In a rapidly changing market environment, planning ahead and responding quickly are the keys to achieving steady returns.

The current global crypto market is closely linked to the overall economic trend. Whether it is inflation rate, central bank policy, or trade data, it will affect the sentiment of the crypto market and investors risk appetite.

In week 49, China’s Caixin Manufacturing PMI and the US ISM index showed that the manufacturing sector performed well, but the service and consumer sectors performed relatively weakly. This “mixed” situation has led many traders to prefer more stable assets such as Bitcoin , while also paying close attention to altcoins that benefit from global trade.

Looking ahead to Week 50, inflation reports, trade data, and central bank decisions will determine the market tone. This information will affect market liquidity, institutional capital layout, and the price trends of Bitcoin , Ethereum , and other crypto assets .

This report will provide you with:

A look back at Week 49s biggest events.

Forecast key data and policy releases for week 50.

Providing trading strategies for this weeks macroeconomic impacts.

Last weeks market review

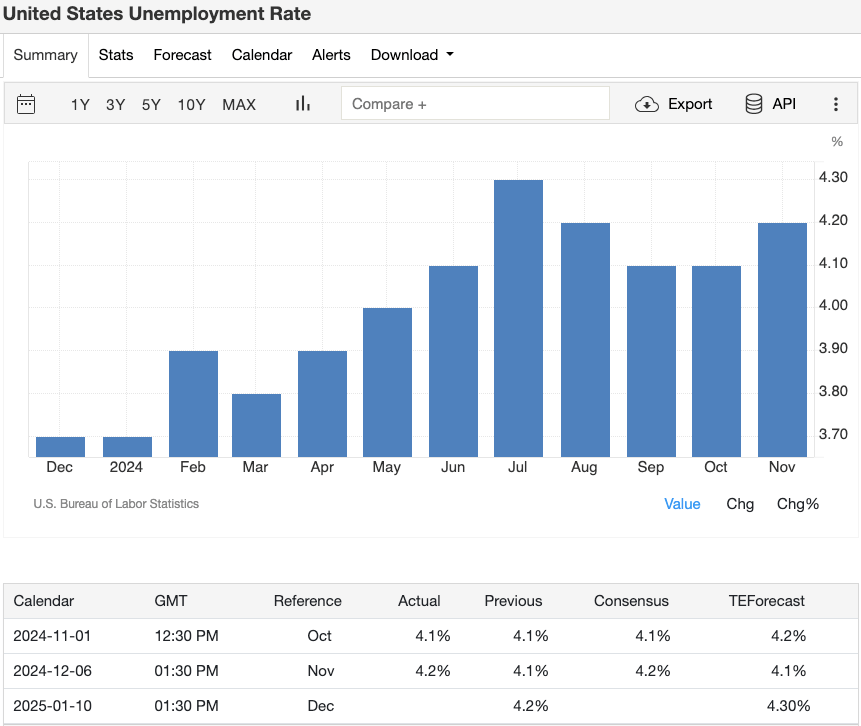

China Caixin Manufacturing PMI (November: 51.5)

Image source: Trading Economics

China’s manufacturing sector grew more than expected, indicating healthy trade flows. This positive signal provided a slight boost to crypto projects related to supply chains and industrial applications.

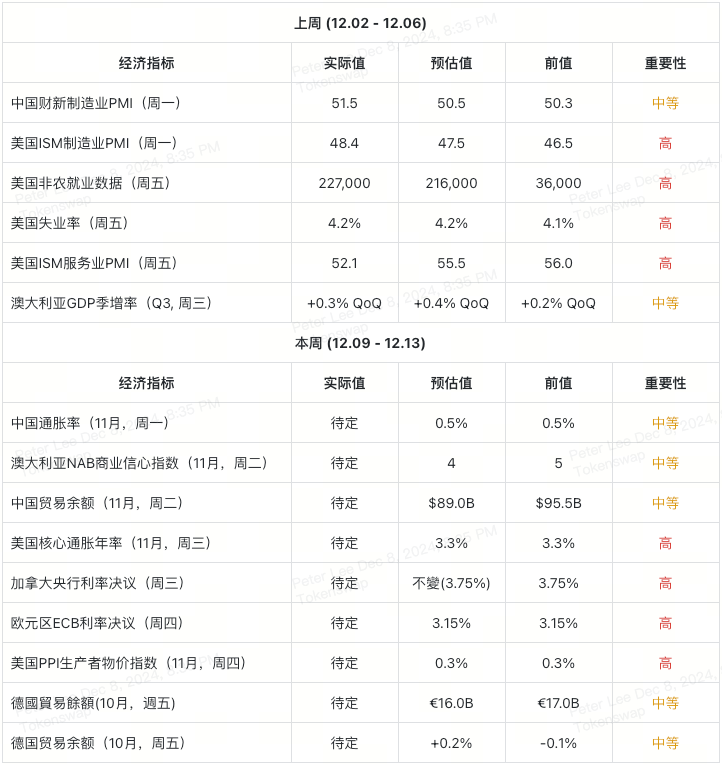

US ISM Manufacturing PMI (November: 48.4)

Image source: Trading Economics

The U.S. manufacturing sector, while still contracting, slowed down, which slightly boosted market sentiment. Bitcoin and major altcoins saw small gains, but the Feds cautious attitude still limited gains.

