Although October is not a fixed month for gains in the crypto market, some years do show outstanding market trends. For example, in October 2020, Bitcoin rose by about 28%, laying a solid foundation for the subsequent bull market. In October 2021, Bitcoin was even more powerful, with the price hitting an all-time high of about $66,900 on the 20th. In October of this year, Bitcoin once again exerted its strength and broke through $70,000. Many analysts point out that the crypto market in the fourth quarter often performs well, which may be closely related to factors such as active trading and high market sentiment at the end of the year.

With the momentum of Bitcoins rise, Meme coins and the Golden Dog narrative are in full swing, from goats to geese, new narratives emerge in an endless stream; VC-backed projects have also returned strongly, with Worldcoin, Uniswap, ApeCoin and others launching blockbuster products one after another. At the same time, the continued inflow of funds from Tether and Bitcoin ETFs has also provided the market with more liquidity and volatility, enhancing the vitality of the overall market... A series of positive market trends pave the way for the arrival of new market conditions.

However, no matter what stage of the Bitcoin bull market the market is in, it is crucial for users to respond to different market conditions. For example, understand which tools can achieve stable returns, which tools are suitable for all market conditions, which tools are more suitable for short-term transactions, which tools are suitable for on-chain, which tools support redemption at any time, etc., rather than relying on intuition to predict market trends. In order to help users better understand and use tools, this article will sort out OKXs top 10 CeFi products and applicable market conditions, hoping that users can respond to the changing market environment more flexibly and build their own tool system.

1. Strategic Products

OKX trading strategy products are a set of tools that help users automate and customize transactions. They are suitable for different market conditions and trading needs. The core feature is to reduce manual operations and improve trading efficiency. They are gradually becoming a trading model favored by users. OKX provides dozens of strategy products such as network, Martingale, Tunbibao, Dip Buying, Arbitrage Order, Iceberg Entrustment, Time Weighted Entrustment, etc. It is one of the most mature platforms on the market that provides multiple strategies, and it has low handling fees and simple operations. Next, select a few strategies for brief description.

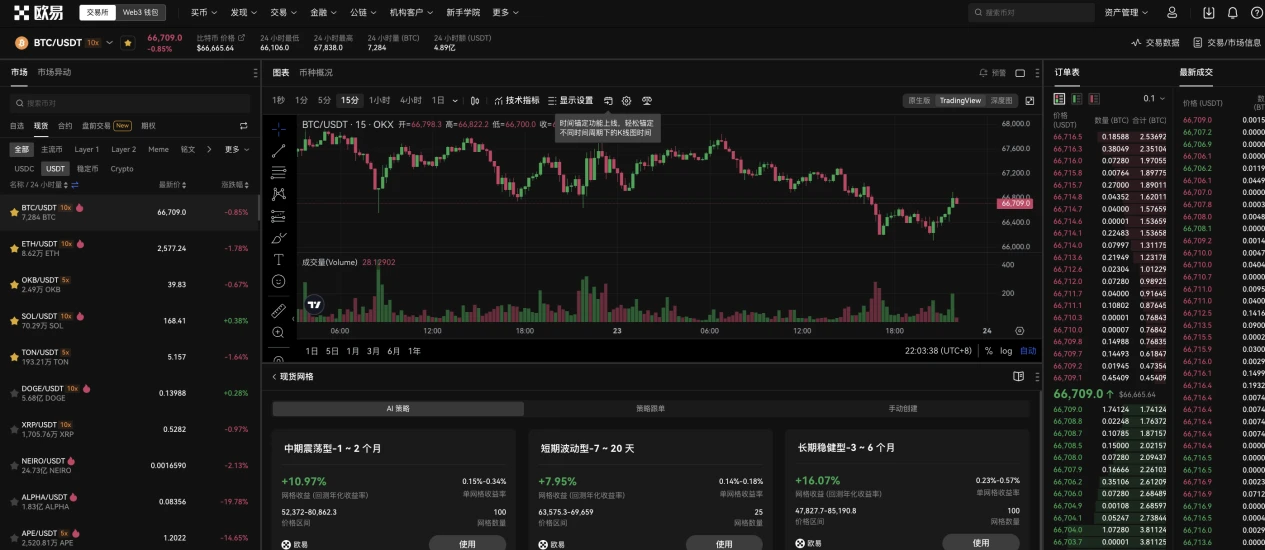

1. Spot grid: buy low and sell high in a specific range, suitable for volatile and volatile rising markets

Strategy Introduction: Spot grid strategy is an automated trading tool that helps users profit from market fluctuations by executing buy low and sell high operations within a specific price range. Users only need to set the highest and lowest prices of the price range and select the number of grids. The strategy will divide the range into multiple small grids, and automatically execute orders in each grid. As the market fluctuates, the strategy continues to buy and sell within the range to capture profits from price fluctuations. OKX provides two modes: manual creation and smart creation: users can set parameters by themselves, or use the smart grid strategy parameters recommended by the system to help quickly deploy strategies.

