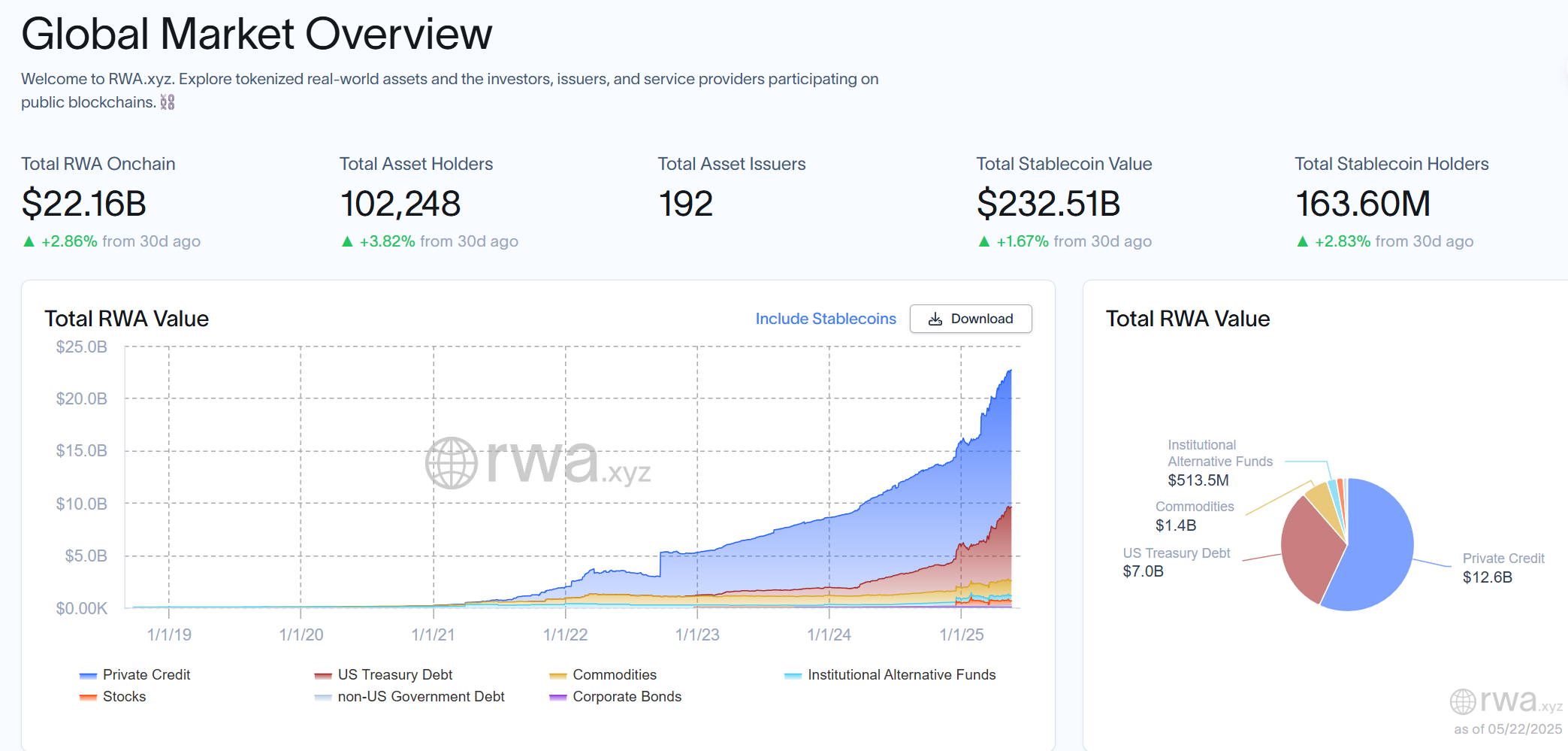

The global asset tokenization process is accelerating. According to data from the RWA.xyz platform, as of April 2025, the total value of RWA assets on the global chain has exceeded US$22 billion. At the same time, Deloitte also predicted in a research report that the tokenized real estate market will reach US$4 trillion in 2035.

In this wave of financial innovation, Hong Kong has rapidly developed into a pioneer in the development of compliance in the RWA field with its unique institutional advantages, from the charging pile asset tokenization project launched by Longsun Group to the first compliant tokenized fund in Asia launched by China Asset Management. The successful implementation of multiple benchmark cases has confirmed the application potential of this innovative financing method in the field of physical assets.

