A full year after the merger of Ethereum, MEV-Boosts market share has remained at 90%. This is Flashbots with a valuation of US$1 billion. Todays MEV is extremely complex, involving only non-user roles such as Searcher and Builder. , Relayer, Validator, Proposer, they all work together in this 12-second block time to compete with each other in an intricate manner, just to seek their own maximum benefits.

This article attempts to compare the changes in profit margins before and after MEV, sort out the MEV life cycle after the merger, and share personal views on cutting-edge issues.

In the authors previous research UniswapX protocol interpretation, summarizing the profit sources of UniswapXs operating process, I want to fully describe the specific rate of return of MEV. After all, this is the source of what he fights against and distributes dividends to users (essentially losing the real-time nature of transactions but in exchange for better exchange prices).

Therefore, the author recently analyzed several MEV types in detail and compared multiple data profit data sources to calculate the MEV profit situation before and after the merger of Ethereum. The complete reasoning process can be found in the research report: MEV Pattern after the First Anniversary of the Merger of Ethereum (https:/ /research.web3 caff.com/zh/archives/11824? ref=shisi), take some data and draw the following conclusions:

1. MEV’s profits dropped sharply after the merger

One year before the merger, the average profit calculated from MEV-Explore was 22 MU/M (starting in September 21 and ending before the merger in September 22, the numerical merger has Arbitrage and liquidation modes)

One year after the merger, the average profit calculated from Eigenphi is 8.3 MU/M (from December 22 to the end of September 23, the value combines the Arbitrage and Sandwich models)

The final change in income is:

In the statistics of the above data,After excluding hacking incidents that should not be attributed to MEV, the overall yield dropped significantly by 62%.

Note that MEV-Explore’s statistics do not actually cover sandwich attack data, but also include liquidation benefits, so if you only look at the pure Arbitrage comparison, the drop may be even greater.

Supplementary note: Since the statistical methods of different platforms are different (and they do not include Cex’s arbitrage and mixed models), it can only be macro-verified and not absolutely accurate. In addition, there are research reports that also use different data sources to compare the income before and after the merger, see Appendixlink

Is it the merger that caused the collapse of on-chain MEV earnings? This needs to start from the MEV process before and after the merger

2. Traditional MEV mode

In fact, the term MEV is easily misleading, because people think that miners are extracting this value. In fact, MEV on Ethereum is currently mainly captured by DeFi traders through various structural arbitrage trading strategies, and miners only indirectly profit from the transaction fees of these traders.

This classic MEV introductory article Escaping the Dark Forest (https://www.paradigm.xyz/2020/08/ethereum-is-a-dark-forest), the core concept is that there are very smart hackers on the chain who are constantly digging. There are loopholes in the contract, but when they discover the loopholes, they will fall into another contradiction, how to make profits without being snatched away by others.

After all, his transaction signature will be sent into the Ethereum memory pool, disseminated publicly, and then miners will sort out blocks. This process may only take 3 seconds or a few minutes. However, in just a few seconds, the signed transaction content can be Being targeted by countless hunters, the simulation was repeated.

If a hacker is stupid and directly implements the method of obtaining profits, he will be snatched away by hunters at a high price.

If the hacker is smart, he may be like the author of this article and use contract arbitrage (i.e. internal trading) to hide his ultimately profitable transaction logic. Unfortunately, the ending is not like that of Escaping the Dark Forest 》(https://samczsun.com/escaping-the-dark-forest/)Finally succeeded, but was still robbed.

This also means that hunters not only analyze the parent transaction on the chain, but also analyze each child transaction to conduct simulated profit deductions. The deployment logic of the gateway contract was even further tested and reproduced, and this was completed automatically within a few seconds.

The so-called dark forest is actually more than that

When the author tested BSC nodes before, I found that a large number of free nodes were only willing to accept P2P links, but did not actively transmit TxPool data. And judging from the exposed IP of the nodes, it can even be considered that they surrounded the main core of BSC. Block producing node.

In terms of motivation, these occupy P2P links but do not provide data, only for nodes in the whitelist to communicate with each other, so that the resource scale can be monetized to increase MEVs profit margin, because BSC has a standard 3 s block, and ordinary players The later the transaction information is seen, the later it will be to deduce a suitable MEV plan. And when ordinary players have MEV transactions that need to be packaged, since BSC is a super node mode, the delay will be lower than that of its own geographical location. The head MEV player of the BSC.

In addition to being surrounded by super nodes, exchange servers will also be surrounded. After all, the spread between CeFi and DeFi is even greater, and the exchange itself is the largest arbitrage robot. Very similar to the early web2 rush to buy tickets, black and gray industries will ambush near the server in advance and use DoS attacks to curb the normal activities of ordinary users.

In short, although traditional transactions also have a lot of invisible competition in the dark forest, they are relatively clear profit models. After the merger of Ethereum, the complex system architecture quickly broke the traditional MEV model, and the head effect became more and more significant.

