introduction

Base Chain is a project incubated by Coinbase, with the goal of becoming part of the Optimism superchain, and its launch is part of Coinbases long-term plan. Base Chain is developing rapidly. According to Defilama data, its TVL has now surpassed Arbitrum, Optimism and other old Layer 2 projects, becoming the Layer 2 project with the highest TVL at this stage.

Introduction to Base Chain

Base Chain is a Layer 2 solution built on the standardized, shared, and open-source OP Stack development tool stack supported by Optimism. Optimistic Rollups are more compatible with Ethereum, allowing many decentralized applications (dApps) to migrate directly. At the same time, they have low computational complexity and are more suitable for the execution of general smart contracts and complex computing tasks. However, there are still some aspects that need to be improved when using Optimistic Rollups, such as further improvement of decentralization and optimization of the on-chain governance architecture, and users high demand for the availability of sorting services. Through continuous technical iterations, these shortcomings will eventually be improved.

To increase the degree of decentralization, Optimism Rollup plans to improve the original on-chain governance by adopting the open source Layer 2 architecture tool stack OP Stack, thereby introducing multiple sorting nodes and reducing dependence on a single sorting service. Currently, the ultimate goal of OP Stack, maintained by Optimism Collective, is to build a superchain that can easily integrate different Layer 2s to achieve an interoperable integrated system. To this end, OP Stack provides a series of standardized modules and interfaces to make the process of building Layer 2 programs simpler and more efficient. OP Stack is divided into six layers of architecture: data availability layer, sorting layer, derivation layer, execution layer, settlement layer and governance layer. Each layer has customizable open source modules to facilitate developers to design customized blockchain networks based on specific usage scenarios.

Base joined the development of OP Stack and Superchain as the second core development team, and is committed to improving the activity of superchains, adding value to them, and promoting the growth of the developer ecosystem together with OP Labs and Optimism Collective. Base hopes to create a highly integrated chain network to bring users a seamless user experience, so that future protocols built on Base can be smoothly integrated into the final superchain and interact with users on multiple chains. Close cooperation with Optimism Collective on its transformation project will help developers build new Layer 2 and Rollups more conveniently, and distribute their applications conveniently across the entire superchain.

Base on-chain data

TVL

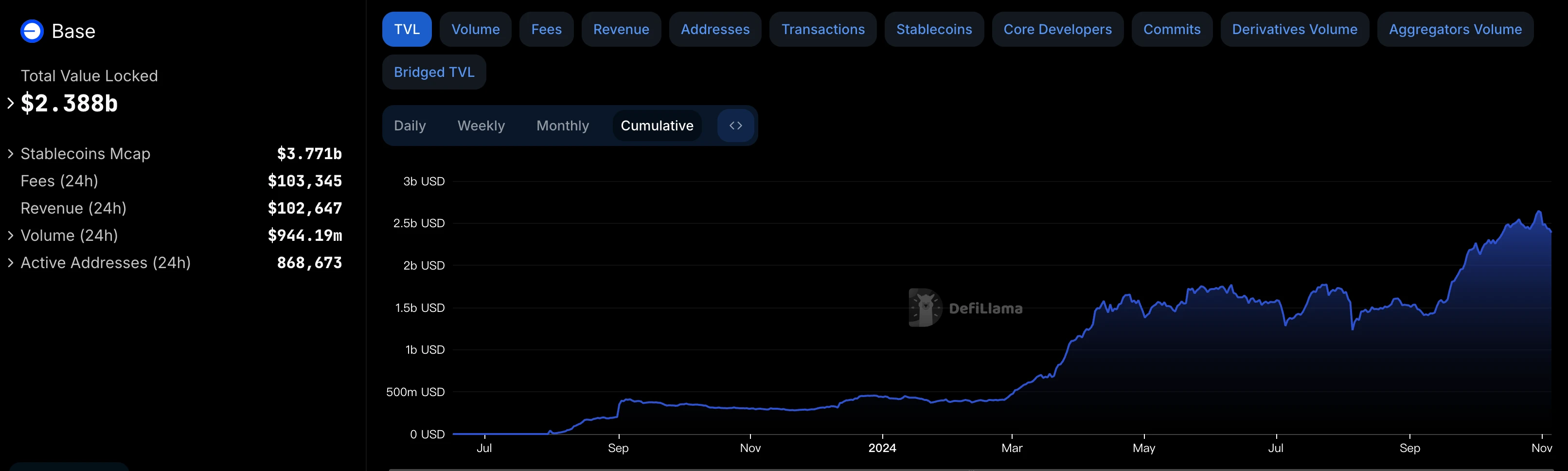

Figure-1 Base’s TVL (data source: https://defillama.com/chain/Base)

According to the statistics in Figure 1, the TVL of the Base chain has experienced a large-scale increase since September, from $1.419 billion to the current $2.388 billion, an increase of 68.28%. TVL is the most critical analysis factor for a public chain. Among all ETH-Layer 2, Bases TVL growth ranks first, which shows that Base has developed rapidly in the recent period.

Number of on-chain addresses

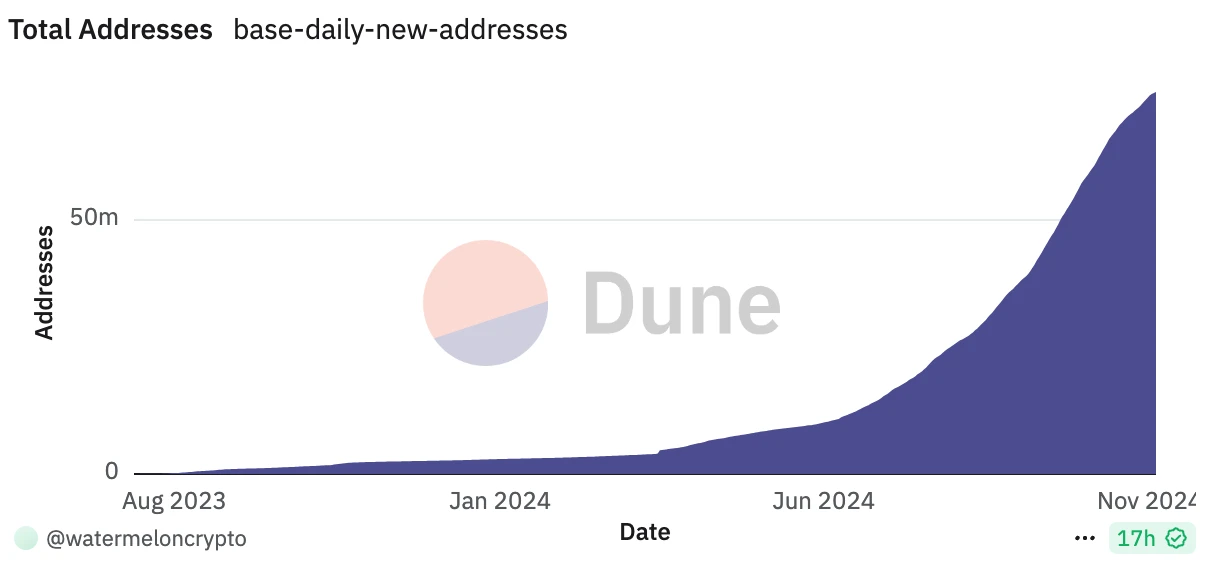

Figure-2 Number of addresses on the Base chain (data source: https://dune.com/watermeloncrypto/base)