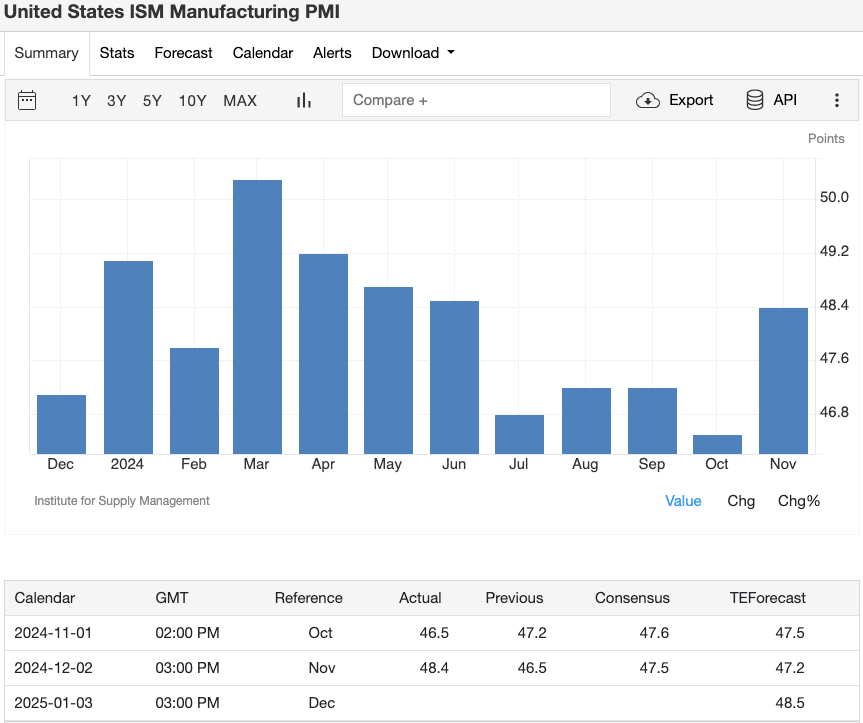

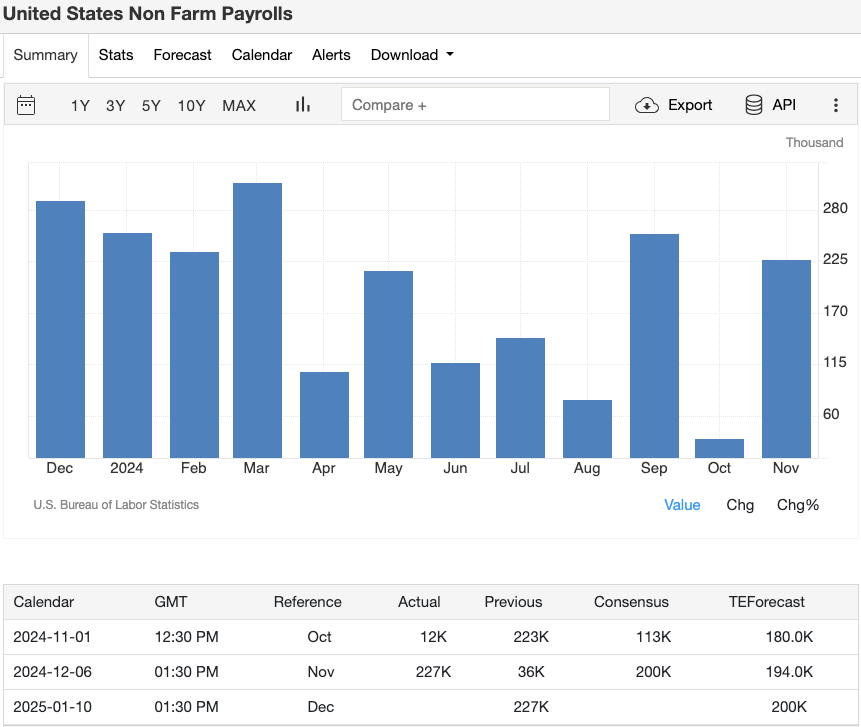

US non-farm payrolls report and unemployment rate (227,000 new jobs, unemployment rate 4.2%)

Image source: Trading Economics

Image source: Trading Economics

Strong employment data supported the markets risk appetite, but a slight increase in the unemployment rate increased uncertainty, prompting some investors to choose Bitcoin as a hedging tool.

US ISM Services PMI (November: 52.1)

Image source: Trading Economics

Missing-than-expected growth in the services sector added to concerns about a broader economic slowdown, leading more traders to opt for the safe-haven option of Bitcoin .