What exactly is RWA?

Why choose RWA and what are its advantages?

How does Hong Kong regulate RWAs?

What compliance points do mainland companies need to pay attention to when conducting RWA in Hong Kong?

The Crypto Salad team has been deeply involved in the cryptocurrency industry for many years and has rich experience in dealing with RWA project architecture design and related complex cross-border compliance issues. In this article, we will combine the teams latest RWA project experience and industry research results to sort out and answer the above questions from the perspective of professional lawyers.

(The above picture is the global on-chain RWA asset dashboard compiled by the website RWA.xyz)

1. What exactly is RWA?

RWA, the full name of which is Real World Assets, is an innovative financial model based on blockchain technology. It uses blockchain technology to map physical assets or financial assets to the chain, thereby converting them into digital tokens with high liquidity and divisibility. This conversion process not only realizes the digital expression of assets, but also gives these real assets unprecedented transparency and traceability through blockchain technology.

Although we can explain the connotation and extension of the concept of RWA at the theoretical level, it is difficult for all parties to reach a complete consensus when it comes to specific project practices.

What is a real RWA? Which projects should be identified as RWA projects? Professionals, regulators, and project owners all have their own perspectives and opinions on the above questions. The Crypto Salad team combined project experience and research results to give its own opinion from the perspective of legal compliance: RWA is actually a broad concept, and there is no so-called standard answer. All processes that realize asset tokenization through blockchain technology can be called RWA. For an in-depth analysis of the concept of RWA, see: Web3 Lawyer Decryption: What kind of RWA do you understand?

2. Why choose RWA? What are its advantages?

1. Activating asset-heavy financing scenarios that are difficult to reach with traditional finance

First, take real estate, infrastructure income rights, commodities and other assets as examples. Due to the complex issues of heavy asset attributes, liquidity restrictions and compliance supervision, it is difficult to complete financing through traditional financial instruments. The RWA model combines blockchain technology to divide the ownership of these physical assets or equity assets, convert them into highly liquid digital tokens, and raise investors funds by issuing digital tokens. RWA has opened up a new financing method for the above assets, allowing these originally sleeping assets to be revitalized. This means that at a time when there are few financing channels, financing is difficult and financing costs are high, RWA can provide companies with a new blood-making method.

For investors, the divisibility of tokens lowers the investment threshold for specific assets. Take real estate investment as an example. Under the framework of traditional finance, investors who want to invest in real estate often need to spend millions of yuan to purchase the entire property. The high capital threshold excludes many small and medium-sized investors. Relying on the RWA model, investors may only need to spend $50 to purchase a token representing part of the property rights. By holding the token, investors will be able to enjoy the investment income brought by the appreciation of real estate and rent.

2. Reduce financing costs and improve financing efficiency

In the traditional securities issuance process, enterprises and projects need to go through a strict and lengthy review process, and the qualifications, scale, project operation methods, etc. of the issuer must meet high requirements. Taking the issuance of asset-backed securities (ABS) as an example, its supervision and approval standards are extremely strict, which greatly limits the financing needs of some enterprises.

Under the RWA model, in addition to complying with local compliance requirements, the financing party has relatively few other access requirements and restrictions, but the underlying assets still need to be compliant. Therefore, this financing method avoids the lengthy review process and cumbersome issuance procedures in the traditional financing process to a certain extent, and also effectively reduces the financing cost.

(III) Customized transaction structure

RWA financing provides companies with unprecedented flexibility, allowing them to tailor financing structures according to market demand and their own development goals. Companies can independently design key terms such as revenue distribution models, redemption mechanisms, token unlocking mechanisms, and adjust issuance conditions in real time based on market dynamics. This high degree of flexibility enables companies to accurately match investors expectations and risk preferences, thereby improving the targeting and success rate of financing.

In essence, in addition to introducing blockchain technology to improve financing efficiency and transparency, RWA has also changed the financing logic under the traditional financial framework. Traditional financing models, whether debt financing or equity financing, mostly rely on corporate credit as a basis. In contrast, RWA uses blockchain technology to effectively separate corporate credit from asset credit. In this way, even if the credit status of the issuer is average, as long as the underlying assets are high-quality enough, financing can be obtained based on the credit of the assets themselves.

