Original - Odaily

Author - loopy

Recently, Bitcoin mining computing power has been declining rapidly. Currently, Bitcoin mining hashrate is hovering around 440 EH/s, while the lowest it ever fell to was about 414 EH/s. In the past few days, Bitcoin’s computing power has dropped by about one-third from its recent highs.

(Image source: coinwarz)

As for industry participants, how will the decline in computing power affect the encryption market (Bitcoin cost price)?

Cold wave hits U.S., energy shortage threatens miners

On January 15, the Electric Reliability Council of Texas (ERCOT) publicly issued a warning that low power supply levels were expected due to continued cold temperatures, record-breaking power demand, and abnormal winds. ERCOT is asking Texas businesses and residents to conserve electricity when it is safe to do so. They also issued warnings indicating the possibility of localized power outages.

The occurrence of extreme weather poses a test to the power grid. Low temperatures, shortages in supply and surge in demand have pushed up electricity prices.

According to data from the power company Pennsylvania-New Jersey-Maryland Interconnection West Hub (PJM West Hub), electricity prices will jump from the usual price of about $35 per megawatt hour (MWh) during the cold wave. Up to around $158. Electricity prices are set to hit their highest levels since December 2022.

High electricity prices have also increased the cost of Bitcoin mining. At present, the United States is the region with the most concentrated and intensive Bitcoin computing power in the world. Therefore, the fluctuations in electricity prices caused by this cold wave have greatly affected the production of miners.

Take Foundry USA, the largest mining pool in the United States, as an example. The hashrate of this mining pool once dropped from about 150 EH/s on weekdays to a minimum of 77 EH/s. Mining company Luxor, also based in the United States, was also affected.

The impact of this cold wave has been most severe in Texas (the center of crypto mining). Marathon Digital, a well-known crypto mining company, also experienced a decline in computing power.

Marathon Digital executives told the media that many miners have shut down some of their mining machines and cut operating costs. “A large number of miners in Texas, including Marathon, have reduced operations in the past few days. We have reduced power consumption. to support the Texas grid and residential power during the current cold snap. In times of crisis, the energy load of Texas miners can be released in just minutes, freeing up energy supplies for others. This has been the case over the past few years. What we saw during the day.”

And this is not the first time this has happened. This is the highest next-day price for electricity at PJM West Hub since December 2022, when the price reached as high as $179 per megawatt hour. For reference, the average price in 2023 is $37 and the average from 2018 to 2022 is $42.

TheMinerMag reports that the miners retreat released about 4 gigawatts of electricity.

Will the cold wave return in 2022? How are the miners doing?

In December 2022, a massive cold snap called Elliott pushed natural gas use to record highs and caused the collapse of some electric and natural gas systems in the eastern half of the United States. The resulting closures of dozens of power plants and record-high electricity levels once jeopardized Bitcoin mining across the United States.

At that time, Texas electricity bills soared more than 400%. At the end of December, the BTC computing power dropped to 156 EH/s, and the computing power fell to the lowest point of the year.

The return of the cold wave this year reminds people of the winter dominated by the cold.

