Market Overview

Overview of major market trends

Market sentiment and trends: The market sentiment index rose to 91%, entering a period of extreme greed; although BTC pulled back after briefly breaking through $100,000 on Thursday, the overall market resilience remained strong; ETHs strong performance drove the entire cryptocurrency market up, showing the markets continued confidence in mainstream currencies.

Analysis of capital flows: The market value of stablecoins continued to grow this week, with USDT increasing by 1.74% to $141 billion and USDC increasing by 2.03% to $40.2 billion, indicating that new funds are continuing to flow into the crypto market; on-chain data showed that large-value transfers were frequent and there were clear signs of institutional capital entering the market; the OTC premium remained in a reasonable range, indicating that the market supply and demand of funds was in a healthy state.

DeFi track performance: The total locked volume (TVL) of the DeFi sector increased significantly from US$46.8 billion to US$53.2 billion, an increase of 13.67%; liquidity staking projects performed the best, mainly benefiting from rising prices of underlying assets and increased staking yields; the activity of lending protocols increased significantly, indicating an increase in leverage demand; DEX trading volume continued to rise, reflecting increased market activity.

Meme coin market: The performance of the Meme coin track was relatively sluggish this week, with a weekly return rate of only 11.94%; the number of new project issuances decreased, and investor interest decreased significantly; funds began to shift to projects with practical application scenarios and fundamentals; social media discussion heat declined, indicating that investors risk appetite decreased.

Hot Attention: Layer 1 projects received the highest social media attention, and the weekly return rate of the PayFi track reached 40.04%; AI Agent projects began to receive a new round of market attention, especially projects on Solana, TON and Base chains; high-yield staking products in DeFi projects continued to receive attention; NFT market trading activity has rebounded, but the overall valuation is still searching for a bottom.

Investment advice: Investors are advised to maintain a cautious and optimistic attitude and pay attention to the following aspects: First, do a good job of risk management, set a reasonable stop loss, and avoid excessive leverage; second, focus on the layout of liquidity pledge and AI Agent tracks, and seize the opportunity of fund rotation; third, pay attention to the impact of important events, including Microsoft’s Bitcoin investment proposal next week (December 11), US CPI data and the European Central Bank’s interest rate decision; fourth, maintain sufficient liquidity to cope with possible market fluctuations, and adopt a phased position building strategy to avoid chasing high prices.

Market Sentiment Index Analysis

The market sentiment index rose to 91%, a significant increase from 83% last week, and market sentiment is at an extremely greedy stage.

Altcoins have basically followed the market this week and have fluctuated upward. ETH has performed strongly this week, and Altcoins have followed ETH in a general rise. Overall, Altcoins have been in a fluctuating upward trend this week. After the rise in ETH prices, various public chain projects have led to an increase in projects in their respective ecosystems. The market generally expects that capital rotation will occur next, and has more confidence in the future trend of Altcoins this week.

The BTC price briefly exceeded $100,000 on Thursday. Although it fell afterwards, market sentiment is at an extremely greedy stage. It is expected that there will still be a possibility of a certain correction in the future, and investors need to increase risk prevention.

Overview of overall market trends

The cryptocurrency market is in a volatile upward trend this week, and the sentiment index is still in the greed stage.

Defi-related crypto projects performed outstandingly, showing the markets continued focus on improving basic returns.

The AI Agent project is gradually gaining market attention and is influenced by the traditional AI market. There may be investment opportunities in the next half month.

This week, the Meme track continued to perform poorly and did not receive more attention from the market.

Led by the rise of ETH, various public chain projects have seen a general rise.

Hot Tracks

Tron Ecosystem

This week, with the sharp rise in the price of TRX tokens, Tron has gained a lot of market popularity. As funds continue to enter the market, Tron, as the main trading chain of USDT, has also seen a significant increase in on-chain activities this week.

Tron’s on-chain data

TVL: Trons TVL rose rapidly this week, ranking first among all large-scale public chains, from 7.97 B last week to 9.3 2B now, an increase of 16.93%. It can be seen that funds are actively entering the Tron chain.

Active accounts: The number of active accounts on the Tron chain increased significantly this week. The number of active accounts this week reached 3.6725 million, an increase of 18.06% from last week, maintaining a high growth rate, indicating that the Tron chain is very active.

USDT weekly trading volume: The USDT trading volume on the Tron chain reached 131.4 billion US dollars this week, an increase of 16.23% from last week. From the weekly trading volume of USDT, it can be seen that the on-chain trading volume of Tron is constantly increasing, indicating an increase in Tron chain activities.