This feature is similar to the ABS model mentioned above. Although the two have similarities in financing logic, the core difference between them lies in the investor groups they cover and the ecological effects they form.

The ABS market is mainly dominated by traditional financial institutions, with a relatively limited number of market participants, and most of the trading entities are institutional investors. This feature makes the overall trading depth of ABS insufficient, the market coverage is relatively narrow, and it lacks a wide range of influence.

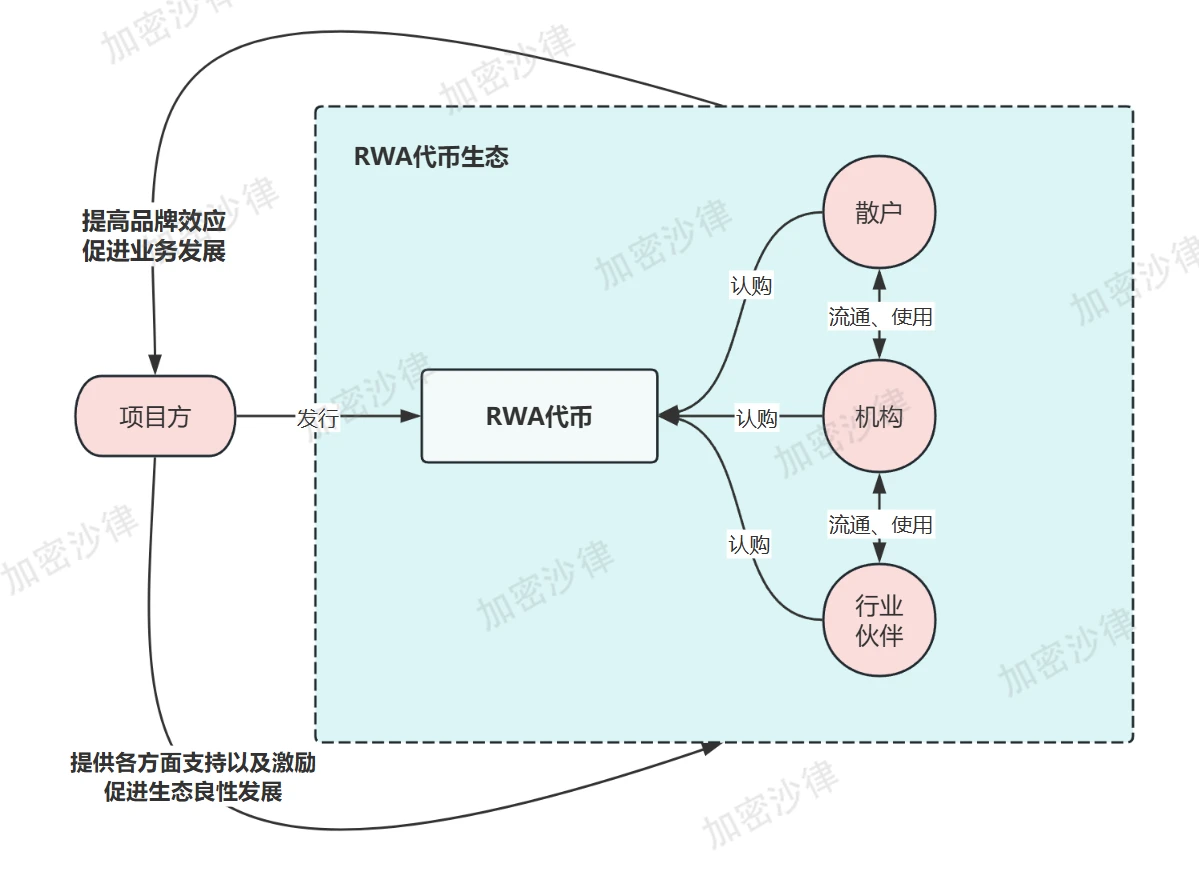

In contrast, the participants in the RWA market are more diverse. In addition to traditional financial institutions, the RWA financial market will also attract many crypto investors and industry ecosystem partners. Therefore, in the RWA market, everyone from professional institutions to ordinary retail investors to partners can freely buy, sell and use the token, and become an important part of the token ecosystem.

