Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

This column aims to cover the low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be ruled out) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

Previous records

I stopped updating last week due to team building, and will continue this week.

Follow up on old mines

Huma Finance

Huma may be the coolest financial project this year. In one sentence, it means “more money, less work, and shorter cycle”.

Although the first season airdrop has ended, Huma officials have announced that they will take a snapshot of the second season airdrop three months after TGE, distributing 2.1% of the total supply (5% in the first season), so there is still some value in participating.

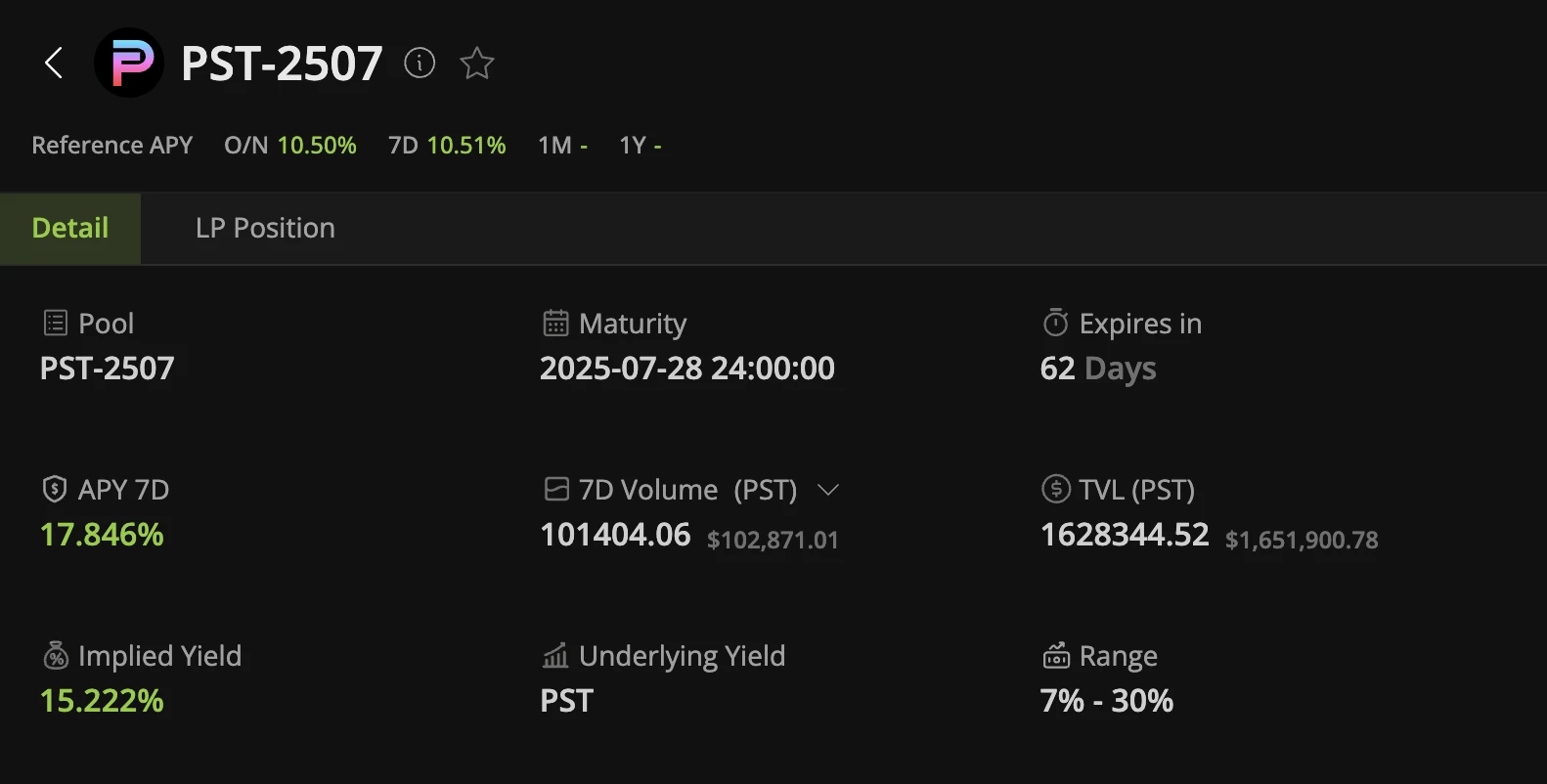

Compared to depositing directly in the Huma protocol, I would currently recommend participating in PST (interest-bearing deposit certificates obtained after depositing stablecoins in Huma) LPs on RateX (Solana’s version of Pendle, portal: https://app.rate-x.io ) . In addition to receiving higher APY returns (temporarily reported at 17.846%: divided into 13.913% basic return + 3.932% estimated points return), you can also receive 2x Huma points bonus and 3x RateX points bonus.

It is worth mentioning that RateX is expected to usher in TGE soon. In addition, its products have recently expanded to the BSC network, and it is not ruled out that it will choose to land on Binance alpha in the future.

Resolv: Airdrop registration ends, starts today

