OKX has teamed up with high-quality data platform AICoin to launch a series of classic strategy research, aiming to help users better understand and learn different strategies and avoid blind use through analysis of core dimensions such as data measurements and strategy characteristics.

Time-weighted strategy and iceberg order strategy are two common trading strategies for splitting large orders, which are particularly suitable for block trading and quantitative trading.

The time-weighted strategy is a strategy that splits large orders and then takes orders in different time periods. Its purpose is to evenly distribute large orders within a specified time period to minimize the impact on market prices. The basic principle is to split a large order into multiple smaller orders and execute them sequentially within a preset time interval, so that the average price of the entire transaction process is close to the average price of the market. This strategy can effectively avoid the market impact caused by a one-time order and reduce the risk of slippage. It is usually suitable for traders or institutional traders who want to avoid excessive impact of market fluctuations on transaction prices.

The Iceberg Order Strategy is a strategy of splitting large orders and placing orders in batches. Its purpose is to hide the actual trading volume. Large orders are divided into multiple smaller visible orders to prevent other market participants from noticing the intention of large transactions, thereby avoiding drastic fluctuations in market prices. The basic principle is to break down a large transaction order into several small sub-orders and only show a part of them to the market. When a sub-order is fully executed, the system will automatically generate the next sub-order until the entire large order is completed. This makes the market only see the tip of the iceberg and hides the true size of the order. It is usually suitable for institutional traders who want to hide their strength or traders with large capital.

In short, in actual trading, two different strategies can be selected according to different usage scenarios to better manage the execution of large orders. By dispersing the time impact through the time-weighted strategy and hiding the trading volume with the iceberg strategy, traders can effectively control market shocks and slippage risks while protecting trading intentions. These strategies are widely used in high-frequency trading, institutional trading, and large order execution, and are particularly suitable for use in market environments with poor liquidity or high volatility.

Pros and cons comparison

In general, the time-weighted strategy has multiple advantages in practical applications. First, the market impact is small. Large orders are divided into multiple small orders according to the time period and executed gradually, which reduces the impact on market prices. Second, price smoothing. By dispersing the trading time, it is possible to avoid drastic price fluctuations caused by large trading orders, thereby obtaining a more average transaction price. Third, it is easy to understand. The strategy logic is relatively simple, easy to understand, and simple to operate. It can be used with one click on the OKX platform. Fourth, it is highly controllable. You can set the price, time interval, quantity, etc. according to your own needs to improve the flexibility of execution.

However, its disadvantages are also relatively obvious. For example, execution risk. Since it is executed in batches at regular intervals, if the market fluctuates violently, it may not be possible to obtain the best price, etc. AICoins time-weighted strategy can randomize the time interval and transaction quantity during operation, making the strategy more difficult to identify and sniper.

The iceberg order strategy also has multiple advantages in practical application. First, hiding the real intention. The iceberg order strategy divides a large order into multiple small orders and gradually releases them in the market, effectively hiding the actual size of the large order and reducing the risk of being discovered and exploited by the market. Second, gradual execution. The gradual execution of orders helps to reduce the impact of large transaction orders on market prices and obtain better transaction prices. Third, flexibility. The displayed order quantity and frequency can be adjusted according to market conditions, and it is highly adaptable.

Of course, the iceberg entrustment strategy also has disadvantages. For example, liquidity risk. Since only a part of the orders are exposed, if the market liquidity suddenly drops, the orders may not be executed in time, etc. AICoins iceberg entrustment strategy can randomize the order position, order interval and transaction quantity during operation, making the strategy more difficult to identify and snipe.

Theoretical analysis - performance of the two major strategies in bull and bear markets

First, a theoretical analysis of the performance of time-weighted strategies in bear and bull markets.

1) Performance in a bull market

In a bull market, the time-weighted strategy avoids the impact of large purchases on the price of the currency by entrusting in batches, thereby reducing the purchase cost. This strategy can achieve better excess returns in a bull market.

2) Performance in a bear market

In a bear market, the time-weighted strategy is more defensive. By setting a limit price for taking orders, you can avoid taking orders at too high a price in a bear market, thereby reducing the risk of losses. At the same time, batch entrustment in a bear market can also better grasp the low point and increase profit opportunities.

In general, time-weighted strategies have significant advantages in dynamic environments. If the users main goal is to disperse the market impact of large orders and execute them gradually over a longer period of time, time-weighted strategies are a good choice, but it is necessary to pay attention to the risks brought by market fluctuations.

Secondly, theoretical analysis of the performance of the iceberg strategy in bear and bull markets.

1) Performance in a bull market

In a bull market, the market is generally bullish, the buyer power is strong, the market is active, and the liquidity is high. The iceberg strategy can effectively hide the actual size of large buy orders and avoid the market from pushing up prices, so that in the rising market, it can buy in batches at relatively low prices. However, if the market price rises rapidly, the exposed small orders may not be fully executed, resulting in failure to buy at a lower price and unable to get on the train.