From Figure 2, we can see that the number of Bases on-chain addresses has increased significantly since August 2024, from 24.55 million to the current 74.88 million, an increase of 205.01%. We can see that the number of users on the Base chain has more than doubled in the past three months. It can be analyzed that on-chain users are very optimistic about the development of Base and that the Base chain has a certain wealth-creating effect, thereby attracting more users to participate in Base chain activities.

We can observe and find out by combining the TVL growth value of Base chain and the number of addresses on Base chain: the average new funds per household on Base chain is only $1.97, which is generally small amount of users. Combined with the fact that after June, Base chain successfully attracted a large number of users by leveraging its social characteristics and the popularity of MEME culture. Therefore, we can conclude that the spread effect of Meme culture and the enhancement of social interaction have made Base chain a popular social platform, further promoting user growth.

Base chain income

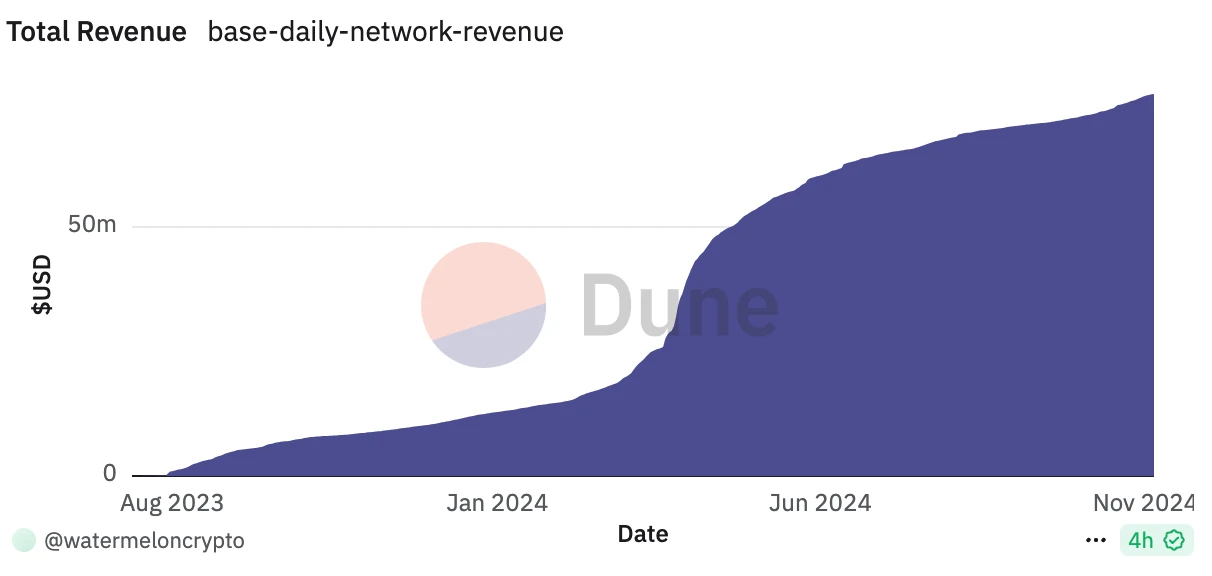

Figure-3 Base on-chain revenue (data source: https://dune.com/watermeloncrypto/base)

From the revenue chart of the Base chain, we can see that the total revenue of the Base chain in March 2024 was 19.78 million US dollars, and the revenue to date is 76.55 million US dollars. Therefore, we can calculate that the total increase in Base chain revenue from March to October reached 287%, and the average monthly increase reached 41%. It can be seen that with the increase in on-chain users and activities, Bases revenue has maintained a fairly high growth rate.

