Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

The latest news is that after 68 votes in favor and 30 votes against, the US Senate has voted to pass the GENIUS Act. The golden age of stablecoins is about to begin. (Recommended reading: Dollar Hegemony 2.0: How does the GENIUS Act reshape the global landscape of stablecoins? )

Previously, we briefly reviewed the past development of the stablecoin industry in the article Stablecoins have gone through 10 years of ups and downs and finally became the peer-to-peer electronic cash officially selected by the United States ; and now, with Circles momentum of becoming the first stablecoin stock and a strong landing on the U.S. stock market with a market value of over US$20 billion, the second dragon USDC in the stablecoin market and the dominant USDT in the stablecoin market are gradually differentiating. The former focuses on compliance, subsidies, and interest-bearing, and is especially active in the Solana ecosystem; the latter focuses on decentralization, diversified layout, and real-world payment applications, and plays an important role in cross-border trade and global currency.

Odaily Planet Daily will systematically sort out the past development history and current status of USDT and USDC in this article. We try to learn from history and trace the future development direction of the two major stablecoin projects.

The stablecoin pattern is initially determined: the growth history of Dragon One and Dragon Two

Looking back, it is no coincidence that the two major stablecoins, USDT and USDC, have reached the status of Dragon One and Dragon Two today. The competitive landscape and market performance between the two have, to some extent, become industry indicators like a crypto barometer.

