Original source: Binance Research (Shivam Sharma)

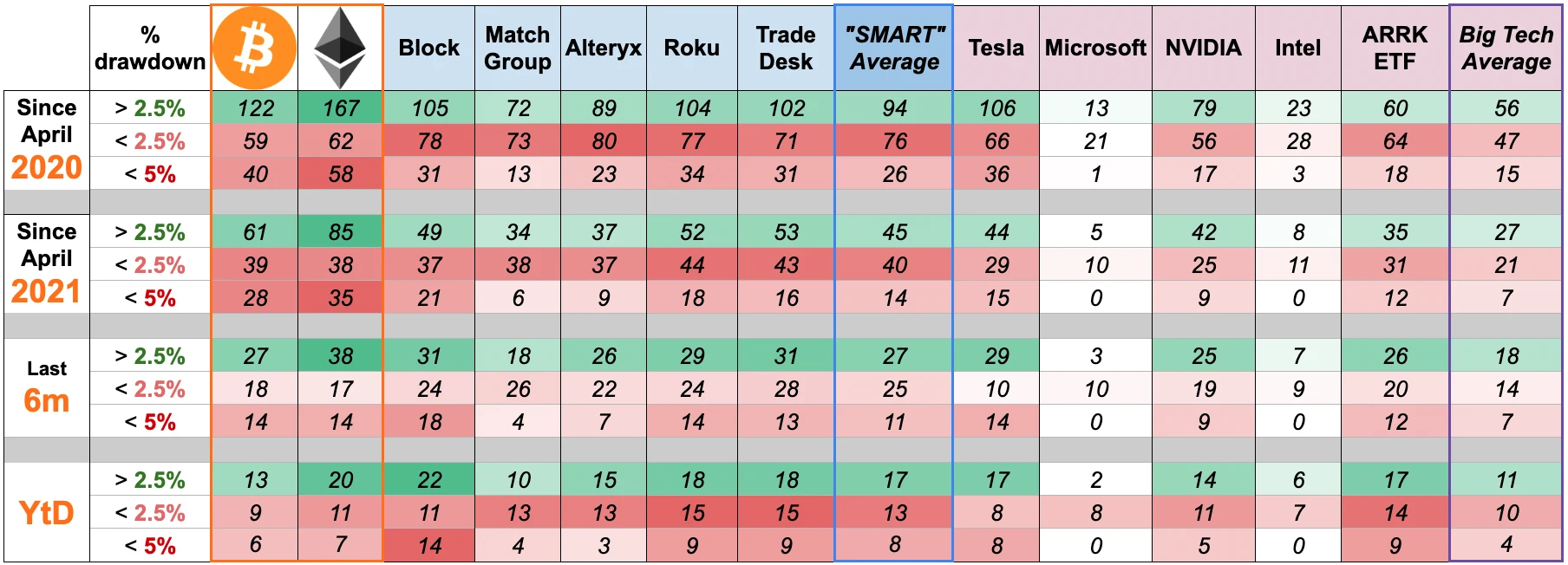

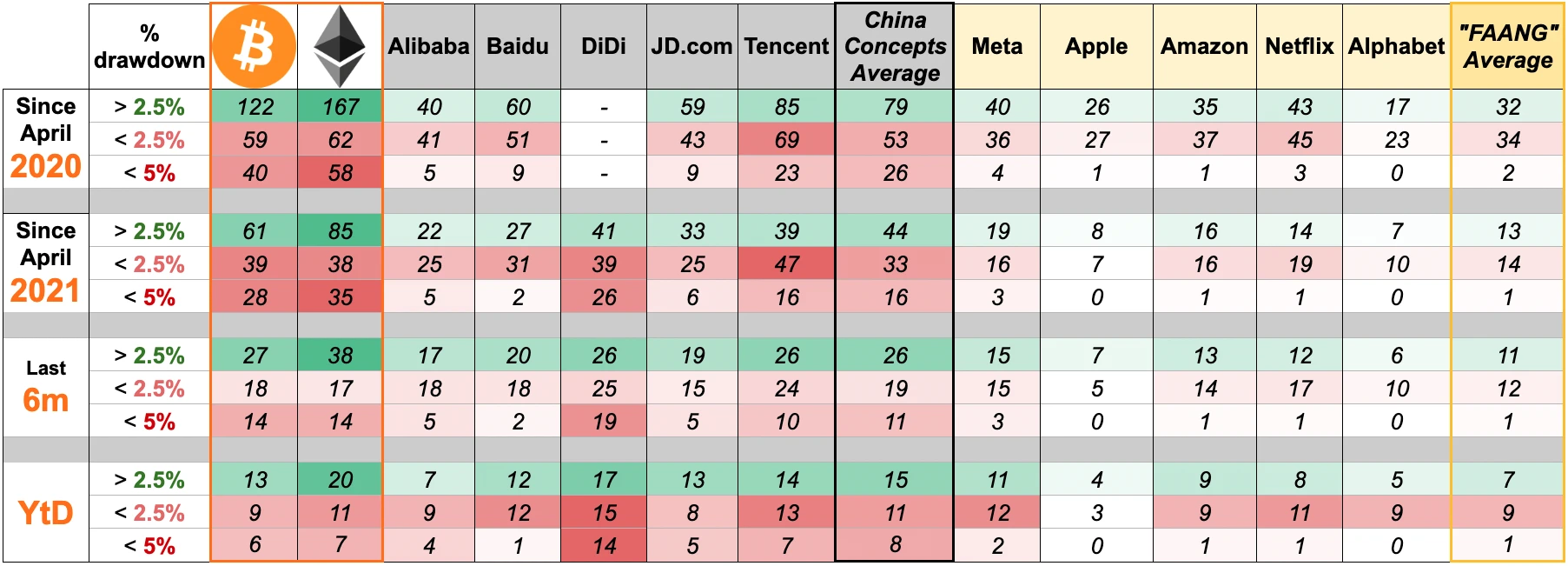

● We conducted a comparative study on the investment risks of encrypted assets and some popular technology stocks in recent years.

● Research shows that with “SMARTgroup stocks andTesla,Compared with Inc stocks, BTC and ETH have fewer losses within 2.5%;

● BTC and ETH suffered more losses of more than 5%, but the situation has improved rapidly recently;

● Most notably,BTC and ETH are the leaders in the group with a daily closing price increase of 2.5%+, of which ETH has been ranked first in the research time frame;

● in terms of absolute losses, and“SMART”Compared with the group and China concept stocks group,Both BTC and ETH exhibit lower risk;

● The performance of BTC is particularly eye-catching, and the risk of loss is lower than that of Netflix, Inc. and Meta Platforms, Inc.;

● In 2022, the highest opening price of BTC is close to 47,500 US dollars, the lowest opening price is 36,300 US dollars, and the largest floating loss this year is 23.6%. But compared to NVIDIA Corp (30.6%), Meta Platforms, Inc. (45.0%) and Roku, Inc. (57.2%), who is the real high risk? The answer is self-evident.

With the increasing popularity of encrypted assets, encrypted assets have also changed from a topic of small talk after dinner to a topic worth discussing (such as: what is the next great encrypted asset?). In the process, we need to prepare ourselves for crypto-asset skepticism. With the advancement of the popularity of encrypted assets, people have more basic understanding of encrypted assets. But we’re also hearing more and more skepticism about “investing in crypto assets? Too much risk for me!” To counter this claim, we compare crypto assets (represented by BTC and ETH) with popular tech stocks in this short article. In the future, if someone buys Tesla stock and tells you that crypto assets are too risky, we can refute them with reason. Below, we will passfirst level title

How BTC and ETH Compare to Hot Tech Stocks

In order to dispel the rumor that investing in encrypted assets is more risky than investing in general assets, we willimage description

image description

Source: Binance Research

main findings

● The volatility of BTC is more stable than that of ETH, and ETH, as the second largest encrypted asset, has higher volatility. This is because in the eyes of most people, BTC is more of a store of value, while ETH is more of a speculative asset, so BTC is more suitable for long-term holding, while ETH is more attractive to frequent investors.