Defi project TVL increment: In the Tron ecosystem, TVL is mainly composed of Justlend and SUN, which are lending and stablecoin exchange, token mining and autonomous integration projects respectively. This week, the TVL growth rate is very rapid, reaching 55.34% and 39.49% respectively. It can be seen that funds in the Tron ecosystem are constantly entering Defi projects.

The most direct criterion for judging whether a public chain is favored by the market is the increase or decrease in its TVL. Based on the above data, we can see that the Tron chain is maintaining rapid development at this stage. As the price of TRX has risen sharply this week, the underlying assets of the TRX ecosystem are constantly rising. In addition, Tron’s special status as the main trading chain of USDT has attracted a large number of on-chain users to participate, promoting the development of the entire Tron ecosystem.

AI Agent

At the end of last year, as the concept of AI entered the Crypto market, as a combination point with the traditional world, the AI track has always been a hot track in the Crypto market. Since the launch of the first AI Agent token GOAT in October this year, AI Agent Meme has quickly become the new focus of the market. After GOAT, AI Agent Meme tokens such as ACT appeared, leading the market trend at the time. After that, investors turned their attention to the launch platform of AI Agent tokens, among which Virtuals Protocol, vvaifu.fun and other projects quickly became popular and began to develop in the direction of AI Agent underlying infrastructure. As a result, three sub-tracks have been formed in the AI Agent track: AI Agent Meme coin, AI Agent issuance platform and AI Agent underlying infrastructure.

Since each chain has different levels of support for AI Agent projects, AI Agent projects are currently mainly developed on Solana, Ton, and Base chains. At present, hundreds of AI Agent Meme tokens are issued every day, and it is too difficult for investors to bet on a project, so some investors in the market have shifted their attention to the launch platform of AI Agent Meme tokens. Among them, vvaifu.fun is the main one in Solana chain, Virtuals Protocol and AI Agent Layer are the main ones on Base chain, and Clanker is the main one in Ton chain. In the past half month, the price of VVAIFU, VIRTUAL, and CLANKER has risen rapidly, and a certain market value has been formed.

Among them, VVAIFU is mainly traded in Raydium and listed in MEXC and Gate in CEX; VIRTUAL has a high trading volume in Uniswap and Cake in DEX, and is listed in second- and third-tier exchanges such as Gate, Bybit, Bitgit, and MEXC in CEX; CLANKER has a high trading volume in Uniswap in DEX, and is listed in second- and third-tier exchanges such as Gate, Bitgit, and MEXC in CEX. From the situation of the exchanges where its tokens are listed, it can be seen that there are currently no projects listed on first-tier exchanges, but from the situation that ACT, GOAT, and ANON in AI Agent Meme have been listed on first-tier exchanges such as Binance, OKX, and Huobi, the launch platform projects of AI Agent tokens will be listed on first-tier exchanges sooner or later, so it is still in the early stages of these projects and it is worth investing in users.

On Wednesday, OpenAI announced that it would start livestreaming a new product or sample every weekday for 12 days, and there will be some large new products during this period. This move has triggered market hype about the AI track. After releasing ChatGPT last year, OpenAI has become a leader in the AI industry, and its every word and deed will have an impact on the development of AI track projects. Especially in the Crypto market, this impact is magnified. For AI track projects in the Crypto market, OpenAIs move will inevitably bring the markets attention back to the AI track during the conference. If the Crypto market does not experience drastic fluctuations during this period, the AI track will see a good increase in the next 10 days. Therefore, investors should pay more attention to projects related to the AI track in the short term, as investment opportunities may arise.

