Original author: Delphi Digital

Compiled by Odaily Planet Daily ( @OdailyChina )

Translated by Azuma ( @azuma_eth )

Editors Note: On December 11, the well-known investment research institution Delphi Digital released a market outlook report for the cryptocurrency industry in 2025. This article is the first part of the report, which mainly outlines Delphi Digitals analysis of Bitcoins trend and upside in 2015.

Delphi Digital mentioned that if the historical trend repeats itself, Bitcoin will rise to about US$175,000 in this round, and may even rise to US$190,000 - US$200,000 in the short term.

The following is the original content of Delphi Digital, translated by Odaily Planet Daily.

At the end of 2022, we outlined the case that the bear market had bottomed.

15 months ago, we began to become more vocal about our confidence in the coming bull cycle.

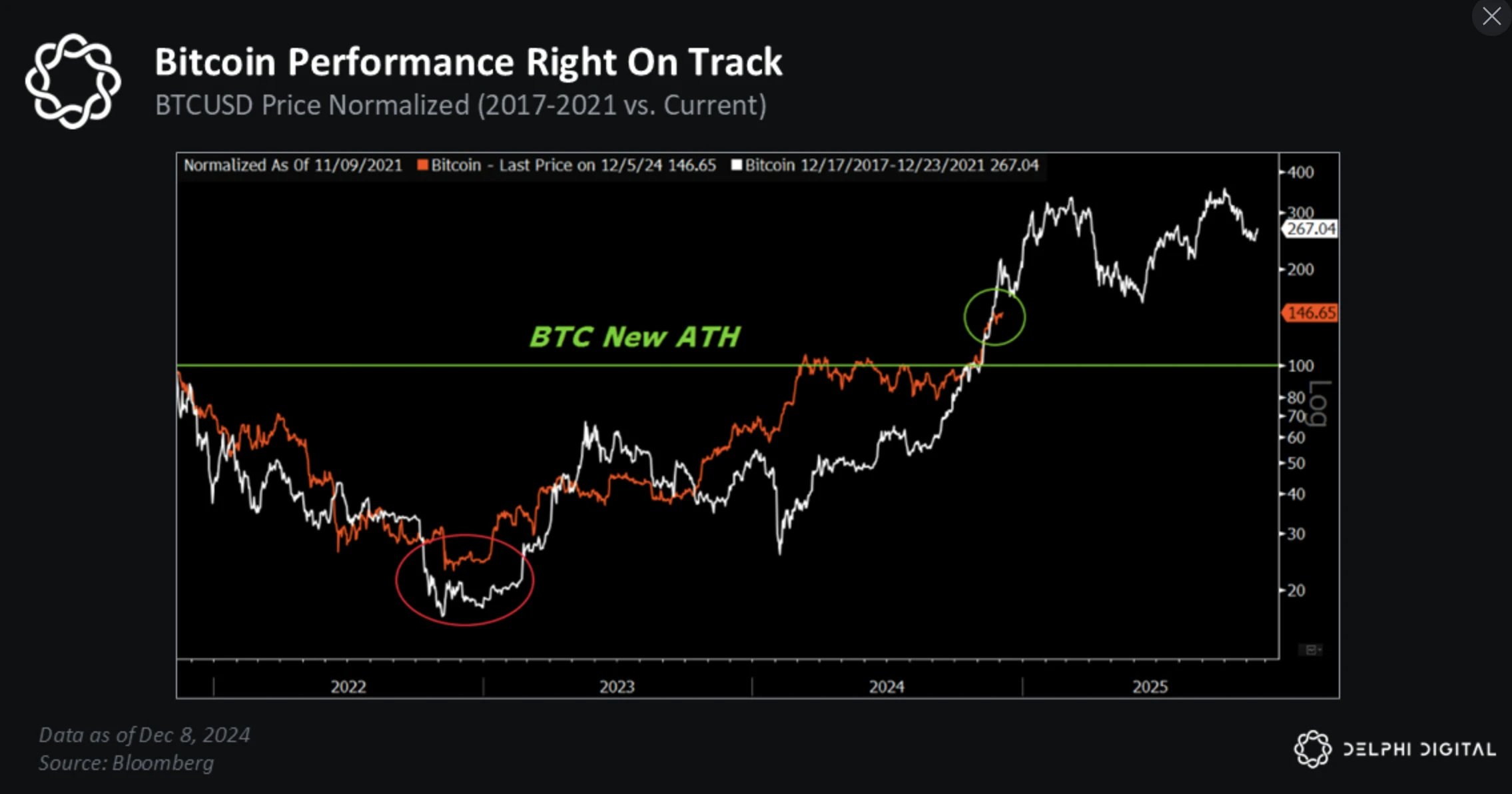

In last year’s annual report, we also predicted that BTC would break new highs in the fourth quarter of 2024.

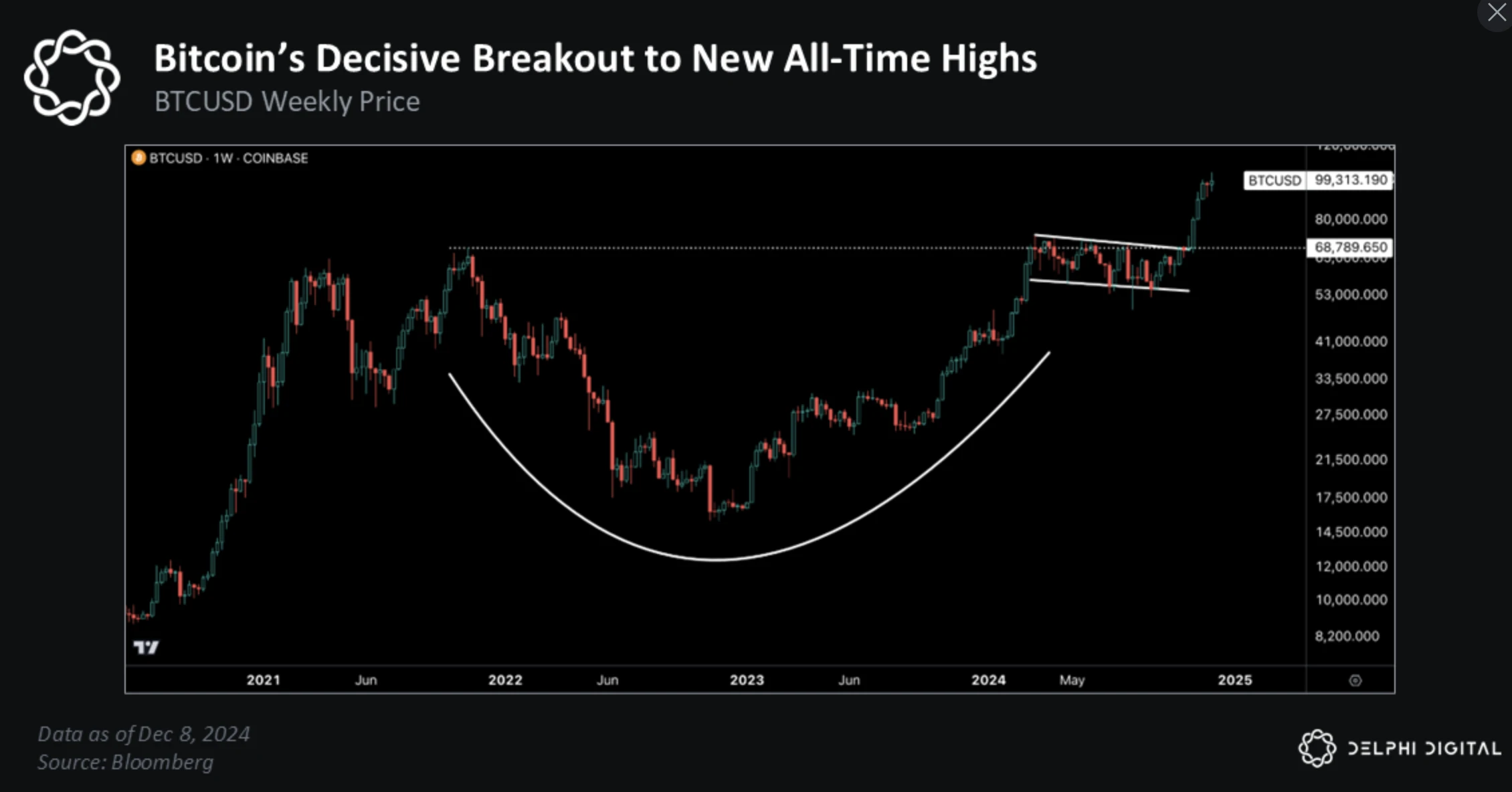

Although from a technical perspective, BTC hit a new high as early as the end of March this year due to ETF hype, the recent breakthrough is more in line with our original expectations.

