The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

On September 18, the Federal Reserve started a rate cut cycle, with the first rate cut being 50 basis points. This marks the end of the rate hike cycle that started in March 2022, and also means that the Federal Reserve and the US government believe that the task of recovering liquidity from the over-issued currency due to the epidemic has been successful, and the focus has shifted to the negative effects of this strong medicine - damage to the economy and employment. One of the best ways to prevent economic damage is to return the money supply to the expansion cycle.

On September 24, the Chinese government announced an unprecedentedly aggressive monetary policy for the economy, stock market and real estate market, increasing liquidity release on the basis of the original interest rate cut and reserve requirement ratio cut. This means that the worlds second largest economy has decided to combat sluggish consumption, falling real estate and rising employment rates by strongly increasing money supply and promoting equity market growth. The record-breaking strong rebound of the Chinese stock market (including Hong Kong stocks) has attracted the attention of the global capital market and capital flows.

Together with the European Central Bank, which has already cut interest rates, three of the worlds four largest central banks have already started monetary easing policies. The total amount of money issued under their control is about 23 trillion US dollars, accounting for about 20% of the worlds total money issued.

It is of great significance that 2024 is the year when major central banks around the world turn to monetary easing. This shift is a necessary means to revive the economy in the post-epidemic era, and it is also the starting point for a new round of asset value revaluation.

As an emerging equity market, Crypto assets will also see a revaluation in the context of monetary expansion. EMC Labs is cautiously optimistic about the market outlook, and believes that the crypto market, which has been fully adjusted internally, will enter the second half of the bull market during the interest rate cut cycle.