3. Merged MEV mode

The merger of Ethereum refers to the upgrade of its consensus mechanism from POW to POS. The final merger plan is based on the most lightweight reuse of the Ethereum infrastructure before the merger, and the consensus module for block decision-making is separately stripped. .

For POS every 12 seconds per block instead of the previous fluctuating value. The block mining reward was reduced by approximately 90% from 2 ETH to 0.22 ETH.

This is very important for MEV for two reasons:

1. The block production interval of Ethereum has become stable. It is no longer a relatively discrete and random situation of 3-30 S before. This is a half-win situation for MEV. Although the Searcher does not have to rush to see a slightly profitable transaction and send it out directly, it can continue to accumulate a more A good total transaction sequence is entrusted to the verifier before the block is produced, but it also intensifies the competition among Searchers.

2. Miner incentives have been reduced, making validators more willing to accept MEV transaction auctions, allowing MEV to reach 90% of the market share in just 2-3 months.

3.1. Life cycle of post-merger transaction

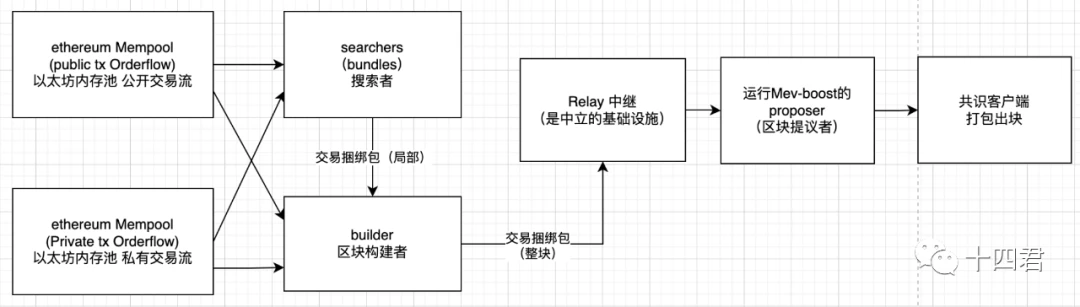

After merging, the total will involve the roles of Searcher, Builder, Relay, Proposer, and Validator. The latter two belong to the system roles in POS, while the first three belong to MEV-boost to achieve separation of block production responsibilities and block ordering.

Searcher: Searchers, they are various memory pools looking for profitable transactions, and arrange the transaction sequence to form a partial sequence Bundle and deliver it to the Builder.

Builder: Builder collects Bundle transaction sequence packages sent by various Searchers and selects more profitable transaction sequences. It can be a combination of multiple bundles, or it can be rebuilt by itself.

Relay: Relay is a neutral facility that is responsible for verifying the validity of the transaction sequence itself and recalculating the income, giving a number of block sequence packages, and finally allowing the verifier to choose to package them.

Proposer and Validator: are the miners of the merged Ethereum. They will select the maximum profit transaction sequence combination given by Relay to complete the block production work. They can obtain both consensus rewards (block rewards) and execution rewards (MEV+Tips).

Block Generation Process after Ethereum Merger Self-made

Combining these roles, each block life cycle is now:

Builders create a block by receiving transactions from users, searchers, or other (private or public) order flows

The builder submits the block to the relay (i.e. there are multiple builders)

The relay verifies the validity of the block and calculates the amount it should pay to the block producer

The relay sends the transaction sequence package and revenue price (also an auction bid) to the block producer of the current slot.

Block producers evaluate all the bids they receive and choose the sequence package with the highest return for themselves.

The block producer sends this signed title back to the relay (that is, the current round of auction is completed)

Post-block rewards are distributed to builders and proposers through transactions within the block and block rewards.

4. Summary

1) What is the ecological impact of the merger on MEV?

This article starts from the comparison of profit data before and after the merger, to the MEV mining process of transaction on-chain before and after the merger. It can be said that the rise of MEV-Boost has fundamentally reshaped the model of the transaction life cycle, splitting out more refined The links allow various participants to compete. If the searchers do not do well in researching the latest strategies, they will gain nothing. If they do well, they can gradually expand their profits and become builders.

Regardless of the shrinking transaction volume on the chain, Searchers and Builders are in a high degree of internal competition, because they can replace each other in terms of system structure, but in the end order flow will be king, and Searchers will hope to gradually expand their profit margins. As long as his private order volume is large enough (the profit of the final constructed block is high enough), he will gradually become the role of Builder.

For example, in the Curve attack due to a compiler vulnerability that caused the reentrancy protection to fail, the handling fee for a single transaction even reached 570 ETH. This is the second highest handling fee MEV transaction in the history of Ethereum, and the competitive situation is evident.

Although MEV is not a problem to be solved by the Ethereum merger itself, the improvement of the systems game confrontation combined with environmental factors will eventually reduce the current total profit margin of MEV. Here, it does not mean that the amount involved in MEV has been reduced, but the profit The lower rate means more revenue flows to the verifiers (https://writings.flashbots.net/open-sourcing-the-flashbots-builder), which is a good thing for users. Low profits will reduce some on-chain transaction attacks. motivation.