Many investors have formed a large and active ecosystem and community around the RWA token. The resulting strong community cohesion and ecological stickiness will provide strong support for the long-term value growth of the RWA token, thereby promoting the healthy development of the market. The prosperity of the on-chain ecology can also feed back the development of the projects off-chain business and significantly improve the projects brand voice.

This positive feedback development model of on-chain and off-chain collaboration is the real subtlety of the RWA model compared to traditional financing methods, and it is also difficult to achieve with the ABS model.

At present, the market is still cultivating and expanding the RWA investor group. In the current RWA track, the leading ones are all kinds of financial asset tokenized products. Because financial assets themselves have high compliance, high degree of standardization, and low difficulty in data capture, the tokens of financial assets have unique advantages and demonstration effects in the RWA track.

The wave of tokenization of financial assets began with products such as U.S. Treasury bonds and money market funds, which have the lowest underlying asset risks. A typical example is the BUIDL tokenized investment fund launched by BlackRock, the worlds top asset management group. As of now, the total market value of BUIDL has reached US$2.89 billion. In addition to low-risk financial assets, high-risk financial assets such as stocks and ETFs have also recently embarked on the fast track of tokenization. On May 22 and 23, Kraken Exchange and Ondo Finance announced that they would promote the tokenization and on-chain trading of financial assets such as stocks and ETFs.

With the rapid implementation and development of various tokenized financial assets and stablecoins, the investor scale and liquidity of the RWA market will reach a new height. In the future, more and more different types of RWA products will enter the investors field of vision, thereby attracting more Web2 users and traditional financial investors to enter the RWA ecosystem. The flywheel of the entire RWA ecosystem will circulate and develop rapidly, bringing new wealth effects and industry opportunities.

(The above picture is a schematic diagram of the RWA ecological development model, for reference only)

3. How does Hong Kong regulate RWA?

1. Supervision principles

As the backbone of Hong Kongs market supervision, the Hong Kong Securities Regulatory Commission has adopted the See-Through Approach in the process of supervising RWA products. The core of this principle is that the core focus of supervision is not whether the product is in the form of tokens, but focuses on the financial attributes of the real assets corresponding to the tokens. In short, Hong Kongs supervision of RWA is to return to the essence of the underlying assets, rather than sticking to the form of tokens. This regulatory principle is also a concrete manifestation of the concept of same business, same risks, same rules.

