Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

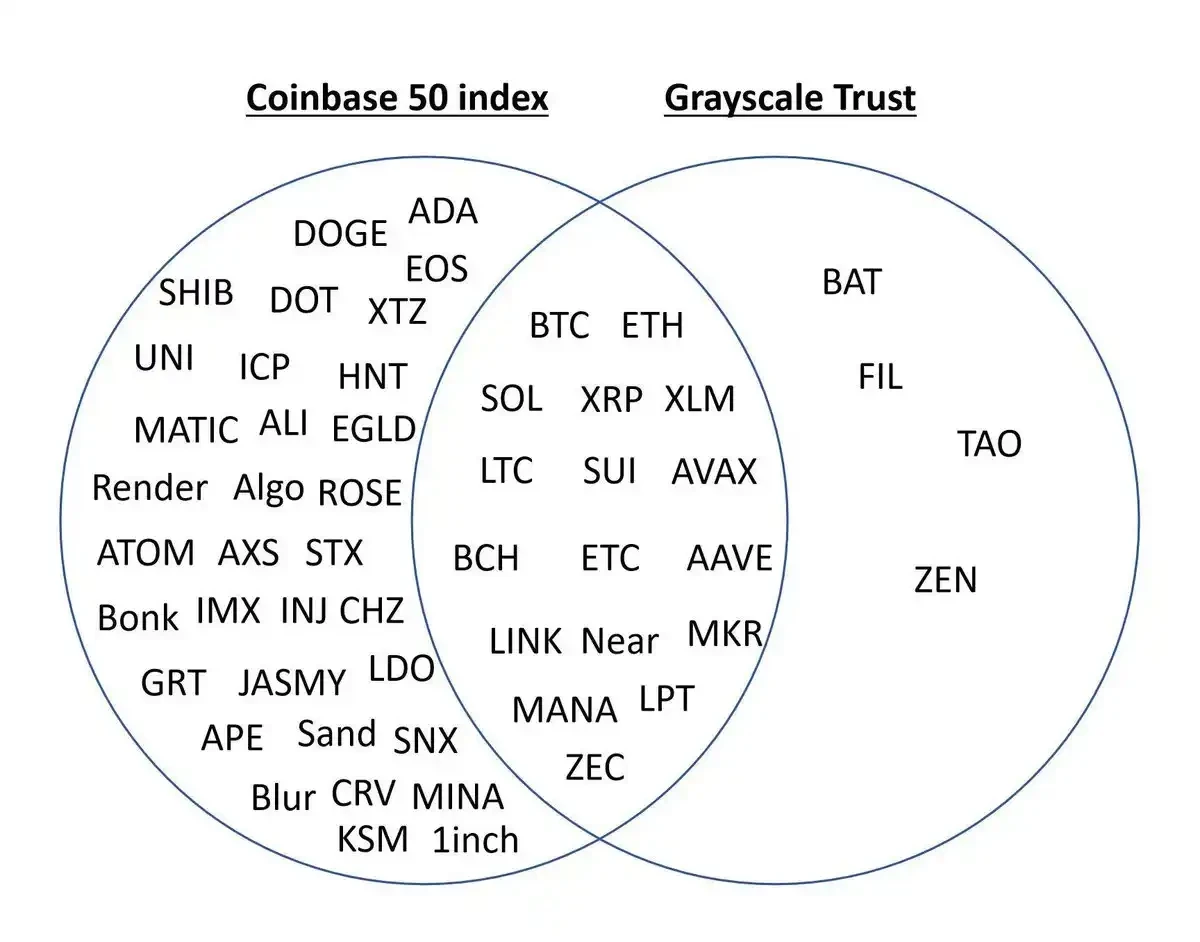

Grayscales mainstream currency fund, decentralized AI fund, and DeFii fund have a strong reference significance for product selection. Combined with the Coin 50 Index, overlapping currencies can be further screened out. The main funds for the growth of these targets come from American institutions and can undertake large funds.

