Original - Odaily

Author - Husband How

Will the fourth quarter of 2023 be the beginning of a new bull market?

At the macro level, the Federal Reserves interest rates remain stable, and news of an interest rate cut in 2024 comes out from time to time, boosting the market; the U.S. SECs expected approval of Bitcoin spot ETFs continues to increase investor confidence, allowing the crypto market value to continue to rise in Q4 2023 .

From an internal perspective of the crypto market, the settlement between the U.S. SEC and Binance provides a certain foundation for the entire crypto market to move towards the mainstream; with the rise of the Bitcoin ecosystem, the leading ecological inscription ORDI continues to break new highs; waves of inscriptions are coming one after another, gradually starting from MEME The nature is becoming functional. At the same time, the popularity of inscriptions on major public chains remains high, and inscriptions have become one of the indicators for testing the popularity of public chains.

From a data point of view, Bitcoin has exceeded the 42,500 mark, and the exchange rates of ETH and BTC have also increased to a certain extent.

It can be said that the fourth quarter of 2023 lays a good foundation for the new year.

Under the influence of comprehensive factors, the primary market has also reached an inflection point, and investment and financing in Q4 have increased to a certain extent in terms of quantity and amount. But at the end of the year, major well-known institutions have reduced their exposure.

Looking back at Q4 primary market investment and financing activities, Odaily found:

● The financing situation in the crypto market is improving, and an inflection point is emerging;