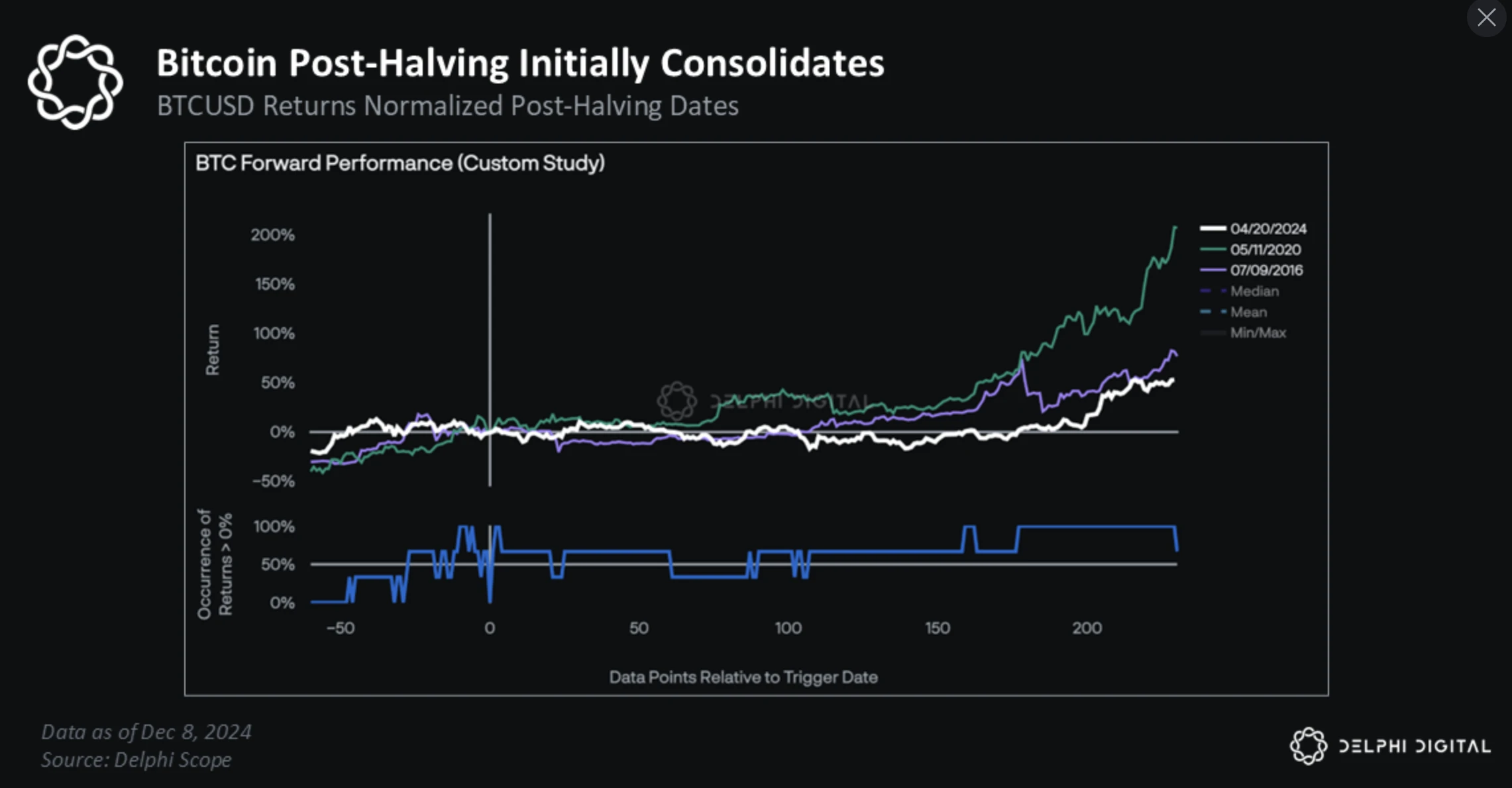

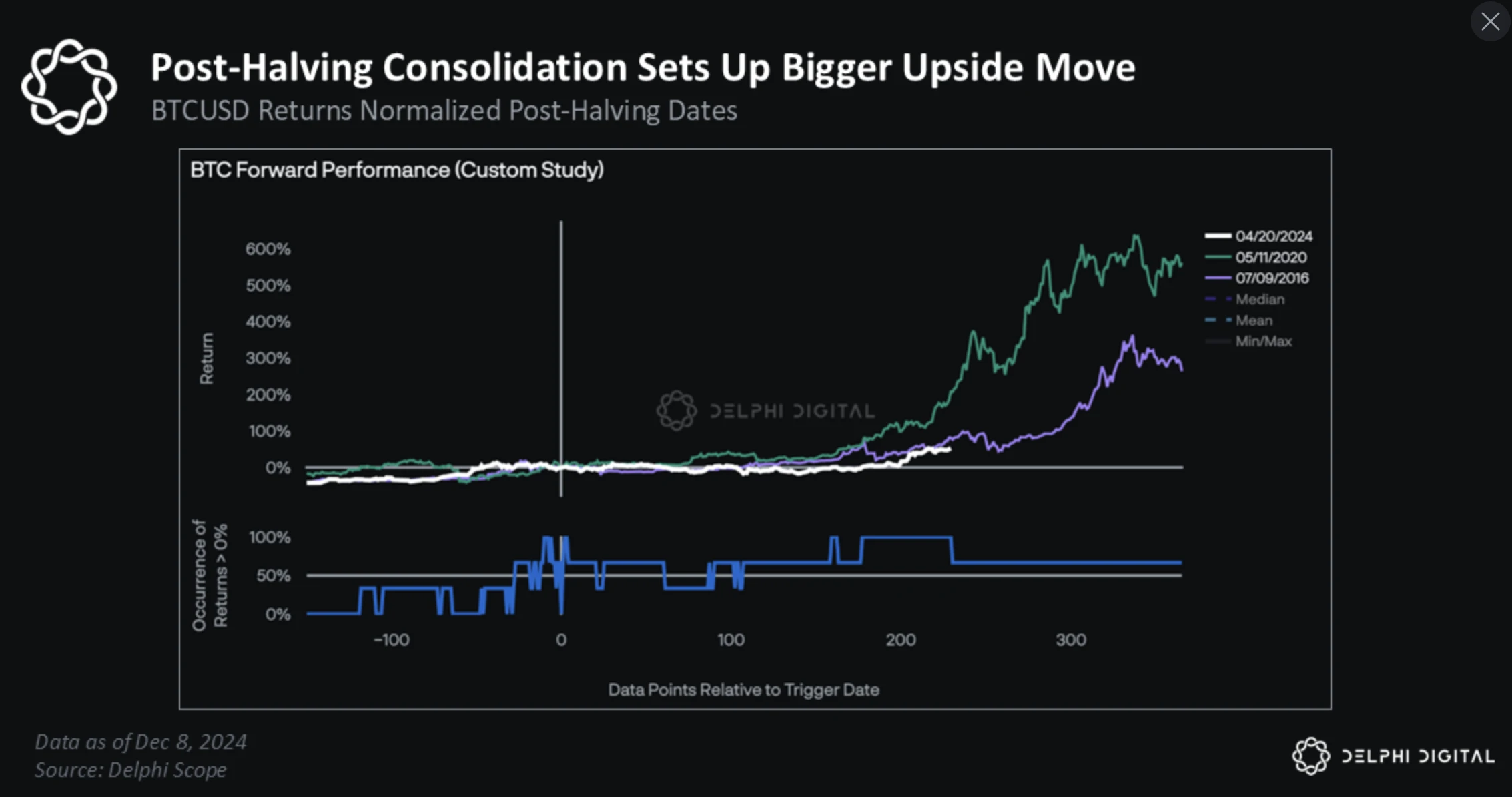

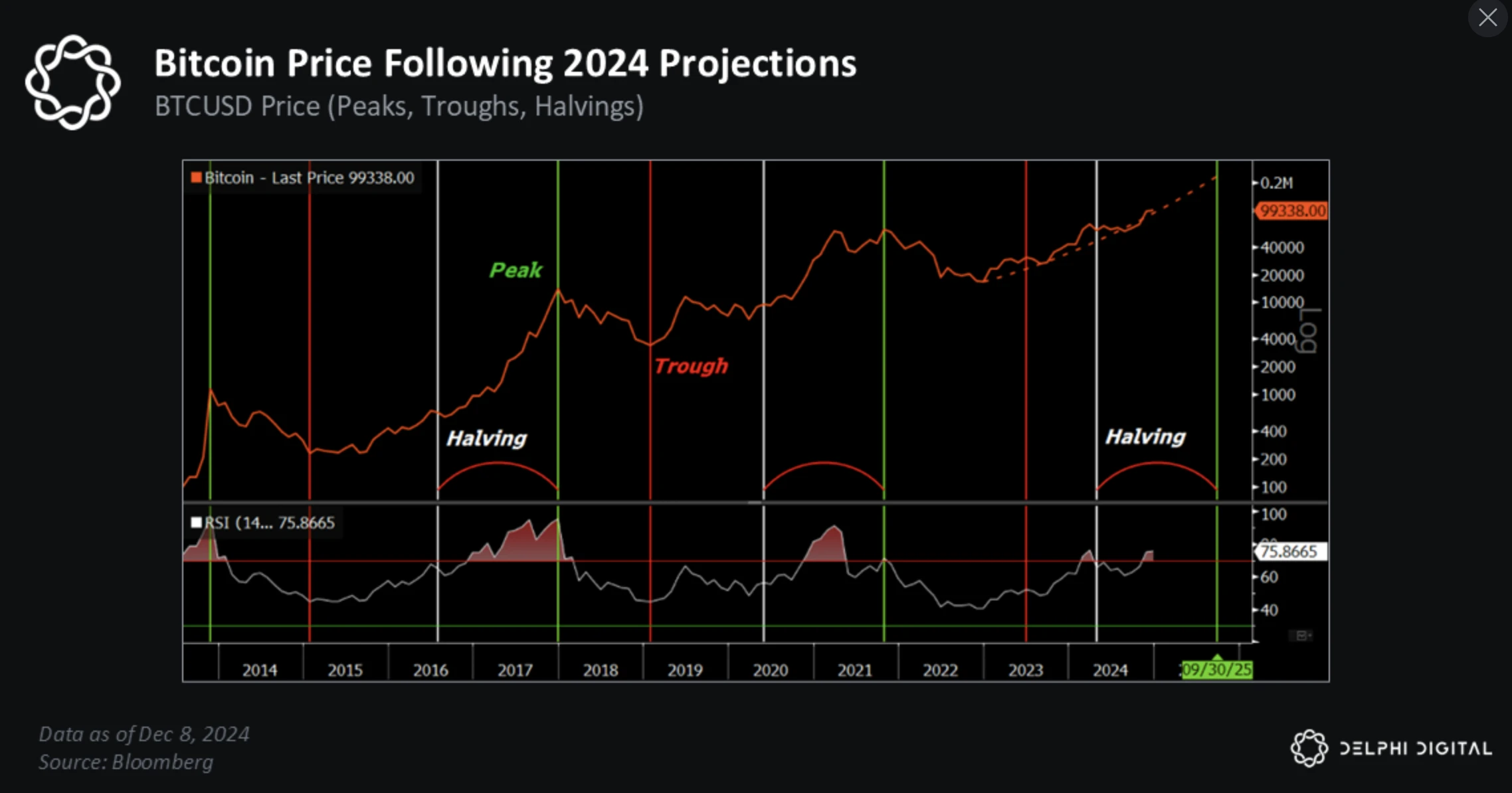

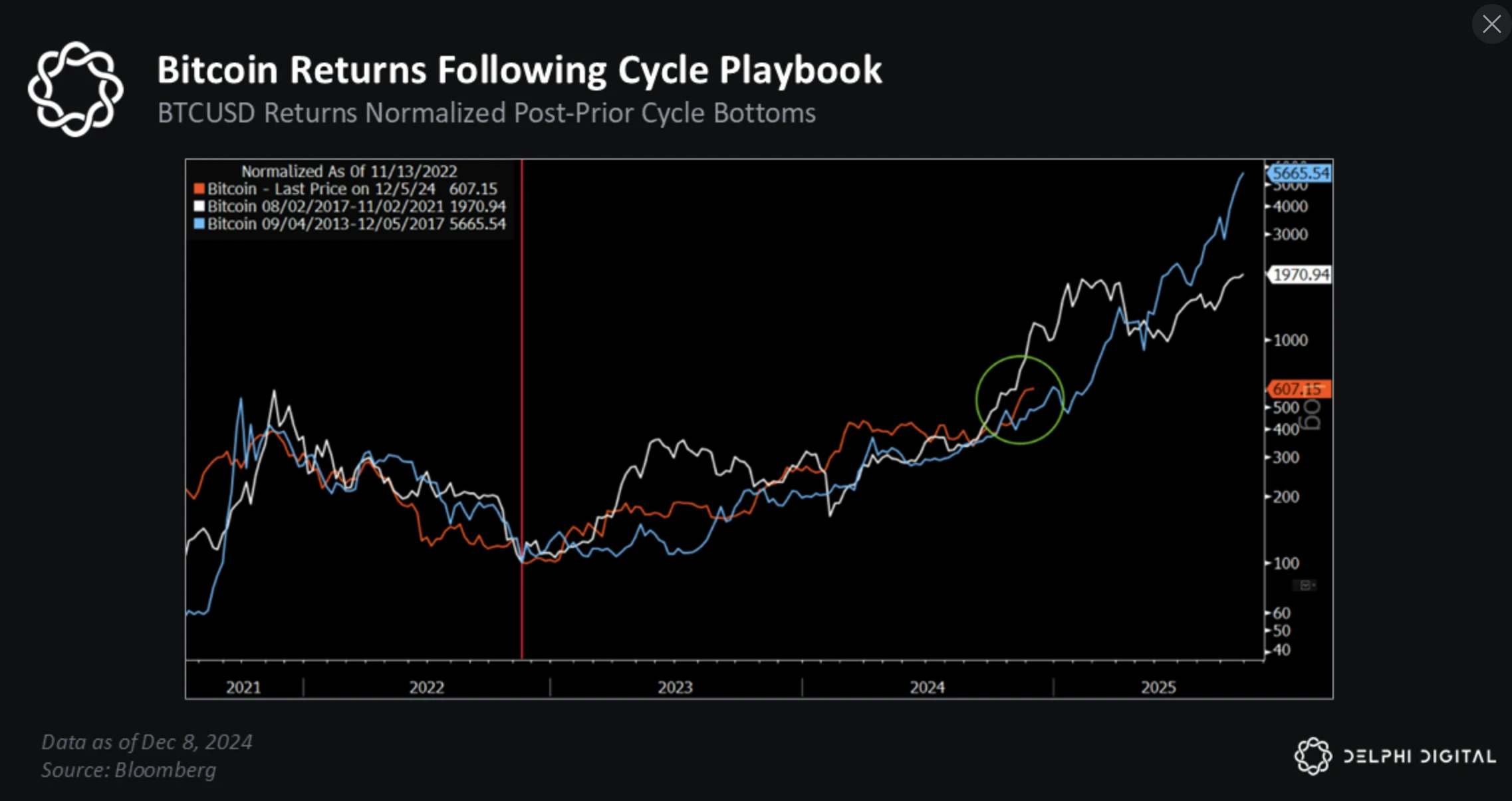

When last year’s annual report was released, there were only more than three months left until the next Bitcoin halving. We have observed from historical data that BTC tends to rise a few weeks before the halving and enter a consolidation period after the halving, laying the foundation for a larger increase thereafter.

