC) support that the price of Bitcoin could rise to $500,000 by the end of 2028. Although direct ETF holdings declined in the first quarter, government agencies increased their holdings of Strategy (formerly MicroStrategy), which is seen as an alternative asset to Bitcoin. This may reflect that government agencies are still trying to increase their Bitcoin holdings despite regulatory restrictions.

PlanB: If the SP index rises to 7,000 points, Bitcoin may reach $300,000

Crypto analyst PlanB published a chart showing that according to the logarithmic regression model he established, if the SP 500 index (SPX) rises to 7,000 points, the corresponding Bitcoin price may reach $300,000. The fitting curve in the figure shows that there is a strong correlation between Bitcoin and the SP index (R²= 0.873), suggesting that in the context of a stronger traditional market, Bitcoin prices have further room to rise. This view is based on historical fitting data and model deduction, not investment advice.

CryptoQuant analyst: Bitcoin shows no signs of overheating and is still in a healthy bull market

CryptoQuant analyst Avocado said that there was no sign of overheating during the rebound of Bitcoin, which is a clear signal that the market is still in a healthy bull market stage. This shows that the market buying sentiment is still conducive to further increases, and now is not the time to consider leaving the market.

The author of Rich Dad Poor Dad: Still buying more Bitcoin, predicting that it will rise to $250,000 this year

Robert Kiyosaki, author of Rich Dad Poor Dad, posted on the X platform that the central bank system is collapsing and many banks are going bankrupt, so the value of gold, silver and Bitcoin will continue to rise. He pointed out that he is still buying more Bitcoin and predicts that Bitcoin will rise to $250,000 this year.