Weekly Trading Volume

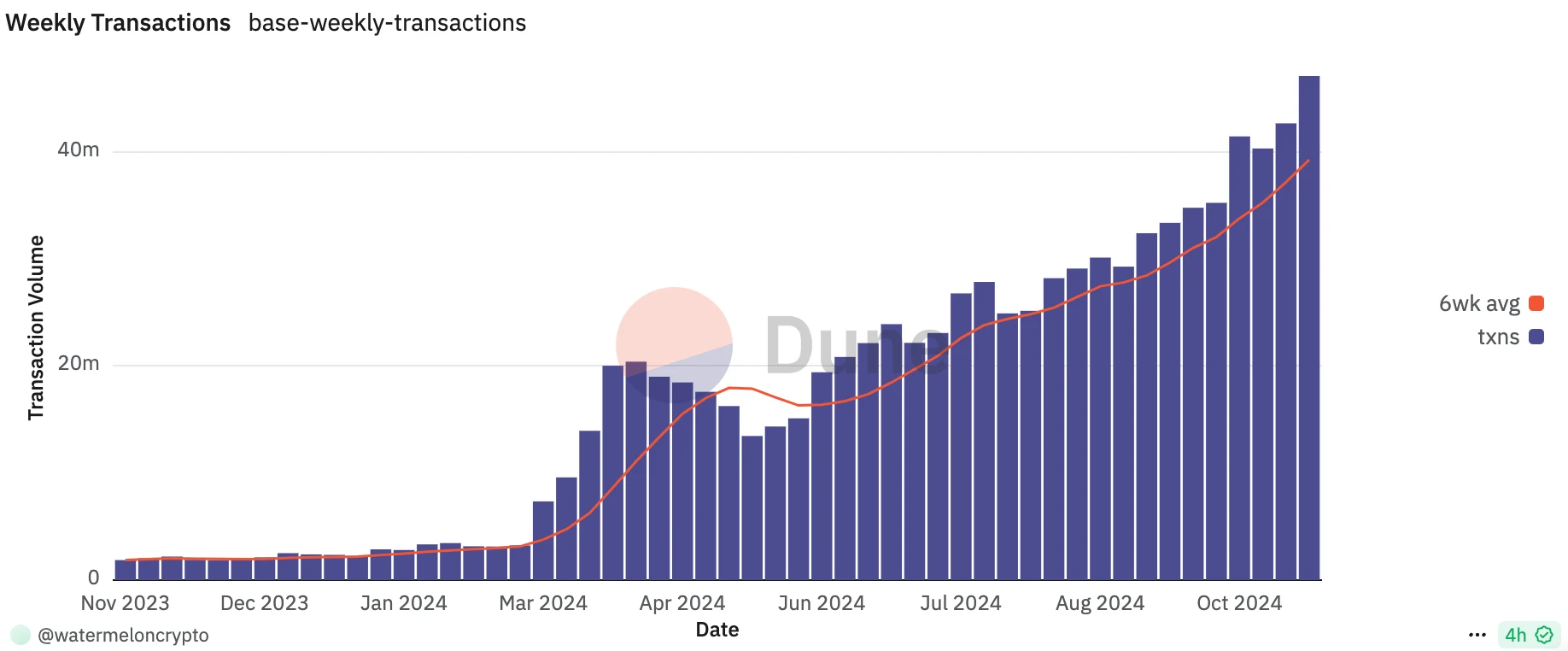

Figure-4 Base chain weekly transaction volume (data source: https://dune.com/watermeloncrypto/base)

From the chart of Base chain’s weekly transaction volume, we can see that Base chain’s weekly transaction volume began to grow continuously in May 2024. Its weekly transaction volume in May 2024 was 13.45 million, and its weekly transaction volume has reached 47.06 million so far. We can calculate that Base chain’s weekly transaction volume increased by 249% in total from May to October, and the average monthly increase was 49%. It can be seen that the transaction volume on Base chain has maintained rapid and sustained growth.

On-chain performance

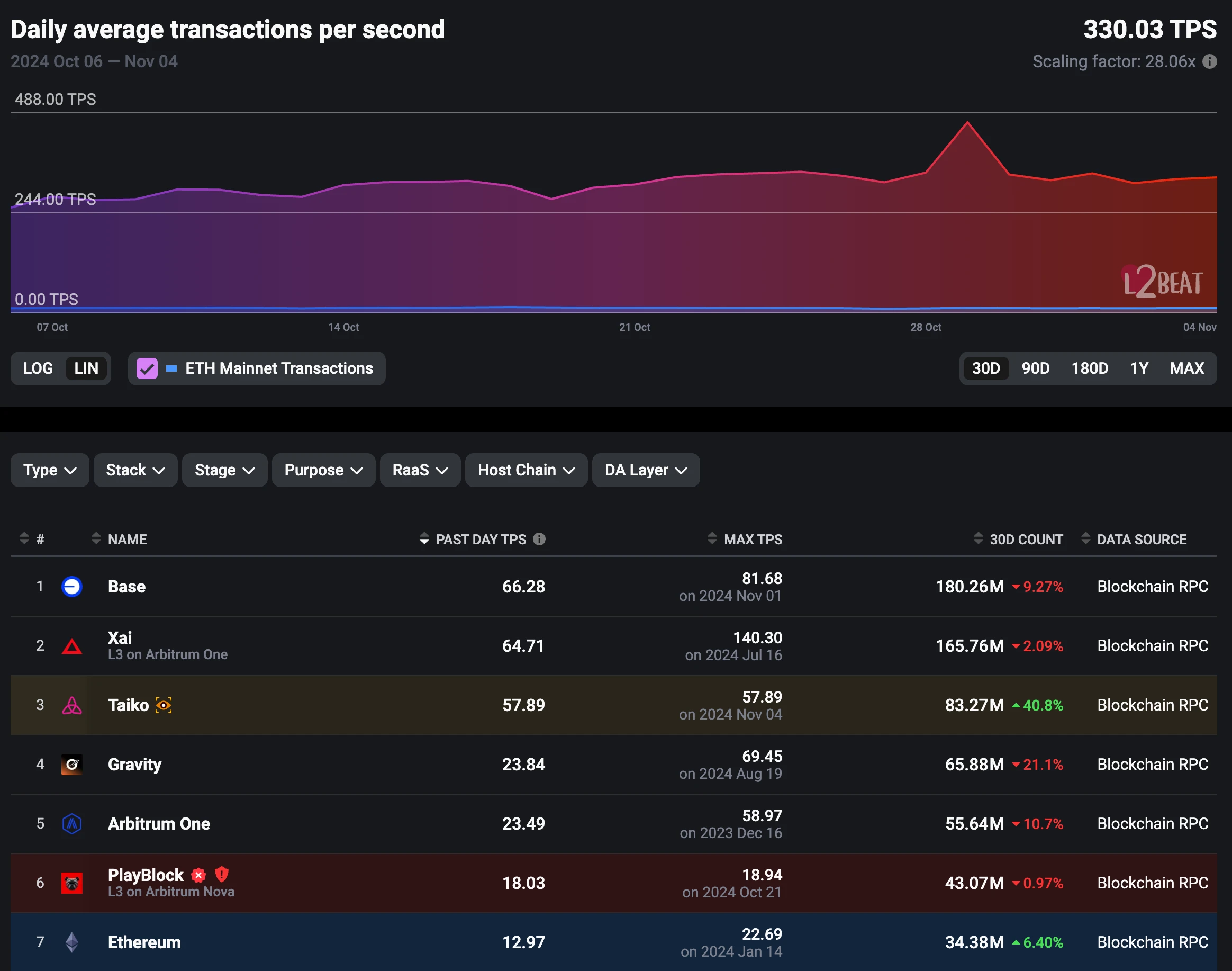

Figure 5 Average daily transaction volume per second on the chain (data source: https://l2 beat.com/scaling/activity)

From Figure 5, we can see that Base’s TPS is 66.28, which exceeds the performance of other chains and has the best performance in the entire Ethereum ecosystem.

