Key Takeaways

The total market value of global cryptocurrencies is $3.65 trillion, up 6.7% from $3.42 trillion last week. As of January 6, 2025, the total net inflow of US Bitcoin spot ETFs was about $38.9 billion, with a net inflow of $240 million this week; the total net inflow of US Ethereum spot ETFs was about $2.64 billion, with a net outflow of $80 million this week.

The total market value of stablecoins is $212 billion, accounting for 5.82% of the total market value of cryptocurrencies, and its increase in the past week is 0.47%. Among them, the market value of USDT is $137.2 billion, accounting for 64.7% of the total market value of stablecoins; followed by USDC with a market value of $45.6 billion, accounting for 21.5% of the total market value of stablecoins; DAI has a market value of $5.4 billion, accounting for 2.5% of the total market value of stablecoins.

This week, the total TVL of DeFi is 128.6 billion US dollars, an increase of 5.8% from last week. Among the three public chains with the highest TVL, Ethereum chain accounts for 55.03%; Solana chain accounts for 7.34%; and Tron chain accounts for 5.92%. The overall share is relatively stable, and Ethereum chain is still the leader in the DeFi field.

From the chain data, the daily transaction volume of Layer 1 public chains this week is on the rise except for BNB and SUI. Among them, BNB has the most obvious decline compared with last week, with a decline of 47.6%. In terms of transaction fees, ETH transaction fees have increased the most, up 71% from last week. From the perspective of daily active addresses, the overall trend is more active, among which SUI has the most obvious increase, up 22%. The total TVL of Ethereum Layer 2 reached 50.68 billion US dollars, with an overall increase of 7.9% this week compared with last week. Arbitrum and Base occupy the top position with 38.13% and 26.2% market share respectively.

Innovative Project Focus: Beacon Protocol : Beacon opens new private data sources to artificial intelligence while ensuring privacy, redistributing incentives and building a sustainable data economy; 0 LiqLend : 0 LiqLend is a peer-to-peer yield market that provides lenders with the best yield strategies; Ape Pro : Ape Pro is Solanas Memecoin terminal, powered by Jupiter Exchange, with a transaction fee of only 0.5%.

Table of contents

Key Takeaways

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

2. Fear Index

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange ratio

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin market value and issuance

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

2. New Project Insights

3. New trends in the industry

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

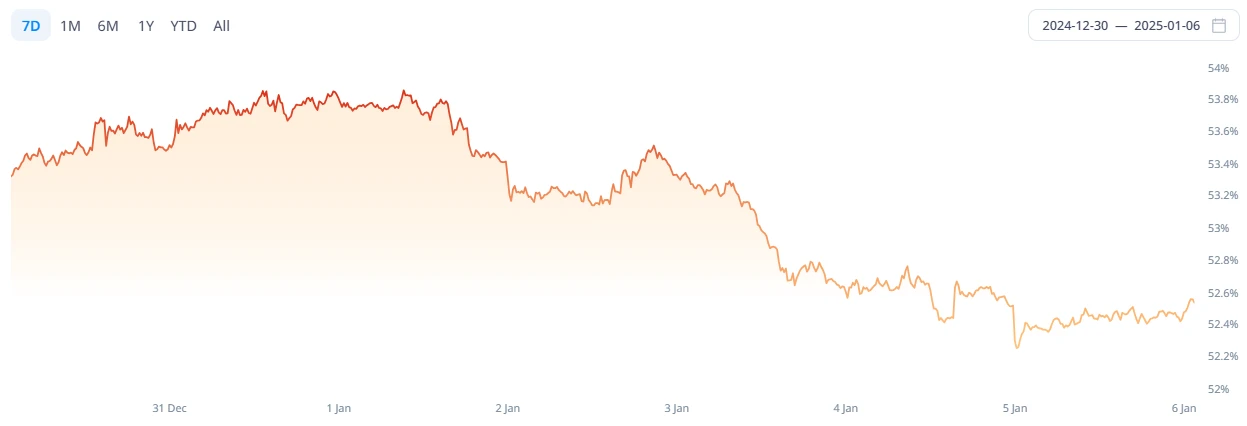

The total market value of global cryptocurrencies is $3.65 trillion, up 6.7% from $3.42 trillion last week.