US dollar, US stocks, US bonds and gold

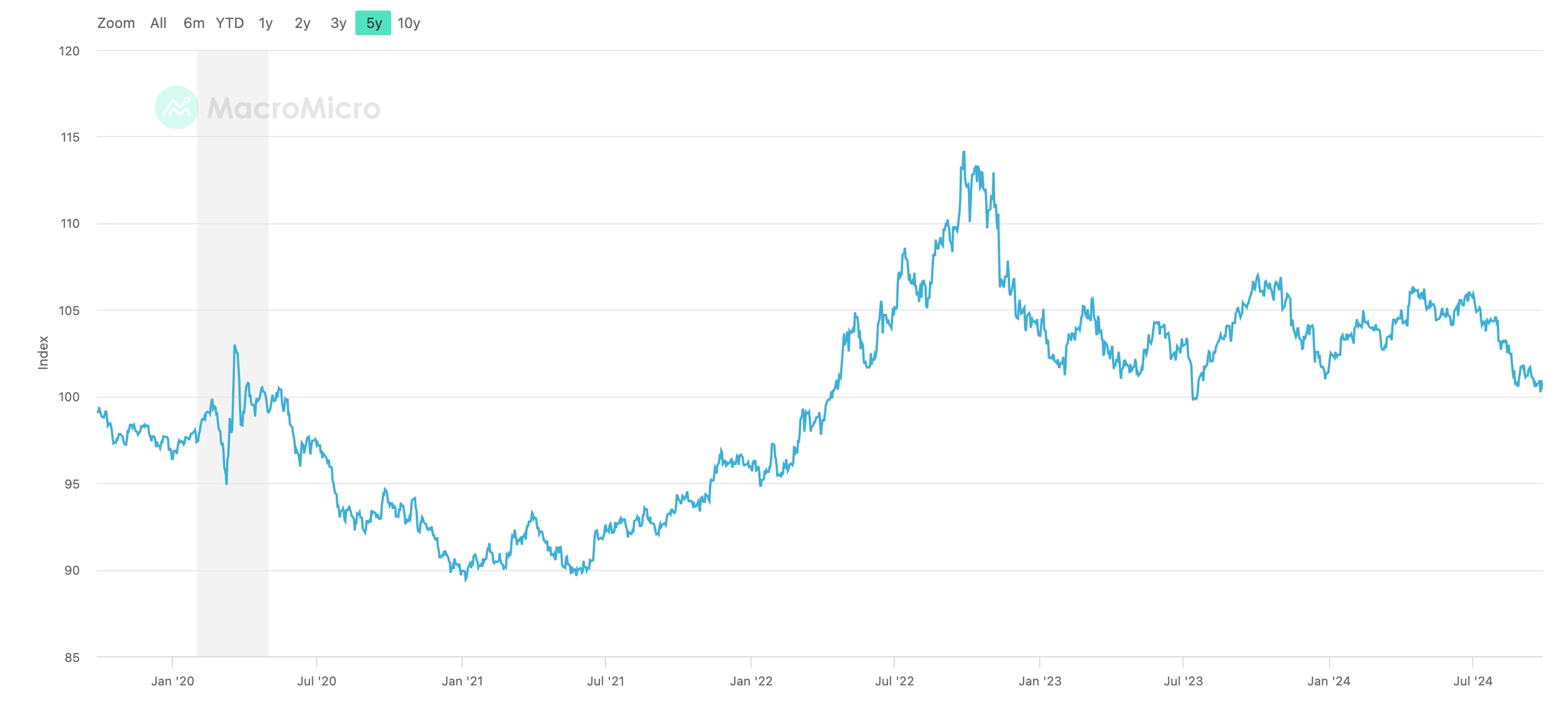

US Dollar Index

After the rate cut started, the US dollar index rebounded slightly and then resumed its downward trend. By the end of the month, it approached the 100 mark again, returning to the point in April 2022. As the rate cut continues, it may only be a matter of time before it falls below 100.

Thanks to the advance pricing of the equity market, the US stock market spent September relatively smoothly. The three major indexes all experienced violent fluctuations in July, August and September to rebalance the differences of various funds. In the monthly cycle, the Nasdaq and Dow Jones gained 2.68% and 1.85% respectively. However, due to the advance pricing, the stock index did not achieve a sharp rise. A reality that must be faced is that the current valuation of US stocks has already reflected a certain degree of interest rate cut expectations and does not appear to be cheap. Traders seem to be unable to find a basis for trading for the time being. This has become the biggest obstacle to the rise of US stocks.

As for the US economic outlook, market participants are still using CPI and employment data to speculate and price. The biggest controversy is whether the US economy will achieve a soft landing or a hard landing, as well as the extent of the interest rate cuts in November and December. At present, US stock prices have basically completed the pricing of a soft landing. If the data deteriorates, downward pricing may occur to prevent investment risks caused by a hard landing. This is the biggest uncertainty. The elimination of this uncertainty may have to wait until later in Q4.

US 10-year minus 2-year Treasury bond yield spread

Along with the interest rate cut, the U.S. bond market also saw a trend change. Concerns about the long-term development of the U.S. economy have caused the 2-year Treasury bond yield to be higher than the 10-year Treasury bond since July 2022. This trend was reversed in September, and the current spread between the 10-year and 2-year Treasury bonds has returned to positive at 0.16. This means that Treasury bond investors have initially completed their confirmation of a soft landing for the U.S. economy.

As another important investment target besides US Treasuries, London Gold responded to the arrival of the monetary expansion cycle with a sharp monthly increase of 6.21%. Such a large monthly increase shows that larger funds have chosen safe targets when the economic outlook is uncertain.

As a representation of the Crypto market, BTC plays a similar role to the market index. Currently, the pricing of BTC is controlled by the BTC ETF channel funds, but such funds seem to refuse to regard BTC as digital gold and prefer to regard it as a technology stock like the Seven Giants. This linkage enabled BTC to stabilize in September and achieve a 7.35% increase, which was higher than the Nasdaq, but it was still constrained by the Nasdaqs trend, which stopped at $65,000 and did not complete the recovery of the previous high.

There are two paths to break through the previous high. The first is that the Nasdaq regains its previous high and BTC follows the breakthrough; the second is that the funds in the market regain pricing power. If the second path is achieved, the trend in the second half of the bull market will be more positive. Based on the principle of prudence, we regard breaking through the previous high as a necessary condition for the resumption of capital inflow and the increase of risk appetite of funds in the market to boost Altcoin targets.