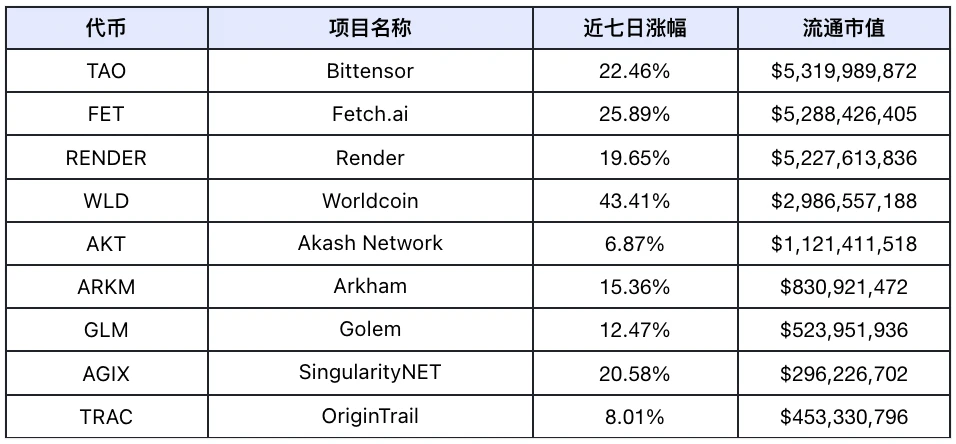

Traditional AI Projects in the Crypto Market

DeFi Track

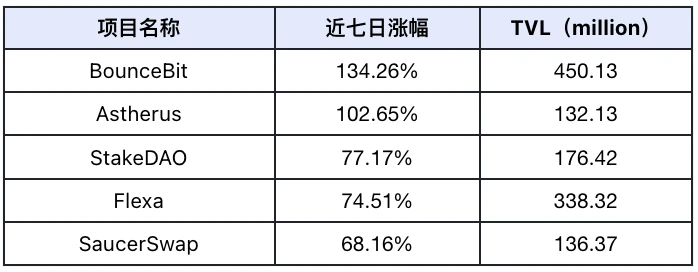

TVL Growth Ranking

The top 5 TVL growth rates of market projects in the past week (excluding public projects with smaller TVL, the standard is more than 30 million US dollars), data source: Defilama

BounceBit(BB):(Recommendation index: ⭐️⭐️⭐️⭐️)

Project Introduction: BounceBit is a restaking foundation layer in the Bitcoin ecosystem. In terms of design, it cooperates deeply with Binance to build a high-yield CeDeFi component; in addition, it builds its own BounceBit Chain to build a specific use case for Restaking.

Latest development: This week, BounceBit increased the staking rates of various tokens, including 35.45% for USDT, 39.85% for BTC, 25.91% for BNB, and 30.57% for ETH, which attracted a large number of users to invest their assets in BounceBit for staking.

Astherus (unissued coin): (Recommendation index: ⭐️⭐️⭐️)

Project Introduction: Astherus is a liquidity center for pledged assets, supporting Liquidity Staking Tokens (LST) and Liquidity Re-staking Tokens (LRT). Users assets can not only obtain pledge APR, but can also be used to trade spot and derivatives, stablecoin Yield, and other profit strategies.

Latest development: This week, Astherus reached a cooperation with Movement Labs, and it can be introduced to the Movement Network chain in the future. This week, Binance Labs announced an investment in Astherus, indicating that the institution is optimistic about the future development of Astherus. At the same time, Astherus held an event this week, and users who use USDF, asUSDF and asBTC to participate in staking can obtain 5 times the AU points.

Stake DAO(SDT):(Recommendation index: ⭐️⭐️⭐️)

Project Introduction: Stake DAO is a decentralized asset management platform that provides users with simplified access to various yield strategies, staking, trading, and indicators on a single dashboard.

Latest development: The yields of various products on Stake DAO have increased significantly this week. The annualized APYs provided to users in CRV, CAKE, PENDLE, FXN, BAL, and FXS in sdToken can reach: 20.46%, 28.78%, 89.35%, 102.16%, 94.75%, and 64.92%, and the annualized APY provided to users in the market strategy can reach up to 152%. This has attracted a large number of users to participate in Stake DAO.

Flexa (unissued): (Recommendation index: ⭐️⭐️)

Project Introduction: Flexa is committed to promoting the natural acceptance of cryptocurrencies in merchant settlement systems and enabling users to use their digital assets in the real world through its payment network.

Latest development: Flexa has made significant progress in offline development recently. Users can use Flexas APP to pay in thousands of Flexa-supported stores and restaurants in the United States, opening up physical payment channels under the chain. This week, Flexa integrated Zashi-Flexa, allowing users to use ZEC in daily consumption, which promoted users holding ZEC to use Flexa for offline consumption.

SaucerSwap(SAUCE):(Recommendation index: ⭐️⭐️⭐️)

Project Introduction: SaucerSwap is a decentralized exchange based on the Hedera chain. It not only supports conventional trading functions, but also launched the SAUCE Pro service, which provides users with advanced functions by using the SaucerSwap protocol token SAUCE as a monthly subscription fee.

Latest development: This week, the HBAR token has risen significantly, driving the popularity of Hedera chain activities. As the largest DEX on the Hedera chain, SaucerSwap has attracted a large number of users on the Hedera chain to participate in transactions. This week, SaucerSwap repurchased $33,000 of SAUCE tokens, raising the annualized APY of users staking SAUCE to 9.9%. This week, SaucerSwap launched the Epoch 28 event, giving SaucerSwap V2 liquidity providers 157,441.90 HBAR as a reward, and the token HLQT is additionally given to participants who provide liquidity for HLQT. As the largest DEX in the Hedera ecosystem, SaucerSwap almost bears all the DEX transaction volume in the Hedera ecosystem. As the on-chain transactions continue to heat up this week, more and more Hedera chain users have entered SaucerSwap to participate in transactions.