Data source: Cryptorank

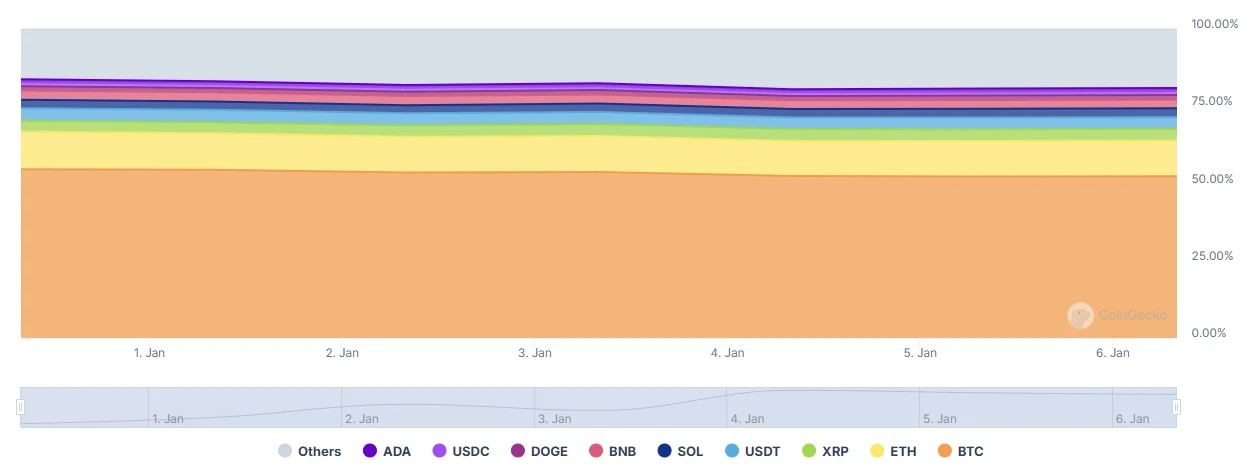

As of press time, Bitcoin (BTC) has a market cap of $1.94 trillion, accounting for 53.22% of the total cryptocurrency market cap. Meanwhile, stablecoins have a market cap of $212 billion, accounting for 5.82% of the total cryptocurrency market cap.

Data source: coingeck

2. Fear Index

The Crypto Fear Index is at 76, indicating greed.

Data source: coinglass

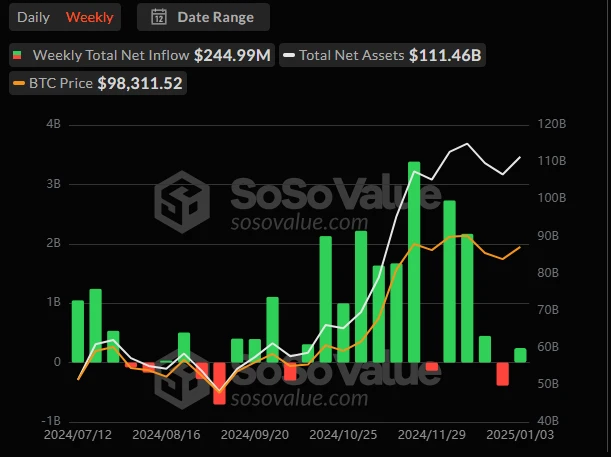

3. ETF inflow and outflow data

As of January 6, 2025, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$38.9 billion, with a net inflow of US$240 million this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$2.64 billion, with a net outflow of US$38 million this week.

Data source: sosovalue

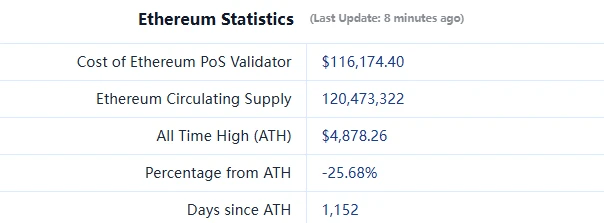

4. ETH/BTC and ETH/USD exchange ratio

ETHUSD: Current price is $3,627, the highest price in history is $4,878, and the decline from the highest price is about 25.64%

