Cryptocurrency enters its teen years

Recently, Ethereum co-founder Vitalik Buterin gave a speech at the TOKEN 2049 conference, discussing topics such as the usability of cryptocurrencies, the use of cryptocurrencies as a means of payment, and the security of the entire ecosystem. He believes that cryptocurrencies are no longer in the initial development stage, but their usability is still in the early stages and the actual usability is increasing. Cryptocurrencies have entered the teenage period, but they are still slow in terms of usability, which is largely due to the high transaction fees and clumsy user interfaces in the past.

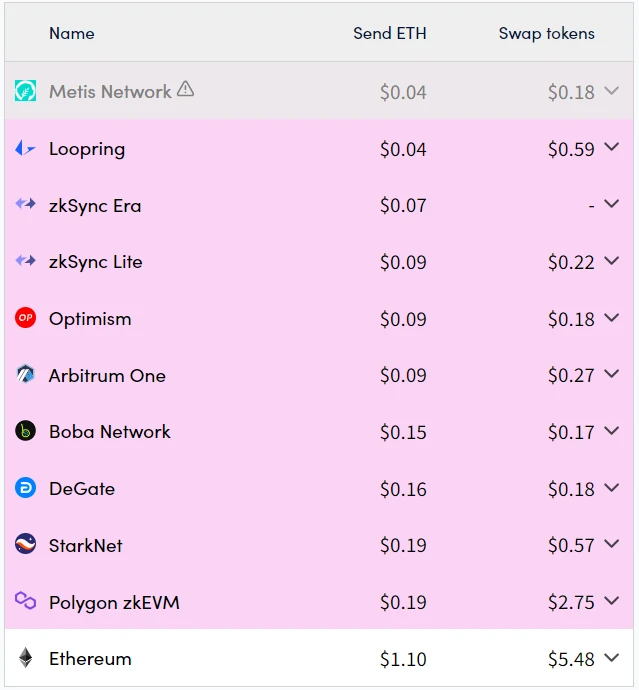

The success of Ethereum L2 and its low fees

Vitalik said that during the peak of network congestion, Ethereum gas fees had soared to more than $200. In the past, he was forced to pay more than $800 for a single transaction in order to protect the privacy of the transaction, but now this situation no longer exists, thanks to the development of Ethereum L2. L2 transfers some transactions from the main network to the second-layer blockchain, which is crucial to reducing the cost of the Ethereum main network and improving its scalability.

Recently, there have been voices in the industry questioning whether the development of Ethereum L2 has weakened Ethereum L1. However, according to vitalik, L2s low transaction fees are an important milestone for the entire Ethereum ecosystem because it solves the main challenges of mainstream adoption. Currently, the reason why L2 ecosystems such as Optimism and Abritrum are booming is that they have successfully reduced fees to less than $0.1. Not only that, rollups have also achieved this milestone, making transactions more secure and users can afford their low fees.

Meeting mainstream needs while maintaining decentralization

In addition to transaction costs, Vitalik also talked about Ethereum’s success in transaction “time.” After the Ethereum merge and the transition to Proof of Stake, the average wait time for the next block was successfully cut in half, which brought transaction wait times down to 5 to 15 seconds, and transaction times on the Ethereum L2 network down to about 1 second.

Vitalik also mentioned that another common challenge in the cryptocurrency industry is meeting demand while maintaining decentralization.

It is worth noting that Vitalik recently published a post on X, hoping that Ethereum L2 will be more decentralized. He believes that in practice, L2 should inherit the security of L1 on which they are based. The current problem is that although Ethereum L1 is decentralized, L2 based on Ethereum is not necessarily decentralized. In fact, it is difficult for L2 to be as decentralized as L1. For example, Coinbases Base chain, it also presents itself as Ethereums L2.

Vitalik said that starting in 2025, he will only publicly recognize L2s that have reached Stage 1 or higher in decentralization work, which requires 75% consensus of the council to overturn the proof system, and at least 26% of the council members must be independent of the rollup team. He believes that this requirement is reasonable and necessary for the security of the network. Moreover, other L2s focusing on zero-knowledge technology are also approaching Stage 1.

Ethereum’s “UX Revolution” and Development Direction

Vitalik also highlighted the advancement of account abstraction technology, as well as the user experience revolution. At present, mainstream society still has reasons not to use crypto assets, such as cryptocurrency is inefficient, but this is not due to the limitations of technology. Blockchain is already empowering the Internet and acting as digital concrete (blockchain can create a digital hardness, creating a durable digital structure that is strong and resistant to destruction, just like using concrete to create a hard physical structure).

In fact, currently a user can create a simple real account (smart contract wallet) from which transactions can only be sent if the user generates a proof that they control a specific email address. So now it is basically possible to bring the social recovery capabilities of Web2 to the Web3 world.

Vitalik also mentioned the need to improve the security of wallets, especially to protect them from centralized actors. He commented on the extreme self-sovereign wallets (mnemonic cold wallets) or the traditional options of relying on trusted third parties (CEX), arguing that both options have inherent flaws.

In contrast, he believes that multi-signature smart wallets are a more compromise solution. By requiring multiple private keys to authorize transactions, multi-signature wallets can provide enhanced protection for user funds while still maintaining a high degree of privacy. (Note: Multi-signature security means that users have multiple keys, for example, there are 6 keys, and 4 are required to send transactions. Custom rules can even be set, and only 1 key is required for small transactions).

In addition, Vitalik also talked about the technical improvements being made on the Ethereum mainnet, such as enhanced decentralization, reduced confirmation times, and improved scalability, which will play a key role in the future success of Ethereum.

According to his prediction, the Ethereum ecosystem will develop in the direction of social networks, payment systems, private mining pools, zero-knowledge and human proof technologies in the future, while being both decentralized and practical.

Let us wait and see as this adolescent agreement gradually matures.