To sum up, we can see that the projects with faster TVL growth this week are mainly concentrated in the liquidity staking track (LRT).

Overall performance on the track

The market value of stablecoins has grown steadily: USDT has increased from $138.6 billion last week to $141 billion, an increase of 1.74%, and USDC has increased from $39.4 billion last week to $40.2 billion, an increase of 2.03%. It can be seen that both USDT, which is mainly based on the non-US market, and USDC, which is mainly based on the US market, have increased this week, indicating that the entire market is still maintaining a continuous inflow of funds.

Liquidity gradually increases: The risk-free arbitrage rate in the traditional market continues to decline as interest rates continue to fall, while the arbitrage rate of on-chain Defi projects continues to increase due to the increase in the value of cryptocurrency assets. Returning to Defi will be a very good choice.

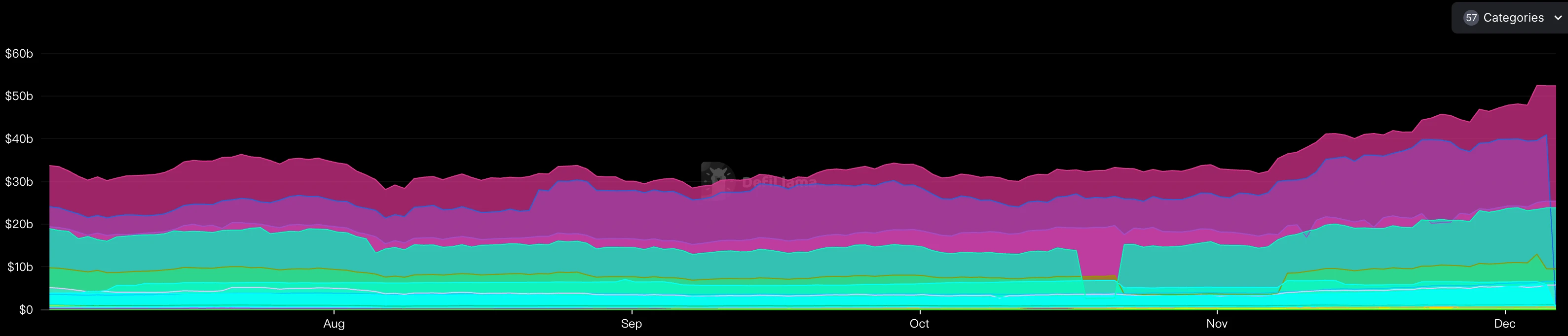

Defi TVL of each track (data source: https://defillama.com/categories)

Funding situation: The TVL of Defi projects has increased from US$46.8 billion last week to US$53.2 billion now, with new funds reaching 13.67%. The growth rate this week is much higher than in previous weeks, and it has maintained a continuous upward trend for nearly two months, proving that funds are constantly flowing into Defi projects.

Deep analysis

Driving force for the rise: BTC price rebounded this week and then rose again. ETH performed slightly better than BTC this week. ETH price rose sharply. Both BTC and ETH maintained a strong growth trend this week. Market investors are more optimistic about the future price trend of BTC and ETH, so they hold more firmly. As ETH price has remained strong recently, various Defi projects have increased APY due to the rise of underlying assets. Therefore, investors actively participate in various Defi projects and can increase their income while holding the original assets.

Growth leaders: For DeFi projects, TVL growth is one of the intuitive indicators to evaluate their performance. By analyzing this weeks TVL growth list, we can see that the projects in the liquidity pledge track are particularly outstanding. This week, the prices of the underlying assets of major public chains have risen significantly, which not only enhances the confidence of coin holders, but also encourages them to increase their returns by participating in other investment activities while holding coins. In this context, liquidity pledge projects have become key. The core of liquidity pledge is to increase the yield by releasing liquidity without changing the number of underlying assets held by users. The effective operation of this mechanism depends on the rise in the price of the underlying assets. As the price of ETH rises, it is expected that the prices of various public chains in the Crypto market will also rise, thereby driving the growth of their corresponding liquidity pledge projects. This trend shows that liquidity pledge projects are not only competitive in the current market environment, but will continue to play an important role in future market fluctuations.

Therefore, when investing in the near future, investors should pay more attention to the liquidity staking track projects of various public chains.