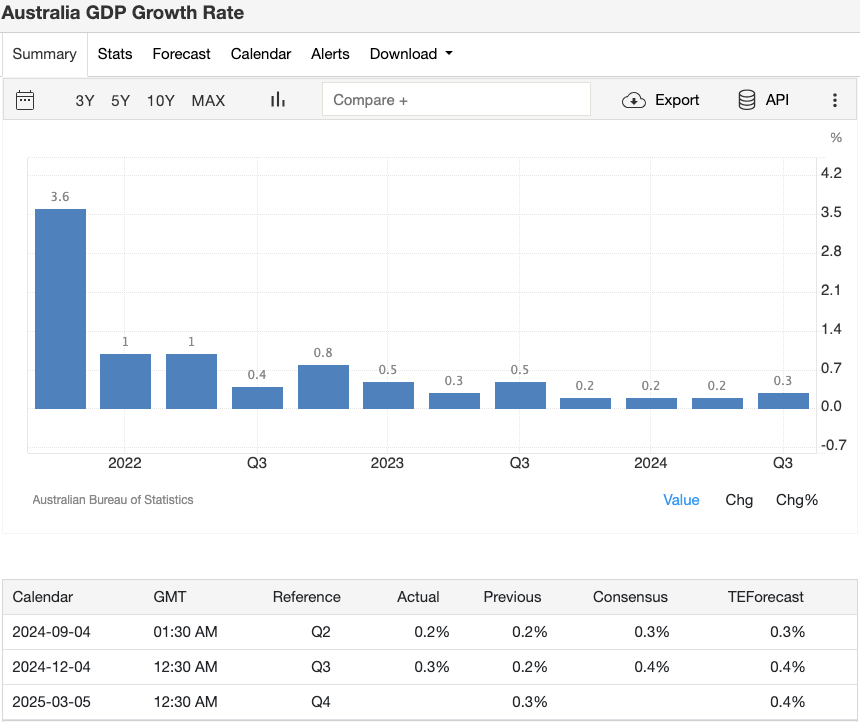

Australias GDP quarterly growth rate (third quarter: +0.3%)

Image source: Trading Economics

Slightly weaker-than-expected economic growth has dampened investor appetite for riskier altcoins, with more money flowing into fundamentally sound assets such as Bitcoin and Ethereum .

Key conclusions

Data for Week 49 was mixed. Manufacturing was OK, but services and consumption were weak. Investors are therefore taking a balancing act - using Bitcoin as a safe haven while choosing specific altcoins that can benefit from the growth in global trade.

Overview of key economic events this week (week 50)

This week, the market focus is on inflation data, trade balances, and interest rate decisions of major central banks. These key information will play a decisive role in market sentiment before the end of the year. Inflation dynamics, monetary policy direction, and global demand trends will directly affect market liquidity and risk appetite for crypto assets.

Key data

Monday, December 9

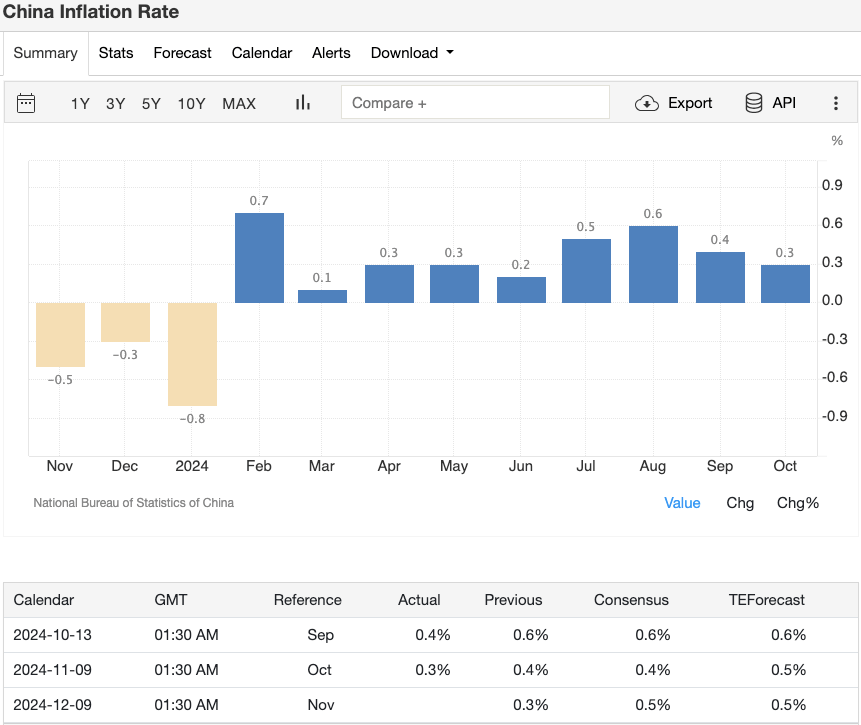

China Inflation Rate (November)

Forecast: 0.5% year-on-year growth (same as October)

Why it matters: Stable or slightly rising inflation suggests that Chinas domestic demand is solid, which can help boost global trade sentiment.

Impact on crypto markets: Stable inflation data will boost demand for Asia-related tokens.