Applicable scenarios: The core of the spot grid strategy is to sell high and buy low to earn profits in volatile markets, so it is particularly suitable for volatile markets or volatile rising markets. In these market environments, the strategy can effectively capture every small fluctuation and accumulate profits. However, if the market shows a unilateral downward trend, the strategy may face the risk of loss due to continuous low buying, so it should be used with caution in a falling market.

For example: Suppose a user plans to use the BTC/USDT spot grid strategy on the OKX platform.

1) Market judgment: The user believes that the price of Bitcoin will fluctuate between $25,000 and $30,000 in the future. As the market is in a state of volatility, the user decides to adopt a spot grid strategy to buy low and sell high, thereby profiting from the volatility.

2) Parameter settings:

• Trading pair: BTC/USDT

• Price range: Set the minimum buying price of Bitcoin to 25,000 USDT and the maximum selling price to 30,000 USDT.

• Grid quantity: The user divides the interval into 10 small grids, and the width of each grid is (30,000 - 25,000) / 10 = 500 USDT. In this way, the system will set automatic buy and sell orders in every 500 USDT price range.

• Investment amount: Users invest 2 BTC as the initial capital for the grid strategy. Part of the funds are used to buy BTC and part are used to sell USDT.

3) Strategy operation:

• As the price of Bitcoin fluctuates between 25,000 USDT and 30,000 USDT, the system will automatically buy BTC below a certain price and sell BTC above a certain price. For example, when the price of BTC drops to 26,000 USDT, the system will automatically execute a buy order; when the price rebounds to 27,000 USDT, the system will automatically sell to realize the difference profit.

4) Operation results:

• If the price of Bitcoin continues to fluctuate within this range, the strategy will continue to buy low and sell high, and users will make profits through the fluctuations of each grid. For example, if the price of BTC drops from 26,500 USDT to 25,500 USDT and then rebounds to 28,000 USDT when the strategy is running, the system will buy low and sell high in different grids to capture multiple small profits.

5) Withdrawal of income or adjustment:

• Users can withdraw the profits from grid arbitrage at any time during the operation of the strategy, or manually stop or adjust the strategy according to market changes. If the market starts to fall unilaterally, users may consider adjusting grid parameters or suspending the strategy to avoid losses.

Advantages summary: The spot grid strategy can sensitively capture small fluctuations in the market, reduce manual intervention by users, allow the system to automatically execute trading plans, and at the same time support users to customize parameters and select the smart grid configuration recommended by the system to meet the needs of users at different levels.

How to use: 1) After logging in to OKX, enter the trading page 2) Select Spot Grid in Strategy Trading Mode 3) Enter the highest price, lowest price and grid quantity of the price range on the trading page, or select the smart parameter recommendation, then determine the amount and create a grid strategy. The invested funds will be isolated from the trading account and used independently for the strategy. 4) After the strategy is successfully created, users can view and manage the running grid strategy in the strategy column at the bottom of the trading page. In addition, during the operation of the strategy, users can withdraw the benefits brought by grid arbitrage at any time, or manually stop the strategy.

Direct access to tools: https://www.okx.com/zh-hans/trade-spot-strategy/btc-usdt#ordtype=grid

2. Contract grid: more suitable for big ups and downs or ups and downs in the bull market, with higher flexibility and fault tolerance

Strategy Introduction: The contract grid strategy is a trading strategy that automatically executes buy low and sell high (or sell high and buy low) within a specific price range, and is specifically used for contract trading. Users only need to set the highest and lowest prices in the range and determine the number of grids, and the strategy will automatically calculate the buy and sell prices of each grid and automatically place orders. When the market price fluctuates, the strategy will buy or sell according to the set price range to capture the benefits brought by the fluctuation.

Applicable scenarios: The core of the contract grid is volatility arbitrage, so it is particularly suitable for predicting volatile markets over a long period of time. On this basis, the contract grid strategy can also be set according to the users market preferences: the long grid only opens and closes long positions, which is suitable for volatile upward markets. The short grid only opens and closes short positions, which is suitable for volatile downward markets. The neutral grid strategy opens/closes short positions above the price range and opens/closes long positions below the price range, which is suitable for situations where the market trend cannot be clearly determined.

For example: refer to the spot grid, no further details will be given.

But it is worth noting that the contract grid allows users to use leverage, that is, to obtain more trading power with less principal. This means that users can obtain greater returns through smaller price fluctuations, but also face higher risks. Generally speaking, the contract grid requires users to provide margin and face the risk of liquidation (that is, when the price fluctuates greatly, the position may be forced to close). The spot grid does not have this risk. The transaction is completely based on the users assets and will not be forced to close due to market fluctuations.

Advantages summary: This strategy is automatically executed, and there is no need to manually monitor the market. Compared with the spot grid, the contract grid can buy low and sell high in a timely manner, whether it is rising, falling or fluctuating. Users can choose the appropriate long and short operation strategy based on their judgment of the market direction. Therefore, this strategy is more suitable for the ups and downs or ups and downs in the bull market, and the overall flexibility and fault tolerance rate are higher. The spot grid is more robust and suitable for users who are unwilling to take leverage risks.

