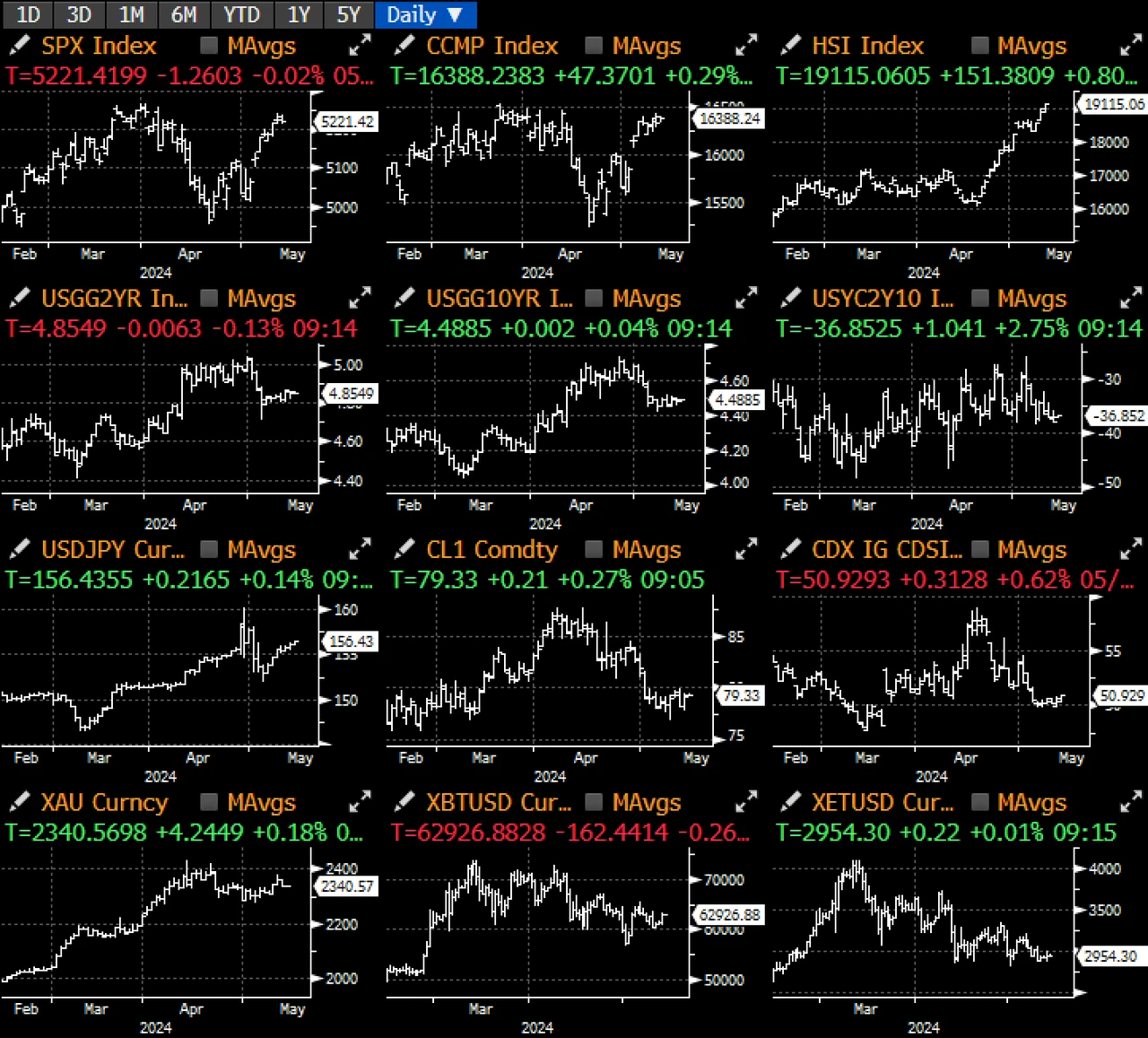

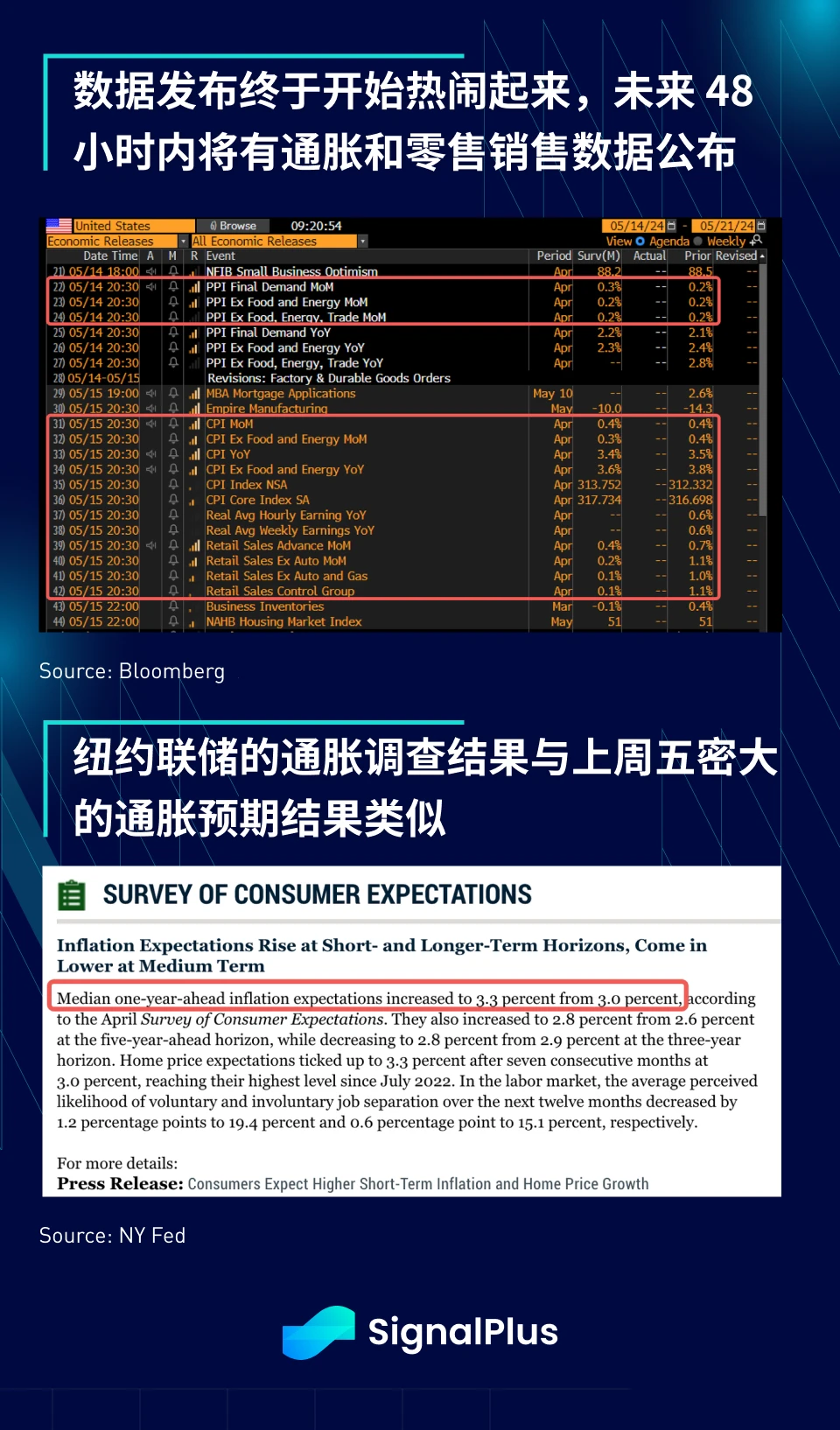

The market started the new week with a quiet trading day yesterday, but there will be several economic data releases that may affect the market in the next few days. PPI data will be released on Tuesday, followed by important CPI and retail sales data on Wednesday. Analysts are busy predicting the results of these indicators. At the same time, following the rise in inflation expectations in the University of Michigan consumer survey last Friday, the New York Fed consumer expectations survey also showed that inflation expectations for the next year rebounded to 3.3% (previously 3.0%), which is the first significant rebound in more than a year.