Other track performance

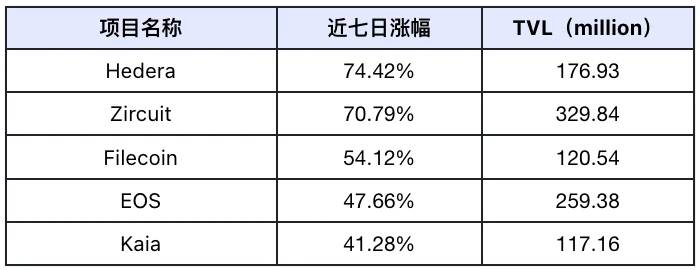

Public Chain

The top 5 public chains with the highest TVL growth in the past week (excluding public chains with smaller TVL), data source: Defilama

Hedera: The recent rise in Hederas token HBAR is because WisdomTree and 21 Shares have applied for ETFs for a series of altcoins such as SOL, XRP, HBAR, and LTC. HBAR has the lowest market value among these tokens, and its founder belongs to the Trump series, which is the same concept as XRP and ADA. The market believes that the current market value is seriously underestimated. At the same time, Hedera pays great attention to on-chain construction and promotes the development of AI, payment and the Internet of Things on its chain. SaucerSwap, the largest TVL project in the Hedera ecosystem, has seen a rapid increase in TVL this week, driving the increase in TVL of the entire Hedera.

Zircuit: This week, Zircuits token ZRC was launched on the Korean exchange Coinone and was supported by Crytpo.com, allowing users to purchase ZRC directly in its APP. It has reached a cooperation with Elara, and ZRC can be used as Elaras collateral to borrow WETH, WBTC, USDT or USDC, expanding the use of ZRC. It has also received support from Kelp DAO, whose gain vault is set up on Zircuit. Users who participate can get an additional 2 times Zircuit points, and attracted $1 million of ETH on the Zircuit chain on the day of its opening.

Filecoin: Filecoin started to make up for the increase this week. The FIL token rose by 44.36% this week, ranking among the top among the old public chains. As its token price rose rapidly, it attracted users holding FIL tokens to participate in Filecoins on-chain staking activities. The two projects with the largest TVL on the Filecoin chain are GLIF and Parasail, both of which are LST and LRT projects based on FIL, with growth rates of 36.75% and 40.78% respectively, which led to an increase in Filecoins TVL.

EOS: Recently, EOS started to participate in BTC-L2 and created exSat Network, which attracted a wave of traffic. At the same time, EOS began to pay attention to the construction of the on-chain ecology at this stage, and announced that it would focus on the construction of Gamefi, AI, and Depin projects on EOS. This week, EOS rose very rapidly, with an increase of 68.7%, attracting many on-chain users to participate in on-chain activities on the EOS chain. The three projects with the largest increases on the EOS chain this week are: EOS REX, DefiBox, and EOS RAM, which are on-chain lending and DEX projects respectively.

Kaia: This week, Kaia launched Kaia Portal v1.3, which supports lending protocols together with DEX and enhances liquidity by introducing Avalon Labs mining pool. At the same time, on-chain activities were launched. For staking users participating in Kaias Epoch 1, 12.5 million KAIA will be added to the Epoch 1 reward pool, and users are expected to receive an annualized APY of 50%+. At the same time, it is promised that when Kaias TVL exceeds 150 million US dollars, another 12.5 million KAIA tokens will be added as rewards. This incentive activity has greatly increased the enthusiasm of users to participate in Kaias Epoch 1 activities.

Overview of the Rising Stars

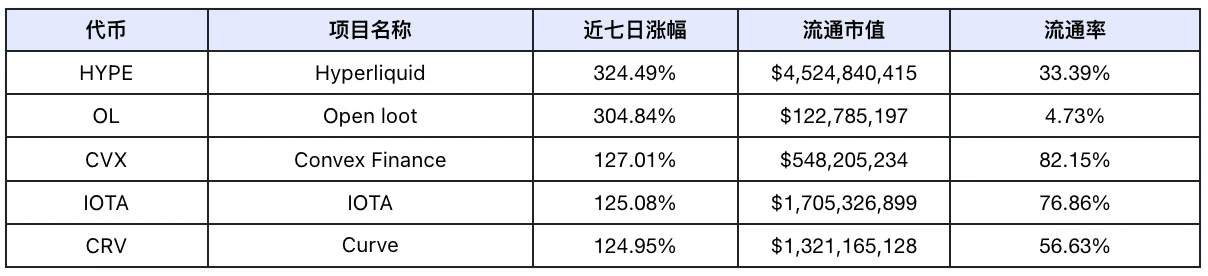

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: Coinmarketcap

This week, the list of rising tokens showed a sector concentration feature, and most of the rising tokens belong to the public chain track.