How to use: 1) Open OKX PC or APP and enter the Trading page 2) Select Contract Grid in Strategy Trading Mode 3) On the trading page, enter the grids highest price, lowest price, number of grids and other parameters, or directly use the smart parameters recommended by the system. After confirming the amount, click Create 4) After the grid strategy is created, the invested funds will be isolated from the trading account and used exclusively for this strategy. 5) Users can view, manage and withdraw the income generated by the grid strategy in the Strategy option at the bottom of the trading page, or stop the strategy at any time.

Direct access to the tool: https://www.okx.com/zh-hans/trade-swap-strategy#ordtype=contract_grid

3. Smart arbitrage: more suitable for long-term positive funding rates, high liquidity currency pairs, and low-risk funding fees

Strategy Introduction: Smart arbitrage strategy is a method that aims to obtain stable returns by hedging market price fluctuations. The core principle is to use the Delta neutral strategy to hedge the risk of price changes by holding positions of the same size and opposite directions in the spot market and the contract market. Users mainly realize profits through the funding fees collected during the holding period (such as the income under the positive funding rate). After the strategy is running, it can help users earn the funding fees paid by the long side of the contract to the short side in a stable manner. This strategy is particularly suitable for bull markets. OKXs smart arbitrage strategy includes two modes: First, the custom mode, users can choose a high annualized return strategy to open a position according to their own judgment, and set the stop profit point by themselves. Second, the smart mode, the system will automatically recommend a better strategy for users, and intelligently perform stop profit and stop loss and increase and reduce positions, but this function has not yet been launched.

Applicable scenarios: Smart arbitrage strategies are particularly suitable for mainstream currencies that have positive funding rates in the long term. This is because under the design mechanism of the funding rate, many mainstream currencies usually maintain positive funding rates, which means that users can obtain funding fee income in the long term by holding positions in these currencies. In custom mode, users try to choose currency pairs with long-term positive funding rates and high liquidity to reduce slippage costs and increase overall returns. Therefore, this strategy is suitable for users who want to achieve stable returns in highly volatile markets, especially those who do not have the time or experience to manually manage strategies.

For example, if a user plans to use the BTC smart arbitrage strategy on the OKX platform, it is very simple to create and run the strategy by entering the amount.

But as far as the strategy itself is concerned, taking BTC as an example, if a user uses 2,100 USDT for futures-spot arbitrage, when the BTC spot price is 65,000 USDT, the system will perform the following operations:

1) Put 2,000 USDT into the spot market to buy BTC (0.03077 BTC).

2) Invest 100 USDT in shorting BTC/USDT perpetual contracts (20x leverage).

Assuming the current funding rate is 0.01% and the BTC price is 65,000 USDT:

3) Funding fees are charged every 8 hours, three times a day, and 2,000* 0.01% USDT * 3 * 365 = 219 USDT can be collected in a year.

4) The annualized return is 219 / 2100 = 10.43%.

Advantages summary: Users can make better use of smart arbitrage strategies to hedge price risks while obtaining stable funding fee income. However, it is worth noting that although smart arbitrage strategies have low long-term operating risks, there are still risks such as liquidation slippage, Delta inconsistency, and forced liquidation of short contract positions.

How to use: 1) After logging in to OKX, enter the trading page and select the strategy trading mode) 2) Select Smart Arbitrage in the strategy options. 3) Select the currency to be traded, enter the amount, and then click Create Strategy 4) After the strategy is successfully created, users can view and manage the running grid strategy in the strategy column at the bottom of the trading page. In addition, during the operation of the strategy, users can stop the strategy at any time.

Direct access to tools: https://www.okx.com/zh-hans/trade-swap-strategy#ordtype=smart_arbitrage