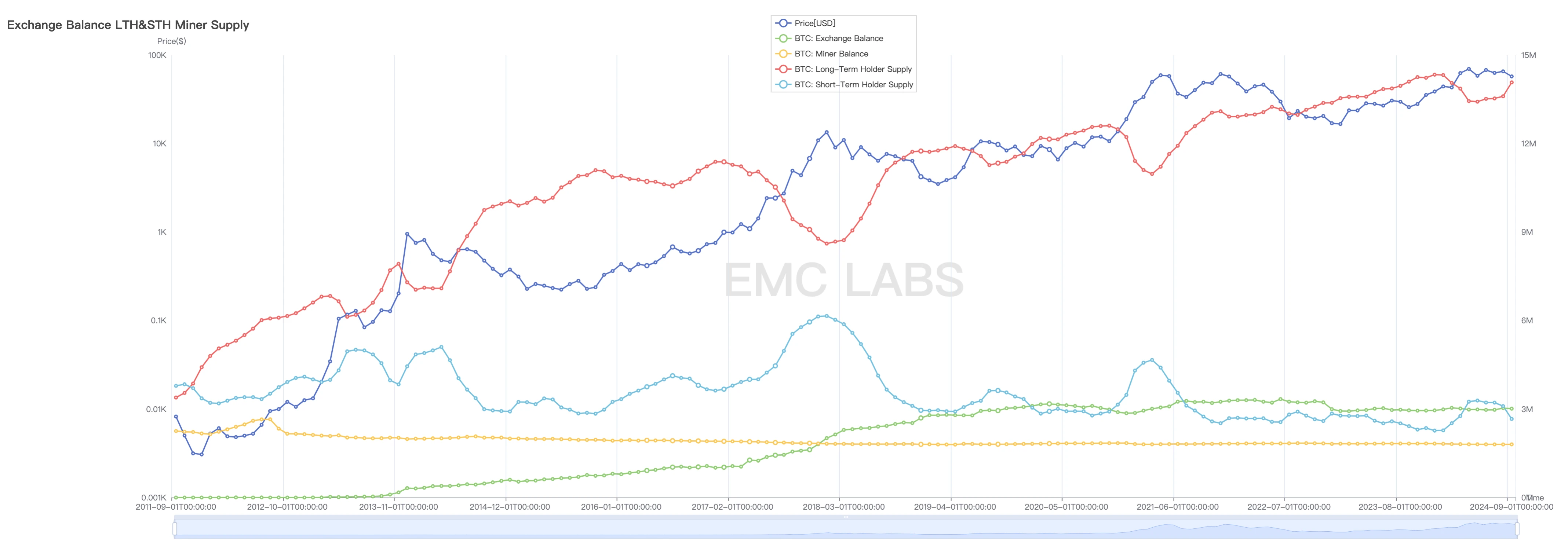

BTC Supply Structure

We view the market cycle as a phenomenon of value transfer between long and short positions within time and space. After long positions reached their peak in December, they continued to reduce their holdings until May. Since June, the second round of increase in holdings in this rising cycle has started. By the end of September, the holdings have risen to 14.07 million. This structural reorganization is conducive to price increases.

Changes in long and short positions (monthly)

