Original author: Severin, MT Capital

TL;DR

Chainflip can realize native inter-chain value conversion, with a higher degree of decentralization, security and composability.

The $FLIP token will remain inflationary in the short term, and we expect that the token repurchase and destruction caused by transaction volume in the short term will not be enough to cause $FLIP to enter deflation.

Chainflip has a better product experience and design than Thorchain, but Thorchain itself has first-mover advantages, such as high market visibility and market share. Therefore, we predict that it will be difficult for Chainflip to completely replace Thorchain in the short term.

The market value of Chainflip is approximately 90M, and the full market value is approximately 460M. Thorchains market capitalization is 2.1B, and its full market capitalization is 3B. From a comparable valuation perspective, $FLIP still has room for imagination of close to 8x. However, Thorchains market value is supported by its total trading volume of 68B and its recent average daily trading volume of 100M+, while Chainflip has not yet generated any transactions.

We will generally remain cautiously optimistic about the subsequent trend of $FLIP, and will pay special attention to whether the incentive plan recently launched on Chainflip’s mainnet can drive a substantial increase in transaction volume.

Chainflip: Decentralized cross-chain liquidity network

Value conversion between native chains

Unlike cross-chain solutions that use wrapped assets or require Mint/Burn assets in the intermediate process, Chainflip chooses to adopt a native inter-chain value conversion method.

This means that on each chain supported by Chainflip, there is a pool of liquid native assets, thus forming a universal settlement layer between chains to meet users needs for inter-chain asset conversion. The advantages that value conversion between native chains can bring are as follows:

Value conversion has nothing to do with the chain or wallet. Chainflip supports users to use ordinary wallets to perform value conversion on any chain.

Value conversion does not involve any packaging assets, synthetic assets or other assets. Users only need to submit an ordinary transaction for exchange. After the exchange is completed, users will not face any other asset risks.

Chainflip does not require additional deployment or execution of other protocols on a specific chain, has higher compatibility and versatility, and puts as much of the calculation process off-chain as possible to reduce users Gas consumption.

Chainflips native inter-chain value conversion method can lower the users operating threshold, reduce the users risk exposure, and bring a better user experience to the user.

source:Image Source

Decentralization

Another big advantage of Chainflip compared to other solutions is its higher degree of decentralization. Chainflips verification network consists of up to 150 verification nodes. Verification nodes will maintain network security, participate in consensus, monitor events on external chains, and jointly control system funds. The process of becoming a verification node is also permissionless. Users only need to pledge enough $FLIP and win the highest price in the auction to become one. The core of Chainflips idea is to use MPC (Multi-Party Computation), specifically TSS (Threshold Signature Scheme) to create aggregate keys held by a permissionless network of 150 validators. All operations and status changes in Chainflip require consensus confirmation from more than 2/3 of the nodes to ensure higher security. Compared with the cross-chain value exchange of centralized exchanges and some cross-chain bridges with a higher degree of centralization, users do not need to worry about the evil risks of centralized exchanges and the evil risks of centralized servers of cross-chain bridges. Chainflip uses a higher degree of decentralization to avoid the single point of failure of a single node and the risk of evil, thus greatly improving the overall security of the system.

source:Image Source

JIT AMM

The calculation process of inter-chain value conversion is completed by Chainflips Just In Time AMM (JIT AMM) on the state chain built based on Substrate. JIT AMM is built on Uni V3. The difference is that JIT AMM is not a series of smart contract sets on different chains, but only performs virtual calculations for value conversion on the state chain. That is, Chainflips accounting and calculation functions are stripped off and completed on the state chain, while the underlying settlement relies on the treasury set up by Chainflip on each chain. **This workflow greatly simplifies the operational complexity of performing inter-chain value exchange calculations, accounting and settlement on different chains, and can effectively reduce users Gas costs. Moreover, Chainflips state chain can also support more customized needs of JIT AMM. **For example, Chainflip supports LP to perform timely and dynamic limit order updates for incoming order quotations. It uses LP competition to prevent MEV robots from pre-empting transactions, improves LPs capital usage efficiency, and enables users to obtain profits with lower slippage. Better market price.

source:Image Source

composability

Chainflip also has better composability than existing cross-chain bridges. Developers can easily integrate the value exchange function between Chainflip native chains into existing protocols or products through the Chainflip SDK. Just like Uniswaps Swap function is widely integrated by DeFi use cases, higher composability will bring more use cases to Chainflip. With the current explosion of highly composable use cases represented by full-chain games, when the Lego bricks of the application layer continue to be stacked, it will also stimulate users demand for the liquidity of underlying assets between multiple chains. However, the current status quo is that the liquidity separation between L1 and L2 is becoming more and more serious. Value exchange between native chains represented by Chainflip may become an indispensable embedded function for multi-chain projects.

Team background

Chainflips team consists of 26 experienced global talents. Simon Harman is the founder and CEO of Chainflip and a board member of the Oxen Foundation. Prior to Chainflip, Simon led the team to build products including Session, a messaging application based on the Signal protocol. CTO Martin was previously the founder of Covariant Labs and CTO and CSO of Finoa. The Chainfllip team has rich Crypto background experience. Nearly 60% of the staff are developers, and the overall team composition is relatively high-quality.

Token economic model

On November 23, 2023, Chainflip announced the launch of the mainnet and the issuance of $FLIP tokens. After $FLIP was released, it quickly became popular in the market. The current price is around $5, which is nearly 2.7x increase from the ICO price of $1.83.

