Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser2010 )

The US presidential election is about to end. At the time of writing, according to FOX website data , Trump is temporarily leading with 248 votes, with only 22 votes left to get 270 votes, and finally become the final winner of the 2024 US presidential election. Combined with Trumps crypto-friendly stance that he has reiterated many times before, the market trend has changed sharply for a while, and the US political arena is likely to fully embrace crypto-friendly regulation. Odaily Planet Daily will briefly sort out the current situation of the US cryptocurrency industry in this article for readers reference.

The U.S. crypto market is approaching 100 million cryptocurrency holders, accounting for about 27.8% of the total population

If you want to talk about regulation, you must first look at the basics.

Previously, we mentioned in the article How did the American Crypto Patriarch Trump come to be? , According to a research report released by CouponBirds in March , the survey showed that 45.2% of American parents who own cryptocurrencies have already bought some cryptocurrencies for their children, and 40.6% of parents plan to buy cryptocurrencies specifically for their children in the future. Its research shows that parents generally believe in the potential of cryptocurrencies as long-term investments and want to educate their children about this asset class.

In May, according to data disclosed by the listed exchange Coinbase on the X platform , in 2023, 52 million Americans will own cryptocurrencies, accounting for 20% of the adult population in the United States; in addition, statistics in April 2024 showed that 13% of American adults said they owned Bitcoin.

Over time, this number has grown significantly.