● Since April 2020, cryptoassets have seen the most losses within 5%, while the “SMART” group,Tesla, Inc.,, Tencent Music, Ark Innovation ETF and other stocks have more losses within 2.5% than encrypted assets.

● The FAANG group is less volatile overall, of which Apple Inc. and Alphabet Inc. are particularly low risk. It is rare for Amazon, Meta, and Netflix to lose less than 5% of their daily closing prices, but losses of less than 2.5% are not uncommon, especially recently.

● Recently, the SMART group, the Chinese concept stock group, NVIDIA Corp., Baidu, etc. all have high volatility, and the trend is positive for BTC and ETH

● The most notable findings are thatBTC and ETH led the group with a daily closing price increase of more than 2.5% with great advantages, among which ETHNo. 1 in nearly every time benchmark category. It can be seen that for the top two encrypted assets, unless they are sold at the lowest level, holdings can continue to make profits.

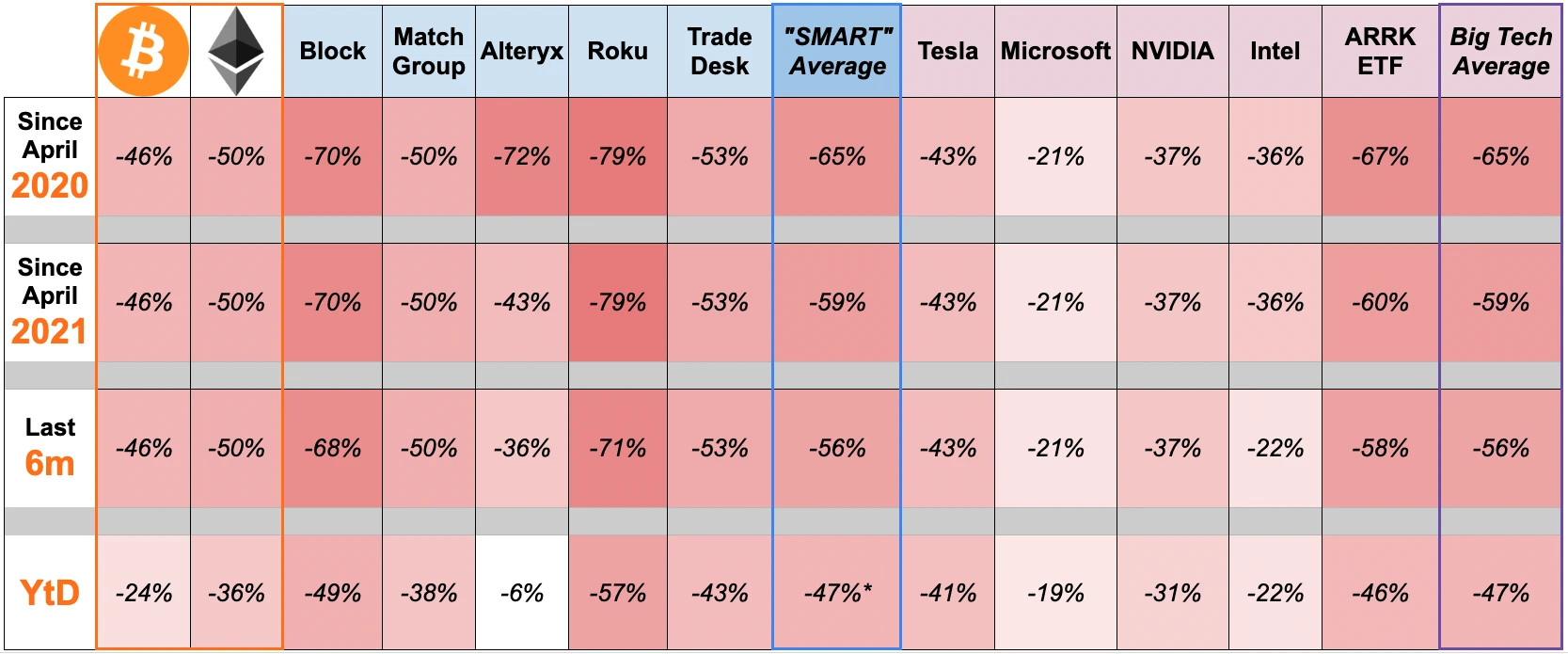

image description

image description

image description

*Excludes YtD data for Alteryx

main findings

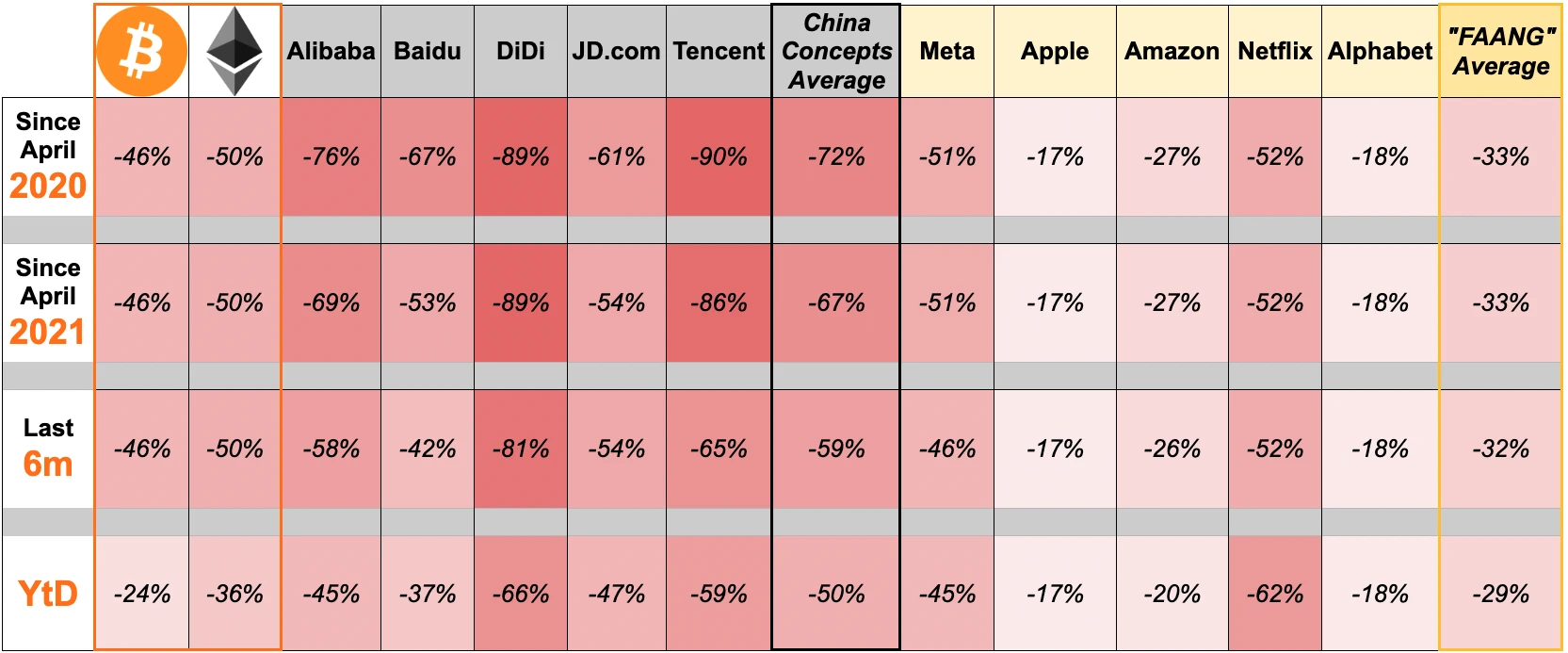

● According to our statistics, the risks of BTC and ETH are lower than those of the SMART group and the Chinese concept stocks group. It is worth noting that,BTC loss risk is lower than Meta Platforms, Inc. and Netflix, Inc.