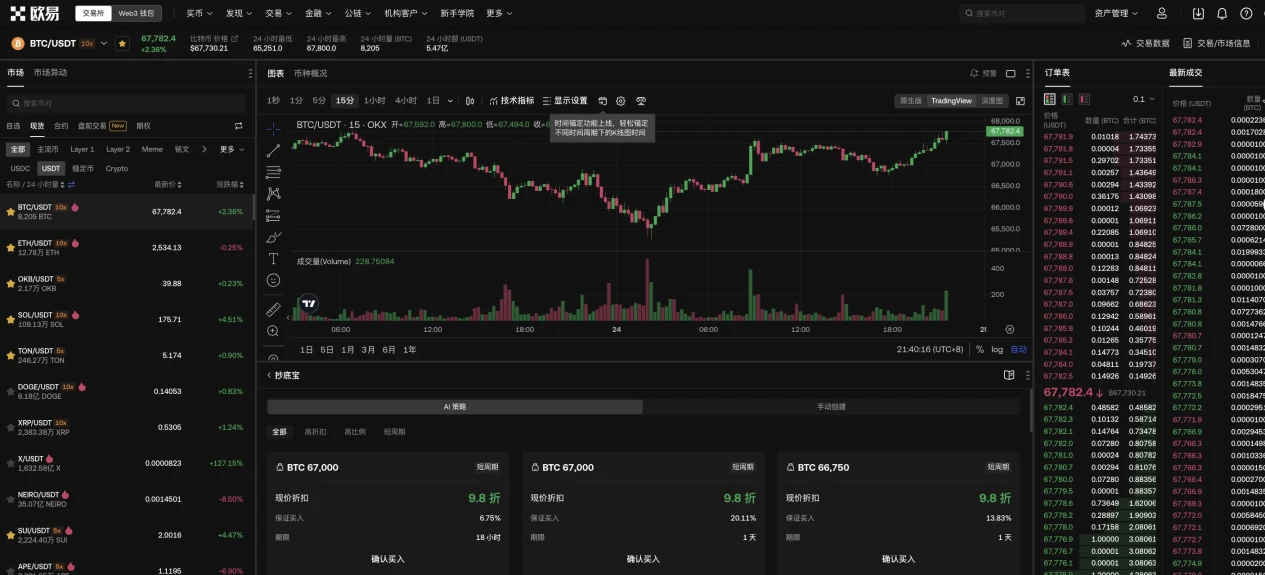

4. Dip Buying Top Selling: No need to watch the market all the time, suitable for users who want to sell high or buy low

Strategy Introduction: Dim Buying is a strategy that guarantees to buy a certain proportion of currencies at a discount price when they expire. When using the Dim Buying strategy, users can choose three system modes or custom modes: high discount rate, short lock-up period, and high guarantee ratio. Top Escape is a strategy that guarantees to sell a certain proportion of currencies at a high price when they expire. When using the Top Escape strategy, users can choose three system modes or custom modes: high premium rate, short lock-up period, and high guarantee ratio. There is no handling fee for both strategies, but the funds will be locked until the expiration date after placing an order.

Applicable scenarios: Top Escape Treasure is suitable for users who expect the market to reach its peak and hope to automatically sell at a high price to avoid asset losses. If the market price on the expiration date is < Top Escape Price, the users currency will be traded at the Top Escape Price, but only the guaranteed proportion of positions will be sold, and the remaining funds will be returned to the users account; if the market price on the expiration date is => Top Escape Price, then the users currency will be traded at the Top Escape Price, and the selling quantity = the order quantity. Bottom Picking Treasure is suitable for users who are optimistic about the market rebound and hope to automatically buy at a low price to achieve a bottom-picking layout. If the market price on the expiration date is > Bottom Picking Price, the users currency will be traded at the Bottom Picking Price, but only the guaranteed proportion of positions will be bought, and the remaining funds will be returned to the users account; if the market price on the expiration date is ≤ Bottom Picking Price, the users currency will be traded at the Bottom Picking Price, and the buying quantity = the order quantity.

For example:

Example of escaping top treasure: Assuming that the current price of BTC is 20,000 U, a user chooses a card with BTC 22,000, a guaranteed ratio of 20%, and a term of 3 days for trading; the user locks in 1 BTC for sale. At the time of delivery:

• If the BTC price is 21,000 U at expiration, the user will trade at 22,000 U, the top-selling quantity is 0.2B TC, and the remaining locked funds will be returned to the users account.

• If the BTC price is 23,000 U at the time of expiration, the user will complete the transaction in full at a price of 22,000 U and the selling quantity will be 1 BTC.

Dip Buying Example: Assuming the current price of BTC is 20,000 U, a user chooses a card with BTC 19,000, a guaranteed ratio of 20%, and a term of 3 days for trading; the user locks in a purchase quantity of 1 BTC. At the time of delivery:

• If the BTC price is 21,000 U at the time of expiration, the user will trade at 19,000 U, the bottom-fishing transaction amount is 0.2B TC, and the remaining locked amount will be returned to the users account;

• If the BTC price is 18,000 U at the time of expiration, the user will complete the transaction in full at the price of 19,000 U, and the bottom-fishing transaction quantity is 1 BTC.

Advantages summary: Advantages of Taodingbao: Taodingbao helps users automatically sell cryptocurrencies when the market price reaches a set high point, lock in profits, prevent subsequent price corrections from causing asset shrinkage, and avoid the risk of price declines. Moreover, there is no need to watch the market all the time, the system will automatically execute the scheduled operations and optimize fund management. Advantages of Dim-picking Bao: Dim-picking Bao helps users automatically buy cryptocurrencies at a set low price when they expect the market to bottom out and rebound. This helps users capture market lows and prevent missed opportunities. Users do not need to watch the market to seize opportunities, and can also accumulate more assets through Dim-picking Bao, seize the opportunity of the market bottoming out and effectively increase their holdings.

