Preface

Since its launch in 2017, Cardano (ADA) has grown into a PoS network that aims to push the limits of blockchain technology. As a platform committed to security, scalability, and functionality, Cardano is more than just a cryptocurrency, but provides a powerful environment for developers and users to build decentralized applications and systems. Through close collaboration with organizations such as Input Output Global (IOG), the Cardano Foundation, and EMURGO, Cardano has taken an important step on its roadmap and entered the competition in areas such as smart contracts, defi, and NFTs.

This article will take you deep into Cardanos latest developments, key data and network features, explore ADAs use cases and its role in the entire crypto economy. Whether you are a developer, investor or blockchain technology enthusiast, this article will provide you with a comprehensive insight into the Cardano ecosystem, from governance innovation to financial health to the dynamic growth of DeFi, and look forward to the future of Cardano towards its ultimate goal - the Voltaire era.

About Cardano

Cardano is a PoS layer 1 network launched in 2017. Its goal is to provide security, scalability, and functionality for decentralized applications and systems built on its network. In addition to community support from developers, node operators, and projects, Cardano is also supported by Input Output Global (IOG), the Cardano Foundation, EMURGO, and others. Together, these organizations drive network development, adoption, and funding, leading Cardano to the final stage of its roadmap - the Voltaire Era.

Cardano takes a unique approach to development compared to other smart contract networks. The Ouroboros consensus mechanism allows for delegation of stake, while the extended eUTXO accounting model facilitates native token transfers, scalability, and decentralization.

With a loyal group of users and developers, Cardano has proven its staying power. After supporting smart contracts through the 2021 Alonzo hard fork, Cardano began to compete in more traditional crypto markets such as DeFi and NFTs.

Key data

Profitability data

ADA is the native asset of Cardano and serves as the main medium of exchange for transactions on the network. It has four main network-level use cases:

(i) Settlement of network transaction fees: ADA is used to pay for transactions conducted on the Cardano network.

(ii) Registering a Stake Pool: Users can use ADA to register a stake pool, participate in network consensus, and become a stake pool operator (SPO).

(iii) Staking: Whether as a stake pool operator or a delegator, staking ADA can help protect network security and earn token rewards.

(iv) Rewarding voters and funding projects: In Project Catalyst, ADA is used to reward voters and fund projects.

ADA has a maximum supply of 45 billion, and its circulating supply will experience inflation before reaching this maximum. After every five-day epoch, 0.3% of the ADA reserve (uncirculated ADA) is allocated to SPOs as rewards. This inflation tends to zero as the reserve is consumed and the circulating supply approaches 45 billion.