● It is worth noting that even if there are top 20 companies with market capitalization in the composition of Chinese concept stocks1, the risk of loss is still high, and the average value within the group is not low.

● Similar to the trend shown in Figure 1,BTC and ETH have been less volatile recently than most of the tech stocks listed.

● For example: the highest opening price of BTC this year is close to 47,500 US dollars, the lowest opening price is 36,300 US dollars, and the largest floating loss this year is 23.6%. But comparing NVIDIA Corp (30.6%), Meta Platforms, Inc. (45.0%) and Roku, Inc. (57.2%), Netflix, Inc. (44.7%), Didi (66.2%), who is the real high risk? The answer is self-evident.

image description

image description

Source: Binance Research

main findings

● Year-to-date,Both BTC and ETH top the list of most popular assets to hold, among which BTC ranks in the top 10 (if Amazon.com, Inc., Intel Corp. or Alphabet Inc., any of the three are not included, BTC will rank in the top 5).

● Year-to-date, only one of all stocks in the group(Alteryx, Inc.)Prices have increased.

image description

image description

image description

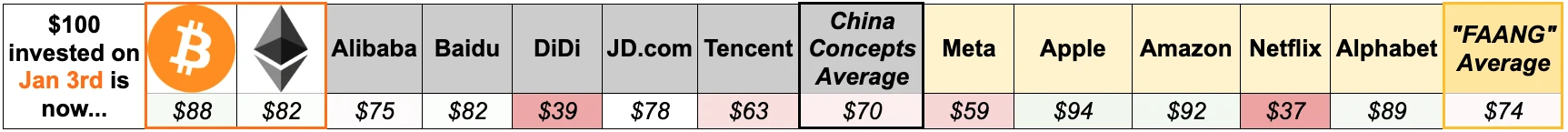

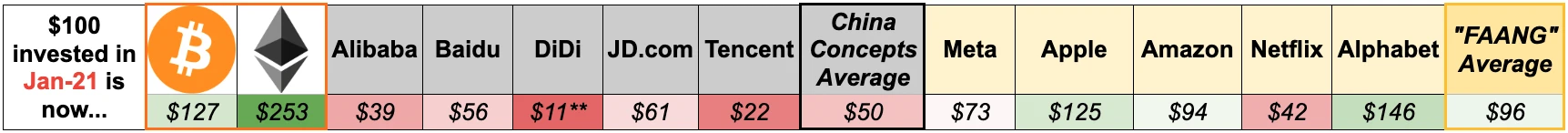

** Assume $100 invested in Didi, which will be listed in June 2021

main findings

● The time frame of this comparison is from January 2021 to the present. It can be seen that the performance of BTC, ETH and technology stocks are very different during this period, and the attractiveness of encrypted assets has greatly increased.

● Of all compared assets, ETH performed the best, rising 153% during this period, more than 5 times the average of the SMART group and the Chinese concept stock group, and more than 3 times the average of the FAANG group and the technology giant group. BTC also outperformed the other group averages.

in conclusion

in conclusion

Our comparison of cryptoassets (represented by BTC and ETH) with popular tech stocks found in many traditional portfolios leads to two important conclusions. First, our data suggest that it is untenable, or at least unfair, to say that cryptoassets are too risky compared to leading tech stocks and requires further validation. Second, and perhaps more importantly, when designing a portfolio, one should be aware of the potential for sustained profitability in cryptoassets, especially given that their maximum losses are relatively low. Dont forget that the market capitalization of the FAANG group is almostNearly 6 times the combined market value of BTC and ETH, among which the valuation of Apple alone will be 2.4 times higher than the current valuation. Such inflows into cryptoassets are bound to happen, the question is just when. We can say that a 2.5%+ increase in BTC and ETH prices is a reasonable estimate, and the entire encrypted asset market will also rise in the future.