Original | Odaily Planet Daily ( @OdailyChina )

Author | Fu Howe ( @vincent 31515173 )

It seems that Bitcoin is no longer the only cryptocurrency in the crypto market; funds are pouring into mainstream altcoins.

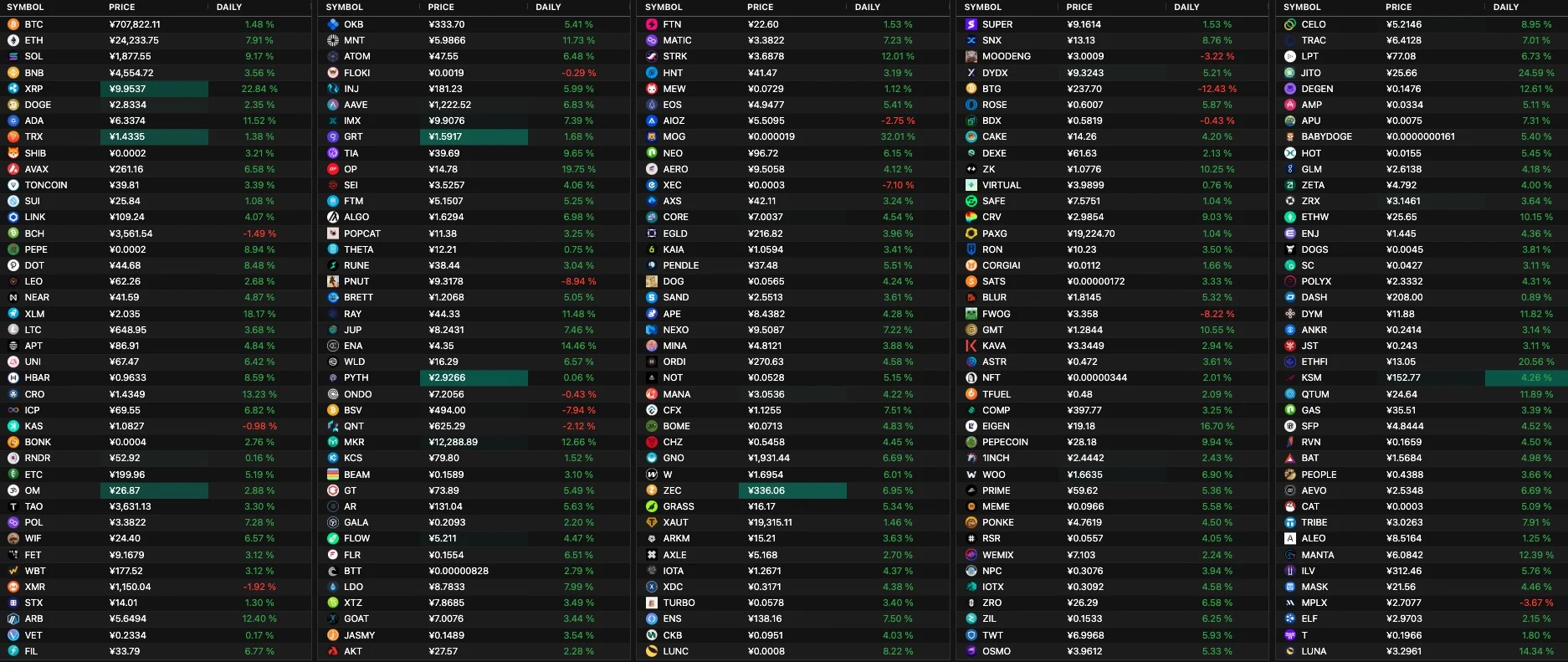

According to Quantify Crypto data, in the past 24 hours, among the top 200 cryptocurrencies by market value, 185 tokens rose, and only 15 tokens fell. Among them, the top 100 currencies by market value generally rose by more than 8%, among which ETH broke through 3400 USDT, with a 24-hour increase of nearly 10%; SOL broke through 260 USDT, setting a record high; Ethereums second-layer OP and ARB both rose by more than 15%. On social media, many users said that the copycat season has finally arrived.