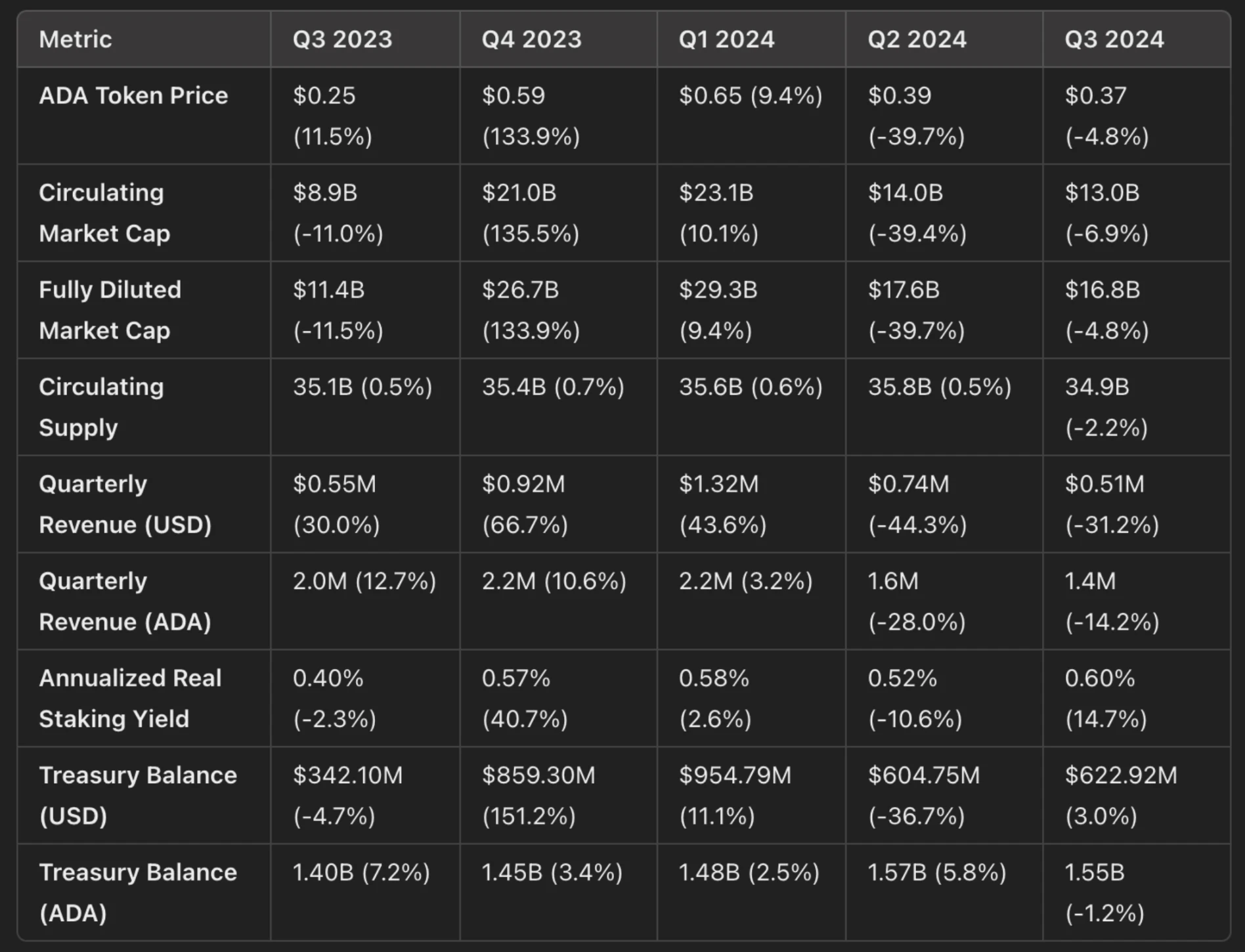

The annualized effective staking yield takes into account the dilution of value due to inflation. In the third quarter, the annualized effective staking yield was 0.6%, but this may vary depending on the different equity pools.