Resolv (portal: https://app.resolv.xyz ) registration for the first season of the airdrop ended last night. Users who missed the registration stage still have the opportunity to contact the team on Discord to complete the registration. The deadline is 23:59 UTC on June 9th.

In addition, Resolv announced this morning that it will open airdrop applications today (May 27th) local time, but the RESOLV tokens after application will be in a pledged state (stRESOLV). stRESOLV cannot be traded or transferred, and can only be exchanged for RESOLV by unstaking. Unstaking requires a 14-day cooling-off period , which means that it will take 14 days (June 10th) at the earliest to unlock the liquidity of the airdrop tokens.

This operation is a bit of a sham. I still have some personal savings left to withdraw. I plan to wait for the airdrop results to come out (I can’t check it now) before deciding whether to continue to participate in the next season.

New opportunities

Recently, due to the thefts of Loopscale and Cetus (Loopscale has recovered the dirty funds, and Cetus has partially frozen the dirty funds), and the redemption FUD of HONEY on Berachain, the operating style has been relatively conservative.

However, there are still some relatively good mines in the past two weeks, and you can choose to participate as appropriate.

SOL-based PT revolving loan

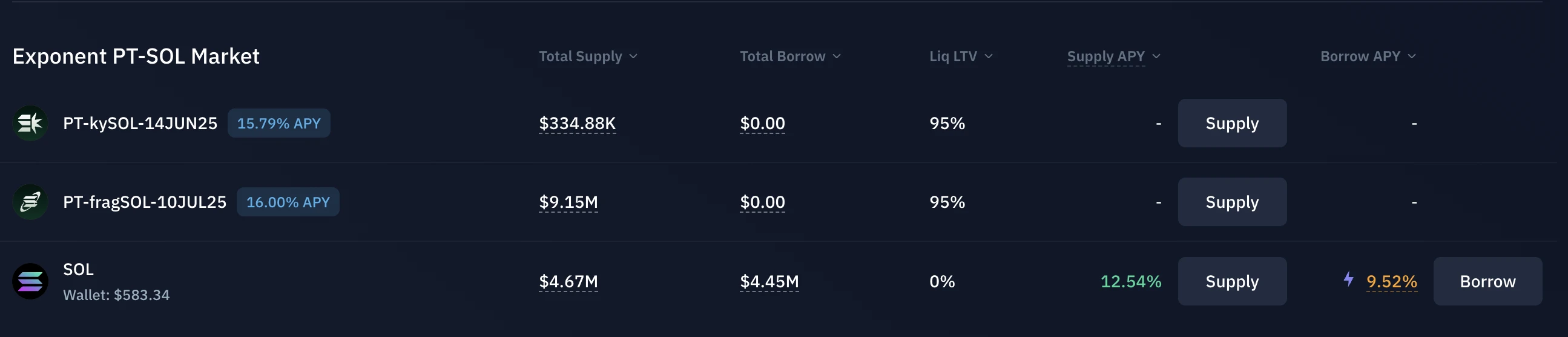

Exponent, another Pendle-like project in the Solana ecosystem, announced yesterday that it has reached a partnership with Kamino to introduce its PT assets into Kaminos lending market. Currently, the assets that have been launched include PT-fragSOL and PT-kySOL.