NEO (NEO) : “China’s Ethereum” may see positive performance as domestic economic confidence recovers.

Conflux (CFX) : A Chinese public chain focused on cross-border activities that is expected to benefit from improving regional economies.

VeChain (VET) : Deep cooperation with Asian companies, demand may increase when the supply chain outlook improves.

Tuesday, December 10

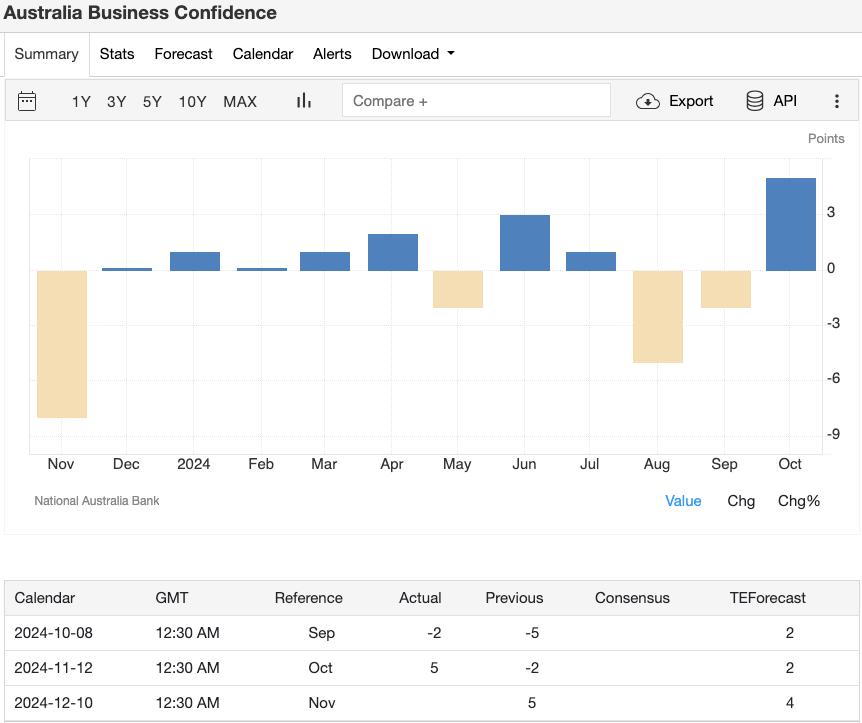

Australia NAB Business Confidence Index (November)

Forecast: 4 (down slightly from 5 in October)

Why it matters: While it may be a small decline, it still shows the resilience of business confidence and helps support market risk appetite.

Impact on the crypto market: A favorable business atmosphere may support DeFi and SME financing projects.

XT.COM Coin (XT) : A trading platform token with an Asia-Pacific market layout background.

Synthetix (SNX) : An Australian-based DeFi protocol, SNX’s performance is worth watching if investor interest increases.

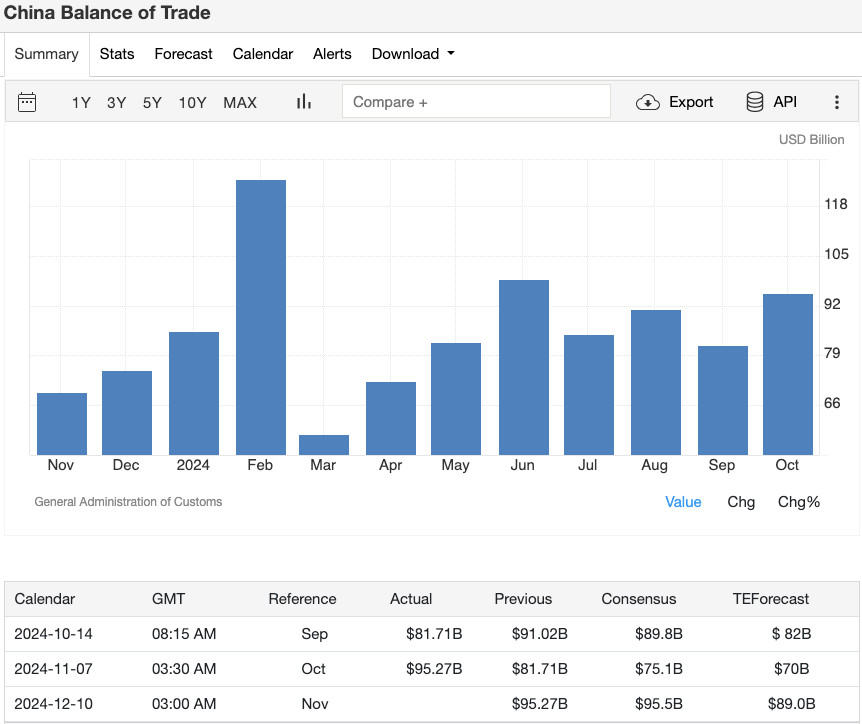

Chinas Trade Balance (November)

Forecast: $89.0 billion (down from $95.5 billion in October)

Why it matters: A smaller trade surplus could reflect slowing global demand and affect risk appetite in the market.