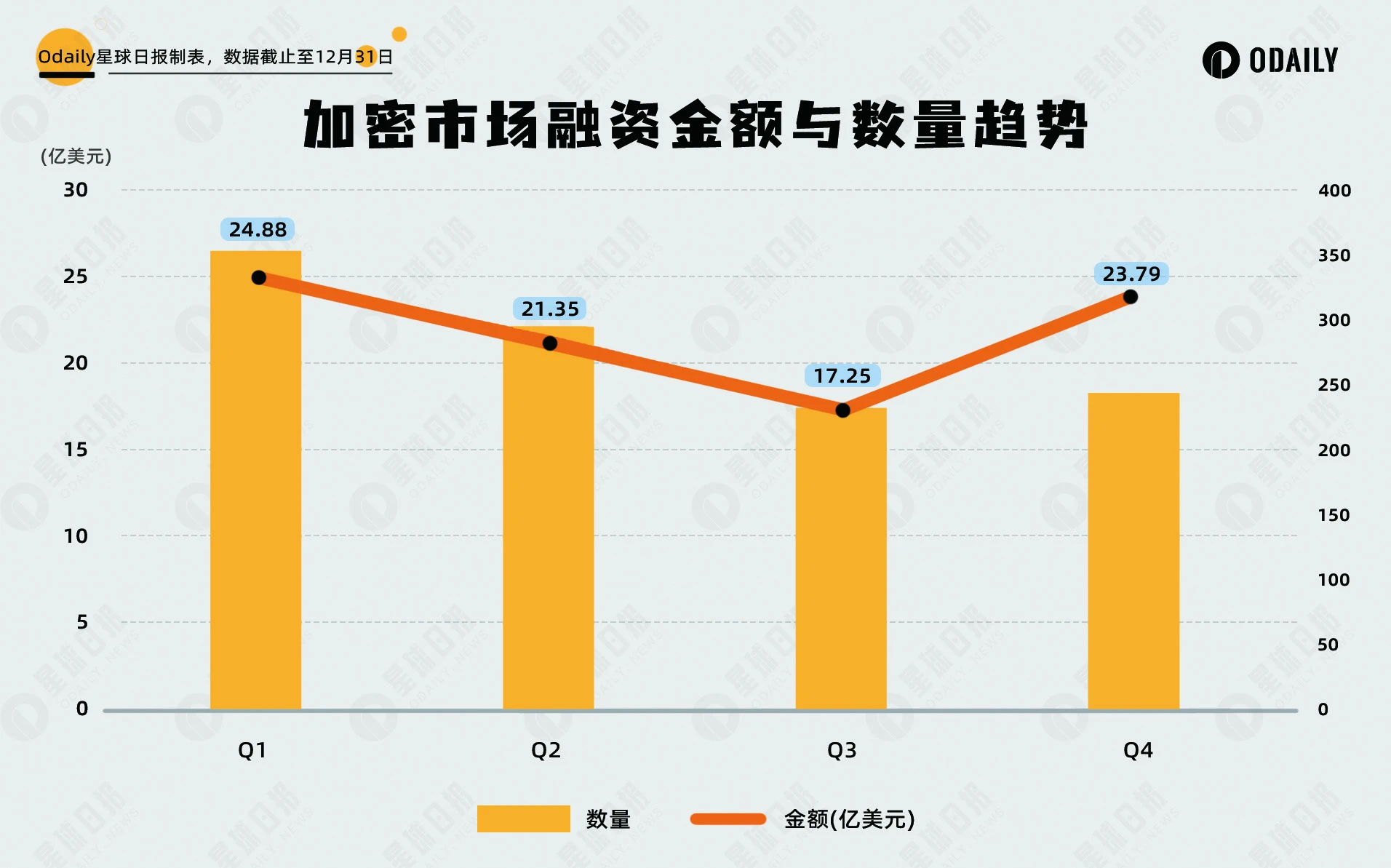

● The number of financings in Q4 was 243, and the total disclosed financing amount was US$2.379 billion;

● Underlying facilities have become the winner of Q4 investment and financing due to the popularity of the DePIN sector;

● 10+ investments in OKX Ventures, Hashkey Capital and Waterdrip Capital.

Note: Odaily divides all projects that disclose financing in Q2 (the actual close time is often earlier than the news announcement) into five major tracks according to the business type, service objects, business model and other dimensions of each project: infrastructure, applications, technical service providers, Financial service providers and other service providers. Each track is divided into different sub-sections including GameFi, DeFi, NFT, payment, wallet, DAO, Layer 1, cross-chain and others.

The financing situation in the crypto market is improving, and an inflection point appears

likeLast quarter reportAs mentioned above, from the first quarter of 2022 to the third quarter of 2023, the global crypto market financing events and financing amounts have generally been on a downward trend (excluding fund raising and mergers and acquisitions), but the overall trend will change in Q4 of 2023, compared with the Q3 financing of 2023 The amount increased by nearly 37.91%, and the number of financings also increased to a certain extent. An inflection point in the financing situation in the crypto primary market seems to have emerged.

The number of financings in Q4 was 243, with a total disclosed amount of US$2.379 billion