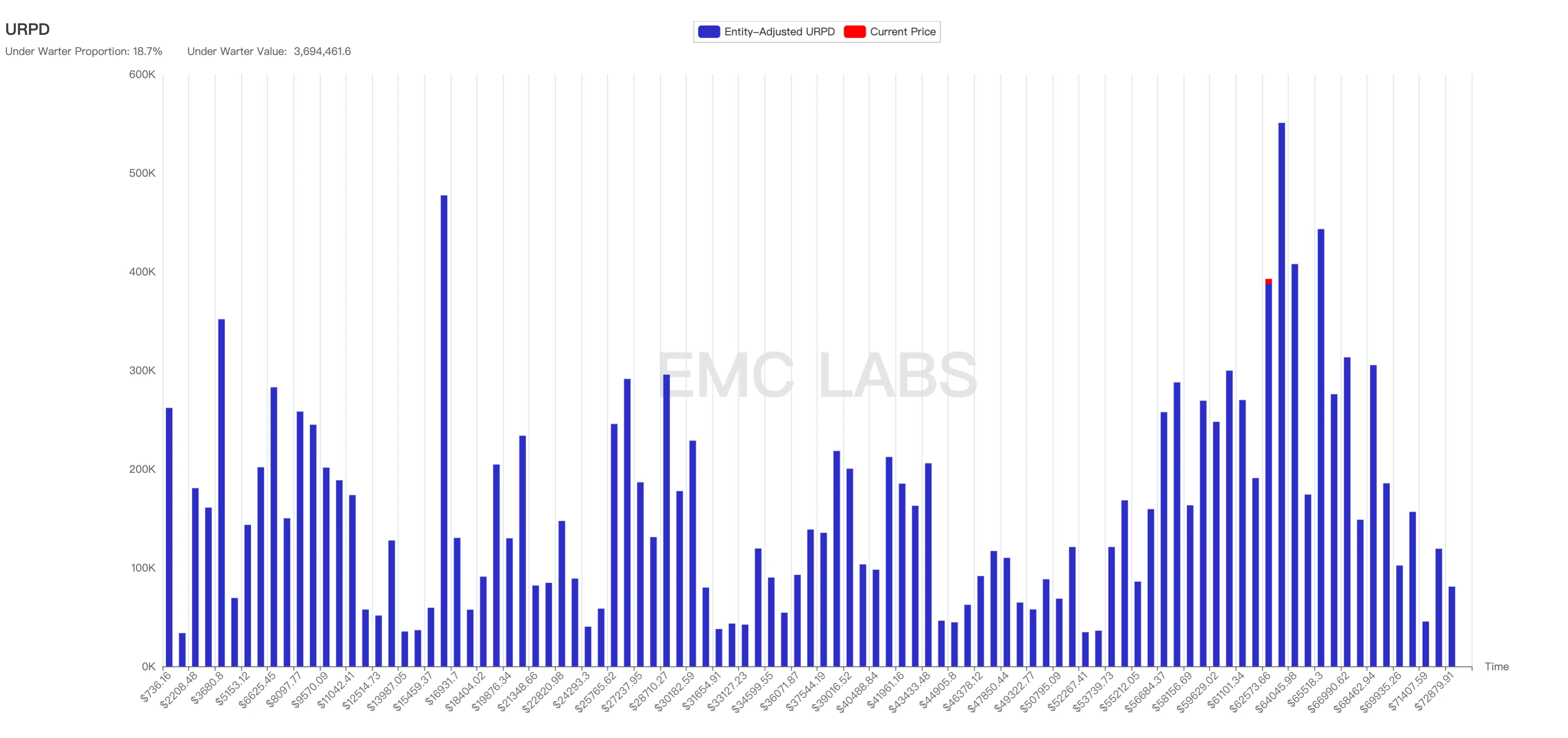

Analyzing the distribution of BTC on all chains, it can be found that as of September 29, more than 87% of BTC is in a profitable state. The distribution of chips in the new high consolidation zone of 54,000 to 73,000 is 6.24 million, an increase of 238,300 compared with August 31. The current maximum holding price has increased from US$58,893 at the end of August to US$65,518. The continuous upward shift of the price center of gravity helps to reduce the selling pressure during the upward price movement.

BTC cost structure

It is worth noting that in late September, with the rebound of BTC, long-term investors began to tentatively reduce their holdings again, while short-term investors began to increase their holdings. This from long to short is a signal of liquidity recovery, and it will also test the strength of buying power again. If buying power cannot absorb selling pressure, the market may fluctuate or even go down. If it fluctuates, long-term investors may return to collecting again, and the time for the market to recover the previous high will be extended. As of now, we cannot conclude that the new trend of from long to short has begun.