Impact on crypto markets: If the data falls short of expectations, it could increase the appeal of safe-haven assets such as Bitcoin while reducing interest in trade-related tokens.

OriginTrail (TRAC) : A protocol focused on supply chain data that relies on strong global trade momentum.

Wednesday, December 11

US core inflation annual rate (November)

Forecast: 3.3% (same as October)

Why it matters: Core inflation is an important reference for the Federal Reserve in setting policy, and a stable reading could reduce the urgency of further rate cuts.

Impact on crypto markets: Steady inflation data could cause Bitcoin and Ethereum to trade sideways as the market awaits clearer policy signals.

Bitcoin (BTC) : If inflation unexpectedly rises, it could strengthen its status as a safe-haven tool.

Ethereum (ETH) : The DeFi ecosystem may drive demand for ETH as liquidity improves.

PAX Gold (PAXG) : If inflation concerns intensify, tokenized gold could become an alternative.

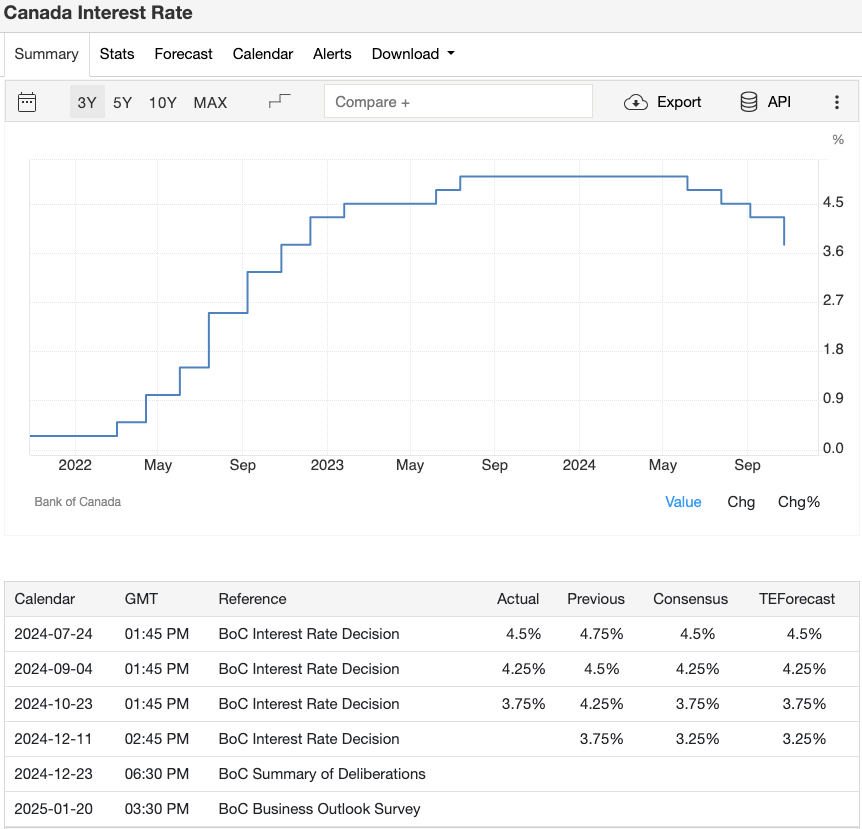

Bank of Canada interest rate decision

Forecast: Remain unchanged at 3.75%

Why it matters: A dovish stance from the Bank of Canada would signal potential easing in global monetary conditions, favoring the performance of riskier assets.

Impact on the crypto market: Expectations of easing may stimulate capital flows to DeFi projects and high-growth tokens.

Aave (AAVE) : As a leading lending protocol, increased liquidity will boost its appeal.

Maker (MKR) : The core protocol that supports the DAI stablecoin . Loose interest rates can promote market lending demand.