2) Performance in a bear market

In a bear market, the market is generally bearish, the sellers are strong, the market transactions are relatively quiet, and the liquidity is low. The iceberg strategy can effectively hide the actual size of large sell orders and avoid panic selling in the market, so as to sell in batches at relatively high prices in a falling market. However, due to low liquidity, the small orders of iceberg orders may be difficult to execute quickly, increasing the risk of pending orders not being executed, and there is also the possibility of not being able to get off the train.

In general, if you want to hide the true size of large orders and avoid market reversals, the iceberg order strategy is very suitable, especially in high-frequency trading.

OKX Two Major Strategy Entrances

Currently, OKX strategy trading provides convenient and diverse strategy products.

The OKX Iceberg Strategy uses a more dynamic and flexible order placement method, rather than simply placing orders based on price distance or ratio. This order placement method can significantly reduce slippage and better hide trading intentions. In addition, the OKX Iceberg Strategy provides a variety of order placement methods, including faster transactions, balanced transaction speeds, and better prices. Users can choose according to their preferences and needs. In general, the OKX Iceberg Strategy has many core advantages, such as large order splitting, hidden transactions, reduced slippage, and customized order preferences.

The characteristics of OKXs time-weighted strategy are: splitting large orders, placing orders at regular intervals, and reducing slippage. The advantage of this strategy is that it will split large transactions into many transactions, enter the market to take orders at different times, and avoid a single order stimulating the market; when the price meets the set conditions, it can be quickly traded by taking orders. Moreover, these orders are entered in the IOC mode. IOC (Immediate Or Cancel) means to trade immediately and cancel the remaining orders. The part of the order that is not traded immediately will be canceled immediately. For example, if the number of orders is 2 and only 1.6 are traded, the remaining 0.4 will be canceled immediately to minimize slippage. Time-weighted orders can be used not only in spot, but also in perpetual contracts, delivery contracts, and leveraged trading. They have a very wide range of uses.

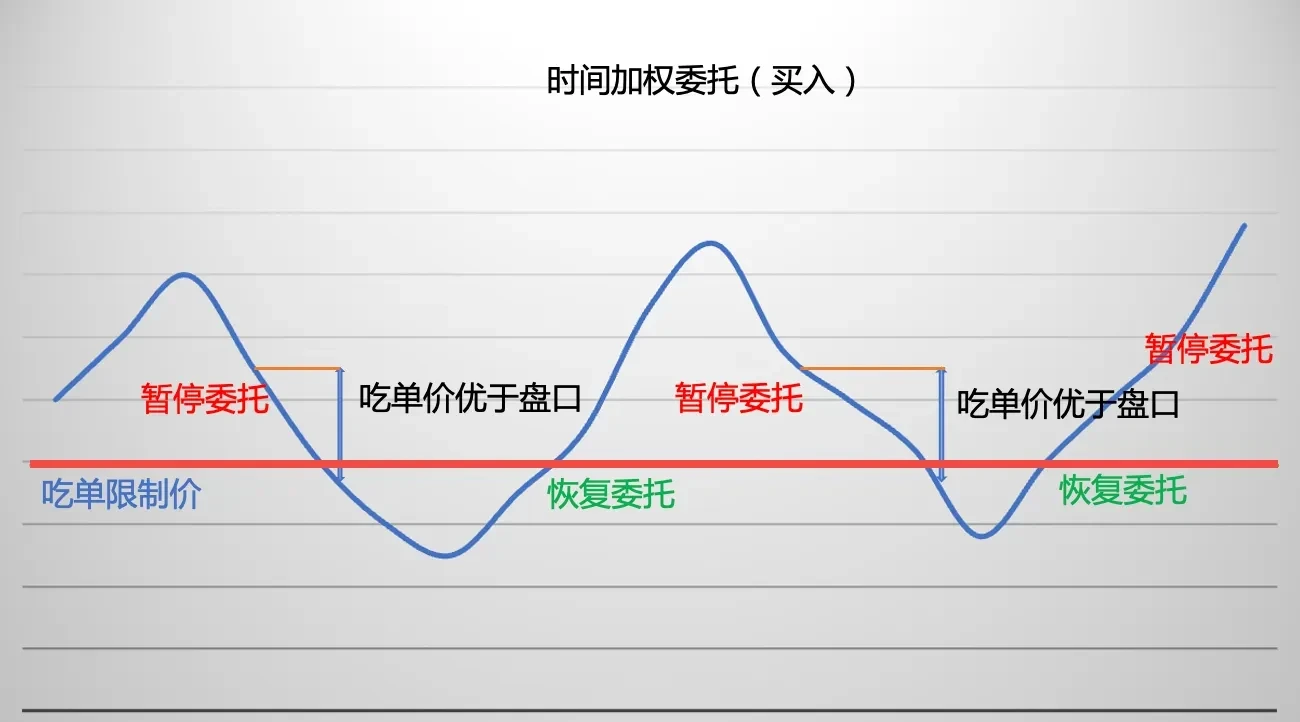

For example, how does OKX time-weighted delegation work?

