Original - Odaily

Author - Loopy Lu

This evening, the United States began to enter the working period on January 8, and the Bitcoin spot ETF made a number of major developments. Bitcoin quickly rose slightly and returned to above $45,000, and the market became volatile again.

The ETF is now less than 48 hours away from getting final results. When ETFs are passed, the market consensus is that there will be huge fluctuations, whether up or down. Bitcoin spot ETF is just a step away.

Odaily summarizes today’s latest developments as follows:

Today’s ETF Application Updates

Hashdex may not be the first batch to pass

As previously reported, the SEC has required all Bitcoin ETF issuers to submit updated documents to the SEC before 8:00 ET.Currently, the deadline has passed.

In addition to Hashdex, all other ETF applicants such as Grayscale, Ark/21 Shares, Blackrock, BitWise, VanEck, WisdomTree, Invesco, Fidelity, Valkyrie, Franklin, etc. have submitted updated versions of S-1 documents (in the case of Grayscale, S-3 document).

The last file submission time of Hashdex was December 26, 2023, which has missed the final deadline for this file update.

Voting is around the corner, when will it take place?

At present, the final revisions to the issuers filing have been completed, and SEC commissioners may vote on it in the next stage.

Bloomberg analyst Eric Balchunas said that there is nothing on the SECs public agenda before January 11, but the SEC can use its authorization policy to make decisions.

This means we still don’t know exactly when the vote on the most important agenda item is likely to take place.

ETF fee price war begins?

Options trading volume surges, ETF betting begins

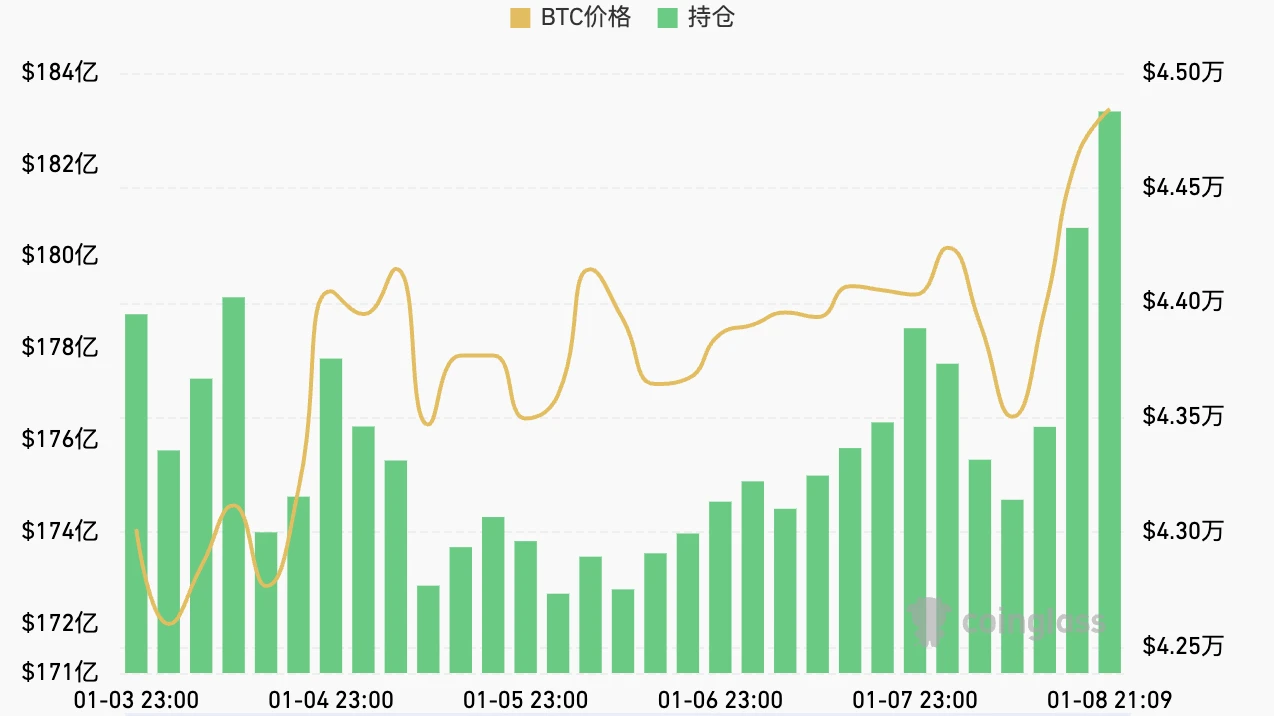

Coinglass data shows that in the past 24 hours, the entire network liquidated $231 million, BTC liquidated $25.96 million, and ETH liquidated $24.24 million; long orders liquidated $173 million, and short orders liquidated $58.12 million.

Currently, the contract holdings are gradually rising, and the total BTC holdings on the entire network are 428,400 BTC, worth approximately US$19.254 billion. CME has the largest holdings at 122,400 BTC, which is approximately US$5.492 billion. Binance holds 97,600 BTC, worth approximately US$4.385 billion. Bybit’s holdings are 76,200 BTC, worth approximately US$3.42 billion.