Thursday, December 12

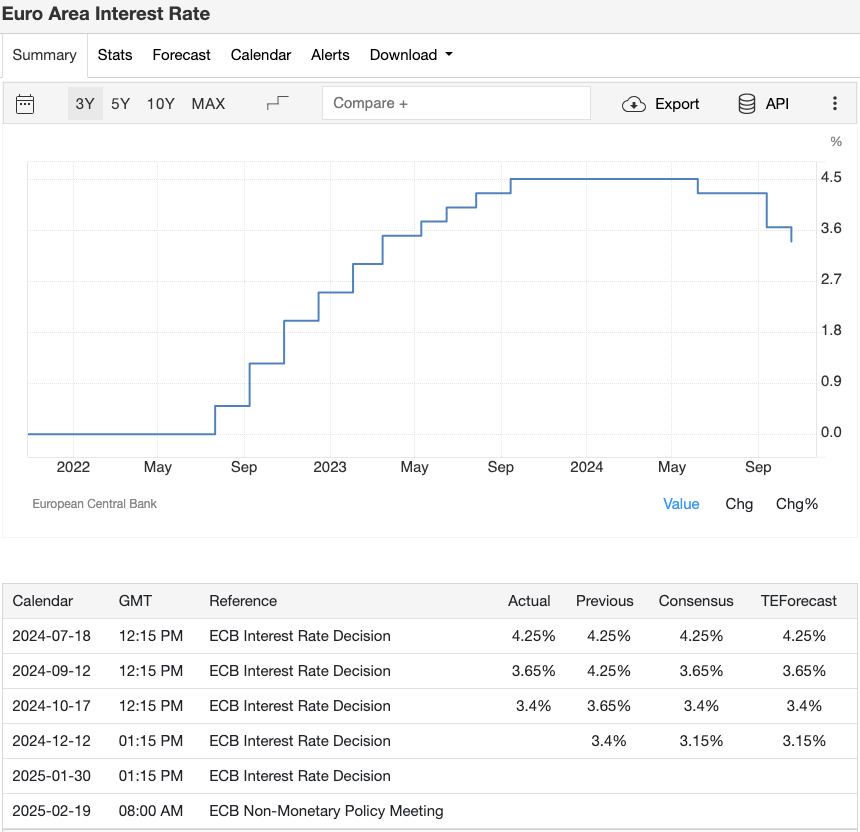

Eurozone ECB interest rate decision

Forecast: 3.15% (remains unchanged)

Why it matters: The ECB’s approach to inflation and economic growth will determine the direction of regional liquidity conditions.

Impact on the crypto market: If the ECB takes a neutral or dovish stance, it will be beneficial to the DeFi ecosystem and euro stablecoins related to Europe.

LCX (LCX) : A token of a compliant trading platform based in Liechtenstein. If the policy is relaxed, the market demand may increase.

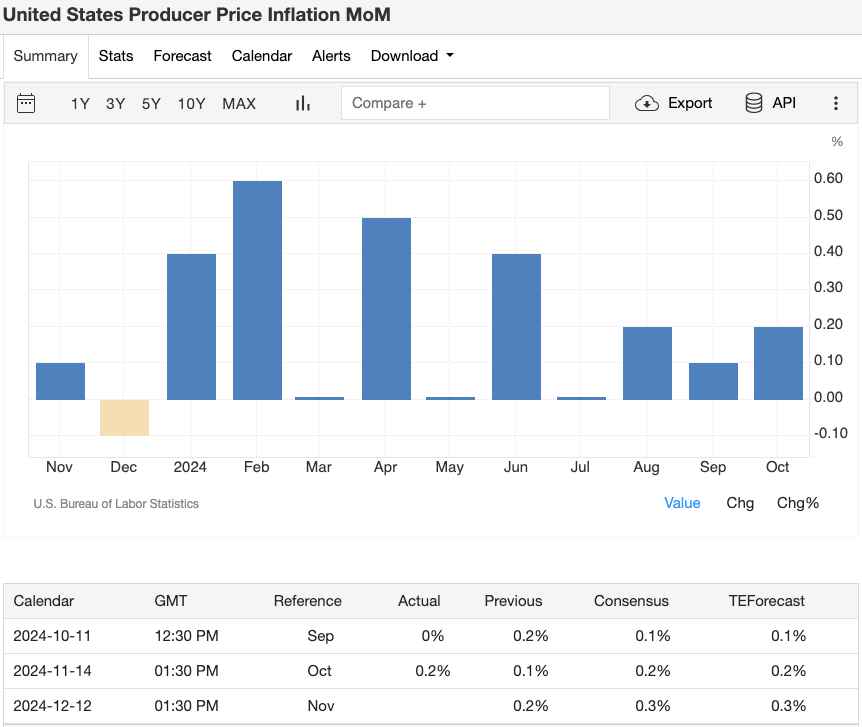

US PPI Producer Price Index (November)

Forecast: Month-on-month growth of 0.3% (same as last month)

Why it matters: PPI is an important indicator for measuring corporate production costs and directly affects future consumer price trends.

Impact on the crypto market: Rising PPI may trigger inflation concerns, thereby increasing demand for Bitcoin as a safe-haven asset. If PPI remains stable or lower than expected, it may be beneficial to DeFi and growth tokens.

Bitcoin (BTC) : Its safe-haven properties are particularly prominent when inflation concerns rise.

Ethereum (ETH) and Polygon (POL) : If PPI pressure is limited, demand for these Layer-2 solutions in the DeFi and NFT ecosystems may increase.

