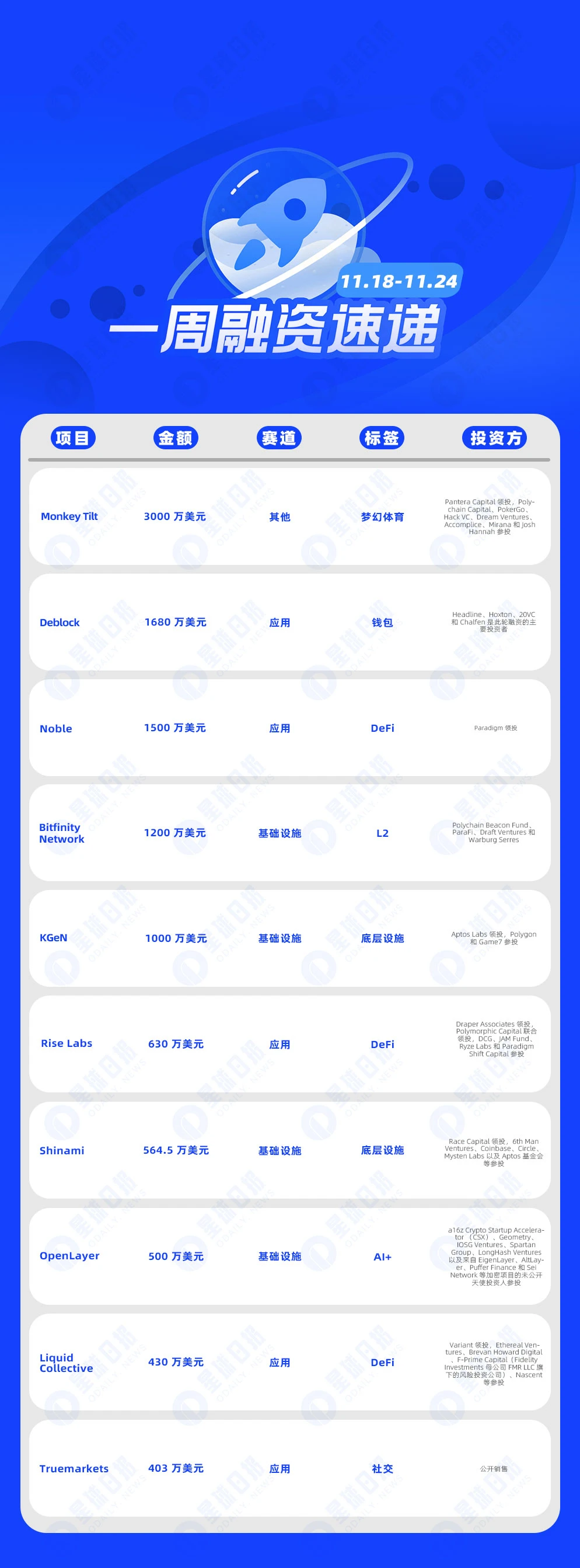

According to incomplete statistics from Odaily Planet Daily, there were 14 blockchain financing events announced at home and abroad from November 18 to November 24, a significant decrease from last weeks data (24 events). The total amount of financing disclosed was approximately US$118 million, a decrease from last weeks data (US$175 million).

Last week, the project that received the most investment was the crypto fantasy sports platform Monkey Tilt ($30 million); followed by the crypto wallet Deblock ($16.8 million).

The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and MA events; 3. * indicates a traditional company whose business involves blockchain):

On November 20, crypto fantasy sports platform Monkey Tilt announced the completion of a $30 million Series A round of financing, which closed this summer but was only recently disclosed. Pantera Capital led the investment, with participation from Polychain Capital, PokerGo, Hack VC, Dream Ventures, Accomplice, Mirana, and Josh Hannah. This latest financing brings the total financing amount to more than $50 million.

On November 21, according to documents filed this month with the UK Companies House, Deblock, a crypto wallet founded by former Revolut and Ledger executives, has completed an additional £13.3 million (about $16.8 million) in seed round financing. Another October document showed that Headline, Hoxton, 20 VC and Chalfen were the main investors in this round of financing. Sifted previously reported that the startup quietly raised 12 million euros last year.

Stablecoin infrastructure platform Noble completes $15 million Series A financing, led by Paradigm

On November 19, the stablecoin infrastructure platform Noble announced the completion of a $15 million Series A financing, led by Paradigm, and other investors have not yet been disclosed. The new financing brings Nobles total financing to $18.3 million. It is reported that the platform will use the funds from this round of financing to accelerate the adoption of stablecoins by developing new user-oriented products and expanding its workforce. Currently, Noble has reached cooperation with stablecoin issuers such as Circle, Ondo Finance, Hashnote Labs and Monerium, and the platform currently manages assets of more than $458 million.

On November 19, Bitcoin L2 solution Bitfinity Network announced the completion of $12 million in financing, including $7 million from institutions such as Polychain Beacon Fund, ParaFi, Draft Ventures and Warburg Serres, and $5 million raised from community over-the-counter (OTC) token sales. The project will use the Chain Fusion technology of the Internet Computer Protocol (ICP) to enable the operation of Bitcoin native assets in an Ethereum-compatible ecosystem.

Additionally, the Bitfinity Network has been launched, with security enhanced by a “robust proof-of-stake protocol leveraging Chain-Key technology,” which provides stronger security than traditional multi-signatures used by most L2s. The ecosystem plans to host dApps such as Sonic, Chapswap, Lendfinity, and Omnity Bridge.