HYPE: Hyperliquid is a decentralized perpetual contract exchange that aims to provide high-performance and user-friendly trading experience. This week, the prices of the entire Crypto market have risen to varying degrees. On-chain users are very active in participating in on-chain trading activities, mainly decentralized perpetual contract exchanges. On-chain users usually prefer to trade contracts in order to obtain greater profits. As the hottest decentralized perpetual contract exchange at this stage, Hyperliquids trading volume has exceeded all other decentralized perpetual contract exchanges on the chain, with a daily trading volume of US$8.5 billion.

OL: Open Loot is a Web3 gaming platform developed by Big Time Studios, which aims to provide a comprehensive solution for game developers and players to simplify the development and user experience of blockchain games. This week, Big Time tokens rose significantly, reaching 59.8%. As a gaming platform developed by it, OL also rose this week following Big Time. In addition, the Gamefi track has not received market attention in this cycle and has been performing mediocrely. After Ethereum rose, funds began to rotate into the Gamefi track.

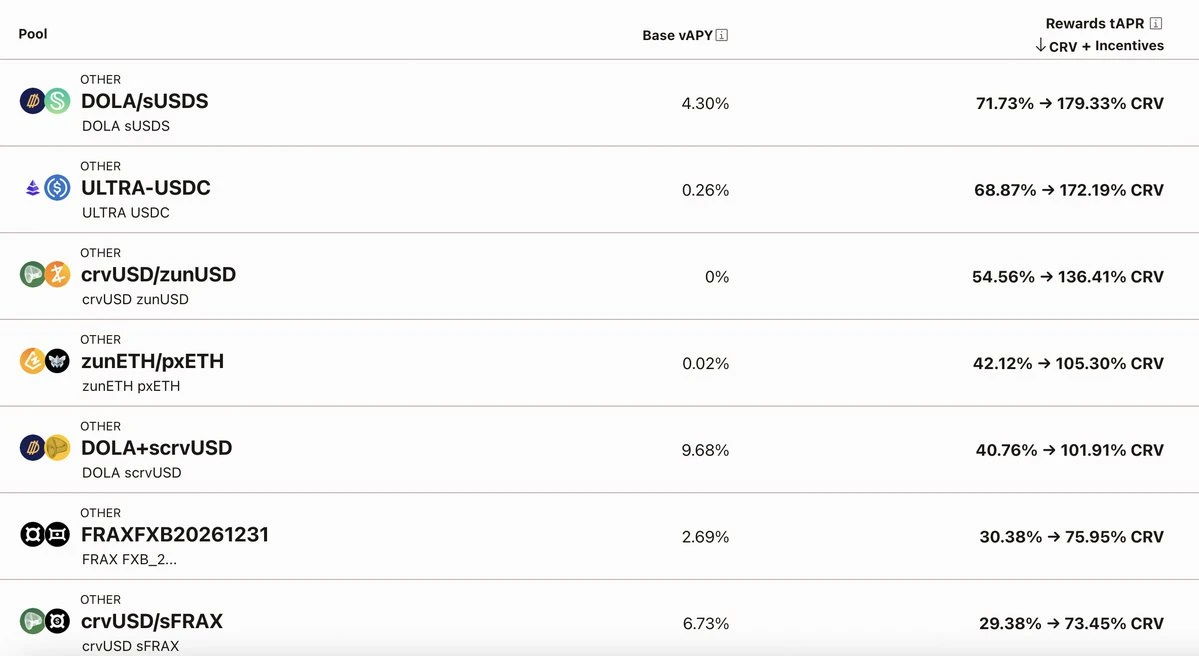

CVX: Convex Finance is a decentralized financial protocol built on the Ethereum blockchain, which aims to optimize the yield of the Curve protocol and introduce liquidity mining rewards. This week, Curves stable yield has been greatly improved, and the annualized yield of some pools has increased to more than 100%, thus attracting a large number of users to participate in arbitrage. As a yield-enhancing project based on Curve, Convex Finance has also been affected by the rise of CRV and has risen with CRV.

IOTA: IOTA is a distributed ledger technology designed for the Internet of Things (IoT) ecosystem. Its core innovation is the use of a directed acyclic graph (DAG) data structure called Tangle. IOTA started voting on the Rebase proposal this week. The Rebase proposal includes Move-based smart contracts, full decentralization, staking, and enhanced token economics, which is a qualitative improvement for the future development of IOTA.

CRV: Curve is a decentralized exchange, based on the exchange pool protocol developed by Ethereum, providing stablecoin transactions with low slippage (good depth). This week, Curves stable yield has been greatly improved, and the annualized yield of some pools has increased to more than 100%. In addition, due to the good market trading sentiment this week, a large number of on-chain arbitrage users have been attracted to Curve.