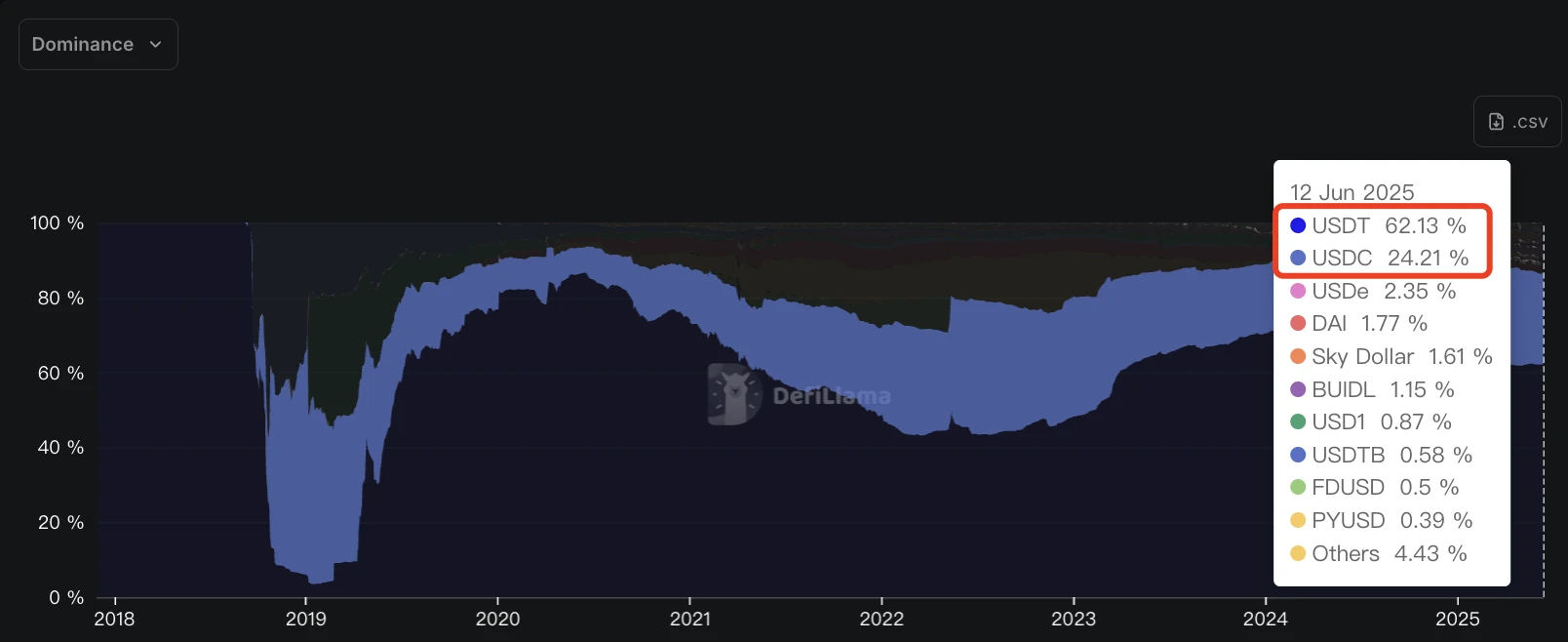

According to DefiLlama data , as of June 12, USDT, issued by Tether in 2014 as the pioneer of the stablecoin track, has long been in the leading position, with a current market value of about US$156 billion and a market share of 62.1%; USDC issued by Circle has been active in the cryptocurrency market as the second leader in the stablecoin track, with a current market value of about US$60.8 billion and a market share of about 24.2%. Other stablecoin projects including USDe, DAI, Sky Dollar, BUIDL, and USD 1 account for less than 15% in total.

If we trace back to the key nodes of the “leading competition” between USDT and USDC, 2019 is undoubtedly the first year to be affected.

USDT/USDC Market Share Status

USDT’s dominance: Joining hands with TRON to seize DeFi Summer and global application scenarios

In 2019, after its sister company BitFinex experienced a theft of 120,000 BTC, Tether’s reserve bank terminated cooperation, and the New York Attorney General’s Office (NYAG) launched an investigation into Tether’s reserves, Tether reached an official cooperation with the TRON ecosystem.

Since then, after the Bitcoin network and Ethereum ecosystem, TRON has become the third ecological network that has boosted the rapid development of USDT, and has gradually become the largest network for USDT issuance through the initial official subsidies and the subsequent energy leasing model. Currently, according to Tethers official website , the issuance of USDT in the TRON ecosystem is as high as 78.2 billion US dollars, accounting for about 50% of the total issuance of USDT, which can be called half of USDT.

In addition, the liquidity mining boom spawned by the DeFi Summer in 2020 has also injected new power into the rapid development of USDT. As a general equivalent, USDT has become the most intuitive price quantification machine in the crypto market. USDT has become the stepping stone or entry ticket for many popular DeFi protocols. The prices of BTC and ETH have also ushered in waves of sharp rises and falls in the increasingly crazy market environment. In order to cope with the volatile market, in addition to BTC, hoarding USD has become the choice of many people to spend the winter in the bear market.

In the real world, USDT has gradually become a common intermediary for illegal activities such as money laundering, fraud, drug trafficking and even human trafficking in Southeast Asia; regions with severe currency inflation such as South America and the Middle East also use USDT, which is pegged 1:1 to the US dollar, as a common tool for daily payments and cross-border transactions.

