Original | Odaily Planet Daily

Author | Nanzhi

On May 13, Zest Protocol announced the completion of a $3.5 million seed round of financing , led by Tim Draper and participated by Binance Labs. It is reported that the protocol uses the Nakamoto upgrade of Bitcoin Layer 2 Stacks and the cross-chain asset sBTC to implement lending services that are completely native to the Bitcoin network. In recent years, Binance Labs has made very few investments in the Bitcoin ecosystem . Does Zest have any unique features? Odaily Planet Daily will analyze Zests business in this article.

Zest Parsing

Zest was founded in 2021, released the Zest Protocol prototype in the second quarter of 2023, and completed the audit in the fourth quarter. It will follow Stacks Nakamoto to upgrade its native Bitcoin lending service.

Zest Lending Program

Existing lending solutions on Stacks rely heavily on centralized entities. Lenders are usually a trusted committee or a consortium of custodians. The underlying operations are very opaque, and centralized organizations will incur additional fees, making lending activities uneconomical.

Stacks is about to undergo the Nakamoto upgrade, which solves the centralization problem mentioned above, and Zest Protocol will use this upgrade to create a native Bitcoin lending service. First of all, what is the Nakamoto upgrade?

Nakamoto is a milestone update for Stacks. After the update, the block time will be shortened to about 5 seconds (before the upgrade, it was consistent with Bitcoin, about 10 minutes or more). In addition, this upgrade will also introduce sBTC, a safe and efficient packaged version of Bitcoin that is naturally integrated with the Stacks consensus mechanism. Previously, depositing BTC was equivalent to depositing money to a centralized institution and delivering a token of the same name created separately on the network. The upgraded sBTC realizes a decentralized, trustless two-way anchor, which is equivalent to BTC being able to freely cross-chain between the Bitcoin mainnet and Stacks.