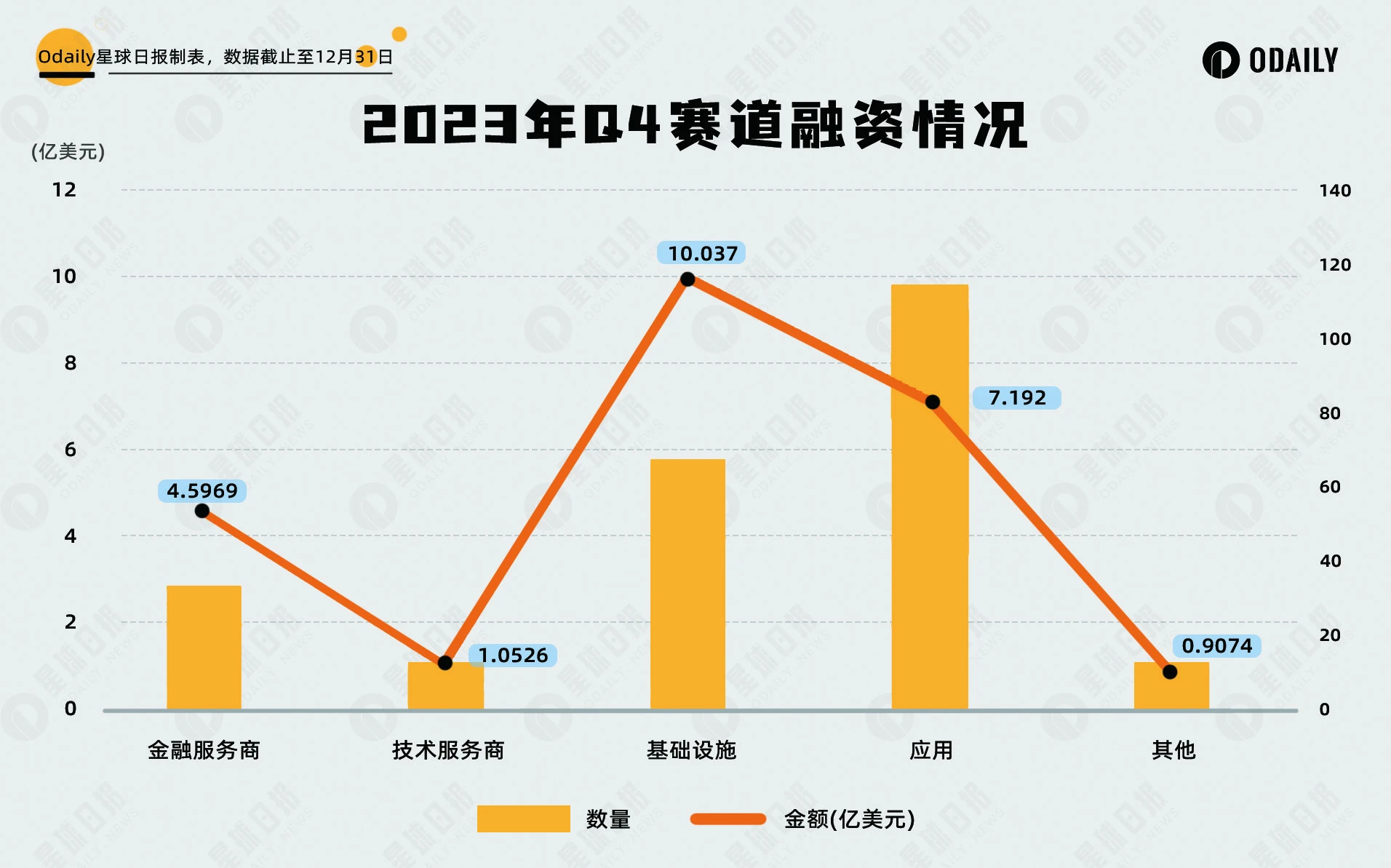

According to incomplete statistics from Odaily, a total of 243 investment and financing events occurred in the global encryption market from October to December 2023 (excluding fund raising and mergers and acquisitions), with a total disclosed amount of US$2.379 billion, distributed among infrastructure and technology service providers , financial service providers, applications and other service provider tracks, among which the infrastructure track received the largest amount of financing, approximately US$1.004 billion; the application track received the largest number of financings, 115.

Judging from the above figure, infrastructure and applications are still the most important sectors for institutional investment, and they also provide diversified options for Web3; the ability of infrastructure to attract funds has significantly improved, and the number of financings in the application track has also increased to a certain extent compared with the previous quarter.

Underlying facilities became the winner of Q4 investment and financing due to the popularity of DePIN sector

According to incomplete statistics from Odaily, financing events in the Q4 segmented tracks are concentrated in underlying facilities, DeFi and CeFi, accounting for nearly half of the total financing events. Among them, there are 43 deals in the underlying facilities track, 42 deals in the DeFi track, and 42 deals in the CeFi track. 33 pens.