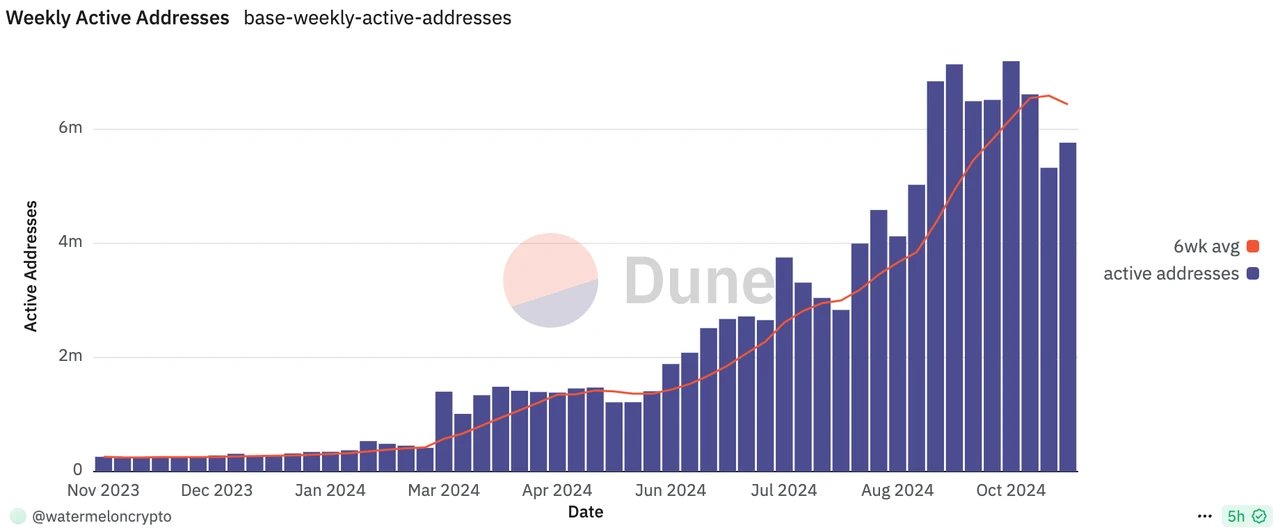

Weekly active addresses

Figure-6 Active addresses of Base chain last week (data source: https://dune.com/watermeloncrypto/base)

From Figure 6, we can see that the weekly active users on the Base chain have maintained a good growth momentum. For a public chain, the increase in active users on the chain is the main factor in evaluating whether a chain is developing healthily.

In summary, we can judge from the above data that the Base ecosystem is now in a booming development trend. The two most important factors for judging whether an ecosystem is healthy and sustainable are: funds and traffic. In these two aspects, the Base chain performs the best among all ETH-Layer 2. The funds are reflected in TVL, transaction volume and chain revenue. These three indicators of the Base chain show a rapid upward development momentum, and the average monthly growth rate exceeds 40%. It can be judged that a large amount of funds are constantly entering the Base ecosystem. From the perspective of traffic, it is mainly reflected in the number of on-chain addresses and the number of weekly active addresses. In these two points, we can clearly see from the chart that the number of users and active users on the Base chain are on an upward trend. Coupled with the superior on-chain performance of the Base chain, the Base chain will have a very good development in the ETH-Layer 2 track.

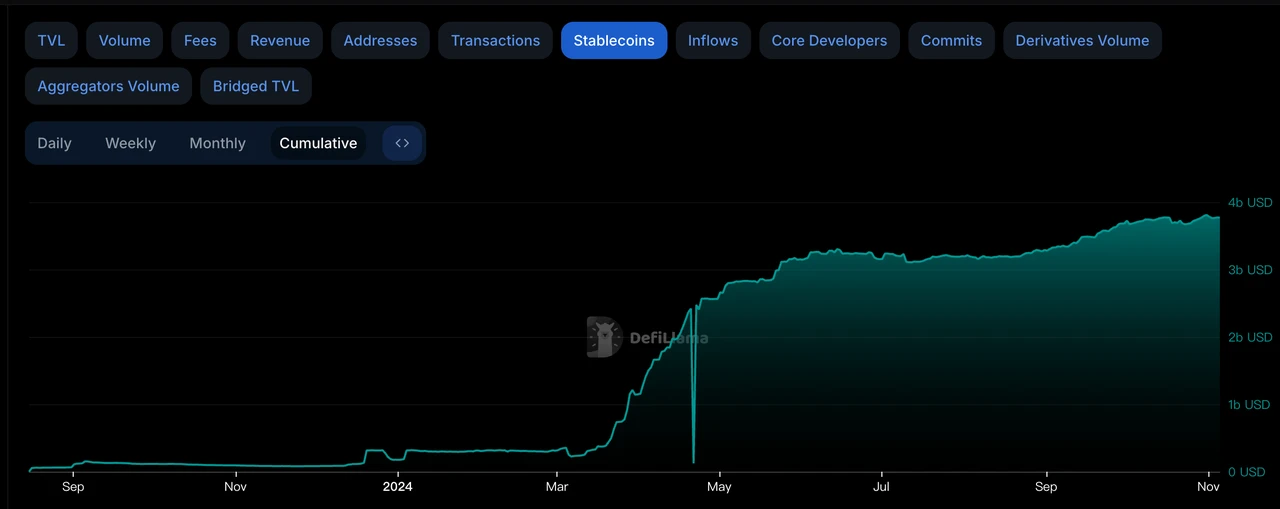

Circle (USDC) support for Base

Figure-7 Number of stablecoins on the Base chain (data source: https://defillama.com/chain/Base?stables=truetvl=falseinflows=false)

From Figure 7, we can see that the stablecoins on the Base chain have been growing rapidly since March of this year. In March 2024, the stablecoins on the Base chain were 319 million US dollars, and the weekly trading volume has been 3.771 billion US dollars so far. We can calculate that the total increase in the number of stablecoins on the Base chain from March to October reached 1082.13%, and the average monthly increase reached 216.42%. It can be seen that the number of stablecoins on the Base chain has maintained rapid and sustained growth.

Although the number of stablecoins on the Base chain is increasing, including stablecoins such as USDT and USDC, most of the users who use USDC are American users, so we can regard the increase in USDC as the increase in funds of American users. In addition, this year, the U.S. Securities and Exchange Commission (SEC) has successively approved BTC spot ETFs and ETH spot ETFs, and various asset management institutions and listed companies in the United States have actively purchased BTC. It can be seen that the market focus of Crypto has shifted to the U.S. market at this stage, and the Base chain mainly relies on the support of Coinbase, which is the first listed cryptocurrency exchange in the United States, so we will focus on USDCs support for the Base chain.

First, in September 2023, Circle officially announced support for the Base chain and issued USDC on the Base chain. USDC is now natively available on the Base network, which means that users and developers can use USDC without bridging, which greatly simplifies operations and improves efficiency. Circle accounts and Circle APIs also fully support USDC on Base, making it more convenient to access USDC liquidity. And Circle has developed CCTP, a permissionless on-chain tool that allows USDC to be transferred securely between different blockchains. With CCTP, USDC can be natively burned and minted on the Base chain, providing more convenience and accessibility to platforms such as ChainPort.

Secondly, Coinbase partnered with Stripe to introduce USDC to the Base platform, enabling faster and cheaper cross-border transfers and fast conversion of USD to cryptocurrency. This not only increases transaction speed and reduces costs, but also further promotes the practicality of cryptocurrency. These include:

Stripe adds USDC to its crypto payments offering: Stripe has integrated USDC into its crypto payments system, making it faster and cheaper for the Stripe platform to send money to over 150 countries.