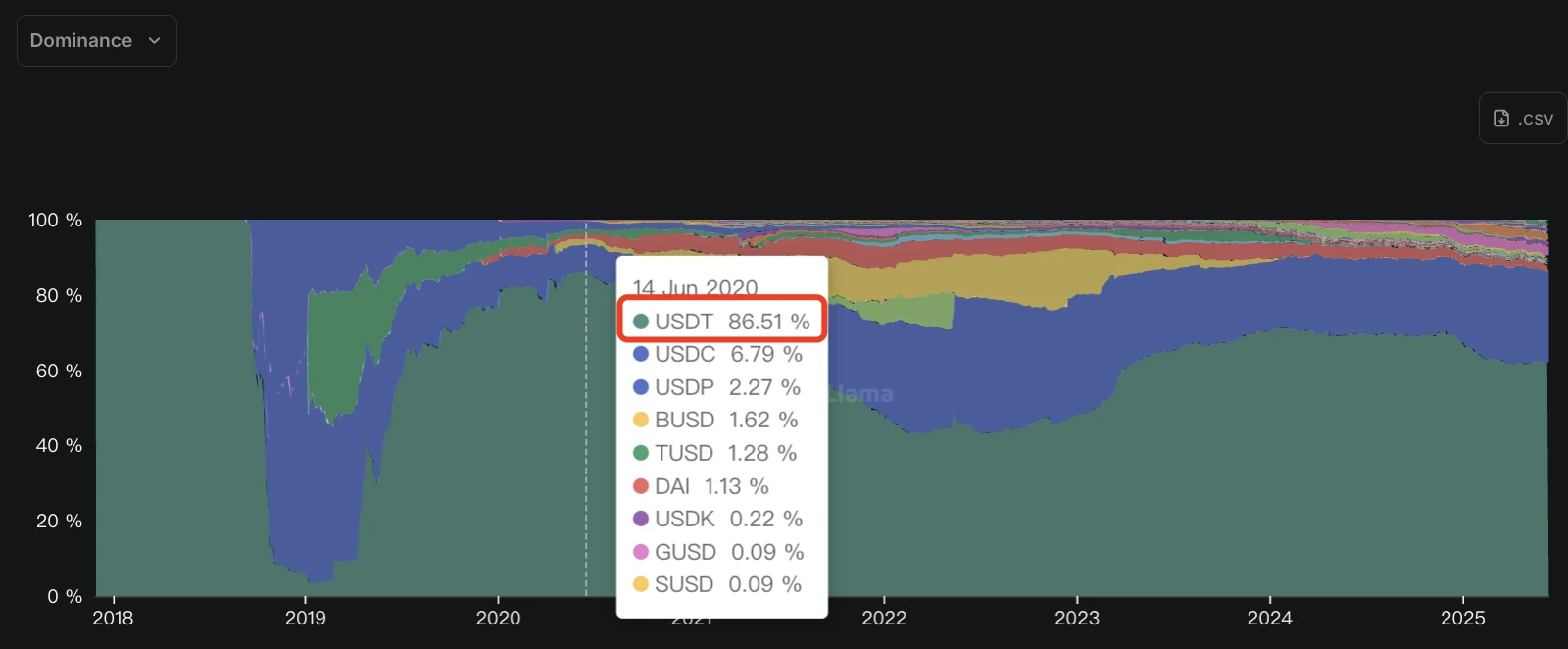

Against this backdrop, USDT issuance and market value have experienced exponential growth: In June 2020, USDTs market value soared to around $9.5 billion, and its market share soared to 86.5%; USDCs market value was around $1.1 billion, and its market share ranked second, but only 6.79%. As for the market value of other stablecoins, including USDP, BUSD, and TUSD, they are already lagging behind USDT by more than one order of magnitude.

In July 2020, USDT became the first stablecoin project with a market value of over US$10 billion, thus establishing its dominant position in the stablecoin track.

Stablecoin Market Share in 2020

“The episode when USDC is closest to USDT”: The crash of ust and luna in 2022

Turning the clock back to 2019, it was a painful year for Circle, the issuer behind USDC.

After the massive market correction in 2018 and the dawn of DeFi Summer, Circles operating costs were out of control and its cash flow was on the verge of collapse. For the sake of the companys development, it had no choice but to quickly clear the burden in a short period of time - selling the Poloniex exchange, Circle Trade over-the-counter trading business, and Circle Invest products for retail investors, while also shutting down and liquidating the payment applications it had launched.

Despite the drastic overhaul, Circle was on the verge of bankruptcy again in the fall of 2019. It was then that Circle had to face its own last stand: ALL IN USDC.

According to Circle founder and CEO Jeremy Allarie, “At the time, USDC had already had early growth momentum, but it was not enough to support a scalable company. But we still chose to shift all the company’s resources to USDC and bet all our funds on it. I remember very clearly that we officially announced this strategy in January 2020. At that time, the homepage of Circle’s official website was completely revamped and turned into a huge billboard, promoting ‘Stablecoins are the future of the international financial system’. The only action button on the page was: ‘Get USDC’, and all other functions were removed.”

Focusing on core business is often the beginning of a companys rebirth.

In March 2020, the Circle platform was upgraded, and the USDC account system and a corresponding set of new APIs came into being. This greatly facilitated developers to seamlessly integrate banks, bank cards and other payment systems into their own application systems. USDC deposit and withdrawal operations became smoother, and Circle was finally back on track.