Fast forward to today, BTC’s actual trend basically follows this path.

The surge in BTC over the past period of time has put the market in a very advantageous position to move towards a larger space.

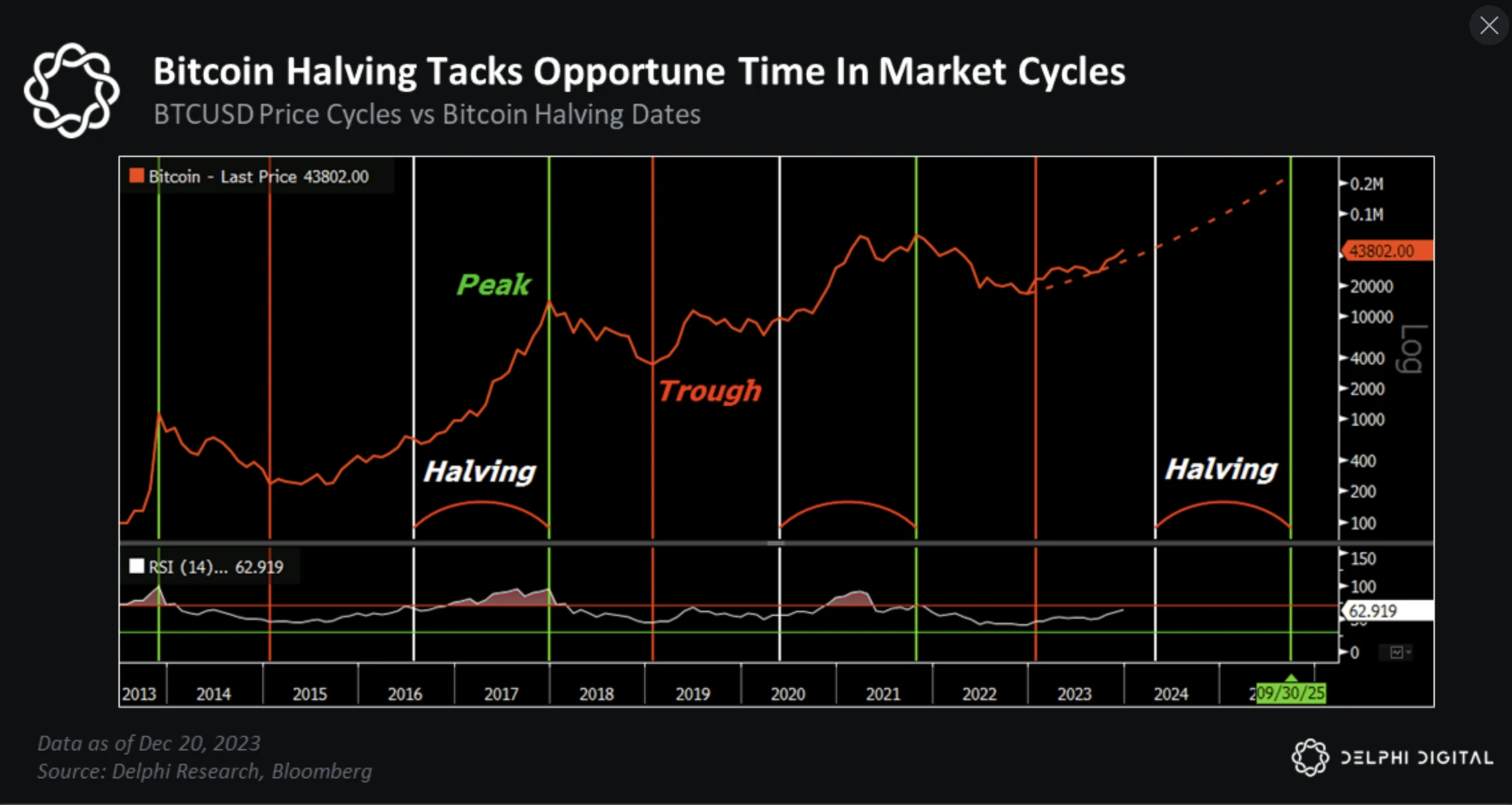

We also reiterated our view that Bitcoin halvings are not the key catalyst for bull runs — they just happen to coincide with cyclical upticks in BTC.

As shown in the figure below, this is the situation at that time.

This is the situation now.

It’s almost a miracle that BTC’s trend is highly consistent with Delphi Digital’s cycle predictions.

Long-time readers of Delphi Digital research reports probably know why this happens - its not a miracle.

Markets are driven by momentum, and nowhere is this more evident than in BTC and other cryptocurrencies.

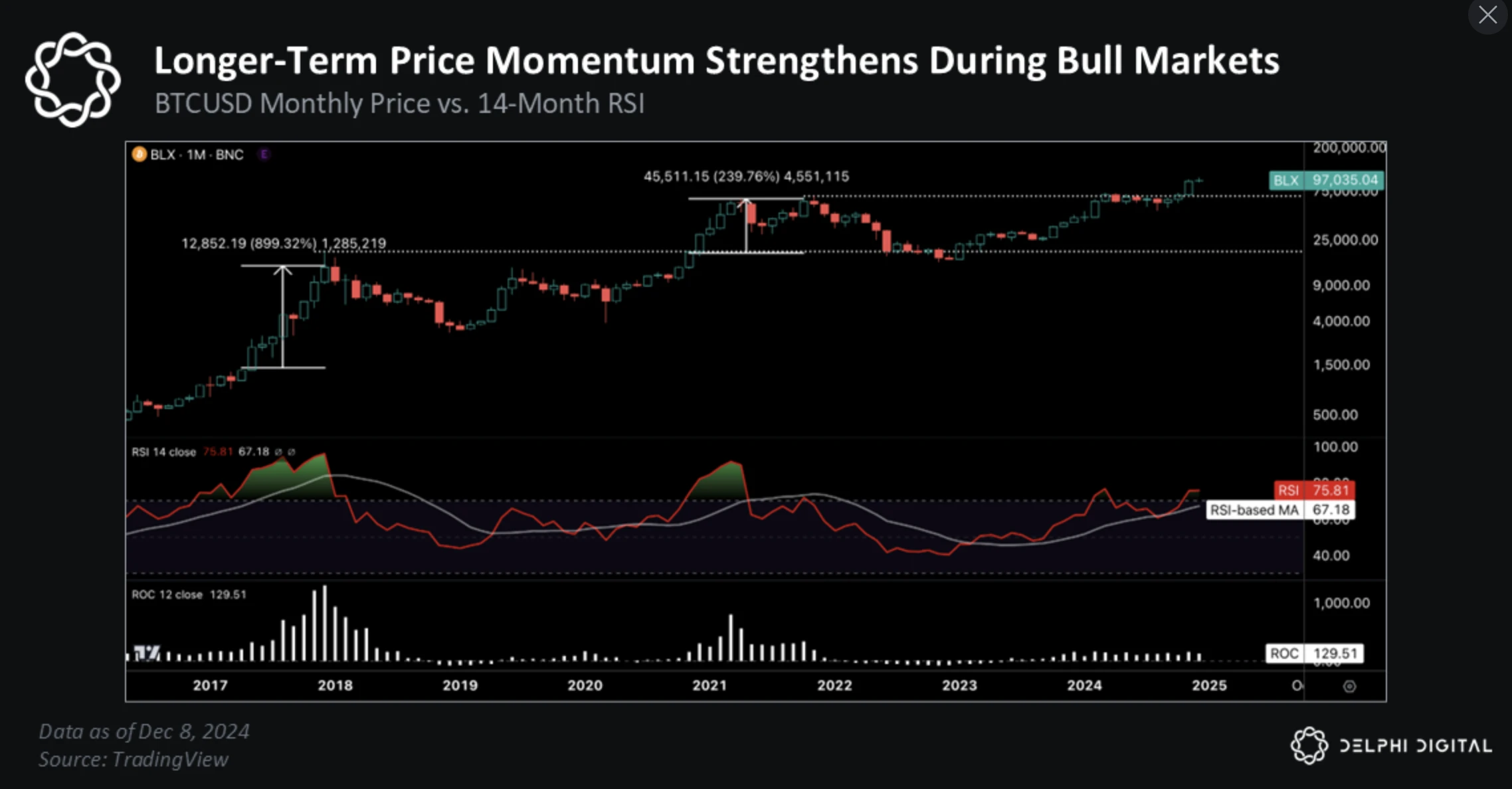

Each of BTC’s all-time highs coincides with a “monthly RSI indicator breaking 70.” In previous bull runs, the market often ran out of steam until the indicator broke 90.