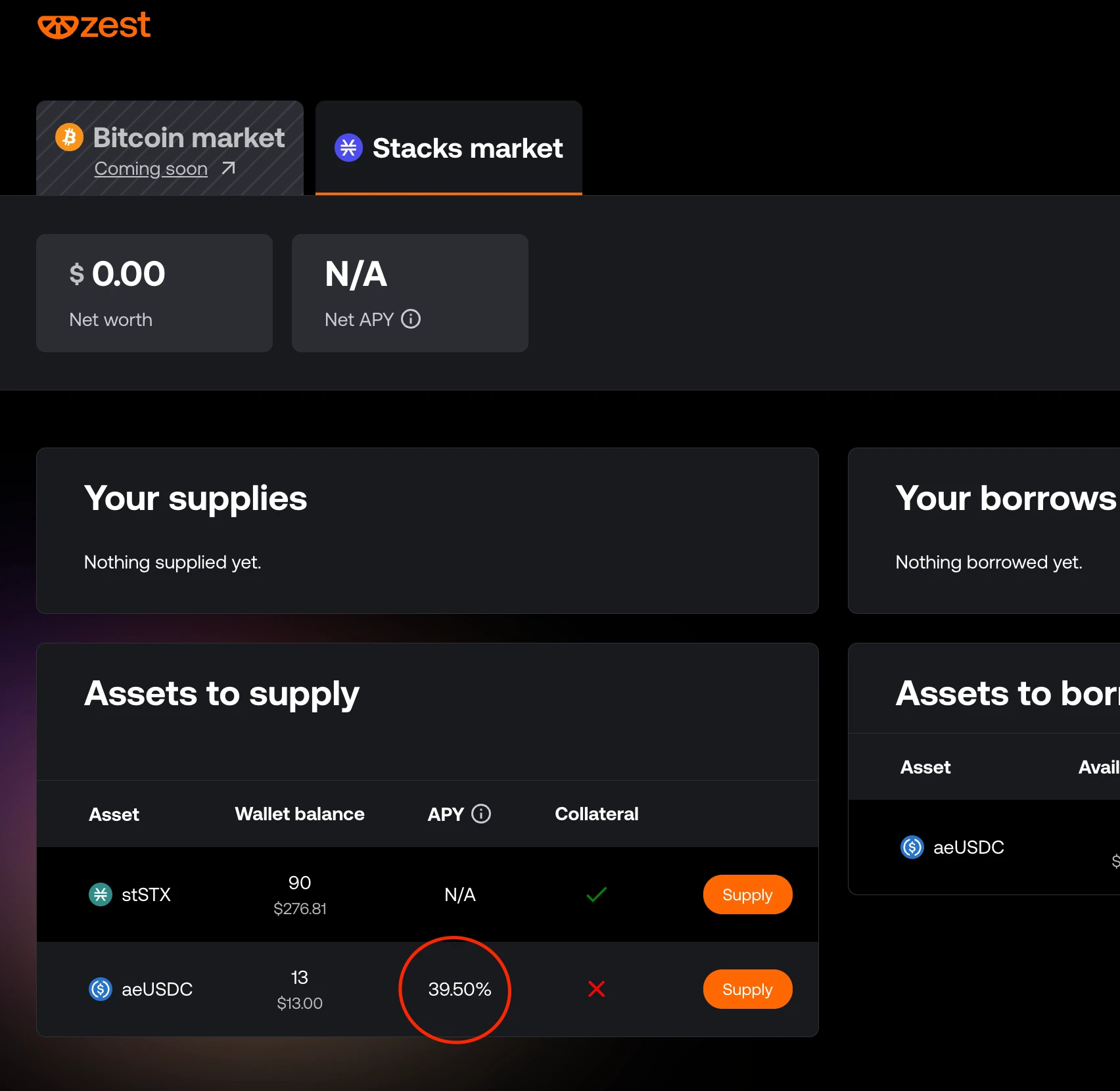

After the upgrade, Stacks has gained high BTC liquidity and network performance, and Zest will use this liquidity to carry out lending business. Users cross-chain native Bitcoin to obtain sBTC and enter Zests pool to obtain income.

Zests BTC liquidity pool is divided into two types: lending pool and income pool. The former is no different from the conventional lending model, adopting the form of pool-to-pool lending. Users borrow/lend in the corresponding currency pool and pay or receive corresponding interest.

In the Earn pool, users only participate as lenders. Zest introduces a third-party role for the Earn pool, namely Pool delegates, credit experts who initiate and manage liquidity pools. Pool delegates conduct due diligence and negotiate terms with borrowers. Pool delegates need to review the reputation, expertise, and performance of borrowers to evaluate loan terms. Once the borrower and the pool delegate agree on the borrower interest rate and collateral ratio, the pool delegate funds the loan from the pool it manages.

Borrowers in the yield pool are limited to institutions, including market makers, exchanges, centralized lending institutions, miners, and enterprises that accept Bitcoin payments. Borrowers need to contact the fund pool representative, join the permission whitelist, create a specific loan vault to deposit assets, and then submit a loan request. What is more special is that the yield pool also supports borrowers to extend the loan, that is, when the repayment date is approaching, a separate loan contract is signed to extend the loan, and only the interest due needs to be paid.

Financing

On May 13, Zest Protocol completed a $3.5 million seed round of financing, led by Tim Draper, with participation from Binance Labs, Trust Machines, Flow Traders, Hyperithm, Bitcoin Frontier Fund, DeSpread, Tykhe Block Ventures, Asymmetric, Primal Capital, Gossamer Capital, Scimitar Capital, etc. This is also the only round of financing so far.

Binance Labs recent investments in the Bitcoin ecosystem include BounceBit on April 11 this year, Babylon on February 27, and earlier, Lorenzo Protocol , invested at the end of 2022. Its investments in Bitcoin are relatively scarce.

He Yi commented on the investment: Zest Protocols technology meets the needs of Bitcoin holders and borrowers, unlocking the potential of Bitcoins programmability and interoperability. At Binance Labs, we are always looking for pioneers who lead the industry, and we look forward to seeing Stacks Nakamoto upgrade drive the growth of Zest Protocol.

“We aim to redefine Bitcoin lending,” said Tycho Onnasch, founder of Zest Protocol. “We are here to complete the long-unfinished task of migrating Bitcoin lending markets to the chain, which is where they belong.”

in conclusion

Zests business model is relatively traditional without any major innovations, but the bundled Stacks ecosystem is not fully developed but has high attention, has great market potential, and coupled with Binance Labs investment attributes, it is worth paying attention to.