ETHBTC: Currently 0.036935, the highest in history is 0.1238

Data source: ratiogang

5. Decentralized Finance (DeFi)

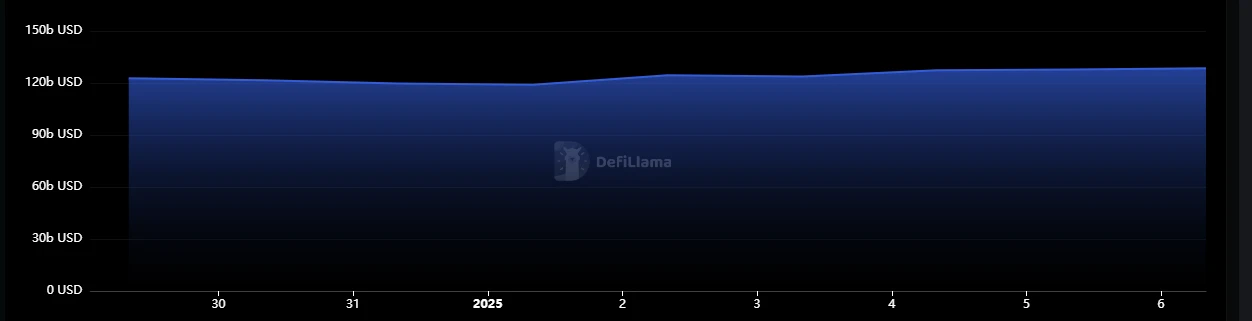

According to DeFiLlama, the total TVL of DeFi this week is $128.6 billion, up 5.8% from last week.

Data source: defillama

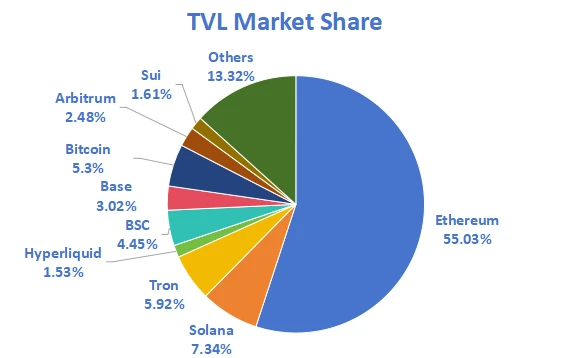

According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 55.03%, Solana chain accounting for 7.34%, and Tron chain accounting for 5.92%. The overall share is relatively stable, and the Ethereum chain is still the leader in the DeFi field.

Data source: CoinW Research Institute, defillama

Data as of January 6, 2025

6. On-chain data

Layer 1 Data

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of January 6, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are the core indicators for measuring the activity of public chains and user experience. In terms of daily trading volume, except for BNB and SUI, the overall trend is upward this week, among which BNB has the most obvious decline compared with last week, with a decline of 47.6%. In terms of transaction fees, ETH transaction fees have increased the most, with an increase of 71% compared with last week.

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, and TVL reflects the users trust in the platform. From the perspective of daily active addresses, the overall trend is more active, among which SUI has the most obvious increase, with an increase of 22%. From the perspective of TVL, ETH is still the leader among public chains.

Layer 2 Data

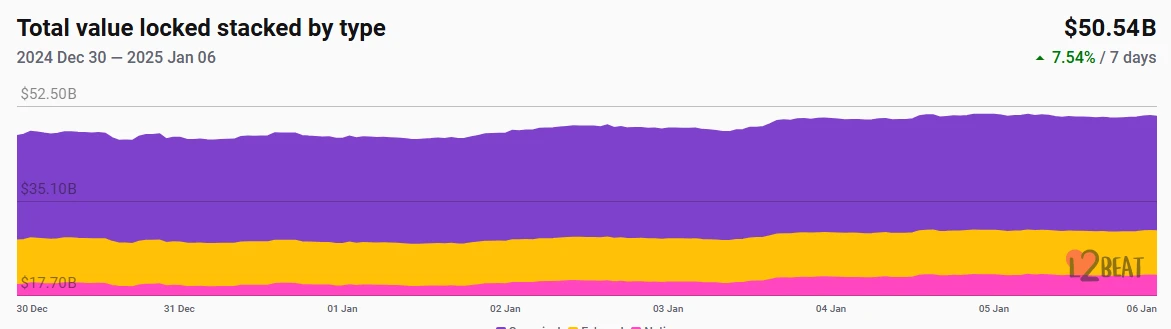

According to L2 Beat data, the total TVL of Ethereum Layer 2 reached US$50.68 billion, with an overall increase of 7.9% this week compared to last week.