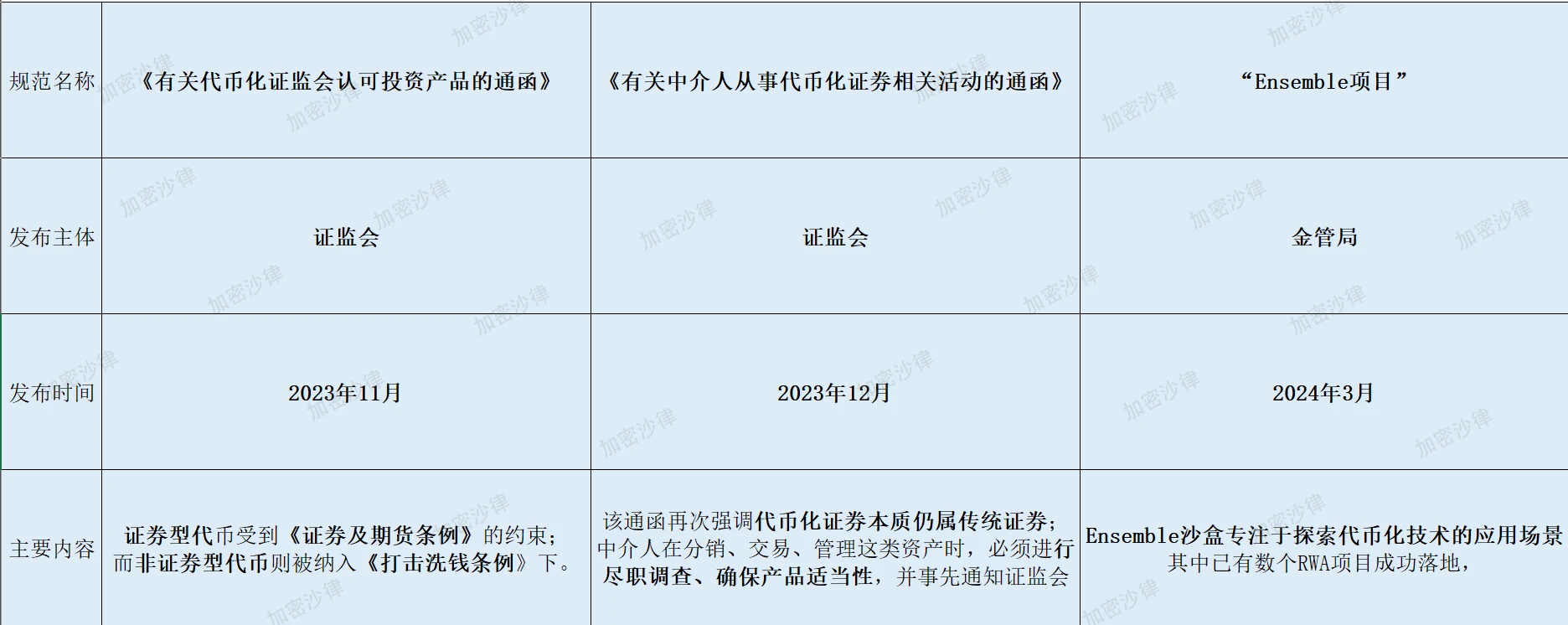

(II) Specific regulatory documents

1. In November 2023, the Securities and Futures Commission (SFC) of Hong Kong issued the Circular on Tokenized SFC-Approved Investment Products, which clarified the concept of tiered supervision for the issuance of security tokens.

According to relevant regulations, Tokenised Securities are subject to the Securities and Futures Ordinance and must meet the relevant requirements set out by the SFC in the above circular, including token issuance qualifications, information disclosure and investor suitability, etc. Non-security tokens are included in the regulatory scope of the Anti-Money Laundering Ordinance.

2. In November 2023, the Hong Kong Securities and Futures Commission issued the Circular on Intermediaries Engaged in Activities Related to Tokenized Securities.

The circular reiterated that although tokenized securities are issued using blockchain technology, they are still traditional securities in nature and must comply with existing securities laws. At the same time, intermediaries must conduct due diligence, ensure product suitability, and notify the CSRC in advance when distributing, trading, and managing such assets.

3. In March 2024, the HKMA launched the “Ensemble Project”.

Among them, the Ensemble Sandbox focuses on exploring the application scenarios of tokenization technology, and several RWA projects have been successfully implemented, covering multiple industries such as green bonds, carbon credits, real estate, and supply chain finance.

Overall, from 2023 to 2024, the Hong Kong Securities and Futures Commission successively issued a number of circulars and guidance documents involving tokenized investment products, further clarifying the specific regulatory standards for RWA products (especially tokenized securities), thereby providing clear regulatory guidance for the stable development of the RWA market.

(The above picture is a summary of the RWA-related regulatory framework)

The above article specifically analyzes Hong Kong’s regulatory framework for RWAs, and a complete and systematic review of Hong Kong’s virtual asset regulatory policies can be found below: “A comprehensive review of Hong Kong’s virtual asset regulatory policy framework”

4. What compliance points should mainland enterprises pay attention to when conducting RWA in Hong Kong?

The reason why the issuance of RWA must be a cross-border structure is that in mainland China, the issuance of tokens is a regulatory red line that cannot be crossed. On September 4, 2017, the Peoples Bank of China and seven other departments issued the Announcement on Preventing the Risks of Token Issuance and Financing, which clearly stated that no organization or individual may illegally engage in token issuance and financing activities, and all types of token issuance and financing activities should be stopped immediately.

