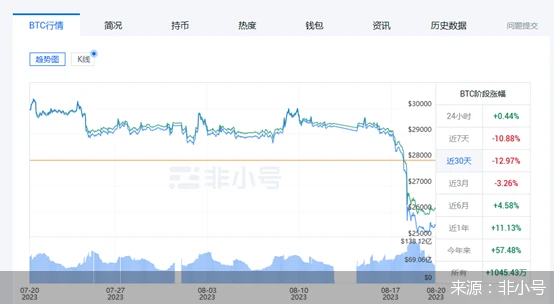

The current market continues to fluctuate, and the price fluctuations are quite obvious. Recently, the price of assets has been fluctuating, sometimes rising sharply, and sometimes falling sharply. For example, the price of Bitcoin may quickly fall from a high of tens of thousands of dollars to less than tens of thousands of dollars in a week. This large fluctuation makes investors feel uneasy.

The recent major trends present a complex situation. On the one hand, the prices of some mainstream assets have a certain upward momentum in the short term, but it is difficult to sustain and soon falls into a correction. On the other hand, although some emerging projects have attracted market attention, their price trends are also unstable due to the lack of sufficient technical support and application scenarios.

At the same time, the market trading volume has also fluctuated greatly. When prices rise, trading volume will increase rapidly, but as prices fall back, trading volume will shrink rapidly, showing that market participants lack confidence and are in a wait-and-see mood. In addition, the uncertainty of the policy environment has also had an impact on the market. The regulatory policies of different countries and regions have changed from time to time, further exacerbating market fluctuations.

1. Analysis of the causes of shock

1. Uncertainty in market regulation

Regulatory policies vary from country to country and are constantly changing. Some countries are open to technology and actively promote the formulation and improvement of relevant laws and regulations to promote its healthy development; while other countries are cautious or restrictive, and even take strict regulatory measures. This inconsistency and volatility of policies has brought great uncertainty to the market, making it difficult for investors to accurately judge the market trend, resulting in market fluctuations.

2. The complexity and volatility of capital flows

The flow of funds in the market presents a complex situation. On the one hand, the entry and exit of a large number of traditional financial institutions and large investment funds will have a significant impact on market prices. When these large funds pour in, they will push prices up; once they withdraw, they will cause prices to fall. On the other hand, the frequent inflow and outflow of short-term speculative funds has also exacerbated market volatility. These funds often pursue short-term high profits and operate more aggressively, further exacerbating the instability of the market.

3. Investor sentiment fluctuates

Investors have polarized attitudes towards stocks. Some investors are confident about their future development and actively participate in investment, while others are skeptical or fearful of them. When the market is good, optimism spreads, leading to overinvestment; when the market is bad, panic spreads quickly, triggering a large-scale sell-off. This extreme change in sentiment has caused an imbalance in market supply and demand, which has led to large price fluctuations and caused continuous market fluctuations.

2. Short-term operation of coping strategies

Stop Loss Setting

In short-term operations with volatile markets, stop loss setting is crucial. Fixed stop loss method can be used to set the loss amount to a fixed ratio, such as 5%, and close the position in time once the loss reaches this ratio. Time stop loss method is also an option. If the price does not rise as expected within a specific period of time after purchase, such as 3 days, the position should be resolutely exited. Technical stop loss method is based on key technical positions, such as important moving averages being broken, trend line tangents being broken, etc., to stop losses in time to avoid further losses. In addition, the balance point stop loss method can set the original stop loss position after opening a position. If the price rises, the stop loss position will be moved to the opening price, that is, the break-even point. In extreme cases, such as a fundamental turn in market fundamentals, an unconditional stop loss method should be adopted to exit at any cost to preserve strength.

Position Control

Position control is indispensable in short-term operations. The pyramid position management method can be adopted. The initial entry capital is large. If the market goes in the opposite direction, no more positions are added. If it goes in the same direction, positions are gradually added and the proportion is gradually reduced. The funnel position management method is that the initial entry capital is small, and when the market goes in the opposite direction, positions are gradually added and the proportion is gradually increased, but you need to pay attention to risks to avoid getting into trouble. The rectangular position management method is that the initial position capital accounts for a fixed proportion of the total capital, and subsequent position additions follow this proportion to evenly share the risk. In short, positions should be flexibly selected and adjusted according to market conditions and personal risk tolerance to ensure that short-term returns are achieved while controlling risks.