Data source: L2 Beat

Data as of January 6, 2025

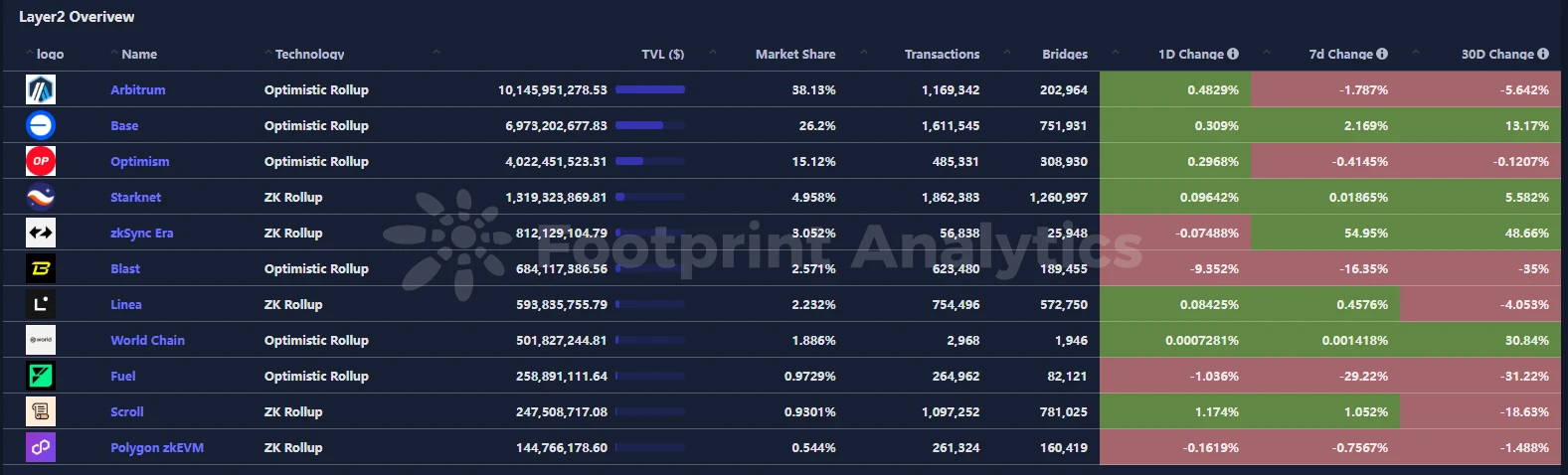

Arbitrum and Base occupy the front row with 38.13% and 26.2% market share respectively.

Data source: footprint

Data as of January 6, 2025

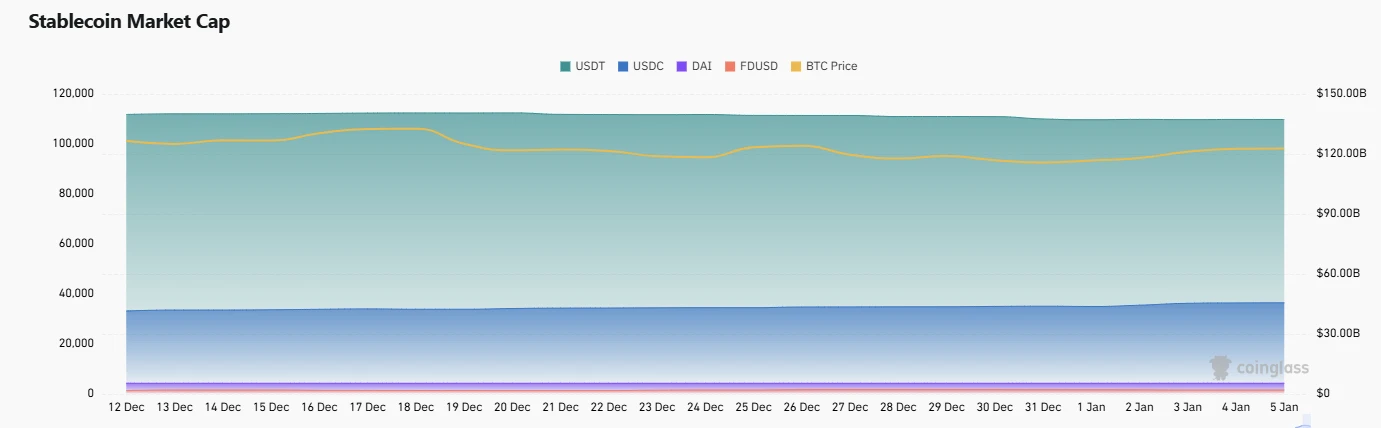

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is now $212 billion, a record high, with a weekly increase of 0.47%. Among them, the market value of USDT is $137.2 billion, accounting for 64.7% of the total market value of stablecoins; followed by USDC with a market value of $45.6 billion, accounting for 21.5% of the total market value of stablecoins; and DAI with a market value of $5.4 billion, accounting for 2.5% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of January 6, 2025

According to Whale Alert data, the USDC Treasury issued a total of 1.85 billion USDC this week, an increase of 70% from the total amount of stablecoins issued last week.