But has the altcoin season arrived? To this end, Odaily Planet Daily will explain the reasons for the rise in altcoin prices and analyze whether it can continue. ( Odaily Planet Daily Note: The author separated the memes on the chain from the altcoin team, and attributed the memes on the top exchanges to altcoins.)

Why are altcoins rising?

The transaction volume of well-known memes on the chain has decreased, and the community discussion has decreased

Previously, the price of Bitcoin continued to break new highs, while altcoins fell instead of rising, which also caused some users to be pessimistic about altcoins in this bull market, especially VC coins that are facing large-scale unlocking.

Therefore, the market is looking to launch fairer meme sectors, which has led to most funds going to on-chain PVP. The former mainstream altcoins are facing the situation of having a large market value but liquidity that is not as good as a meme project that has just exploded. For example, the 24-hour trading volume of the top 100 tokens in terms of market value is not even as good as that of the newly popular CHILL GUY.

However, the high intensity of meme PVP is also daunting, and it is inevitable that funds will return to altcoins, which gradually evolves into a new mechanism: Bitcoin breaks through first, and meme and altcoin funds rotate. The rise of altcoins this time is partly due to the decline in the popularity of on-chain memes, including:

The trading volume of well-known meme coins has begun to decline, such as ai16z, RIF, uppercase and lowercase ELIZA, etc. These are representatives of previously popular meme coins. According to GMGN data, almost most of the trading volumes have been halved.

Community discussion has declined. Most of the meme communities I am in have changed from discussing which meme projects to pursue to talking about how to persist and wait for the next wave of meme hype.

SEC Chairman is about to leave office, triggering altcoin frenzy

Since the approval of Bitcoin and Ethereum spot ETFs, the crypto market has begun to rise continuously, and the market is also looking forward to the next cryptocurrency to go mainstream.

Today, Bloomberg senior ETF analyst James Seyffart wrote: Cboe has submitted applications to the US SEC for four Solana spot ETFs, with issuers VanEck, 21 Shares, Canary Capital and Bitwise. If the SEC does not reject the above application, the final deadline will be around early August next year.

The application for a cryptocurrency spot ETF requires the issuer to prepare two documents, namely S-1 and 19 b-4. This time it is the S-1 document, which represents the document required for the SOL spot ETF to be listed. The documents that really face review difficulties are mostly concentrated in 19 b-4. Therefore, the SOL spot ETF is just getting started.

However, SEC Chairman Gary announced on the X platform that he would officially resign on January 20. The new SEC Chairman may speed up the review of the SOL spot ETF, and it may not have to be extended to the final deadline like the previous Bitcoin and Ethereum ETFs.

In addition, Garys upcoming departure will also give a respite to the heavily regulated altcoin projects. Ripple, which has always had a grudge with the US SEC, saw its token XRP rise by nearly 30% in a single day.

With the support of regulation and SOL spot ETF, it is reasonable for altcoins to rise.

Can altcoins continue to rise?

Whether the craze for altcoins can continue still requires observation and verification from more dimensions.

From historical experience, the market of altcoins is often driven by short-term popularity, but whether the price can be maintained depends on the long-term development ability of the project and the coordination of the overall market environment. Although there are calls for a altcoin season in the current market, if there is a lack of new technological breakthroughs, application landing or ecological development support, this wave of market may be more of a game of short-term capital rotation rather than a trend of increase.

Therefore, both institutional and individual investors need to remain vigilant in the face of this round of altcoin market. On the one hand, we need to pay attention to changes in the flow of funds in the market, such as key indicators such as on-chain token transfer data; on the other hand, we also need to guard against the risk of a pullback after a short-term increase, especially the capital flow of the top project parties may become an important indicator of the subsequent market. At present, the altcoin season is still a game field where opportunities and risks coexist, and investors should remain calm.