By the end of 2020, the circulation of USDC had soared from $400 million at the beginning of the year to nearly $4 billion, an increase of nearly 10 times. Of course, the increase in USDT was equally astonishing. At that time, its market value had soared to about $20 billion, making it the absolute leader in stablecoins.

It is worth mentioning that the global COVID-19 pandemic has provided some impetus for the development of on-chain stablecoins such as USDT and USDC. After all, compared with the real-world banking system with cumbersome procedures and complicated formalities, stablecoin payments in the cryptocurrency industry are more flexible, convenient and less costly.

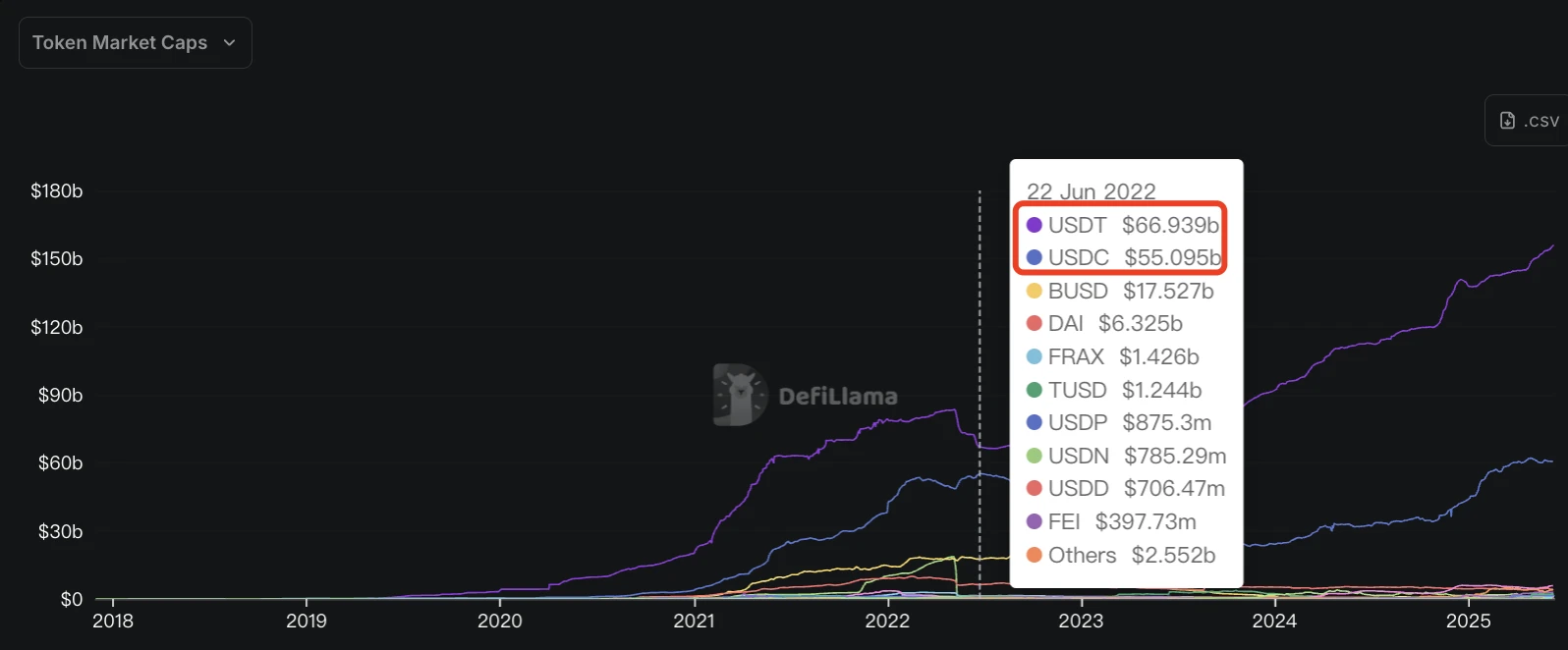

As for USDC, the moment when it was closest to the market value of USDT in its subsequent development process was June 2022.