Decentralized game player network KGeN completes $10 million financing, led by Aptos Labs

On November 21, the decentralized gamer network KGeN (Kratos Gamer Network) announced the completion of a $10 million ecosystem round of financing, led by Aptos Labs, with participation from Polygon and Game 7. As of now, the total financing has reached $30 million. It is reported that its gamer network mainly operates in India, Brazil, Nigeria, Southeast Asia, the Middle East and North Africa.

On November 21, hybrid payment platform Rise Labs announced the completion of a US$6.3 million Series A financing round, led by Draper Associates and co-led by Polymorphic Capital, with participation from DCG, JAM Fund, Ryze Labs and Paradigm Shift Capital.

According to reports, Rise Labs mainly develops hybrid payment infrastructure that integrates fiat currency, stablecoins and cryptocurrencies. Currently, Rise has more than 150 customers and more than 100,000 contractors. Its customer base includes traditional enterprises, Web3 enterprises, as well as DAOs, protocols and platforms.

On November 21, Move ecosystem developer platform Shinami announced the completion of a $5.645 million seed round of financing, led by Race Capital, with participation from 6th Man Ventures, Coinbase, Circle, Mysten Labs, and Aptos Foundation.

Shinami is committed to becoming the Consensys of the Move ecosystem, providing developers with a one-stop tool platform to simplify the construction of applications on Move blockchains such as Aptos, Sui and Movement.

Additionally, Shinami joined the Move Collective.

On November 20, OpenLayer, a crypto AI startup co-founded by three former Robinhood employees, completed a $5 million seed round of financing. A16z Crypto Startup Accelerator (CSX), Geometry, IOSG Ventures, Spartan Group, LongHash Ventures, and undisclosed angel investors from crypto projects such as EigenLayer, AltLayer, Puffer Finance, and Sei Network participated in the investment.

OpenLayer acts as an AI data layer, enabling users to contribute and verify data through a Chrome extension and earn points. According to its website, application developers can access this user data with user consent, thereby protecting privacy. Use cases include training AI models, user targeting, and enhancing functionality.

In addition, OpenLayer plans to launch its own token in the future. Currently, there are 7 people working at OpenLayer in the United States, and it plans to hire two more engineers.

Alluvial, a staking protocol developer, completes $4.3 million in strategic financing led by Variant

On November 19, according to official news, Alluvial, the developer of the institutional-grade liquidity staking protocol Liquid Collective, completed a new round of strategic financing of US$4.3 million, led by Variant, with participation from Ethereal Ventures, Brevan Howard Digital, F-Prime Capital (a venture capital company under Fidelity Investments parent company FMR LLC), Nascent and others, bringing its total financing amount to US$22.5 million.

The new funds are intended to facilitate product development and expansion to meet growing ETF and global institutional demand.

Earlier in July last year, Alluvial completed a US$12 million Series A financing round, led by Ethereal Ventures and Variant.

On November 19, Truemarkets, a market-based news and entertainment platform, raised more than $4 million through a public NFT sale, raising $4.03 million by selling 15,071 NFTs, with a minting fee of 0.08 ETH (about $250) per NFT. Ethereum co-founder Vitalik Buterin purchased 400 of the NFTs, spending a total of 32 ETH (about $107,000).

Truemarkets allows users to bet on real-world events. Truemarkets has two types of NFTs: Oracle Patron NFTs and Truth Seeker NFTs. NFT holders are eligible to claim the upcoming asset, TRUE tokens, during the platform’s token generation event.

DeFi liquidity solution Barter completes $3 million seed round of financing, led by Maven 11

On November 19, Barter, a decentralized financial liquidity solution system, announced the completion of a $3 million seed round of financing, led by Maven 11, with participation from Lattice, Anagram, Heartcore, DCG, and Daedalus Angels. Barter was founded in 2023 and is mainly engaged in on-chain transaction matching and settlement. The company intends to use the funds to expand the team, speed up research, and continue to develop AppChain, a DeFi tool that connects liquidity and order flow.

On November 22, according to official news, the DeFi project Exponent on the Solana chain announced the completion of US$2.1 million in financing, led by RockawayX, with participation from Solana Ventures, Cherry Ventures, Mechanism Capital, Robot Ventures and others.

Decentralized AI cloud service Heurist raises $2 million, with Amber Group and others participating

On November 19, according to official news, the decentralized AI cloud service Heurist recently announced the completion of US$2 million in financing, with Amber Group, Contango Digital, Manifold Trading, Selini Capital, X Ventures, Sharding Capital, Blue 7 Capital, Mozaik Capital, Zephyrus Capital, Origin Capital, Steroids Capital, DCF God and others participating in the investment.

It is reported that based on the ZK stack, Heurist is solving key AI infrastructure challenges and making it as accessible as the Internet:

-True serverless deployment;

- Elastic resource expansion;

-Community owned computing network.

On November 20, according to official news, Gabby World announced that it had completed a US$2 million financing with a valuation of US$20 million. Investors included 13 institutions including SevenX Ventures, OnePiece Labs, Everest Ventures Group, Phoenix Capital, Zonff Partners, and 8 angel investors including former partners of Republic, former partners of Hashed, and partners of Gam 3 Girl Ventures.

It is reported that Gabby World is an AIGC Dungeons Dragons game co-created by the community, and through the fair release token economy, it realizes the issuance of VC coins with ultra-low market value like memes, aiming to explore a new paradigm for the issuance of VC coins that is against low circulation and high FDV and anti-time unlocking. The token GABBY was issued on Solanas DEX at the end of October with a market value of US$10,000, and has successfully verified the on-demand release and repurchase destruction advocated by the fair release token economic model in the past few weeks.