How to use: 1) After logging in to OKX, enter the trading page 2) Select the strategy trading mode - Dim Buy or Top Sell. 3) Then select the currency, strategy mode, and amount to complete the setting.

Direct access to tools:

Buy at the bottom: https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=lvf_buy

Escape Top Treasure: https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=lvf_sell

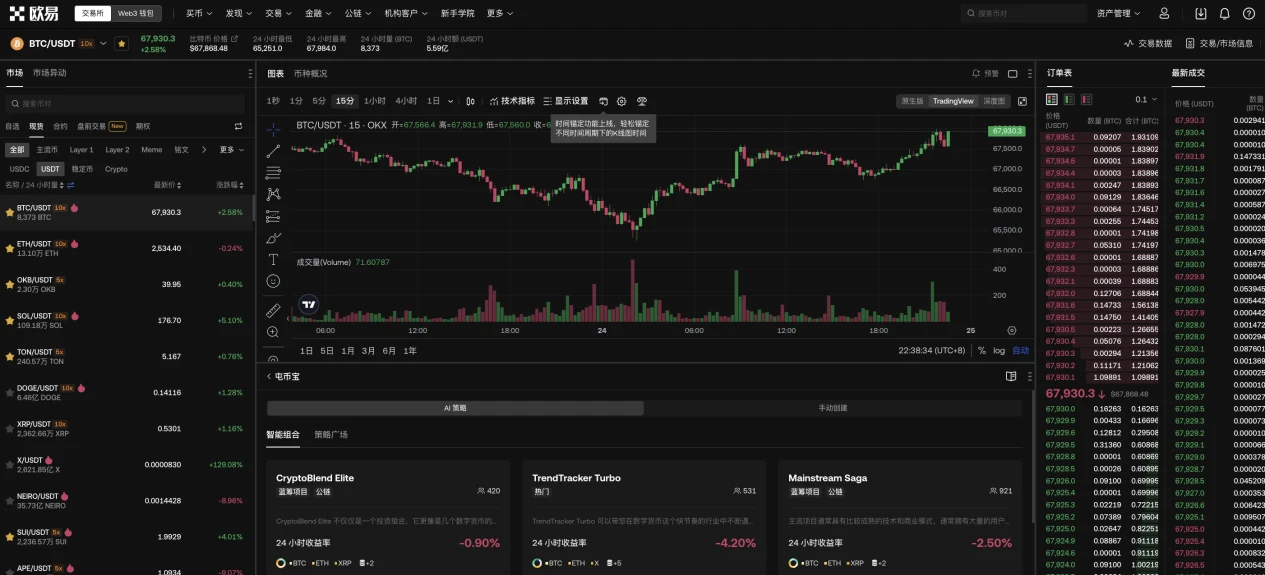

5. Tunbibao: Intelligent position adjustment and capture opportunities brought by hot spot rotation

Strategy Introduction: The Tunbibao strategy is an automated strategy that makes intelligent dynamic adjustments in the currency portfolio selected by the user. Dynamic adjustments will help the users Tunbi portfolio maintain a constant ratio of each currency. Users can choose two adjustment modes to trigger adjustments, namely, according to a fixed time period and according to the change ratio of the currency market value, that is, the two balance modes of proportional balance and timed balance.

Applicable scenarios: There is often a rotation between currencies or sectors in the market. After a few currencies rise, they begin to pull back, and at the same time, several other currencies begin to rise. If you just hold the currency, you are likely to miss most of the profits due to price pullbacks. However, if you cash in the profits in time when the first few currencies rise, and buy other potential currencies at the same time, you will not only lock in profits, but also increase the holdings of potential currencies. In this way, you can get extra returns from this combination.

For example:

Proportional balance example: Suppose a user selects this mode

1) Set parameters

• Currency configuration: BTC 丨 50%; ETH 丨 30%; SOL 丨 20%

• Balance mode: Proportional balance | 10%

• Investment amount: 10,000 USDT

2) Strategy operation

• Phase 1 - Exchange target currencies. The 10,000 invested will be exchanged for 5,000 USDT worth of BTC (market price ₮ 1,000, i.e. 5 BTC), 3,000 USDT worth of ETH (market price ₮ 500, i.e. 6 ETH), and 2,000 USDT worth of SOL (market price ₮ 100, i.e. 20 SOL) in the form of smart transactions.

• Phase 2 - Triggering balance. Assuming that the BTC market price rises to 1,500, and the prices of ETH and SOL remain unchanged, the market value ratio of each currency is: 60%: 24%: 16%, of which the BTC ratio deviates by ≥ 10%, triggering balance. At this time, the strategy sells 0.83334 BTC and buys 1.5 ETH and 5 SOL through smart transactions to return the market value ratio to the target ratio. That is, after this balance is completed, you hold 4.16666 BTC (market value 6,250 USDT), 7.5 ETH (market value 3,750 USDT), 25 SOL (market value 2,500 USDT)

Timed balancing example: Assume a user selects this mode

1) Set parameters

• Currency configuration: BTC 丨 50%; ETH 丨 30%; SOL 丨 20%

• Balance mode: Time balance | 4 hours

• Investment amount: 10,000 USDT

2) Strategy operation

• Phase 1 - Exchange target currencies. The 10,000 invested will be exchanged for 5,000 USDT worth of BTC (market price ₮ 1,000, i.e. 5 BTC), 3,000 USDT worth of ETH (market price ₮ 500, i.e. 6 ETH), and 2,000 USDT worth of SOL (market price ₮ 100, i.e. 20 SOL) in the form of smart transactions.

