Original article by Vitalik Buterin

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

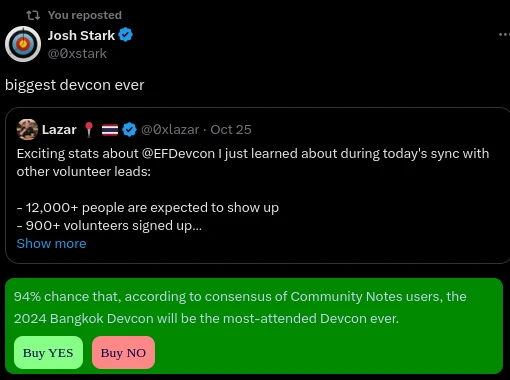

The US election has further boosted the prediction market Polymarket. People seeking profits have started to place bets, while those seeking results use it as a news data platform to get information. As a blockchain application that goes out of the circle, Polymarket combines on-chain funds and real-world predictions very well. Vitalik has repeatedly praised Polymarket, and he is also a loyal fan of the early prediction market Augur. Today, Vitalik published an article to explore the information finance through the prediction market. The following is the full text, compiled by Odaily Planet Daily:

One of the Ethereum applications I’m most excited about is prediction markets. I wrote about futarchy, Robin Hanson’s prediction-based governance model, in 2014. I was an active user and supporter of prediction market Augur back in 2015, where I made $58,000 betting on the 2020 election. This year, I’ve been a big supporter and follower of Polymarket.

To many, prediction markets are about betting on elections, and betting on elections is about gambling — which is great if it helps the masses have fun, but fundamentally it’s no more fun than buying a random meme on pump.fun. From this perspective, my level of excitement about prediction markets may seem puzzling. So in this article, I’ll explain what it is about the concept of prediction markets that interests me. In short, I believe that:

1. The prediction markets that exist today are a very useful tool for the world;

2. Further, prediction markets are just a precursor to a more popular field with potential applications in social media, science, journalism, governance, and other fields, which I will label infofinance.

The two sides of Polymarket: a gambling site for participants, a news site for everyone else

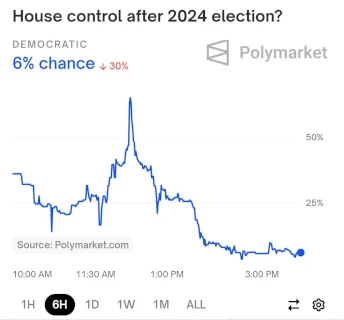

Over the past week, Polymarket has been a very effective source of information about the US election. Not only did Polymarket predict a 60/40 chance of Trump winning (while other sources predicted 50/50, which is not too impressive in itself), it also demonstrated something else: when the results came in, while many pundits and news sources had been baiting viewers into hearing favorable news for Harris, Polymarket went straight to the truth: Trump had a better than 95% chance of winning and a better than 90% chance of taking control of all branches of government.

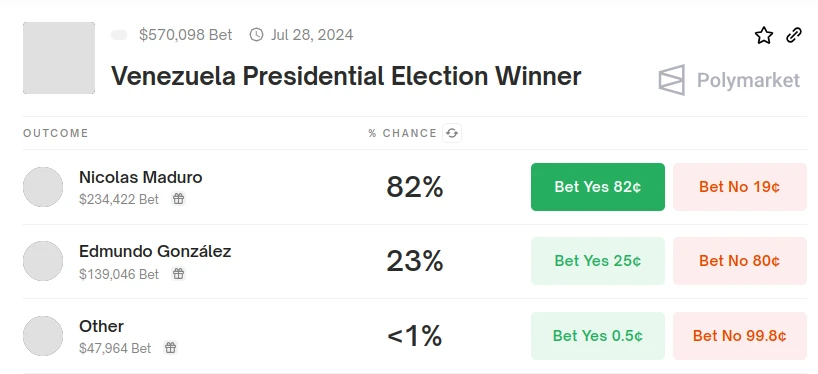

But to me, that’s not even the best example of why Polymarket is interesting. So let’s look at another example: During the Venezuelan presidential election in July, the day after the election, I stumbled upon a protest against the highly rigged presidential election in Venezuela. At first, I didn’t think much of it. I knew Maduro was already one of those “basically a dictator” figures, so I thought, of course he’s going to fake every election result to keep himself in power, there will be protests, and the protests will fail. Unfortunately, many others have failed. Later, while browsing on Polymarket, I saw this:

People are willing to put over $100,000 more on a 23% chance that Maduro will be overthrown in this Venezuelan election, and now Im paying attention.