Friday, December 13

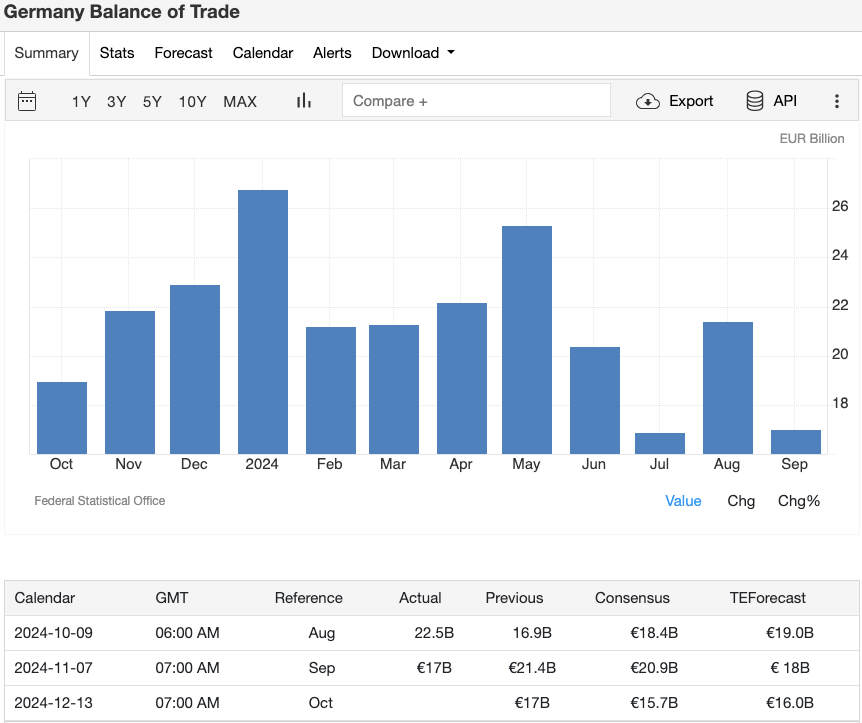

German trade balance (October)

Forecast: €16 billion (down from €17 billion)

Why it matters: As Europes largest economy, Germanys trade data is a key indicator of the strength of global demand.

Impact on crypto markets: If the trade surplus shrinks, it could weaken risk appetite and boost interest in safe-haven assets such as Bitcoin .

IOTA (MIOTA) : Focusing on the industrial Internet of Things, if external demand is weak, market expectations for its application ecosystem may decline.

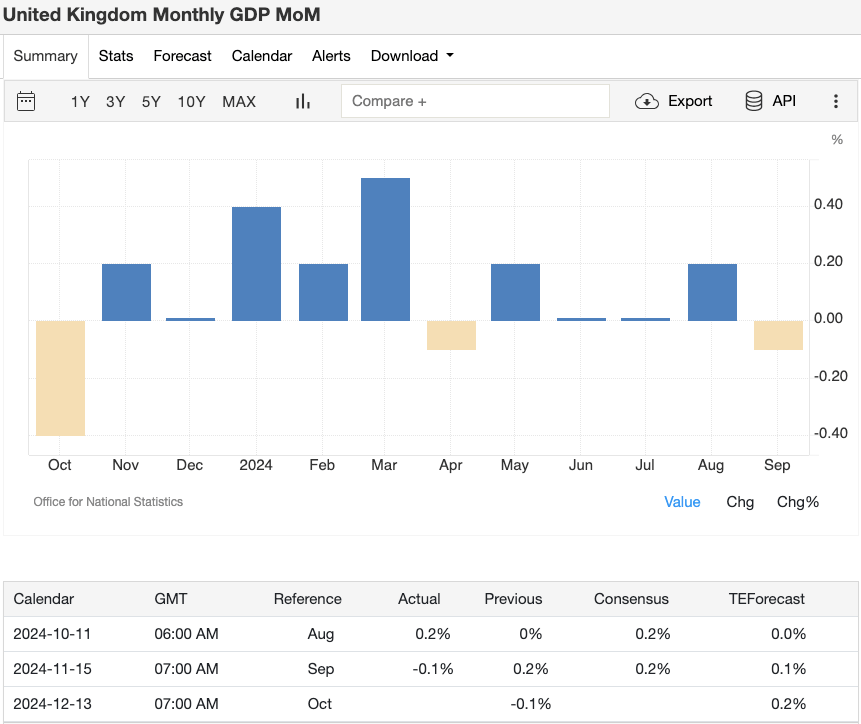

UK GDP monthly rate (October)

Forecast: +0.2% (rebound from -0.1% previously)

Why it matters: Signs of an economic recovery will boost market sentiment, especially for investments tied to European markets.

Impact on the crypto market: The UK’s economic recovery will help support demand for regional tokens.

Quant (QNT) : A London-based cross-chain project that could see demand increase if economic confidence picks up.

Chiliz (CHZ) : Closely linked to the European sports and entertainment sector, improved consumer confidence could drive its growth.

Summary of market themes for Week 50:

1. Inflation dynamics: Whether the data is in line with expectations will determine the extent of market volatility.

2. Monetary policy orientation: ECB and BoC decisions will directly affect capital liquidity and the performance of risky assets.

3. Global demand strength: Trade data (China, Germany) and growth signals (UK GDP) will guide market sentiment.

Crypto Traders Insights Guide

1. Inflation trends (US, China, Europe):

If US inflation remains stable, Bitcoin and Ethereum may fluctuate in a range in the short term, lacking a clear direction. If Chinas inflation data shows a strong economic recovery, Asian-focused tokens such as VeChain or Conflux may benefit. If US inflation unexpectedly rises, investors may turn to Bitcoin as a safe haven.