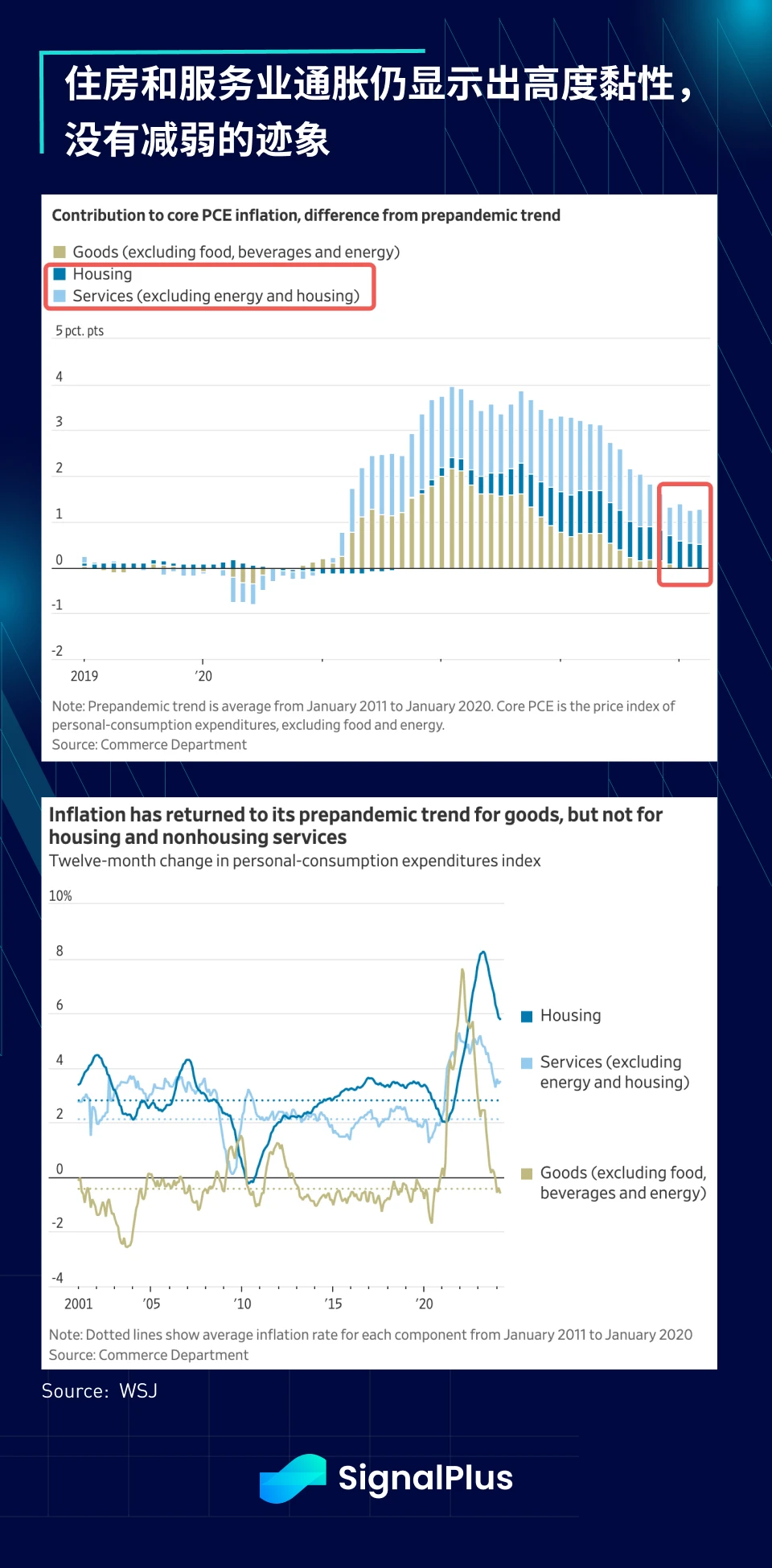

One thing that is evident in this cycle is that housing and services inflation are quite entrenched compared to historical data, with housing supply shortages, rising raw material costs and stubborn rental prices (has anyones rent dropped lately?) seemingly becoming the norm of our time, just as quantitative easing/loose monetary policy has in the past few decades. This situation is likely to keep the upcoming nominal inflation at a certain level, but as the Fed tends to endorse its dovish narrative, expect the market to over-analyze the data results, trying to find any subtle details or unexpected parts to fit the Feds narrative.