3. Medium- and long-term planning of response strategies

1. Selection of high-quality projects

In the context of continued market fluctuations, it is crucial to choose high-quality projects for medium- and long-term layout. First of all, we should pay attention to the technical strength of the project. Projects with advanced and innovative technologies often have an advantage in future competition. For example, projects with efficient consensus mechanisms, strong scalability and excellent security are more likely to stand out. Secondly, examine the application scenarios and implementation capabilities of the project. Projects that are closely integrated with the real economy, can solve practical problems and create real value have greater investment potential. For example, projects with practical application cases in the fields of supply chain finance, medical health, government services, etc. In addition, evaluate the background and experience of the project team. Team members have rich development experience, industry resources and good operational capabilities, which are important guarantees for the success of the project.

(II) Long-term trend judgment

Judging long-term trends requires a comprehensive consideration of many factors. At the macro level, pay attention to the global economic situation, the direction of policies and regulations, and the trend of technological innovation. For example, the continuous strengthening of support policies for technology in various countries may indicate that the industry will usher in a broader space for development. At the industry level, analyze the application progress and market acceptance of technology in different fields. When more and more traditional industries begin to adopt technology for upgrading and transformation, it means that the industry is maturing. At the technical level, pay attention to technological breakthroughs and innovations, such as the development of cross-chain technology and privacy protection technology. At the same time, the markets capital flow and investor sentiment are also important references for judging long-term trends. However, it should be noted that the judgment of long-term trends is not achieved overnight and requires continuous tracking and analysis.

(III) Asset allocation and risk management

The mid- to long-term layout does not mean to concentrate all funds on a single project, but to make reasonable asset allocation. You can choose projects of different types and different application fields to reduce the risks brought by a single project. At the same time, determine the proportion of each project in the investment portfolio according to your personal risk tolerance and investment goals. In terms of risk management, set reasonable stop loss and stop profit points to avoid suffering too much loss or missing profit opportunities in market fluctuations. In addition, regularly evaluate and adjust the investment portfolio, and optimize asset allocation in a timely manner according to the development of the project and market changes.

4. Mentality adjustment and risk control

1. Maintain a positive attitude

In the case of continued market fluctuations, it is crucial to maintain a good mentality. First of all, we must realize that market fluctuations are normal, and we should not be overly anxious or excited because of short-term price fluctuations. Avoid blindly following the trend and chasing ups and downs, and have your own judgment and decision-making basis.

Secondly, dont be too concerned about temporary gains and losses, and look at the market from a long-term investment perspective. Dont be dazzled by short-term profits, and dont lose confidence because of short-term losses.

At the same time, we must learn to accept failure and mistakes. Mistakes are inevitable in the investment process. We must summarize experience and lessons in a timely manner, adjust strategies, and move forward.

2. Risk control methods

1. Diversify your investments

Dont invest all your money in one project or one asset. Diversified investments can reduce the risk of fluctuations in a single asset. You can choose projects of different types, fields, and development stages for investment.

1. Set risk thresholds

According to your own risk tolerance, set a clear risk threshold. When the investment loss reaches a certain proportion, resolutely implement the stop loss operation to avoid further loss.

1. Regular evaluation and adjustment

Evaluate the investment portfolio regularly and adjust investment strategies and asset allocation in a timely manner according to market changes and project development to adapt to new risk conditions.

1. Learning and improvement

Keep learning knowledge and investment skills to improve your ability to identify and respond to risks. Pay attention to market trends and industry research reports to make more informed investment decisions.

In short, in an environment of market volatility, a good mentality and effective risk control are the key for investors to achieve long-term stable returns.

V. Future Outlook

1. Technological innovation drives industry development

As technology continues to advance, it is expected to achieve major breakthroughs in performance, security, and scalability. For example, the application of new consensus algorithms and encryption technologies will improve transaction processing speed and data security, and the development of technologies such as side chains and lightning networks will enhance scalability and lay the foundation for large-scale commercial applications.

2. Expansion and deepening of application scenarios

Applications in the fields of finance, supply chain, medical care, government affairs, etc. will continue to expand and deepen. In the financial field, decentralized finance (DeFi) is expected to further change the traditional financial service model; in the supply chain field, it will achieve more efficient traceability and supply chain management, reduce costs and risks; in the medical field, it will promote the safe sharing and management of medical data and improve the quality of medical services.

3. Improvement and standardization of the policy environment

As countries gain a deeper understanding of technology, relevant policies and regulations will become more complete and clear. This will provide a more stable and predictable policy environment for the development of the industry and attract more traditional companies and institutions to participate.

4. Market consolidation and maturity

With the development of the market, industry competition will intensify, some projects with weak technical strength and unclear application scenarios will be eliminated, the market will gradually concentrate on leading companies and high-quality projects, and the industry as a whole will become more mature and standardized.

5. Integration with other technologies

It will be deeply integrated with artificial intelligence, the Internet of Things, big data and other technologies to create more innovative and valuable application scenarios. For example, the combination with the Internet of Things will enable trusted interaction and data sharing between devices, bringing new development opportunities to smart cities, industrial Internet and other fields.