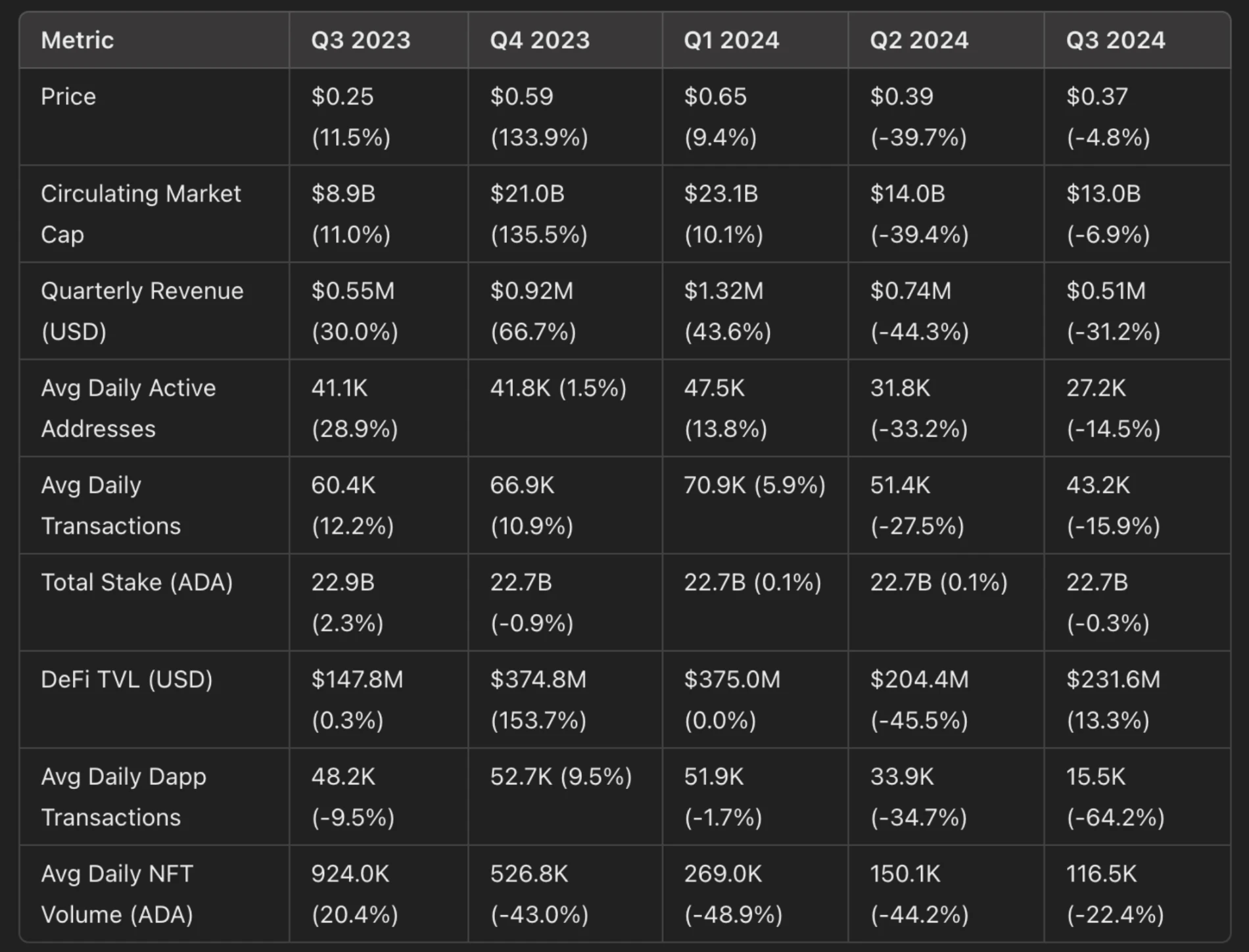

In Q3, ADA’s price dropped by 4.8% to $0.37. Correspondingly, ADA’s total market capitalization dropped by 6.9% quarter-over-quarter to $13 billion. The slight difference in total market capitalization is due to a 2.2% decrease in circulating supply. Due to the price drop, ADA’s total circulating market capitalization ranking dropped from 10th to 11th in Q3.

On Cardano, each transaction is subject to a network transaction fee, which is used to process the transaction and cover storage costs. The fee calculation includes a minimum fee plus a variable fee based on the size of the transaction. Revenue (in USD) fell 31.2% quarter-on-quarter to $510,000, while revenue (in ADA) fell 14.2% quarter-on-quarter to 1.4 million ADA. This difference is due to the decline in ADAs price throughout the quarter.

Currently, 20% of Cardano’s transaction fees go into the treasury. Cardano’s treasury balance (in ADA) fell 1.2% month-over-month to 1.55 billion ADA, but the dollar value of the treasury increased 3% to $622.92 million.

Daily activity data

In Q3, Cardano’s average daily transaction volume fell by 15.9% month-on-month to 43,200, while the average number of daily active addresses (DAAs) also fell by 14.5% to 27,200. Cardano’s average transaction fee remained the same at $0.13. However, the average transaction fee (in ADA) fell by 17.9% month-on-month to 0.54.

The ratio of transactions to active addresses (txs/DAAs) fell 1.7% month-over-month to 1.59. An increase in this ratio generally means that activity is more evenly distributed among users; conversely, a decrease in the ratio indicates an increase in “heavy users.”

Total stake (ADA) and ADA’s staking ratio decreased by 0.3% and 4.1% month-on-month, respectively. Total stake (in USD) decreased by 5.1% month-on-month to $8.5 billion, due to the decline in ADA’s price. Total stake (in USD) represents the economic security of the network.

Governance and Forks

In April 2024, Cardano announced the Chang hard fork, a two-phase network upgrade designed to enable on-chain governance and complete the core goals of the final roadmap phase of Cardano. Voltaire is the final step towards the self-persistence of Cardano through on-chain voting and off-chain mechanisms and institutions such as the member base organization Intersect.

Phase 1: Begins with the launch of the Chang hard fork on September 1, 2024. This phase kicks off a technical bootstrapping period, setting the stage for decentralized voting and governance actions.