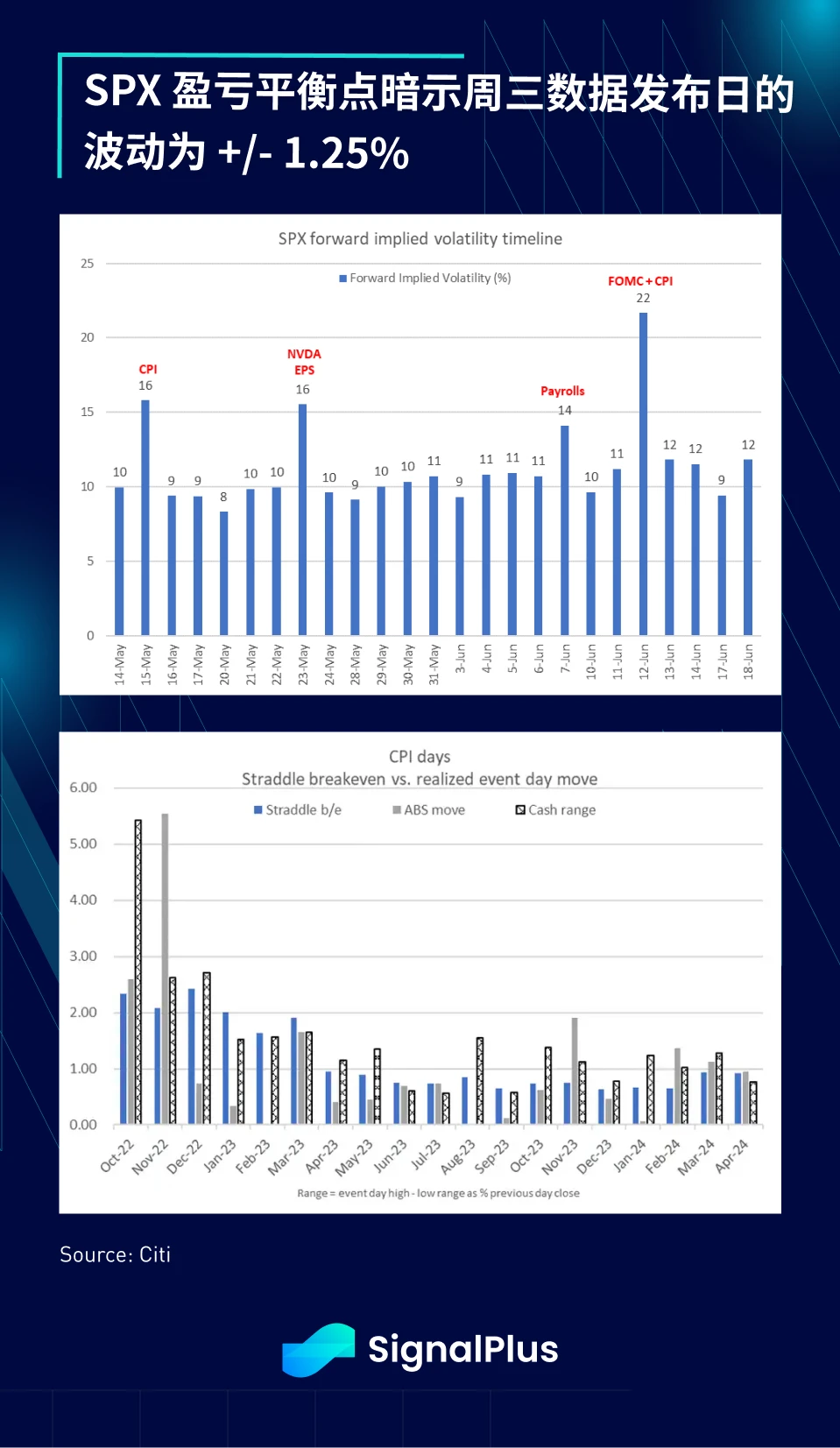

According to Citigroups calculations, the SPX has fluctuated +/-1.3% on average over the past 24 CPI release days, with actual fluctuations below the 1-day straddle breakeven point on about 40% of trading days and higher on 60% of trading days. The current straddle pricing is similar to March, with a breakeven point of about 1.25%, which is at the higher end of the recent range, but considering that CPI and retail sales data will be released on the same day, this expectation is also quite reasonable. Be careful when trading!