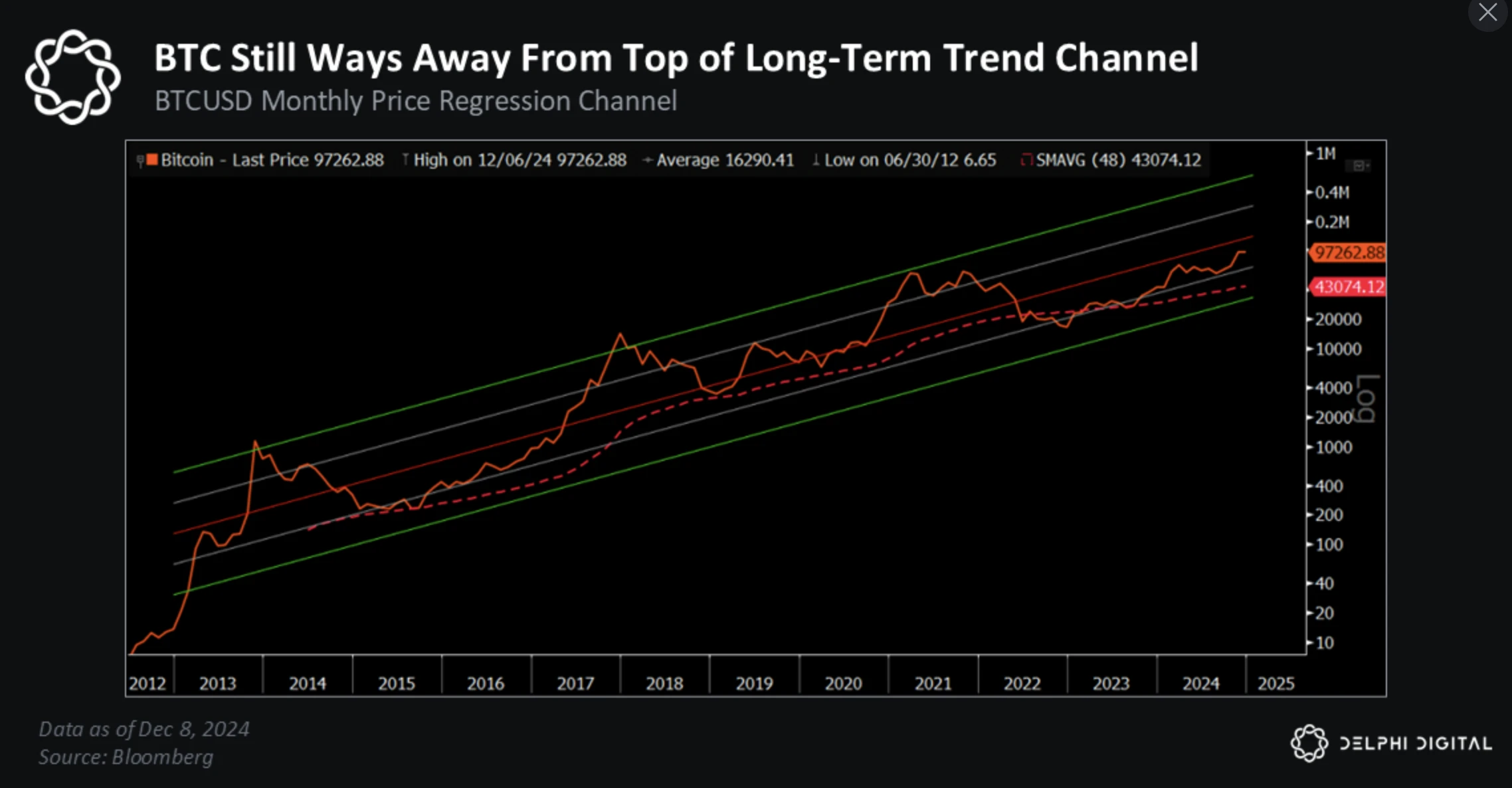

If this historical pattern repeats itself, BTC will have to rise to about $175,000 in this cycle to reach the corresponding RSI level (or even $190,000-200,000 if it really starts to rise wildly). This prediction assumes that the top of the current cycle will be followed by a period of accelerated rise like most previous cycles.

In terms of volatility, BTC’s current volatility is also far below the “1-2 standard deviation” fluctuations that usually indicate a cyclical top.

In an industry that moves so quickly, it can be hard to see the forest through the trees. As we all know, volatility is a double-edged sword, which is why time horizons matter.