2) What are the other cutting-edge exploration points currently underway around MEV?

Starting from private transactions: There are threshold encryption, delayed encryption, and SGX encryption. They basically encrypt transaction information and require decryption conditions, or time locks, multi-signatures, or trusted hardware modes.

Starting from fair transactions: MEV Auction with fair sorting FSS and order flow auction, as well as MEV-Share, Mev-Blocker, etc., the difference is from completely no profit to profit sharing to weighing profits, that is, the user decides at what cost to obtain The relative fairness of the transaction.

Improve PBS at the protocol level. Currently, PBS is actually a proposal of the Ethereum Foundation, but the implementation has been separated with the help of MEV-boost. In the future, such core mechanism will be converted to the protocol mechanism of Ethereum itself.

3) Is Ethereum resistant to OFAC scrutiny?

As the cryptocurrency industry matures, regulation is inevitable. All entities incorporated in the United States and their institutions operating Ethereum POS validators should comply with OFAC requirements. However, the system mechanism of the blockchain is destined to not only Existing in the United States, as long as there are other relays that comply with local policies, it can be ensured that it can be spread on the chain at a certain opportunity.

Even if more than 90% of Validators are censoring transactions routed by the relay through MEV, those censorship-resistant transactions will still be able to be on-chain within an hour, so anything other than 100% is equal to 0%

4) Are repeaters without incentives sustainable?

This seems to be an invisible problem at present. If there is no profit, complex relay services must be maintained, which will eventually lead to a shift to strong centralization. Recently, Blocknative has also stopped the MEV-boost relay service. In the future, more than 90% of Ethereum’s block settlements will be controlled by 4 companies. It can be said that the current MEV-Boost relay has 100% risk but 0% return. Since the relay will aggregate the txs reported by various Builders, as a gathering place for data, it may be gradually expanded through MEV-share and MEV Auction. A complete system can gain benefits, such as directly receiving users’ private transaction requests. In the past, map software APPs were also trapped in such services. As public relations items, it was impossible to charge on a membership basis. However, they were still doing well under the pilot model of accessing exposure ranking ads and multiple taxi-hailing services. In short, there was traffic. If there is fairness among users, there will be no profit.

5) How will ERC 4337 bundled transactions be affected under MEV?

There are currently more than 687,000 AA (account abstraction) wallets and more than 2 million user operations (UserOps). The overall trend is considered explosive growth compared to the slow growth of CA wallets in the past. ERC-4337 has a complex operating mechanism, especially the propagation of transaction signatures does not share the memory pool of Ethereum itself. Although it will increase the difficulty of MEV initially, it will be unstoppable in the long term.

Expandable reading of previous research reports: Account Abstraction Scheme ERC-4337 Latest Review Scheme Research Report https://research.web3 caff.com/zh/archives/6900?ref=shisi

6) Facing the threat of MEV, can DeFi catch up with CeFi?

Although many current solutions are to make DeFi smoother in terms of experience, such as using meta transactions or cross-chain Swap or ERC-4337 to reduce the restriction that users must pay handling fees to execute transactions, or through the multiple customization functions of contract wallets. To improve account security (layering, grading, social replies), in the author’s opinion, no matter how we catch up with CeFi, there are always unique and unparalleled advantages, from speed to experience, but DeFi also has unique advantages that are also unparalleled by CeFi. , each has its own audience group, and each has its own development cycle.

7) What is the current status of MEV in Layer-2?

In Optimism, there is a unique module called Sequencer, which is used to generate signed receipts that ensure transaction execution and sequencing. The sequencer will be checked by a group of verifiers for forfeiture rights, and the MEVA (MEV Auction) scheme will be used to select the unique sequencer through the auction process.

In Arbitrums sequencer structure, Arbitrum uses the FSS (Fair Sequencing Services) scheme developed by Chainlink to determine the order.

The above methods all eliminate MEV from miners to a certain extent by leveraging the particularity of L2. However, there are still opportunities for MEV in side chains that are not interoperable with the Ethereum main network, such as BSC, BASE, etc.

Finally, this article is an excerpt of 1/3, and the data involved and conclusion reasoning can be found in the complete research report: Research Report on the MEV Pattern after the One-Year Anniversary of the Ethereum Merger: How does the chain of beneficiaries appear in the face of highly complex game confrontations? 》https://research.web3 caff.com/zh/archives/11824?ref=shisi

appendix

https://github.com/flashbots/mev-research/blob/main/resources.md

https://web3 caff.com/zh/archives/60550

https://web3 caff.com/zh/archives/61086

https://collective.flashbots.net/t/merge-anniversary-a-year-in-review/2400

https://hackmd.io/@flashbots/mev-in-eth2

https://frontier.tech/the-orderflow-auction-design-space

https://web3 caff.com/zh/archives/54535