• Phase 2 - Triggering balance. Assume that after 4 hours, the BTC market price rises to 1,500 USDT, and the prices of ETH and SOL remain unchanged. At this time, the market value ratio of each currency is: 60%: 24%: 16%, of which the BTC ratio deviates by ≥ 3%, triggering balance. At this time, the strategy sells 0.83334 BTC and buys 2.5 ETH and 5 SOL through smart transactions to return the market value ratio to the target ratio. That is, after this balance is completed, you hold 4.16666 BTC (market value 6,250 USDT), 7.5 ETH (market value 3,750 USDT), 25 SOL (market value 2,500 USDT)

Advantages summary: It helps users avoid missing out on opportunities to earn coins due to fixed positions in a hot market. The advantage of this strategy is that it can make use of exchange rate fluctuations between different currencies to earn and store coins.

How to use: 1) After entering the OKX Web or App, select Strategy Trading Mode on the Trading page, and then select Tunbibao. 2) Enter the parameters on the trading page, confirm the amount, and you can create Tunbibao. (After Tunbibao is created, the funds invested will be isolated from the trading account and used independently in the strategy) 3) After the creation is completed, you can view and manage the strategy in Strategy at the bottom of the trading page.

Direct access to tools: https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=smart_portfolio

2. Coin-earning Products

Earn Coins is a one-stop service platform created by OKX to help users discover a variety of coin holding product opportunities, including simple coin earning, structured products, and on-chain coin earning, etc., providing users with a rich selection of products. Among them, 1) Simple coin earning is a product created by OKX to help users with idle digital assets earn coins with a low threshold. It is easy to get started and provides two options: current and fixed. 2) Structured products include Double Coin Win, Seagull, Shark Fin, Snowball, Tuncoin Snowball, etc., which are innovative financial tools for earning income from the derivatives market. Users can choose products based on the current market and risk preferences. Currently, all OKX structured products do not charge handling fees. 3) OKX on-chain coin earning provides selected pledge and DeFi protocols to help users earn on-chain rewards.

6. Dual Currency Win: Suitable for users who are unsure of the market direction but want to earn a profit

Product Introduction: Dual Currency Win is a non-principal-protected structured product created by OKX, which can help users earn extra income while buying or selling digital currencies at the target price. Currently, OKX has launched ETH/BTC-based Dual Currency Win, which supports BTC and ETH investment subscription to achieve low buy and high sell. Compared with USDT-based Dual Currency Win, it provides a new way to earn income, 0 fees to achieve conversion between the two major cryptocurrencies, continuous interest generation, and no fear of missing the market due to conversion to USDT, etc., helping users to hold coins without worry.

Applicable scenarios: This product is more suitable for volatile or sideways markets, that is, when the market trend is relatively stable and the price fluctuates within a certain range, but the user is uncertain about the future price trend direction, you can choose Dual Currency Win. As long as the price does not reach the preset trigger price at maturity, regardless of whether the price of the underlying asset rises or falls, the user can lock in the maturity income.

For example: Suppose a user plans to use ETH/BTC dual-currency win on the OKX platform. The main advantage in a bull market is that he can earn profits without worrying about the risk of being washed out.

1) Market judgment:

The user believes that the ETH/BTC price may drop slightly in the short term, and hopes to use the dual-currency win product to earn profits and increase BTC holdings at the same time, but he does not want to miss the opportunity to hold positions due to market fluctuations (i.e., he will not be washed out).

2) Product selection: Users choose OKX’s coin-based dual-currency win-sell high ETH/BTC

• Current ETH price: 0.03 BTC

• Target price: 0.02 BTC

• Duration: 1 day

• Expected return: Reference annualized 21.40%

3) Two possible outcomes:

• Expiration price ≥ 0.02 BTC: If the ETH/BTC price does not fall below 0.02 at expiration, the user’s ETH will be sold at the target price (0.02 BTC) and the corresponding amount of BTC will be obtained. At the same time, he can also obtain the expected annualized return.

• Expiration price < 0.02 BTC: If the ETH/BTC price falls below 0.02 at expiration, users will continue to hold ETH and at the same time receive income in the form of ETH (reference annualized 21.40%).