$FLIP is Chainflips ERC-20 native token with an initial supply of 90 M and follows a dynamic token supply model. Currently, Chainflip expects an annualized token inflation of 8% to incentivize validator nodes. In addition, Chainflip’s transaction fees will also buy back and burn $FLIP, making $FLIP likely to be deflationary. The token empowerment of $FLIP is mainly reflected in its use for pledge verification and value capture of the protocol.

source:Image Source

$FLIP Staking Verification

Similar to most verification networks, since 150 Chainflip nodes will control all funds and operations of the system, in order to prevent nodes from doing evil, nodes must pledge sufficient $FLIP as a penalty to participate in verification. Nodes with more $FLIP pledges have a higher chance of becoming an authoritative verification node, thereby receiving additional verification rewards.

It is currently expected that an annualized 7% token reward will be divided equally among authoritative validator nodes. Ordinary backup verification nodes will also be allocated an annual 1% token reward based on the proportion of $FLIP pledged. Therefore, it is not difficult to find that the pledged amount of **$FLIP will significantly affect the verification reward of the verification node, which will amplify the nodes need to hold and pledge $FLIP tokens. Chainflip also predicts that the pledge rate of $FLIP will account for 37%-66% of the total supply. Large token pledges will help maintain the stability of token prices and reduce market selling pressure.

source:Image Source

$FLIP Value Capture

For every token exchange conducted through Chainflip, Chainflip charges a 0.1% handling fee. This fee will be charged in the form of USDC and used to purchase $FLIP. Purchased $FLIP tokens will be burned directly. Likewise, gas fees on the state chain will also be used to purchase $FLIP and burn it. Chainflip aims to use the mechanism of token repurchase and burning so that the value generated by the protocol can be dynamically reflected in the price of $FLIP, giving back to $FLIP holders and enhancing the value capture capability of $FLIP. Of course, since $FLIP itself has token inflation, Chainflip also needs to obtain enough daily trading volume for its token repurchase and burning to drive up the price of $FLIP.

future expectations

potential market

With the successive launch of a large number of L1 and L2, the problem of liquidity fragmentation between chains has become increasingly serious. According to DeFiLlama data, there are a total of 71 chains with a TVL of more than 10 M. The rise of Rollup as a Service and application chains will further exacerbate the problem of liquidity fragmentation. Traditional cross-chain bridges with frequent hacker problems are no longer the first choice for users to solve cross-chain liquidity. Native inter-chain token exchange solutions represented by Thorchain and Chainflip may become mainstream. At present, the accumulated value on the cross-chain bridge is about 12B, while Thorchains TVL is only about 300M. The native inter-chain token exchange solution still has market space of dozens of times.

Compare Thorchain

Overall, Chainflips market positioning is similar to Thorchains, but there are some differences in product experience and product design:

Product experience: Thorchain requires a separate multi-chain wallet, while Chainflip only requires an ordinary on-chain wallet to be used, making the user experience more convenient. Of course, Thorchain is also currently making it compatible with mainstream wallets to gradually close the gap in wallet experience.

Degree of decentralization: Thorchain currently has a total of 104 nodes to maintain the security of the on-chain treasury, and Chainflip’s decentralized verification network consists of 150 nodes. From the perspective of the number of nodes, Chainflip will be relatively more decentralized, but there is no obvious gap between the two.

Product design: Thorchain’s capital pool formation and token exchange rely on $RUNE as an intermediary, while Chainflip does not rely on a specific token. Therefore, Chainflip’s capital pool and token exchange process are not exposed to the risk exposure of a specific token, and are relatively safer.

source:Image source 1 & Image source 2

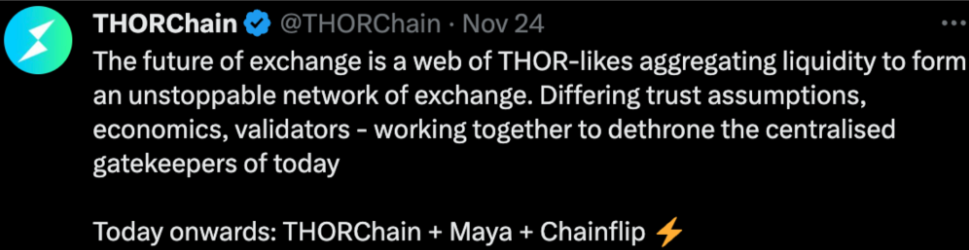

To sum up, the current user experience, decentralization and security of Chainflip will be slightly better than Thorchains, but Thorchains own first-mover advantage, market visibility and market share are also its important competitive advantages. Therefore, we predict that it will be difficult for Chainflip to completely replace Thorchain in the short term. **It is more likely that, as Thorchain’s official tweet states, Chainflip will continue to erode the market share of cross-chain bridges together with Thorchain.

Currently, Chainflip’s market value is approximately 90M, and its full market value is approximately 460M. Thorchains market capitalization is 2.1B, and its full market capitalization is 3B. From a comparable valuation perspective, $FLIP still has room for imagination of close to 8x. However, Thorchains market value is supported by its total trading volume of 68B and its recent average daily trading volume of 100M+, while Chainflip has not yet generated any transactions. Therefore, we will only remain cautiously optimistic about the subsequent trend of $FLIP in general, and will pay special attention to whether the incentive plan recently launched on Chainflips mainnet can drive a substantial increase in transaction volume.

Reference

MT Capital

MT Capital, headquartered in Silicon Valley, is a crypto-native fund focusing on Web3 and related technologies. We have a global team, and our diverse cultural backgrounds and perspectives allow us to have an in-depth understanding of the global market and to seize investment opportunities in different regions. MT Capitals vision is to become the worlds leading blockchain investment firm, focused on supporting early-stage technology companies that can generate significant value. Since 2016, our investment portfolio covers Infra, L1/L2, DeFi, NFT, GameFi and other fields. We are not just investors, we are the driving force behind the founding team.

Official website: https://mt.capital/

Twitter: https://twitter.com/MTCapital_US

Medium:https://medium.com/@MTCapital_US