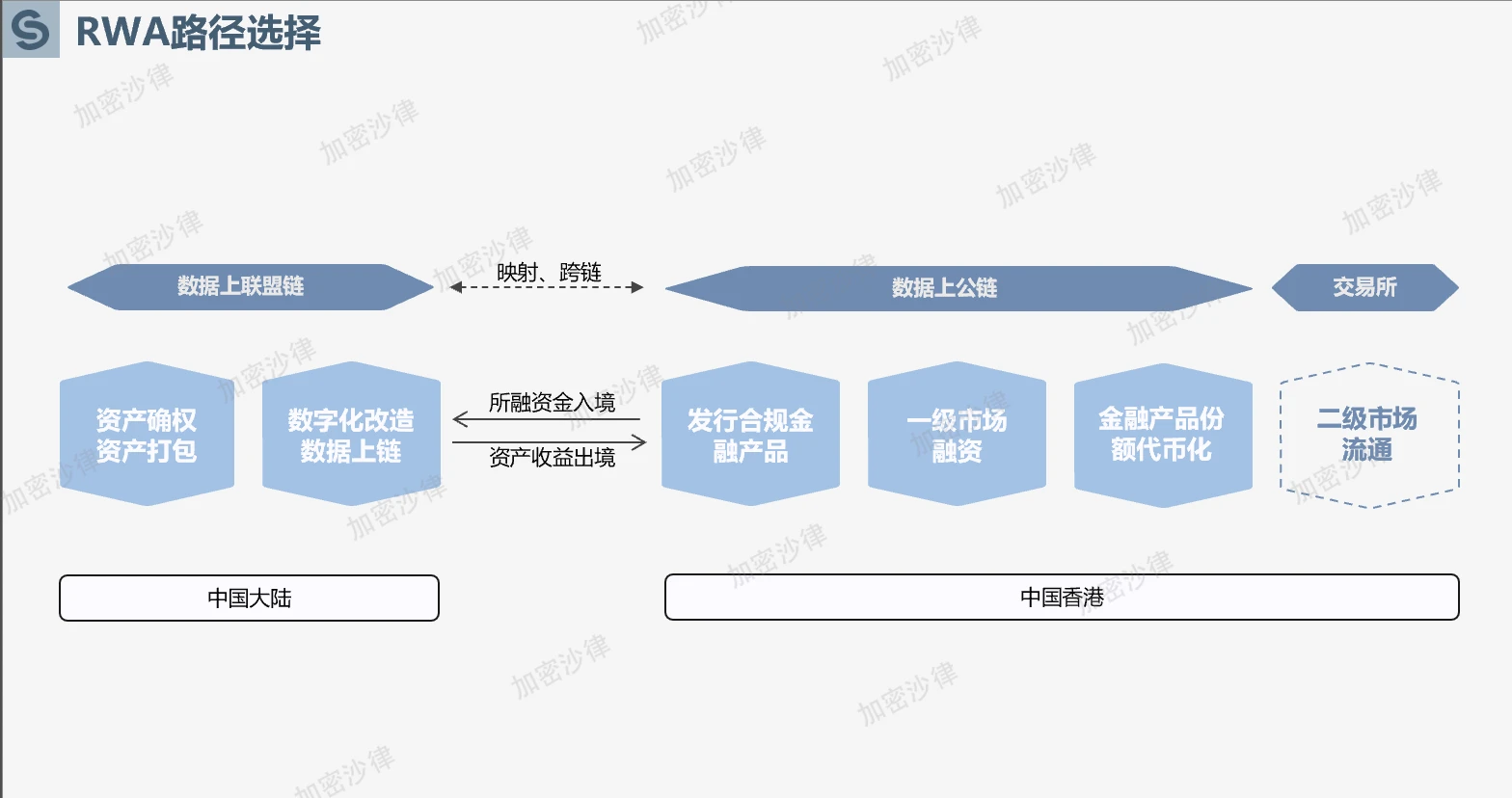

Therefore, the issuance of RWA projects in mainland China must take place overseas. Among them, Hong Kong has become one of the best choices for Chinese companies to implement RWA projects due to its perfect regulatory framework, friendly policy attitude and rich industry ecology. The following article will analyze the key compliance points and framework design ideas for carrying out RWA projects in Hong Kong from three aspects: underlying assets, data on-chain, and capital circulation.

(The above picture shows the overall framework for issuing RWA in Hong Kong)

1. Compliance of underlying assets

1. Asset confirmation

Since the essence of RWA is the tokenization of real-world assets, the holders of the tokens will directly or indirectly own the specific ownership of real-world assets. Therefore, in order to ensure that the subsequent RWA tokens can be legally issued, circulated and redeemed, the underlying asset owner, that is, the RWA project party, must ensure that they have legal and clear ownership of the assets.

The RWA project compliance team needs to conduct detailed due diligence on the underlying assets during the project to ensure the legitimacy of ownership. Specifically, the compliance team will investigate ownership disputes during the due diligence process, collect and verify relevant information such as ownership documents, public registration information, litigation status, pledge, mortgage or judicial freeze of the underlying assets.

2. Asset Audit

After completing the asset confirmation, the project party also needs to hire a professional auditing agency to audit the underlying assets.