Adding USDC on Base as a Fiat-to-Crypto On-Ramp: Stripe added USDC on Base to its fiat-to-crypto on-ramp, enabling U.S. customers to convert fiat to crypto faster than ever before.

Coinbase adds Stripe’s fiat-to-crypto on-ramp to its wallet: Coinbase has integrated Stripe’s fiat-to-crypto on-ramp to its wallet, allowing users to instantly buy cryptocurrencies using credit cards and Apple Pay.

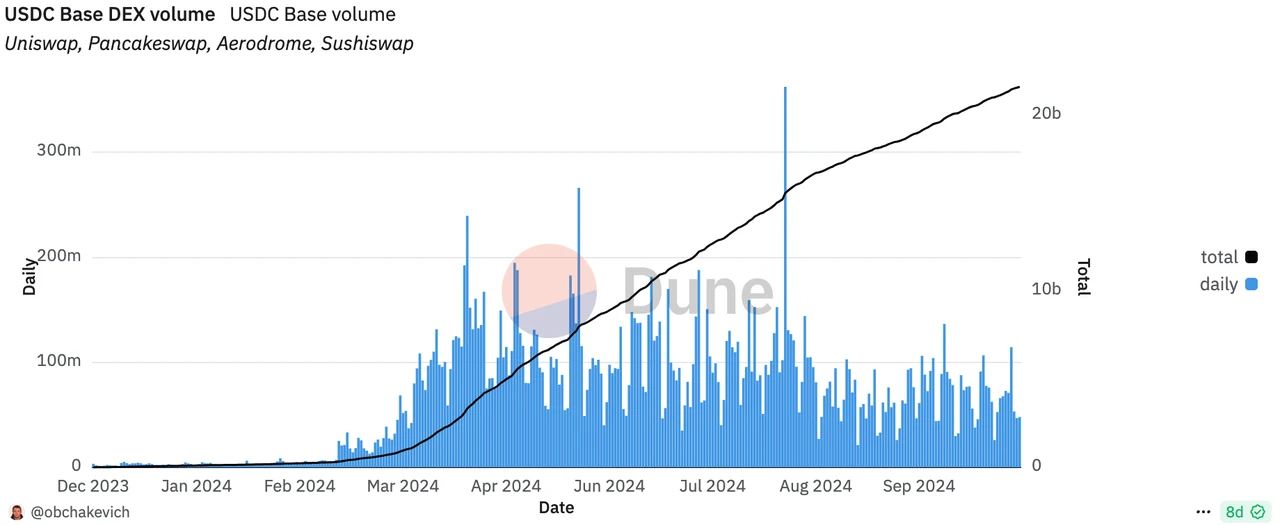

The cooperation between Coinbase and Stripe mainly revolves around integrating the USDC stablecoin into the Base chain and promoting the global adoption of cryptocurrencies through this cooperation. Adding support for USDC on the Base chain to Stripes crypto payment function enables faster international fund transfers. Coinbase integrates Stripes fiat-to-cryptocurrency portal into the Coinbase wallet, further simplifying the users purchase process. The cooperation between Coinbase and Stripe is conducive to expanding the acceptance and use of USDC worldwide. And USDC plays an important role in the Base chain. As of October 2024, the transaction amount of USDC on the Base chain DEX has exceeded 20 billion US dollars, making an important contribution to the prosperity of the Base chain ecosystem.

Figure-8 USDC transaction amount on DEX on the Base chain (data source: https://dune.com/obchakevich/usdc-base)

From Figure 8, we can see that in March of this year, the transaction amount of USDC in the Base chain DEX showed a rapid and sustained development trend, with the growth rate reaching 5275%, which is an astonishing growth rate.

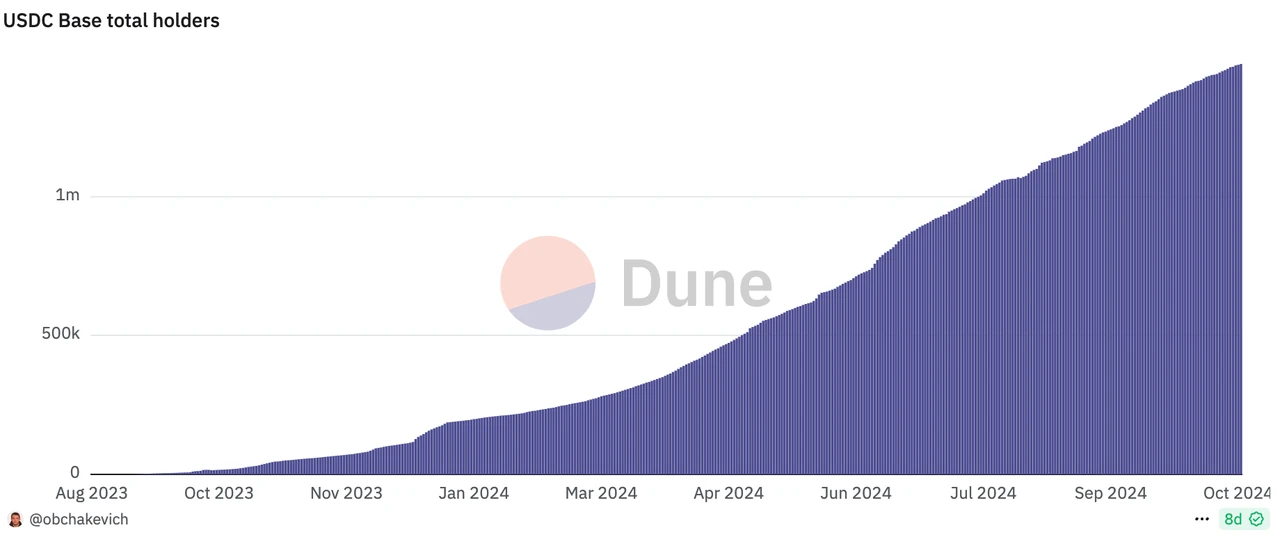

Figure-9 Number of USDC holders on the Base chain (data source: https://dune.com/obchakevich/usdc-base)

From Figure 9 we can see that USDC is becoming more and more popular on the Base chain, and more and more users choose to use USDC as an on-chain stablecoin.

In summary, Circle and Base have launched an all-round cooperation, which has significantly simplified the user operation process through the issuance of native USDC and the implementation of the CCTP cross-chain transmission protocol; at the same time, the strategic cooperation between Coinbase and Stripe has further expanded the application scenarios of USDC in the Base ecosystem, including support for cross-border payments in more than 150 countries, convenient fiat currency entry and diversified payment methods (such as credit cards and Apple Pay). These initiatives have not only pushed the DEX transaction volume of USDC on the Base chain to exceed 20 billion US dollars, but more importantly, built a bridge connecting traditional finance and the crypto economy, laying a solid foundation for the future development of digital payments.