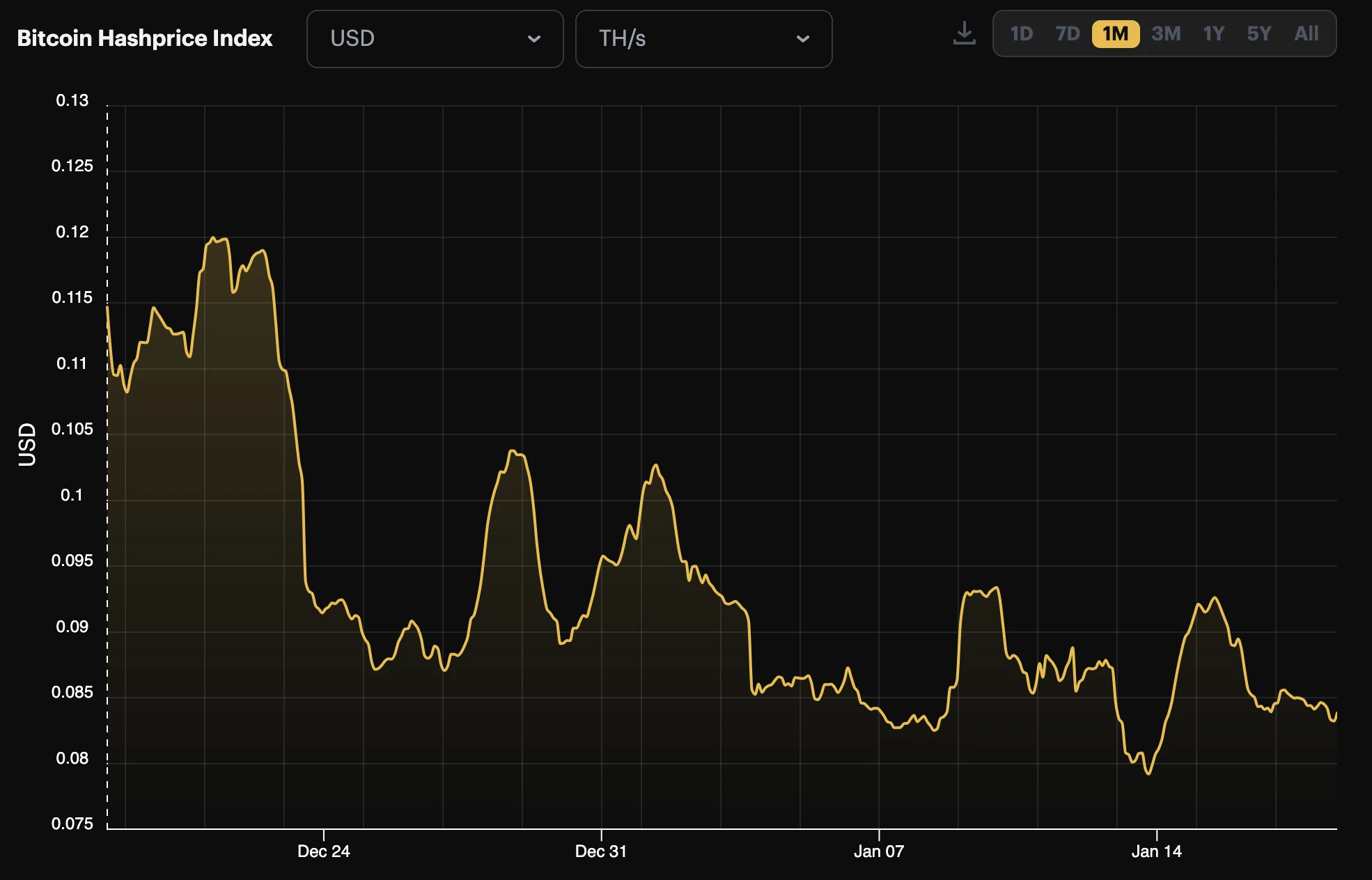

If we look at the larger time period, the income of miners is indeed gradually declining as the ETF effect disappears.

The value of a miner’s hash rate, or the dollar amount earned per unit of computing power produced, has fallen by about 30% in the past month.

The inscription craze brought about by BRC-20 once brought extremely high fee income to miners. The current popularity of inscriptions has come to an end, and miner fees are also decreasing.

According to data from BTC.com, the transaction fee of the entire Bitcoin network yesterday was approximately 104.6 BTC, a decrease of approximately 52% from three days ago (219 BTC).

Along with the reduction in computing power, the difficulty of BTC mining will also usher in a rare reduction. According to BTC.com data, the difficulty of the entire Bitcoin network is currently 73.2 T. The next adjustment is expected to be made in 2 days, and the difficulty is predicted to be adjusted to 70.92 T.

Although this blizzard is coming, it will only have a short-term impact. However, as the Bitcoin halving cycle approaches, the pressure faced by mining companies and miners will further increase. The halving is less than a hundred days away, and the average production cost of each Bitcoin after the halving is expected to be $37,856. Most miners will be challenged by the cost of selling and administrative expenses, with breakeven points expected to be around $40,000.

Judging from the current currency prices and market expectations, there is no pressure on the profitability of mining companies, but a decline in profit margins may be inevitable.