Social Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, the statistics for this week (11.30-12.6) are as follows:

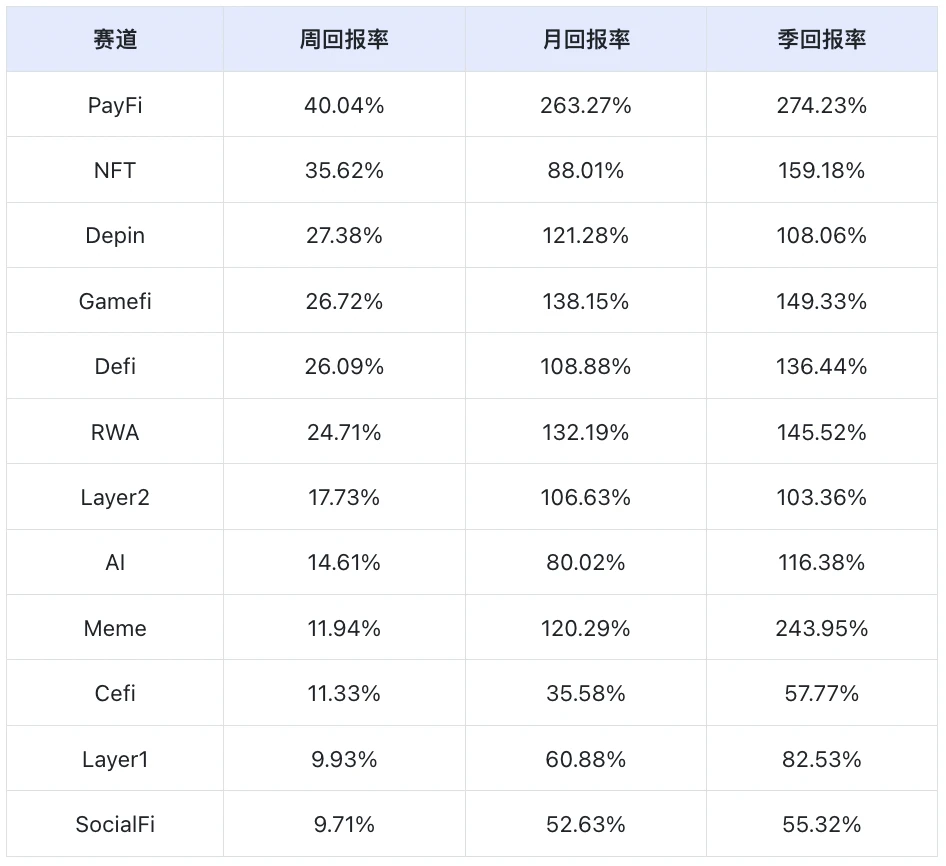

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: Lunarcrush and Scopechat

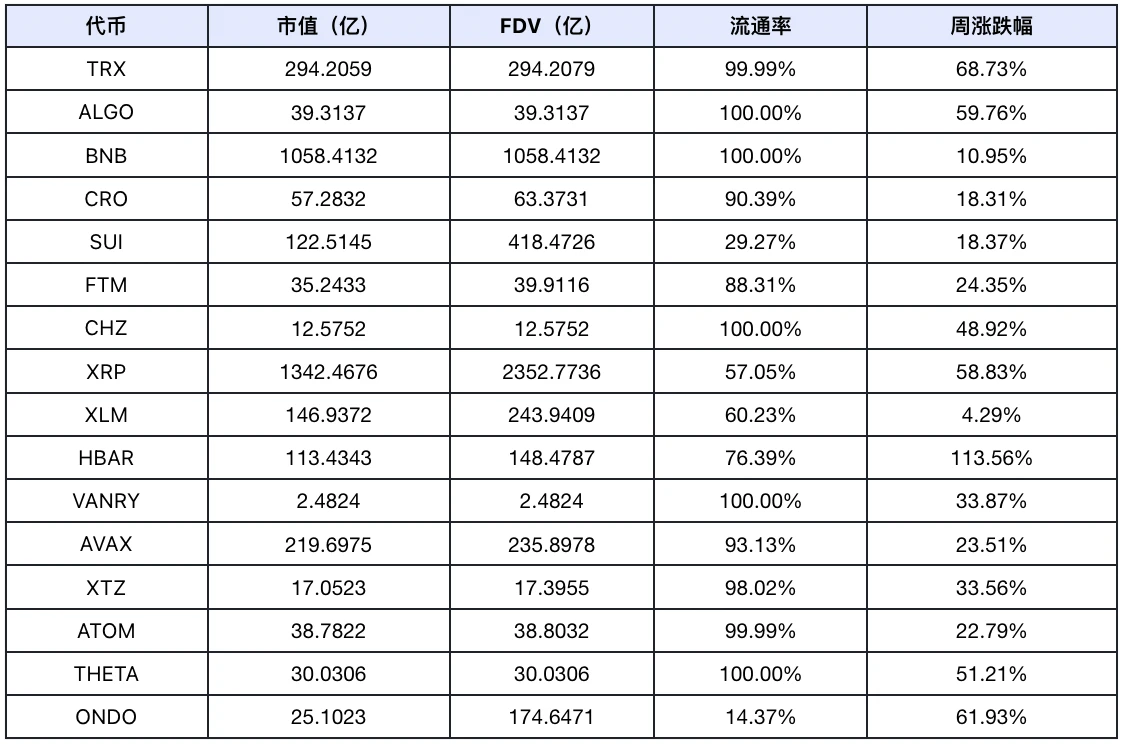

According to data analysis, the Layer 1 blockchain projects received the most attention on social media this week, and generally showed an upward trend, generally performing better than BTC and ETH. Defi projects in various public chain ecosystems continued to be hot this week, because the rise in the prices of the underlying assets of various public chains led to an increase in the APY of various Defi projects, thereby increasing the TVL and transaction volume of various Defi projects. This phenomenon reflects that in the current market environment, investors remain optimistic about the future market.

Overall overview of market themes

Data source: SoSoValue

In terms of weekly returns, the PayFi track performed the best, while the SocialFi track performed the worst.

PayFi track: XRP, BCH and XLM account for a large proportion in the PayFi track, accounting for 71.81%, 8.29% and 10.09% respectively, totaling 90.19%. This week, XRP and BCH performed very strongly, rising by 58.83% and 21.36% respectively. Although other projects accounted for a small proportion, they rose significantly this week, so the entire PayFi sector performed very well.

SocialFi track: The absolute main force of the SocialFi track is still TON, which accounts for 88.91% of the market value of the SocialFi track. The increase this week was very limited, at 4.82%, resulting in the worst performance of the SocialFi track. From this, it can be seen that market funds have not paid enough attention to the SocialFi track recently, and no large amount of funds have entered the SocialFi track during the fund rotation.

Crypto Events Next Week

On Wednesday (December 11), Microsofts December shareholders meeting will discuss Bitcoin investment proposals, the Bank of Canadas interest rate decision, and the U.S. seasonally adjusted CPI annual rate at the end of November.

Thursday (December 12): ECB Deposit Mechanism Rate, 3rd Taipei Blockchain Week, US Initial Jobless Claims for the Week

Outlook for next week