The audit report will provide reference data for subsequent asset pricing and issuance, including but not limited to the following elements:

Asset Market Value - Fair market value assessment is conducted by professional appraisers or valuation experts, with reference to historical transaction data, market conditions and prices of similar assets.

Asset depreciation and impairment - For fixed assets, consider the depreciation method, asset useful life and possible impairment to ensure that the assessed value reasonably reflects the actual value.

Asset risk identification - Identify risks associated with assets, such as market risk, legal risk, liquidity risk, operational risk, etc.

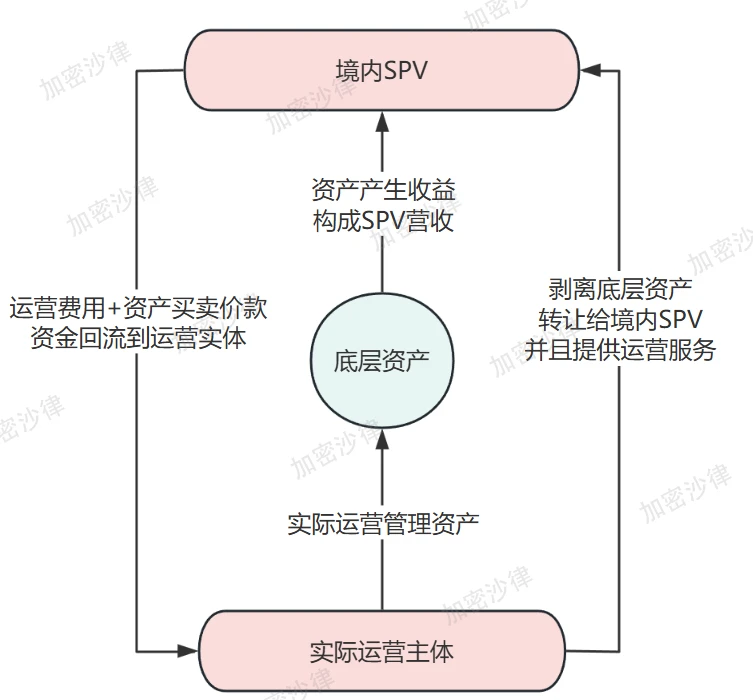

3. Asset divestiture

As mentioned above, the core value of RWA lies in directly financing based on the credit of high-quality assets, thus breaking away from the traditional financing model based on corporate credit. Therefore, when carrying out RWA projects, it is necessary to separate the underlying assets from the actual operating entity of the project party, so as to achieve risk isolation between the operating entity and the underlying assets.

The following will combine the actual cases that the Crypto Salad team is promoting to illustrate one of the asset divestiture architecture designs:

First, the project compliance team will assist the project party in setting up an SPV (special purpose entity) in the country.

Secondly, the actual operating entity transfers the underlying assets to the SPV through a buying and selling transaction.

Finally, the SPV will sign an operation service agreement with the project party, and the project party will be responsible for the operation and management of the underlying assets, and the SPV will pay the corresponding service fees to the project party on a regular basis.

(The above picture is a schematic diagram of the asset divestiture framework design, for reference only)

In summary, through this asset divestiture structure, the project party can transfer the ownership of the assets to the SPV company, achieving risk isolation while facilitating subsequent asset packaging and issuance. At the same time, although the actual operating entity no longer owns the ownership of the asset, it can continue to manage and operate the underlying assets through a service agreement.

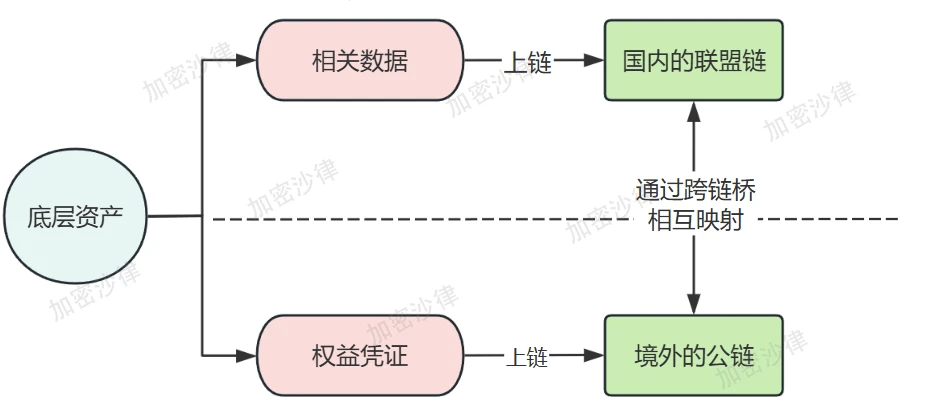

2. Compliance of data on-chain

Due to my countrys current strict supervision over cross-border data transmission and data exchange, most RWA projects will not choose to transfer relevant data overseas and circulate and disclose it on the public chain.