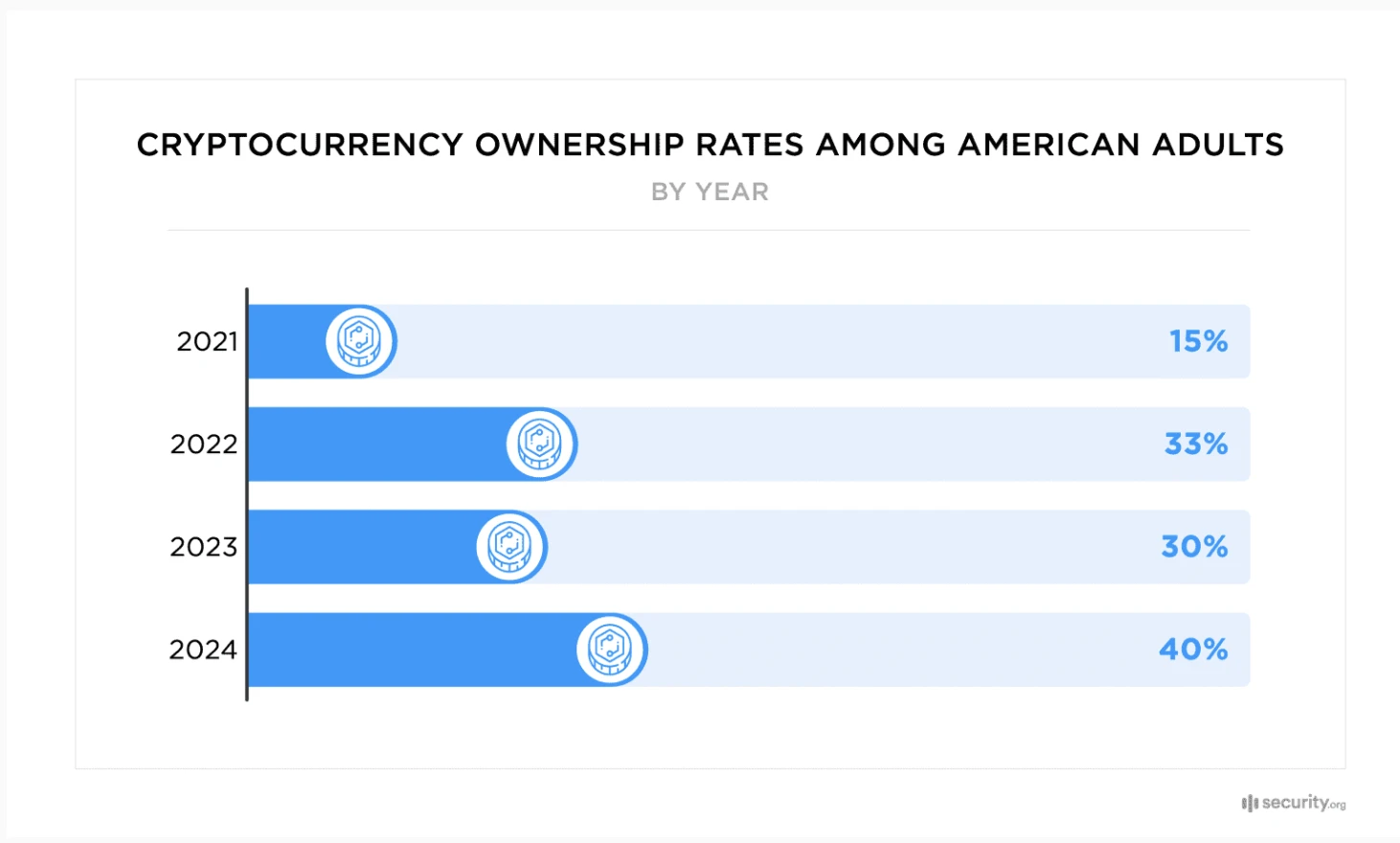

According to a report released by security.org at the end of September this year :

Currency holding rate among U.S. adults

Cryptocurrency awareness and ownership have risen to record levels: 40% of US adults now own cryptocurrency, up from 30% in 2023, a number that could reach as many as 93 million people.

21% of non-Bitcoin holders said the prospect of a Bitcoin ETF would make them more likely to invest in cryptocurrencies, meaning as many as 29 million Americans could soon join the market.

In the past year, the cryptocurrency ownership rate among women has soared from 18% to 29% (compared to 43% to 48% among men), which may be influenced by many news reports on the development of female practitioners in the blockchain field and cryptocurrency investment and related behaviors. Including Unchained Crypto podcast host Laura Shin, Ark Invest founder and CEO Cathie Wood , and crypto-friendly SEC Commissioner and Crypto Mom Hester Pierce .

You know, according to statistics, the current total population of the United States is about 335 million, and the number of 93 million cryptocurrency holders is equivalent to about 27.7% of the total population. Especially considering that cryptocurrency holders are usually adults with voting rights, it is no wonder that the crypto crowd has become the target of the Republican and Democratic parties in this years US election.

US political arena shifts to crypto-friendly regulation

At the same time, the US political arena has also ushered in a major turning point in its regulatory attitude towards cryptocurrencies. Crypto-friendly regulation may have become a foregone conclusion. The key turning points include two main events:

First, Republican Bernie Moreno, who supports cryptocurrency, won the Ohio Senate race . He successfully defeated Ohio Democratic Senator Sherrod Brown and is expected to take over Browns current position as Chairman of the Senate Banking Committee in the subsequent job arrangement (Note from Odaily Planet Daily: This committee has jurisdiction over the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). For more information, see the article In addition to the president, the election for this seat will also deeply affect the future of Crypto ). Previously, the cryptocurrency-supporting super PAC Defend American Jobs spent $40.1 million to support Moreno, and his campaign raised at least $54,600 directly from the cryptocurrency industry; famous donors include Coinb CEO Brian Armstrong, a16z founder Marc Andreessen, benahorowitz.eth, a16z investor cdixon.eth, and Fred Ehrsam.

