In May, the crypto market was in full swing, continuing the long-standing ups and downs of volatility and opportunity coexisting, becoming a stage where investors hearts beat faster. Bitcoin enjoyed the TACO (TRUMP ALWAYS CHIECKENS OUT) trading dividend and achieved a super rebound. At the same time, Binance Alpha became the focus of the market, and its platform competition entered a white-hot stage.

The Meme coin market has entered the 2.0 stage, saying goodbye to the simple animal meme narrative and gradually integrating more complex ecological themes such as believe and Virtuals. In a short period of time, the market sentiment is extremely excited, and retail investors are swept up by the story of getting rich overnight. Some people bet on small coins with hundreds of dollars and make hundreds of thousands of profits in just a few days. For newcomers who have just entered the market, this dream-chasing journey intertwined with greed and fear is both an opportunity and a test.

The test of human nature under FOMO

“The first coin of the launch platform, Believe series LAUNCHCOIN unlimited purchase!”

According to the news, a smart money address achieved a profit of $190,000 with only $332

As a new investor who has just entered the market, I was gradually swept up in the myth of the Hundred-fold Meme - fearing that I would miss any possible next PEPE, I began my own speculative journey in the highly volatile market where greed and fear were intertwined.

When the Trump family bought $B, the price of the currency soared, and I couldnt resist the impulse and bought in at a high position. As a result, after buying, $B quickly fell back, the increase was halved, and the account turned red in an instant. I realized that I had become a victim of excessive emotions and stood on the top of the mountain to take the last baton. After thinking about it, I wanted to be cautious, but I was attracted by the Internet celebrity currency $LABUBU. Labubus trendy IP swept overseas, and European and American celebrities rushed to promote the product. I bought it with great expectations. The price of the currency once soared, and my position had considerable floating profits, but greed made me reluctant to stop profit. As a result, the heat subsided, the price of the currency rose and fell, and the profit turned into a loss. The hesitant mentality of stopping profit made me pay the price again.

After a series of failures, I was in a state of confusion. I regretted missing the opportunity, but I was unwilling to chase the high and lose. At this time, the contract V James Wynn made a high-profile platform for $MOONPIG, claiming to be the next PEPE. I was very excited and decided to invest heavily in LBank. I was impressed by the speed of LBanks listing. On the first day of $MOONPIGs launch, USDT-based perpetual contracts were opened simultaneously, supporting up to 50 times leverage and two-way trading. The price of the coin soared from $0.003 to $0.135, and the market value exceeded $100 million, a 15-fold increase in just a few days. My book profit continued to rise, as if I saw hope of making a comeback.