Judging from the distribution of financing amounts in sub-tracks, investment trends tend to be diversified, butDeFi and underlying facilities are still important areas for capital deployment。

Judging from the distribution of financing amounts in sub-tracks, investment trends tend to be diversified, butDeFi and underlying facilities are still important areas for capital deployment。

From the perspective of quantity and amount of Q4 investment and financing, underlying facilities are undoubtedly the biggest winners. As the DePIN sector enters the public eye, institutions will also focus on the underlying facilities track. It is understood that,Institutions and market makers will focus on the DePIN track next year, and combining virtual reality will be more in line with Web2 user habits.。

Secondly, in the DeFi track, with the continuous launch of new chains and second layers, the number of DeFi supporting packages continues to increase; the launchpad project has received the attention of most institutions; the growth in the number of DEX in the Mingwen Ecology indicates that Mingwen is gradually moving towards a new asset model Public view.

The increase in investment and financing in the DeFi track in Q4 is attributed to the development of the Bitcoin ecosystem and the second-layer ecosystem.

In addition, the CeFi track is also very active in financing news, with a total of 33 transactions, ranking third. The increase in project financing in the CeFi track reflects to a certain extent that old money in the traditional market is making arrangements in the crypto world, and the most suitable investment target for them is undoubtedly CeFi.

The maximum amount of investment received in a single transaction is US$225 million (Wormhole)

According to incomplete statistics from Odaily, the financing amount of Q4 segmented tracks is led by underlying facilities, supplemented by CeFi, and other tracks have become flat. Funding for the underlying facility, Raceway, is $675 million.

At this stage, when the overall financing amount is relatively low, the financing amount of a single project has a greater impact on the financing trends of subdivided tracks. In order to avoid large error analysis, the Q4 financing amount analysis will focus on the introduction of the TOP 10 projects. The projects in the figure below are divided according to segmented tracks, and also include traditional companies involved in the encryption business.

Wormhole is a decentralized universal messaging protocol that enables developers and users of cross-chain applications to take advantage of multiple ecosystems.

LINE NEXT is composed of two companies. South Koreas LINE NEXT Corporation focuses on the strategic planning of the global NFT platform, while the United States LINE NEXT Inc. is responsible for developing and operating the NFT platform business.

Arkon Energy is a data center infrastructure company that uses excess renewable energy to run its Bitcoin mining operations.

Blockchain.com is a digital asset platform that provides cryptocurrency trading, blockchain browser and cryptocurrency wallet services. Blockchain.com also offers a range of solutions for institutions, such as asset custody and lending services.

MapleStory is a free, 2D, side-scrolling massively multiplayer online role-playing game developed by South Korean gaming giant Nexon. The game IP already has a stable online player base of more than 380,000.

Fnality was founded in 2019 but originated from a blockchain project led by UBS. It is building digital versions of major currencies for bulk payments and transactions involving digital securities.

YouTrip mainly provides consumers with multi-currency digital wallets and provides small and medium-sized enterprises with business account services that support corporate cards.

Andalusia Labs is a digital asset risk infrastructure provider. It has three major digital asset technology solutions, including a second-layer blockchain called Karak, a crypto risk management marketplace called Subsea, and a security-focused institutional platform, Watchtower.

Prove is a global digital identity solutions provider that provides an identity verification and authentication platform dedicated to providing users with business support and anti-fraud related services.

Blockaid is a Web3 security tool that stops malicious transactions before they occur, protecting Web3 users from scams, phishing, and hacking attacks.

OKX Ventures, Hashkey Capital and Waterdrip Capital became the institutions with the most transactions in Q4

In a good environment for the overall market, the number of transactions by well-known institutions does not seem to increase. Perhaps due to the end of the year, Binance Labs and a16z, which made more transactions in the last quarter, only made about 5 transactions. On the other hand, OKX Ventures, Hashkey Capital and Waterdrip Capital took 10 shots.

Looking at the Q4 investment and financing projects of well-known institutions, they focus on underlying facilities and the DeFi track. Although the proportions are slightly different, they are generally consistent with the situation described above.