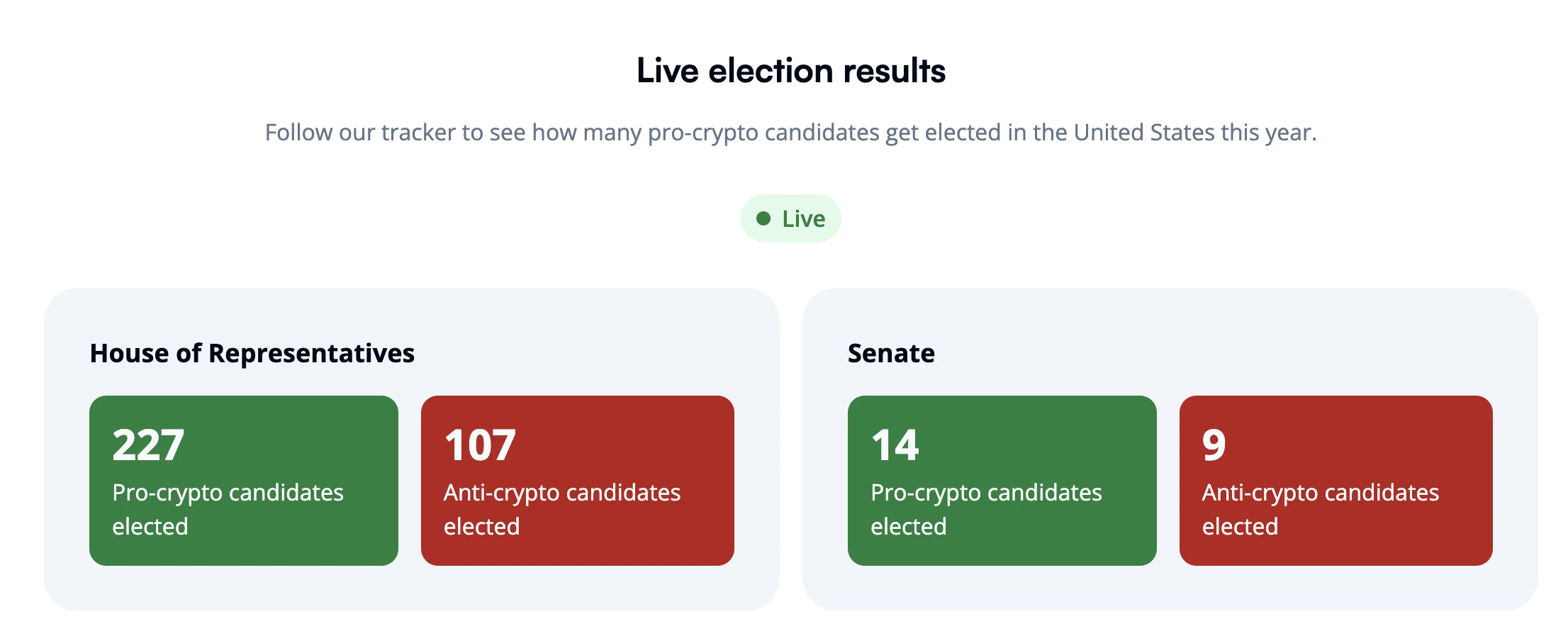

The second is the latest statement from Brian Armstrong, CEO of Coinbase. After Bernie Moreno won the Ohio Senate race, he said, Bernie understands that cryptocurrency is an important part of Americas future. Bernie and the cryptocurrency owners who helped him win this victory understand that everyone can benefit from cryptocurrency and are willing to fight for it. Welcome to the most cryptocurrency-supportive Congress in American history. In addition, he once posted : There are now more than 219 cryptocurrency-supporting candidates elected to the House of Representatives and Senate. Tonight, these cryptocurrency voters decisively made a decisive voice - across party lines, in key campaigns across the country. Americans disproportionately care about cryptocurrencies and want clear rules for digital assets. We look forward to working with the new Congress to achieve this goal. Thank you to everyone who stood with cryptocurrency today. We succeeded!

According to the official website of StandWithCrypto , as of the time of writing, the number of candidates currently elected as senators and representatives who support cryptocurrency is 14 and 227 respectively, far exceeding the number of opponents.

Compared with the data at the beginning of this year (according to news in January , 18 US senators supported cryptocurrencies and 30 senators were firmly opposed to cryptocurrencies), crypto-friendly regulation may be ready to take off in the US political environment.

StandWithCrypto official website information

Summary: Trump came to power, and the Republican faction boosted the crypto bull market

Judging from the current situation, the suspense of whether Trump can be elected as the US president is disappearing rapidly. According to the latest data from the FOX website , Trumps current vote count has reached 277 votes, meeting the 270 vote threshold for the US presidential election, and has been successfully elected as the next US president. As the election dust settles, he will also become one of the few two-term presidents in US history.

Next, compared with the Democrats who have a very strict attitude towards crypto regulation, Republicans represented by Trump will gradually become the vital force of the US government and regulatory authorities, jointly promoting the arrival of the crypto bull market. Based on Trump’s previous speech at the 2024 Bitcoin Conference in Nashville in September this year, the establishment of a strategic reserve of Bitcoin, the increase in the priority of Bitcoin in US national assets, and the release of Silk Road founder Rose may become the next step.

At the same time, Bitcoin, which has already broken a new high today, may continue to rise in price. As for whether the price of BTC can reach $100,000 as expected by crypto investors, let us wait and see.