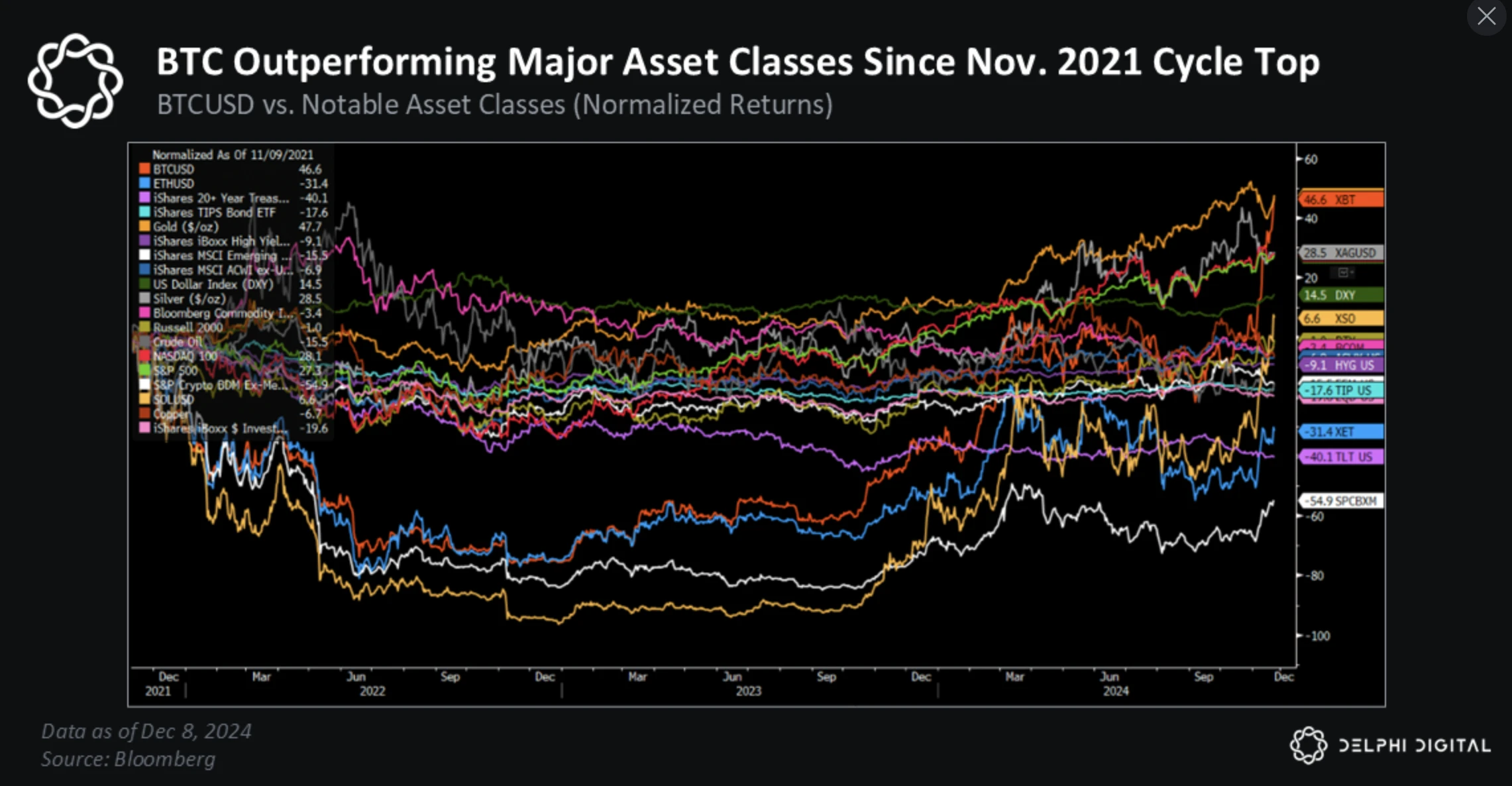

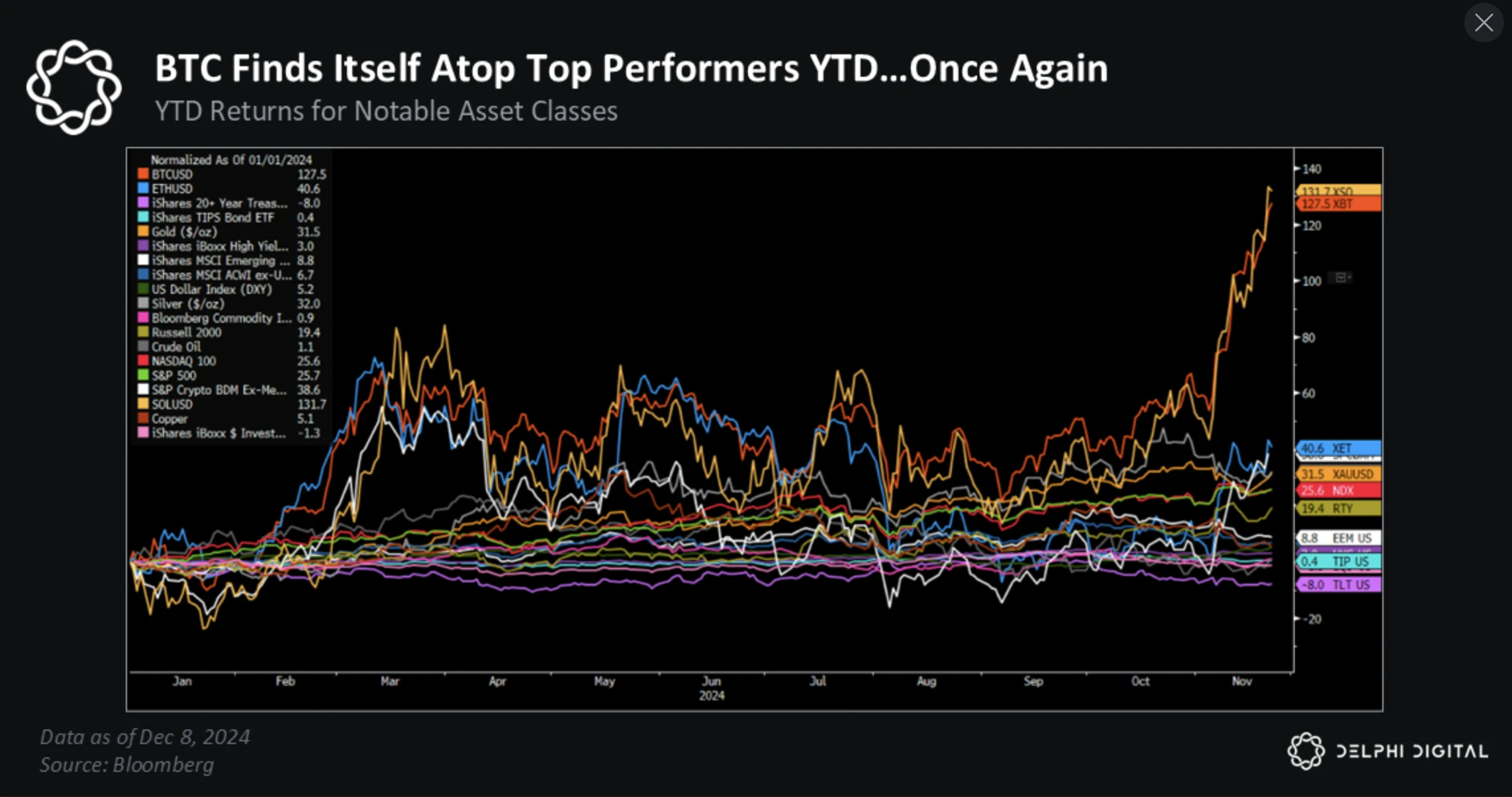

If you need more proof, here’s a fun fact: Even if you had bought BTC at the cyclical top in November 2021, if you had held on, it would still be outperforming every other major asset class today.

Bitcoin’s breakout to a new all-time high is more than just a catchy headline; it’s the ultimate driver of “risk-on” for the cryptocurrency market.

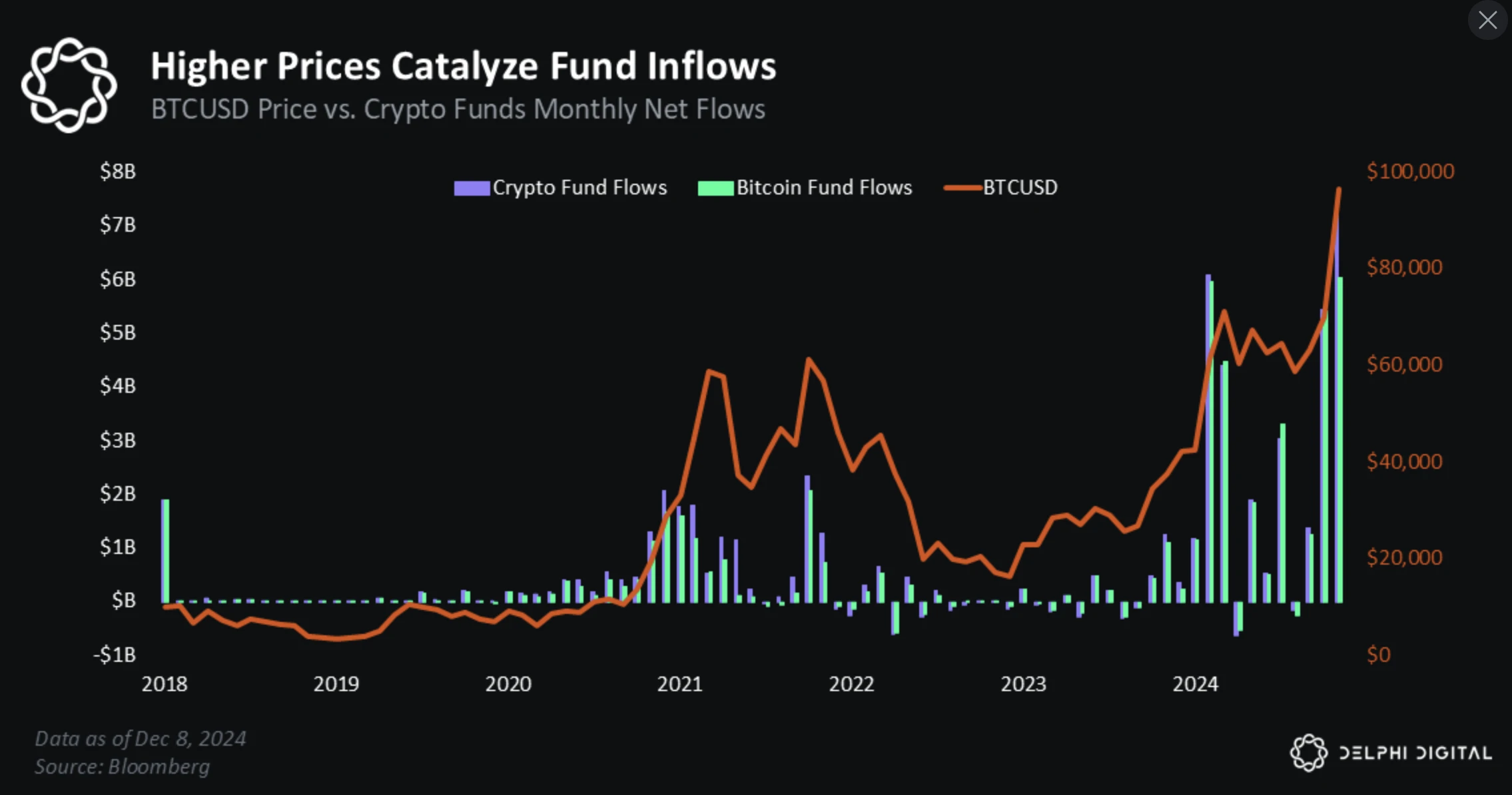

“ Price is the ultimate driver of attention, capital flows, and on-chain activity.”