Currently, the APY returns of PT-fragSOL and PT-kySOL are 15.79% and 16% respectively. At the same time, under the JTO incentive subsidy, the SOL borrowing cost is only 9.52%, leaving a lot of room for revolving loan operations.

Spark efficient scoring

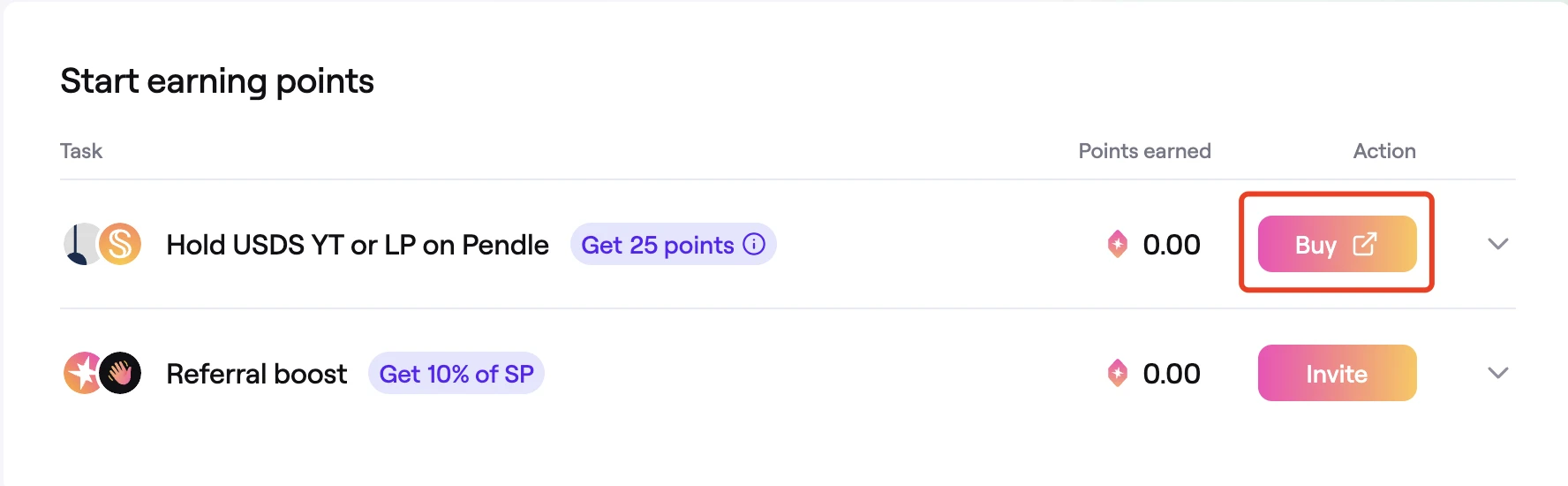

Spark, a sub-project of Sky (formerly Maker), recently announced a partnership with Cookie Snaps and launched a points program. It seems that they are finally going to issue coins. We also released a tutorial yesterday. For details, please refer to The Latest Big Hair: Cookies First Cooperation Project Spark Points Guide 》.

