Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

In the early morning of September 2, Beijing time, Ethena Labs, the developer of USDe, officially announced that the second season of airdrops has officially ended, and ENA tokens accounting for 5% of the total supply of ENA will be distributed to all users who participated in this seasons activities this month. In addition, Ethena Labs also announced that it will immediately launch the third season of airdrops. The new season of activities has now begun and will last until March 23, 2025.

Season 2 Airdrop Review

On April 1 this year, Ethena Labs announced the launch of the second season of Sats, an airdrop event. This seasons event uses multiple standards for the end time, and can last until September 2 (5 months) or until the supply of USDe grows to 5 billion, whichever comes first.

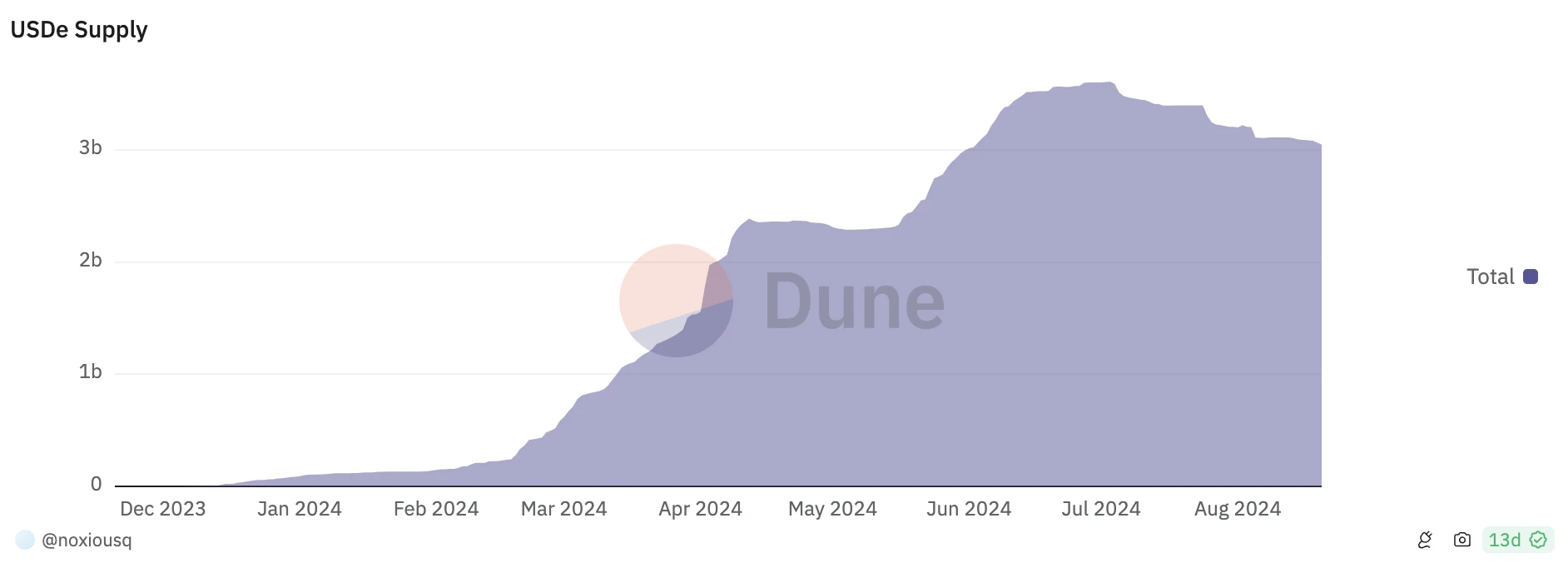

Although USDe maintained a relatively strong growth trend in the early stage of the second season (at one point it grew to $3.6 billion in early July), as the market downturn drove down funding rates, USDe supply also gradually shrank as yields decreased. In the end, USDe failed to reach a supply level of 5 billion before September 2, and the seasons activities also ended today, the latest time node.

During the second season of activities, the supply of USDe eventually grew from 1.3 billion to 3 billion. The Ethena protocol generated more than $105 million in revenue during this period and distributed $54 million in rewards to the sUSDe staking contract, with an average APR of approximately 15%.