At that time, due to the collateral effects of the collapse of Terra Labs algorithmic stablecoins UST and LUNA, the market once again emerged with panic and FUD about USDTs impending decoupling. In extreme cases, Tether, the issuer behind USDT, once quickly processed about $7 billion in redemptions within 48 hours , which was almost 10% of its capital reserves at the time, which was the most extreme stress test.

At that time, the market value of USDT fell to around US$66.9 billion; USDC, which was backed by Coinbase and insisted on compliance and sufficient reserves, experienced a wave of peak growth, and its market value once increased to around US$55 billion. The market value gap between the two was less than US$12 billion.

Comparison of USDT VS USDC market capitalization gap in June 2022

But then, USDT, which does not need to pay tribute and has more diversified business and broader application scenarios, gradually took the lead, while USDC was restricted by conditions such as profit sharing with partners such as Coinbase and Binance. Although its market value is also in a rapid growth stage, its net profit from business is inferior to that of Tether, a money-making machine with an annual net profit of over 10 billion US dollars.

Judging from the initial team composition and subsequent development direction, the development path of USDT and USDC may be predetermined.

USDT’s choice: Going left and moving towards decentralized intermediaries

For USDT and Tether behind it, they chose a left route - decentralized intermediary service provider.

Speaking of this, apart from Paolo Ardoino, the founder and CEO of Tether , Giancarlo Devasini, a core figure of Tether who has not attracted much attention from the outside world but owns 40% of the shares, is more critical. He worked in plastic surgery in his early years, and later switched to the field of electronic product import and software resale, and even involved in pirated software transactions. It is precisely with his extraordinary adventurous spirit and unconventional business practices that Devasinis personal net worth has grown to about US$9.2 billion, and his wealth once surpassed Piero Ferrari, an executive of the famous luxury car company Ferrari and the son of Enzo Ferrari.

“The giant behind Tether”

Its aggressive business philosophy and bold operation methods later led to Tether misappropriating user funds for interest-bearing investments, and the market has been questioning whether Tether has sufficient reserves. When cooperating with Puerto Rico’s Noble Bank to deposit funds, Devasini insisted on putting the money in yielding bonds but was rejected by the bank’s founder John Betts. Devasini bluntly stated: “We need to invest customer funds in bonds. We need more income, and we don’t need to respond to critics and do so many things.”

As for the wildly growing cryptocurrency industry, perhaps wild street smarts can make a crypto project more anti-fragile.

Despite a series of turmoil and even excessive issuance of additional coins, Tether has been able to maneuver on the edge of regulation and compliance, becoming what CEO Paolo Ardoino said in his recent speech at the Bitcoin Conference - a disintermediate infrastructure provider.

As Paolo describes it -

“ Financial and big tech companies often rely on layers of intermediaries: financial intermediaries charge fees from every transaction we make, and tech giants control our data. This is essentially the same thing: we have lost sovereignty over both money and data. Tether’s goal is to use technology to provide tools to help people get rid of these intermediaries and achieve true individual sovereignty. ”

Yes, this is the story told by Tether, a sovereign individual support service provider that fights against traditional big tech companies and big financial companies, a decentralized stablecoin project that does not care about the users identity, nationality, age, gender or even purpose of use.

Specifically, the advantages of USDT issued by Tether are mainly reflected in:

The audit of reserve funds is conducted by BDO, Tethers partner accounting firm, and is essentially a black box. This situation is expected to change after the introduction of the US stablecoin regulatory bill Genius Act, when Tether may publish annual, quarterly or even monthly transparency reports;

USDT exists based on the blockchain network, and its transaction records are stored on the decentralized blockchain, which is transparent and cannot be tampered with. Users have direct control over USDT assets in non-custodial wallets; and they can circulate freely in DeFi protocols, DEX, CEX and other scenarios.

As a centralized issuer, Tether has full control over the issuance, destruction and reserve management of USDT, and can freeze USDT assets at specific addresses through blacklist authority (if involved in illegal activities). In the previous Bybit $1.5 billion asset theft case, Tether was also one of the parties assisting in the handling.