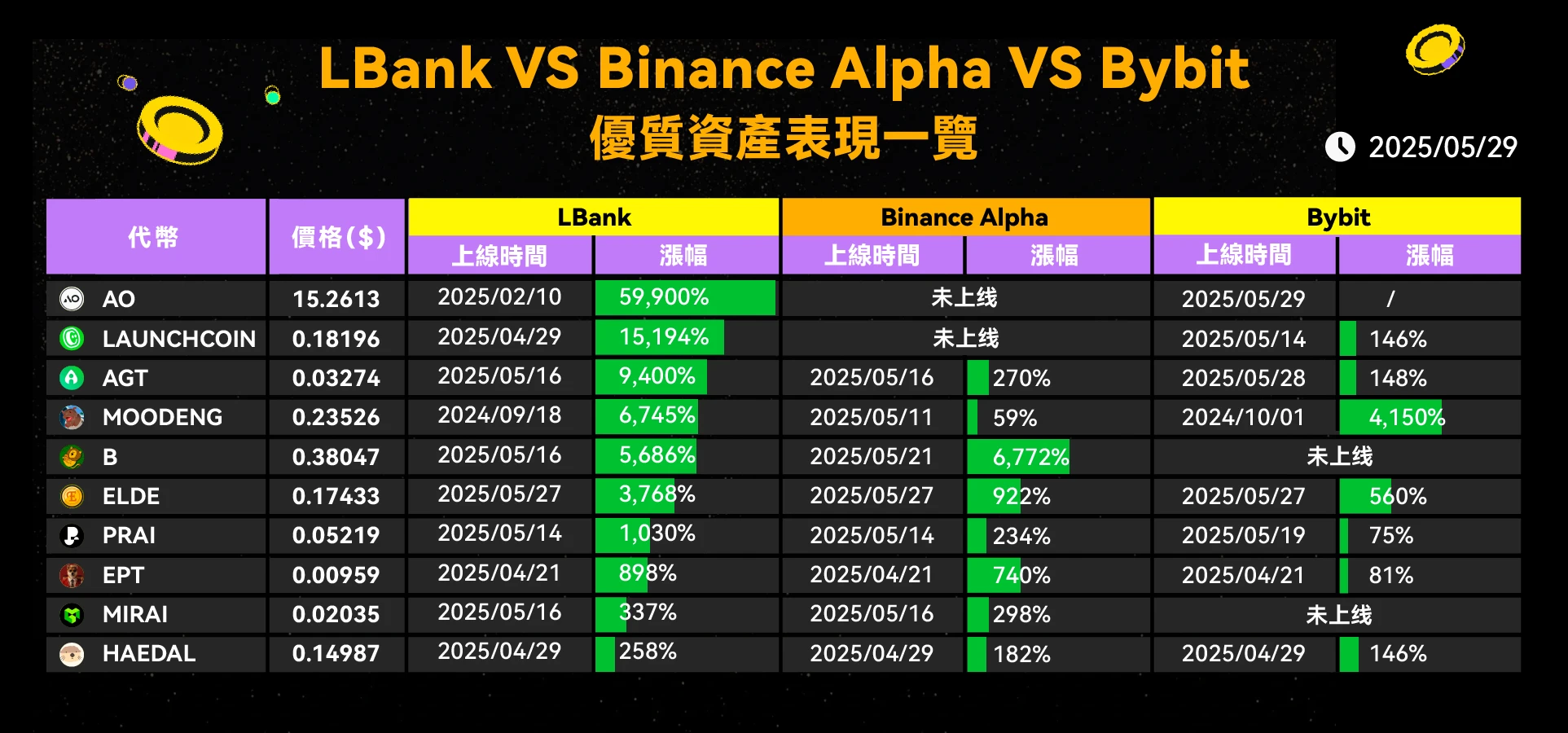

Previously, I tried to trade new coins on other trading platforms, but found that many platforms had slow listing speed, few popular Meme coins, and often insufficient liquidity. After chasing highs, I wanted to run away, but because no one took over, the price plummeted by 40%, which was extremely passive. In contrast, LBank Meme coins have many initial launches, and the Coingecko report also shows the market depth and liquidity of its Meme coins, small slippage for large transactions, and more relaxed operations for retail investors. Moreover, many of the coins currently launched on Binance Alpha have basically been launched on LBank.

Meme Arbitrage Space

Not limited to conventional copycat spot goods, Meme arbitrage is also an art.

After many roller coaster experiences, I started to study the various trading tools provided by LBank, wondering if I could add some insurance to my spot positions. At this time, I found that LBank had already equipped popular Meme coins with contract trading support. For example, on the day when MOONPIG was launched, the platform simultaneously opened its USDT-based perpetual contract, providing a maximum leverage of 50 times, which can be long or short in both directions. I rarely touched contracts before, but seeing that my spot profits had retreated significantly, I decided to try to hedge the risk with a short contract.

I recalled my operation at that time: during the process of MOONPIG rising and falling, I judged that the decline might continue, so I gritted my teeth and opened a short order of MOONPIG at a high level.

Because I was not familiar with high leverage, I only opened a small position with a low multiple, mainly to lock in some floating profits. When the price of MOONPIG continued to decline, although my spot position was shrinking, the short contract began to make a profit, which offset the spot loss to a certain extent. After the decline slowed down, I closed the short position and made a profit. This money just filled the short position deficit, which was equivalent to making the asset curve much more stable.

This attempt at spot + contract hedging made me feel relieved, and also taught me an important lesson for my risk control strategy: in the face of the highly volatile Meme coin market, learning to use contract tools for short hedging is indeed one of the effective ways to control drawdowns.