In the last cycle, retail investors did not rush in until the price of Bitcoin completely broke through its previous high. This trend can be seen from the surge in Google searches and news reports about Bitcoin to the growth of Coinbases retail trading revenue. Investor confidence and risk appetite tend to rise when Bitcoin takes off and breaks through its previous high.

Prices drive up attention, which in turn accelerates FOMO and capital inflows.

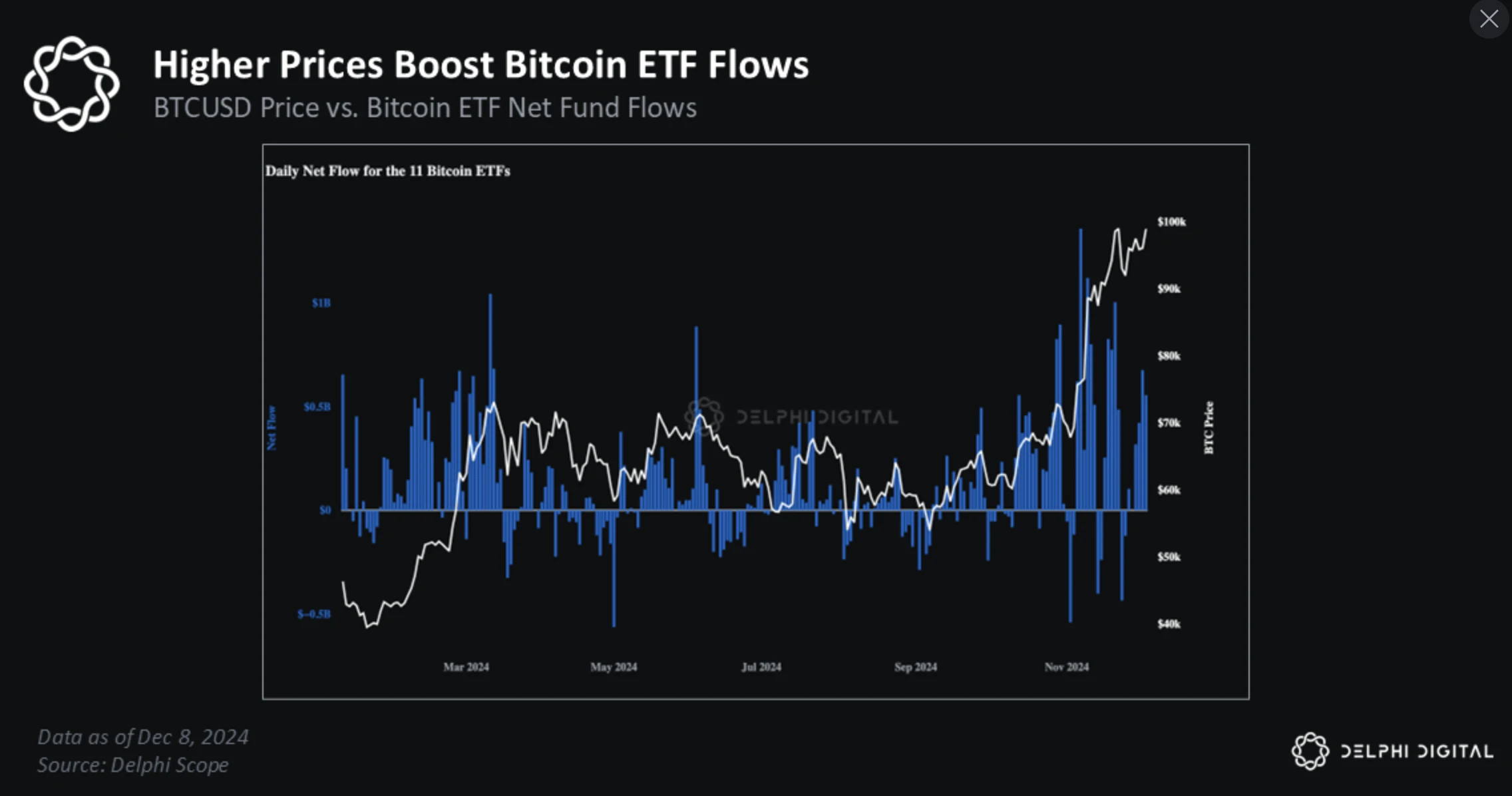

The flow trend of BTC ETF this year clearly shows this trend.

The iShares Bitcoin Trust ETF (IBIT) has the third-largest inflows of all ETFs this year, with the only ones to surpass it being the two largest SP 500 ETFs, which have a combined AUM of 20 times greater than IBIT’s (about $1.1 trillion).

Price is the ultimate driving force, and Bitcoin has topped the list of asset gains compared to traditional asset classes for two consecutive years.

BTC has not only hit new highs against the USD price, but it has also hit new highs against the NDX (Nasdaq 100 Index), which itself is up nearly 30% this year.

BTC has also hit new highs against the SPX (SP 500)… and the SPX is on track to have its best year in the past three decades.

BTC has also hit new highs compared to gold.

We have long said that there will come a day when the stigma surrounding Bitcoin will be removed. There will come a day when not being involved in Bitcoin will become the biggest risk facing investors and institutions. In our opinion, that day has arrived.

It’s no longer cool to laugh at Bitcoin. This cycle solidifies BTC as a macro asset that can no longer be ignored.