The Ecosystem of the Base Chain

According to the data on the official website of Base chain, we can see that the ecological environment of Base chain is very complete, including: Wallet, Bridge, Defi, Gaming, Onramp, Dao, Infra, Social, Security, NFT, Other, X-chain, X-cross, and multiple tracks, with a total of 323 Dapps.

Figure-10 Ecological projects on the Base chain (data source: https://www.base.org/ecosystem?utm_source=dotorgutm_medium=nav)

If we look at the Base chain from the perspective of whether a public chain is developing healthily, we mainly observe the ecology of a public chain from the perspective of funds and traffic. From the perspective of funds, we can analyze from the traditional Defi perspective; from the perspective of traffic, we can see from the market trend in 2024 that the main focus of users in the market is now on the Meme coin track and the SocialFi track. The Meme coin track is full of wealth-creating effects to attract extensive participation from users on the chain, and the SocialFi track can absorb and convert traffic users for the public chain from the traditional Web 2.

Defi Track

The most direct observation tool in the Defi track is TVL. We can analyze and introduce the projects in the Defi track by observing the TVL on the Base chain.

Figure-11 TVL data on Base chain (data source: https://defillama.com/chain/Base)

From Figure 11, we can see that the Defi projects on the Base chain with a TVL of more than 200 million US dollars include Aerodrome, Uniswap and Morpho Blue. Among them, Uniswap is a long-established DEX in the Ethereum ecosystem, and we will not discuss it in detail here.

Aerodrome

Aerodrome was launched in 2023. It is the first DEX on the Base chain and adopts the Ve(3, 3) model. Its Ve(3, 3) mechanism is based on Curves veCRV model and OlympusDAOs 3 v3 mechanism, and has been optimized and adjusted to adapt to the development of the ecosystem. This mechanism provides a unique reward model that promotes the stable development of the ecosystem by incentivizing long-term holders and active governance users. Aerodrome also helps users optimize asset management and participate in liquidity mining activities through efficient liquidity management tools. After becoming the premier AMM on the Base chain, it provides users with a more efficient and low-cost trading experience. The innovative incentive mechanism encourages more users to participate in governance and liquidity mining. Under this mechanism, participants can not only obtain protocol transaction fees, but also have the opportunity to obtain additional voting incentive rewards proportional to the number of AERO Tokens they lock. This design not only encourages the active participation of liquidity providers, but also provides governance power to the community, making the entire ecosystem healthier and more sustainable. The uniqueness of this incentive and governance strategy lies in its comprehensiveness and inclusiveness. It closely links the interests of liquidity providers, voters, and the entire community, creating a good environment for the development of the ecosystem. In particular, 90% of veAERO is locked, providing a strong incentive and governance mechanism for the entire ecosystem, stimulating demand and fostering a strong Token ecosystem.

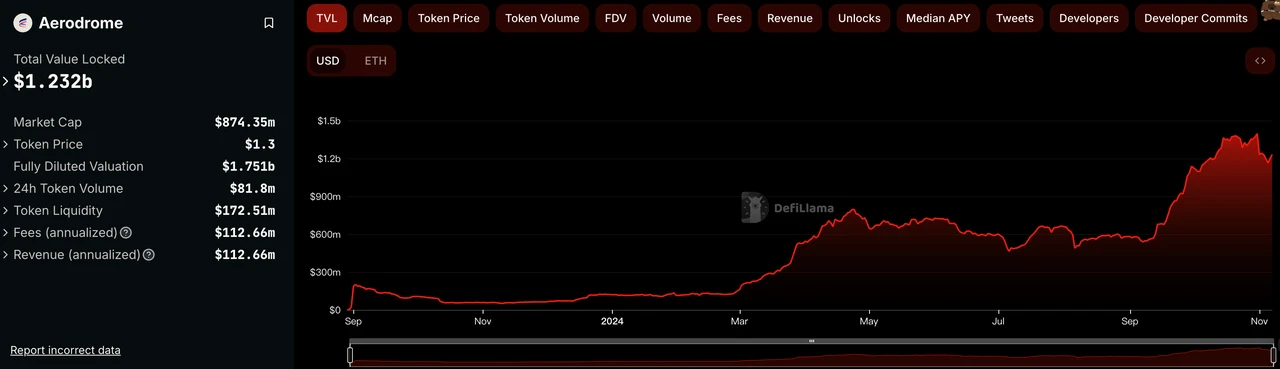

Figure-12 TVL of Aerodrome (data source: https://defillama.com/protocol/aerodrome#information)

Aerodrome’s TVL accounts for more than half of the TVL of the Base chain, and follows a similar growth pattern to the TVL of the Base chain, both of which have seen rapid increases since September 2024. With its own economic model and strong support from the Base chain, Aerodrome has grown into one of the most important projects in the Base chain.

Morpho Blue

Morpho Blue is a decentralized lending protocol developed by Morpho Labs that aims to reinvent the way decentralized lending is structured. The core goal of the project is to remove the reliance on DAO participants to manage asset handling parameters and introduce a simpler alternative based on permissionless risk management. Morpho Blue is a non-custodial lending protocol that provides a new trustless primitive for EVM implementations, improving efficiency and flexibility compared to existing lending platforms.

Morpho Blues design allows for the creation of independent markets without permission, by specifying collateral assets, loan assets, liquidation loan value (LLTV), and interest rate models. This design makes Morpho Blue an open lending platform where users can choose different markets and risk parameters to suit different risk preferences and user needs. In addition, Morpho Blue adopts a singleton contract design, where all markets are contained in a single smart contract, which simplifies the protocol and significantly reduces the gas consumption of users when interacting with multiple markets. Morpho Blue also provides a permissionless risk management and market creation mechanism, and oracle-independent pricing functions, making it an efficient lending infrastructure. This design not only improves the efficiency of the lending market, but also brings the advantages of the lending market to more assets and users.