Take buying as an example. When the market price is above the taker limit price, the order is suspended. When the market price is below the taker limit price, the strategy resumes the order, calculates the order price based on the current latest buy price and the price you set, and then entrusts a small order to take the order. When the price continues to be below the limit price of the pending order, the order will be placed regularly until the transaction quantity is equal to the total amount of the order.

Diagram of time-weighted buy order

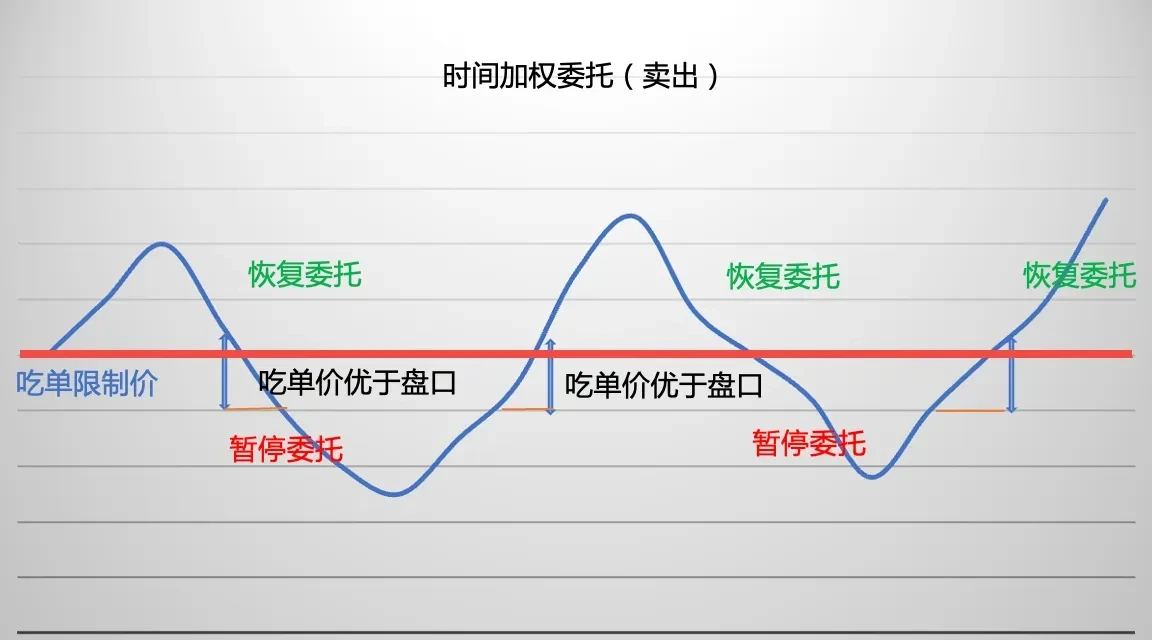

Take selling as an example. When the market price is below the taker limit price, the order is suspended. When the market price is above the taker limit price, the strategy resumes the order, calculates the order price based on the current latest ask price and the price you set, and then entrusts a small order to take the order. When the price continues to be above the limit price of the pending order, the order will be placed regularly until the transaction quantity is equal to the total amount of the order.

Time-weighted sell order diagram

How to access OKX Strategy Trading? Users can enter the Strategy Trading mode in the Trading section through the OKX APP or official website, and then click on the Strategy Square or Create Strategy to start the experience. In addition to creating strategies by yourself, the Strategy Square currently also provides Quality Strategies and Quality Strategies with Strategy Leaders. Users can copy strategies or follow strategies.

OKX strategy trading has multiple core advantages such as easy operation, low fees and security. In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically; and provides graphic and video tutorials to help users quickly get started and master them. In terms of fees, OKX has comprehensively upgraded the fee rate system to significantly reduce user transaction fees. In terms of security, OKX has a security team composed of top global experts who can provide you with bank-level security protection.

How to access AICoins strategy?

How to access AICoin Strategy Trading? Users can go to the AICoin homepage, enter the Trading mode on the right side of the Quotes section, and then click Smart Order Splitting to start the experience. In addition to the smart order splitting strategy, Community Indicators also provides many high-quality indicators that users can search and add as My Indicators.

AICoin provides intelligent parameters to help users set trading parameters more scientifically, and provides graphic and video tutorials to quickly get started. Intelligent order splitting has the advantages of flexible order placement, order interval as short as 0.3 seconds, and highly hidden order splitting numbers that cannot be monitored by opponents.

Disclaimer

This article is for reference only and represents the authors views only, not the position of OKX. This article is not intended to provide (i) trading advice or trading recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/trading professional for your specific situation. Please be responsible for understanding and complying with local applicable laws and regulations.