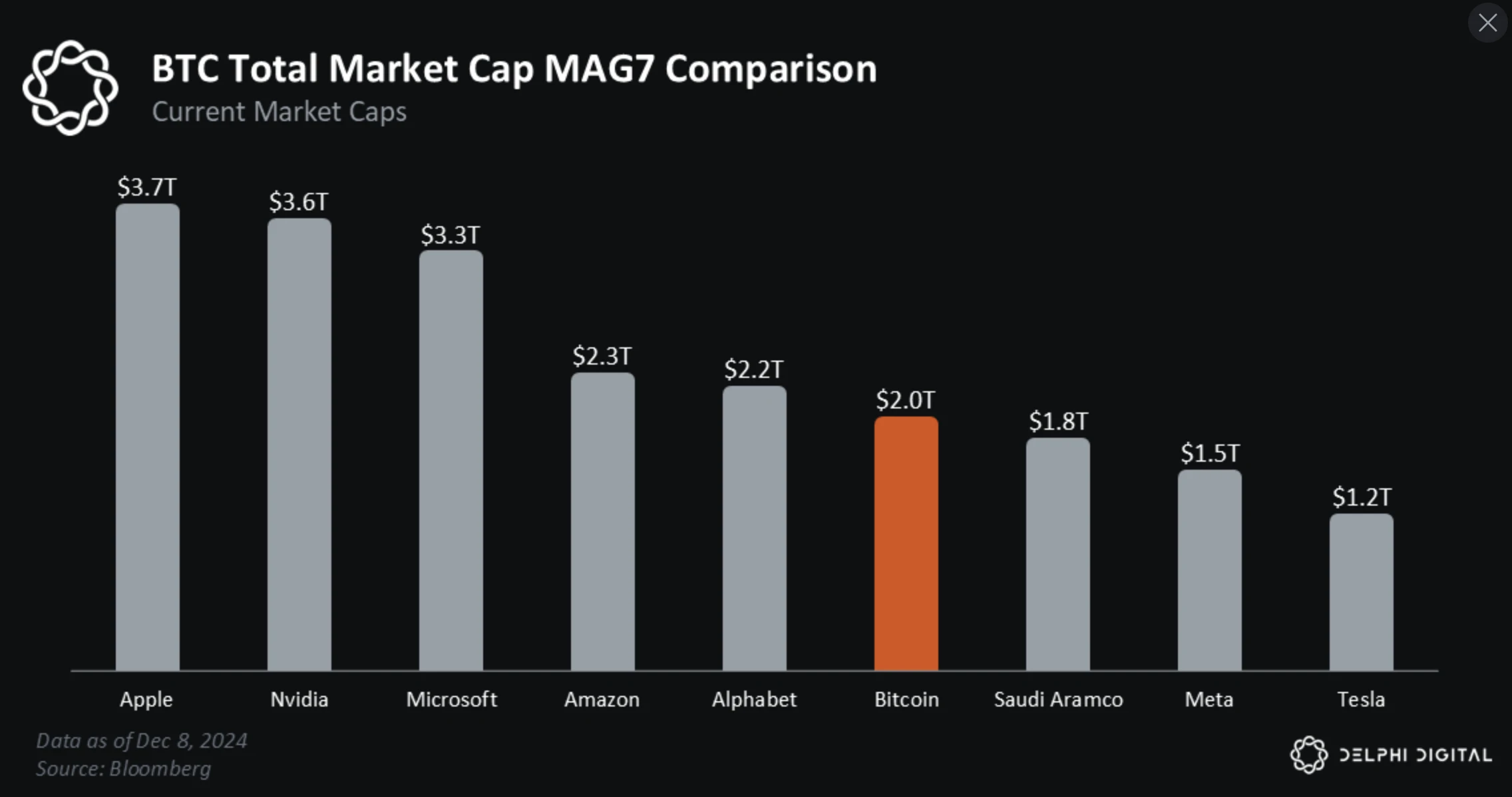

BTCs current market capitalization is around $2 trillion.

That’s a big number. If Bitcoin were a public company, BTC would be the sixth most valuable asset in the world.

Not too long ago, many thought $100,000 BTC was just a pipe dream. Now, social media timelines are filled with such expectations.

At $91,150, BTC flipped Saudi Aramco;

At $109,650, BTC will flip Amazon;

At $107,280, BTC will flip Google;

At $156,700, BTC will flip Microsoft;

At $170,900, BTC will flip Apple;

At $179,680, BTC will flip Nvidia…

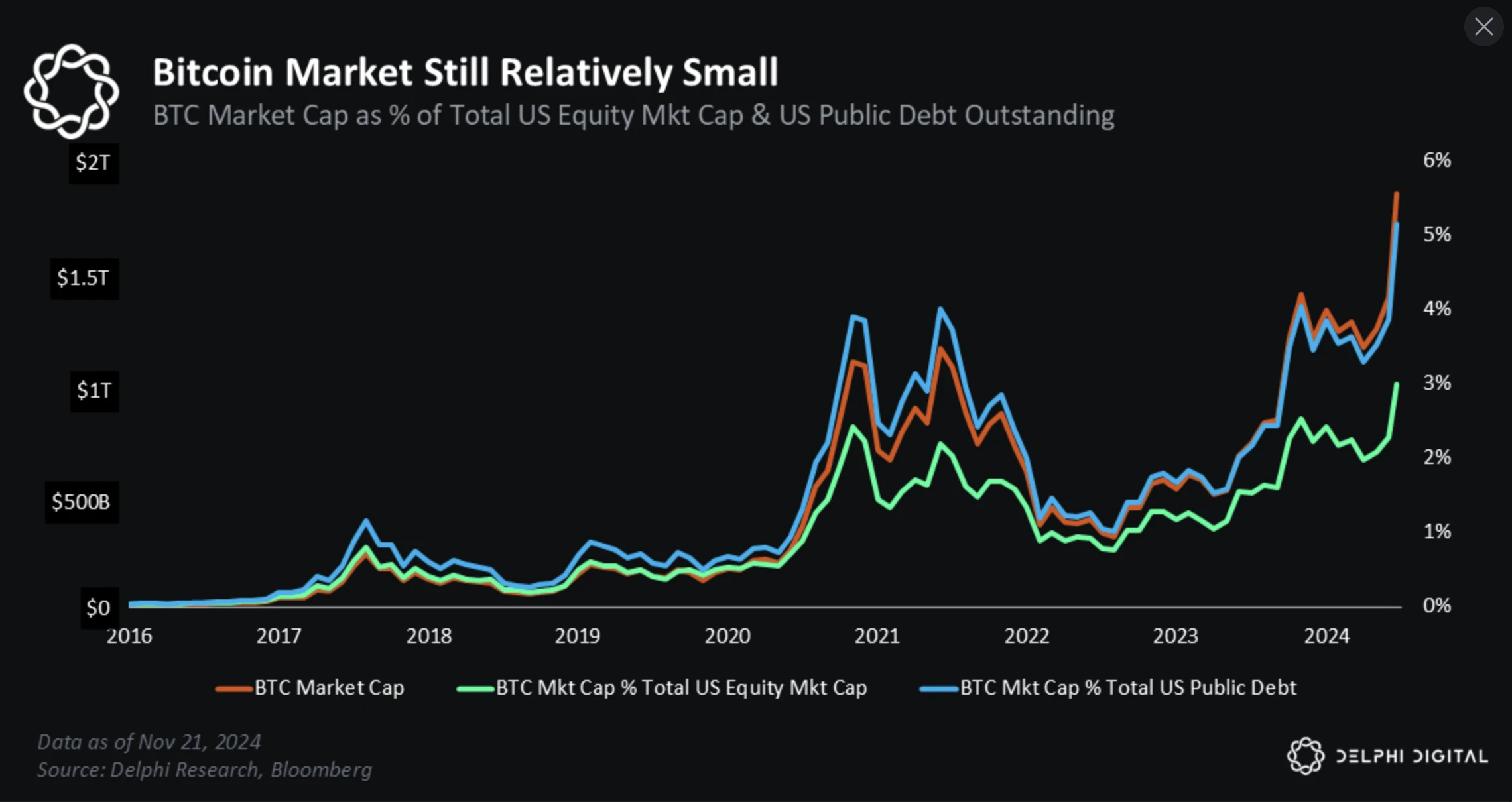

Bitcoin is now big enough to get the attention it deserves, but it’s not so big that it doesn’t have enough room to grow.

At the time of writing:

BTC’s market capitalization still only accounts for 11% of the total market capitalization of MAG 7 (AAPL, NVDA, MSFT, AMZN, GOOGL, META, TSLA);

The market value of BTC is less than 3% of the total market value of US stocks and 1.5% of the total market value of global stocks;

The entire market value of BTC still only accounts for 5% of the total outstanding US public debt and less than 0.7% of the total global debt (public + private debt);

US money market funds hold 3 times the market value of BTC;

BTC’s market value is still only equivalent to 15% of the total global foreign exchange reserve assets. Assuming that global central banks reallocate 5% of their gold reserves to BTC, this will bring more than $150 billion in additional purchasing power, equivalent to 3 times the total net inflow of IBIT this year;

Household net worth is at an all-time high (over $160 trillion) — more than $40 trillion above its pre-pandemic peak — driven largely by rising home prices and a booming stock market. That figure is 80 times the current market value of Bitcoin.

The point is that there are still a lot of deep pools of capital available for BTC and the cryptocurrency market to tap into. All of this will become latent demand when people become confident that the cryptocurrency market will move higher.

With the Federal Reserve and other central banks pushing their currencies down 5-7% per year, investors need to achieve a 10-15% annual return to offset the loss of real purchasing power.

Thats why investors attention is increasingly turning to high-growth sectors, as these are the best places to seek above-average returns.

We believe that as the accumulated positives continue to outweigh the potential negatives, investors will be more willing to take certain risks in pursuit of higher returns.