At the same time, USDe has achieved further expansion in both DeFi and CeFi directions, and has expanded to new chains such as Solana, Mantle, Blast, Arbitrum, Base, and leading projects such as Aave, Symbiotic, and LayerZero, and has been accepted by Bybit and Bitget as new collateral.

According to the official announcement of Ethena Labs, users who participated in the second season of the event will be able to view the ENA airdrop share on claim.ethena.fi on September 9 and claim their ENA airdrop from September 30.

Similar to the first season airdrop, the top 2,000 addresses in the airdrop ranking will have a 50% lock-up limit, and the locked-up shares will be unlocked linearly within 6 months.

It is worth mentioning that although the snapshot of the second quarter airdrop has been completed, before the token distribution is completed, if the USDe balance in the users wallet is lower than the 30-day average balance at the September 1 snapshot, the airdrop share obtained will be reduced proportionally (calculated by the gap percentage) , and the reduced share will be redistributed to other users who have locked ENA or sENA (new concept, detailed below).

In addition, Ethena Labs also mentioned that users will have 30 days to claim unclaimed ENA (excluding the locked portion).

Outlook for Season 3 Airdrops

Ethena Labs officially mentioned that users can start accumulating airdrop points for the third season starting from September 2. The season activity will last until March 23, 2025 (6 months). Users who participated in the first or second season activities will receive a 10% bonus on points in the third season activities. However, Ethena Labs has not yet mentioned the total amount of ENA allocated to the third season.

Similar to the previous two seasons, users can accumulate points for the third season by holding (USDe), staking (sUSDe), liquidity configuration (lending, LP) or other leverage methods (Pendle). Ethena Labs has stated that it will update the different points multipliers for various participation methods on the front end as soon as possible . The general multipliers for some participation methods are as follows:

USDe held in any application listed on the Ethena Liquidity dashboard (such as Morpho, Aave, Pendle, or Curve LP) will receive 20x rewards;

sUSDe held in applications such as Morpho, Aave, or Curve LP will receive 5x rewards;

For any new USDe Pendle pool, if the expiration time is 3 months from the date of the pool launch, the reward will be 25 times, and if it is 6 months, the reward will be 30 times;

For any new sUSDe Pendle pool, if the expiration time is 3 months, you will receive a 20x reward, and if it is 6 months, you will receive a 25x reward.

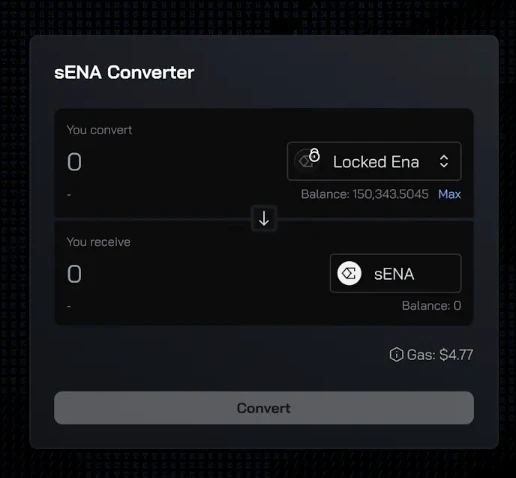

In addition, Ethena Labs will introduce the sENA mechanism at the beginning of the new season.

sENA is essentially a liquidity voucher token with a 7-day unlocking cooldown period. In the previous second season event, Ethena Labs allowed users to obtain higher points by locking ENA. The lock of ENA also has a 7-day unlocking cooldown period, but the locked ENA will no longer have liquidity. Compared with the mechanism of locking ENA, sENA feels the same in terms of unlocking cooldown, but it can continue to retain liquidity and invest in various other DeFi protocols.

In the third season airdrop event, sENA will receive a maximum multiplier reward of 40 times. Ethena Labs will provide a migration tool for users who lock ENA, so that they can convert the locked ENA directly into sENA, thereby earning more rewards in the third season event.

In summary, Ethena Labs third season activities have certain differences in the details of execution compared to the second season activities (mainly reflected in sENA), but there is not much difference in the corresponding strategy.

Odaily Planet Daily previously wrote an article about the second season activities, Analysis of Ethenas Second Season Mining Yield, 400% +APY is not a dream? , outlining three different mining strategies: low, medium, and high. Although with the sharp drop in the price of ENA, todays figures may be quite different, but the general operation mode is no different. Interested readers can use this article as a reference.