After that incident, I started to think about exit and hedging strategies in advance every time I traded a new Meme coin. For example, when I later encountered a coin like MOONPIG that had a huge short-term increase, I would consider taking profits on a portion of the spot in batches at highs, and at the same time opening some short orders near key resistance levels to hedge, so that even if the coin price turns downward, it will not be a roller coaster ride to spit back profits. It can be said that the flexible combination of spot and contracts has given me more initiative in LBank transactions. I no longer rely on luck to bet on the rise and fall, but can actively manage position risks.

After the frenzy, move forward rationally

Looking back on the whole month of May, I felt like I was on a high-speed emotional roller coaster: I was excited, but also regretful; I tasted sweetness, but also suffered bitterness. This trading adventure as a new retail investor has given me a lot of valuable experience and lessons, and I hope to take this opportunity to share them with ordinary investors like me:

Dont be swayed by emotions, beware of the FOMO trap: When your friends circle is full of news about a certain coins explosive profits, be sure to stay calm. The fanatical atmosphere often amplifies human greed and fear, making people chase high and sell low and make irrational decisions. I learned to take three deep breaths before each transaction, reminding myself to think rationally: Is entering the market at this time because of objective judgment, or just because of fear of missing out? Only by overcoming FOMO can you avoid being the last one to take over.

Formulate clear stop-profit, stop-loss and hedging strategies: Short-term gambling on Meme coins is like dancing on the edge of a knife, and risk control must not be sloppy. Now, before I open a position, I will first think of an exit strategy: how much is the target profit and what is the maximum loss I can bear. Once the preset point is reached, strictly enforce discipline and never change your mind temporarily because of greed or unwillingness. In addition, for highly volatile currencies, it is very important to learn how to use hedging methods. If there is a contract tool, you can lock in part of the profit by shorting a small amount when the spot position is profitable; even if there is no contract, you can consider selling high and buying low in batches to reduce the cost of holding positions. In short, always be prepared for the worst case scenario so that you can calmly deal with sudden changes in the market.

If you are not a professional P player, then choosing a suitable trading platform will get you twice the result with half the effort. Among them, LBank is a good example.

First of all, LBank is very fast in listing coins. It has been one of the first platforms in the world to list popular Meme coins. Imagine if the platform is slow to act, retail investors will often miss the best price when they can buy.

Secondly, the platform’s liquidity and trading tools directly affect the trading experience and results. High liquidity means that large transactions are less likely to cause severe slippage, and timely stop-profit and stop-loss are more secure. LABUBU’s market share is even higher than DEX.

Perfect tools give retail investors more strategic options. For example, leverage and contracts can be used to amplify returns or avoid risks, and real-time information push helps us quickly understand market trends.

Although it is not convenient for me to directly recommend a certain platform here, I would advise every retail investor in the same field to research the reputation, functions and fees of the exchange before trading, and choose a reliable platform that suits your needs. This will give you an advantage in the fierce market competition.

Finally, face up to the speculative nature and short-term characteristics of Meme coins. After this experience, I have a more rational understanding of Meme coin investment. Meme coins are essentially a speculative game about emotions and popular culture. It may achieve astronomical gains in a very short period of time, but it usually lacks long-term support value, and the surge is often accompanied by the risk of a sharp correction or even zero. For such short-term varieties, we should adopt the attitude of small gambling for pleasure, big gambling for harm - use spare money to participate, and have a normal mentality of profit and loss. Dont expect to get rich overnight, nor blindly and firmly hold a certain Meme coin for a long time. When the wind direction changes and the heat subsides, it is more important than anything else to know when to stop.

Looking back after the frenzy, the Meme coin feast in May is more like a magnifying glass, which reveals the irrationality of the market and the weaknesses of investors themselves. But I am glad that I am still here after the storm and have learned from it. As a new retail investor, my investment journey has just begun. Looking forward to the future, I will continue to move forward in the ever-changing crypto world with this hard-won sobriety and restraint. After all, there are always opportunities, but the next opportunity that belongs to me can only be truly seized when rationality is at the helm.