Of course, we still knew that the overthrow outcome was unlikely. Ultimately, Maduro remained in power. But the market made me realize that this attempt to overthrow Maduro was serious. There were massive protests and the opposition had an unexpectedly well-executed strategy that proved to the world that the election was fraudulent. If I hadn’t received the initial signal from Polymarket that “this time, there’s something to pay attention to,” I wouldn’t have even started to pay that much attention.

You should not trust the charts completely: if everyone believed the charts, then anyone with money could manipulate the charts and no one would dare to bet. On the other hand, trusting the news completely is also a good way to go. The news has a motivation to sensationalize, to exaggerate the consequences of anything for clicks. Sometimes a thing is justified, sometimes not. If you see a sensational article, then you go to the market to check and find that the probability of the related event has not changed at all, then it is reasonable to be skeptical. In addition, if you see an event happening in the market with an unexpectedly high or low probability, or a sudden move, this is a signal to read through the news and see what led to this conclusion.

Conclusion: You can get more information by reading both news and charts than by looking at either one alone.

If you are a bettor, then you can deposit money with Polymarket, to you it is a betting site. If you are not a bettor, then you can read chart data, to you it is a news site. You should never trust charts completely, but I personally have made reading chart data a step in my information gathering workflow (alongside traditional and social media) and it has helped me get more information more efficiently.

Information finance in a broader sense

Predicting election results is just one use case. The broader concept is that you can use finance as a way to align incentives in order to provide valuable information to an audience. Now, a natural response is: isn’t all finance fundamentally about information? Different actors will make different buy and sell decisions because they have different views of what the future will hold (besides personal needs like risk appetite and desire to hedge), and you can infer a lot about the world by reading market prices.

To me, information finance is like that, but structurally correct. Similar to the concept of structural correctness in software engineering, information finance is a discipline that requires you to

1. Start with the facts you want to know;

2. Then deliberately design a market to optimally extract that information from market participants.

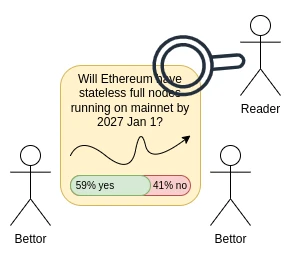

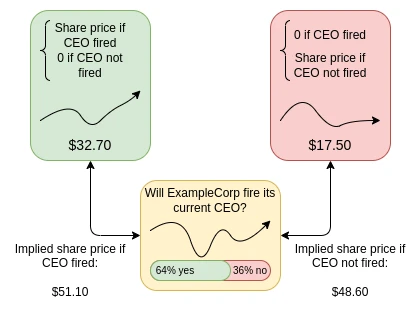

One example is a prediction market: you want to know if something will happen in the future, so you set up a market and let people bet on it. Another example is a decision market: you want to know if decision A or decision B will produce a better outcome based on some metric M, and to do this, you set up a conditional market:

You ask people to bet on which decision they will choose: if they choose decision A, then the value of M is 0, otherwise it is; if they choose decision B, then the value of M is 0, otherwise it is. With these three variables, you can calculate whether the market thinks decision A or decision B is more optimistic about the value of M.

I expect that AI (whether LLMs or some future technology) will have a huge impact on the financial industry over the next decade. This is because many applications of information finance are about “micro” problems: mini-markets with millions of decisions, where the impact of individual decisions is relatively low. In practice, low-volume markets often do not work efficiently: it does not make sense for an experienced participant to spend time on detailed analysis just to make a profit of a few hundred dollars, and many even argue that such markets would not work at all without subsidies, because there are not enough novice traders for experienced traders to profit from except for the most significant and sensational problems. AI completely changes this equation, meaning that we can probably get fairly high-quality information even on markets with a volume of $10. Even if subsidies are needed, the size of the subsidy per problem is affordable.