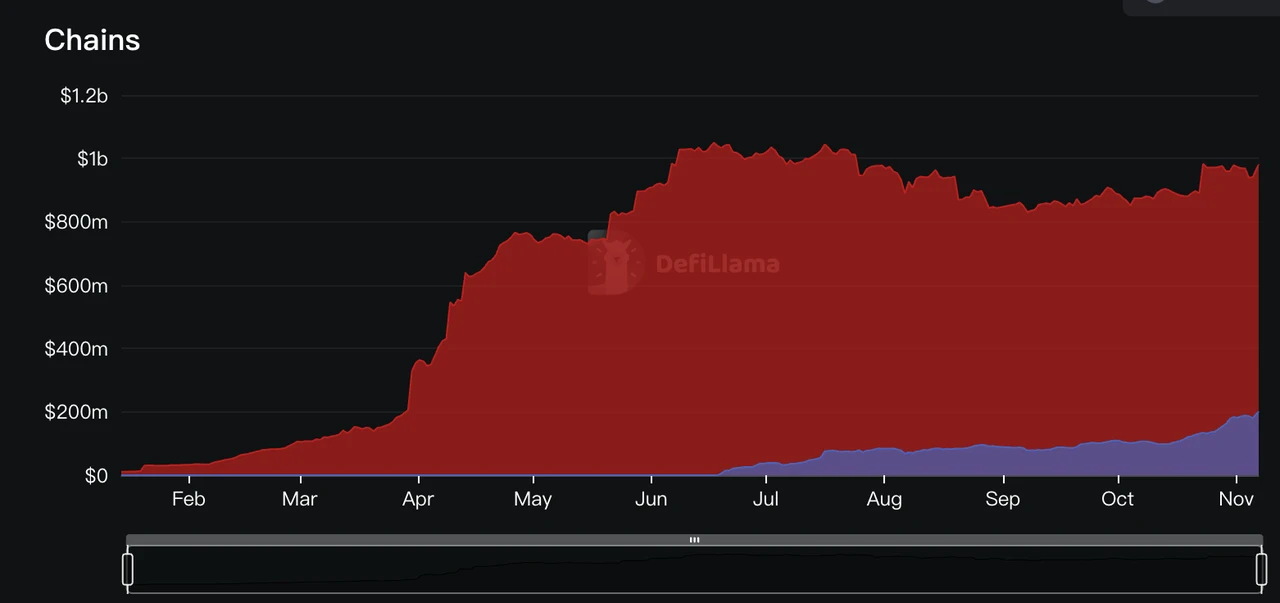

Figure-13 Morpho Blue TVL distribution on each chain (data source: https://defillama.com/protocol/morpho-blue#tvl-charts)

From Figure 13, we can see that Morpho Blue’s TVL is mainly distributed on the Ethereum chain, and its TVL on the Base chain has experienced rapid growth since July.

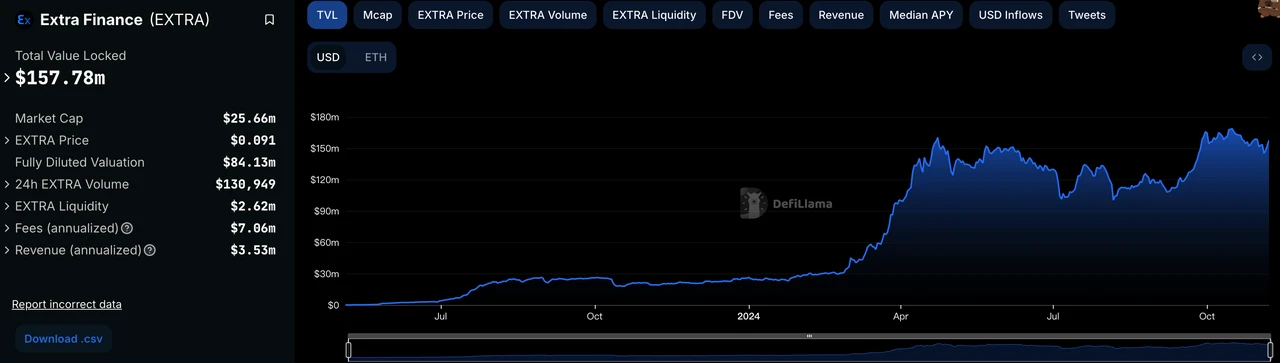

Extra Finance

Extra Finance is a decentralized lending and automatic compound leveraged yield aggregation protocol based on the Optimism network. It mainly provides users with a variety of financial tools such as leveraged lending, farming strategies with up to 3x leverage, long/short strategies, and neutral strategies. The goal of Extra Finance is to leverage the LYF protocol, allowing users to flexibly use up to 3x or higher leverage factors for reinvestment and market operations.

The platform has also integrated mainstream Dex such as Velodrome, and plans to integrate more mainstream Dex such as Uniswap V3 and Beethoven in the future. Users can participate in various farming strategies through the Extra Finance ecosystem, including reinvestment, market neutrality, and long/short position arming to meet different risk preferences and investment goals.

Extra Finance provides an innovative financial solution designed to maximize users returns by leveraging assets and increasing yield farming positions. In addition, Extra Finance has embedded LI.FIs widget, allowing users to easily bridge assets to Optimism and start earning yield.

Figure-14 TVL of Extra Finance (data source: https://defillama.com/protocol/extra-finance#information)

Meme coin track

In the Crypto industry this year, various Meme coin wealth creation myths are common. It can be said that the Meme coin project has become the main force to promote funds and users to participate enthusiastically, and can almost be regarded as a marketing method for the Base chain to attract users. For example, projects like TYBG, Degen and Brett, the Base chain has very popular Meme coins almost every once in a while, attracting a large amount of market traffic in a short period of time, and even some Meme projects on the Ethereum mainnet have transferred their contracts to the Base chain. This phenomenon highlights the huge influence and unique status of the Meme coin project in the cryptocurrency world. As a community-driven digital asset, the value of the Meme coin project usually comes from community consensus and emotional resonance. The popularity and market performance of the Meme coin project are often determined by the communitys emotions and behaviors, so it has extremely high uncertainty and volatility. There are also many risks behind the Meme coin project wealth creation myth. On the one hand, the price of the Meme coin project fluctuates violently, which puts investors at great risk; on the other hand, its value has no real economic basis, but relies on market sentiment and hype, and it is very likely to form a bubble. In short, the rise of the Meme coin project has brought both challenges and opportunities. Whether it is for the Base chain or the entire cryptocurrency market, it is particularly important to rationally examine the Meme craze. In the long run, only in this way can the industry develop healthily and stably.

SocialFi

We can see in this cycle that the SocialFi project has attracted a lot of new users from the traditional Web 2 world for various public chains, which not only brings new traffic to the chain but also brings new funds. Therefore, the SocialFi project is the best track to break the circle in the Crypto industry. The Base chain also seized the break-the-circle effect brought by SocialFi, and brought rapid growth through friend.tech in September 2023. By strongly binding with Twitter, friend.tech enables users to purchase the share (Share) of any friend.tech user through the ETH of the Base chain, thereby obtaining the right to directly communicate with them, and it is possible to profit from it. And later Farcaster made the Base chain famous. It attracted a large number of on-chain and off-chain users to the Base chain, bringing new growth points for the development of the Base chain.

Friend.tech

Friend.tech is a decentralized social platform based on the Base chain, which was officially launched on August 10, 2023. The platform allows users to use it by binding Twitter accounts and monetize social value by buying and selling Twitter users keys. Each account has its own unique social value, similar to stocks, and users can enter specific private chat rooms and interact with account holders by purchasing these keys.