During the research process, the Crypto Salad team found that under the premise of meeting the compliance requirements of my countrys Data Security Law and Personal Information Protection Law, the project party is more inclined to choose the two chains and one bridge model to realize data on the chain.

Specifically, RWA asset data is uploaded to the domestic alliance chain and stored, while the corresponding RWA token is deployed on a high-performance public chain abroad. The RWA tokens circulating abroad and the data on the domestic chain are mapped and bound through a cross-chain bridge.

This kind of architectural design not only solves the problem of on-chain notarization of RWA underlying asset-related data, ensures the transparency and traceability of asset data, but also avoids the compliance red line of cross-border data transmission.

(The above picture is a schematic diagram of the two chains and one bridge model, for reference only)

In addition to the two chains and one bridge model, the RWA project can also rely on the Hainan Free Trade Port Cross-border Data Flow Pilot Zone (hereinafter referred to as the Hainan Free Trade Data Port) to complete cross-border data on-chain and circulation. Based on the relevant information that has been disclosed, the Crypto Salad team concluded that the core framework of the current Hainan Free Trade Port data outbound plan is as follows:

Active classification and grading of data by regulatory agencies;

Establish a data whitelist. If the data is included in the whitelist, it can be directly exported without approval;

If the data is not included in the whitelist, the regulatory authority will apply corresponding regulatory procedures based on different data types: personal information protection certification, data outbound security assessment, and filing of standard contracts for the outbound transfer of personal information.

In the actual process of promoting the project, the Crypto Salad team found that in addition to the compliance requirements in the data circulation link, there are also some key compliance points and administrative supervision requirements in the data collection, storage, desensitization, and packaging of RWA underlying assets. Due to the length of this article, we will not discuss them here.

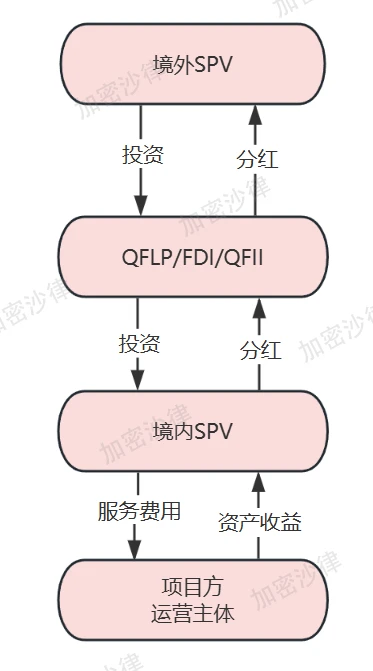

(III) Compliance of capital circulation

Since my country implements strict foreign exchange controls, the funds raised from issuing RWAs overseas cannot be directly transferred to the actual operating entities in China. The compliance team needs to specifically design a framework and path for the collection and circulation of overseas funds.

According to the project experience of the Crypto Salad team, after the RWA project completes financing by issuing tokens overseas, the funds of the overseas SPV will generally be collected through the funding channel and finally transferred to the actual operating entity. The funding channel in this architecture has the following three options:

QFLP (Qualified Foreign Limited Partner)

FDI (Foreign direct investment)

QFII (Qualified Foreign Institutional Investor)

When designing a capital flow structure, the compliance team generally needs to consider the following factors: tax burden, entry threshold, procedural requirements, compliance costs, etc. In the actual implementation of the project, the project team must also pay attention to compliance first. The preparation of application materials for different capital channel entities, window opinion responses, and the adjustment and improvement of the corresponding framework all require the full support of a professional legal team.

(The above picture is a schematic diagram of the RWA project funding channel, for reference only)

This article only represents the personal views of the author and does not constitute legal advice or legal opinion on specific matters.