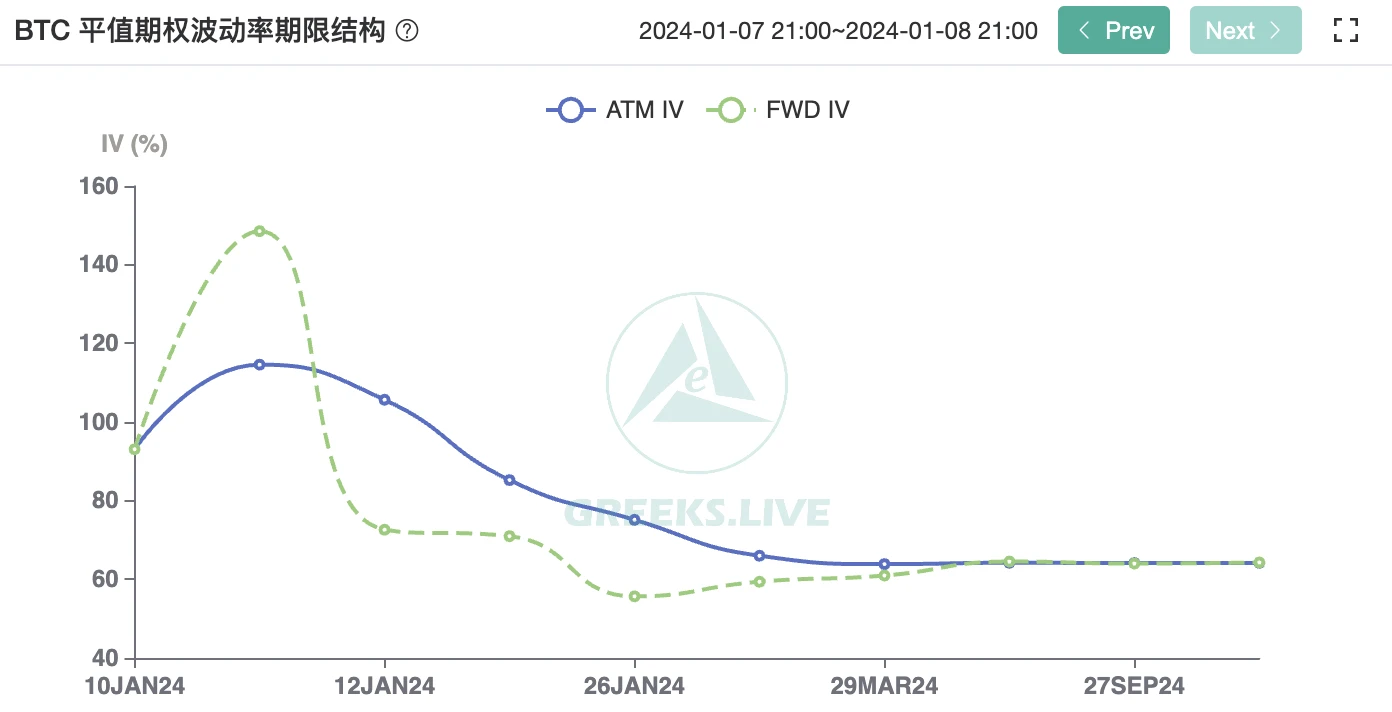

Adam, a macro researcher at Greeks.live, said that the review results of the Bitcoin spot ETF are about to be finalized, and the current market generally believes that it will pass smoothly.

Adam further said that stimulated by the continuous emergence of good news, BTC is currently returning to a short-term high of $45,000. The current IV of at-the-money options expiring on the 12th has reached 110%, and the IV of the at-the-money options expiring on the 11th is as high as 120%. After today’s delivery, the IV rose again by nearly 20%.

Options trading volume also surged.

Deribit data shows that the most traded BTC options today are those expiring on January 12, which may be related to expectations for the approval of a spot Bitcoin ETF. Volume (notional value) was $165.7 million in puts and $157.7 million in calls, indicating active market activity.

Although no one can know the ultimate outcome of an ETF, and the event is nearly impossible to predict. However, various analysts, investors and other major market participants have given their own predictions.

Bloomberg ETF analyst James Seyffart said that the current probability of approval of spot Bitcoin ETF may have exceeded 90%; another Bloomberg ETF analyst Eric Balchunas said that he believed that the current probability of approval of spot Bitcoin ETF may have reached 95% , but some extreme situations cannot be completely ruled out.

BlackRock, for its part, gave something of an “official forecast” for its ETFs. BlackRock expects its Bitcoin spot ETF to receive SEC approval next Wednesday, Fox Business reported.

In the on-chain world, predictions are also in full swing. In the prediction market polymarket’s question “Will Bitcoin be approved before January 15th?”, 85% of the funds flowed to the “yes” option, and only 15% chose “no”. More than $3.3 million has been contributed to the forecast so far.