In an interview at the DealBook/Summit conference overnight on Wednesday, Fed Chairman Powell said that Bitcoin is not a rival of the US dollar, but a rival of gold. Trumps nomination of cryptocurrency-friendly Paul Atkins as SEC chairman was considered by the market to be a relatively large positive, so the price of Bitcoin broke through $100,000. Although it fell afterwards, it led to subsequent optimism in the Crypto market. Whether the Bitcoin investment proposal will be approved at Microsofts December shareholders meeting next week will greatly affect the short-term market trend. The announcement of the US seasonally adjusted CPI annual rate at the end of November will be considered an important indicator of whether the Federal Reserve will continue to cut interest rates in December. Therefore, it is expected that the Crypto market will be greatly affected by macro data and Microsofts vote next week, and there is a high probability that it will go out of the volatile trend. Investors should remain cautious.

Projects in the DeFi field, especially liquidity pledge protocols, machine gun pools, and DEX tracks, performed relatively well this week. This is mainly because liquidity pledge protocols and machine gun pools benefit from the rise in the price of underlying assets, so the arbitrage interest rate of DeFi projects gradually rises due to the increase in the value of encrypted assets, so it is expected to continue to attract a large number of investors to participate in search of higher yield opportunities. DEX projects are the main form of on-chain activities. With the continuous rise in asset prices and the continuous rise in market conditions, DEX projects have naturally become the fastest growing track on the chain.

AI Agent track projects are now in the initial stage, mainly focusing on Solana, Ton and Base chains. At this stage, there are two types of projects that are mainly hyped: Meme coin projects linked to the concept of AI, and AI Agent token launch platforms. Among them, for ordinary investors, the probability of betting on a single Meme coin is extremely low, and they should focus on AI Agent token launch platform projects, similar to Memes launch platform Pump.fun, and mainly pay attention to whether the number of tokens launched by the platform every day continues to increase and whether the transaction amount maintains positive growth.