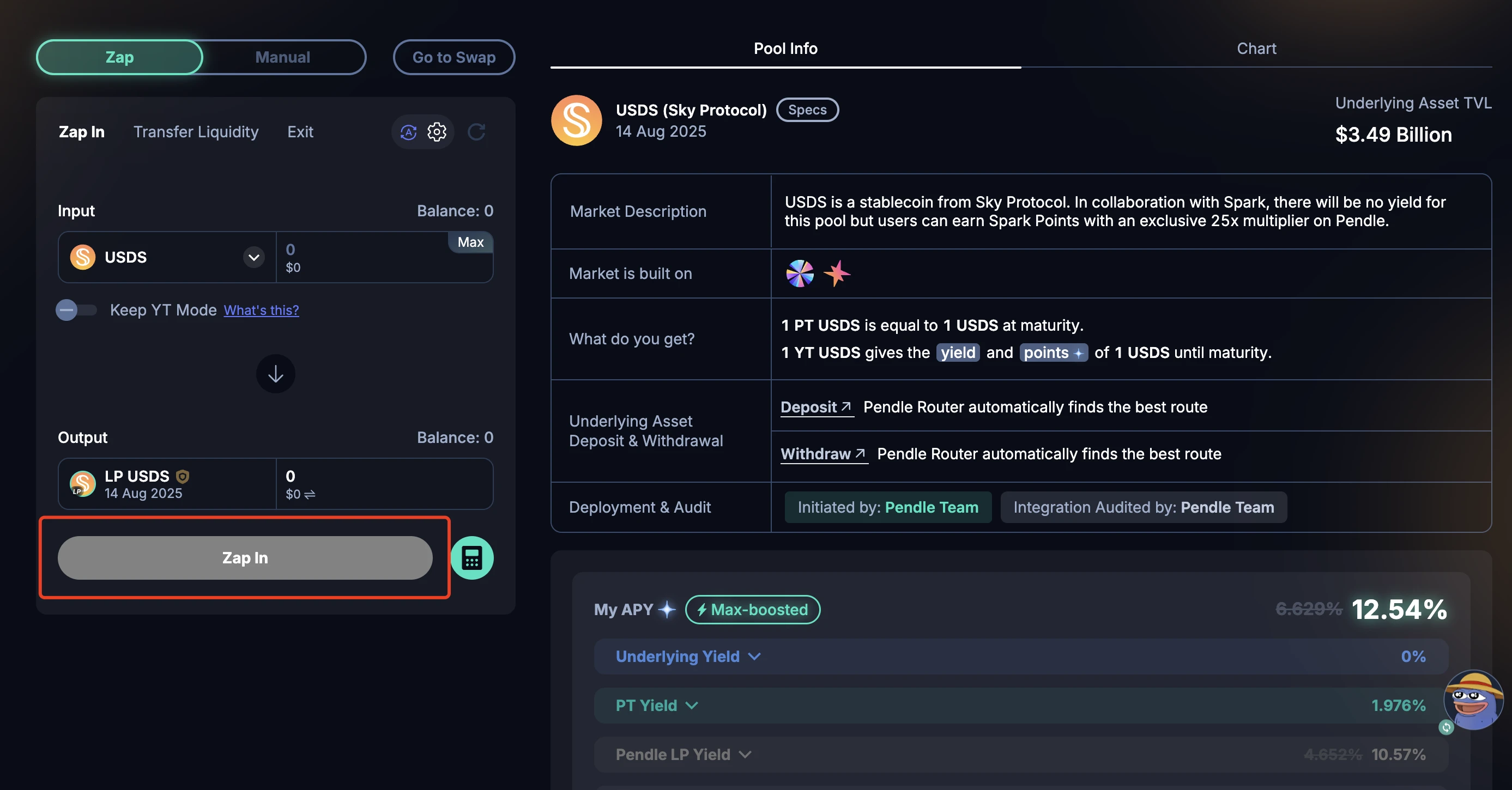

Simply put, in addition to talking to get Cookie Snaps, the most efficient strategy for brushing points is to directly participate in the USDS LP on Pendle. You can directly enter the interface through the Spark front-end (portal: https://app.spark.fi ), and then directly deposit (Zap In) the expected amount (it is not necessary to deposit USDS, Pendle will handle the exchange), and the points will be automatically accumulated.

Although Spark’s overall participation is very high, Pendle’s USDS LP already has a basic yield of 6.63% (12.54% if sufficient PENDLE is pledged), which is quite impressive at a time when basic yields are generally not high.

HyperEVM Gold Rush

The popularity of the HyperEVM ecosystem has been gradually increasing recently. A quick look at protocols such as Felix and HypurrFi shows that they all have good returns. At the same time, a points plan has also been launched, and there is a certain expectation of airdrops.

However, I don’t know much about the background and characteristics of various projects in the HyperEVM ecosystem. I plan to sort them out in detail and then come up with an overall strategy later.