Chainalysis report: Stablecoins, TradFi and RWA are leading the next wave of Web3

Current asset prices and DeFi activity are not the only indicators of market adaptability and resilience - global adoption of stablecoins, explosive interest in traditional finance (TradFi), and the rise of services for new use cases such as tokenization (RWA) all indicate that cryptocurrencies are becoming more widely accepted and integrated into the global economy.

XRP surges 400%, an article to understand the ISO 20022 concept behind the surge of old coins

ISO 20022 (Financial Services - Universal Financial Industry message scheme) is an international financial communication standard developed by ISO (International Organization for Standardization) Technical Committee TC 68 (Financial Services). After years of development, it has become a unified standard for global financial messaging, covering multiple financial fields such as payment, securities, trade, cards and foreign exchange.

The ISO 20022 concept tokens recognized by the market include XRP (Ripple, the only officially certified one), XLM (Stellar), ADA (Cardano), QNT (Quant), ALGO (Algorand), HBAR (Hedera), IOTA (MIOTA), and XDC (XDC Network).

Compared with orthodoxy, what deserves more attention is the actual implementation of the project.

Also recommended: Delphi Digital 2025 Outlook: If history repeats itself, BTC will break through $175,000 , 6 major strategies to teach you how to grasp the altcoin market , Electric Capital Report: 39,000 new developers joined, Solana is the ecosystem with the most new developers .

Meme

In 2024, the Meme coin market performed well, with the Benchmark index performing 279.8%, surpassing mainstream currencies such as Bitcoin and Ethereum.

The prosperity of the Meme coin market is largely based on the continuous improvement of the underlying infrastructure, especially the introduction of new products such as launch platforms Pump.fun, Sunpump, and Moonshot, which have greatly reduced the cost of token issuance and player participation.

In the current narrative, animal memes and cult culture memes are the majority, and they have deep cultural roots and a loyal fan base.

Don’t let slippage eat up your profits: Advanced ways to exit Meme trading with profit

The article describes how to use concentrated liquidity (CL) pools to maximize returns while gradually exiting positions. It is important to note that providing liquidity for Memecoins has both advantages and disadvantages.

Meme Training Manual: Rebirth: I Want to Be a Diamond Hand (Final Chapter)

In addition to profitability, attention should be paid to timing ability; it is necessary to put the cause and effect in the wrong place for the style of smart addresses.

Tokens with a market value of tens of millions are usually linked to AI tools, not just AI memes, and have room for further growth as the platform develops.

The article further introduces GRIFFAIN, Top Hat, AVA, REALIS, FXN, and CHAOS.

After PEPE, what is the next animal meme that will hit a market value of tens of billions?

FLOKI (FLOKI), Brett (BRETT), Peanut the Squirrel (PNUT), DOG•GO•TO•THE•MOON (DOG), Neiro (NEIRO), Moo Deng (MOODENG) are worthy of attention.

Bitcoin Ecosystem

Cycle Trading: BitDeer’s original intention, rebirth, and leap

Its first growth curve: self-developed chips, sales of mining machines, and self-operated mining farms; market concerns lie in the ratio of mining machine sales to self-use, and the competitive relationship between Bitmain and Xiaolu. The second growth curve is AI computing power.

Things to note: Risk of Bitcoin price fluctuations; TSMC wafer risks caused by sanctions.

Behind the historical high stock price, BitDeer’s three new layouts

Behind the stock price performance, BitDeer’s three major layouts in recent years are worthy of attention: entering the mining machine market, Tether becoming its major shareholder, and cooperating with the Kingdom of Bhutan to operate mining farms.

Also recommended: Roger Ver reveals the dark history: How was Bitcoin hijacked by intelligence agencies? Bitcoin breaks through $100,000, but the ecosystem is still tepid. What do veteran players think?

Multi-ecology and cross-chain

Recommended: Primitive Ventures: The logic behind the reverse investment movement and the growth secrets of the 10 billion FDV Comma 3 Ventures: Why did we choose to support the Sui ecosystem at the earliest stage?

DeFi

Sushi officials plan to liquidate SUSHI tokens in the treasury. Where is DeFi 2.0 heading?