Yes, you read that right. The value stability and convertibility of USDT are highly dependent on the reputation of Tether. As crypto people who frequently use USDT, we can only hope that Tether will not suddenly destroy this business with an annual net profit of over $10 billion.

In addition, according to Tethers subsequent development map, its plans cover mining, AI, digital agriculture, education, mobile communications and many other sectors, which undoubtedly reveals the ambition and adventurous enterprising attitude of this stablecoin overlord.

The latest news is that Tether CEO Paolo Ardoino also forwarded the news that Bank of America is about to issue a stablecoin on the social media platform, and wrote Select your player, which seems to imply that the two parties will cooperate in the future.

USDC’s decision: Go right and embrace a centralized compliance system

Unlike Tether, Circle takes a more cautious and difficult, but more down-to-earth centralized compliance route.

Specifically, as Circle CEO Jeremy Allaire previously mentioned in the article “How I went all in on stablecoins 7 years ago” :

Circle was the first company to go from startup to full compliance license in the crypto industry, the first crypto company to get an Electronic Money Institution (EMI) license in Europe, and the first company to get the so-called BitLicense in New York - the first regulatory license specifically for the crypto industry. For nearly a year after that, we were the only one holding this license.

We always adhere to the concept of regulatory priority and always choose to go the front door route to ensure that we have a good and robust compliance system. By the way, it is precisely because of this compliance foundation that we can achieve another key goal: liquidity. What is liquidity? It means that you can actually create and redeem stablecoins, you can connect to a real bank account, and buy and redeem stablecoins with fiat currency. If you are a shady offshore company and no one is willing to open a bank account for you, then you cant do this at all. You dont even know where your bank is.

Circle was the first company to establish high-quality banking partnerships and bring in strategic partners like Coinbase to distribute USDC on a large scale on the retail side, allowing any ordinary user with a bank account to easily buy and redeem USDC. We also provide institutional-grade services. In other words, from transparency, compliance, regulatory framework, to actual liquidity, we have done it all.

As for Circles business composition and profit sources, please refer to our previous article Circle IPO may be delayed, what is the valuation of the first stablecoin stock? . At present, Circle still mainly relies on reserve interest to generate income, and this situation may change after the IPO.

It is worth mentioning that Circle’s compliance banner is indeed solid: it is registered as a money services business (MSB) in the United States and complies with relevant regulations such as the Bank Secrecy Act (BSA); it has money transmission licenses in 49 states, Puerto Rico and the District of Columbia; in 2023, Circle obtained a major payment institution license issued by the Monetary Authority of Singapore (MAS), allowing it to operate in Singapore; in 2024, Circle obtained an electronic money institution (EMI) license issued by the French Prudential Supervision and Resolution Authority (ACPR), enabling it to issue USDC and EURC in Europe in accordance with the EU’s Markets in Crypto-Assets (MiCA) regulations.

In the future, USDCs rightward trajectory may hold high the banner of American localism, further expand its global footprint with the help of favorable regulatory policies, and shine in sectors such as institutional payments, PayFi and TradFi. At the same time, it will also provide certain assistance or monetary support for the Trump administrations plans to digest U.S. debt and Bitcoin strategic reserves.

Thanks to the rapid development of the Solana ecosystem and the PayFi track, as the main circulating stablecoin in this ecosystem, the future of USDC is also worth looking forward to.

Conclusion: You reap what you sow.

Looking at the development history of USDT and USDC, as well as the rise of stablecoin issuers such as Tether and Circle, after more than a decade, the persistence and perseverance have finally led to the day when stablecoins take root and blossom as a peer-to-peer electronic payment system.

The differentiated development ideas of one adhering to the mass line and the other focusing on compliant operations have also opened up new ideas for the subsequent development ceilings of USDT and USDC respectively: the formers market is tens of trillions or even hundreds of trillions of dollars in cross-border foreign trade and life payments; the latters market is the global legal electronic currency with a total scale of over 100 trillion US dollars.

The last round of competition in the cryptocurrency industry has come to an end, and a new round of competition has quietly begun after the official implementation of the GENIUS Act.

Recommended reading:

Bloomberg investigative reporter Zeke Faux reveals the giant behind Tether: Giancarlo Devasini