Beyond CPI, fundamental volatility measures for stocks remain favorable, with VIX and its second-order VVIX still in historically low percentiles, and convexity still leaning to the upside, in other words, SPX delivering stronger returns on up days, and the index not having a -2% daily decline since mid-February. Recent monthly and quarterly ranges are also among the lowest in nearly 40 years, while implied correlations are low. In short, the markets ideals remain alive and well, and market pricing is also incorporating more subtle and indirect Fed policy responses and adjustments from the smallest macro developments.

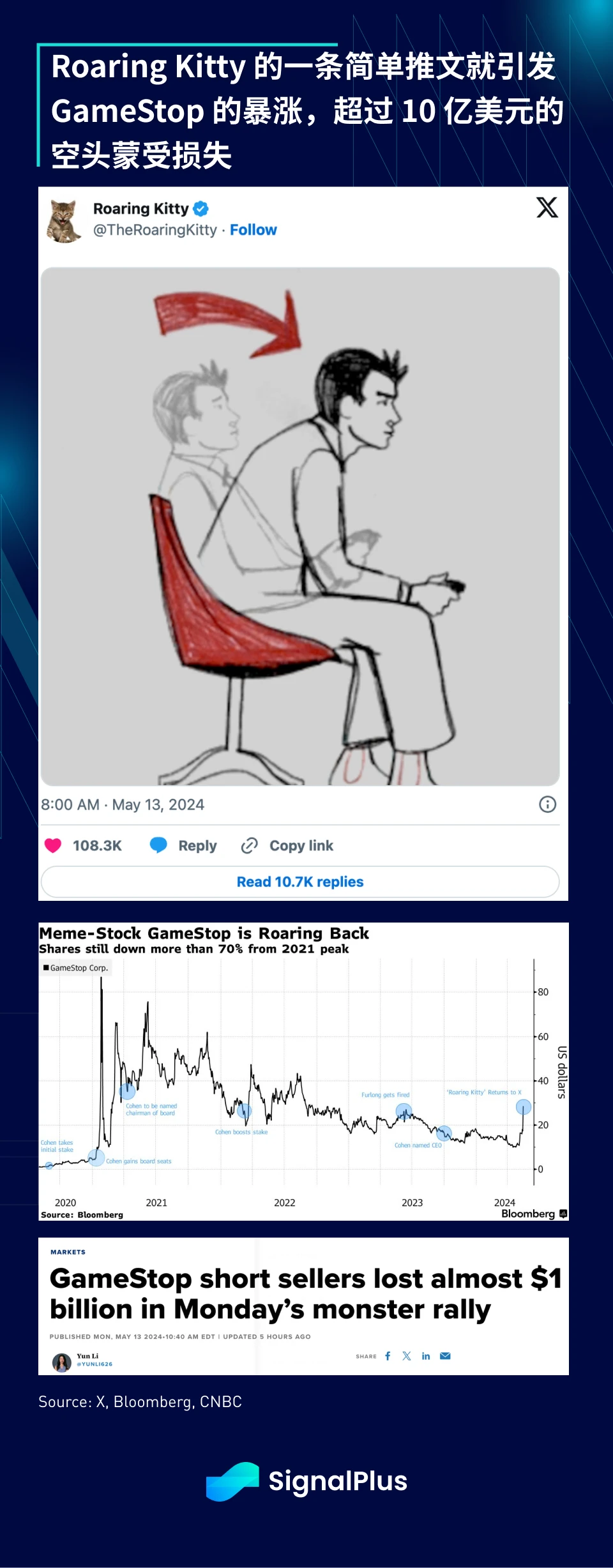

While the cryptocurrency craze has calmed down somewhat recently, the famous TradFi meme stock OG (Roaring Kitty) made a triumphant return on Twitter (X) yesterday, posting a simple meme with no accompanying information, but his appearance was enough to stimulate the price of Gamestop to surge by more than 100%, causing short sellers (professionals?) to lose more than $1 billion yesterday, which was reminiscent of the heady days during the epidemic. In the past month, the SPX index has risen only 2%, while the most shorted group of stocks has risen nearly 16%, and the 0 DTE call-put ratio has risen to more than 1, and trading volume is strong. Who is the ultimate winner?

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com