Information Finance, Refining Human Judgment

Suppose you have a human judgment mechanism that you trust, and there is a whole community that trusts its legitimacy, but it takes a long time and is very costly to make judgments. However, you want to at least have access to a cheap copy of that expensive mechanism in a cheap and real-time manner. Here is Robin Hansons idea of what you could do: every time you need to make a decision, set up a prediction market that predicts what the mechanism will do about the decision if the expensive mechanism is called. Then the prediction market starts running, and a small amount of money is invested to subsidize the market maker.

99.99% of the time, you don’t actually invoke the expensive mechanism: maybe you “revert the trade” and give everyone back their money or not, or maybe you look at the average price and see if it’s close to a “yes” or close to a “no” price and use that as ground truth. 0.01% of the time, maybe randomly, maybe the highest volume market, maybe both, you actually run a costly mechanism and compensate participants based on that.

This provides a trusted, neutral, fast, and cheap refined version of the original highly trusted but extremely costly mechanism (using the word refined in analogy to the LLM distillation). Over time, this refined mechanism roughly mirrors the behavior of the original mechanism, because only the participants who helped achieve that outcome make money, and everyone else loses money.

This applies not only to social media, but also to DAOs. A major problem with DAOs is that there are too many decisions to make for most people to be willing to participate, which leads to either extensive use of delegation, with the risk of centralization and principal-agent failure common in representative democracies, or openness to attack. If actual voting rarely happens in a DAO, and most things are determined by prediction markets, where humans and AI combine to predict voting outcomes, then such a DAO may work well.

As we have seen in the example of decision-making markets, information finance contains many potential paths to solving important problems in decentralized governance. The key lies in the balance between market and non-market: the market is the engine and some other non-financialized trust mechanism is the steering wheel.

Other Use Cases of Information Finance

Personal tokens — projects like Bitclout (now deso), friend.tech, and many others that create tokens for everyone and make them easy to speculate on — are a category I call “raw information finance.” They intentionally create market prices for specific variables (i.e., expectations of a person’s future status) but the exact information revealed by the price is too vague and susceptible to reflexivity and bubble dynamics (Odaily Planet Daily Note: price surges attract buying). It may be possible to create improved versions of such protocols and solve important problems such as talent discovery by more carefully considering the economic design of tokens (especially where their ultimate value comes from). Robin Hanson’s view in “The Future of Prestige” is a possible end state.

Advertising - The ultimate expensive but trustworthy signal is whether you will buy a product. Information based on this signal can be used to help people decide what to buy.

Scientific peer review - There has been a replication crisis in science, whereby some well-known results that have become part of folk wisdom in some cases cannot be reproduced in new studies. We could try to identify results that need to be re-examined through prediction markets. Such markets would also give readers a quick estimate of how much they should trust any particular result before it is re-examined. Experiments with this idea have been done and appear to be successful so far.

Public Goods Funding — One of the main problems with public goods funding mechanisms used in Ethereum is their “popularity contest” nature. To gain recognition, each contributor needs to run their own marketing operation on social media, and contributors who are not well-equipped to do this, or who naturally have more “background” roles, have a hard time getting significant funding. An attractive solution is to try to keep track of the entire dependency graph: for each positive outcome, which project contributed how much to it, then for each project, which project contributed how much to it, and so on. The main challenge of such a design is to figure out the weights of the edges so that they are resistant to manipulation. After all, such manipulation happens all the time. A refined human judgment mechanism might help.

in conclusion

These ideas have been theorized for a long time: the earliest writings on prediction markets and even decision markets are decades old, and financial theory that says similar things is even older. However, I think there is a big opportunity for the current decade of information for several key reasons:

Infofinance solves real trust problems. A common problem of this era is the lack of awareness (or worse, lack of consensus) about who is trustworthy in political, scientific and business contexts. Infofinance applications can be part of the solution.

We now have scalable blockchains as a foundation, and until recently, the fees were too high to really implement these ideas. But now, the fees are no longer high.

AI as a participant, when information finance must rely on human participation to solve each problem, it is relatively difficult to play a role. AI has greatly improved this situation, and it can establish effective markets even on small-scale problems. Many markets may have a combination of AI and human participation, especially when the volume of a specific problem suddenly increases from small to large.

To make the most of this opportunity, now is the time to explore what financial information can teach us through election forecasts.