Funding

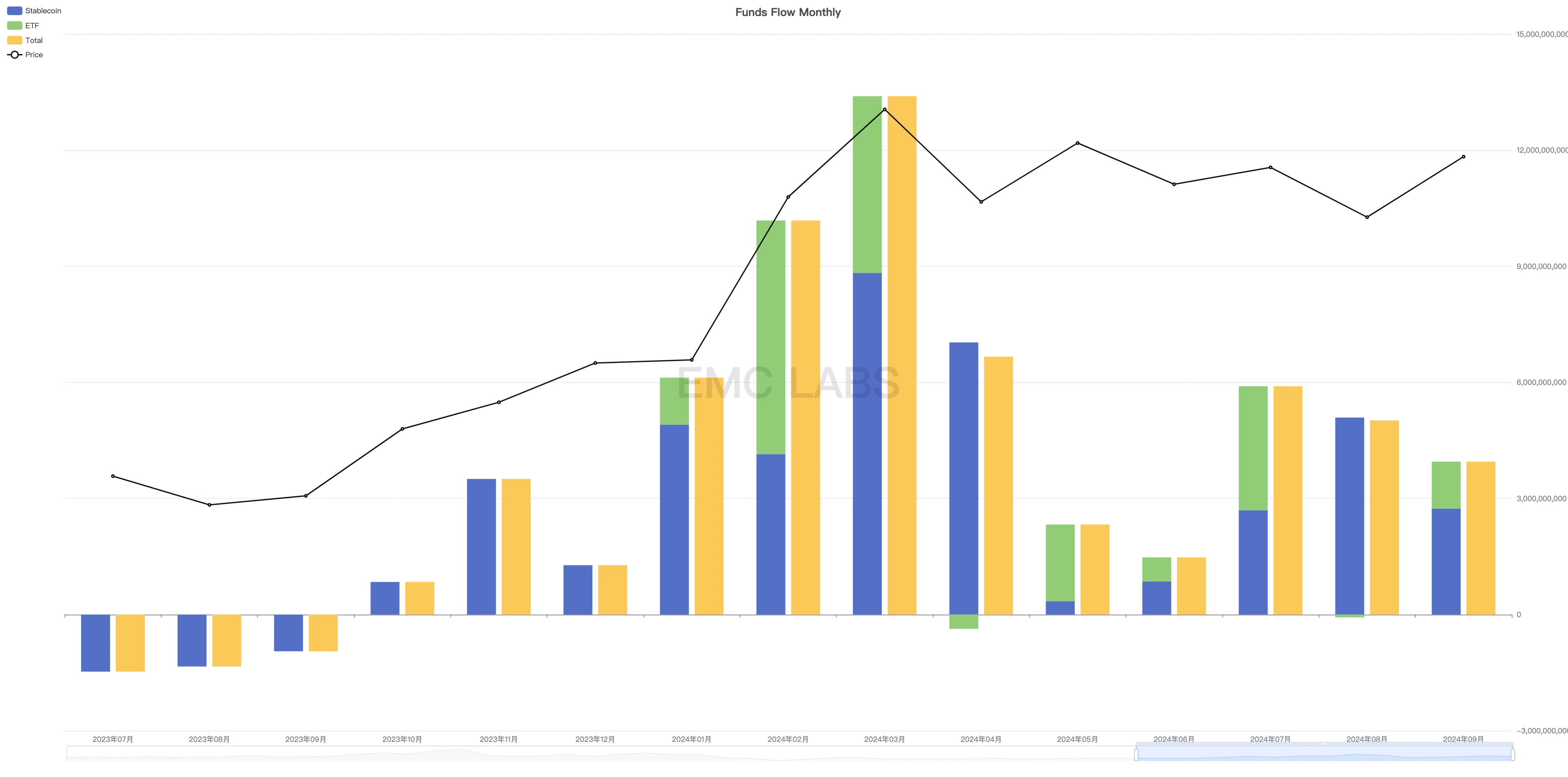

Stablecoins and 11 BTC ETFs in the United States: Monthly Fund Flow Statistics

There was also an optimistic performance in terms of funds this month. The two major channels eliminated differences and recorded positive inflows, with a total scale of US$3.788 billion. Among them, the stablecoin channel was the main inflow, with a scale of US$2.588 billion. The ETF channel, which was in an outflow state last month, resumed inflows this month, recording US$1.2 billion.