Sushi officially released a Super Swap roadmap. From ecological expansion to product aggregation, from seamless integration to cross-chain swaps, from LP risk management to LP process simplification, Sushi has started a new round of product iteration and update in many aspects, hoping to introduce liquidity on a larger scale and attract more users.

Other recent hot DeFi protocols and platforms include: Hyperliquid (L1 public chain that promotes DeFi 2.0), Uniswap (Unichain is ready to go), ORCA, RSR, DYDX, CRV, etc.

MemeFi may lead the next round of industry growth.

An article interpreting Aave’s trends: Trump family “supports” and V4 is about to be launched

V4 will build on the successful features of V3 (eMode, isolation mode, etc.), improve capital efficiency, and enhance integration with GHO. Its ultimate goal is to create a true, immutable, permissionless financial layer.

NFT

The NFT sector is recovering, what other opportunities are there to participate?

Pudgy Penguins, Milady; in addition, NFT infrastructure projects still have room for growth (such as Metaplex on Solana).

Web3 AI

OKX Ventures Report: From innovation to pricing, DeSci track potential and development path

The DeSci track is hot, but the market is in the early game stage. Scientific research funding projects such as BioDAO face closed-loop challenges. Meme-driven is the core of DeScis current narrative. Product landing and marketization still have a long way to go. Return to the core advantages of blockchain and break through the landing difficulties.

14 Popular Use Cases of AI Agents

AI influencers and Memecoins, AI venture capital agents, hedge fund trading agents, multi-party agent governance, prediction market agents, AI reply experts, autonomous community strategists, content review agents, hackathon organizers, developers’ smart assistants, analysts, 24/7 support service agents, DAO’s financial management agents, media subscription agents.

Hot Topics of the Week

In the past week, the alt season continued; preliminary voting results showed that Microsoft shareholders voted against the Bitcoin investment proposal ;

In addition, in terms of policies and macro markets, Russian lawmakers proposed to establish a national Bitcoin reserve to counter economic sanctions; the South Korean National Assembly has approved the postponement of virtual asset taxes until January 1, 2027; the Vancouver City Council in Canada passed its motion to become a Bitcoin-friendly city; Elon Musk became the first person in the world with a net worth of more than $400 billion ; Google launched a new generation of quantum computing chip Willow ;

In terms of opinions and voices, institutions: US CPI data is unlikely to change the Feds recent policies; Ray Dalio: Will invest in hard currencies such as gold and Bitcoin , while avoiding debt assets; Michael Saylor: It is recommended that the United States sell its gold reserves to purchase at least 20% to 25% of circulating Bitcoin; Bloomberg: MicroStrategy disclosed in its October filing that a sharp drop in BTC may have a significant adverse impact on its financial condition; Matrixport: The inflow of stablecoins has slowed down, and Bitcoins gains may be moderate in the short term ; Bitwise released the top ten predictions for 2025 : In the first year of crypto IPOs, Bitcoin will exceed $200,000; Avalanche founder: Bitcoins early P2PK format will leak public keys, and Satoshi Nakamotos 1 million bitcoins should be frozen under quantum threats; Magic Eden CEO: The co-founders will lock up ME for 18 months ; CZ: The project team should launch products as soon as possible , or minimum viable products;

In terms of institutions, large companies and leading projects, Ripple CTO: We still hope that the RLUSD stablecoin will be launched before the end of the year , but it is currently greatly affected by the holidays; Movement launched TGE and Movement Mainnet Beta; Sushi released its 2025 product roadmap and hinted at multi-token airdrops ; EigenLayer: Plans to launch an upgraded version of Rewards v2 in January 2025 to enhance the flexibility of the ecosystem; Community users feedback OpenSea V2 has launched a trial experience value system ; Milady founders Meme coin CULT is online ; Nature magazine introduced the DeSci protocol ResearchHub;

According to statistics, since Trumps victory, the US Bitcoin spot ETF has inflows of nearly $10 billion ; on December 8 , Pudgy Penguins floor price surpassed BAYC ;

In terms of security, the Cardano Foundation ’s Twitter account was hacked ; Gate.io responded to the theft rumors : the reserve fund has exceeded 10 billion... Well, it’s another week of ups and downs.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~