2. Central bank policies (ECB, BoC):

If the Bank of Canada (BoC) remains patient or the European Central Bank (ECB) takes a neutral stance, it may mean a friendlier liquidity environment, which is beneficial to DeFi and growth tokens. For example, if the BoC is dovish, DeFi protocols such as Aave or Maker may benefit; if the ECB policy is stable, European-focused projects such as the euro stablecoin or LCX may also benefit.

3. Trade and economic growth data (China, Germany, UK):

If Chinas trade data is good, supply chain-related tokens (such as OriginTrail ) may see a positive reaction; conversely, if Germanys trade data is weak, it will prompt investors to choose Bitcoin as a safe-haven asset. If the UK GDP performs better than expected, it may boost European-focused tokens (such as Quant or Chiliz ).

Trading opportunities by asset class

Bitcoin (BTC) : Bitcoin is often the macro hedge of choice in moments of concern about inflation or trade data. If US inflation data is worse than expected or German trade performance is poor, expect funds to shift to Bitcoin as a safe haven. Keep an eye on US core inflation on December 11th and the ECB decision on December 12th.

Ethereum (ETH) : Ethereum benefits from stable liquidity conditions, especially when DeFi activity is strong. If inflation remains stable, liquidity does not shrink, and growth data such as UK GDP and US PPI show positive signals, ETH is expected to benefit and gain additional growth momentum.

Altcoins DeFi Tokens:

If China’s economic and trade data performs well, tokens focused on supply chain and cross-border activities such as VeChain (VET) , Conflux (CFX) or OriginTrail (TRAC) may also strengthen.

If the Bank of Canada (BoC) or the European Central Bank (ECB) send dovish signals, expect funds to shift to DeFi protocols and eurozone-related tokens such as Aave (AAVE) , Maker (MKR) or LCX .

Improving UK GDP data helped boost Quant (QNT) and Chiliz (CHZ) as these tokens are relatively closely aligned with the European market.

Stablecoins ( USDT , USDC ): A good way to stay neutral before the release of major data is to park your funds in stablecoins. After the market reacts to the data, you can reinvest in Bitcoin, Ethereum or specific altcoins according to the situation to strive for a better entry time.

Market sentiment and investor behavior

Risk Appetite vs. Risk Aversion: When economic performance or central bank attitude is better than expected (such as solid inflation data, positive UK GDP or moderate central bank policy), market sentiment tends to shift to risk appetite, driving up altcoins and DeFi tokens. On the contrary, if trade data is weak or inflation is not as stable as expected, investors will prefer Bitcoin or stablecoins to reduce risks.

Institutional movements: Pay attention to the movements of large institutional funds after the release of key data (such as inflation and central bank decisions). These funds are often the first to make adjustments, which is indicative of medium-term market trends. The layout of institutional funds in Bitcoin and Ethereum , especially the movement after inflation or interest rate news, can often predict the market direction in the coming weeks.

Practical trading strategy advice

Short term (days to weeks):

Before the release of important data (such as US inflation data on December 11 and ECB decision on December 12), stablecoins should be used for hedging to reduce volatility caused by market uncertainty.

Seize the short-term rise and fall opportunities of BTC and ETH before and after the release of key inflation reports and PPI data, and use short-term fluctuations to gain profits.

Medium term (weeks to months):

Diversify allocations based on regional advantages. If Chinas trade data continues to be strong, supply chain-related tokens can be considered; if the liquidity environment is loose, DeFi platforms can be deployed.

After macro signals stabilize, closely track signs of institutional money flowing into BTC and ETH, as these movements often indicate subsequent market trends.

Long term (months to years):

Focus on projects with solid foundations, practical application scenarios and active developers, such as Bitcoin , Ethereum and Layer-2 solutions.

Combine staking and yield strategies with your macro perspective, observe the regulatory direction revealed by central bank policies, and prioritize regions that are conducive to the development of the crypto industry.

Comprehensive Analysis and Conclusion

Week 50 will see the release of several important macro data that will not only challenge traditional markets, but will also have a profound impact on crypto markets. From inflation indicators, central bank decisions to trade data, each piece of data may reshape market liquidity, investor sentiment and risk-taking willingness. Whether it is stable inflation in the United States, policy signals from the European Central Bank, or trade conditions in China and Germany and GDP performance in the United Kingdom, this information has the potential to change market expectations and narratives.

Key topics of focus:

Central bank signals: A cautious European Central Bank (ECB) or a patient Bank of Canada (BoC) could inject new life into risky crypto assets and boost market liquidity expectations.

US Inflation: If the data is stable, market sentiment will remain stable; but if there are unexpected changes, volatility may increase significantly and crypto assets will react quickly.

Global trade signals: Trade data from China and Germany will reflect the strength of global demand. Positive trade data is good for supply chain tokens, while bad data may prompt funds to flow into safe-haven assets such as Bitcoin .

By closely following the economic calendar and understanding the potential impact of each data on the crypto market, you can better control your investment strategy. In a rapidly changing market environment, planning ahead and reacting quickly are the keys to achieving stable returns.