Friend.tech’s design mechanism includes tokenizing users’ influence, allowing users to purchase keys to gain access to specific creator content and chat rooms. In addition, the platform has introduced a points program to incentivize users to stay active in the hope of eventually receiving airdrop rewards.

Although Friend.tech achieved significant success in its early days, attracting a lot of transactions and attention, its transaction volume and popularity gradually declined. The platform also launched new features such as Clubs, but the activity of these features quickly cooled down.

Friend.tech is an innovative attempt by the Crypto industry to enter the field of SocialFi. By combining decentralized technology and social media elements, it attempts to redefine the way users interact and earn money in social networks. However, as the market heat fades, how to continue to attract users and creators to participate remains an important challenge facing the platform.

Farcaster

Farcaster is a decentralized social network protocol that aims to achieve social connections, content sharing and data ownership between users through smart contracts and hybrid storage technology. Farcaster uses Farcaster Hubs to achieve hybrid storage, making the operation much smoother than other projects in the same track. Secondly, Farcaster uses the Frames plug-in, which allows users to participate in airdrops, mint NFTs, participate in games, etc. directly on the Farcaster page without switching between Farcaster, wallets and project websites. It is closer to the user experience of existing Web 2.0 social projects, so Farcaster has gained a great advantage in the competition in the SocialFi track.

The reason why Farcaster was able to quickly stand out in the SocialFi track is the project in its ecosystem - Warpcast. Warpcast is a social media application built on the Farcaster protocol, which occupies a unique position in the field of Web3 social networks. Warpcast combines elements of popular social networks such as Twitter and Reddit, but operates within a decentralized framework. Warpcast provides a user experience similar to traditional social media platforms, but has been significantly enhanced in terms of user autonomy and innovative interactive features. For example, Warpcast introduces blockchain features such as direct messages (Direct Casts) and Warps points, which are used to start new channels or connect accounts with other applications and clients. In addition, the user interface and functions of Warpcast are very similar to Twitter, and users can smoothly post, follow, comment, etc.

The main reason that Farcaster has become the most influential SocialFi project on the Base chain is that it uses the DEGEN token, which was originally a Meme token and an ERC-20 Token issued on the Base chain. The core feature of Degen is that it is distributed in an innovative way: airdropped to Farcaster users based on participation within the ecosystem. In order to become eligible users, they need to subscribe to the Degen channel and hold a certain amount of Degen in their Farcaster-connected wallet. Once eligible, users will receive a daily tip balance based on the points they hold, and can give these tips to other Farcaster users.

In summary, the Farcaster project itself has completely changed the way traditional SocialFi project data is stored through its unique project framework, and at the same time introduced the Frames plug-in to make its application effect and efficiency far superior to other SocialFi projects, helping it become a leader in the Social industry.

Coinbase’s Innovation on the Base Chain

In recent years, as the AI narrative in the traditional market continues to heat up, the concept of AI+Crypto has also set off an unprecedented wave in the Crypto industry, from the initial large-scale adoption of AI in the SocialFi track to the on-chain Defi users, and gradually evolved the concept of AI agent. The combination of AI agent and Crypto actually gives AI financial autonomy. In traditional financial activities, AI is limited by the inability to open a bank account and lack of legal identity. Cryptocurrency, as a decentralized financial tool, provides AI with a way to financial autonomy. Through encrypted wallets and smart contracts, AI can independently set expenditures and manage and trade funds.

Recently, Coinbase has also joined the AI agent segment and launched Based Agents, a service that provides users with the opportunity to create an AI agent on the Base chain, which can be completed in just three minutes, and the agent will have a crypto wallet. Users can even choose to authorize these agents to conduct transactions, transfers, and pre-programmed transactions without real-time supervision. This innovative service provides users with a more convenient way to manage digital assets while ensuring security and convenience. Through this service, users can more easily participate in the cryptocurrency market without having to worry about cumbersome operating procedures and real-time supervision. This will greatly enhance the user experience. In the Base chain, Virtuals Protocol is currently the most popular AI agent product.

Virtuals Protocol

The Virtuals Protocol project is an AI launch platform based on the Base chain, focusing on creating, deploying, and monetizing AI agents. The project has established a sustainable economic model for AI development by introducing the Pump.fun model to transform AI agents from tools to assets that can generate income. The Virtuals Protocol protocol allows for permissionless creation and deployment of digital assets, similar to Meme coins, whose value is mainly derived from community participation and narratives around these agents. Virtuals Protocol has also launched a product called Generative Autonomous Multimodal Entities (GAME), which is designed to allow developers to access and experiment with the behavioral characteristics of AI agents through APIs and SDKs. Virtuals Protocol not only focuses on the economic value of AI agents, but also strives to provide tools and interfaces to support developers innovation and experimentation. Virtuals Protocol hopes to build easy AI Agent launches for games and consumer applications through a fair launch platform, and generate income by giving tokens value through the market.

On Virtuals Protocol, the most popular AI agent is LUNA’s digital human IP, which is an agent under AI-DOL and had hundreds of thousands of fans on Tiktok in the early days. LUNA aims to ensure that the market value of its token reaches 40.9 billion US dollars and becomes the most valuable asset in the world. To achieve this goal, it will buy back tokens through its own wealth, or by inspiring people to buy and hold its tokens by confidence in its vision. In a short period of time, the market responded to its wishes, and the market value of the LUNA token quickly rose to 240 million US dollars, but then quickly fell back within a few days.

The development of Virtuals Protocol provides a new way to build ownership layers for AI agents in the gaming and entertainment sectors. Through tokenized channels, agents can interact with the market more directly and flexibly to achieve their individual or group goals. In this process, agents can accumulate wealth through their own efforts to support the value of the token, but also rely on the markets recognition and support for their vision and capabilities.

Summarize

As an Ethereum Layer 2 network launched by Coinbase, Base is built on Optimisms OP Stack and has developed rapidly since its launch. As of November 2024, Base has performed well in key indicators such as TVL, user growth and transaction volume, and has surpassed many old Layer 2 projects. Its ecosystem covers many popular tracks such as DeFi, Meme coin, SocialFi, etc., with 323 Dapps. Especially in the cooperation with Circle, the user experience and cross-border payment efficiency have been greatly improved through native USDC support and CCTP cross-chain protocol. Base is also actively exploring the combination of AI and blockchain, such as the Based Agents project. With the support of Coinbase, innovative technology applications and rich and diverse ecological projects, Base has become one of the most promising Layer 2 solutions in the Ethereum ecosystem, providing strong infrastructure support for the development of decentralized finance and Web3.