Interim Cardano Constitution: To fill the gap until a real constitution is iterated through the Cardano Constitution Workshop and approved at the Cardano Constitution Assembly in Buenos Aires, Argentina in December 2024.

Interim Constitutional Committee (ICC): Composed of seven members, three of whom are elected by vote. In the first phase, the ICC has veto power over certain on-chain governance actions.

Phase 2: will see Cardano’s on-chain governance come fully online as the Cardano Constitution is completed and approved. This phase will empower ADA token holders to direct technical changes and treasury withdrawals, in part by introducing a new user role, delegated representatives. ADA token holders will be able to delegate governance power to DReps and SPOs, who can vote on governance proposals on their behalf.

Sign up to become a DRep: Open, requires a one-time deposit of 500 ADA.

Once Phase 2 is complete, DReps, the SPO, and the Constitutional Council will govern all areas of the network through an on-chain voting and treasury system based on CIP-1694. This will transfer responsibility from the IOG, the Cardano Foundation, and EMURGO, the three institutions that have historically held all seven governance (genesis) keys together. Actions that can be governed include matters related to the Constitutional Council, parameter changes, constitution updates, hard fork initiations, protocol parameter changes, and treasury withdrawals.

Intersect SanchoNet

Testing related to CIP-1694 continues on SanchoNet, a test network launched in Q3 2023 that is designed to serve as a sandbox to test and build processes and tools for Cardano on-chain governance. Developers use this testnet to launch new infrastructure (such as wallets and voting explorers), SPOs can test voting and proposals, and details about DReps can also be discussed here.

SanchoNet and the wider Voltaire outreach are led by Intersect, a membership-based organization serving the cardano ecosystem that combines the strengths of community members, SPOs, and project teams. Intersect was established to bring together ADA token holders under a common vision for a more transparent, collaborative, and innovative cardano ecosystem.

Intersect maintains over 60 code repositories, including the full cardano Haskell code, and drives cardanos open source approach through various standing committees and working groups. In addition, Intersect is working on creating an open product roadmap, an annual budget process, and has been operating a grant program where projects are awarded for developing governance-related areas such as education and the DRep platform.

DeFi

In the third quarter, Cardanos DeFi total locked value (TVL, in US dollars) increased by 13.3% month-on-month to $231.6 million, while the DeFi diversity score increased by 12.5% to 9. There were also many changes in the TVL of various protocols in the third quarter.

Minswap’s TVL increased slightly by 4.4% month-on-month to $58.6 million.

Liqwid’s TVL increased dramatically by 77.2% to $47.1 million, surpassing Indigo, whose TVL fell 19.7% Q-o-Q to $38.4 million.

Smaller protocols like Splash Protocol and SundaeSwap grew 76% and 26% to $16.9 million and $16 million, respectively.

Indigo is a synthetic asset issuer that provides iUSD, iBTC, and iETH. A week after the end of the third quarter, Indigo completed its upgrade to V2.1. This upgrade introduced an algorithmic interest rate, which splits the interest between the treasury and INDY stakers, as well as some other improvements.

Splash is a decentralized exchange (DEX) that launched in July, after raising 17.2 million ADA in the SPLASH token sale in May. Splash is also working on snek.fun, a protocol similar to pump.fun on Solana that allows users to easily launch and trade tokens. The app launched in September and saw over 2,230 tokens created and 4.5 million (ADA) traded on its first day.

SundaeSwap continued its momentum from the second quarter with the launch of the V3 upgrade, which introduced a dynamic fee model and increased transaction load capacity. The launch included a 90-day trading fee waiver, which expired in August, and a proposal to increase fees was passed in September. SundaeSwaps revenue is distributed to SUNDAE token holders, SundaeSwaps treasury, Sundae Labs, etc.