4) Result analysis: One advantage of this strategy is that no matter how the ETH/BTC price fluctuates, users can obtain stable annualized returns through the Dual Coin Win product. In a bull market, users will not miss the opportunity to hold ETH, because even if the ETH price does not reach the target price, users will still hold positions. In addition, if the ETH price reaches or exceeds the target price, users will be able to sell ETH smoothly and obtain more BTC in the bull market. When the market is expected to fall or fluctuate, users can earn returns and flexibly respond to market fluctuations through the low-risk strategy of Dual Coin Win, without missing the opportunity to increase holdings due to a sharp rise or fall.

Advantages summary: OKX Dual Currency Win supports users to exchange between different popular cryptocurrencies without slippage. This means that users will not be affected by market fluctuations when exchanging, ensuring the price stability of currency conversion, while also earning annualized returns. In addition, no matter how the market fluctuates, as long as the expiration price reaches the target price set by the user, OKX will ensure that the digital currency is bought or sold as agreed, helping users lock in profits. In addition, users can freely customize Dual Currency Win products according to their needs, choose different currencies, maturities, target prices, etc., and flexibly control the use of funds, so as to obtain a more personalized experience.

How to use: 1) After logging in to OKX, enter the financial page 2) Then select structured products-Dual Currency Win 3) After determining the currency, term, target price, etc., enter the subscription quantity.

Direct access to tools: https://www.okx.com/en/earn/dual

7. Snowball: More suitable for rising and volatile markets

Product Introduction: Tunbi Snowball is a single-currency structured product that helps users trade their own digital currencies and earn profits in rising markets. Users will have three possible settlement situations: early stop profit, maximum profit and early warning, which can achieve certain risk protection while achieving position growth.

Applicable scenarios: OKX Coin Snowball is more suitable for users who hold coins for the medium and long term. It helps to ensure returns and avoid risks brought by extreme declines in volatile markets or under expectations of stable growth.

For example:

1) Market judgment: Assume that a user believes that the price of BTC will remain relatively stable in the next few days, but there is a high probability that it will fluctuate upward.