However, there is also a worrying side. Since the inflow scale resumed in July, the inflow scale in July, August and September has been shrinking month by month. Against the backdrop of the overall positive trend of stock markets in various countries, BTC urgently needs to break through the previous high to attract accelerated capital inflows through the rising effect.

During the six-month consolidation in the new high consolidation zone, the inflow of stablecoins and ETF channels has exceeded 38 billion so far. These funds have taken over the selling pressure of the new high consolidation zone, refreshing the cost price of more than 6 million BTC in this area to around US$64,000.

Technical indicators

BTC price trend (Daily)

Technical indicators are important trading tools for short- and medium-term traders. At present, the market is in the early stage of continuous capital inflow and liquidity recovery. The decisions of short-term traders have a significant impact on market trends.

64,000, 66,000, 70,000, and 73,000 USD are the short-term focus prices, representing short-term cost suppression, downward trend line suppression, upward trend line reversal suppression, and new high suppression, respectively. This months breakthrough of the 200-day moving average, which has already shown a downward shift, is of great significance. The price of 64,000 USD is also the short-term cost price and the high point of the August rebound. The effective conquest of this barrier is very important, followed by the breakthrough of 66,000 USD and 70,000 USD. At present, 3 of the 4 key price levels have not been broken, and the hope should be on the funds of the BTC ETF channel.

An effective breakthrough of $73,000 means the awakening of the most conservative funds in the market and the gradual entry of off-market funds.

Second half possibilities

In previous reports, we mentioned many times that the driving force of the first stage of the bull market mainly came from the position covering of on-site funds and the new funds before and after the approval of BTC ETF. As major central banks around the world enter the stage of liquidity expansion, EMC Labs believes that the subsequent rise in BTC asset prices mainly comes from the revaluation caused by monetary expansion and the new allocation of traditional capital to BTC ETF.

As risk appetite gradually increases, in the second half of this round of Crypto bull market, attention and funds will gradually flow into Altcoins that have been fully adjusted. We believe that BTCs market share will gradually decline from the peak of this round, close to 60%, to 40%. Altcoins will gradually differentiate after the general rise of the rebound. We focus on blockchain infrastructure and Web3 applications that represent the direction of industrial development, have technological or model innovation, have user acquisition capabilities, and are friendly to token models.

Conclusion

At present, the eMerge Engine developed by EMC LABS shows that the rising index has been restored to 0.75, gradually entering a state of moderate expansion. The restoration of this indicator marks a great restoration of the BTC ecosystem and market structure, and it is also the internal structure adjustment that we have repeatedly emphasized. BTC is ready to mark a higher price under greater liquidity shocks.

Predicting and taking action to participate in the development of the market will be richly rewarded. We believe that increasing risk appetite, a positive attitude and bold actions have become the best choice at this stage.

The biggest concern is whether the US economy will have a hard landing. Once a hard landing occurs, risk appetite will decline, leading to a decline in asset values. US stocks may experience an annual weakening trend. If so, the crypto asset market may find it difficult to develop independently.

In addition, the crazy rebound of the Chinese stock market has also attracted a certain inflow of international capital. Considering that this rebound comes from the unprecedented monetary policy investment of the Chinese government (various fiscal policies will be introduced in October), we believe that the rebound of the Chinese market has a certain sustainability, and the inflow of international capital will also continue. This will undoubtedly affect the rebound and stability of the US stock market, and in turn may affect BTC and the entire Crypto market, which have higher requirements for risk appetite.

This negative impact comes from the chaos and conflicts that are bound to occur during the shift in global monetary policy. In the short term, it will inevitably cause continued fluctuations in BTC prices, but it will not change our judgment on its long-term trend.

About EMC Labs

EMC Labs was founded by crypto asset investors and data scientists in April 2023. It focuses on blockchain industry research and Crypto secondary market investment, takes industry foresight, insight and data mining as its core competitiveness, and is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and crypto assets to bring benefits to mankind.

For more information, please visit: https://www.emc.fund