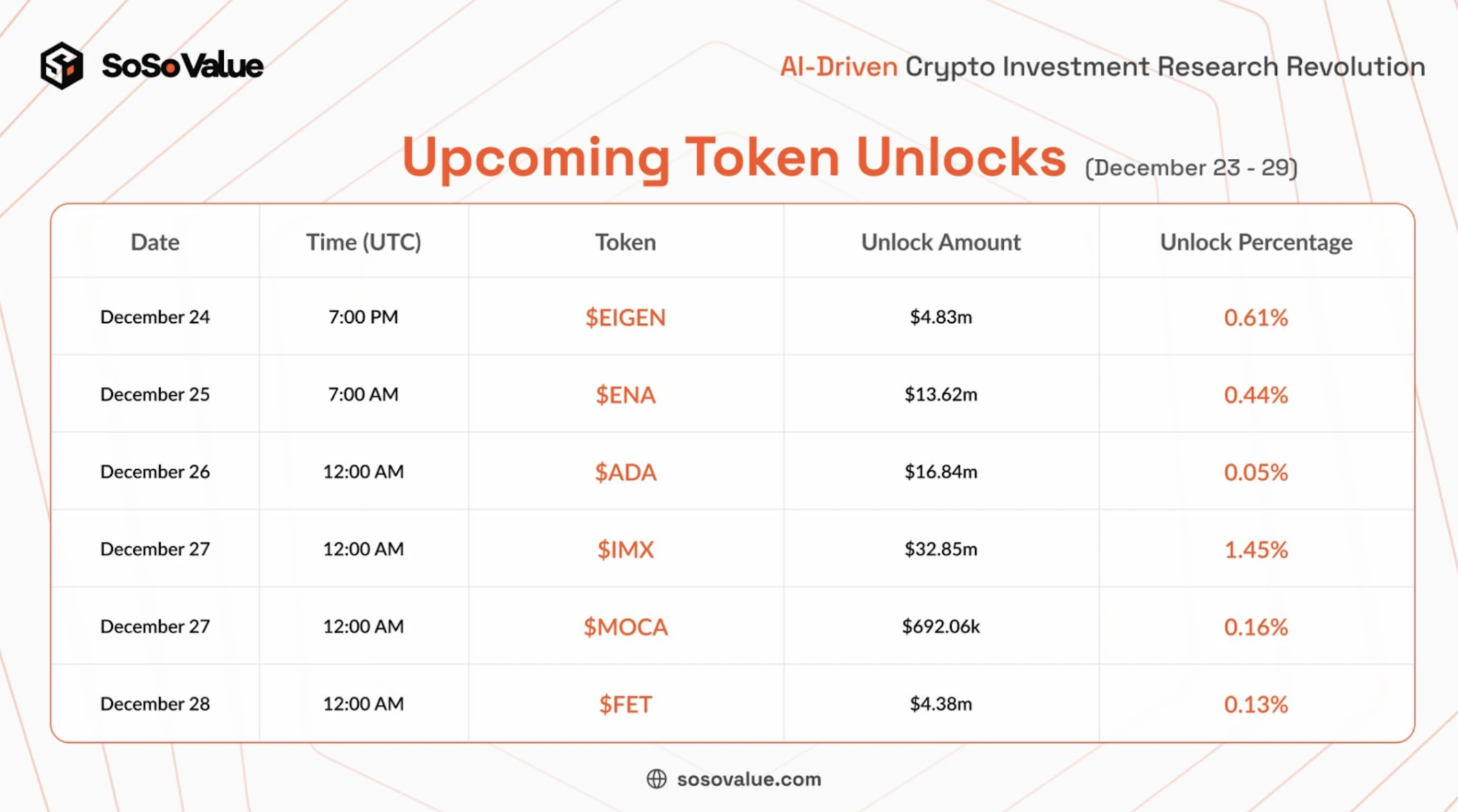

Ada Token Unlock

Recently, Cardano (ADA) will unlock tokens this week. It is expected that about 16.84 million ADA tokens will be unlocked, which accounts for 0.05% of the current circulation.

Future Outlook

Cardano was launched in 2017 as a PoS layer 1 network, aiming to provide a secure, scalable and feature-rich platform to support decentralized applications and systems. Through its unique Ouroboros consensus mechanism and extended eUTXO model, Cardano has demonstrated competitiveness in the fields of smart contracts, DeFi and NFT.

With the implementation of the Alonzo hard fork in 2021, Cardano has entered a new stage of development after supporting smart contracts. In the future, Cardano will achieve full on-chain governance and self-persistence through the Chang hard fork, ushering in the Voltaire era. By introducing new governance mechanisms, improving the diversity of the DeFi ecosystem and TVL growth, Cardano is expected to continue to consolidate its position in the blockchain industry and promote the further development of its ecosystem through continuous technological innovation and community governance.