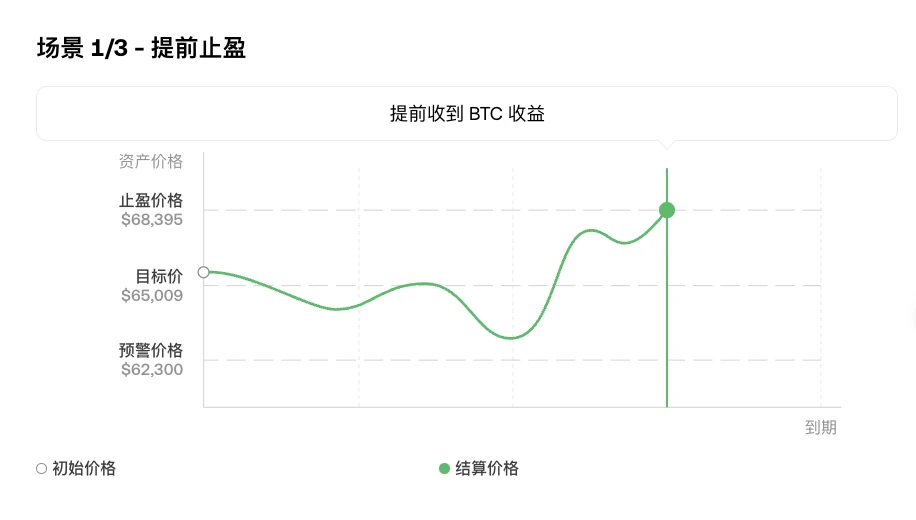

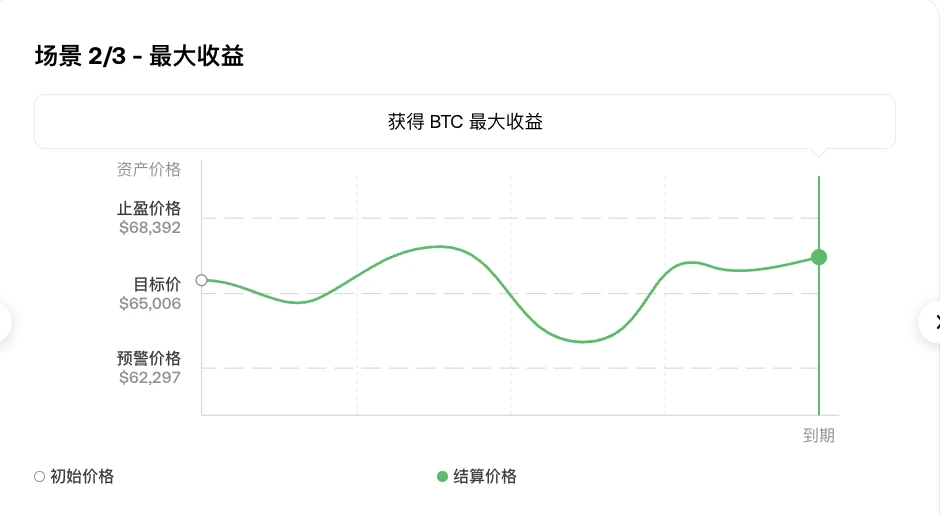

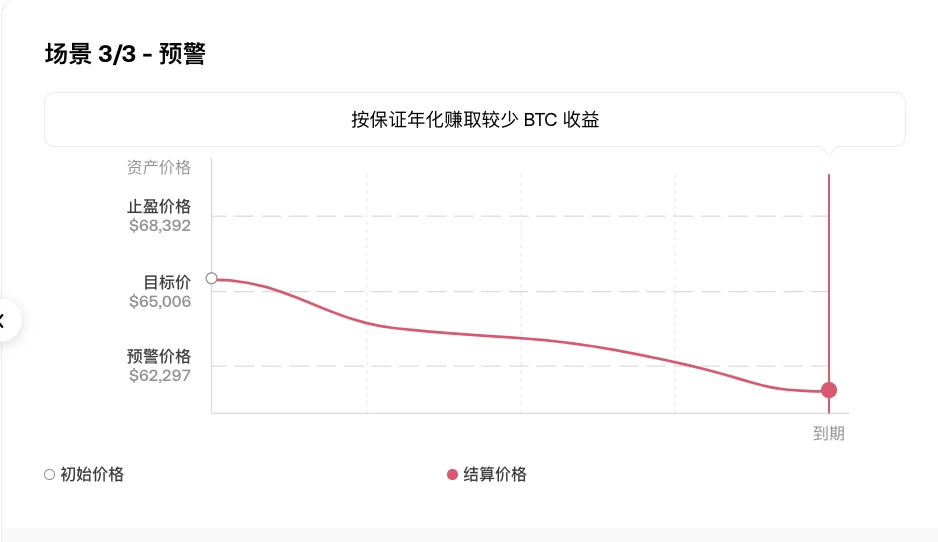

2) Product operation: Users enter the OKX Tunbi Snowball product, select 7 days, an annualized rate of return of 25.25%, an initial price of $ 64,997, a target price of $ 65,007, a take-profit price of $ 68,393, and a warning price of $ 62,300, and then enter the subscription quantity to participate immediately.

3) Operation results: After purchasing this product, there will be 3 possible situations

Scenario 1: When the coin price breaks through the take-profit price on any day, the users order will be settled in advance and the payment will be received.

The amount of repayment is: Subscription quantity × (1 + annualized rate of return × term / 365)

Scenario 2: If the coin price remains between the take-profit price and the warning price, the user will earn the maximum profit and receive the payment on the settlement date.

The amount of repayment is: Subscription quantity × (1 + annualized rate of return × term / 365)

Scenario 3: When the price of the currency breaks down below the warning price on any day, the users order will be settled in advance

The amount of repayment is: Subscription quantity × [(settlement price/target price) + (annualized rate of return × term/365)]

Advantages summary: 1) No currency conversion: Users can invest in BTC or ETH, and no matter how the market fluctuates, the currency of the return remains unchanged, which simplifies the operation and does not have to worry about the complexity of currency conversion. 2) Guaranteed annualized income: Regardless of the settlement situation of the market, users can earn income in all settlement scenarios, providing a stable annualized return and reducing risks. 3) Daily early profit-taking opportunities: Users can observe market dynamics every day, track the profit-taking price, and flexibly stop profit according to market conditions to lock in profits. 4) Currency price drop protection mechanism: When the currency price drops sharply and breaks through the warning price, the system will automatically settle the order to provide users with additional security. 5) Low threshold: The starting threshold is very low. Users only need 0.0004 BTC or 0.005 ETH to participate, which is suitable for all types of users. 6) Zero handling fees: In addition to the principal invested, users do not need to pay additional fees to ensure maximum returns.

How to use: 1) After logging in to OKX, enter the financial page 2) Then select the structured product - Tunbi Snowball 3) After determining the currency, term, target price, etc., enter the subscription quantity. It is very simple and convenient.

Direct access to the tool: https://www.okx.com/en/earn/snowball-hodl

The above is only a selection of OKXs CeFi products. In addition to strategic products and coin-earning products, the OKX platform also provides a variety of lending products, copy trading products, etc., which can fully meet the diverse needs of users and help them flexibly respond to market fluctuations. Users can download the OKX APP: https://www.okx.com/zh-hans/download or log in to the OKX official website: https://www.okx.com/zh-hans to experience it immediately.

3. Disclaimer

This content is for reference only and does not constitute and should not be considered as (i) investment advice or recommendation, (ii) an offer or solicitation to buy, sell or hold digital assets, or (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Digital assets (including stablecoins and NFTs) are subject to market fluctuations, involve high risks, may depreciate in value, or even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation and risk tolerance. Please consult your legal/tax/investment professional for your specific situation. Not all products are available in all regions. For more details, please refer to the OKX Terms of Service and Risk Disclosure Disclaimer. OKX Web3 Mobile Wallet and its derivative services are subject to separate terms of service. Please be responsible for understanding and complying with local applicable laws and regulations.