Data source: Whale Alert

Data as of January 6, 2025

2. Hot money trends this week

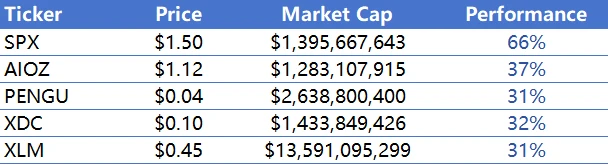

1. The top five VC coins and meme coins with the highest growth this week

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of January 6, 2025

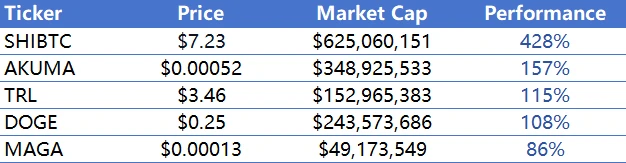

Top 5 Meme Coins That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of January 6, 2025

2. New Project Insights

Beacon Protocol : Beacon opens new private data sources to AI while ensuring privacy, redistributing incentives, and building a sustainable data economy. By bringing on-chain orchestration control to off-chain private data, the Beacon Protocol will usher in a new era of secure and fair use of private data by AI.

0 LiqLend : 0 LiqLend is a peer-to-peer yield marketplace that provides lenders with the best yield strategies.

Ape Pro : Ape Pro is Solana’s Memecoin terminal, powered by Jupiter Exchange, with transaction fees of only 0.5%.

3. New Industry Trends

1. Major industry events this week

Nimble released its first quarter roadmap, focusing on Agent development and token launch. NimbleNetwork, a composable AI protocol, released its first quarter 2025 roadmap, which includes: Agent Launchpad, focusing on Agents growth, and token launch.

DWF Labs released a report stating that Memecoin has grown from $20 billion to $120 billion by 2024, indicating that this is not a short-lived phenomenon, but the emergence of a new asset class. This growth reflects the markets recognition of social capital as a legitimate source of value in the digital age.

Xterio, the blockchain game publisher, announced the token economic model. The total supply of XTER token is 1 billion, the initial circulation is 112.5 million, and TGE will be held on January 8. The community allocates 28%, and 20 million tokens will be fully unlocked at TGE; the ecosystem allocates 26%, and 20 million tokens will be fully unlocked at TGE; investors allocate 15%; the team allocates 12%; 9% of the tokens are allocated for marketing, and 15 million tokens will be fully unlocked at TGE; 4.25% of the tokens belong to the treasury, and 5.75% of the tokens are used to provide liquidity and pledge during TEG. The initial circulation of XTER is 112.5 million.

The 3A blockchain game Seraph Foundation officially launched the TGE on January 6, 2025, and simultaneously launched the S 1 Genesis Season. As a blockchain game that integrates blockchain and AI technology, Seraph aims to lead Web3 games into a new era. In addition, the official said that detailed information on the Seraph token economic model will be announced in subsequent announcements.

BounceBit announced the launch of RWA trading capabilities that support tokenized securities on the BounceClub Quanto platform. The first batch of assets listed include MSTR (MicroStrategy), COIN (Coinbase) and BB (BlackBerry). Users can use BB tokens as collateral to conduct up to 200 times leveraged transactions.

2. Big events coming up next week

The Base LP incentive program on Synthetix will last until January 7 and is aimed at liquidity providers (LPs) on the Base chain. The rewards include 80,000 SNX and 100,000 USDC.

The Wavedrop 2 event of re-staking protocol Swell Network has ended, and claims will be open until January 10.

Xterio, a gaming infrastructure and AI gaming studio, has officially announced that its Token Generation Event will be officially launched on January 8, 2025. Officials said that this will usher in a new era of integrating AI, games and communities.

@SonicSVMs token SONIC, blockchain game @WanderCorpos token WANDER, @XterioGames token XTER, and @VibrantXFinances token VIBE will launch TGE this week.

@unichain mainnet plans to enable permissionless fault proof function on January 6, and the mainnet will be launched in the first quarter.

3. Important investment and financing last week

AlloyX, Series A, raised $10 million, with investors including Solomon Fund, Arbitrum, Offchain Labs, etc. AlloyX is a DeFi protocol that aggregates tokenized credit, bringing liquidity, composability, and efficiency to real-world assets (RWA). AlloyX enables protocols, decentralized autonomous organizations (DAOs), and institutional investors to easily and conveniently develop diversified investment strategies in RWA. (December 30, 2024)

Fold, Debt Financing, raised $20 million, with investors including ATW Partners. Fold is a payment application that allows users to earn Bitcoin. Users can earn Bitcoin on their daily purchases by using the Fold Visa debit card and purchasing gift cards from the Fold Store. (January 2, 2025)